1.Introduction

In the context of the new era, corporate innovation is the engine of economic development. The 2024 Government Work Report emphasized that, for China's economy, "stability" is the overarching situation and foundation, while "progress" is the direction and driving force. The internal environment of China’s economy has shown signs of recovery, and it is necessary to pursue progress while ensuring stability. The key to stimulating the momentum for progress lies in driving breakthroughs in core technologies and enhancing independent innovation capabilities.

Externally, some Chinese enterprises face economic pressure from foreign countries, constantly reminding both the government and businesses that only by mastering core technologies, especially in the field of basic research innovation, can China take control of trade initiatives [1]. The electronic information manufacturing industry plays a supporting, leading, and enabling role in the development of the industrial economy. In recent years, it has faced challenges such as weaker expectations and slower growth rates. Ensuring stable operation within the industry and promoting high-quality development have become important and challenging tasks. The industry is characterized by high output value, high growth, low consumption, and low pollution, aligning with the green and sustainable development strategy of the new era. The ESG (Environmental, Social, and Governance) framework, which focuses on these three pillars, provides new ideas for companies to accomplish the above tasks.

This article intends to establish a theoretical relationship between ESG information disclosure levels and corporate innovation capabilities, analyzing the mechanism through which ESG information disclosure impacts corporate innovation. The structure of the article is as follows: The second section will summarize the relevant literature and research findings, making hypotheses for this study and laying a solid theoretical foundation for the discussion; the third section will present empirical analysis, constructing an empirical model based on data to verify the relationship between ESG disclosure levels and corporate innovation capabilities; the fourth section will conduct a case study, using Hikvision, a well-known company in the electronic equipment manufacturing industry, as a practical example to further explain the reasons and impact of the empirical results; finally, the article will conclude with insights and propose new directions for the field.

2.Literature Review and Research Hypotheses

Currently, there is limited literature on the relationship between "ESG disclosure levels and corporate innovation capabilities." Corporate innovation requires significant financial support, and external financing is an important source of funding for innovation (Czarnitzki & Hottenrott, 2011) [2]. Therefore, companies need to address issues with shareholders and other investors who provide financing. The separation of ownership and control in a company often leads to significant agency problems within the organization (Fama, 1980) [3]. Jin Xiangyi (2019) suggested that shareholders, who own the company, need to supervise the management to ensure the effective implementation of business decisions made by the shareholder meetings, with the goal of maximizing shareholder profits. Strengthening the effective disclosure of corporate information can help reduce the information asymmetry between shareholders and managers. It also helps to reduce managers' motivations to deviate from the goal of maximizing shareholder profits. Under a more detailed information disclosure policy, shareholders and investors can monitor the company's investment projects in a timely manner, abandoning investments in poor projects and increasing investments in promising ones [4].

Corporate innovation requires good resource allocation. Proper resource allocation can help companies improve efficiency, reduce costs, and enhance competitiveness. Scholar Lu Yaoyi (2023) argued that ESG disclosure helps companies build a good corporate image and brand value [5]. Zhang Hang (2023) believed that through comprehensive ESG disclosure, companies can obtain more resources, such as capital, customers, employees, and suppliers, and achieve better resource allocation, thereby improving the company's competitive advantage [6]. High-level ESG disclosure helps companies obtain more and higher-quality resources, which in turn promotes innovation and R&D investment and output, enhancing their core competitiveness.

Corporate innovation requires talented personnel. Liu Wenqing (2023) pointed out that ESG, as an important reflection of a listed company’s values, helps companies attract and retain talent by practicing high-quality ESG principles. It also effectively stimulates employees' enthusiasm and innovation, helping the company achieve innovation and development [7]. Technological innovation is an important aspect of corporate innovation. Good ESG disclosure performance can reflect a favorable working environment, where innovative talents can better leverage their professional knowledge and practical experience to respond to market demands, develop new technologies, and seize market share.

In summary, the following hypothesis is proposed: There is a positive correlation between the quality of ESG information disclosure and corporate innovation, where higher-quality ESG disclosure increases corporate innovation input and output.

3.Empirical Analysis

3.1.Sample Selection and Data Sources

This study selects A-share listed companies in China’s computer, communication, and other electronic equipment manufacturing industries from 2018 to 2022 as the research sample. The data is sourced from the Guotai An database. Companies with incomplete financial data or abnormal related indicators are excluded. Ultimately, a sample of 1,881 observations from 42 listed companies is obtained for empirical analysis.

3.2.Variable Description

3.2.1.Dependent Variables

The dependent variables are used to measure corporate innovation behavior. This paper measures corporate innovation from both innovation input and output perspectives. Innovation input is measured by R&D expenditure and patent output. To eliminate the impact of company size, the R&D intensity, i.e., the ratio of R&D expenditure to operating income, is used as a measure. Patent output is measured by the number of patents, with the natural logarithm of patent count used for calculation.

3.2.2.Independent Variable

The independent variable is used to measure the quality of corporate accounting information disclosure. This paper selects the Hua Zheng ESG index to measure the level of ESG information disclosure. The Hua Zheng ESG rating system is divided into nine levels: AAA, AA, A, BBB, BB, B, CCC, CC, and C, from high to low. The ESG disclosure level is assigned a value based on the rating, with "C" assigned a value of 1, increasing incrementally, and "AAA" assigned a value of 9.

3.2.3.Control Variables

Based on the research of Zou Fenghua (2020) [1] and Duan Tingting et al. (2024) [8], the following control variables are selected: years since listing, debt-to-asset ratio, company size, return on equity (ROE), ownership concentration, and board size.

Table 1. Table of Definitions of Variables

|

Variable |

Definition |

|

Dependent Variable: rd |

R&D intensity, i.e., the ratio of total R&D expenditure to operating income |

|

Dependent Variable: patent |

The cumulative number of patents, measured by the natural logarithm of patent count |

|

Independent Variable: esg |

Hua Zheng ESG information disclosure level rating (1-9 points) |

|

Control Variable: age |

Company age, plus 1, measured by the natural logarithm |

|

Control Variable: lev |

Debt-to-asset ratio |

|

Control Variable: size |

Total assets, measured by the natural logarithm |

|

Control Variable: roe |

Return on equity |

|

Control Variable: top11 |

Percentage of shares held by the largest shareholder |

|

Control Variable: ind |

Number of directors, measured by the natural logarithm |

3.3.Descriptive Statistics

The descriptive statistics for the dependent variables are as follows:

The mean of the innovation input (R&D intensity) variable rd is 0.078, with a standard deviation of 0.058. The minimum value is 0.009, and the maximum value is 0.474.

The mean of the innovation output (patent count) variable patent is 5.339, with a standard deviation of 2.048. The minimum value is 1.386, and the maximum value is 10.88.

Table 2. Descriptive Statistics Table

|

Variable |

Obs |

Mean |

Std. Dev. |

Min |

Max |

|

rd |

210 |

0.078 |

0.058 |

0.009 |

0.474 |

|

patent |

210 |

5.339 |

2.048 |

1.386 |

10.88 |

|

esg |

210 |

4.143 |

1.225 |

1 |

7 |

|

age |

210 |

3.106 |

0.307 |

2.079 |

3.761 |

|

lev |

210 |

0.433 |

0.18 |

0.051 |

0.916 |

|

size |

210 |

22.64 |

1.527 |

19.994 |

26.832 |

|

roe |

210 |

0.025 |

0.399 |

-4.666 |

0.273 |

|

top11 |

210 |

0.275 |

0.115 |

0.01 |

0.545 |

|

ind |

210 |

2.06 |

0.203 |

1.609 |

2.485 |

3.4.Correlation Analysis

From the results in the correlation analysis table below, we can see that the correlation coefficients between all variables are less than 0.7. This suggests that the possibility of multicollinearity issues between these variables is low. Specifically, for the independent variable esg, the correlation coefficients with the dependent variables rd (innovation input) and patent (innovation output) are positive. This indicates a potential significant positive correlation between the independent variable esg and the two dependent variables. However, since the correlation analysis only examines the correlation coefficients between pairs of variables without including other factors, the results from correlation analysis provide only an initial indication of the relationship between variables. To determine the factors influencing the dependent variables, further analysis is required with subsequent model regression results.

Table 3. Correlation Analysis Table

|

Variables |

(rd) |

(patent) |

(esg) |

(age) |

(lev) |

(size) |

(roe) |

(top11) |

(ind) |

|

rd |

1.000 |

||||||||

|

patent |

0.013 |

1.000 |

|||||||

|

esg |

0.0003 |

0.485*** |

1.000 |

||||||

|

age |

-0.083 |

0.250*** |

0.091 |

1.000 |

|||||

|

lev |

-0.041 |

0.384*** |

0.098 |

0.353*** |

1.000 |

||||

|

size |

-0.050 |

0.549*** |

0.422*** |

0.396*** |

0.408*** |

1.000 |

|||

|

roe |

-0.430*** |

0.019 |

0.185*** |

0.043 |

-0.245*** |

0.148** |

1.000 |

||

|

top11 |

0.037 |

-0.102 |

0.121* |

-0.028 |

0.023 |

0.003 |

0.187*** |

1.000 |

|

|

ind |

0.031 |

0.289*** |

0.127* |

-0.014 |

0.165** |

0.244*** |

-0.213*** |

-0.072 |

1.000 |

|

*** p<0.01, ** p<0.05, * p<0.1 |

|||||||||

3.5.Multicollinearity Test

To avoid multicollinearity issues between variables that could lead to incorrect regression results, we perform a multicollinearity test. According to the results of the multicollinearity test, the VIF (Variance Inflation Factor) values of all variables are less than 2. Generally, a VIF value below 10 indicates that there are no multicollinearity problems between the variables. Therefore, all variables can be included in the model for empirical analysis.

Table 4. Multicollinearity Test Results

|

Variable |

VIF |

1/VIF |

|

size |

1.770 |

0.563 |

|

lev |

1.450 |

0.688 |

|

roe |

1.300 |

0.771 |

|

age |

1.290 |

0.775 |

|

esg |

1.270 |

0.786 |

|

ind |

1.170 |

0.857 |

|

top11 |

1.060 |

0.940 |

|

Mean |

1.330 |

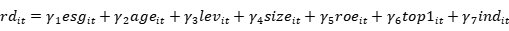

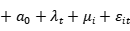

3.6.Model Construction

Panel Double Fixed Effects Model:

(1)

(1)

(2)

(2)

In this model, the dependent variables rd (innovation input) and patent (innovation output) are the outcome variables, with esg as the core independent variable. The control variables include age, lev, size, roe, top1, and ind. The regression coefficient is represented by γ, ε is the random disturbance term, a0 is the constant term, λ represents time fixed effects, and μ represents individual fixed effects.

3.7.Model Regression

To study the impact of the core independent variable esg on the dependent variables rd (innovation input) and patent (innovation output), two fixed effects regression models are constructed.

Table 5. Model Regression Results

|

(1) |

(2) |

|

|

VARIABLES |

rd |

patent |

|

esg |

0.010*** |

0.260*** |

|

(3.026) |

(2.797) |

|

|

age |

-0.130 |

-1.541 |

|

(-1.481) |

(-0.632) |

|

|

lev |

-0.086*** |

-0.363 |

|

(-2.938) |

(-0.449) |

|

|

size |

0.011 |

-0.245 |

|

(1.072) |

(-0.845) |

|

|

roe |

-0.100*** |

-0.142 |

|

(-12.005) |

(-0.615) |

|

|

top11 |

0.134** |

3.014** |

|

(2.449) |

(1.984) |

|

|

ind |

-0.029 |

-0.313 |

|

(-1.208) |

(-0.475) |

|

|

Constant |

0.229 |

13.936 |

|

(0.712) |

(1.562) |

|

|

Observations |

210 |

210 |

|

R-squared |

0.545 |

0.142 |

|

Number of id |

42 |

42 |

|

ID |

YES |

YES |

|

YEAR |

YES |

YES |

|

F |

17.10 |

2.353 |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

From the Results of Column (1): It can be seen that esg has a significantly positive effect on the dependent variable innovation input (rd), with a coefficient of 0.01, and this result passes the test at the 1% significance level. This indicates that a 1% increase in esg will lead to a 0.01% increase in innovation input (rd). Therefore, esg is one of the key factors positively influencing innovation input (rd).

From the Results of Column (2): When the dependent variable is innovation output (patent), the core independent variable esg also has a significantly positive effect on innovation output (patent), with a coefficient of 0.26. This result passes the test at the 1% significance level. This indicates that a 1% increase in esg will lead to a 0.26% increase in innovation output (patent). Therefore, esg is also a key factor positively influencing innovation output (patent).

4.Case Study — Hikvision

4.1.Company Overview

Hangzhou Hikvision Digital Technology Co., Ltd. (hereafter referred to as Hikvision) was founded in 2001. It is a technology company focused on innovation, with over 20 years of experience in the fields of security and smart IoT (Internet of Things). The company’s business covers more than 150 countries and regions globally.

Hikvision is committed to applying multidimensional sensing, artificial intelligence, and big data technologies across various industries to lead the future of smart IoT. With comprehensive sensing technologies, Hikvision helps people and objects connect better and builds the foundation for a smart world. Through a wide range of intelligent products, the company meets diverse needs and makes intelligent solutions accessible. By innovating IoT applications, Hikvision builds a convenient, efficient, and safe intelligent world, contributing to a better future for everyone.

4.2.ESG Management Philosophy and Framework

Hikvision adheres to the ESG management philosophy of integrating corporate social responsibility and sustainable development into its business, driven by technological innovation, with the aim of becoming a globally respected technology company. Based on the company’s core competencies and the demands and expectations of its stakeholders, the company identifies "technology for good" as the core of its ESG development. The key directions for its ESG development are: integrity and compliance, green low-carbon initiatives, and harmonious coexistence.

Based on operational, enabling, and supporting processes, the company implements ESG management through a PDCA (Plan, Do, Check, Act) cycle, ensuring continuous improvement and elevating ESG management from reporting disclosure to sustained improvement.

4.3.ESG Disclosure Quality Level

Table 6. Comparison of Hikvision’s ESG Information Disclosure Level with the Industry

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Hikvision ESG |

6 |

6 |

6 |

6 |

6 |

|

Average ESG of the Industry |

4.136585 |

4.136585 |

4.141463 |

4.146341 |

4.15122 |

From the Comparative Data Above, it can be observed that although the ESG information disclosure level of the industry as a whole has improved compared to the previous year, Hikvision's improvement is significantly larger. The new regulations and guidelines released by the China Securities Regulatory Commission (CSRC) during the year imposed new requirements on listed companies in areas such as environmental protection, social responsibility, and stakeholder engagement. Hikvision has actively responded to these policy trends, leading to enhanced disclosure of information in various areas.

Hikvision’s ESG information disclosure level consistently exceeds the industry average. This is closely related to the company’s long-standing attention to global issues, its promotion of sustainable supply chains, its proactive practice of ESG responsibilities, and its strong risk-resilience capabilities.

4.4.Innovation Capacity Analysis

Table 7. Comparison of Hikvision’s R&D Investment Intensity with Industry

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Hikvision’s Innovation Investment Intensity |

8.99 |

9.51 |

10.04 |

10.13 |

11.80 |

|

Industry Innovation Investment Intensity |

7.74 |

7.82 |

7.85 |

7.89 |

7.95 |

Figure 1. Hikvision's R&D Expenditures from 2018 to 2022

Table 7. Hikvision’s Invention Patent Statistics from 2018 to 2022

|

Company Patents Cumulative |

Invention Authorizations |

Invention Patents |

Utility Model Patents |

Design Patents |

|

|

2018 |

2784 |

234 |

1744 |

298 |

508 |

|

2019 |

4080 |

301 |

2616 |

468 |

695 |

|

2020 |

5569 |

497 |

3690 |

545 |

837 |

|

2021 |

6668 |

811 |

4303 |

600 |

954 |

|

2022 |

6781 |

902 |

4311 |

601 |

967 |

From the data above, it is evident that Hikvision’s R&D expense ratio has continuously increased, surpassing the average level of the electronic equipment manufacturing industry. Additionally, the output of invention patents shows an upward trend in the same period. This suggests that the company places significant emphasis on technological progress, and the continuous launch of new products will expand the company’s growth potential. Some analyses indicate that the increasing R&D expense ratio is due to Hikvision's deep investment in fields such as artificial intelligence and big data. This high level of investment is expected to bring more innovations and enhance the company's market competitiveness.

Figure 2. Innovation and R&D Case Study of Hikvision

The company has not only made significant progress in ESG information disclosure but has also taken solid steps in sustainable development. By increasing R&D investments and driving green technological innovation, Hikvision has successfully developed a series of environmentally friendly products and introduced new ideas for innovation in the industry.

5.Research Conclusions and Outlook

5.1.Research Conclusions

Based on relevant literature and empirical research, the level of ESG information disclosure has a positive impact on corporate innovation capacity. Improving the level of ESG disclosure injects more momentum and opportunities for innovation. As societal attention to sustainable development continues to rise, companies are placing increasing importance on their responsibilities in environmental, social, and governance aspects. In this context, companies not only need to maintain a leadership position in innovating products and technologies but also need to demonstrate a higher sense of ethics and social responsibility in the field of sustainable development. Therefore, improving the level of ESG disclosure can enhance a company’s competitiveness and promote outstanding achievements in innovation.

From the case study, the results support the above conclusions. Additionally, diversifying innovation business is conducive to long-term development. As shown in the case of Hikvision, by introducing renewable energy and smart manufacturing technologies, the company has successfully advanced the process of green innovation. With the joint efforts of its R&D team, Hikvision has launched a series of eco-friendly products, which have gained a strong reputation in the market and set a benchmark in the industry. The company actively responds to global sustainable development goals, continuously strengthening its ecological and environmental responsibilities, and contributing its unique strength to building a better tomorrow.

In conclusion, to enhance the innovation performance of the electronic equipment manufacturing industry and stimulate its strong competitiveness in the international market, the industry must inject new vitality into the real economy. To this end, the electronic equipment manufacturing industry should actively assume ESG responsibilities, integrate environmental and resource issues into its development plans, and take responsibility for all relevant stakeholders, promoting synergy and sustainable development, and driving comprehensive progress across the entire industry.

5.2.Research Outlook

Based on this study, to further enhance the positive impact of ESG information disclosure on corporate innovation, the following recommendations are provided:

(1) Establish Long-Term ESG Responsibility Awareness and Enhance Proactivity in Information Disclosure: In today’s era, companies should not only pursue economic growth but also adjust their development strategies to achieve sustainable development goals. ESG principles should be integrated into the company's strategic decision-making processes, with an emphasis on building ESG awareness from top management down to grassroots employees, in order to maximize social benefits. Companies should implement standardized management measures and systems to ensure the accessibility, reliability, timeliness, relevance, and authenticity of ESG data, laying the foundation for effective ESG information disclosure. The long-term responsibility and reputation accumulation of ESG not only bring short-term benefits but also improve a company’s innovation capabilities, strengthen its competitiveness, and generate long-term returns.

(2) Enhance Long-Term ESG Responsibility and Explore the Sustainability of Innovation: Further promote green innovation, focusing on the development of eco-friendly products. By utilizing technology to improve resource efficiency and advocating for a circular economy, companies can combine environmental protection with business value. This not only helps companies reduce environmental risks but also leads the industry toward sustainable development.

In pursuing sustainable development, companies must practice responsibility and continue exploring new innovation models. Strengthening cooperation with various links in the supply chain, promoting the construction of a green supply chain, and working together to reduce carbon emissions and resource waste are key steps. Companies should also strengthen employee training and education, raising awareness of environmental protection, and fostering a culture of collective participation to drive change. Only in this way can companies truly achieve sustainable development goals and create more value for society, the environment, and their own operations.

References

[1]. Zou, F. (2020). Accounting information disclosure and corporate innovation. Rural Economy and Technology, 31(24), 152-153.

[2]. Czarnitzki, D., & Hottenrott, H. (2011). R&D Investment and Financing Constraints of Small and Medium-Sized Firms. Small Business Economics, 36(1), 65-83.

[3]. Fama, E. F. (1980). Agency Problems and the Theory of the Firm. Journal of Political Economy, 88(2), 288-307.

[4]. Jin, X., & Zhang, W. (2019). Effective information disclosure and corporate growth ability. World Economic Review, (03), 38-56.

[5]. Lu, Y. (2023). ESG information disclosure practices and insights under the dual carbon goals: A case study of Heng Rui Medicine. International Business and Accounting, (7), 36-39.

[6]. Zhang, H. (2023). Literature review on the impact of ESG information disclosure quality on corporate value. Business Observation, 9(32), 26-28+36.

[7]. Liu, W. (2023). Research on the current situation and quality improvement path of ESG information disclosure in listed companies in China. Modern Marketing (Late Issue), (09), 95-97.

[8]. Duan, T., & Zhang, L. (2024). Capital market openness and corporate ESG information disclosure: Based on the quasi-natural experiment of A-shares being included in the MSCI Index. Economic Review, (01), 153-168.

[9]. Li, X. (2022). Research on corporate development and innovation based on ESG information disclosure. Science and Technology Economy Market, (12), 68-70.

[10]. Qiu, J., & Xue, Q. (2024). A review of ESG and information disclosure systems. Cooperative Economy and Technology, (06), 145-147.

Cite this article

Li,Q. (2024). The Impact of ESG Disclosure Levels on Corporate Innovation Capabilities: A Case Study of the Electronic Equipment Manufacturing Industry. Journal of Applied Economics and Policy Studies,13,69-76.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zou, F. (2020). Accounting information disclosure and corporate innovation. Rural Economy and Technology, 31(24), 152-153.

[2]. Czarnitzki, D., & Hottenrott, H. (2011). R&D Investment and Financing Constraints of Small and Medium-Sized Firms. Small Business Economics, 36(1), 65-83.

[3]. Fama, E. F. (1980). Agency Problems and the Theory of the Firm. Journal of Political Economy, 88(2), 288-307.

[4]. Jin, X., & Zhang, W. (2019). Effective information disclosure and corporate growth ability. World Economic Review, (03), 38-56.

[5]. Lu, Y. (2023). ESG information disclosure practices and insights under the dual carbon goals: A case study of Heng Rui Medicine. International Business and Accounting, (7), 36-39.

[6]. Zhang, H. (2023). Literature review on the impact of ESG information disclosure quality on corporate value. Business Observation, 9(32), 26-28+36.

[7]. Liu, W. (2023). Research on the current situation and quality improvement path of ESG information disclosure in listed companies in China. Modern Marketing (Late Issue), (09), 95-97.

[8]. Duan, T., & Zhang, L. (2024). Capital market openness and corporate ESG information disclosure: Based on the quasi-natural experiment of A-shares being included in the MSCI Index. Economic Review, (01), 153-168.

[9]. Li, X. (2022). Research on corporate development and innovation based on ESG information disclosure. Science and Technology Economy Market, (12), 68-70.

[10]. Qiu, J., & Xue, Q. (2024). A review of ESG and information disclosure systems. Cooperative Economy and Technology, (06), 145-147.