1. Introduction

Environmental, Social and Governance (ESG) policies have been increasingly integral to global attempts at sustainable economic development in the past years as a comprehensive framework for reducing environmental risks and fostering social equity. China, though one of the fastest-growing economies in the world, has realized this and has started to embed ESG principles into its policy framework. The Chinese government has been instituting ESG-tied reforms over the course of a decade, including efforts to mitigate environmental degradation (E), improve governance standards in response to corruption scandals and corporate excesses (S & G) along with expanding social welfare across its large underprivileged population. Yet different from western countries like the U.S. and EU, China's ESG practices are influenced by its substantial social economic development problems which require personalized solutions that typically cater to specific local needs while considering international responsibilities [1].

The origins of ESG policies in China date to the 2010s, when amid growing domestic and international pressures for environmental sustainability. Uncontrolled industrialization in 1990s and early 2000s led to environmental contamination throughout the country, resulting in a stringent environmental regulation by government [2]. During the embryonic phase (2013–2016), ESG actions in China were mainly rooted in environment-driven policies, especially focused on air quality control level, more energy saving and resource efficient. The domestic concern over air pollution and pressures from China's role in the Paris Agreement negotiations [3] have spurred these efforts.

The middle (2017–19) was more circumspect on ESG, by this time the Chinese government broadened its environmental base to include governance reforms. Institutional changes established are the so-called governance flagship reforms, such as anti-corruption drives and corporate governance improvements or a broad intragovernmental transparency campaign [4]. In this context, the governance reforms were aimed at increasing accountability not only in government but also among corporations and thus fit within broader Chinese plans for a more innovation-led economy with balance between regulation/competition. By 2019, China also expanded its focus to social issues — e.g., reducing income inequality, and further improvements in education access and healthcare reform though at a more modest pace compared with environmental or governance policies [5].

The current stage (2020–2023) reflects how China has become more advanced in its capacity to develop state-of-the-art ESG policies. In this phase the govt is scaling up its social policies in an attempt to eliminate some of these differences which, were brought further into sharp relief during pandemic. Launched in 2020, The "Dual Circulation" strategy which is used to guide China's economic policy moves also took on board ESG principles by centering domestic growth within sustainable framework for the first circulation whereas international development will not only contribute towards climate change and sustainability objectives [6]. Moreover, China's 14th Five-Year Plan (2021–2025) stresses "green development" and includes two key tasks—involving carbon neutrality by 2060—and a more extensive social welfare agenda [7]. This focus on "carbon peaking" and "carbon neutrality", represent China's commitment to global sustainability objectives, together with its position as a frontrunner in renewable energy investment worldwide and green finance [8].

While these are positive steps forward, Chinese ESG policies have significant differences with the developed world's. Social Department Issues have usually taken higher precedence in ESG frame-works, especially from the view of Europe and US where they arise more as social equity & direction governance reforms supported through personal sector involvement& stake-holder stress [9]. In comparison, China is yet to establish a comprehensive ESG framework by the government. Instead, its current environment protection stops at rather macro level with national initiatives on environmental control and local measures in setting up eco-cities or green development zones for flood prevention among others, Govt social aspects only target areas that coincide with 'national governance’ – anti-corruption, poverty alleviation Govt focuses mainly on human rights connected topics - from one-child policy overseas freedom-of-speech suppression. The thesis investigates China's ESG policies and contrasts them with the developed countries, identifies challenges as well as trends in its development issues so far on this frontier.

This research addresses several questions: What are the development trends of China's ESG policy over the past decade? How do these compare with more mature markets? In the next phase of policy development, where does China need to focus more regarding each letter in ESG? This project systematically reviews China's ESG developments in the period of 2013–2021 based on empirical research papers by creating an indicator database with environmental, governance and social dimensions data between for better expectation that what can happen to their policies after 2020 until it will cross boarders globally.

2. Data and methods

In this study, we retrieved data from the Environmental Social Governance (ESG) Data Portal of World Bank which is rich in ESG indicators across countries and regions available. The China data covers 2013 to 2023 and the key ESG dimensions: Environmental (E), Governance(G) and Social (S) policies. These are reputable datasets for understanding policy trends over the last decade. The indicators provide rich, granular data concerning every dimension of China's ESG landscape: from carbon emission and renewable energy penetration to corporate governance transparency and social welfare programs.

Environmental indicators can be measured with such metrics as CO2 emissions per capita, consumption of renewable energy or air pollution levels (evidence on PM 2. 5 and PM10). Given the global climate commitment and its domestic pollution-reduction targets, these indicators are critical for evaluating China’s environmental policies [10]. Governance indicators monitor corporate governance, regulatory transparency and anti-corruption reforms. This lies at the foundation of China's ESG initiatives, and demands us to apprehend how these governance metrics tend work in its structural reforms. The social indicators include income distribution, healthcare availability, educational access and outputs as well as reduction of poverty in addition to other important aspects that might not yet allow for concrete conclusions with tight international comparisons but exhibit the efforts China is undertaking towards more balance societal developments.

These country-specific data were supplemented by datasets from the same ESG Data Portal of developed countries in Europe and North America for cross-country comparisons. However, these datasets underline how ESG compliance in China compares and contrasts to global ESG benchmarks. The approach also facilitates the detection of differences in policy focus between China and developed economies, particularly with respect to social equity or corporate governance conditions favourable for growth enjoyed by companies situated in advanced countries.

Python was used to process and analyze the data, with normalization techniques applied in order to balance comparisons along indicators/countries. These indicators were then grouped into the categories of ESG (environmental, governance and social) so as to identify trends in decision making processes overall over time. The analysis offers a basis for interpretation of the direction China is taking in ESG and what implications this has for future policy configurations.

The analysis can be decomposed into three main sections: China ESG policy trend review, developed jurisdictions comparative evaluation and staged development of policies consideration.

1. Trend Analysis: The data were analysed to lift the key trends in China ESG policies from 2013–2023. This resulted in annual average values for each of the ESG categories (E, G and S) across all indicators. The authors then charted these averages to map the changes in China's attention across every ESG factor over two decades. In order to calculate the main trend of policy development, all trends were further averaged for each stage: early stage (2013–2016), middle stage (2017– 2019) and current one that is divided into isolation years — until improvement in indicators developed—in 2020 with projection to be continued through at least part of year 2023.

2. Comparative Analysis: The same approach was applied to datasets in the U.S., UK, and Germany respectively ensuring that we will be able assess where China's ESG policies overlap with international practices or diverge. It drew the ESG trends for each country’s normalized data compared with China. This made it possible to pinpoint areas where China had policy priorities that were different from those of developed countries and achieved a high degree of consensus, with the exception of governance and social dimensions — places in which developing countries tended to lag behind their already established frameworks.

3. Stage-based Policy Review: Analyzing how ESG policy priorities have evolved within China by breaking it down into different stages. To that end, we have taken an analytical approach by calculating average values of the selected ESG indicators for three separate time periods: early stage (2013–2016), middle stage (2017– 2020) and current operating base (2021-...). This study determined important trends of focus within policy by aggregate the values for each period. Environmental indicators were improving continuously from the most accessible site to latest stage, whilst social policies had a slower progression.

3. Results and discussion

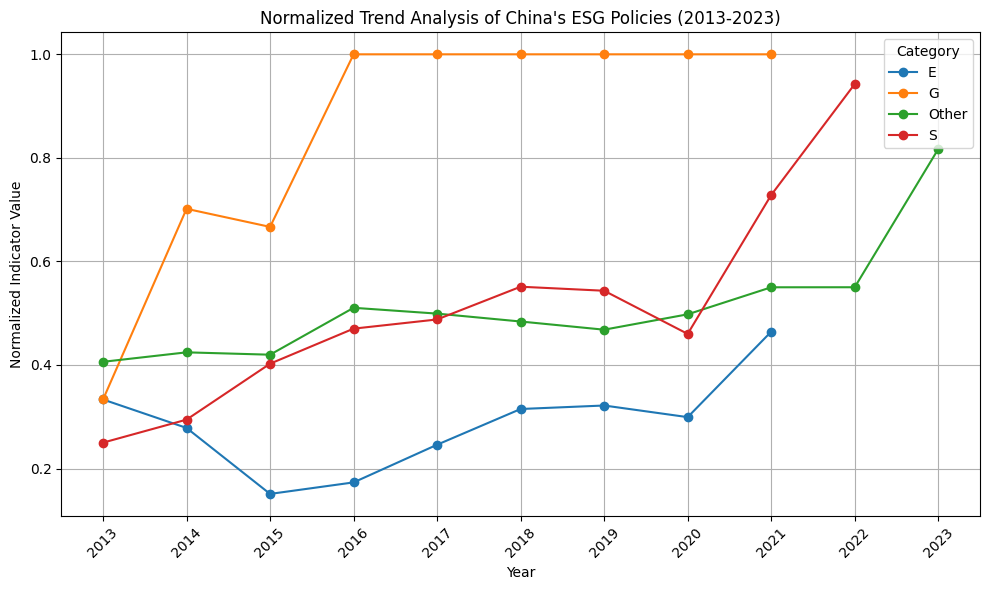

The analysis of China's ESG policy development from 2013 to 2023 reveals distinct trends across the environmental (E), governance (G), and social (S) dimensions. As shown in Table 1, the early years (2013–2016) saw steady growth in environmental sustainability efforts, with the "E" category indicators increasing from 22.48 in 2013 to 24.57 in 2016. This reflects China’s heightened focus on reducing carbon emissions and implementing stricter air quality regulations. By 2020, the environmental indicators had reached 27.29, highlighting the continued emphasis on renewable energy adoption and pollution control (Figure 1). However, the environmental trend remained moderate compared to other categories, particularly governance.

|

Category |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

E |

22.5 |

23.2 |

23.8 |

24.6 |

25.4 |

26.1 |

26.7 |

27.3 |

28.1 |

- |

- |

|

G |

65.2 |

65.1 |

64.7 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

- |

- |

|

Other |

29307.4 |

32589.7 |

38195.9 |

49255.9 |

49708.3 |

50175.9 |

46777.9 |

57451.7 |

81823.8 |

24929.8 |

44460.7 |

|

S |

41.6 |

42.3 |

42.9 |

43.7 |

44.3 |

45.3 |

52.5 |

47.3 |

- |

- |

- |

Governance (G) indicators in China demonstrate a different trajectory. From 2014 onwards, the governance indicators reached a maximum of 100, as shown in Table 1 and Figure 1, reflecting a decade of policy consistency. The stability in the governance sector points to China's commitment to corporate governance reforms, regulatory transparency, and anti-corruption campaigns. These policies remained robust throughout the middle and current stages, without significant fluctuations. The consistency of governance policies highlights the long-term focus on enhancing regulatory frameworks and corporate transparency in China, aligning with international expectations for governance improvements.

The "Other" category, which includes miscellaneous ESG indicators beyond the core environmental, social, and governance metrics, shows significant fluctuations over the studied period. These indicators increased dramatically, peaking in 2021 with a value of 81,823.8, before declining sharply to 24,929.8 in 2022. This category's variability reflects broader policy integration efforts, where sporadic policy adjustments are made to address specific challenges, such as economic volatility and new governance frameworks (Figure 1). The fluctuating nature of these policies suggests that China is experimenting with new frameworks to integrate diverse ESG goals, which may continue to fluctuate until they stabilize.

Social (S) policies, while growing steadily, showed slower progress relative to the environmental and governance dimensions. Starting at 41.63 in 2013, social indicators had only modest increases over the decade, reaching 47.30 in 2020 and climbing to 52.54 in 2019 before declining slightly (Table 1, Figure 1). This slower growth indicates that while China has made some strides in addressing income inequality, healthcare access, and education, these areas require further policy focus to match the country’s environmental and governance achievements. The potential for expansion in social policies is significant, especially in light of the disparities highlighted during the COVID-19 pandemic.

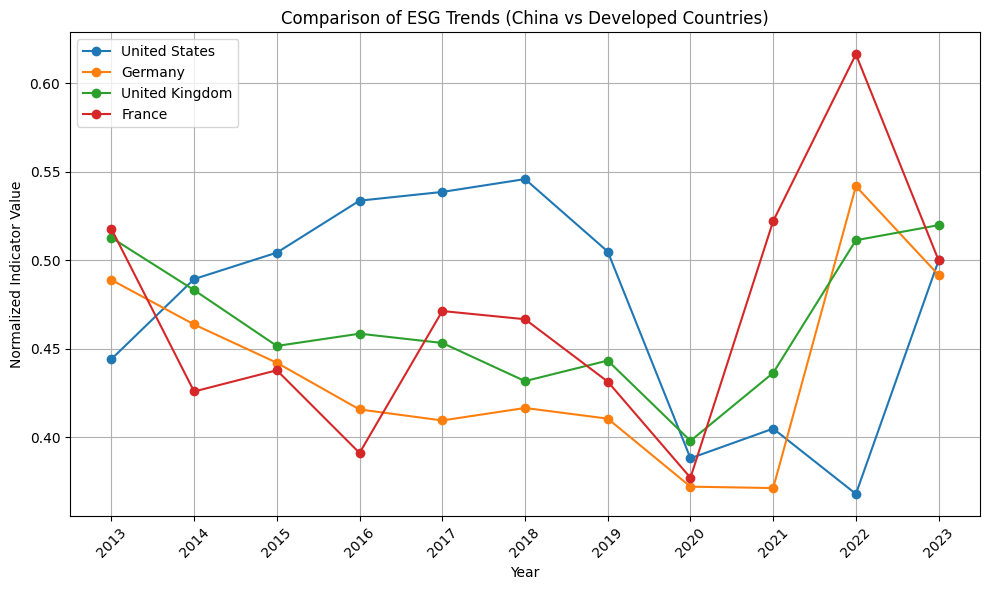

When comparing China's ESG trends with those of developed countries, as seen in Figure 2, notable differences arise. While the United States and the United Kingdom demonstrate relatively stable trends in ESG policies, with gradual improvements across all three dimensions, China shows a more rapid and variable trajectory. For example, governance in China has remained consistently high since 2014, whereas countries like Germany and France experienced fluctuations in their governance indicators, reflecting changing political priorities. In contrast, China’s social policies lag behind those of the developed nations, where social equity has been a more significant focus.

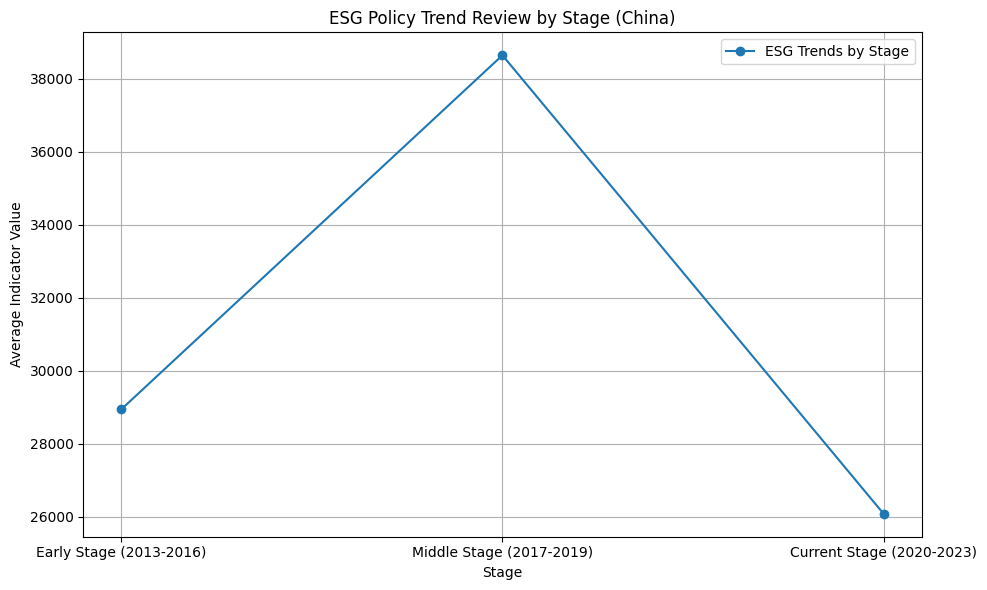

The stage-based review (Figure 3) reveals a peak in ESG efforts during the middle stage (2017–2019), where the average indicator values reached 38,000, before declining in the current stage (2020–2023) to approximately 26,000. This decline reflects the challenges posed by the COVID-19 pandemic and economic shifts, which may have caused a temporary slowdown in policy implementation. However, the steady increase in social and environmental policies toward the end of the current stage suggests that China is poised to ramp up its ESG efforts in the coming years.

Based on these findings, several key points for the next stage of China's ESG policy development can be identified (Table 2). First, there is a clear need for continued growth in social policies, especially given the relatively slow progress made in this area. Environmental sustainability will likely remain a key focus, given the steady upward trend in environmental indicators and China's commitments to global climate goals. Governance policies, while stable, may need to adapt to new global expectations for transparency and corporate accountability. Finally, the fluctuating nature of the "Other" category suggests that broader policy integration, especially in response to external economic shocks, will be critical moving forward.

|

Category |

Key Observations |

|

E |

Increased focus on environmental sustainability in recent years |

|

G |

Stable governance policies over the past decade |

|

S |

Social policies showing slow growth, with potential for expansion |

|

Other |

Other categories showing significant fluctuations, reflecting broader policy integration |

4. Conclusion

This paper has reviewed the progress of China's Environmental, Social and Governance (ESG) policies over 2013–2023 in all dimensions based on such a background for comparison with developed countries. Our results would imply that compared to social policy development, China has been more successful in the fields of environmental sustainability and governance. Your question hits on my optimistic lean that the environmental policies are things like a moat which keeps rising ARPU, helped by China setting goals to slash their emissions and shift onto renewables in earnest. The stability of governance policies allows for the continued improvement or development in corporate governance, regulation transparency and anti-corruption measures.

The analysis reveals the most active period of ESG policy development in China was during the middle stage (2017–2019), with certain progress made especially across governance and environmental indicators. Nevertheless, the decrease in some indicators — especially within social sphere— shows that a reorientation towards consideration of equitable and well-being policies is necessary from here on out as China balances between post Covid-19 consequences and significant global economic changes.

Compared with the United States, Britain, Germany and other developed countries show that China's governance policy implementation is as rigorous as those of major Western economies. Conversely, its social policies point at slower improvements that may highlight some areas as potential for future development such as healthcare, education and income inequality reduction. Solving these social issues could improve the country's overall ESG framework, making it consistent with international standards.

In the long term, China will probably prioritize environmental sustainability and governance reform in its future ESG efforts. It appears clear, though that largest area of future progress is social policies — where the country trails significantly despite its green and governance leadership. Closing this gap will be critical as China emerges onto the global stage as a new sustainability leader. The Evolutionary nature of the wider policy scope also suggests that future adaptations will be needed to ensure that China's ESG policies can align with those regionally and globally. China is at a stage in its ESG development where an integrated approach covering social welfare improvements as well as environmental and governance initiatives has become necessary.

References

[1]. Zeng, L., Li, H., Lin, L., Hu, D. J. J., & Liu, H. (2024) ESG Standards in China: Bibliometric Analysis, Development Status Research, and Future Research Directions. Sustainability, 16(16), 7134

[2]. Beyer, S. (2006) Environmental law and policy in the People's Republic of China. Chinese journal of international law, 5(1), 185-211.

[3]. Xiong, W., Tanaka, K., Ciais, P., & Yan, L. (2022) Evaluating China’s role in achieving the 1.5° C target of the Paris Agreement. Energies, 15(16), 6002.

[4]. Xi, T., Yao, Y., & Zhang, Q. (2021) Purifying the leviathan: The anti-corruption campaign and changing governance models in China. working paper.

[5]. Dalen, K. (2020) Welfare and social policy in China: building a new welfare state. In The socialist market economy in Asia: development in China, Vietnam and Laos (pp. 267-290). Singapore: Springer Singapore.

[6]. Wu, Y. (2023) ESG Transformation in the Largest Emerging Capital Market of China. A Literature Review. Корпоративные финансы, 17(4), 132-150.

[7]. NDRC (National Development and Reform Commission). (2021) "China’s 14th Five-Year Plan (2021-2025)." NDRC Reports.

[8]. UNFCCC (United Nations Framework Convention on Climate Change). (2020) "China’s Commitment to Carbon Neutrality by 2060." UNFCCC Bulletin.

[9]. OECD. (2018) "ESG Frameworks in Developed Economies: Europe and North America." OECD Policy Briefs.

[10]. World Bank. (2023). "ESG Data Portal." Retrieved from https: //esgdata.worldbank.org/?lang=en.

Cite this article

Fang,G.(. (2025). Analysis of ESG Policy Development in China: Trends, Comparisons, and Future Implications (2013–2023). Advances in Economics, Management and Political Sciences,217,190-196.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zeng, L., Li, H., Lin, L., Hu, D. J. J., & Liu, H. (2024) ESG Standards in China: Bibliometric Analysis, Development Status Research, and Future Research Directions. Sustainability, 16(16), 7134

[2]. Beyer, S. (2006) Environmental law and policy in the People's Republic of China. Chinese journal of international law, 5(1), 185-211.

[3]. Xiong, W., Tanaka, K., Ciais, P., & Yan, L. (2022) Evaluating China’s role in achieving the 1.5° C target of the Paris Agreement. Energies, 15(16), 6002.

[4]. Xi, T., Yao, Y., & Zhang, Q. (2021) Purifying the leviathan: The anti-corruption campaign and changing governance models in China. working paper.

[5]. Dalen, K. (2020) Welfare and social policy in China: building a new welfare state. In The socialist market economy in Asia: development in China, Vietnam and Laos (pp. 267-290). Singapore: Springer Singapore.

[6]. Wu, Y. (2023) ESG Transformation in the Largest Emerging Capital Market of China. A Literature Review. Корпоративные финансы, 17(4), 132-150.

[7]. NDRC (National Development and Reform Commission). (2021) "China’s 14th Five-Year Plan (2021-2025)." NDRC Reports.

[8]. UNFCCC (United Nations Framework Convention on Climate Change). (2020) "China’s Commitment to Carbon Neutrality by 2060." UNFCCC Bulletin.

[9]. OECD. (2018) "ESG Frameworks in Developed Economies: Europe and North America." OECD Policy Briefs.

[10]. World Bank. (2023). "ESG Data Portal." Retrieved from https: //esgdata.worldbank.org/?lang=en.