1. Introduction

The advent of crypto assets, exemplified by decentralized technologies such as Bitcoin and Ethereum, has instigated a revolutionary transformation in the global financial landscape. Distinct from traditional fiat currencies, crypto assets function on blockchain networks, eliminating the need for centralized intermediaries. This decentralized nature not only enhances transactional transparency but also boosts efficiency, as noted by De Filippi & Wright [1] and Bullmann et al[2]. Nonetheless, the swift integration of crypto assets into traditional banking operations, encompassing custody services and payment system integration, has presented novel and formidable challenges to financial stability and regulatory consistency. As pointed out by Jovanić[3] and the Financial Stability Board[4], the traditional banking sector is grappling with the implications of this new phenomenon.

Existing research has illuminated the dual characteristics of crypto assets. On one hand, their decentralized framework promotes financial inclusion, democratizing access to financial services, as argued by Qiao[5]. On the other hand, the extreme volatility and vulnerability to market manipulation in the crypto space pose significant systemic risks, as evidenced by LI et al.[6] and ESMA[7]. The 2022 collapse of algorithmic stablecoins serves as a stark reminder of the fragility of crypto markets and the potential spillover effects on traditional financial institutions, as emphasized by Ullah[8]. Additionally, the regulatory environment for crypto assets remains fragmented globally. The EU, for example, is advocating for unified legislation like the Markets in Crypto-Assets Regulation (MiCA), while the U.S. relies on state-level guidelines such as the BitLicense. This disparity creates substantial compliance challenges for international banks, as discussed by Ferreira & Sandner[9] and Poskriakov & Cavin[10].

This study employs two principal research methods: literature review and historical observation. Through an in-depth literature review, the author comprehensively analyzes the existing research on the impact of crypto assets on traditional banking and the associated systemic risks. The author uses the historical observation method to trace the development of crypto assets and their interaction with the traditional banking sector over time. First, it explores the operational impact of crypto assets on the traditional banking model, especially in areas such as custodial services, payment systems, and product innovation. Second, it investigates the mechanisms through which cryptocurrency market volatility is transmitted to the broader financial system and proposes strategies for regulators to mitigate these risks. This research is significant as it offers practical insights for banks to navigate the challenges of technology adoption and risk management. For policymakers, it underscores the pressing need for global regulatory coordination to safeguard financial stability while fostering fintech innovation. This paper aims to contribute to both academic discourse and real-world financial policy formulation.

2. Current Involvement of Crypto Assets in Traditional Banking

2.1. Crypto Asset Custody Services

The participation of traditional banks in the field of crypto asset custody services marks the gradual acceptance of the financial industry towards the emerging asset class. As the crypto-asset market matures, more and more banks are beginning to offer crypto-asset custodial services to their clients, not only as a response to market demand, but also as an important attempt to diversify their own business. Custody services usually include core functions such as private key management, asset storage, transaction execution, and compliance checking, which bring new sources of revenue for banks and enhance customer stickiness.

However, banks face multiple risks and challenges when offering crypto asset custody services. The first and foremost is technical risk. The secure storage of crypto assets relies on complex encryption technology and hardware equipment, and any technical loopholes may lead to asset loss.[11] In addition, regulatory risks should not be ignored, as regulatory policies on crypto assets vary widely across countries and regions, and banks need to find a balance between compliance and business innovation.[12] Market risk also exists, as crypto-asset prices are highly volatile and may adversely affect banks' balance sheets.

Compared to other custodians, traditional banks have certain advantages in providing crypto asset custody services. A bank's brand reputation and client base earns it more trust, especially among high net worth clients and institutional investors. In addition, banks' experience in risk management, compliance operations, and customer service makes them better equipped to deal with the complexities involved in crypto asset custody. However, the disadvantages of banks should not be overlooked; traditional financial institutions are relatively slow in updating their technology and may struggle to keep up with the rapid changes in the crypto-asset market.[13]

Custody services are important for banks to expand their business scope and customer base. By providing crypto asset custodian services, banks are not only able to attract customers interested in crypto assets, but also enhance their competitiveness in the digital asset field.[14] In addition, custodian services provide banks with the opportunity to collaborate with other fintech companies to further promote financial innovation.

2.2. Integration with Traditional Payment Systems

The incorporation of crypto assets in traditional banking payment systems is gradually changing the face of financial services. Banks are redefining the payment process by leveraging the properties of crypto-assets, such as decentralisation, transparency and efficiency. For example, the introduction of blockchain technology has enabled transactions to be completed within seconds without relying on traditional clearing systems. This increased efficiency not only reduces transaction times, but also significantly lowers operational costs.[15] The use of crypto assets is particularly prominent in the area of cross-border payments. While traditional cross-border payments typically take days and are accompanied by high fees, blockchain-based payment solutions are able to complete transactions within minutes and at a fraction of the cost of traditional methods.[16]

However, while crypto-assets have shown great potential in the payment system, their integration has not been a smooth process. Regulators are wary of the anonymity and potential risks of crypto-assets, which has led many countries to take a more conservative stance when formulating relevant policies. For example, certain countries require banks to comply with strict anti-money laundering (AML) and know-your-customer (KYC) regulations when using crypto-assets for payments. While these regulatory requirements aim to protect the stability of the financial system, they also create additional complexity for banks to implement the technology.[1]

Technical hurdles cannot be ignored as well. Despite the high level of security inherent in blockchain technology, its integration with existing banking systems faces a number of challenges. Traditional banks' payment systems are usually based on a centralised architecture, whereas blockchain is decentralised, and this architectural difference makes compatibility between the two difficult.[17,18] In addition, scalability issues of blockchain networks limit their efficiency in processing large-scale transactions. To address these issues, some banks are exploring hybrid solutions, i.e. combining blockchain technology with traditional payment systems to achieve greater flexibility and scalability.[18]

At a practical level, some banks have already successfully applied crypto assets to their payment systems. For example, certain banks have launched blockchain-based cross-border payment platforms that allow customers to complete international remittances at lower costs and faster speeds.[19] These platforms not only improve payment efficiency, but also enhance the customer experience. However, these success stories are often accompanied by significant technology investments and close cooperation with regulators. Banks need to find a balance between technological innovation and compliance to ensure that their payment systems meet both customer needs and regulatory requirements.[1]

2.3. Positive Impacts of Crypto Assets on Traditional Banking

The emergence of crypto-assets has injected an unprecedented innovative impetus into the traditional banking industry, serving as a key catalyst for change. In the area of payment systems, the decentralised nature of blockchain technology has prompted banks to revisit their traditional clearing and settlement processes. By adopting distributed ledger technology, banks are able to significantly shorten transaction processing time, reduce cross-border payment costs, and increase transaction transparency.[5] For example, some leading financial institutions have begun to explore the use of stable coins for real-time cross-border payments, which not only improves the efficiency of capital flows, but also brings a better service experience to customers.[2]

In terms of product design, the rise of crypto assets has forced banks to rethink their service models. While traditional financial products are often limited by geography and regulatory frameworks, the borderless nature of crypto-assets has opened up new space for banks to innovate. Many banks have begun to launch financial products related to crypto assets, such as cryptocurrency custodian services and digital asset portfolio management, which not only enriches their product lines, but also attracts a new generation of tech-savvy customer groups.[11]

In the field of risk management, the technical characteristics of crypto assets also bring new opportunities for banks. The application of smart contracts allows banks to develop more flexible and automated financial products. For example, a blockchain-based lending platform can automate credit assessment and repayment processing, greatly reducing operational risks and labour costs.[20] At the same time, blockchain's immutability provides new technological tools for anti-money laundering and compliance management.

The rise of crypto assets has also driven banks to innovate in customer service. By integrating blockchain technology, banks are able to offer more personalised and real-time financial services. For example, some banks have begun to use blockchain technology to create digital identity systems, which not only improves the efficiency of customer identity verification, but also lays the foundation for personalised financial services.[21] In addition, the popularity of crypto-assets has prompted banks to rethink their customer relationship management strategies, and by providing education and services related to digital assets, financial institutions are better able to meet the increasingly diverse financial needs of their customers.[22]

In terms of business model innovation, crypto assets have opened up new profit channels for banks. In addition to the traditional deposit and lending business, banks have begun to get involved in emerging areas such as cryptocurrency trading and digital asset custody. This has not only increased banks' revenue streams, but also improved their competitiveness in the era of the digital economy. Some forward-looking banks have even begun to explore the convergence of decentralised finance (DeFi) and traditional finance in an attempt to capitalise on emerging market opportunities while maintaining regulatory compliance.[23]

Cryptoassets' innovation push on the traditional banking industry is not only reflected in the technology and product level, but also profoundly affects the operational thinking and culture of banks. Facing the challenges of crypto assets, banks have to accelerate the pace of digital transformation and cultivate a more innovative talent pool. This transformation not only enhances the adaptability of banks, but also lays the foundation for the sustainable development of the entire financial system. By embracing the innovation opportunities presented by crypto assets, traditional banks are reinventing themselves to better adapt to the rapidly changing financial landscape.

2.4. Challenges Posed by Crypto Assets to Financial Stability

The price volatility of crypto-assets is one of their most distinctive features, and this volatility not only poses a risk to investors, but also poses a serious challenge to the stability of the traditional financial system. The volatility of the crypto-asset market far exceeds that of the traditional financial market, and its price may experience sharp fluctuations within a short period of time, and this instability stems from a combination of factors. Market manipulation is one of the key reasons, as the lack of effective regulatory mechanisms in the crypto-asset market allows a small number of large holders or ‘whales’ to artificially influence market prices through large-scale buying and selling behaviour, leading to sharp price fluctuations.[6] In addition, uncertainty in the regulatory environment has fuelled market volatility. Regulatory policies on crypto-assets have not yet been harmonised across countries, and news of policy changes or regulatory tightening often triggers panic selling or speculative buying in the market, further amplifying price volatility.[3]

The high volatility of crypto-asset prices is not limited to their own markets, but may also be transmitted to the traditional financial system through a variety of channels, thereby triggering systemic risks.[7] For instance, as more and more investors and financial institutions hold crypto-assets, big changes in the prices of these assets could cause big changes in the balance sheets of these institutions, which could affect their ability to pay off debt and access cash. When the crypto-asset market falls sharply, investors may sell other high-risk assets out of a need for risk aversion, triggering a chain reaction across markets.[8]

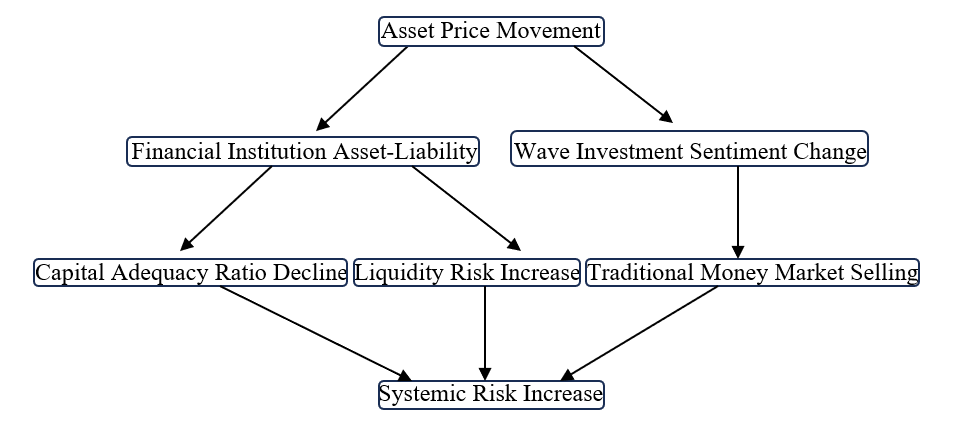

To demonstrate more visually the potential impact of crypto-asset price volatility on financial stability, a simple schematic of the market transmission mechanism is shown below:

Figure 1: Schematic diagram of the transmission mechanism of crypto-asset price fluctuations to the market

This transmission mechanism suggests that the volatility of the crypto-asset market not only affects its own market, but may also have far-reaching implications for the financial system as a whole through a complex financial network. Specifically, the growing correlation between crypto-assets and traditional financial assets intensifies the potential for such risk transmission. Regulators and market participants therefore need to pay close attention to the volatility of the crypto-asset market and take appropriate measures to guard against its potential threat to financial stability.

The volatility of the crypto-asset market is also closely related to its unique market structure. Unlike traditional financial markets, crypto-asset markets lack a centralised clearing and settlement mechanism and transactions are dispersed across multiple platforms, a decentralised feature that makes the market more vulnerable to information asymmetry and illiquidity. In addition, the participant structure of the crypto-asset market exacerbates volatility. The participation of a large number of retail investors makes the market more susceptible to sentiment, while the lack of participation by professional investment institutions makes the market more vulnerable to shocks. [24]

While the volatility of crypto-asset markets poses many challenges, it also offers new possibilities for financial innovation. For example, the rise of decentralised finance (DeFi) has provided the traditional financial system with new sources of liquidity and risk management tools. However, how to effectively control the risks associated with these innovative tools while utilising them remains an important issue that regulators and market participants need to face together.

3. Future Outlook of Crypto Assets in Traditional Banking and Financial Stability

The integration of crypto assets into traditional banking systems is poised to reshape the financial landscape in profound ways. As digital currencies and blockchain technology continue to evolve, banks are increasingly exploring ways to incorporate these innovations into their existing frameworks. This shift is not merely a technological upgrade but a fundamental reimagining of how financial services are delivered and consumed. Traditional banks, long seen as bastions of stability and conservatism, are now at the forefront of adopting crypto assets, driven by both competitive pressures and the need to meet evolving customer demands.[25]

One of the most significant trends is the development of hybrid financial products that bridge the gap between traditional banking services and crypto assets. For instance, some banks are offering crypto-backed loans, where digital assets serve as collateral for fiat currency loans. This innovation not only provides liquidity to crypto holders but also introduces a new revenue stream for banks. Similarly, the emergence of crypto savings accounts, which offer interest rates on digital asset holdings, is attracting a new demographic of tech-savvy customers who might otherwise bypass traditional banking altogether. These products are not just add-ons but are becoming integral to banks' service offerings, signaling a deeper integration of crypto assets into the financial ecosystem.[26]

Customer service is another area where the integration of crypto assets is making a noticeable impact. Banks are increasingly offering personalized financial advice that includes crypto assets, recognizing that a growing number of clients are interested in diversifying their portfolios with digital currencies. This shift is not just about providing information but about building trust and credibility in a market that is often perceived as volatile and risky. By offering educational resources, risk management tools, and tailored investment strategies, banks are positioning themselves as trusted advisors in the crypto space. This approach not only enhances customer loyalty but also helps demystify crypto assets for a broader audience.[4]

The regulatory environment is also playing a crucial role in shaping the integration of crypto assets into traditional banking. As governments and regulatory bodies around the world develop frameworks to govern digital currencies, banks are finding themselves at the intersection of innovation and compliance. This dual role requires banks to navigate a complex landscape of regulations while still pushing the boundaries of what is possible with crypto assets. The result is a more robust and secure financial system, where the risks associated with digital currencies are mitigated through careful oversight and collaboration between banks and regulators.[9]

4. Conclusion

In this evolving landscape, the role of traditional banks is being redefined. No longer just custodians of fiat currency, banks are becoming hubs of financial innovation, where traditional and digital assets coexist and complement each other. This transformation is not without its challenges, but it offers a glimpse into a future where the boundaries between traditional banking and the crypto economy are increasingly blurred. As banks continue to adapt and innovate, the integration of crypto assets will likely become a defining feature of the financial industry, shaping the way we think about money, value, and trust in the digital age.

References

[1]. P. De Filippi and A. Wright, “Blockchain and the Law, ” Apr. 2018, doi: https://doi.org/10.2307/j.ctv2867sp.

[2]. D. Bullmann, J. Klemm, and A. Pinna, “In Search for Stability in Crypto-Assets: Are Stablecoins the Solution?, ” SSRN Electronic Journal, 2019, doi: https://doi.org/10.2139/ssrn.3444847.

[3]. T. Jovanić, “An Overview of Regulatory Strategies on Crypto-Asset Regulation - Challenges for Financial Regulators in the Western Balkans, ” Ssrn.com, Oct. 12, 2020. https://ssrn.com/abstract=3784258 (accessed Jan. 29, 2025).

[4]. Board F S. International Regulation of Crypto-asset Activities: A proposed framework–questions for consultation[J]. 2022.

[5]. Qiao Pengcheng. ‘Distributed Ledger Technology: Blockchain and the International Evolution of Economic Management Research.’ Science and Technology Progress and Countermeasures 34.23 (2017): 33-41.

[6]. LI Zihua, LU Juan, ZHANG Wei. Overview of the development of the UK crypto asset market, regulatory policies and implications for China[J]. International Finance, 2021: 02.

[7]. Risk T R V. Crypto-assets and their risks for financial stability[J]. European Securities and Markets Authority, 2022.

[8]. M. Ullah, “Dynamic Connectedness between Crypto and Conventional Financial Assets: Novel Findings from Russian Financial Market, ” Journal of applied economic research, vol. 23, no. 1, pp. 110–135, Jan. 2024, doi: https://doi.org/10.15826/vestnik.2024.23.1.005.

[9]. A. Ferreira and P. Sandner, “Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure, ” Computer Law & Security Review, vol. 43, p. 105632, Nov. 2021, doi: https://doi.org/10.1016/j.clsr.2021.105632.

[10]. F. Poskriakov and C. Cavin, GLI – Blockchain & Cryptocurrency Regulation 2022, 4th Edition.2021, pp. 130–145. Available at: https://www.acc.com/sites/default/files/resources/upload/GLI-BLCH22_E-Edition.pdf#page=141

[11]. R. Cyrus, “Custody, Provenance, and Reporting of Blockchain and Cryptoassets, ” Emerald Publishing Limited eBooks, pp. 233–248, Jan. 2023, doi: https://doi.org/10.1108/978-1-80455-320-620221016.

[12]. T. Brand and I. Karhu, “An institutional approach to the custody of crypto assets: The decision making and trade-offs in crypto asset custody, ” Journal of securities operations & custody, vol. 15, no. 4, pp. 304–304, Sep. 2023, doi: https://doi.org/10.69554/ccme9861.

[13]. H. Nabilou, “The Law and Macroeconomics of Custody and Asset Segregation Rules: Defining the Perimeters of Crypto-Banking, ” SSRN Electronic Journal, 2022, doi: https://doi.org/10.2139/ssrn.4075020.

[14]. E. Micheler, “CUSTODY CHAINS AND ASSET VALUES: WHY CRYPTO-SECURITIES ARE WORTH CONTEMPLATING, ” The Cambridge Law Journal, vol. 74, no. 3, pp. 505–533, Aug. 2015, doi: https://doi.org/10.1017/s0008197315000598.

[15]. Vipul Walunj, Vasanth Rajaraman, J. Dutta, and A. Sharma, “Integrating Crypto-Based Payment Systems for Data Marketplaces: Enhancing Efficiency, Security, and User Autonomy, ” Lecture notes in computer science, pp. 443–452, Dec. 2024, doi: https://doi.org/10.1007/978-3-031-80020-7_25.

[16]. S. Inikhov, “A Comparative Study of Cryptocurrency and Traditional Payment Systems in International Trade: A New Trade Theory Perspective, ” Theses.cz, 2024. https://theses.cz/id/4j2hmd/ (accessed Jan. 26, 2025).

[17]. Blommestein H J, Summers B J. Banking and the payment system[J]. The payment system: Design, management, and supervision, 1994: 15-28.

[18]. B. Eichengreen, “From Commodity to Fiat and Now to Crypto: What Does History Tell Us?, ” Jan. 2019, doi: https://doi.org/10.3386/w25426.

[19]. “Digital Currencies and Decentralized Payment Systems, ” Harvard University Press eBooks, pp. 61–71, Apr. 2018, doi: https://doi.org/10.2307/j.ctv2867sp.6.

[20]. Lee, Suk-yin. (2018). A case study of blockchain application in SME lending (Master's thesis, Huazhong University of Science and Technology).

[21]. Alexandru-Cristian Careja and Nicolae Tapus, “Digital Identity Using Blockchain Technology, ” Procedia Computer Science, vol. 221, pp. 1074–1082, Jan. 2023, doi: https://doi.org/10.1016/j.procs.2023.08.090.

[22]. Jessop M. Digital Asset Management Education and Training[C]//Archiving Conference. Society of Imaging Science and Technology, 2010, 7: 152-156.

[23]. S. Hadi, N. Renaldo, Intan Purnama, K. Veronica, and S. Musa, “The Impact of Decentralized Finance (DeFi) on Traditional Banking Systems: A Novel Approach, ” International Conference on Business Management and Accounting, vol. 2, no. 1, pp. 295–299, 2023, doi: https://doi.org/10.35145/icobima.v2i1.4376.

[24]. F. Vasselin, “Crypto-Asset Market: Classification, Composition, and Competition, ” 2024, doi: https://doi.org/10.2139/ssrn.5048914.

[25]. F. Vasselin, “Crypto-Asset Market: Classification, Composition, and Competition, ” 2024, doi: https://doi.org/10.2139/ssrn.5048914.

[26]. Y. Wang, A. Jiang, S. Zhang, and W. Chen, “Traditional finance, digital finance, and financial efficiency: An empirical analysis based on 19 urban agglomerations in China, ” International Review of Financial Analysis, vol. 96, p. 103603, Sep. 2024, doi: https://doi.org/10.1016/j.irfa.2024.103603.

Cite this article

Shi,X. (2025). The Role of Crypto Assets in the Traditional Banking System and Its Impact on Financial Stability. Advances in Economics, Management and Political Sciences,165,121-127.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. P. De Filippi and A. Wright, “Blockchain and the Law, ” Apr. 2018, doi: https://doi.org/10.2307/j.ctv2867sp.

[2]. D. Bullmann, J. Klemm, and A. Pinna, “In Search for Stability in Crypto-Assets: Are Stablecoins the Solution?, ” SSRN Electronic Journal, 2019, doi: https://doi.org/10.2139/ssrn.3444847.

[3]. T. Jovanić, “An Overview of Regulatory Strategies on Crypto-Asset Regulation - Challenges for Financial Regulators in the Western Balkans, ” Ssrn.com, Oct. 12, 2020. https://ssrn.com/abstract=3784258 (accessed Jan. 29, 2025).

[4]. Board F S. International Regulation of Crypto-asset Activities: A proposed framework–questions for consultation[J]. 2022.

[5]. Qiao Pengcheng. ‘Distributed Ledger Technology: Blockchain and the International Evolution of Economic Management Research.’ Science and Technology Progress and Countermeasures 34.23 (2017): 33-41.

[6]. LI Zihua, LU Juan, ZHANG Wei. Overview of the development of the UK crypto asset market, regulatory policies and implications for China[J]. International Finance, 2021: 02.

[7]. Risk T R V. Crypto-assets and their risks for financial stability[J]. European Securities and Markets Authority, 2022.

[8]. M. Ullah, “Dynamic Connectedness between Crypto and Conventional Financial Assets: Novel Findings from Russian Financial Market, ” Journal of applied economic research, vol. 23, no. 1, pp. 110–135, Jan. 2024, doi: https://doi.org/10.15826/vestnik.2024.23.1.005.

[9]. A. Ferreira and P. Sandner, “Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure, ” Computer Law & Security Review, vol. 43, p. 105632, Nov. 2021, doi: https://doi.org/10.1016/j.clsr.2021.105632.

[10]. F. Poskriakov and C. Cavin, GLI – Blockchain & Cryptocurrency Regulation 2022, 4th Edition.2021, pp. 130–145. Available at: https://www.acc.com/sites/default/files/resources/upload/GLI-BLCH22_E-Edition.pdf#page=141

[11]. R. Cyrus, “Custody, Provenance, and Reporting of Blockchain and Cryptoassets, ” Emerald Publishing Limited eBooks, pp. 233–248, Jan. 2023, doi: https://doi.org/10.1108/978-1-80455-320-620221016.

[12]. T. Brand and I. Karhu, “An institutional approach to the custody of crypto assets: The decision making and trade-offs in crypto asset custody, ” Journal of securities operations & custody, vol. 15, no. 4, pp. 304–304, Sep. 2023, doi: https://doi.org/10.69554/ccme9861.

[13]. H. Nabilou, “The Law and Macroeconomics of Custody and Asset Segregation Rules: Defining the Perimeters of Crypto-Banking, ” SSRN Electronic Journal, 2022, doi: https://doi.org/10.2139/ssrn.4075020.

[14]. E. Micheler, “CUSTODY CHAINS AND ASSET VALUES: WHY CRYPTO-SECURITIES ARE WORTH CONTEMPLATING, ” The Cambridge Law Journal, vol. 74, no. 3, pp. 505–533, Aug. 2015, doi: https://doi.org/10.1017/s0008197315000598.

[15]. Vipul Walunj, Vasanth Rajaraman, J. Dutta, and A. Sharma, “Integrating Crypto-Based Payment Systems for Data Marketplaces: Enhancing Efficiency, Security, and User Autonomy, ” Lecture notes in computer science, pp. 443–452, Dec. 2024, doi: https://doi.org/10.1007/978-3-031-80020-7_25.

[16]. S. Inikhov, “A Comparative Study of Cryptocurrency and Traditional Payment Systems in International Trade: A New Trade Theory Perspective, ” Theses.cz, 2024. https://theses.cz/id/4j2hmd/ (accessed Jan. 26, 2025).

[17]. Blommestein H J, Summers B J. Banking and the payment system[J]. The payment system: Design, management, and supervision, 1994: 15-28.

[18]. B. Eichengreen, “From Commodity to Fiat and Now to Crypto: What Does History Tell Us?, ” Jan. 2019, doi: https://doi.org/10.3386/w25426.

[19]. “Digital Currencies and Decentralized Payment Systems, ” Harvard University Press eBooks, pp. 61–71, Apr. 2018, doi: https://doi.org/10.2307/j.ctv2867sp.6.

[20]. Lee, Suk-yin. (2018). A case study of blockchain application in SME lending (Master's thesis, Huazhong University of Science and Technology).

[21]. Alexandru-Cristian Careja and Nicolae Tapus, “Digital Identity Using Blockchain Technology, ” Procedia Computer Science, vol. 221, pp. 1074–1082, Jan. 2023, doi: https://doi.org/10.1016/j.procs.2023.08.090.

[22]. Jessop M. Digital Asset Management Education and Training[C]//Archiving Conference. Society of Imaging Science and Technology, 2010, 7: 152-156.

[23]. S. Hadi, N. Renaldo, Intan Purnama, K. Veronica, and S. Musa, “The Impact of Decentralized Finance (DeFi) on Traditional Banking Systems: A Novel Approach, ” International Conference on Business Management and Accounting, vol. 2, no. 1, pp. 295–299, 2023, doi: https://doi.org/10.35145/icobima.v2i1.4376.

[24]. F. Vasselin, “Crypto-Asset Market: Classification, Composition, and Competition, ” 2024, doi: https://doi.org/10.2139/ssrn.5048914.

[25]. F. Vasselin, “Crypto-Asset Market: Classification, Composition, and Competition, ” 2024, doi: https://doi.org/10.2139/ssrn.5048914.

[26]. Y. Wang, A. Jiang, S. Zhang, and W. Chen, “Traditional finance, digital finance, and financial efficiency: An empirical analysis based on 19 urban agglomerations in China, ” International Review of Financial Analysis, vol. 96, p. 103603, Sep. 2024, doi: https://doi.org/10.1016/j.irfa.2024.103603.