1. Introduction

Over the past five years from 2019 to 2024, China has rapidly emerged as one of the most important players in the global electric vehicle (EV) industry. This has been made possible by the Chinese government's unwavering determination to implement its national strategy. This resulted in a series of policies, and regulations that aimed at accelerating and boosting the production and promotion of EVs. This has not only greatly promoted the development of China's domestic new energy vehicle market, but has also enabled China to occupy a pivotal position in the global market, becoming one of the world's largest exporters of new energy vehicles. Many Chinese brands are placing greater than before with new strategies made. They are focusing on research and development of battery technology, electric vehicle infrastructure, and innovations in environmental sustainability, further solidifying their position as the world's leading manufacturer of new energy vehicles. Aurélien Duthoit [1] from Allianz said in the Chinese challenges to the European automotive industry, that China “now leads the global EV landscape, selling over double the number of BEVs in 2022 compared to Europe and the US combined, while also holding a competitive edge in nearly all aspects of the BEV value chain.” This shows, that today, Chinese brands rank among the world's biggest producers of new energy vehicles in terms of production and market share. EVs brought economic booms to those brands, and they also led driven technological advances and increased brands’ influence in the global sustainable energy arena.

However, as China's new energy vehicle market has boomed, it also brings new challenges. Recognizing the opportunities and potential threats posed by China's new energy vehicle expansion, the European Union (EU) market quickly responded with tough import policies. These policies protect the local European industries while guaranteeing the market’s competition fairness. They mainly include tariffs on imported new energy vehicles, stricter environmental and safety standards, and also relative regulatory measures. For example, the EU recently announced a new battery law that will replace the old ones in 2025, and the EU also plans to start new traffic which is named Carbon Border Adjustment Mechanism (CBAM) to increase tax on carbon-intensive products. Thus, for Chinese new energy vehicle manufacturers entering the European market, they are under a passive situation which includes competitive pressure and many challenges. The situation reveals the vulnerability of China's new energy vehicle industry in response to economic policies in the European region, so Chinese new energy vehicle manufacturers are at risks of shocks admitting fluctuating international trade relations.

Therefore, Chinese new energy vehicle manufacturers are vigorously exploring and making new strategies. These strategies include increasing investment in overseas production facilities, establishing closer and stronger partnerships with European local companies, and fulfilling market standards by improving product quality and technology. In the future, whether China's new energy vehicle industry can continue to maintain its global leadership position will largely depend on its ability to respond flexibly to the changing economic and regulatory environment while continuing to innovate and lead the way in green technology. In this study, the goal is to research how Chinese EV companies face a series of challenges and impacts on export in the European market and find out if there is a better solution for them in the future.

2. The impact on China's foreign trade balance

According to the fact sheet of the European Automobile Manufacturers Association, “China is the third largest market by value for EU vehicle exports after the US (ranked first) and the UK (ranked second)” [2]. China has been one of the major suppliers of electric vehicles and electric vehicle parts to Europe, and it has made positive contributions to maintaining the trade balance between China and the EU.

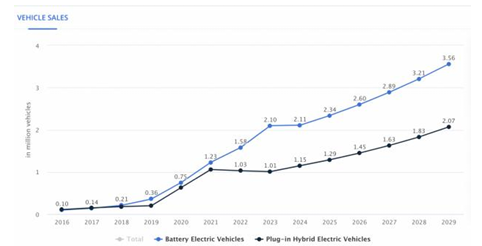

As stated in data provided by Statista Market Insights, the demand for electric vehicles in Europe is increasing.

From 2019 to 2023, Chinese manufacturers benefited from the growing demand for EVs in Europe. European authorities implemented a series of measures to urge the uptake of EVs, such as subsidies, tax breaks, and investments in charging infrastructure. The introduction of strict emissions regulations by the European Union, such as the EU Green Deal and targets for reducing CO2 emissions, had a substantial impact on increasing demand for NEVs. Moreover, sales of new energy vehicles have a sharp rise due to policy support and increased consumers' awareness of environmental protection. Thus, China's share in the European EV market increased, bolstering overall export figures. Over the next five years, Chinese exports could face headwinds as Europe tightens import regulations, raises tariffs, or encourages local production through subsidies and quotas. Reduced access to European markets could hurt China's export earnings and trade balance, especially if Chinese manufacturers are unable to offset the losses by entering new markets or increasing domestic sales. Chinese manufacturers may respond by setting up local production facilities in Europe, mitigating some of the negative impact on exports.

3. The impact of manufacturing and industrial output

European demand for Chinese electric vehicles has led to an expansion of domestic manufacturing capacity. In the period from 2019 to 2023, to meet the growing demand in Europe, Chinese electric vehicle manufacturers have increased production. This includes building new plants, expanding existing ones, and increasing automation to increase production. The demands on supplying the European market urged investment in battery production, semiconductors, and raw materials which ends up with a wider supply chain. “China dominates almost every stage of the battery manufacturing process,” as a report from the International Energy Agency makes clear. This expansion led to the growth of industrial production, the creation of jobs, and technological progress in China. The improvement of manufacturing capacity from the push has also driven innovation in production technologies. For example, smart manufacturing, the use of artificial intelligence (AI), and robotics, to make EV production in China more efficient and cost-effective.

In the future from 2024 to 2029, European regulations will possibly impose restrictions on the import of Chinese EVs, because of overcapacity for domestic manufacturers. This could lead to increased price competition as manufacturers try to absorb excess production capacity by lowering prices to attract consumers. Additionally, manufacturers' profit margins may be squeezed by intensified price competition and potential increases in raw material costs. The surplus capacity could also result in an accumulation of finished car inventory, directly increased warehousing costs, and capital occupancy that impact cash flow. In response to this situation, companies may consider reducing production shifts or temporarily halting production to address the excess capacity, and it could have implications for employee morale and employment stability.

To adapt, Chinese enterprises need to redirect their attention towards innovation, and enhancing operational efficiency, or they can venture into new market segments to maintain sustainable industrial growth.

4. The impact of China's Foreign Direct Investment and joint ventures

The attraction of Foreign Direct Investment (FDI) is a critical component of economic growth. The European EV import policy can significantly impact China's Foreign Direct Investment (FDI) and joint ventures between 2019 and 2023.

The expansive domestic market of China, with its growing middle class and increasing demand for electric vehicles, has been a major draw for foreign investors. FDI inflows contribute substantial capital to China, which is utilized for establishing production facilities, procuring equipment, and recruiting the labor force, all of which serve to invigorate economic expansion. In the context of China, FDI associated with the electric vehicle sector has played a pivotal role in funding the swift amplification of manufacturing capacity and infrastructure enhancement.

Foreign direct investment usually creates job opportunities. In China, foreign companies have built new production facilities and research and development centers, creating jobs for engineers, factory workers, and professionals. This not only reduces unemployment but also helps to develop a skilled workforce. BMW has had a joint venture with Brilliance China Automotive Holdings for several years to produce BMW cars in China. With the growing importance of the electric vehicle market, BMW has invested heavily in China to expand its electric vehicle production capacity. In 2022, BMW's stake in the joint venture increased from 50% to 75% [3]. BMW has also invested in its production facilities in Shenyang to increase its capacity for electric vehicle production. These plants are central to BMW’s strategy of meeting Chinese consumer demand for luxury EVs. The milestone of the six millionth car, the fully electric model BMW i5, rolling off the production line at China's Dadong plant underscores the success of BMW Brilliance Automotive's joint venture. Notably, it only took 15 months to produce the last million cars, showcasing the exceptional research and development capabilities of the Shenyang plant [4].

While foreign direct investment (FDI) has the potential to stimulate economic growth, an excessive dependence on foreign investment carries inherent risks. If foreign investors divest as a result of economic downturns, policy adjustments, or geopolitical tensions, it could trigger economic instability in the recipient country.

Over the long term, the influx of foreign direct investment (FDI) is very important for sustaining China's economic growth, because the influx broadens its access to capital and advanced technology. Furthermore, it has facilitated the country's transition from a manufacturing-oriented economy to one that increasingly prioritizes high-tech industries and fosters innovation

5. Impacts of EU’s laws and regulations on Chinese EV companies

The European Union (EU) legislated a series of laws regulating and improving the local market with high-quality products and environmental protection standards. Chinese EV companies have also made corresponding measures on their operations and decision-making on market access to adapt to the EU market laws and regulatory agencies.

In the Prohibiting products made with forced labor on the Union market, the contents aim to ensure that all products entering the EU market do not involve any forced labor. The implementation of this act requires Chinese EV companies to follow rigorous social responsibility standards in their production processing and supply chain management. Under this act, the EU carefully inspects all products for sources of forced labor, and this is a significant notice for all Chinese EV companies. In response to the act, these Ev companies should track and report in detail on every aspect of their supply chain to ensure that all raw materials and components are produced without forced labor [5]. Thus, this requirement will add extra compliance costs for Chinese EV companies. Companies will need to invest and build more appropriate supply-chain management systems to improve their transparency and meet compliance, such as detailed scrutiny of suppliers, implementation of monitoring mechanisms, and the potential need to reorganize and restructure the supply chain. In addition, the EU customs strengthen their investigation of companies violating products and take necessary enforcement measures. Therefore, Chinese EV companies will face risks such as delays in product imports, market bans, and fines when if they fail to provide products that fit the compliance.

The Battery Regulations and related laws set out standards for batteries and accumulators for environmental protection. These regulations cover battery composition limits, recycling and reuse requirements, and marking specifications. Chinese EV companies need to be aware of these requirements. This means the use of battery materials must be strictly controlled during the production process to ensure compliance with EU environmental standards. For example, hazardous substances in batteries must comply with legal limits. Also, all companies must build efficient recycling and disposal systems limited to regulatory requirements for managing used batteries [6].

On the other hand, compliance costs of Chinese EV manufacturers also increase because of battery labeling requirements. Every battery must be labeled with its chemical composition and accompanied by clear instructions for disposal when entering the EU market. This adds complexity to when manufacturers produce batteries and leads to higher production costs. Chinese EV companies will need to make additional investments to ensure that their battery products comply with these regulations and must also take financial responsibility for battery recycling and disposal. This is a considerable financial burden for companies, especially when entering the European market.

Furthermore, the EU had announced the Carbon Border Adjustment Mechanism which will take effect in 2026. CBAM is a carbon tariff on carbon-intensive products, such as steel,cement, and electricity, imported to the European Union. Guilherme, Etienne, and Antonie mentioned in their research that “In absolute terms, Russia, China, Turkey, and Ukraine are the main EU trade partners in CBAM products, and hence the most exposed countries in external and socio-economic dimensions [7].” As China is one of the main trading partners of the EU, its companies will obviously be significantly affected by CBAM. These companies will face rising costs of their products due to CBAM requirements on imported products, and they will pay additional taxes to export their products if the products are not compliant with CBAM requirements. They will also consider the competitive risk of their products. Since the EU will impose this tariff on Chinese export products, the prices of the products may increase due to the additional costs. This may lead to a decrease in the market share of Chinese electric vehicles in the European Union. Then, Chinese companies will lose their competitiveness with local products.

6. Impact on electric vehicle sales in China

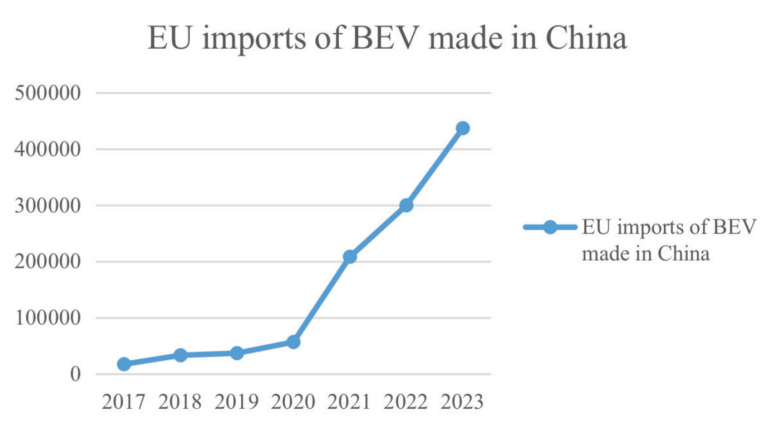

As can be seen from Figure 1 above, China's new energy vehicle exports to Europe began to gradually increase from 2019-2020 [8], and then comes a sharp increase in 2021, thanks to the Chinese government's strong support for the new energy vehicle industry and the European market's increased demand for new energy vehicles. China's new energy vehicle exports exceeded the traditional export of new energy vehicles in Asia, accounting for 48% of new energy vehicle exports, and Europe became the largest region for China's new energy vehicle exports. In 2022, exports increased by 90% year-on-year, with the main export markets being Europe and Asia. China's new energy passenger vehicle exports of 1.73 million units, reaching a strong growth of 55%, to 2023, exports continued to grow, from January to April new energy vehicle exports of 660,000 units, an increase of 27%, the main markets for Brazil, Belgium, the United Kingdom and so on. Total exports for the year reached 437,554 units.

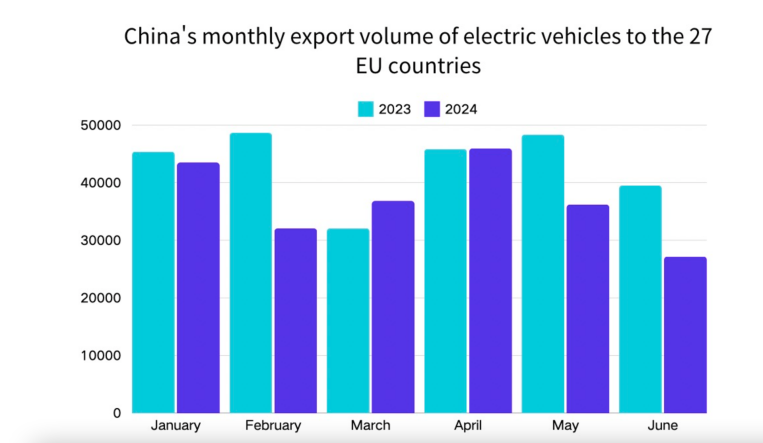

On October 4, 2023, the European Commission officially launched an anti-subsidy investigation into pure electric vehicles (BEVs) imported from China. The European Union plans to impose tariffs on Chinese electric cars on top of the existing 10% import tariff. Saic was slapped with a 38.1 percent tariff, which would bring the rate to 48.1 percent. By contrast, the EU's proposed tariffs on BYD and Geely are much lower than SAIC's, at 17.4 percent and 20 percent respectively. In addition, some EU member states have implemented protective policies for Chinese-made electric vehicles to avoid the impact of Chinese electric vehicles on the local auto industry. For example, the French government announced in September last year that it would introduce new subsidies for electric vehicles from January 2024, which will take into account the carbon footprint of vehicles. On December 14, 2023, France announced the list of electric vehicles eligible for subsidies in the new regulations, each electric vehicle can get a subsidy of up to 7,000 euros, and Chinese-made electric vehicles are not on the list. According to China's General Administration of Customs, monthly exports of electric vehicles in February, May, and June 2024 fell by 34 percent, 25 percent, and 31 percent, respectively, from a year earlier [9].

7. Changes in China's electric vehicle export strategy to Europe

In the context of the European countervailing investigation against China, Chinese car companies will still firmly develop in Europe and speed up the localization process. In December last year, BYD announced that it would build a new energy vehicle production base in Szeged, Hungary. The plant will be completed and put into operation in three years, and in January this year, BYD and the Hungarian Szeged municipal government officially signed a land pre-purchase agreement for BYD Hungary passenger car factory, the construction of the plant will increase local employment opportunities and will contribute to Hungary's green economy transition.

8. The export boom shifted to South-East Asia

In the face of various challenges in Europe, many Chinese car companies have set their sights on Southeast Asian countries. At present, ASEAN countries represented by Thailand, Indonesia, and Malaysia have become an important choice for China's electric vehicle exports. In 2023, BYD sold 30,650 new cars in Thailand, and its share of the electric vehicle market reached 40%. Chinese electric vehicles account for 80% of the market in Thailand's new energy vehicle sector. Statistics from the Malaysian Automotive Industry Association (MAA) show that domestic car sales in Malaysia in 2023 amounted to 799,000 units, up 11% year-on-year. In the first quarter of this year, car sales in Malaysia totaled 202,000 units, up 5% from a year earlier. Malaysia is the second largest automotive market in Southeast Asia after Indonesia.

9. Discussion

In the analysis above, the rise in European demand for electric vehicles significantly benefited Chinese manufacturers, leading to expanded production capacity and technological advancements. However, the EU’s stringent import policies and regulations, battery laws, and future imposed tariffs, on importing Chinese EVs and EV components, reveal the problem of EV overcapacity to Chinese EV companies while introducing substantial cost pressures and market barriers. In response, Chinese manufacturers change their strategies such as building up production lines in Europe and shifting their export target to Southeast Asia. These changes illustrate manufacturers’s proactive approach to diversifying markets and reducing dependency on the European market. Besides, Chinese EV companies increased investment in technological progress in the entire electric vehicle industry and contributed to the long-term development of Chinese electric vehicles in the global market. Thus, Chinese NEV manufacturers will maintain their competitive power in the global market despite external pressures.

10. Conclusion

In conclusion, Chinese EV companies are processing a transformative phase from 2019-2024. The remarkable growth in exporting EVs to Europe also brings significant challenges. The EU’s regulating initiatives have created serious obstacles, causing Chinese manufacturers to increase costs and market uncertainties. Chinese EV companies have performed resilience by realigning their strategies to adapt EU’s import policies and explore to Southeast Asia market. Looking forward to the future, Chinese EV exportation will depend on the ability to monitor and adapt complex import regulations and policies and capitalize on emerging opportunities. These companies should continue to refine their strategies to ensure sustainable growth of their competitiveness in the global market. This study analyzes the economic impact of EU electric vehicle import policies and regulations on Chinese EV manufacturers and provides strategic responses in the EV sector.

Acknowledgement

All the authors contributed equally to this work and should be considered as co-first author.

References

[1]. Duthoit, Aurélien.(2023). the Chinese challenges to the European automotive industry.

[2]. ACEA - European Automobile Manufacturers’ Association, (2024). Fact sheet: EU-China vehicle trade.

[3]. BMW Group. (2022). Ad-hoc: BMW AG acquires majority stake in BMW Brilliance Automotive Ltd. leading to full consolidation effective 11 February 2022.

[4]. BMW Group. (2024). Production milestone in Shenyang: BBA reaches 6 million vehicles.

[5]. European Parliament. (2024). Prohibiting products made with forced labour on the Union market.

[6]. European Commission (2023). New Batteries Regulation.

[7]. Magacho Guilherme, Espagne Etienne, Godin Antonie. (2023). Impacts of the CBAM on EU trade partners: consequences for developing countries

[8]. Jorge Liboreiro (2024) Your essential guide to the EU probe into Chinese electric cars

[9]. China Automotive News(2024)China's exports of pure electric vehicles to the European Union fell more than 30 percent in June from a year earlier

Cite this article

Jiang,X.;Wang,P. (2025). Navigating Challenges and Opportunities: China's Electric Vehicle Exports to Europe 2019-2024. Advances in Economics, Management and Political Sciences,217,173-180.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Duthoit, Aurélien.(2023). the Chinese challenges to the European automotive industry.

[2]. ACEA - European Automobile Manufacturers’ Association, (2024). Fact sheet: EU-China vehicle trade.

[3]. BMW Group. (2022). Ad-hoc: BMW AG acquires majority stake in BMW Brilliance Automotive Ltd. leading to full consolidation effective 11 February 2022.

[4]. BMW Group. (2024). Production milestone in Shenyang: BBA reaches 6 million vehicles.

[5]. European Parliament. (2024). Prohibiting products made with forced labour on the Union market.

[6]. European Commission (2023). New Batteries Regulation.

[7]. Magacho Guilherme, Espagne Etienne, Godin Antonie. (2023). Impacts of the CBAM on EU trade partners: consequences for developing countries

[8]. Jorge Liboreiro (2024) Your essential guide to the EU probe into Chinese electric cars

[9]. China Automotive News(2024)China's exports of pure electric vehicles to the European Union fell more than 30 percent in June from a year earlier