Volume 204

Published on July 2025Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

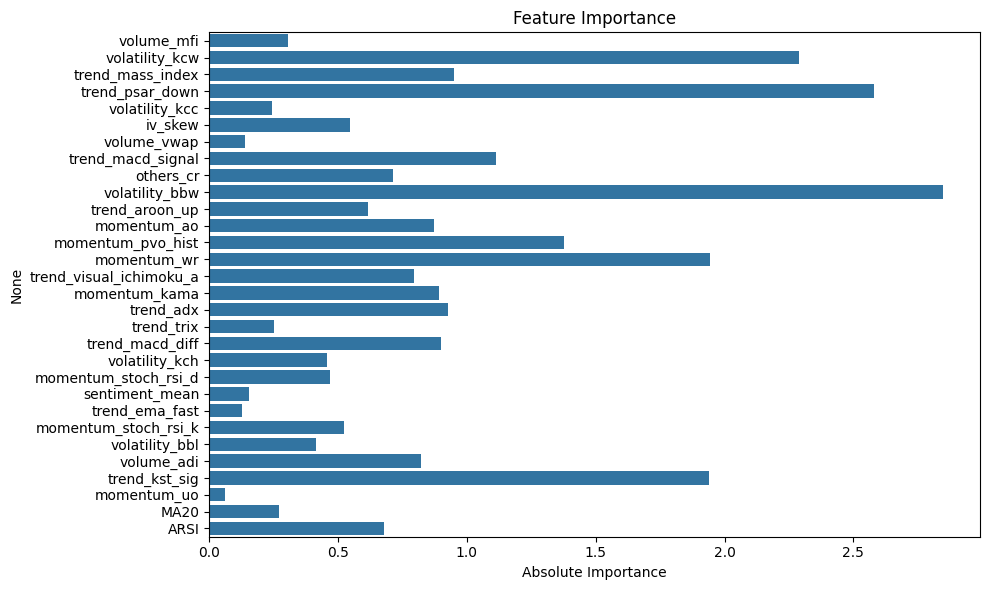

Stock price prediction remains a complex challenge in financial markets due to the dynamic interplay of economic indicators, global events, and investor sentiment. This study explores the integration of sentiment analysis into stock price forecasting using a FinBERT-LSTM model. By leveraging financial news data and market indicators, we aimed to enhance predictive accuracy. Sentiment features, such as sentiment intensity and daily sentiment ratios, were extracted using the FinBERT model and combined with traditional market data in an LSTM framework. Comparative analysis demonstrated that the sentiment-enhanced model significantly outperformed the baseline LSTM model, particularly during periods of high market volatility. These findings highlight the critical role of sentiment in market dynamics, providing a foundation for more robust predictive models. Future research directions include the incorporation of additional sentiment sources and advanced model architectures to further improve performance and adaptability in diverse market conditions.

View pdf

View pdf