1. Introduction

1.1. Research background

China is experiencing a rare population aging process in the world. Currently, it has entered the stage of deep aging and is accelerating its evolution towards severe aging, presenting the prominent characteristics of "large scale, fast growth rate and high degree". According to data from the Ministry of Civil Affairs of the People's Republic of China, by the end of 2024, the population aged 60 and above in China had reached 310 million, accounting for 22.0% of the total population; the population aged 65 and above was 220 million, accounting for 15.6%, which far exceeded the international standard for deep aging.

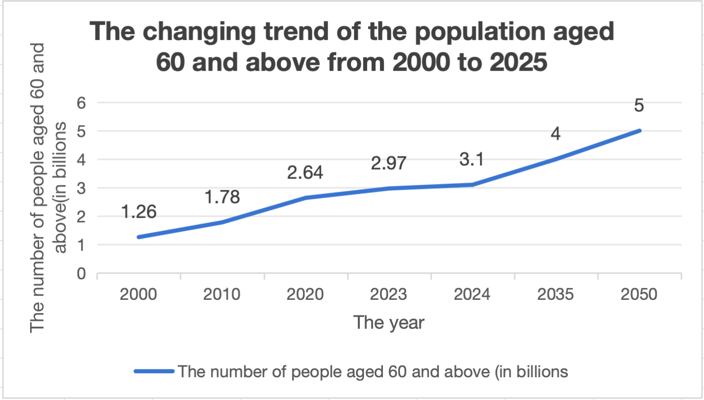

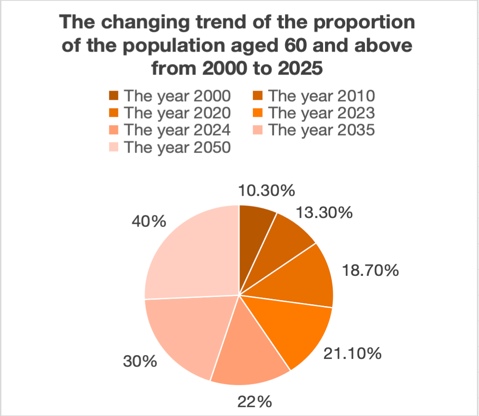

From the perspective of development stages, China's aging process can be divided into two key periods. The first is the "initial aging" stage from 2000 to 2010, during which the population aged 60 and above increased from 126 million to 178 million, with its proportion rising from 10.3% to 13.3%, and the growth rate was relatively stable. The second is the "rapid aging" stage from 2010 to 2024. In this decade, the population aged 60 and above increased by a net 132 million, with an average annual growth of over 9 million, which was 1.7 times that of the previous stage.

From the perspective of long-term trends, it is estimated that by 2035, China's population aged 60 and above will exceed 400 million (accounting for over 30% of the total population), officially entering the stage of severe aging. By the middle of this century, the scale of this population group will reach 500 million (accounting for nearly 40% of the total population), and the problems of advanced aging and disability will intensify simultaneously.

Parallel to the aging process is the rapid digital transformation in China, where digital technology has been deeply integrated into social operations and residents' daily lives. According to the 55th Statistical Report on Internet Development in China released by the China Internet Network Information Center (CNNIC), as of December 2024, the number of netizens in China had reached 1.108 billion, with the internet penetration rate rising to 78.6%. In the payment sector, the number of online payment users stood at 1.029 billion, accounting for 92.9% of the total netizens. Intelligent payment has become the mainstream choice in scenarios such as shopping, bill payment, and medical treatment.

However, the elderly group shows obvious characteristics of being "digitally marginalized". On one hand, there is a gap in digital access: elderly people aged 60 and above account for nearly 40% of the total non-netizens in China. Even among elderly people who have accessed the internet, their internet penetration rate is far lower than the national average. On the other hand, their digital application ability is insufficient. Although the proportion of netizens aged 50 and above increased from 32.5% in 2023 to 34.1%, only a small number of elderly people can proficiently use mobile payment. This creates a significant digital divide between the elderly and other age groups, making it difficult for the elderly to enjoy the convenience brought by digital technology simultaneously. In some cases, they even face obstacles in "cashless" scenarios, which has become a core bottleneck restricting their integration into the digital society.

1.2. Policy responses

In the governance of the elderly digital divide, countries around the world have built diverse support systems around the field of smart payments, forming a common governance logic and demonstrating differentiated practices to help elderly people integrate into digital life. At the level of institutional protection, China will implement the "Law of the People's Republic of China on the Construction of Barrier free Environment" in 2023, which clarifies the optimization of elderly friendly services by payment institutions. The State Council and the Ministry of Industry and Information Technology have successively issued policies requiring payment apps to set up an "elderly mode" and retain manual services, and proposed the goal of full coverage of mainstream payment app elderly modes by 2025; The European Union has mandated payment platforms to adapt to accessibility features through the Digital Services Act, imposing a maximum fine of 6% on global revenue for companies that fail to meet the standards. The United States has improved rural broadband through the Infrastructure Act, increasing the monthly subsidy for elderly internet fees to $50 in 2023, and introducing anti-fraud guidelines. By 2024, elderly payment fraud cases will be reduced by 27%.

At the level of scenario implementation and practice, countries focus on combining resources and services to promote policy implementation. The People's Bank of China is promoting the deployment of payment guides in bank branches, hospitals are launching a "green channel for elderly medical payment", and Shanghai and Guangdong are incorporating smart payment training into community elderly care, with a coverage of over 18 million elderly people by 2024; Japan relies on the "Care Insurance System" to subsidize the research and development of elderly friendly payment devices. Payment training will be conducted in communities in 2023, and the usage rate of elderly smart payments will reach 58% by 2024; Singapore has organized volunteer paired teaching through the "Digital Bridge Program" and set up community "digital service stations". By 2024, the usage rate of elderly payment will increase from 32% to 61%. Countries such as Germany and France also provide "elderly digital allowances" to lower the threshold for elderly use and jointly build an inclusive digital payment environment.

1.3. Research significance

Smart payment is the "basic entrance" to digital life, and solving the dilemma of smart payment for the elderly has dual value. On the one hand, the elderly group is an important part of society. With the deepening of population aging in China, it is an inevitable requirement of social development to pay attention to the quality of life and social integration of the elderly group. In the digital age, smart payments have widely penetrated into various scenarios of life, such as shopping and consumption, medical payment, transportation, etc. Solving the smart payment dilemma of the elderly can effectively improve their convenience and happiness in life, promote social equity and harmony. On the other hand, in-depth exploration of the dilemma of intelligent payment for the elderly population can help us to have a more comprehensive understanding of the root causes and impacts of the digital divide, provide scientific basis for formulating targeted and effective policies, and help promote the balanced development of digital technology in the whole society, so that the digital dividend can benefit everyone, especially those elderly groups who are in a disadvantaged position in the digitalization process, and further promote the improvement of China's digital society construction, achieving sustainable economic and social development.

2. Literature review

2.1. Research on the theory of digital divide

The theory of digital divide was proposed by the United States National Telecommunications and Information Administration in the 1990s. Its connotation has been continuously enriched and expanded through scholars' research, making it a highly complex and dynamic phenomenon [1]. Norris divided the digital divide into three major gaps: global, social, and democratic. Wei Lu and others further analyzed it from three levels: access gap, usage gap, and knowledge gap [2]. The access gap manifests as disparities in digital technology access opportunities among different groups. Lu Jiehua and others' research showed that in 2024, the proportion of elderly internet users aged 60 and above in China was only 14.3%, and the internet penetration rate in rural areas was 55.9%, significantly lower than that in urban areas (83.3%). Rural elderly face significant barriers in equipment acquisition and network coverage [3], and Chen Runqing found that the elderly population in China generally lacks enthusiasm for actively learning smart devices [4]. The usage gap focuses on differences in digital technology usage patterns and skills. Van Dijk's resource and possession theory points out that individuals undergo differentiation in four stages: digital technology motivation, physical access, skills, and usage [5]. Data from Tencent Research Institute shows that elderly people master 11.5 WeChat functions, far fewer than the 16.8 functions mastered by young people, and only 50% of elderly people can use payment functions [3]. Tang Yong and others found that the consumption needs of the elderly are mainly to ensure basic material life and physical health [6]. The knowledge gap focuses on the social consequences of differences in digital technology usage. Yang Jianghua and others found that over 66.2% of elderly people have encountered online rumors, 37.4% have experienced online fraud, and their ability to discern information and prevent risks is weak, forming a progressive "access-usage-knowledge" gap that exacerbates their social exclusion [7]. Education can buffer this risk [8].

2.2. Research on payment difficulties faced by the elderly

In the study of the predicament faced by the elderly in smart payment, multiple obstacles are intertwined and prominent. From the perspective of payment demand characteristics, He Qinyao's research shows that rural elderly prefer traditional payment methods such as cash and passbooks, with 82.4% preferring to handle transactions at bank counters. This is due to both doubts about the security of mobile payments and the objective limitations of rural areas, where there are fewer bank branches and long distances need to be traveled for transactions [9]. At the technical adaptation level, Ba Shusong et al. point out that smart payment products are often designed with young and middle-aged people as the core, featuring high information density on the interface and complex operational steps. Due to the deterioration of vision and touch, elderly people are prone to making mistakes in scanning and password input, and the lack of a "fault-tolerant" mechanism in payment systems exacerbates technological fear [10]. For example, Sun Huiqian et al. found that elderly people face a huge usage gap when using ride-hailing applications [11]. In terms of security guarantees, Li Zhongxia's research shows that 51% of elderly people have leaked personal information, and 40% have encountered online fraud. Telecommunications fraudsters exploit the elderly's anxiety about their health and weak information acquisition ability to carry out fraud, leading to their "not daring to use even if they want to" [12]. Coupled with issues such as insufficient digital feedback from family members and community training that is divorced from practical needs [13], it further hinders the elderly from integrating into the smart payment system. Solutions need to be sought from multiple dimensions, including technology, systems, and social support.

3. Research question

3.1. Core issues from a theoretical perspective

3.1.1. The "three-layer barrier" under the framework of digital divide theory

The theory of digital divide focuses on the gap formed by different social groups in the acquisition and use of digital technology, with the core being "technological inequality", and its connotation continues to expand with the development of digital technology. The digital divide is not a single dimensional gap, but a multidimensional concept that can be broken down into three levels: access gap, usage gap, and outcome gap.

Under the framework of digital divide theory, the "three-layer barrier" affects the use of digital payments by the elderly. From the perspective of access channels, some elderly people may not be equipped with smartphones due to limited economic conditions, or their old phones may not support mainstream payment apps. Elderly people in rural or remote areas may also face problems such as poor network coverage and high data costs, leading to the inability to connect to the internet when they want to use digital payments; From the perspective of usage, elderly people have skills and psychological barriers of "not knowing how to use" and "not daring to use". In terms of operation, they are prone to lag in the multi-step process of digital payments due to memory decline and unfamiliarity with touch screen operations. For example, they cannot bind bank cards, cannot distinguish between "payment codes" and "receipt codes", and have difficulty identifying fraudulent means in terms of security literacy, making them hesitant to use them with confidence; From the perspective of the results, elderly people find it difficult to enjoy the convenience and benefits of digital payments. They are unable to complete transactions smoothly in scenarios where digital payments are needed, and can only choose cumbersome methods or even give up services. They also miss out on merchant promotions for digital payment users, resulting in relatively higher consumption costs.

3.1.2. Information differentiation within the framework of knowledge gap theory

The knowledge gap theory was proposed by American scholars Ticino et al. in 1970, which refers to the gradual widening of the knowledge gap between groups with higher socioeconomic status and those with lower social status as mass media spreads information extensively. This theory focuses on the gap in knowledge acquisition and accumulation among different social groups, with the core being the "knowledge differentiation" caused by "information inequality".

From the perspective of the knowledge gap theory framework, there is an "information differentiation" among the elderly in digital payments, which is essentially an inequality in the acquisition and accumulation of "digital payment related knowledge", and the gap gradually widens with the complexity of digital payments. In terms of knowledge acquisition, there is a gap between motivation and channels among the elderly. They have a weak perception of digital payment needs, are accustomed to cash transactions, lack active learning motivation, and rely more on their children or communities for information channels. However, due to their children's lack of patience and the professional or fast-paced nature of community training content, they find it difficult to absorb; In terms of knowledge processing, elderly people have a "skill gap" and find it difficult to understand the correspondence between abstract concepts such as "account balance" and "transaction records" and actual cash. They also have a vague understanding of digital risks and may be overly cautious and refuse to use or easily believe in fraudulent language, leading to losses; In terms of knowledge accumulation, digital payment technology iterates quickly, allowing young people to quickly adapt to new features, while older people have slower knowledge updates. The "digital payment knowledge gap" with young people continues to widen, for example, when young people are proficient in using "digital RMB", some older people still cannot transfer money through WeChat.

3.2. Implementation status of questionnaire survey

3.2.1. Questionnaire design and core dimensions

The core theme of this questionnaire is "the dilemma of intelligent payment for the elderly from the perspective of the digital divide", which aims to systematically understand the specific problems encountered by the elderly in the process of using intelligent payment (such as WeChat payment, Alipay, etc.), analyze the manifestations and causes of the digital divide among the elderly, and provide data support for improving the elderly's intelligent payment experience and narrowing the digital divide. The questionnaire structure is divided into five parts, with a total of 21 questions (including open-ended questions), as shown in Table 1.

|

Dimension |

Core content |

Corresponding research objectives |

|

Basic Information |

Interviewee's identity (elderly/children), age, educational level, and residential situation |

Analyzing the correlation between demographic characteristics and digital divide |

|

Current usage status |

Whether to use smart payment, first contact time, usage scenario, monthly frequency |

Describe the "depth of use" of smart payments (frequency+scenario) |

|

Faced with difficulties |

Difficulty in operation, safety concerns, physiological limitations, and channels for seeking help |

Specific obstacles encountered during disassembly and use |

|

Digital divide |

Equipment ownership, proficiency in operation, and channels for obtaining information |

Verify the three-layer structure of "access use result" for the digital divide |

|

Other suggestions |

Overall evaluation and improvement suggestions |

Collect targeted solutions |

3.2.2. Survey object and distribution scope

The survey subjects for this questionnaire are divided into two categories: the direct target is elderly people aged 60 or above, who need to understand their own smart payment usage through the questionnaire. The indirect target is the children (or grandchildren) of the elderly, and from the perspective of family members, it supplements the difficulties and digital divide of the elderly in using smart payments.

The questionnaire is distributed through channels such as WeChat, mutual questionnaire filling, and direct mobile access, covering multiple provinces across the country (such as Beijing, Hubei, Guangdong, Jiangsu, Shandong, etc.). The IP addresses of the collected samples involve more than 30 provincial-level administrative regions, with a certain degree of regional representativeness.

3.2.3. Recycling situation and sample structure

The number of questionnaire responses is sufficient. A total of 135 valid questionnaires were collected, with an average answering time of 70 seconds and a maximum answering time of 1145 seconds (approximately 19 minutes), indicating that respondents generally filled out the questionnaire seriously and the sample data had high reliability.

The sample structure is also relatively rich, as shown in Table 2:

|

Sample classification dimension |

Specific categories |

number of people |

percentage |

|

Identity |

The elderly themselves |

54 |

40% |

|

Elderly children |

81 |

60% |

|

|

Age |

60-69 years old |

84 |

62.2% |

|

70-79 years old |

39 |

28.9% |

|

|

Over 80 years old |

12 |

8.9% |

|

|

educational level |

Never attended school |

17 |

12.6% |

|

primary school |

75 |

55.6% |

|

|

Junior high school and above |

43 |

31.8% |

3.3. The dilemma of intelligent payment for the elderly presented in the questionnaire

3.3.1. Insufficient operational skills: weak ability to use digital tools

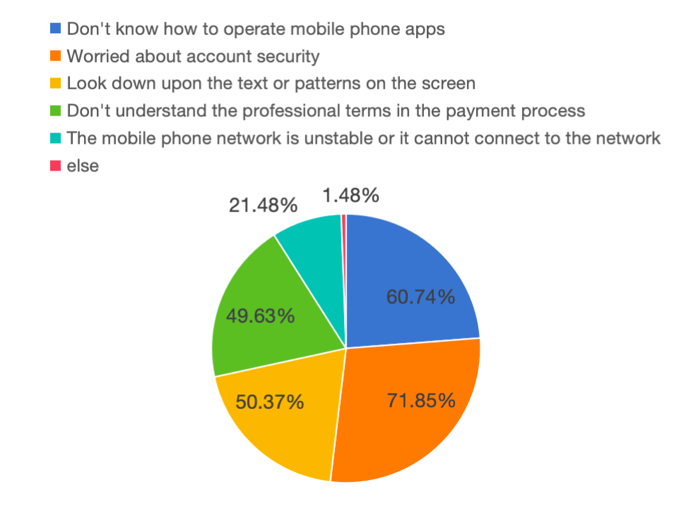

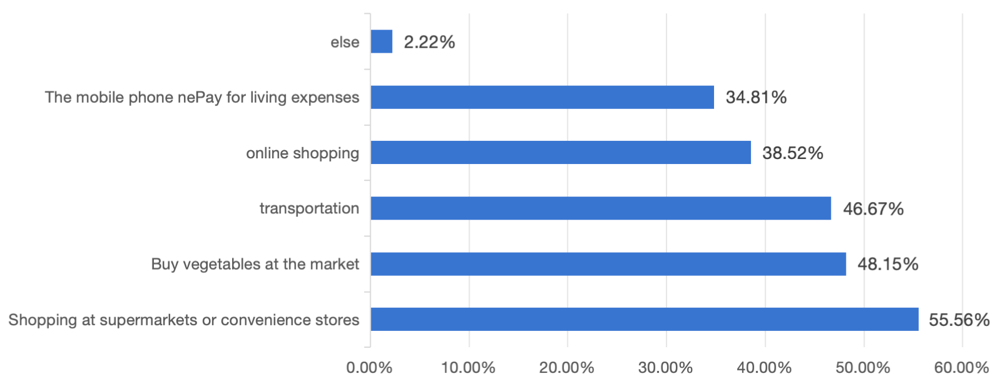

The third part of the questionnaire shows that "not knowing how to operate mobile apps (such as binding bank cards, transferring money, etc.)" (option A) is the most prominent dilemma encountered by elderly people in smart payments, with 71.85% of respondents (or their elderly family members) choosing this option, as shown in Figure 3. Specifically, it manifests as the inability to complete the basic settings of the payment app (such as bank card binding and password modification), unfamiliarity with the entry locations of core functions such as "scan" and "receive/pay", and even accidentally touching advertisements or unrelated buttons during the payment process. At the same time, the selection rate of "not understanding professional terms (such as' verification code 'and' QR code ')" (option D) reached 49.63%, reflecting the lack of awareness of basic concepts in digital payment scenarios among the elderly, leading to interruptions in the operation process.

This lack of skills also directly limits the expansion of smart payment usage scenarios for the elderly - the second part of the questionnaire shows that smart payment scenarios for the elderly are concentrated in offline scenarios such as supermarkets/convenience stores (55.56%) and vegetable markets (48.15%), while the usage rate of complex scenarios such as online shopping (38.52%) and transportation (46.67%) is relatively low, as shown in Figure 4.

3.3.2. Significant safety anxiety: insufficient ability to discern information and perceive risks

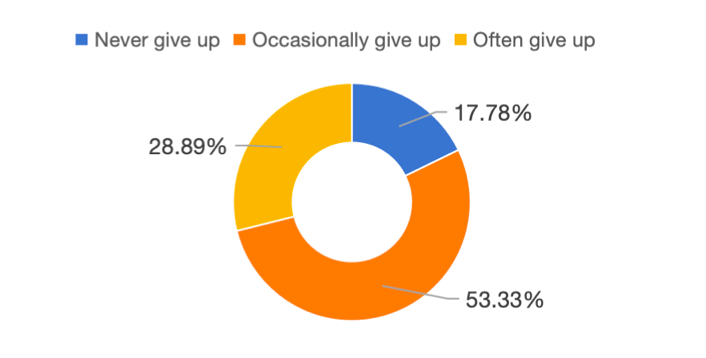

The selection rate of option B, "Worried about account security (such as theft and fraud)" in the questionnaire, reached 71.85%, as shown in Figure 3, which is the second largest dilemma after operational skills. From the perspective of usage behavior, 28.89% of elderly people often give up using smart payments due to safety concerns, and 62.2% of respondents said that their elderly family members only dare to use them with their children, as shown in Figure 5.

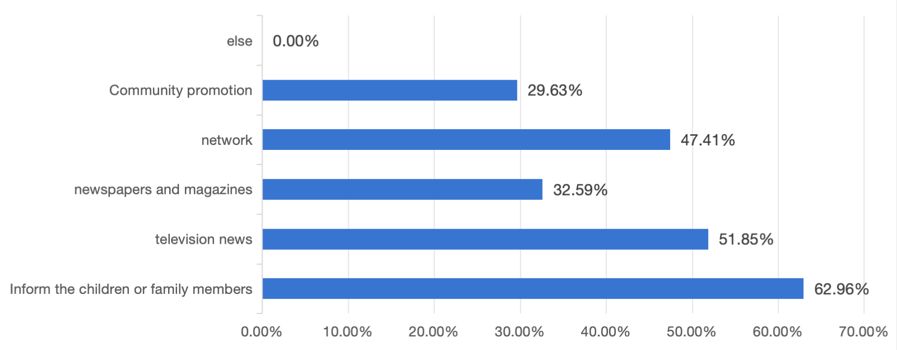

This dilemma is directly related to the ability to discern information: according to the fourth part of the questionnaire, 83.7% of elderly people only have "a little" or "no understanding" of "digital payment related laws, regulations, and security knowledge", and the channels for obtaining security information are highly dependent on "child notification" (62.96%). The proportion of obtaining information through "community promotion" and "online platforms" is relatively low, resulting in weak ability to identify fraudulent means such as fake QR codes and phishing links.

3.3.3. Physiological limitations: insufficient hardware adaptation and ease of use

In the dilemma faced by the elderly, the selection rate of "unable to see screen text or patterns clearly" (option C) is 50.37%, reflecting the contradiction between elderly vision degradation and smart device interface design. Multiple respondents in the questionnaire suggested "increasing font size" and "strengthening voice prompts", which confirms the direct impact of physiological functions on user experience. In addition, the selection rate for option E, which states that some elderly people not only face objective barriers to network access but also lack basic network debugging skills, further limiting the use of smart payments, is 38.5%.

3.3.4. Frequency of use and scene limitations: the "shallow use" feature of digital tools is obvious

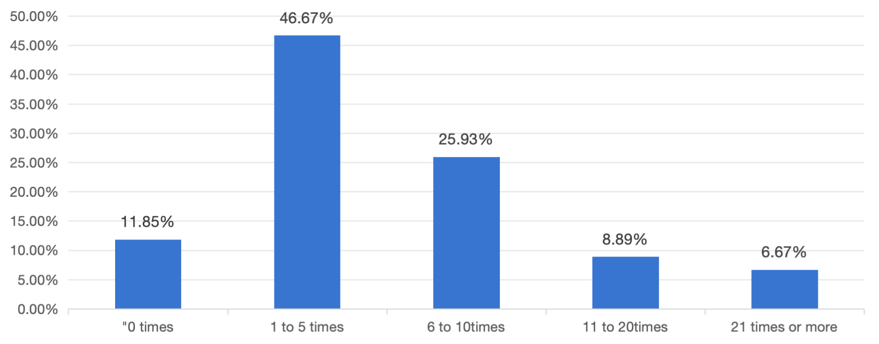

The second part of the questionnaire shows that the "shallow use" feature of smart payment for the elderly is significant: 46.67% of the elderly use it only 1-5 times a month, and 11.85% have "never used it", as shown in Figure 7; In usage scenarios, offline basic consumption (supermarkets, markets) accounts for over 80%, while scenarios involving remote operations such as "paying utility bills" (34.81%) and "online shopping" (38.52%) have lower usage rates, as shown in Figure 4. This "low-frequency, narrow scenario" usage pattern is essentially the result of difficulties such as operational skills and safety anxiety mentioned above - the accumulation of difficulties leads to elderly people actively narrowing their usage range, forming a vicious cycle of "dare not use, do not know how to use → use less → use even less".

3.3.5. Social support dependence: single channel for seeking help and insufficient support

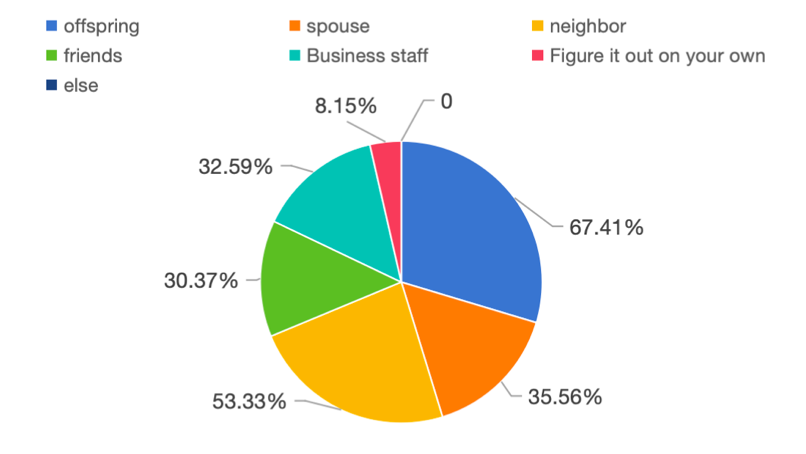

According to a questionnaire survey, when faced with difficulties, 67.41% of elderly people prioritize seeking help from their "children" (option A), while the proportion of seeking help from "businesses" is only 32.59%. 8.15% of elderly people "do not know how to seek help and explore on their own", as shown in Figure 8. This data reflects the high dependence of elderly people on family support, but in reality, some children have limited time and patience, making it difficult to provide continuous guidance, leading to an exacerbation of the dilemma of having no way to seek help.

In summary, the dilemma of intelligent payment for the elderly presented in the questionnaire is essentially a concrete manifestation of the combined effects of the "access use result" three-layer barrier under the digital divide theory and the "information differentiation" under the knowledge gap theory. From the perspective of the digital divide, insufficient operational skills correspond to the lack of digital skills in the "use gap", and safety anxiety and physiological limitations exacerbate the objective obstacles of the "access gap". Narrow usage scenarios and low frequency are direct manifestations of the "result gap", reflecting that elderly people find it difficult to obtain digital dividends through smart payments; From the perspective of knowledge gap, elderly people rely on a single channel to acquire digital payment knowledge, have weak processing capabilities, and lag in accumulation speed, forming a significant "information differentiation", further amplifying the difficulties in operation and security. The interweaving of the two has led to a cycle of "not knowing how to use, not daring to use, and not using well" for the elderly in the field of smart payments, which also confirms the necessity and rationality of analyzing the dilemma of elderly smart payments from a dual theoretical perspective.

4. Research question

4.1. Government departments: overall planning, strengthening guarantees

4.1.1. Building a digital aging friendly policy framework

The government should take the lead in formulating a comprehensive and systematic digital aging development strategy, clarify the goals and tasks of each stage, and ensure the orderly progress of intelligent payment aging transformation work. Establish a special fiscal budget to support digital aging projects and encourage research institutions and enterprises to carry out aging technology research and product innovation. At the same time, establish a cross departmental coordination mechanism to promote collaboration among departments such as civil affairs, finance, industry and information technology, and financial supervision, forming a policy synergy and providing solid policy guarantees for the elderly to integrate into the digital payment environment. For example, reference can be made to the "Opinions of the General Office of the State Council on Further Optimizing Payment Services and Improving Payment Convenience" to refine the implementation plans in various regions and ensure that policies are implemented effectively.

4.1.2. Strengthen the promotion of digital literacy education

Incorporate elderly digital literacy education into the national education system and develop specialized plans for elderly digital education. Integrate online and offline educational resources, and offer free smart payment courses online based on national elderly education platforms, learning powerhouses, and other apps; Offline, with the help of senior universities, community cultural activity centers, and other venues, regular intelligent payment training lectures and practical courses are held. Organize volunteer teams to go deep into the community, provide one-on-one tutoring for the elderly, help them master smart payment operation skills, gradually improve their digital literacy and application abilities, and fundamentally narrow the digital divide.

4.2. Financial institutions: innovative services, optimized experience

4.2.1. Upgrade payment products with aging friendly design

Financial institutions should carry out in-depth aging adaptation of mobile payment apps based on the usage habits and demand characteristics of the elderly population. Simplify the registration, login, and payment processes, remove complex functions, and highlight commonly used functional modules, such as setting up one click payment, family payment, and other convenient functions. Increase the font and icon size of the interface, use high contrast color matching, optimize voice prompt function, and ensure convenient and clear operation for elderly users. At the same time, reasonable payment limits should be set, transaction risk warnings should be strengthened, and big data and artificial intelligence technologies should be used to monitor abnormal transactions in real time to ensure the safety of elderly users' funds. Taking the elderly version of mobile banking apps launched by some banks as an example, the interface is simple and clear, and the operation steps are greatly simplified, which has been highly praised by elderly users.

4.2.2. Optimizing aging friendly services for bank branches

Accelerate the aging friendly construction of bank branches, set up exclusive service areas for the elderly, equipped with comfortable seats, reading glasses, magnifying glasses, emergency medicine and other facilities. Arrange dedicated personnel in the self-service equipment area to guide elderly customers in using self-service ATMs, smart terminals, and other devices to handle business. To meet the business needs of elderly customers, a "green channel" will be established to prioritize business processing and reduce waiting time. Strengthen employee training on aging friendly services, enhance communication skills and service levels between employees and elderly customers, provide caring and patient services for elderly customers, and create a warm offline payment service environment.

4.3. Payment platform: improve functions and strengthen guidance

4.3.1. Continuously promote the platform's aging friendly upgrade

Payment platforms need to continuously optimize their aging friendly features, in addition to existing measures such as enlarging fonts, simplifying interfaces, and adding voice prompts, further exploring innovative functions. Developing an AI based operation guidance assistant that can provide intelligent guidance in a timely manner when elderly users encounter operational difficulties; Launch a payment operation simulation exercise function to help elderly users familiarize themselves with the payment process in a secure environment. At the same time, strengthen platform security protection, regularly conduct security vulnerability detection, ensure the security of payment information for elderly users, and enhance the confidence of the elderly population in using smart payments.

4.3.2. Carry out targeted user education activities

Utilize the advantages of our own platform to produce a rich variety of intelligent payment science popularization content, including short video tutorials, graphic guides, online live lectures, etc., to explain intelligent payment knowledge and operation skills in an easy to understand way, and reach elderly users through platform push, social media dissemination, and other means. Collaborate with communities and elderly organizations to conduct offline intelligent payment training activities, and conduct on-site demonstrations and guidance for the elderly population in the community. Establish a feedback mechanism for elderly users, collect user opinions and suggestions in a timely manner, continuously improve platform services, and enhance the user experience for elderly users.

4.4. Social organizations: empowering and creating an atmosphere

4.4.1. Organize volunteer assistance services

Social organizations can recruit and train volunteers to form volunteer teams for elderly digital services. Regularly visit communities, nursing homes, and other places to provide on-site guidance services for smart payments for the elderly, helping them solve practical operational problems. Carry out "one-on-one" paired assistance activities, volunteers establish long-term contact with elderly users, and provide consultation and assistance to elderly users at any time. Through volunteer assistance, we aim to enhance the awareness and application capabilities of the elderly towards smart payments, enabling them to feel cared for by society.

4.4.2. Organize digital exchange activities

Collaborate with community organizations, senior universities, and other institutions to organize digital life exchange activities for the elderly, such as smart payment experience sharing sessions, digital skills competitions, etc. In the event, encourage the elderly to share their experience and insights in using smart payments, learn from each other, and make progress together. At the same time, invite professionals to answer questions and clarify doubts on-site, popularize new knowledge and applications of intelligent payment, create a positive digital learning atmosphere, stimulate the enthusiasm of the elderly to actively learn intelligent payment, and promote social interaction and integration of the elderly in the digital age.

5. Conclusion

Based on the background of China's deep aging and digital transformation, this study systematically explores the manifestations, formation mechanisms, and solutions to the dilemma of elderly people's smart payment, from the dual perspectives of digital divide and knowledge gap theory, using 135 questionnaire data covering more than 30 provincial administrative regions across the country. The study finds that the three-layer barrier of "access-use-outcome" under the digital divide theory and the information differentiation of "knowledge acquisition-processing-accumulation" under the knowledge gap theory are intertwined, jointly leading to multiple dilemmas for the elderly, such as insufficient operational skills, significant security anxiety, poor physiological adaptability, narrow usage scenarios, and limited social support, ultimately forming a vicious cycle of "not knowing how to use, afraid to use, and unable to use well," which restricts their integration into the digital payment environment. Based on this, this study proposes targeted suggestions from four major entities: government, financial institutions, payment platforms, and social organizations, including coordinating policies and digital literacy education, upgrading age-friendly products and services, optimizing functions and user guidance, and carrying out volunteer assistance and exchange activities, aiming to build a support system with collaborative efforts from multiple entities. In the future, with the deepening of aging and digital technology iteration, it is necessary to further pay attention to the differentiated needs of urban and rural areas and the elderly population, continuously improve age-friendly solutions, promote the true "age-friendliness" and "inclusiveness" of smart payment, enable the elderly to equally share the benefits of digital economic development, and help build a more inclusive digital society.

References

[1]. Sophie Lythreatis, Sanjay Kumar Singh, Abdul-Nasser El-Kassar, The digital divide: A review and future research agenda, Technological Forecasting and Social Change, Volume 175, 2022, 121359, ISSN 0040-1625.

[2]. van Dijk, J., & Hacker, K. (2003). The Digital Divide as a Complex and Dynamic Phenomenon. The Information Society, 19(4), 315–326.

[3]. Zhang Ying The current situation, causes, and bridging paths of the digital divide among the elderly population in China under the digital background [J]. Journal of Guilin Aerospace Industry College, 2024, 29 (6): 859-864.

[4]. Lu Jiehua, Wei Xiaodan Analysis framework, concept, and path selection for the governance of the elderly digital divide: based on the perspective of digital divide and knowledge gap theory [J]. Population Research, 2021, 45 (3): 17-30.

[5]. Chen Runqing Research on the Path of Crossing the Digital Divide among the Elderly under the Background of Digital Economy [J]. Jiangsu Business Forum, 2025(8): 37-41.

[6]. Tang Yong, Lei Pingrui, Sun Kaigang, etc Crossing the Digital Divide: Analysis of Factors Influencing the Willingness of Elderly People to Use Mobile Payment [J]. Journal of Aging Science, 2021, 9 (10): 36-46+78.

[7]. Yang Jianghua, Zhang Mengzhu The digital divide in the era of artificial intelligence: theoretical context and new developments [J]. New Media and the Internet, 2025, 2 (2): 1-12.

[8]. Yuan Zeng, Yusen Yang, Chun Wang, Jianke Zou, Exploring the digital divide–poverty.link: Roles of education and family dependency, Finance Research Letters, Volume 85, Part C, 2025, 108023, ISSN 1544-6123.

[9]. He Qinyao Research on Payment Services for Rural Elderly [J]. Market Outlook, 2025(10): 220-222.

[10]. Ba Shusong, Wang Kexin, Wang Kaixuan Mobile payment aging adaptation from the perspective of digital exclusion: solving the technological marginalization dilemma of the elderly population [J]. Financial Development Research, 2025(6): 42-51.

[11]. Huiqian Sun, Peng Jing, Yaqi Liu, Daoge Wang, Jie Ye, Wanru Du, Hongyu Ma, Can Wang, Shuang Zhang, How do older adults cross the digital divide and enjoy the benefits of ride-hailing services with the collision of the aging and digital society in China?, Telematics and Informatics, Volume 97, 2025, 102239, ISSN 0736-5853.

[12]. Li Zhongxia Problems and Countermeasures in the Use of Electronic Payment Services by the Elderly in the Digital Age [J]. Hebei Finance, 2022, (12): 64-66.

[13]. Zhang Ping Strategies for intervening in the digital divide among rural elderly from the perspective of social work [J]. Market Weekly, 2025, 38 (4): 18-21.

Cite this article

Yang,J. (2025). Study on the Dilemma of Smart Payment for the Elderly and Its Solution Paths — From the Perspective of the Digital Divide and Knowledge-Gap Theory. Advances in Economics, Management and Political Sciences,223,38-52.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sophie Lythreatis, Sanjay Kumar Singh, Abdul-Nasser El-Kassar, The digital divide: A review and future research agenda, Technological Forecasting and Social Change, Volume 175, 2022, 121359, ISSN 0040-1625.

[2]. van Dijk, J., & Hacker, K. (2003). The Digital Divide as a Complex and Dynamic Phenomenon. The Information Society, 19(4), 315–326.

[3]. Zhang Ying The current situation, causes, and bridging paths of the digital divide among the elderly population in China under the digital background [J]. Journal of Guilin Aerospace Industry College, 2024, 29 (6): 859-864.

[4]. Lu Jiehua, Wei Xiaodan Analysis framework, concept, and path selection for the governance of the elderly digital divide: based on the perspective of digital divide and knowledge gap theory [J]. Population Research, 2021, 45 (3): 17-30.

[5]. Chen Runqing Research on the Path of Crossing the Digital Divide among the Elderly under the Background of Digital Economy [J]. Jiangsu Business Forum, 2025(8): 37-41.

[6]. Tang Yong, Lei Pingrui, Sun Kaigang, etc Crossing the Digital Divide: Analysis of Factors Influencing the Willingness of Elderly People to Use Mobile Payment [J]. Journal of Aging Science, 2021, 9 (10): 36-46+78.

[7]. Yang Jianghua, Zhang Mengzhu The digital divide in the era of artificial intelligence: theoretical context and new developments [J]. New Media and the Internet, 2025, 2 (2): 1-12.

[8]. Yuan Zeng, Yusen Yang, Chun Wang, Jianke Zou, Exploring the digital divide–poverty.link: Roles of education and family dependency, Finance Research Letters, Volume 85, Part C, 2025, 108023, ISSN 1544-6123.

[9]. He Qinyao Research on Payment Services for Rural Elderly [J]. Market Outlook, 2025(10): 220-222.

[10]. Ba Shusong, Wang Kexin, Wang Kaixuan Mobile payment aging adaptation from the perspective of digital exclusion: solving the technological marginalization dilemma of the elderly population [J]. Financial Development Research, 2025(6): 42-51.

[11]. Huiqian Sun, Peng Jing, Yaqi Liu, Daoge Wang, Jie Ye, Wanru Du, Hongyu Ma, Can Wang, Shuang Zhang, How do older adults cross the digital divide and enjoy the benefits of ride-hailing services with the collision of the aging and digital society in China?, Telematics and Informatics, Volume 97, 2025, 102239, ISSN 0736-5853.

[12]. Li Zhongxia Problems and Countermeasures in the Use of Electronic Payment Services by the Elderly in the Digital Age [J]. Hebei Finance, 2022, (12): 64-66.

[13]. Zhang Ping Strategies for intervening in the digital divide among rural elderly from the perspective of social work [J]. Market Weekly, 2025, 38 (4): 18-21.