1. Introduction

Asset-backed security (ABS) is a financial instrument that pools similar assets (such as loans, receivables, lease contracts, etc.) into an asset pool. Through structured financial techniques, the future cash flows of these assets are separated and used to issue securities backed by these cash flows [1]. According to the People's Bank of China, ABS is a structured financing activity selling credit assets in securities. Investors in ABS typically purchase these securities to gain the cash flow income generated by the underlying assets in the future.

Since 2008, China's asset-backed securities (ABS) market has experienced multiple stages of development, from pilot to rapid expansion, reflecting the gradual maturity of the market mechanism and regulatory environment [2]. From 2008 to 2024, China's ABS market experienced a process from initial exploration to standardization, rapid growth, and diversified development. It is mainly divided into four stages.

Stage 1: Initial stage (2008 to 2013)

The circulation of ABS at this stage is relatively small, and the market participants are mainly large institutional investors.

Stage 2: Normalization and expansion stage (2014 to 2017)

2014 is an important turning point for developing China's ABS market. At this stage, the ABS market has expanded rapidly, and the issuer has expanded from banks to non-bank financial institutions and enterprises. ABS's asset classes are also gradually diversified, including consumer loans, corporate loans, lease assets, etc.

Stage 3. Market maturity and diversification stage (2018 to 2020)

Regulators have strengthened information disclosure and risk management requirements to promote a more transparent and healthy market development. In 2018, China's ABS market significantly improved in terms of product types, issuance scale, and market depth, positively contributing to the financial market's stability and development.

Stage 4. Risk Management and Innovation Stage (2021 to 2024)

To sum up, the market mechanism has been continuously improved, the regulatory environment has gradually matured, and the risk awareness of market participants has also been increasing daily.

In-depth understanding of how ABS securities, identifies high-quality assets and potential opportunities, and makes more informed investment choices. Master the credit, liquidity, and market risks in the securitization process and improve risk identification and management capabilities.

2. The analysis of the securitization process and structure

2.1. Overview

There are three main types of securitization products issued domestically in China, including Asset-backed by the cash flow from enterprise assets or projects, Collateralized Debt Obligation (CDO) based on debt instruments such as bonds and loans as underlying assets, and Asset-backed Notes (ABN) [3]. The cash flows from enterprise assets and projects back ABN and ABS. ABN has a shorter term than ABS and is usually issued by the enterprise or financial institution rather than investment banks.

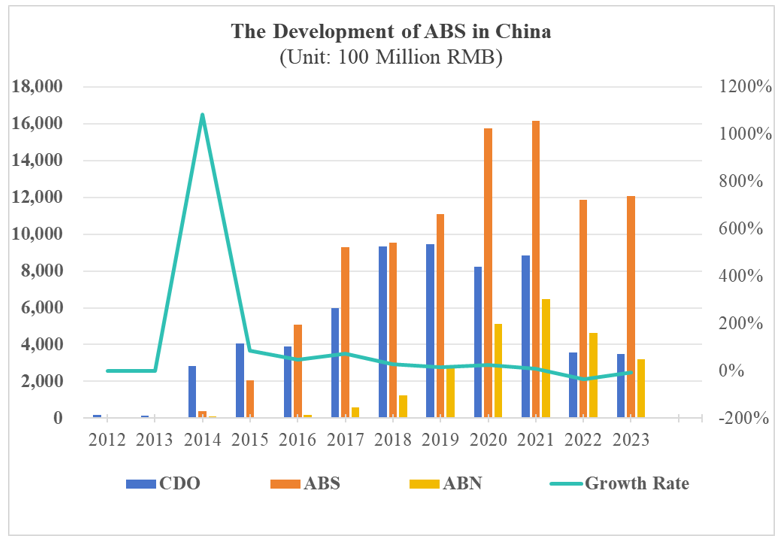

The market for ABS in China has seen significant development since its restart of construction in 2012. Although the market showed signs of contraction in 2022 and 2023, the overall trend indicates substantial future potential. Currently there have been a total of 12,965 ABS deals issued, with a cumulative market capitalization of 18.8 trillion yuan. As shown in Table 1 and Figure 1, the growth rate from 2014 to 2023 reflects rapid expansion combined with slight fluctuations. Notably the diversified asset classes have driven this growth rate, such as credit assets and corporate assets.

|

The Development of the ABS Market (unit,100million RMB) |

||||

|

Years |

CDO |

ABS |

ABN |

Total Market |

|

2012 |

193 |

32 |

57 |

282 |

|

2013 |

158 |

74 |

48 |

280 |

|

2014 |

2820 |

401 |

89 |

3310 |

|

2015 |

4056 |

2045 |

35 |

6136 |

|

2016 |

3909 |

5074 |

167 |

9150 |

|

2017 |

5972 |

9290 |

575 |

15837 |

|

2018 |

9323 |

9535 |

1261 |

20119 |

|

2019 |

9433 |

11084 |

2887 |

23404 |

|

2020 |

8230 |

15730 |

5108 |

29068 |

|

2021 |

8828 |

16142 |

6454 |

31424 |

|

2022 |

3557 |

11855 |

4624 |

20036 |

|

2023 |

3496 |

12048 |

3216 |

18760 |

2.2. Structure of Huaxia Bank securitization product

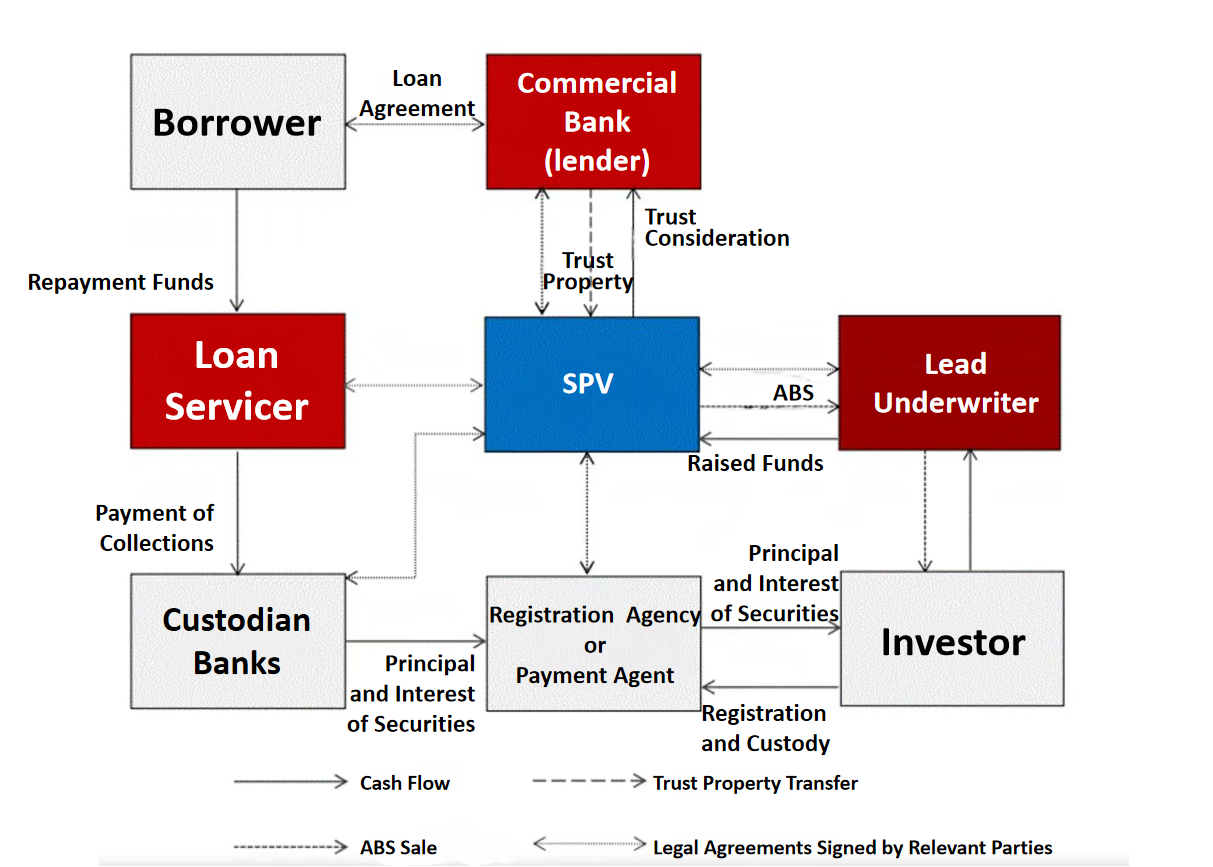

Below is the structure of the securitization process, which is funding from the investors of Huaxia Bank. The asset cauterization process involves several key steps and participants, as illustrated in Figure 2.

Borrowers obtain loans from the originators (commercial banks), covering various types such as consumer loans, mortgage loans, and corporate loans. The originators package these loan assets and, through trust and asset transfer agreements, transfer them to a Special Purpose Vehicle (SPV). The SPV issues asset-backed securities (ABS) and sells these securities to major underwriters. The lead underwriter distributes ABS to investors through market channels to obtain funds as a return. After purchasing securities, investors register them with the registration custodian or payment agent and entrust them to these institutions for custody. Loan Servicers manage loans, collect repayments, and hand over the collected funds to fund custodian banks. The custodian banks will then hand over these funds to the registration custodian or payment agent.

Finally, investors obtain the principal and interest of securities through agencies, completing the cash flow cycle. During this process, risks will be transferred from banks to investors in the market.

2.3. Main participants within the securitization

(1) Commercial Banks (Lenders & Sellers)

Commercial banks are key players in initiating loans and participating in the saucerization process. They provide various types of loans, including consumer, mortgage, and auto loans. Banks can transfer loan risk off their balance sheets and obtain liquidity by packaging these loans into security products and selling them to investors [4]. The cash flow paid by these SPVs can help banks respond more flexibly to other investment opportunities or obligations. Meanwhile, by selling loan assets to SPVs, the bank's balance sheet no longer includes these loans, thereby reducing risk.

(2) Special Purpose Vehicles (SPV)

Special Purpose Vehicles (SPVs) play a significant role in asset securitization. They are responsible for packaging loan assets into securities [5]. An SPV is an independent legal entity primarily responsible for purchasing assets, including them on its balance sheet, and conducting subsequent sales. These SPVs are often subsidiaries controlled by commercial banks or state-owned enterprises in China. SPVs work closely with lead underwriters to ensure the successful issuance of securities.

(3) Custodian Banks

Custodian banks are responsible for ensuring the safety, independence, and compliant use of funds. Their duties include safeguarding funds, supervising usage, and performing payment and settlement according to regulations. The presence of custodian banks helps prevent the misappropriation and misuse of funds, protecting the interests of investors.

(4) Lead Underwriters

In China, lead underwriters play a pivotal role in the underwriting process of securities issuance. They organize and coordinate securities issuance, pricing, and sale. Underwriters conduct due diligence on the issuers, assist in formulating issuance plans, set the prices for the securities, and sell them through various channels to investors, ensuring the successful issuance of ABS.

(5) Investors

There are different types of investors in the Chinese ABS market. Commercial Banks may include ABS as part of their investment portfolios to balance risk and return. They invest across different credit ratings and prefer large-scale, asset-intensive, long-duration projects. Fund Companies prioritize liquidity and often select highly liquid, high-grade products such as consumer finance ABS and receivables ABS. Securities Companies invest through their asset management departments, engaging in proprietary trading and asset management activities. Proprietary trading involves using the firm's funds, while asset management activities involve managing client funds. Insurance Institution uses their long-term funds to achieve stable returns, favoring long-term, stable investment strategies.

(6) Rating Agencies

Rating agencies play a crucial role in the ABS market. Their primary duty is to provide credit ratings for security products, assisting investors in assessing risks and ensuring market transparency and stability. The independence and objectivity of rating agencies are key characteristics that ensure the credibility of their ratings. Major international rating agencies like Moody's and Standard & Poor's in China provide global rating services for various ABS products. The main local rating agencies include China Chengxin International and China Bond Credit, which play an important role in the domestic market and provide rating services that align with the local market's characteristics.

2.4. Asset pool and tranches

An asset pool is a collection of financial assets bundled together to support the issuance of securities. These financial assets typically generate cash flows, which are then used to pay interest and principal to investors in the securitized instruments [6].

Table 2 below shows the structure of Huaxia Bank’s asset pool. The assets are divided into priority A-level, Priority B-level, and secondary-level assets.

|

Issuance scale (Million RMB) |

Proportion |

Coupon |

Issuance Date |

Maturity Date |

Rating |

|

|

Priority A-level assets support securities |

748 |

71.95% |

Floating interest rate |

October 26, 2020 |

January 26, 2025 |

AAA |

|

Priority B-level assets support securities |

75 |

7.21% |

Floating interest rate |

January 26, 2021 |

January 26, 2025 |

AA+ |

|

Secondary-level support securities |

217 |

20.84% |

No coupon rate |

January 26, 2022 |

January 26, 2025 |

No Rating |

|

Total |

1039 |

The Secondary level Assets Support Securities have the highest risk. Since they have no coupon rate and rating, the possibility of defaulting is relatively high.

3. Pass-through of the risk

3.1. Default risk from the borrowers

Since small and medium-sized enterprises(SMEs) are the main borrowers in securitization, the borrowers’ probability of defaulting is high for several reasons [7]. First, SMEs have limited financial resources. They have less liquidity, so they may not have enough cash to repay the loans. Their ability to repay is also easily impacted by the economic condition, increasing uncertainty. Another important reason is that members of SMEs often lack management experience and have to face fierce competition in the market. Based on the above reasons, SMEs are often more prone to default. Therefore, the securities packaged from their loan assets also have higher risks.

3.2. How the risk pass through

In asset securitization, banks sell loan assets to SPVs to obtain cash flow while removing assets with credit risk from their balance sheets.

Specifically, banks sell their loan assets, such as home mortgages, car loans, or credit card receivables, to SPVs. These assets are packaged and transferred to the SPV, isolating them from the bank's other assets and liabilities. Banks can obtain cash flow from asset pools through this structure while transferring these loan assets' credit risk to SPVs.

Next, SPVs package these loan assets into tranches of securities with different risk levels and sell them to the investors. After stratifying the loan assets, SPV creates securities of different levels, such as priority and subordinated, based on the risk characteristics of each layer. Then, these securities are sold in the market, and SPVs gain cash flow while further diversifying and transferring the risk of loan assets to different investors.

Investors accept the risks associated with the loan assets behind these securities when purchasing them. Specifically, investors in priority securities bear lower risks due to their securities having higher priority in the asset pool. In comparison, investors in secondary securities bear higher risks due to their securities having lower priority in the asset pool. While obtaining returns, investors need to bear the risks associated with these securities assets on their own, including potential default risk. The loan servicer can’t take the repayment funds when the borrower defaults. This causes the custodian banks to have nothing to pay to the agencies to serve investors. Therefore, the investors lose their principal.

Banks can divest loan assets from their balance sheets through this securitization structure, reducing the risks they need to bear; SPVs generate cash flow by selling securities and diversifying risks to investors in the market. Investors pursue returns and bear corresponding risks.

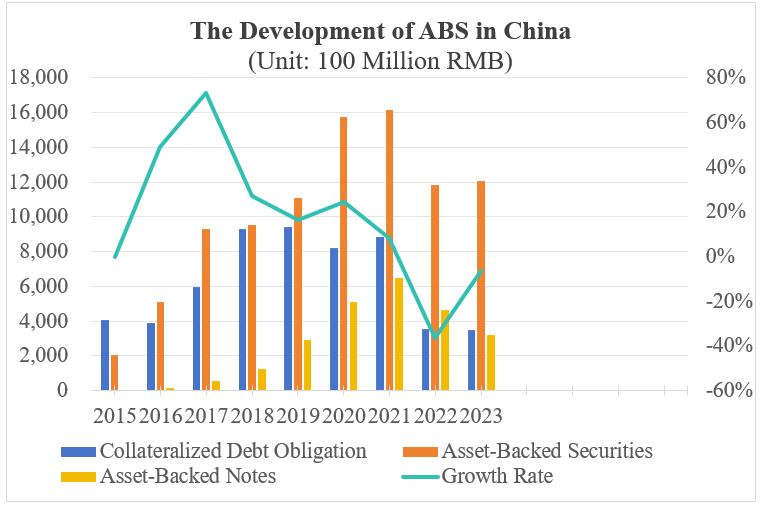

4. Regulatory

To deal with the risk, the Chinese government imposed policies. The most influential regulatory document by the Chinese government on the ABS market in recent times is the "Guiding Opinions on Regulating Asset Management Business of Financial Institutions." This document was released on April 27, 2018, and officially implemented in early January 2022 [2]. Looking at Figure 3 below, we will find out that the Chinese ABS market's growth rate experienced a continuous fall from 2018 to 2021 and sudden falls in 2018 and 2022. The document mainly proposes four policies. The purpose of these policies is also obvious - to make investors bear the main risks of securities and weaken the dominance of commercial banks and financial institutions in investing in securities to avoid systemic crises.

4.1. Prohibition of bail-out

Government agencies define the following behaviors of financial institutions trying to bail out as “rigid redemption.”

1) The issuer or manager of an asset management product violates the principle of a true and fair determination of net asset value, which means that the product is guaranteed to break even without disclosing important information such as asset valuation.

2) Adopting rolling issuance and other methods to transfer the principal, returns, and risks of asset management products among different investors to achieve product preservation and return.

3) Raising funds to repay or entrust other institutions to repay the investors when asset management products cannot be redeemed on time or face difficulties in redemption

When financial institutions (mainly banks) guarantee principal and interest to investors, they take risks for investors. Once banks cannot withstand the risks, they may cause a systemic crisis similar to the 2008 subprime mortgage crisis due to insufficient liquidity.

Different financial institutions will face varying degrees of punishment after violating this regulation.

Deposit financial institutions will be regulated by the banking and insurance regulatory authority under the State Council and the People's Bank of China by the deposit business, make up the deposit reserves and insurance premiums in full, and be subject to administrative penalties. And non-deposit licensed financial institutions will be identified as operating in violation of regulations. The Financial Supervision and Regulation Department and the People's Bank of China will correct and punish them according to law, including warnings, fines, confiscation of illegal income, suspension of business for rectification, revocation of financial business license, and other measures.

4.2. Regulation on the net worth assets

Net asset value management mainly refers to the practice of no longer specifying the expected return rate of "guaranteed capital and guaranteed income" when issuing asset management products but instead accounting for and disclosing the product's net asset value. This allows investors to enjoy profits or bear losses based on the product's operation.

Financial institutions shall implement net asset value management for asset management products. Net asset value generation shall comply with the provisions of the Enterprise Accounting Standards, timely reflect the income and risk of the underlying financial assets, be accounted for by the custodian institution regularly, provide reports, and be audited and confirmed by external auditing institutions. The audited financial institution shall disclose the audit results and submit them to the financial management department simultaneously.

Valuing the underlying assets invested in the product and timely and accurately conveying the product's risk and return changes to investors helps to break the "rigid redemption."

4.3. Requiring simplicity and transparency

The document mentions that the government will crack down on multi-layered nested asset management products, requiring simple asset structures and transparent information. The regulation and requirement of securities' simplicity can partially explain the shrinkage of the Chinese ABS market from 2020 to 2022.

Multi-layer nested asset management products typically refer to an asset management product (upper layer product) investing in one or more asset management products (lower layer products), and the lower layer products may then invest in other asset management products, forming a multi-level nested structure.

The complex structure makes it difficult to penetrate underlying assets, increasing the length of the funding chain and financing costs while also exacerbating the cross-industry and cross-market transmission of risks.

The document advanced several requirements.

Strengthen penetrating supervision:

Require identification of the product's ultimate investors upwards and the underlying assets downwards (excluding public securities investment funds), ensuring that supervision can penetrate the complex product structure and directly affect the underlying assets and ultimate risk bearers.

Standardize channel business:

Prohibit financial institutions from providing channel services aimed at expanding investment scope and avoiding regulatory requirements, and cut off the path of regulatory arbitrage through multi-layer nesting.

Establish a unified reporting system:

Financial institutions must regularly report basic, fundraising, asset liability, and termination information about asset management products to facilitate regulatory authorities' comprehensive grasp of their operation and risk status.

Strengthening investor protection:

Financial institutions must establish and improve internal approval and evaluation mechanisms, fully disclose product information, ensure investors can fully understand product risk and return characteristics, and make independent investment decisions.

4.4. The extension of closed-end asset management products minimum term

The minimum shelf life for closed products is extent to 90 days.

A closed-end asset management product is an investment tool that determines the scale and duration of fundraising at the time of establishment. Investors entrust their funds to a professional asset management team, who allocate and manage their assets based on their goals, risk preferences, and market conditions. Investors typically cannot redeem their investment shares until the product expires or specific conditions are met.

Financial institutions often use mismatches to generate profits when selling closed-end products, splitting long-term loans into lower-interest short-term securities for sale. This mismatch can easily lead to liquidity risk, where financial institutions cannot timely realize loans to pay investors. Stipulating a minimum term of 90 days for closed-end asset management products helps reduce the behavior of financial institutions investing in long-term assets through the rolling issuance of short-term wealth management products.

5. Conclusion

This study provides a detailed analysis of the structure of Huaxia Bank's securitization products, including major participants such as commercial banks, SPVs, custodian banks, lead underwriters, investors, and rating agencies. Commercial banks package loan assets and transfer them to special purpose companies, securitizing these assets and issuing securities of different risk levels to investors, thereby achieving risk transmission. Through this process, banks can eliminate credit risk from their balance sheets, and special-purpose companies can generate cash flow by selling securities, dispersing risk to market investors.

And further discussed the regulatory policies implemented by the Chinese government to control risks in the ABS market. These policies aim to reduce systemic financial risks, improve market transparency, and enhance investors' risk awareness by prohibiting "rigid redemption," requiring net asset value management, simplifying and transparent asset structures, and extending the minimum term of closed-end asset management products.

Overall, in asset securitization, the risk transferred with the flow of funds is one of the government's and banks' main objectives in building this system.

References

[1]. James Chen (2024). Asset-Backed Security (ABS): What It Is and How Different Types Work, https: //www.investopedia.com/terms/a/asset-backedsecurity.asp

[2]. Guiding Opinions on Regulating Asset Management Business of Financial Institutions. (2018). https: //www.gov.cn/gongbao/content/2018/content_5323101.htm

[3]. Kothari, & Vinod. (2006). Securitization: the financial instrument of the future. John Wiley & Sons Inc, 108-188.

[4]. Badertscher, B. A., Burks, J. J., & Easton, P. D. (2010). A convenient scapegoat: fair value accounting by commercial banks during the financial crisis. Social Science Electronic Publishing, 88(1), 59-90.

[5]. Gorton, G., & Souleles, N. (2005). Special purpose vehicles and securitization. NBER Working Papers.

[6]. Schaber, A. (2009). Asset pool quality and tranching of CDOs.

[7]. Mehrtens, J., Cragg, P. B., & Mills, A. M. (2002). A model of internet adoption by SMEs. Information & Management, 39(3), 165-176.

Cite this article

Zhang,L.;Guo,Z.;Ye,Z. (2025). The Pass-Through of the Risk Within the Asset-Backed Securitization in China – Taking the Huaxia Bank as an Example. Advances in Economics, Management and Political Sciences,217,181-189.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. James Chen (2024). Asset-Backed Security (ABS): What It Is and How Different Types Work, https: //www.investopedia.com/terms/a/asset-backedsecurity.asp

[2]. Guiding Opinions on Regulating Asset Management Business of Financial Institutions. (2018). https: //www.gov.cn/gongbao/content/2018/content_5323101.htm

[3]. Kothari, & Vinod. (2006). Securitization: the financial instrument of the future. John Wiley & Sons Inc, 108-188.

[4]. Badertscher, B. A., Burks, J. J., & Easton, P. D. (2010). A convenient scapegoat: fair value accounting by commercial banks during the financial crisis. Social Science Electronic Publishing, 88(1), 59-90.

[5]. Gorton, G., & Souleles, N. (2005). Special purpose vehicles and securitization. NBER Working Papers.

[6]. Schaber, A. (2009). Asset pool quality and tranching of CDOs.

[7]. Mehrtens, J., Cragg, P. B., & Mills, A. M. (2002). A model of internet adoption by SMEs. Information & Management, 39(3), 165-176.