Volume 150

Published on November 2025Volume title: Proceedings of the 5th International Conference on Computing Innovation and Applied Physics

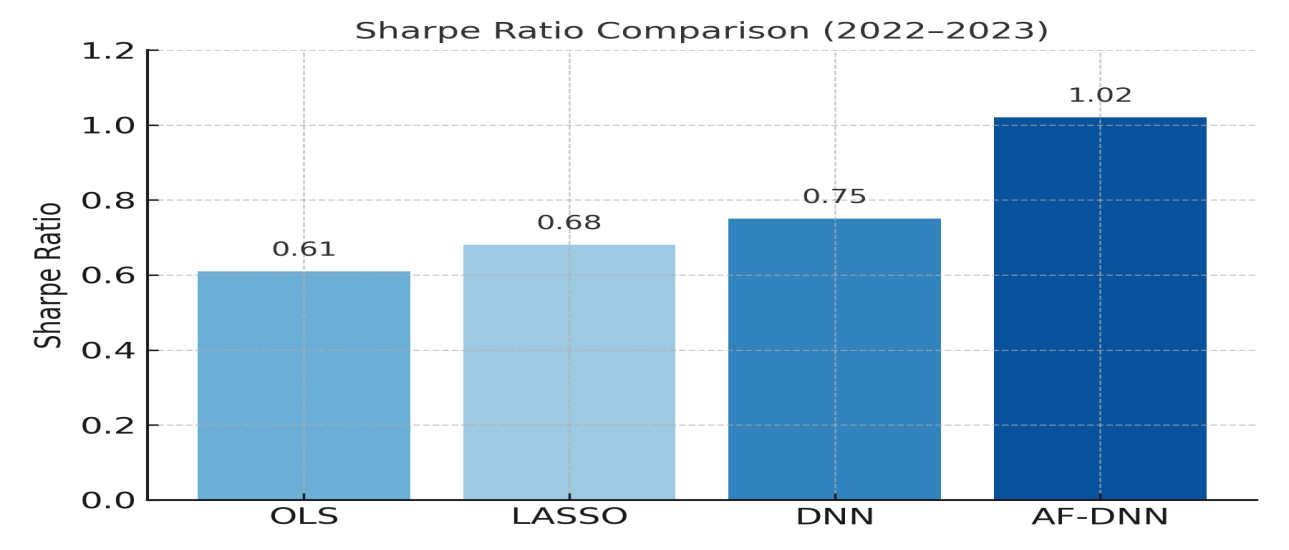

The high volatility and non-stationarity of financial markets pose significant challenges to the application of traditional machine learning models in portfolio optimization and asset pricing. Under distributional shifts and extreme market conditions, these models often suffer from performance degradation and failure in risk control. Although existing studies have made progress in factor modeling and portfolio optimization, most approaches rely on the assumption of independent and identically distributed data or weak robustness constraints, leaving the problem of generalization under non-stationary and adversarial environments insufficiently addressed. To tackle this issue, this paper proposes a statistical learning generalization guarantee framework tailored to adversarial distributional shifts. The framework incorporates adversarial regularization into a multifactor deep neural network and derives PAC-Bayes generalization error bounds, thereby achieving consistency between theoretical guarantees and empirical robustness. Empirical experiments are conducted using high-frequency factor and trading data from the Chinese A-share market and the U.S. NYSE/NASDAQ market between 2015 and 2023. Three experimental settings, baseline model comparisons, adversarial perturbation simulations, and cross-market transfer evaluations, are designed. Results show that the proposed method significantly outperforms OLS regression, LASSO regression, and standard deep neural networks in key metrics such as annualized return, Sharpe ratio, and maximum drawdown, while also demonstrating stronger risk control through improvements in the Robustness Index. Further cross-market and temporal transfer experiments confirm the generalizability of the proposed model, proving its applicability not only in stable markets but also under extreme shocks, where it maintains return consistency and robustness.

View pdf

View pdf