1. Introduction

Real-estate companies worldwide are more than steel jungles; they constitute a vast, orderly and diverse ecosystem where capital converts land into durable, highly leveraged and spatially fixed assets. Listed investment trusts include American Tower, Vonovia and Link REIT; diversified developers such as Vanke, Poly Developments and Ayala Land; specialised homebuilders such as Lennar, Taylor Wimpey and Sekisui House; and vertically-integrated service enterprises like Jones Lang LaSalle and Colliers International - together controlling assets worth more than USD 10 trillion, roughly half of the world’s fixed capital stock [1].

Alongside their enormous economic weight, these firms contribute substantially to environmental damage: construction operations and related energy use currently account for 39% of global greenhouse-gas emissions and 36% of final energy consumption [1]. Because physical buildings are immovable and their future cash flows stretch decades ahead, the sector’s transition faces multiple constraints - carbon pricing, energy-efficiency regulation, green-finance statutes - attributes that make real-estate firms the focal research subjects for whether ESG factors suppress or enhance financial performance.

A corporate balance-sheet dissection offers a typical case. Dallas homebuilders customarily finance land purchases with short-term trust loans or bank credit, pre-selling projects, and repaying the loans upon completion. Yet maturity mismatch remains unavoidable: on average, 60% of Chinese developers’ balance sheets are financed by debt maturing within three years, whereas the full cycle from land acquisition to delivery often exceeds four years [2]. In the European office market, some REITs lock rents into five- to ten-year leases but refinance in bond or note markets every two to three years; this duration transformation renders capital markets highly sensitive. When ESG premiums must be paid, spreads widen rapidly. During the 2022 energy-price shock, real-estate companies with poor environmental scores were forced to pay an extra 120–180 basis points on newly issued bonds [3]. Conversely, buildings or issuers that comply with ESG rules enjoy tighter spreads and longer tenors.

During the COVID-19 pandemic, US shopping-centre REITs that granted rent relief to small retailers saw their share prices fall 15% less than peers that pursued aggressive collection strategies [4]. Meanwhile, at the governance level, the collapses of China Evergrande and Country Garden illustrate how governance failures can swiftly evolve into systemic liquidity events [5].

Regulators are now concentrating high-pressure oversight on these pain points. The EU Corporate Sustainability Reporting Directive (CSRD) already requires large real-estate entities to disclose, under the double-materiality standard, Scope 1, 2 and 3 emissions, energy-intensity indicators and social-impact metrics [6]. China’s “dual-carbon” strategy imposes per-square-metre energy caps on new construction, and higher ESG ratings correlate with land acquisition [6, 7]. In the United States, the SEC’s draft climate-risk disclosure rule specifically demands that real-estate investment managers provide asset-level data down to individual buildings [8]. Investors, for their part, embed ESG scores into investment mandates, making sustainability a prerequisite for capital access.

These multi-directional demands interact as a complex force-field. On the one hand, retrofitting existing assets to meet net-zero targets can cost USD 15–30 per square foot, a non-trivial expense for existing owners [9]. On the other hand, ESG-certified offices in New York and London command rental premiums of 3–7% and maintain occupancy rates 100–200 basis points above non-certified stock [10]. Developers that actively engage with local communities - by reserving affordable housing units or signing community-benefit agreements - often enjoy faster permitting and lower litigation risk. In governance, separating the roles of chair and CEO or adopting claw-back provisions is associated with a 50–80 basis-point narrowing of corporate bond spreads one year after implementation [11].

Together, these dynamics make real-estate companies an ideal laboratory for evaluating whether ESG drives long-term value or suppresses short-term costs.

2. Literature review

The first strand of research asks whether stronger environmental, social, and governance performance can generate more pronounced capital accumulation for real estate firms. Early single-country studies on this issue are mostly affirmative. For example, Cajias et al. show U.S. REITs portfolios holding green-building certifications enjoy significantly higher asset returns and markedly lower risk, confirming an “eco-premium” embedded in operating cash-flows and market valuations [12, 13]. In Europe, firms whose ESG completion scores are above the industry median deliver an annual equity-return premium of roughly 7.3% [14].

2.1. Relationships between ESG and a firm’s performance

However, global evidence presents divergent findings. Nguyen and Nguyen analysed 1,260 listed real-estate companies across 44 countries and found ESG premiums only during crisis periods (2019–2022); during tranquil years, the effect diminishes or even reverses for small developers [11]. The authors interpret this as investors treating ESG as a tail-risk hedge rather than a permanent value-enhancement channel. Similarly, Biasin et al. found that an environmentally screened European real-estate index delivers a superior Sharpe ratio relative to its benchmark when market volatility spikes, again indicating that ESG returns are time- and context-dependent [10]. This reveals the first research gap: the ESG-performance relationship depends on the macro environment, firm size, and investor sentiment, making the distinction between crowding-in and crowding-out effects unclear.

To explain the observed heterogeneity, the second strand of research dissects the transmission channels and boundary conditions through which ESG affects firm outcomes, with the cost-of-capital channel receiving the most rigorous scrutiny. Lu and Han noted that every one-notch improvement in ESG rating lowers the bond-issuance spread by an average of 25.5 basis points, with the effect doubling for state-owned enterprises (SOEs), implying that government backing amplifies ESG value [12]. Wang et al. found that positive sentiment reduces the maturity-mismatch between financing and investment by 5.1%, achieved mainly through greater access to long-term debt rather than equity [15].

2.2. Moderators’ impacts

Firm-level moderators further tilt the ESG-performance relationship. When mature and growing firms are compared, mature real-estate companies benefit from ESG improvements in mitigating maturity mismatch, whereas growing firms show no response, consistent with the explanation that resource constraints make ESG spending procyclical. Ownership structure is equally critical. Nguyen and Nguyen found that the ESG premium is concentrated in firms with dispersed shareholdings because ESG disclosures substantially increase the transparency of controlling groups and thereby ease the classic agency conflict between managers and minority shareholders [11]. Conversely, family-controlled firms derive smaller ESG benefits, suggesting that tunnelling and opacity attenuate the marginal value of ESG transparency. The metrics themselves are fluid and ill-defined. Zhou et al. compared the applicability of the GRI, SASB, CSRC, and GRESB frameworks to 50 Chinese developers and found that 79% of the indicators are not comparable across standards; merely adjusting the weighting scheme may flip a regression coefficient from significantly positive to insignificant [16]. These findings reveal a second research gap: we still lack a systematic understanding of how corporate-governance quality, capital-structure choices, or regulatory stringency condition the ESG-performance nexus.

2.3. Data qualities

Although the above studies establish broad regularities, they overlook the unique institutional context of real-estate developers: high leverage coupled with high returns, cyclical cash flows, and stringent land-use regulation. Tan et al. analysed ESG reports issued by 117 Chinese listed developers between 2020 and 2022 and classified firms into four legitimacy-oriented disclosure strategies: compliant (28%), selective (34%), resistant (18%), and evasive (20%). Surprisingly, they found that 38% of firms adopt resistant or evasive strategies, suppressing negative news or engaging in pseudo-green projectivisation [12]. Such strategic behaviour severely weakens the true ESG-performance relation, yet is rarely incorporated into empirical models.

Data quality further compounds the problem. Palm noted two pervasive difficulties: on the one hand, a lack of transaction-based empirical evidence linking specific ESG attributes to price discounts or premiums; on the other hand, large discrepancies in ESG indicators across rating agencies, undermining comparability. Appraisers default to energy-performance certificates as the observable ESG variable, excluding broader social and governance factors from pricing and rendering them hard to detect. Similarly, Zhou et al. found that 72% of the sampled Chinese developers meet the minimum ESG disclosure completeness, and 54 % exhibit significant gaps between their disclosures and third-party ESG scores [15].

These observations expose a final set of research gaps, requiring the completion of three key tasks. First, a longitudinal causal analysis examining how investor learning or regulation impacts ESG coefficients throughout a full real-estate cycle. Second, the creation of a micro-level empirical foundation clarifying how ESG attributes translate into specific operational metrics. Third, the promotion of a unified ESG metrics framework to enable multidimensional analysis and cross-country comparative studies.

3. Analysis

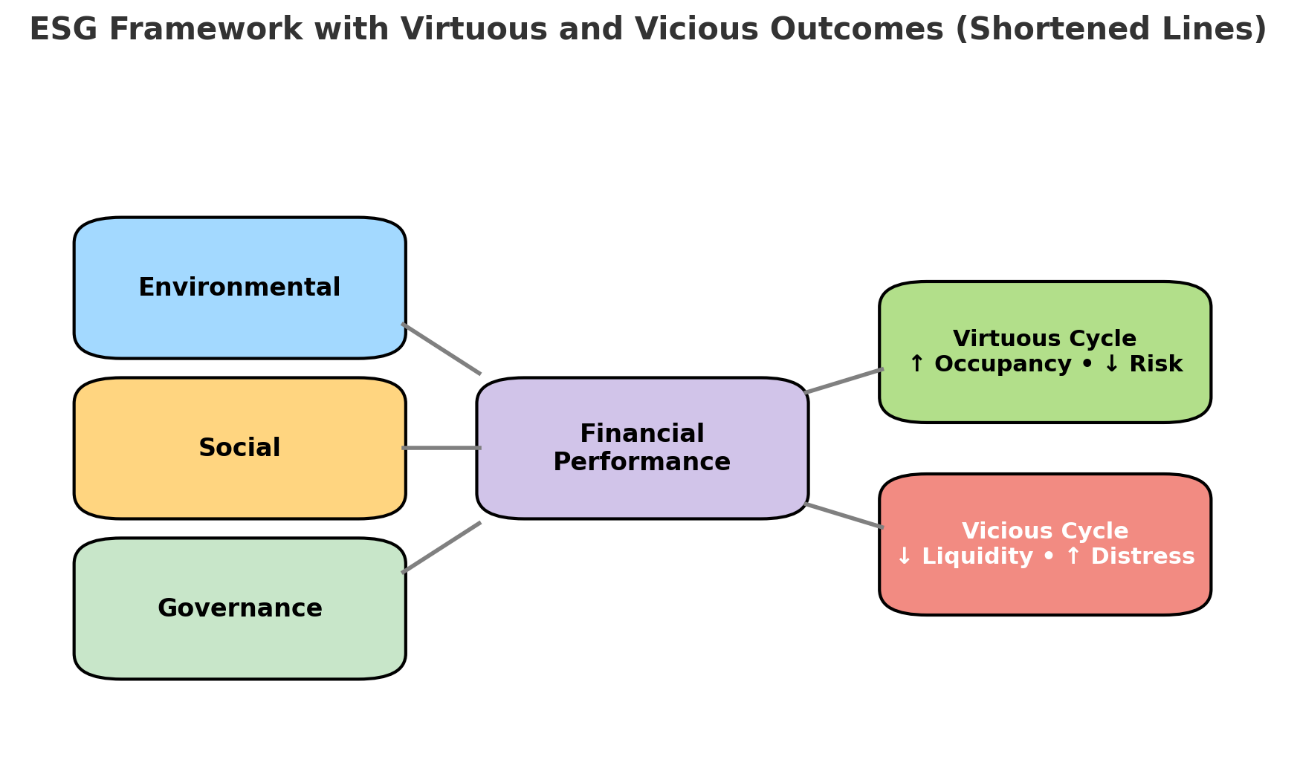

The relationship between the real estate industry and ESG is neither linear nor homogeneous. Instead, it is determined by three distinct yet mutually reinforcing channels - environmental management, social responsibility, and governance quality - that influence whether ESG is capital-accretive or capital-destructive for real estate. By disentangling them, it becomes possible to explain why they are mission-critical for real-estate firms. As shown in Figure 1, the three ESG pillars affect financial performance. Strong alignment leads to a virtuous cycle (higher occupancy, lower risk), while weak governance or misallocation may result in a vicious cycle (lower liquidity, higher distress).

3.1. Environmental management

The first transmission mechanism through which ESG affects real-estate performance is environmental performance, manifested mainly through energy-efficient design and third-party green certification. Cross-market macro studies show that green-certified buildings command a statistically significant rent premium. In the Tokyo office market, there is an average rent premium of 6.5% for green-certified stock, with this premium falling to 2.6% for large new buildings and 5.4% for medium-sized vintage stock [17]. The heterogeneous premiums indicate that, in commoditised existing space, environmental certification creates sizeable differentiation value.

Similarly, a global review by Leskinen et al. found that rent premiums for green buildings range from 0% to 23% (mean 6.3%), while sales premiums can reach up to 43% (mean 14.8%). The largest gains occur when energy savings are substantial and tenants directly bear utility costs [18]. Using proprietary data from North America, Devine and Kok show that ENERGY STAR and LEED certifications are associated with 3-4% higher rents and, more importantly, with 4–10% lower vacancy rates, demonstrating that environmental quality materially reduces landlords’ vacancy risk [19]. They also argue that green buildings increase tenant satisfaction and renewal propensity, translating into lower re-leasing costs and more stable cash-flows. Overall, environmental investments stabilise cash-flow, lift revenue and reduce vacancy and turnover risks, thereby strengthening real estate operating performance.

3.2. Social responsibility

Social responsibility constitutes the second transmission mechanism, encompassing factors such as tenant health and safety, community engagement and labour practices. Earlier literature typically quantified social performance indirectly - typically through tenant retention and satisfaction - whereas more recent studies have broadened the lens. Devine and Kok found that Canadian offices meeting green standards post a 4% rise in overall tenant satisfaction, climbing to 20% for BOMA BESt-certified stock. These gains translate directly into higher renewal rates and rent concessions [19].

An internship report on Climax Holdings Ltd. highlights how quality-assurance practices build client trust and positive word-of-mouth. Features such as seismic design and transparent inspection protocols led 54.9% of customers to favour the developer for its reputation, with 80.4% rating its perceived quality as excellent [20]. For investors and developers, visible social responsibility boosts leasing appetite and investment enthusiasm. Landlords’ social spending is strategic, not charitable - by exceeding seismic-risk norms, for example, a developer can differentiate itself and sustain pricing power.

Montso’s study of the South-African construction supply chain further shows that social responsibility extends to labour practices. Trust-based, sustainable worker relations improve coordination, resulting in timely delivery, fewer defects, welfare allowances and, ultimately, higher financial returns [21]. Although these performance gains are measured at the project level rather than the asset level, they underscore how the residual capital created by social responsibility is monetised through higher occupancy, increased renewal rates, premium pricing and cost savings.

3.3. Governance quality

The third channel is corporate governance, which not only affects access to capital but also determines how efficiently environmental and social initiatives are executed. Njoka’s study of Kenyan property-management firms found that powerful audit-committee oversight, internal-audit effectiveness and managerial ability are positively related to revenue productivity. Regression analysis shows that a one-unit increase in the governance index raises financial performance by 0.33–0.64 standard deviations [22].

In Indonesian listed real-estate firms, board independence, audit-committee rigour and balanced ownership structures - including institutional and foreign participation - jointly explain 56% of the variation in Tobin’s Q and ROE [23]. Both studies stress complementarity: unstable governance can raise agency costs and prevent promised returns from materialising.

A cautionary tale comes from the Chinese market. Recent research uses the following formula to analyse environmental issues in China:

Where

Although higher leverage initially accelerates land acquisition and sales, it magnifies the risk of rapid financial collapse. Developers that climbed the rankings between 2016 and 2020 were 37 percentage points more likely to experience financial distress after the 2020 ‘three red lines’ policy and the COVID shock. This implies that governance mechanisms curbing excessive risk-taking, such as independent directors, transparent disclosure, and prudent capital-structure policies, are mission-critical to prevent ESG investment from morphing into value-destroying over-expansion. Leverage can yield outsized returns and rapid capital accumulation in the short run, but extreme leverage is eventually self-liquidating; ESG acts as a powerful circuit-breaker against such capital explosions. Table 1 shows the summary of issues from the three pillars.

|

Pillar |

Transmission Path |

Financial Impact |

Risks/Constraints |

|

Environmental |

Green building certification, energy-efficient design, retrofitting |

Rent premium, higher occupancy, reduced vacancy |

High upfront costs: payoffs depend on building age and market maturity |

|

Social |

Tenant health & safety, community engagement, labour relations |

Higher tenant loyalty, lower turnover, reputational gains |

Benefits are long-term and harder to monetise in the short run |

|

Governance |

Board oversight, audit committees, ownership balance, risk controls |

Optimises capital efficiency, reduces cost of capital, sustains ESG value creation |

Weak governance fosters agency problems, excessive leverage, financial fragility |

4. Solutions

The environmental, social, and governance (ESG) pillars do not operate in isolation. This section presents solutions based on interaction effects on net performance, sectoral and temporal nuances, and analytical synthesis and implications.

4.1. Interaction effects on net performance

Environmental upgrades yield greater returns when paired with strong governance - particularly professional asset management. Likewise, the occupancy benefits of green certification are strongest in well-governed, professionally managed portfolios. Conversely, the Chinese case shows that in the absence of governance oversight, aggressive green marketing undertaken purely for ranking purposes can breed financial fragility. These dynamics imply a contingency view: ESG creates value only when all three pillars are jointly optimised.

Regression evidence reinforces this interpretation, corroborating the mediating role of coordinated governance and stakeholder management in linking supply-chain coordination inside the construction sector to corporate performance. Extending this logic to listed developers, governance quality determines whether environmental and social initiatives can be deployed efficiently and monitored adequately.

4.2. Sectoral and temporal nuances

The ESG-performance relationship varies across sub-markets and over time. The Tokyo-based study mentioned previously shows that vintage medium-sized buildings in secondary sub-markets enjoy the largest green premium, indicating that differentiation value is greatest where product homogeneity is high. In contrast, top-tier new stock bundles multiple amenities, so green certification adds only marginal value.

As certification schemes proliferate and standards converge, green premiums have been compressed over the past decade - a trend consistent with product-life-cycle theory: early adopters earn scarcity rents, which are eroded as the market matures. Additionally, regulatory shocks - such as China’s debt-ratio cap - can abruptly alter the cost-benefit calculus of meeting ESG compliance, underscoring the need for a dynamic governance framework that adapts to market swings and new policies.

4.3. Analytical synthesis and implications

The analysis yields three conclusions. First, environmental upgrades through energy-efficient design and third-party ESG certification can lift rental income and cut vacancy risk, but the payoff is conditional on building age, market segment and tenant cost structure. Second, social responsibility - through tenant safety, satisfaction, engagement and community participation - enhances brand equity and tenant loyalty, reducing re-leasing costs and stabilising capital values. Third, governance quality is a critical enabler: without robust oversight and a balanced capital structure, environmental and social initiatives may be poorly executed or even precipitate financial distress. Therefore, real-estate firms seeking to enhance performance through ESG should adopt an integrated strategy: (i) target environmental retrofits with the highest marginal differentiation return, (ii) embed social responsibility in product design and tenant relations, and (iii) strengthen governance mechanisms to monitor and fine-tune environmental and social programs. The absence of any one pillar risks turning ESG from a performance enhancer into a capital sink.

Firms that pursue long-term, targeted renovations can enter a virtuous cycle - reducing rental costs, increasing occupancy rates, stabilising cash flow, and reducing stock price declines. Conversely, failure in any pillar can trigger a vicious cycle: weak governance systems lead to poor management decisions, excessive green spending strains liquidity, and loss of social credibility forces asset sell-offs.

Looking ahead, dynamic ESG regulatory thresholds should be established - raising standards during booms and lowering them during busts - to transform sustainable development from a pro-cyclical marketing tool into a counter-cyclical risk buffer. Table 2 shows the summary of these solutions to solve the issues proposed in the previous section.

|

Dimension |

Key Insights |

Implications for Real Estate Firms |

|

Interaction Effects |

Governance quality enhances environmental and social payoffs; weak governance undermines ESG returns. |

Integrate ESG pillars holistically; ensure governance oversight for E and S investments. |

|

Sectoral Nuances |

Green premiums vary by market segment and building age; certification value strongest in mid-tier, homogeneous markets. |

Target ESG investments where differentiation is most valued (secondary markets, older stock). |

|

Temporal Dynamics |

ESG payoffs shift over time; early adopters gain scarcity rents, while premiums compress as standards mature. |

Time investments strategically; capture early-move advantages before market saturation. |

|

Policy Shocks |

Regulatory interventions (e.g., China’s debt-ratio cap) can abruptly alter ESG cost-benefit trade-offs. |

Maintain flexible governance frameworks to adapt to policy and market shifts. |

|

Analytical Synthesis |

ESG creates value only when the three pillars are optimised jointly; poor coordination risks financial fragility. |

Adopt a systems view of ESG, embedding checks on leverage and risk-taking. |

5. Conclusion

Real estate companies own nearly half of the world’s fixed assets and are responsible for nearly 40% of CO₂ emissions due to construction. ESG pathways therefore have systemic implications. The review finds that ESG does not inherently create or destroy value; its impact depends on how environmental, social, and governance actions interact with capital structure and regulation.

Green certifications bring the highest rent premiums in older real estate stock, but as standards become widespread, the premium gradually shrinks. As this occurs, enhancing user health and fostering community engagement can further reduce rental costs and boost income. However, superficial greenwashing yields no benefit, and strong governance is needed to constrain it. Independent boards can promote sustainable development, manage risk, and prevent excessive leverage.

In the absence of sound governance, ESG spending may become a catalyst for capital fragility in real estate. Investors, developers, and regulators should treat the three ESG pillars as a unified portfolio. Future research should shift from panel data to asset-level longitudinal experiments, tracking investor learning throughout the real estate investment cycle. A globally harmonised ESG disclosure template - integrating GRI, SASB, and GRESB metrics - will unlock cross-border capital and accelerate the industry toward net-zero. Until such integration is achieved, ESG remains only a possible, but not guaranteed, source of long-term excess returns in real estate.

References

[1]. International Energy Agency. (2022). Technology and innovation pathways for zero-carbon-ready buildings by 2030. Paris: IEA.

[2]. Wang, H., Wu, Y., & Tan, W. (2024). ESG news sentiment and debt risk of real-estate enterprises: Evidence from financing–investment maturity mismatch.Journal of Xiangtan University (Philosophy & Social Sciences), 48(6), 46–54.

[3]. Biasin, M., Delle Foglie, A., & Giacomini, E. (2024). Addressing climate challenges through ESG-real-estate investment strategies: An asset allocation perspective.Finance Research Letters, 63, 105381.

[4]. Nguyen, H. H., & Nguyen, H. T. (2025). Do the ESG factors truly enhance real-estate companies’ valuation and performance in uncertain times?Journal of Property Investment & Finance, 43(2), 190–221.

[5]. Zhang, J. (2025). The driving forces of ESG development in real-estate enterprises: A dual analysis of internal and external environments.Economic Review, 3, 14–17.

[6]. European Commission. (2023). Corporate sustainability reporting directive (CSRD) – Final text.Official Journal of the European Union, L 322.

[7]. Lu, H., & Han, Y. (2025). The mechanism of ESG rating on financing cost of real-estate enterprises under the “dual carbon” context.China Economic & Trade Herald, January, 43–45.

[8]. U.S. Securities and Exchange Commission. (2022). Proposed rule: The enhancement and standardization of climate-related disclosures for investors.Federal Register, 87(46).

[9]. Wang, H., Wu, Y., & Tan, W. (2024). ESG news sentiment and debt risk of real-estate enterprises: Evidence from financing–investment maturity mismatch.Journal of Xiangtan University (Philosophy & Social Sciences), 48(6), 46–54.

[10]. Biasin, M., Delle Foglie, A., & Giacomini, E. (2024). Addressing climate challenges through ESG-real-estate investment strategies: An asset allocation perspective.Finance Research Letters, 63, 105381.

[11]. Nguyen, H. H., & Nguyen, H. T. (2025). Do the ESG factors truly enhance real-estate companies’ valuation and performance in uncertain times?Journal of Property Investment & Finance, 43(2), 190–221.

[12]. Lu, H., & Han, Y. (2025). The mechanism of ESG rating on financing cost of real-estate enterprises under the “dual carbon” context.China Economic & Trade Herald, January, 43–45.

[13]. Cajias, M., Fuerst, F., McAllister, P., & Nanda, A. (2014). Do responsible real-estate companies outperform peers?International Journal of Strategic Property Management, 18(1), 11–27.

[14]. Brounen, D., Marcato, G., & Op’t Veld, H. (2021). Pricing ESG equity ratings in listed real-estate securities.Sustainability, 13(2037).

[15]. Zhou, X., Wang, C., & Li, J. (2024). Fairness and efficiency of ESG rating data processing: The case of Chinese real-estate enterprises.New Economy, (9).

[16]. Tan, H., Du, J., & Zhu, L. (2025). ESG disclosure strategies under legitimacy pressure: Evidence from Chinese real-estate enterprises.Journal of Engineering Management, 39(1), 141–147.

[17]. Onishi, J., Deng, Y., & Shimizu, C. (2021). Green premium in the Tokyo office rent market.Sustainability, 13(12227). https: //doi.org/10.3390/su132112227

[18]. Leskinen, N., Vimpari, J., & Junnila, S. (2020). A review of the impact of green building certification on the cash flows and values of commercial properties.Sustainability, 12(2729). https: //doi.org/10.3390/su12072729

[19]. Devine, A., & Kok, N. (2015). Green certification and building performance: Implications for tangibles and intangibles.Journal of Portfolio Management, Special Real Estate Issue.

[20]. Jahan, S. (2024). Importance of quality assurance in real estate to satisfy the customers of Climax Holdings Ltd. Internship report, BRAC Business School.

[21]. Montso, M. E. (2021). Supply chain coordination and firm performance in the construction industry in Gauteng Province (Master’s dissertation). Vaal University of Technology.

[22]. Njoka, P. G. (2010). The relationship between corporate governance practices and financial performance of property management companies in Kenya (MBA management research project). University of Nairobi.

[23]. Suhendar, W., Sahusilawane, W., et al. (2023). Determinants of corporate governance and ownership structure in increasing the company’s financial performance.International Journal of Economics,Business and Accounting Research, 7(1).

[24]. Chan, W., Hui, E. C. M., Shen, J., & Zhang, L. (2025). Capital structure and financial distress in China’s real estate sector: A perspective from sales tournament.Humanities & Social Sciences Communications, 12, 885.

Cite this article

Zhang,C. (2025). From green premiums to governance discipline: ESG transmission paths and financial outcomes in global real estate. Advances in Social Behavior Research,16(8),198-204.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Advances in Social Behavior Research

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. International Energy Agency. (2022). Technology and innovation pathways for zero-carbon-ready buildings by 2030. Paris: IEA.

[2]. Wang, H., Wu, Y., & Tan, W. (2024). ESG news sentiment and debt risk of real-estate enterprises: Evidence from financing–investment maturity mismatch.Journal of Xiangtan University (Philosophy & Social Sciences), 48(6), 46–54.

[3]. Biasin, M., Delle Foglie, A., & Giacomini, E. (2024). Addressing climate challenges through ESG-real-estate investment strategies: An asset allocation perspective.Finance Research Letters, 63, 105381.

[4]. Nguyen, H. H., & Nguyen, H. T. (2025). Do the ESG factors truly enhance real-estate companies’ valuation and performance in uncertain times?Journal of Property Investment & Finance, 43(2), 190–221.

[5]. Zhang, J. (2025). The driving forces of ESG development in real-estate enterprises: A dual analysis of internal and external environments.Economic Review, 3, 14–17.

[6]. European Commission. (2023). Corporate sustainability reporting directive (CSRD) – Final text.Official Journal of the European Union, L 322.

[7]. Lu, H., & Han, Y. (2025). The mechanism of ESG rating on financing cost of real-estate enterprises under the “dual carbon” context.China Economic & Trade Herald, January, 43–45.

[8]. U.S. Securities and Exchange Commission. (2022). Proposed rule: The enhancement and standardization of climate-related disclosures for investors.Federal Register, 87(46).

[9]. Wang, H., Wu, Y., & Tan, W. (2024). ESG news sentiment and debt risk of real-estate enterprises: Evidence from financing–investment maturity mismatch.Journal of Xiangtan University (Philosophy & Social Sciences), 48(6), 46–54.

[10]. Biasin, M., Delle Foglie, A., & Giacomini, E. (2024). Addressing climate challenges through ESG-real-estate investment strategies: An asset allocation perspective.Finance Research Letters, 63, 105381.

[11]. Nguyen, H. H., & Nguyen, H. T. (2025). Do the ESG factors truly enhance real-estate companies’ valuation and performance in uncertain times?Journal of Property Investment & Finance, 43(2), 190–221.

[12]. Lu, H., & Han, Y. (2025). The mechanism of ESG rating on financing cost of real-estate enterprises under the “dual carbon” context.China Economic & Trade Herald, January, 43–45.

[13]. Cajias, M., Fuerst, F., McAllister, P., & Nanda, A. (2014). Do responsible real-estate companies outperform peers?International Journal of Strategic Property Management, 18(1), 11–27.

[14]. Brounen, D., Marcato, G., & Op’t Veld, H. (2021). Pricing ESG equity ratings in listed real-estate securities.Sustainability, 13(2037).

[15]. Zhou, X., Wang, C., & Li, J. (2024). Fairness and efficiency of ESG rating data processing: The case of Chinese real-estate enterprises.New Economy, (9).

[16]. Tan, H., Du, J., & Zhu, L. (2025). ESG disclosure strategies under legitimacy pressure: Evidence from Chinese real-estate enterprises.Journal of Engineering Management, 39(1), 141–147.

[17]. Onishi, J., Deng, Y., & Shimizu, C. (2021). Green premium in the Tokyo office rent market.Sustainability, 13(12227). https: //doi.org/10.3390/su132112227

[18]. Leskinen, N., Vimpari, J., & Junnila, S. (2020). A review of the impact of green building certification on the cash flows and values of commercial properties.Sustainability, 12(2729). https: //doi.org/10.3390/su12072729

[19]. Devine, A., & Kok, N. (2015). Green certification and building performance: Implications for tangibles and intangibles.Journal of Portfolio Management, Special Real Estate Issue.

[20]. Jahan, S. (2024). Importance of quality assurance in real estate to satisfy the customers of Climax Holdings Ltd. Internship report, BRAC Business School.

[21]. Montso, M. E. (2021). Supply chain coordination and firm performance in the construction industry in Gauteng Province (Master’s dissertation). Vaal University of Technology.

[22]. Njoka, P. G. (2010). The relationship between corporate governance practices and financial performance of property management companies in Kenya (MBA management research project). University of Nairobi.

[23]. Suhendar, W., Sahusilawane, W., et al. (2023). Determinants of corporate governance and ownership structure in increasing the company’s financial performance.International Journal of Economics,Business and Accounting Research, 7(1).

[24]. Chan, W., Hui, E. C. M., Shen, J., & Zhang, L. (2025). Capital structure and financial distress in China’s real estate sector: A perspective from sales tournament.Humanities & Social Sciences Communications, 12, 885.