1.Introduction

In recent years, the center of the global luxury consumption market has gradually shifted to developing countries, and China, as one of the largest developing countries, has become a major player. In this passage, the influence of brands effect which acts on heterogeneous consumer groups by some investigations and data, analyzing the situation of luxurious good market in China.

The concept of Luxury is derived from the Latin word "Luxus" and contains two meanings: "an item that creates pleasure and comfort" and "an expensive item that costs a great deal of money". Luxury good is generally considered to be non-essential, that is, items other than what is necessary for human survival and development. The rarity, uniqueness and preciousness of luxury goods themselves make their prices extremely high. In the eyes of economists, luxury goods are commodities with a high ratio of price to quality, or commodities with a high ratio of intangible value to tangible value [23]. Luxury has a frame of reference; it is luxury for others, but not luxury for oneself [14]. Luxury can be divided into broad sense and narrow sense and is a relative concept [30]. This paper agrees with this concept and believes that luxury goods are divided into broad sense and benefit. The broad sense of luxury goods refers to consumer goods beyond the basic needs of consumers, while the narrow sense of luxury goods refers to consumer goods at the highest level in the consumption structure of consumers. In a certain period, the connotation of luxury goods changes in different regions and different periods.

Branding is a phenomenon which appears in modern society, more and more youngsters pursue the designer and luxury goods brands which can show their personality, power, wealth and social classes [6]. In this time period, the winner of the market in China will be a firm which can control one of the hobbies that lots of youngsters will pay for (Cao, 2014). In US, there is an experiment that investigates the acknowledge of different brands, people who had these brands and what kinds of status in society these brands can stand for. Gucci is one of the largest fashions groups all over the world today, but in the past, it nearly went broke because of the family dispute. When Tom Ford became the director of Full Product entrepreneurship, lots of advanced fashion clothes attracted lots of youngsters at that moment such as satin shirts, mohair tops and velvet trousers. It is also successful in the multi-brand career change and becomes one of the biggest fashions empires. (https://www.tomford.com/)

In comparison, the elderly had totally different idea of purchase of products with mega brands or without any brand, they think that the qualities of products and services and cost performance of products are the only things which can attract them to buy [2]. The ages will affect the acknowledge of people about different brands like the elderly does not know supreme and youngsters do not know some old brands, this will decide the range of brands which people in different age groups choose (Pandraud et al. 2017). Although for this, luxurious brands cannot ignore the elderly market any more. According to the investigation, consumption by the elderly accounts for one-third of the country's total, the change of purchase preference from following the public to the fast consumption and service quality. That is to say the elderly became easy to entice to consume by the good service quality when they can have a good mood. [25]

We can see that different types of consumers have different purchasing behaviors for luxury goods. These different types of consumers are not necessarily defined by age, but can also be defined by the economic status and environment of different regions and the different income levels of different groups to determine the division of different consumers' luxury consumption behaviors to ensure more accurate analysis and discussion. Therefore, considering the purchase behavior of heterogeneous consumers is also a top priority for luxury marketing.

In conclusion, through the analysis of the research status of brand effect from luxurious goods and services at China and abroad. This paper shows that managers need to develop an age group specific competitive marketing strategy concerning the positioning of luxury brands, particularly focusing on age group specific adjustments of the social functions. After all, the luxurious goods and services are just addictions in creature comforts with different characters which can attract different kinds of people, so that the quality of products and designs can only touch consumers’ hearts in order to gain more consumption [19]. In this research, the outline is as follow:

Firstly, the first part is the introduction of the article. This part is mainly to lead to a series of questions about the topic and some objects to be studied. The second is literature review, which extracts useful information on the basis of consulting data. The third part is the discussion, through the known information to discuss whether to support the theme of the article. Then is the conclusion part, which summarizes the conclusion through discussion. Finally, it is self-assessment and evaluation of their work in all links.

2.Literature Review

2.1.Related Research of Luxury Good in Abroad

Luxury came from ‘Luxus’. Luxus is a Latin word meaning "great fecundity," which later came to mean waste and excess. Nowadays, dictionary defined it like ‘a thing that is expensive and enjoyable but not essential’, ‘something expensive which is pleasant to have but is not necessary’, ‘some- thing adding to pleasure or comfort but not absolutely necessary’. In conclusion, luxury is good, expensive and unnecessary.

Luxury goods first came into the eyes of researchers in the 19th century. American economist Thor- stein Bunde Veblen was the first person who decided to study luxury. In his book ‘Theory of the Leisure Class: An Economic Study of Implements’, the concepts of "conspicuous consumption" and "conspicuous leisure" are introduced, described and explained: "conspicuous consumption" is consumption of resources and money which is in order to illustrate one’s social status, it means telling people you're posh basically; "conspicuous leisure" is Extend time to pursue pleasure, like doing some exercise or painting. This is in order to show one’s freedom on the engagement in economically productive occupations so that they have time to do something to improve themselves on physical and intellectual [21].

Many years later, as many nations move into a postmodernist, post-scarcity era and as global communications continue to have such significant effects on the material ambitions of consumers worldwide, so the need to fully understand the psychology and economics of status-related consumer behavior increases. More and more people start to consume resources for showing their status and wealth, this had been defined as an international behavior and the most typical way is the purchase of Luxury [17].

Although luxury has been known by most of people in these days, however, the academic circle has not formed a unified definition of the concept of luxury goods. The definition of luxury is multifarious. Economics defines luxury goods as goods for which the increase in demand is higher than the increase in income. It is above inferior goods and necessities, and is a symbol of people's pursuit of high quality. It can cover a wide range, from ginseng to designer watches to luxury cars, which can be luxury goods [22]. Explaining it in terms of basic economic concepts, it can be also defined as an item whose income elasticity of demand is greater than one. When a person's real income increases by 1%, that person's purchase of luxury goods will increase by more than 1%. In recent years, with the development of economy and society, the pursuit of luxury consumption in today's market started to change from the curiosity to the new things to the most direct way to demonstrate social status. In psychology, we can find that the reasons why people purchased on the luxury were more exterior, the public had no knowledge and image about luxury, all of them were defined by society or other people who studied on this. With its scarce production and high price, the advanced luxury goods bring people the supreme pride of their rising social status, so the luxury goods gradually become a symbol of powerful power on people’s wealth [5]. In addition, the birth of some new aristocratic groups has promoted the prosperity of the luxury market, thus developing a luxury consumption culture different from the traditional market, despite the financial crisis, it is still standing [18].

2.2.Related Research of Luxury Good in China

2.2.1.Research Status of Luxury Goods in China

There are few research results on luxury goods and consumers' purchasing behavior in China. On the one hand, as a novel import, luxury goods need time for the Chinese public to accept and under- stand. In addition, the development trend and macro-influencing factors make it impossible for China to conduct far-reaching research on luxury goods at the first time, and more discussions and in- depth studies are based on existing foreign studies.

Firstly, there were some analyses about the situation when the luxury goods were brought into China and the attitude and position from consumers to the luxury goods. For example, by combing the growth background of Chinese millennials, combined with the future development trend of China, this paper investigates the consumption characteristics and product demands of millennials in leather luxury goods, summarizes the current marketing methods and product design status of luxury brands, and proposes to make use of demographic dividend and geographical advantages to vigorously develop the local market with the help of consumption return trend. Integrating online and offline touch points with digital marketing as the core, providing design services with more resonant value and development suggestions such as local cultural identity [4].

The bad effects brought about by the introduction of luxury goods are also addressed through the study and the imposition of policies. This paper analyzes the influence and effect of China's current luxury consumption tax on the luxury market, and puts forward relevant suggestions on the defects of the current luxury tax, such as too narrow tax scope, low tax rate and unreasonable setting [13].

Chinese people evaluate the entry of luxury goods and solve the economic problems it brings from the perspective of their own people. This paper makes a comprehensive analysis of the current situation of luxury consumption in China, analyzes its existing problems and influencing factors, and puts forward relevant countermeasures to the problems existing in the current situation of luxury consumption in combination with China's national conditions [9].

On the other hand, some studies are mainly based on the motivation of luxury consumption in developed countries and related theories, combined with the behavioral preferences and consumption habits of Chinese consumers, and study the consumption behavior of Chinese consumers from different dimensions. For example, the macro-structure theory, micro-power theory, socioeconomic condition theory and production efficiency theory of luxury goods production and consumption in Marx's Capital are regarded as the basic theoretical basis for China to develop luxury goods production and meet the legitimate social demand for luxury goods [16]. The Chinese public has recognized luxury goods as a symbol of social status, and people's love for new things has not stopped, so that many people prefer to reduce their demand for essential goods and increase their financial resources to buy luxury goods to satisfy themselves. Some other effects have been gradually discovered, such as wasting resources and polluting the environment; Destroy the relationship between people, people and all aspects of society, and destroy social harmony [26].

2.2.2.Research on Brand Effect and the Influence of Brand-Name Effect on Luxury Sales in China

Brand effect refers to the use of the brand on the product, the benefits and influence brought by the users of the brand, is the role of brand use. When the brands appear in a market, it can be under- stood that the commodity economy of this country has developed to a certain stage, because the brand can only appear when the commodity economy is extremely developed. The high recognition of the brand can allow enterprises to develop more rapidly and bring huge economic and social benefits to the producers. After registration, the brand will become a unique resource of the business, protected by law, and other enterprises cannot be counterfeited and used. In the promotion of the enterprise, the brand can also be the focus of publicity, so that consumers will be deeply impressed with it and have a sense of familiarity and stimulate the desire to buy. When a brand is famous, consumers will follow the public opinion to buy, after all, ordinary consumers can not try all the same type of products, so that consumers have a degree of recognition and dependence. The commodity economy is highly developed, the homogenization of products is getting higher and higher, that is, the difference between similar products is reduced, in this case, enterprises in order to protect their own interests, the brand came into being, the brand was only a sign, is a very personalized sign, but it is the endorsement of the company's products. The brand effect itself has some positive effects, just like the centripetal force in physics, which makes the enterprise stronger. But similarly, in the process of enterprise development, the brand effect also restricts the development of enterprises, just like the centrifugal force in physics. Brands are not only protective, they can also bring huge benefits. The brand is the generalization of the quality, characteristics, performance and use level of the enterprise's products, which condenses the style, spirit and reputation of the enterprise. When consumers are exposed to products bearing the brand, these contents will surface. The brand will bring some other things, such as slogan, which can also encourage producers to increase the breadth and depth of publicity and improve the quality of products and services. Along with some negative effects, the establishment of the brand image makes people trust the brand's signature products. However, if the company starts to switch to other industries, such as KFC began to make mobile phones, it remains to be verified whether the brand new products can have the same quality as the signature products in the eyes of consumers. This is a point that many merchants ignore, so they rush into the market and leave bitterly [15].

In the degree of brand effect, brand-name effect came into being. Brand-name effect refers to the phenomenon caused by brand-name intangible assets that can bring new economic utility to its owner or operator. A famous brand is a strong brand that is well-known in the single market, and it has the power to suppress the brand that is not as well-known and strong in the market. Based on this, famous brands lead the progress and development of products, enterprises and society. Famous brand as an enterprise asset in the market development, capital expansion, personnel cohesion and other aspects will have an impact on the enterprise, so that the enterprise has a magic weapon for success. One of the big winning points of famous brands is quality, and they are trusted by consumers with excellent quality. Its popularity is also unique, so that consumers in the encounter of a product, the first time to think of is to this product as a sign of the famous brand. Different from the brand effect, the brand-name effect is also caused by fashion, which is in the current information age with highly developed social media and the Internet, and the trendy brand-name can also make people flock to it. They are brand new and change from year to year, keeping consumers fresh all the time. What is more different from ordinary brands is that they will pay attention to charity and environmental protection, which are the most favorable methods for consumers to get a good impression of this brand, so that consumers are more comfortable to consume.

Of course, luxury brands are different from famous brands and ordinary brands. Luxury brands can only become luxury goods if their products have high value preservation, such as Rolex and LV.

Luxury goods do not exist in a kind of enjoyment, unlike some goods in famous brands are necessities, it itself has a high premium because of its status, the cost of goods made with the same material and process is far lower than the price of goods sold in luxury brands. Luxury goods have gone be- yond the level of consumables to the level of collections, and we can see that many people spend extra money to maintain luxury goods, but they are willing to keep their luxury goods in a new look. There are very few brands that can become luxury brands today, because these brands were founded decades before the so-called golden age, and they were the pioneers of the industry. They have no competitors, and the loyal consumers and brand heritage accumulated in their early development are beyond the reach of emerging brands. The precipitation of brand history and culture has also become the proud capital of these luxury brands [1].

In addition, there are some categories of research on luxury consumption behavior of heterogeneous consumer groups. To give some examples, the Era Z includes contemporary college students and some new social groups, and the difference between the second-hand luxury consumption market and the ordinary luxury market. [11, 28]

2.3.Review of Relevant Research

Through the investigation, it is found that there are few researches on the luxury purchasing behavior of heterogeneous consumer groups globally. Based on this, this paper will analyze the differences in luxury consumption behaviors of different groups based on the characteristics of heterogeneous groups and the different concepts of the global population on luxury goods, so as to estimate the situation and trend of the world commodity economy. In this paper, we will talk about why the young people are so keen on luxury goods today, but the middle-aged and elderly people who can really afford to enjoy luxury goods are not interested in it; Why young people have become so fanatical about luxury goods that they force themselves to enjoy luxury goods even if they overspend their assets or adjust their use of normal goods and inferior goods or even reduce the consumption of necessary goods in daily life; With the permanent presence of luxury goods in the market, does the attitude of heterogeneous consumer groups towards luxury goods change.

3.Discussion

3.1.Research Methods

3.1.1.Literature Research

Literature research method is a method to comprehensively and correctly understand and master the issues to be studied by searching, reading and sorting out relevant domestic and foreign literature extensively according to the research theme and certain research purposes. By using authoritative literature retrieval tools and possible literature acquisition channels, this paper extensively collects information about the frequency of consumers buying luxury goods and the influencing factors, including age, income, region, etc., so as to grasp the relevant global research results and research trends more comprehensively and systematically, laying the foundation for the demonstration and research of this paper.

3.1.2.Quantitative Research

Quantitative research method is a kind of research method that accurately reveals and describes the interaction and development trend between research objects through statistical calculation of quantitative characteristics, quantitative relations and quantitative changes of research objects. On the basis of theoretical analysis, this paper uses quantitative research methods to obtain data from different official platforms, so as to conduct a more accurate and effective analysis of luxury consumption behaviors of heterogeneous groups.

3.2.China's Luxury Market Position in the World.

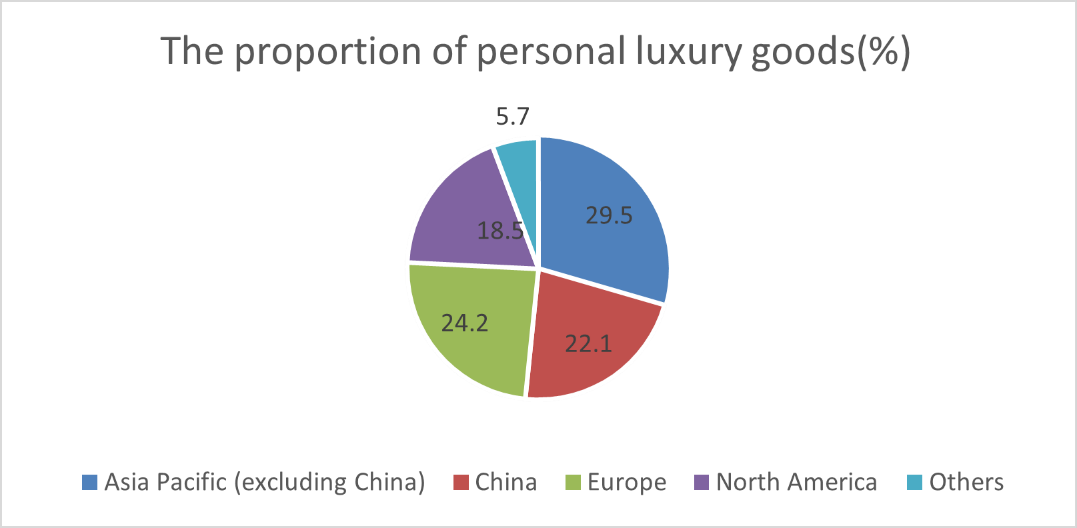

As the global economy recovers after the pandemic, a study by consulting firm Bain & Company and Italian luxury goods association Fondazione Altagamma shows that in 2022, the global luxury consumption will reach a record high of 345 billion euros. In Figure3-1, sales increased by about 19% compared to 2021. To be specific, the proportion of personal luxury goods in 2022 will be used here because the data for 2023 is not complete. First of all, the Asia-Pacific region excluding China ac- counts for 29.5% of luxury consumption; It was followed by China and Europe with 22.2% and 24.2% respectively. North America is not far behind, with 18.5; The rest accounted for just 5.7%. In the whole chart, only China is a single country as a legend compared with other continents, and China's proportion is no less than or even far beyond the other continents. It can be seen that China's luxury market occupies a large proportion and has great potential and broad prospects. The Chinese will also become a large group of luxury consumers worldwide.

Figure 1. Share of global sales of personal luxury goods in 2022 (%)

Data source:2022 Global Luxury Market Trends Insight Report(Made by Shanghai Oriental Wealth Securities Investment Consulting Co., LTD)

So, what about luxury consumption among different groups within China's large newly middle in- come group? According to data from a team led by Xie Fuzhan, a member of the Department of Science at the Chinese Academy of Social Sciences, all types of social people in the figure do not maintain a very high frequency of luxury goods consumption, and their luxury consumption frequency is mostly less than five luxury goods per year. It can be seen that although China's luxury consumer market is very large, ordinary social people do not have enough assets to recklessly buy luxury goods. Among them, employees in private enterprises have the highest frequency of consumption, with the proportion of one to ten items per year being the highest. The frequency of luxury consumption of employees in foreign companies, intermediary social organizations and self- employed people is decreasing one by one; Other groups are the lowest, basically owning one or none.

Figure 2. Proportion of luxury consumption among different groups within the new social class (%)

Data Source: New Social Class Survey (2017)

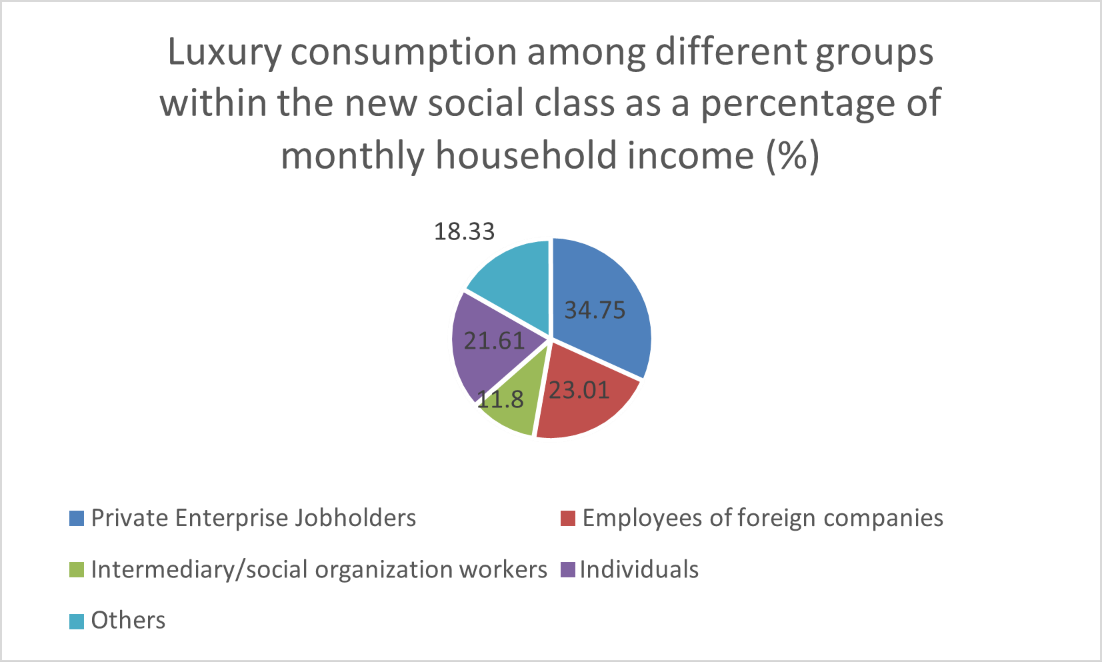

Similarly, luxury consumption among different groups within the new social class accounts for monthly household income, as shown in Figure 3. Employees in private enterprises earn the highest income. Followed by foreign employees, self-employed and other social personnel decline in turn; Workers in intermediary/social organizations earn the least. According to the consumption frequency of luxury goods of the five types of social personnel in Figure 2, the income of other social personnel is proportional to the consumption frequency of luxury goods, except the intermediary/social organization employees. Intermediary/social organization employees have the lowest income, but have the highest frequency of luxury consumption, it is not difficult to see that they are overspending. They know very well that they can't afford so many luxury goods, so they get consumer capital in other ways such as loans. Not only are they unable to identify the causes of their plight, but they also have no desire to change the situation, so there seems to be no hope for the new poor to emerge from their plight and effect social change. They look glamorous and wear many luxury goods, but they don't have many assets. These people are called the "new poor" [7].

Figure 3. Luxury consumption among different groups within the new social class as a percentage of monthly household income (%) (Data Source: New Social Class Survey Data (2017)

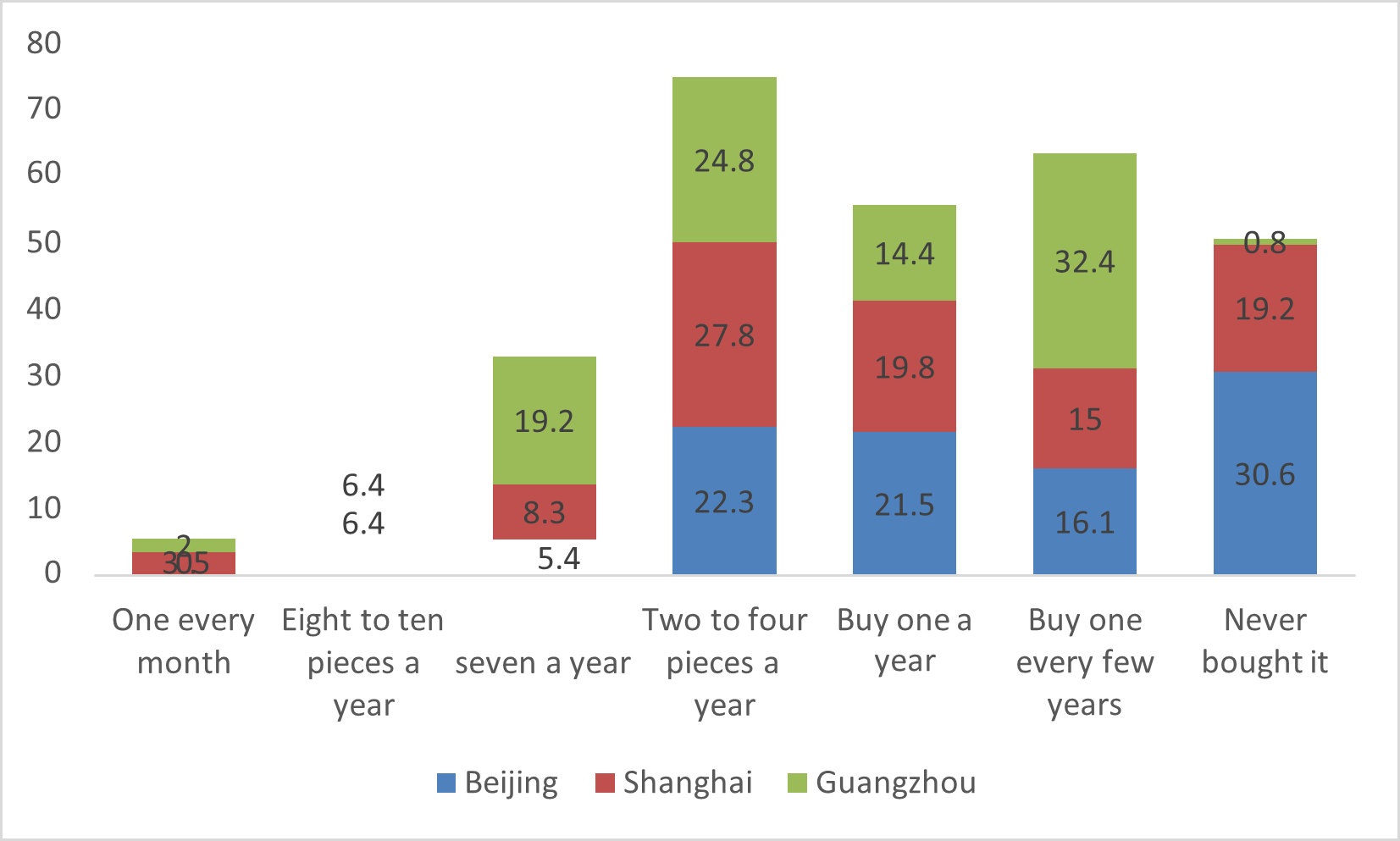

In addition, each luxury consumption market in China is also different. The cities in China are big and small, prosperous and poor. Take Beijing, Shanghai and Guangzhou as examples. As is shown in the figure 4, the frequency of consumption of luxury goods related to the new social class living in Shanghai is mostly higher than that of the new social class living in Beijing and Guangzhou. Especially in the two options of "buy at least every month" and "buy two to four pieces a year", the frequency of purchase of new social classes in Shanghai is higher than that of Guangzhou and Beijing. But when it comes to "buying five to seven items a year", Guangzhou's new social class buys luxury goods more frequently. The results starkly reveal regional differences in the frequency of luxury purchases among new social classes.

Figure 4. Comparison of luxury consumption among new social classes in Beijing, Shanghai and Guangzhou

Data Source: New Social Class Survey Data (2017)

Why is the Chinese luxury market known as the most potential market? China is a country with a vast territory, a long history and a huge population. The total amount of resources owned by Chinese people is also very large, and they are all entitled to consume luxury goods, although each per- son may not be able to spend a large amount of consumption. The most important thing is that as a new product entering China, luxury goods bring Chinese people the novelty and freshness has not weakened, so there are still a large number of Chinese people willing to consume luxury goods. Re- fer to Figure 5 here, just two years after entering the Chinese market, the growth rate has reached an astonishing 154%. Although the growth rate was pitifully low and even fell two years later, the year-on-year growth rate of consumption in China's domestic luxury market has not been lower than 10% since 2017. Because the new coronavirus has had little impact on most parts of China, the growth rate after 2020 will remain high, albeit with some decline.

Figure 5. Growth rate of Chinese luxury goods consumption in China from 2011 to 2021 Data Source: China Luxury Goods Report 2020-2021 (Yao Ke Institute)

The Chinese luxury market known as the most potential market is not only because of the huge Chinese market, but also because of the high consumption power of Chinese luxury goods, which is not only reflected in the domestic market, but also in the foreign market. It can be seen that Chinese people's pursuit of luxury goods. Let's take a look at the total global luxury consumption of Chinese people and its growth rate during the decade from 2011 to 2021. According to Figure 6 and some calculations, the global luxury consumption power of Chinese people has been steadily increasing in the past ten years, but for the arrival of the new coronavirus, this data has reached a frightening point. Although the epidemic has reduced the consumption of $29 billion in 2020, it cannot resist the strong consumption power of Chinese luxury goods, and the consumption of $22.8 billion in 2021 has risen on its basis, although it is still not as good as $152.7 billion in 2019, but such a terrible market resilience can also prove its potential. Due to the impact of the epidemic, the global luxury market fell by 31% in 2020, with a total consumption of only 263.4 billion US dollars, but the Chinese market gained a rapid growth of 45%, reaching 68.9 billion US dollars, and its share in the global market increased from 12% to 26%, but it still failed to change the situation that the global luxury market suffered a large proportion of decline in the epidemic. The sharp decline in Chinese overseas consumption has become one of the most important reasons and manifestations of the global luxury goods market has suffered a setback during the epidemic, and the global luxury goods consumption of Chinese people in 2020 has fallen by 19% to 123.7 billion US dollars. However, due to the strong domestic consumption in China, the proportion of Chinese people's domestic consumption of luxury goods increased from 31% to 56%, realizing for the first time that domestic consumption is greater than overseas consumption. Chinese consumers still contribute 47% of the global luxury consumption, and further become the veritable life-saving straw of the global luxury market in 2020.

Figure 6. China's global luxury consumption and growth from November 2011 to 2021 Data Source: China Luxury Goods Report 2020-2021 (Yao Ke Institute)

3.3.The Differences of Luxury Goods Purchasing Behaviors in China

According to the TMI2021 Luxury Consumer survey, 42% of China's high-end boutique consumption comes from high-end consumer groups with net assets greater than 10 million yuan, accounting for 0.3% of China's total population, while the macro environment and the epidemic have a slight impact on high-end consumer groups' purchasing behavior of high-end boutique. The biggest crisis in 2021 will certainly be COVID-19, which will increase the number and variety of necessities for people and make people's lives more expensive. Still, overall spending on high-end goods was unaffected. At the same time, China's purchasing channels have begun to shift more from offline to online, and the former foreign purchasing or tourism purchasing behavior has decreased, but the major shopping centers in China still have a lot of attraction. Although luxury goods are still bought, after all, life has become tight, and the purchase of these luxury goods began to become deliberate, and classic and preservation products have become the most important luxury goods consumption objects, because these kinds of luxury goods can be sold in the economic crisis to survive. So, what is the reason why this situation still maintains the consumption of high-end goods? When the epidemic is rampant in 2021, in fact, only those who have the ability to consume luxury goods as daily consumption before this can still maintain their lives at this time, which is an asset and strength that many people who can only buy luxury goods when traveling do not have. Some luxury goods sold at this time, many are limited purchases, which makes high-end people very sought after, not only because of its unique, but also because over time, its value will continue to rise. Among them, there is also the help of the government. For example, the tax reduction policy for luxury goods and the rapid development of duty-free markets in Hainan Island and other regions, including the high re- turn on consumption, make the government willing to help and encourage people to consume.

Here is some data influenced by the global situation which was came from COVID-19: In 2021, as the global coronavirus epidemic has not improved, most Chinese consumers still choose to consume luxury goods at home. The digital development of the luxury industry is driving huge changes in the luxury market. According to the China Internet Network Information Center (CNNIC), by December 2021, the number of online shoppers in China has reached nearly 842 million, an increase of 12.3% over 2020. China International E-commerce Center data show that in the third quarter of 2021, the national online retail penetration index increased by 2.5% year-on-year and decreased by 0.5% quarter-on-quarter. Driven by the policy environment, technological innovation, user change and consumption upgrading, the integration of online and offline consumption has accelerated, and community group buying has entered a period of calm precipitation.

3.3.1.Purchasing Channel

Through KPMG's analysis of some customer surveys, we can find that high-end consumers have full confidence in the future economic environment, and they will not reduce their consumption level due to the impact of COVID-19. As travel restrictions and global supply chain disruptions during the epidemic prevented Chinese consumers from leaving the country or purchasing high-end products through daigou, the purchasing pattern of Chinese high-end product consumers has been affected and changed by the epidemic for three years, and consumers have become more favored domestic offline consumption channels. China is expected to grow into the world's largest consumer market for individual high-end products in the future. In the current environment, Hainan is expected to cater to the return trend of high-end boutique consumption, continue to release growth potential, and become the first choice for domestic high-end boutique consumption. The positive attitude of high-end consumers towards the economic environment and their purchase desire in- crease with the increase of income can be shown in the following figures 7, 8 and 9.

Figure 7. In the next 2-3 years, how your high-end boutique consumption level will change?

Data Resources: Customer Survey from KPMG

Figure 8. How will your high-end boutique shopping channel change when the borders reopen?

Data Resources: Customer Survey from KPMG

Figure 9. How much of your high-end goods will flow out when the border is reopened?

Data Resources: Customer Survey from KPMG

According to these, we can find that high-end consumers not only continue their previous consumption level, but also have more stringent requirements for services. Therefore, shopping centers in China can more conveniently provide daily luxury consumption needs, and high-end shopping centers provide intimate services for high-end consumers through membership VIP programs. Many people believe that the outflow of high-end boutique products is not large, mainly because the loss is mostly caused by tourism retail, and it is obvious that other countries have price advantages and more product portfolios and inventories, which makes it an unwise choice for foreign tourists to buy luxury goods in China.

3.3.2.Consumer Profile

According to the KPMG China and DLG2023 research report "The New Landscape of the Luxury Industry: Sincerity, Consistency, and Building Trust with Chinese Consumers" released in February 2023, we divided Chinese consumers into five groups. The characteristics and demographics of each Chinese consumer group are as follows:

The first group of people's understandings of luxury goods is limited to its name and birthplace, these people do not explore the differences between different brands, mainly concentrated in second tier cities over 45 years old consumers.

The second type of people value luxury and conspicuous clothing and like to buy some high-end products to show their status. These people are mainly 25-34 years old and concentrated in second- tier cities.

The third type of people pay more attention to quality of life and like to share their life experience on social media, which is mainly concentrated in first-tier cities and Hong Kong consumers aged 25 to 34.

The fourth type of people pay more attention to the details of the product, they will be careful to appreciate the brand heritage history, materials and manufacturing process, which is often living in first-tier cities and Hong Kong some people over 45 years old will pay attention to.

The last type of people will pay attention to the future, they will choose their own consumption intentions based on their own cognition, and they are more eager for sustainable development of enterprises, which is what 18-24 years old people in first-tier cities will do in the new era.

They were identified by KPMG as ‘Go international’, ‘Show achievement’, ‘Fit in with the group’, ‘Quality first’, ‘Create a better future together’.As shown in Figure 10, the five groups are not fixed, and Chinese consumers can seamlessly transition between groups. At the same time, Chinese consumers will change among different groups as their experience of the high-end boutique market and their mentality evolve. Chinese consumers will analyze high-end boutique consumption from a multi-dimensional perspective, which is due to the growth of globalization and the advancement of the Internet to make information access easier.

Figure 10. Five major groups as a percentage of the total population

Data Resources: A New Outlook for the Luxury Industry: Be Honest, be Consistent, and Build Trust with Chinese Consumers", KPMG China, DLG, February 2023, KPMG Analysis

3.3.3.More Sorts of Consumer Profiles

In 'China Luxury Consumption Behavior Report 2022 - Development of China's Luxury Market in the Context of Online-Offline Convergence', heterogeneous luxury consumer groups are divided into three categories: Millennials (born 1980-1995), Generation Z (born 1996-2012), and Generation X (born before 1980).

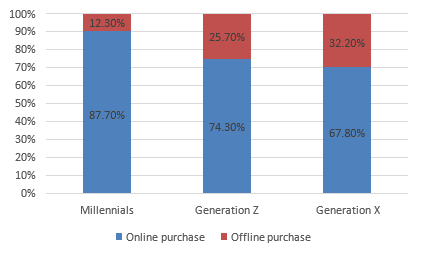

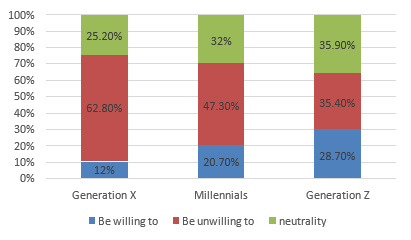

From the perspective of the year, Generation Z, who grew up in the Internet era, is more inclined to understand product information online (Figure 11). Millennials who are more comfortable with the digital economy and Gen Z have a higher proportion of online purchases than older Gen X (Figure 12). Consumers have different attitudes towards second-hand luxury goods. Not only the ordinary luxury consumption market, but also the second-hand luxury consumption market is worth studying.

The second-hand luxury market is an important part of the luxury market. According to the 2021 Research Report on the Development of China's second-hand luxury Market released by China Luxury Research Center, the scale of China's second-hand luxury market only accounts for 5% of the market scale of the luxury industry, and the future development potential is huge. The results of this survey show that 43.9% of consumers do not want to buy second-hand luxury goods (Figure 13). The low purchase intention of second-hand luxury goods also shows that the development of China's second-hand luxury goods market is not mature, and consumers have little understanding. In addition, the second-hand luxury market is tilting towards the younger generation. Survey data show (Figure 14) that Generation Z is significantly more willing to buy second-hand luxury goods. Compared with "new products", Generation Z is more concerned about "unique products" that can reflect their personal style.

Figure 11. Access to product information (age group)

Data Resources: China Luxury Consumption Behavior Report 2022 - Development of China's Luxury Market in the Context of Online-Offline Convergence

Figure 12. Consumer purchase channels (age group)

Data Resources: China Luxury Consumption Behavior Report 2022 - Development of China's Luxury Market in the Context of Online-Offline Convergence

Figure 13. Consumers' willingness to buy second-hand luxury goods

Data Resources: China Luxury Consumption Behavior Report 2022 - Development of China's Luxury Market in the Context of Online-Offline Convergence

Figure 14. Different consumers' willingness to buy second-hand luxury goods

Data Resources: China Luxury Consumption Behavior Report 2022 - Development of China's Luxury Market in the Context of Online-Offline Convergence.

4.Conclusion

This study provides implications for both research and practice. In research, this study provides empirical evidence for the differences of the luxury goods purchasing from heterogeneous consumer groups. This model could be applied to empirical studies of Economics and Sociology. In practice, the empirical findings from some surveys, data research and some expertise provide convincing evidence for the reliability of the model. It can be used that people with different characteristics have different purposes when acquiring luxury goods.

Although there are some limitations in the current study, the findings could give researchers and practitioners suggestions to the impact of population heterogeneity on luxury purchases. Specifically, this study demonstrates that gender, age, personal or family income, job content and local development level will all influence people's different opinions on luxury brands, so they have different purposes for using luxury goods in China. Which indicates that we need to discover the purpose of the consumer and use it to reach the heart of the consumer and increase sales. The attitude towards is another essential factor to that China's luxury market has a promising future due to the intensification of world trade competition and the impact of the epidemic in the future, it indicates that the world's luxury brands should open up the Chinese market as much as possible and let more Chinese consumers enter.

References

[1]. Bastien, V. & Kapferer, J. (2013). The luxury strategy of the world's top luxury goods. China Ma- chine Press.

[2]. Brucks, M., Zeithaml, V., & Naylor, G. (2000). Price and brand name as indicators of quality di- mensions for consumer durables. Journal of the academy of marketing science, 28, pp: 359-374.

[3]. Chandon, J., Laurent, G., & Lambert-Pandraud, R. (2022). Battling for consumer memory: As- sessing brand exclusiveness and brand dominance from citation-list. Journal of Business Re- search, 145, pp: 468-481.

[4]. Ding, W., Rui, Y., Xu, M., Huang, J., Meng, Z., Zheng, F. & Yao, Y. (2021). Analysis on the con- sumption status and future development of luxury leather brands: with Chinese "millennial" con- sumers as the center. Leather Science and Engineering (06), pp: 76-80. (in Chinese) doi:10.19677/j.issn.1004-7964.2021.06.014.

[5]. Dubois, D., Jung, S., & Ordabayeva, N. (2021). The psychology of luxury consumption. Current Opinion in Psychology, 39, pp: 82-87.

[6]. Eastman, J., Iyer, R., Shepherd, C., Heugel, A., & Faulk, D. (2018). Do they shop to stand out or fit in? The luxury fashion purchase intentions of young adults. Psychology & Marketing, 35(3), pp: 220-236.

[7]. Feng, Y. & An, J. (2022). "Defective" Consumers and Possible atrocities: A Study of Sigismund Baumann's New Poor Thought. Journal of Qiqihar University (Philosophy and Social Sciences Edi- tion), pp: 41-45. Doi: 10.13971 / j.carol carroll nki cn23-1435 / c. 2022.04.005.

[8]. Hogg, M., Bruce, M., & Hill, A. (1999). Brand recognition and young consumers. ACR North American Advances.

[9]. Hou, R.(2019). The status quo of luxury consumption in China and its influencing factors. Business News, (06), p.19+p.25.

[10]. Lee, H., Chen, W., & Wang, C. (2015). The role of visual art in enhancing perceived prestige of luxury brands. Marketing Letters, 26, pp: 593-606.

[11]. Li, S. (2022). A reference group influence on second-hand luxury consumers purchase intention studies, Master's thesis, Guangzhou: South China University of Technology. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFDTEMP&filename=10 22761299.nh

[12]. Liu Y. (2023) The global luxury goods market is expected to grow by up to 12% this year. China Trade News.

[13]. Li, Z. (2021). China's luxury goods consumption tax reform research. cooperative economy and science and technology, (16), pp: 158-159. The doi: 10.13665 / j.carol carroll nki hzjjykj. 2021.16.066.

[14]. Lu, C., Qin, Q. & Lin, Y.(2013). Theoretical model of luxury consumption characteristics. Man- agement Review (05), pp: 123-135. doi:10.14120/j.cnki.cn11-5057/f.2013.05.001.

[15]. Luo, J.(2009). Centripetal and centrifugal forces of brand effect. China Brand, (06), pp: 72-76.

[16]. Ma, B.(2013). On the production and consumption of luxury goods in China -- Also on the thought of production and consumption of luxury goods in Marx's Capital. Social Science (02), pp: 32-43.

[17]. Mason, R. (1992). Modelling the demand for status goods. ACR Special Volumes.

[18]. Ni, L. (1900). Luxury Consumption During Economic Crisis.

[19]. Schade, M., Hegner, S., Horstmann, F., & Brinkmann, N. (2016). The impact of attitude functions on luxury brand consumption: An age-based group comparison. Journal of business research, 69(1), pp: 314-322.

[20]. Shen, D., Guo S., Tong, J. & Lin, X. (2023). Brand Youth: Finding the young people who really be- long to you. China Advertising (03), pp: 14-19.

[21]. Thorstein, V. (2017). The Theory of the Leisure Class. Taylor and Francis.

[22]. Vickers, J., & Renand, F. (2003). The marketing of luxury goods: An exploratory study–three con- ceptual dimensions. The marketing review, 3(4), pp: 459-478.

[23]. Wang. (2017). China's luxury consumer behavior factors affecting the empirical research , Ph.D.'s thesis, China: university of foreign economic relations and trade. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2022&filename= 1017219647.nh

[24]. Wu, F. (2023) Research on marketing strategy of high-end leather products based on luxury con- sumer psychology. Chinese leather DOI: 10.13536/j.cnki.issn1001-6813.2023-012-030

[25]. Wu, Y. (2022). A study of the impact of brand value of new energy automobile industry on consum- ers purchase intention with brand personality as an intermediary variable, Doctor's thesis.

[26]. Yin, S. (2008). Some questions about luxury consumption. Journal of Xiangtan University (Philos- ophy and Social Sciences Edition) (02), pp: 14-19+p.144.

[27]. Yin, X., Yang, Y., Kim, H.(2023). An analysis of luxury consumption motivation in the context of brand building. Chinese Business Theory, (18).

[28]. Zhang, Y. & Su, T. (2022). Analysis of luxury consumption behavior of Generation Z. International Brand Observation, (16), pp: 22-26.

[29]. Zheng, G., Zhong, L., Ji, D., & Jin, W. (2015). Development of Made in China Brand: Problems, Causes and Upgrade Strategies. Strategic Study of Chinese Academy of Engineering, 17(7), pp: 63- 62.

[30]. Zhu, X. (2006). An empirical study on Chinese consumers' luxury consumption motivation. Busi- ness Economics and Management (07), pp: 42-48. doi:10.14134/j.cnki.cn33-1336/f.200

Cite this article

Xin,C. (2024). What Are the Differences of Luxury Goods Purchasing Behaviors of Hetero- Geneous Consumer Groups?. Journal of Applied Economics and Policy Studies,9,56-69.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bastien, V. & Kapferer, J. (2013). The luxury strategy of the world's top luxury goods. China Ma- chine Press.

[2]. Brucks, M., Zeithaml, V., & Naylor, G. (2000). Price and brand name as indicators of quality di- mensions for consumer durables. Journal of the academy of marketing science, 28, pp: 359-374.

[3]. Chandon, J., Laurent, G., & Lambert-Pandraud, R. (2022). Battling for consumer memory: As- sessing brand exclusiveness and brand dominance from citation-list. Journal of Business Re- search, 145, pp: 468-481.

[4]. Ding, W., Rui, Y., Xu, M., Huang, J., Meng, Z., Zheng, F. & Yao, Y. (2021). Analysis on the con- sumption status and future development of luxury leather brands: with Chinese "millennial" con- sumers as the center. Leather Science and Engineering (06), pp: 76-80. (in Chinese) doi:10.19677/j.issn.1004-7964.2021.06.014.

[5]. Dubois, D., Jung, S., & Ordabayeva, N. (2021). The psychology of luxury consumption. Current Opinion in Psychology, 39, pp: 82-87.

[6]. Eastman, J., Iyer, R., Shepherd, C., Heugel, A., & Faulk, D. (2018). Do they shop to stand out or fit in? The luxury fashion purchase intentions of young adults. Psychology & Marketing, 35(3), pp: 220-236.

[7]. Feng, Y. & An, J. (2022). "Defective" Consumers and Possible atrocities: A Study of Sigismund Baumann's New Poor Thought. Journal of Qiqihar University (Philosophy and Social Sciences Edi- tion), pp: 41-45. Doi: 10.13971 / j.carol carroll nki cn23-1435 / c. 2022.04.005.

[8]. Hogg, M., Bruce, M., & Hill, A. (1999). Brand recognition and young consumers. ACR North American Advances.

[9]. Hou, R.(2019). The status quo of luxury consumption in China and its influencing factors. Business News, (06), p.19+p.25.

[10]. Lee, H., Chen, W., & Wang, C. (2015). The role of visual art in enhancing perceived prestige of luxury brands. Marketing Letters, 26, pp: 593-606.

[11]. Li, S. (2022). A reference group influence on second-hand luxury consumers purchase intention studies, Master's thesis, Guangzhou: South China University of Technology. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFDTEMP&filename=10 22761299.nh

[12]. Liu Y. (2023) The global luxury goods market is expected to grow by up to 12% this year. China Trade News.

[13]. Li, Z. (2021). China's luxury goods consumption tax reform research. cooperative economy and science and technology, (16), pp: 158-159. The doi: 10.13665 / j.carol carroll nki hzjjykj. 2021.16.066.

[14]. Lu, C., Qin, Q. & Lin, Y.(2013). Theoretical model of luxury consumption characteristics. Man- agement Review (05), pp: 123-135. doi:10.14120/j.cnki.cn11-5057/f.2013.05.001.

[15]. Luo, J.(2009). Centripetal and centrifugal forces of brand effect. China Brand, (06), pp: 72-76.

[16]. Ma, B.(2013). On the production and consumption of luxury goods in China -- Also on the thought of production and consumption of luxury goods in Marx's Capital. Social Science (02), pp: 32-43.

[17]. Mason, R. (1992). Modelling the demand for status goods. ACR Special Volumes.

[18]. Ni, L. (1900). Luxury Consumption During Economic Crisis.

[19]. Schade, M., Hegner, S., Horstmann, F., & Brinkmann, N. (2016). The impact of attitude functions on luxury brand consumption: An age-based group comparison. Journal of business research, 69(1), pp: 314-322.

[20]. Shen, D., Guo S., Tong, J. & Lin, X. (2023). Brand Youth: Finding the young people who really be- long to you. China Advertising (03), pp: 14-19.

[21]. Thorstein, V. (2017). The Theory of the Leisure Class. Taylor and Francis.

[22]. Vickers, J., & Renand, F. (2003). The marketing of luxury goods: An exploratory study–three con- ceptual dimensions. The marketing review, 3(4), pp: 459-478.

[23]. Wang. (2017). China's luxury consumer behavior factors affecting the empirical research , Ph.D.'s thesis, China: university of foreign economic relations and trade. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2022&filename= 1017219647.nh

[24]. Wu, F. (2023) Research on marketing strategy of high-end leather products based on luxury con- sumer psychology. Chinese leather DOI: 10.13536/j.cnki.issn1001-6813.2023-012-030

[25]. Wu, Y. (2022). A study of the impact of brand value of new energy automobile industry on consum- ers purchase intention with brand personality as an intermediary variable, Doctor's thesis.

[26]. Yin, S. (2008). Some questions about luxury consumption. Journal of Xiangtan University (Philos- ophy and Social Sciences Edition) (02), pp: 14-19+p.144.

[27]. Yin, X., Yang, Y., Kim, H.(2023). An analysis of luxury consumption motivation in the context of brand building. Chinese Business Theory, (18).

[28]. Zhang, Y. & Su, T. (2022). Analysis of luxury consumption behavior of Generation Z. International Brand Observation, (16), pp: 22-26.

[29]. Zheng, G., Zhong, L., Ji, D., & Jin, W. (2015). Development of Made in China Brand: Problems, Causes and Upgrade Strategies. Strategic Study of Chinese Academy of Engineering, 17(7), pp: 63- 62.

[30]. Zhu, X. (2006). An empirical study on Chinese consumers' luxury consumption motivation. Busi- ness Economics and Management (07), pp: 42-48. doi:10.14134/j.cnki.cn33-1336/f.200