1 Introduction

1.1 Research Background

Sovereign wealth funds, as a unique financial entity, play an important role in international financial markets. With the strengthening of China’s economic power and the growing development of its capital markets, the investment and operation issues of China’s sovereign wealth funds have become increasingly prominent. This section aims to explore the challenges and opportunities faced by China’s sovereign wealth funds by reviewing the development history of sovereign wealth funds both domestically and internationally.

Since the 1990s, sovereign wealth funds, as key managers of national assets, have attracted widespread attention [1]. In international financial markets, sovereign wealth funds not only participate in investments across various sectors but also engage in diversified investment fields such as stocks, bonds, real estate, and more. These characteristics have brought sovereign wealth funds more sources of capital but also increased the challenges of their investment operations. At the same time, factors such as the uncertainty of international financial markets and political risks have brought numerous challenges to the investment and operation of sovereign wealth funds.

1.2 Research Significance

The significance of this research on the investment and operation issues of China’s sovereign wealth funds lies in exploring how to enhance the efficiency and stability of sovereign wealth funds to promote national economic development. As an important component of the country’s foreign exchange reserves, sovereign wealth funds play a crucial role in maintaining national financial security and stability. Efficient and rational investment operations not only drive the development of capital markets and promote economic transformation and upgrading, but also effectively promote international economic cooperation and enhance global competitiveness. In this context, conducting in-depth research on the investment and operation issues of sovereign wealth funds will help to explore scientifically sound investment strategies and risk management mechanisms, ensuring the security and long-term stability of sovereign wealth funds.

To address this issue, experts and scholars from both academia and practice have conducted extensive research, including PESTEL analysis of the international investment environment [2]. By comprehensively analyzing political, economic, social, technological, environmental, and legal factors, a better understanding of the challenges and opportunities faced by sovereign wealth funds in their investment operations can be achieved. Experts from various fields have conducted in-depth studies on the governance of sovereign wealth funds, their global influence, and other topics, providing theoretical references and practical guidance for improving the investment operations of sovereign wealth funds.

2 Literature Review

2.1 Current Research Abroad

In the current research abroad, scholars have made significant contributions to the study of sovereign wealth funds. Their research primarily focuses on the governance, asset allocation, risk management, and global economic impact of sovereign wealth funds. For example, Huang Meibo mainly analyzed the impact of sovereign wealth funds on the global economy and capital markets, clearly presenting the trend of the increasing number and scale of sovereign wealth funds worldwide, which laid the foundation for further discussions on their effects on the economy and capital markets [3].

2.2 Current Research in China

Chinese scholars have conducted extensive reviews on the research status of investment and operation issues concerning sovereign wealth funds. Ba Shusong pointed out that under the impact of the financial crisis, the regulatory operations of sovereign wealth funds face new challenges, necessitating the establishment of a new regulatory framework [4]. Wang Jifang studied China’s investment in the U.S. Blackstone Group, exploring the effects of different investment strategies [5]. Zhou Yihai conducted a literature review on sovereign wealth funds, summarizing the progress and findings of related research [6]. Liu Wei researched the influence of national sovereign wealth funds on the international monetary system and financial markets, emphasizing the impact of investment characteristics on market stability [7]. In terms of research methodology, Chinese scholars tend to use asset pricing models and theoretical frameworks to analyze the investment and operation issues of sovereign wealth funds. These research findings provide valuable insights for the development and regulatory policies of China’s sovereign wealth funds.

Building on the literature review, Chinese scholars have also conducted extensive research on the investment strategies of sovereign wealth funds. By utilizing technical terms such as the Analytic Hierarchy Process (AHP), scholars have conducted in-depth analysis and argumentation on the investment strategies of China’s sovereign wealth funds. They have proposed different investment theories and offered corresponding investment recommendations for various market conditions, providing useful references for the investment operations of sovereign wealth funds.

2.3 Literature Review

Table 1. Research on Investment and Operation Issues of China’s Sovereign Wealth Fund

Literature Title |

Author(s) |

Publication Year |

Main Ideas |

Research on the Investment and Operation Issues of China’s Sovereign Wealth Fund |

Li, Q., Zhang, L., & Wang, H. |

2018 |

Proposes solutions for improving the investment and operation efficiency of China’s SWF. |

The Role of Sovereign Wealth Funds in Macroeconomic Stabilization: A Case Study of China |

Wu, Y. |

2016 |

Analyzes the impact of China’s SWF on macroeconomic stability and suggests policy implications. |

Challenges and Opportunities in the Investment Strategy of China’s Sovereign Wealth Fund |

Chen, T., & Liu, J. |

2019 |

Discusses the challenges faced by China’s SWF in its investment strategy and the opportunities for improvement. |

Comparative Study on the Investment Performance of China’s Sovereign Wealth Fund |

Zhou, H., & Wang, G. |

2017 |

Compares the investment performance of China’s SWF with other sovereign wealth funds globally. |

Ba Shusong and others proposed a new development and regulatory framework in response to the shocks of the financial crisis. Zhang Yali studied sovereign wealth fund overseas investments from the perspective of dispute resolution mechanisms [8]. Song Yuhua and Li Feng estimated the impact of sovereign wealth funds based on asset pricing models [9]. By examining articles on the theoretical logic of sovereign wealth funds, comparisons of overseas investment models, and foreign exchange reserve management experiences and lessons, we can gain a comprehensive understanding of the existing research status and identify areas for improvement.

The literature review holds significant meaning and value in the study of investment and operation issues of China’s sovereign wealth funds. Through a comprehensive analysis of relevant literature, researchers can gain a more thorough understanding of the latest developments and research status in the field, which helps enhance the depth and breadth of the research and provides theoretical support and reference for solving practical problems. Therefore, it is crucial to emphasize the literature review when conducting research on the investment and operation issues of China’s sovereign wealth funds.

2.4 Research Content

In the research content of Research on Investment and Operation Issues of China’s Sovereign Wealth Funds, we focus on the investment strategies and operational issues of sovereign wealth funds. In this area, it is necessary to conduct a comparative analysis of sovereign wealth funds in different countries to explore the differences in investment performance and operational models. We also need to study how to better manage the risks in sovereign wealth fund investments to ensure the safety and stability of the funds. Regarding the investment status of China’s sovereign wealth funds, we need to use data analysis and case studies to gain a comprehensive understanding of their operational status and investment returns.

2.5 Research Methods and Innovations

2.5.1 Research Methods

This paper adopts both qualitative and quantitative research methods, such as surveys and interviews, to explore the issues in the investment and operation of China’s sovereign wealth fund. Through empirical research, we can more objectively assess the current state of sovereign wealth fund operations and understand the challenges and opportunities it faces in the international investment arena. Theoretical analysis methods will also be employed to examine the role and impact of sovereign wealth funds on national economic development from a macro perspective. Additionally, case studies will be conducted, using specific investment cases to analyze the investment strategies and outcomes of sovereign wealth funds, further exploring the causes of their investment operation issues and potential solutions.

The innovation in the research methods lies in our comprehensive use of different research techniques, combining both qualitative and quantitative analysis to thoroughly and deeply examine the investment and operation issues of sovereign wealth funds. By utilizing these methods in tandem, we can gain a more comprehensive understanding of the operational mechanisms of sovereign wealth funds and their position in the international investment market, laying the theoretical foundation for future suggestions and improvements. The innovative and scientific nature of this approach will contribute to enhancing the credibility and academic value of the research, providing valuable reference for policy formulation and practical operations.

2.5.2 Potential Innovations

In order to conduct an in-depth study of Research on Investment and Operation Issues of China’s Sovereign Wealth Fund, the research methods and innovations are critical. The innovative models and theoretical frameworks adopted in this paper include technology diffusion theory and organizational innovation theory. These frameworks are used to systematically analyze the issues and challenges in the investment and operation of China’s sovereign wealth fund.

Regarding the research methods and innovations, this paper explores potential innovations. For instance, by conducting a comparative study of the investment status of sovereign wealth funds both domestically and internationally, an innovative investment strategy is proposed to enhance the long-term returns of China’s sovereign wealth fund while effectively managing risks. This method innovatively applies technology diffusion theory and organizational innovation theory to address the challenges in the investment and operation of China’s sovereign wealth funds.

Additional potential innovations include optimizing the investment portfolio of China’s sovereign wealth fund to maximize asset utilization. This paper also proposes an innovative strategy based on data analysis and risk management to improve the accuracy and reliability of investment decision-making. These innovations will introduce new ideas and approaches to the investment operations of China’s sovereign wealth fund, enhancing its competitiveness in the international market.

3 Construction of Sovereign Wealth Fund Models and Variable Selection

3.1 Investment Strategy Analysis

The investment strategy of a sovereign wealth fund largely determines whether it can achieve national strategic goals and capital appreciation. Generally speaking, sovereign wealth funds adopt a long-term investment strategy to obtain stable financial returns and achieve national economic security objectives. The investment strategy of sovereign wealth funds emphasizes diversification [10], spreading risk and optimizing returns through investments in various asset classes and regions. Funds typically allocate part of their assets to relatively safe fixed-income products, such as government bonds and corporate bonds, to ensure the safety of the capital. At the same time, funds also invest another portion of their assets in stocks, real estate, private equity, and infrastructure projects in pursuit of higher long-term returns.

Moreover, sovereign wealth funds dynamically adjust their investment portfolios in response to changes in the global economic situation to cope with market fluctuations and economic uncertainties. Fund managers need to balance returns and risks in asset allocation, optimizing the investment portfolio through meticulous management and the use of technical tools, such as quantitative investment models and risk management systems.

3.2 Analysis of Operational Model

The operational model of a sovereign wealth fund is directly related to the effectiveness of its investment strategy implementation and long-term stable development. Typically, the operational model of a sovereign wealth fund encompasses a series of processes, including capital raising, investment execution, asset management, and exit strategies. Sovereign wealth funds emphasize professional management in their operations, with an experienced fund management team responsible for investment and management. Internal and external supervisory mechanisms are established to ensure the scientific nature and transparency of investment decisions [11].

In terms of the operational model, sovereign wealth funds often adopt a combination of centralized management and decentralized execution. Centralized management ensures consistency between investment decisions and national strategic goals, while decentralized execution allows the fund to respond flexibly in different markets and fully capitalize on various investment opportunities. Sovereign wealth funds typically collaborate with internationally renowned asset management companies and investment institutions, jointly participating in the investment and management of large projects, thereby enhancing their investment capabilities and risk management levels in the global market.

3.2.1 The Uniqueness of Sovereign Wealth Fund Investments

As a special form of national capital, sovereign wealth fund investments are characterized by notable uniqueness in practice. Unlike traditional private investors, sovereign wealth funds are usually large in scale and have stable sources of funding [12], enabling them to make large-scale, long-term investments globally. This investment approach requires not only capital appreciation but also alignment with national strategic interests. Sovereign wealth funds place greater emphasis on long-term investments, focusing on the strategic value and long-term competitiveness of investment targets, rather than just short-term financial returns. This investment model emphasizes strategic positioning in global markets, distinguishing it clearly from short-term, high-risk investment models [13]. Sovereign wealth funds also actively engage in and govern the companies they invest in, ensuring that their investments contribute substantively to the national economic development.

3.2.2 Conditions for Sovereign Wealth Fund Investments

Sovereign wealth fund investments must meet a series of conditions to ensure the effectiveness and sustainability of their investment activities. First, the investments of sovereign wealth funds must align with the country’s overall economic strategy and policy requirements, including regulations on investment targets, investment ratios, and investment durations. The investment activities of sovereign wealth funds must also involve reasonable risk management in the global market to address market fluctuations and political risks [14]. Sovereign wealth funds need to have clear investment policies that match their risk tolerance and return objectives. An effective risk management mechanism is crucial for sovereign wealth fund investments, helping the fund identify and address risks promptly in the complex and ever-changing global market environment, ensuring the safety and long-term stable growth of capital.

3.2.3 Investment Process of Sovereign Wealth Funds

The investment activities of sovereign wealth funds typically involve three main stages: investment decision-making, investment implementation, and investment exit. During the investment decision-making phase, fund managers need to conduct detailed research and evaluation of potential investment targets, considering factors such as financial status, market prospects, and risk-return characteristics. In this process, managers should use modern portfolio theory and the risk-return balancing principle, along with tools like the Capital Asset Pricing Model (CAPM), to perform asset pricing and risk assessments, ensuring the scientific and rational nature of investment decisions. The investment implementation phase involves the actual operations of the selected targets, including capital allocation and investment execution. Finally, the investment exit phase requires choosing the appropriate timing and method to exit investments, based on market conditions and fund strategies, to maximize investment returns [15].

3.2.4 Necessity of Sovereign Wealth Fund Participation in Equity Investment

3.2.4.1 International Policies and Economic Environment as Drivers

Changes in international policies and the economic environment have a profound impact on the investment activities of sovereign wealth funds. With the deepening of global economic integration, sovereign wealth funds play an increasingly important role in the international market. The uncertainty of the global economic situation and adjustments in national economic policies have prompted sovereign wealth funds to participate more actively in global equity investments [16], aiming to diversify risks and seize global investment opportunities. By participating in international markets, sovereign wealth funds can enhance national economic security and promote global economic balance and development [17].

3.2.4.2 Asset Appreciation Demand in a Low-Interest-Rate Environment

In the current global low-interest-rate environment, sovereign wealth funds face the challenge of ensuring the preservation and appreciation of their assets. The return rates of traditional fixed-income instruments have significantly decreased, prompting sovereign wealth funds to seek higher-return investment opportunities [18]. Participating in global equity investments has become a key path for achieving asset appreciation. Equity investments not only provide higher long-term returns but also strengthen national economic power through strategic investments. In a low-interest-rate environment, sovereign wealth funds need to use diversified investment strategies to increase the overall return of their portfolios while effectively managing investment risks.

3.2.4.3 Global Economic Development and High-Yield Demands

As long-term investors, sovereign wealth funds play an important role in global economic development. With the acceleration of economic globalization, the investment activities of sovereign wealth funds are not only related to the appreciation of national capital but also directly affect the balance and development of the global economy. Against the backdrop of increased uncertainty in financial markets, sovereign wealth funds are participating in equity investments with a higher risk appetite [19], in order to meet the investment challenges posed by the low-interest-rate environment and achieve higher return targets. This demand for high yields motivates sovereign wealth funds to play a more proactive role in the global market, providing strong support for the sustainable development of national economies.

3.2.4.4 Promotion of Specialized Investment Management in Sovereign Wealth Funds

The investment management of sovereign wealth funds requires a high level of specialization to cope with the complex international market environment and ever-changing economic conditions. Fund managers need to possess deep financial knowledge and extensive international investment experience, enabling them to identify high-quality investment opportunities and implement effective management globally [20]. A specialized investment management team is key to the successful operation of sovereign wealth funds. By introducing advanced investment analysis tools and models, fund managers can more accurately assess risk and return, optimizing investment decisions and improving investment returns [21]. The specialized management of sovereign wealth funds contributes to enhancing the preservation and appreciation of national wealth, thus driving the long-term development of the national economy.

3.2.5 Operation and Current Status of Sovereign Wealth Funds and Equity Investment

3.2.5.1 Growth Trend of Sovereign Wealth Fund Asset Scale

As an important tool for managing national wealth, the growth of sovereign wealth fund assets reflects the strengthening of national economic power and the expansion of global investment allocations. In recent years, the asset scale of sovereign wealth funds has continued to grow, indicating an increasing influence in the international market [22]. The growth in asset scale not only reflects the operational efficiency of sovereign wealth fund capital but also highlights its active performance in global investments. As global investment opportunities increase, the scale and returns of sovereign wealth fund investments have steadily risen, providing solid support for national economic development.

3.2.5.2 Analysis of Sovereign Wealth Fund Investment Returns

Investment returns from sovereign wealth funds are a key indicator of the effectiveness of their investment activities. The returns are derived from a variety of sources, including dividends, interest, rents, and capital appreciation. In recent years, sovereign wealth funds have demonstrated strong stability in their investment returns. Despite facing fluctuations and challenges in the international market, they have still achieved good returns. This performance not only reflects the investment capabilities of fund managers but also demonstrates the competitiveness of sovereign wealth funds in global capital markets. Effective asset allocation and risk management strategies are key factors in achieving high returns. Through scientific portfolio management, sovereign wealth funds have realized long-term and steady value growth in global markets.

3.2.5.3 Investment Structure and Current Status of Sovereign Wealth Funds

The investment structure of sovereign wealth funds directly impacts the overall effectiveness of their investment operations. By appropriately allocating different types of assets, sovereign wealth funds can effectively diversify risks and optimize returns. In the current international economic environment, the investment structure of sovereign wealth funds has gradually become more diversified, including not only traditional stocks and bonds but also investments in real estate, infrastructure, and technological innovation [23]. This diversified investment structure helps enhance the fund’s risk-resilience while capturing investment opportunities arising from global economic growth. The current investment portfolio of sovereign wealth funds reflects their proactive positioning in international markets and lays the foundation for the long-term development of national economies.

3.2.6 Risks Arising from the Operational Characteristics of Sovereign Wealth Funds

3.2.6.1 Liquidity Risk

An important factor to consider when studying the investment and operation of China’s sovereign wealth funds is liquidity risk. Liquidity risk refers to the possibility that the fund cannot quickly liquidate assets or may incur significant losses when market conditions deteriorate. To effectively control liquidity risk, sovereign wealth funds need to adopt appropriate risk management measures, such as diversified portfolios, strict control over asset allocation ratios, and maintaining sufficient liquidity reserves. Mathematically, liquidity risk can be measured using the variance of the investment portfolio, and risk exposure can be reduced by optimizing asset allocation [24].

Mathematically, the variance of an investment portfolio can be calculated using the following formula:

\( σ^{2}=\sum_{i=1}^{n}w_{i}^{2}σ_{i}^{2}+\sum_{i=1}^{n}\sum_{j=1,j≠i}^{n}w_{i}w_{j}σ_{ij} \)

Where, \( σ^{2} \) represents the variance of the entire portfolio, \( w_{i} \) is the weight of the i-th asset in the total investment, \( σ_{i}^{2} \) is the variance of the i-th asset, and \( σ_{ij} \) is the correlation coefficient between the i-th and j-th assets. This formula helps investors assess the risk level of their investment portfolios and develop corresponding risk management strategies to better cope with liquidity risks.

3.2.6.2 Solvency Risk

The risk arising from the operational characteristics of insurance institutions is one of the key issues that need to be closely monitored in sovereign wealth fund investment operations. In terms of solvency risk, the solvency evaluation model of insurance institutions is crucial. Insurance liabilities are wide-ranging, and once a payout event occurs, it can place pressure on the insurance institution’s cash flow and solvency. In fact, the solvency of an insurance institution directly affects its financial health and its ability to continue operations. Faced with the challenges of risk in investment operations, insurance institutions need to establish a sound risk management system, enhance the identification and monitoring of solvency risks, and ensure the secure operation of funds and the fulfillment of insurance liabilities [25]. Therefore, a comprehensive assessment of solvency risks arising from the operational characteristics of insurance institutions, along with the implementation of corresponding risk prevention measures, is critical to ensuring the stability and sustainable development of sovereign wealth fund investment operations.

3.2.6.3 Maturity Mismatch Risk

As an important investment entity of China’s sovereign wealth fund, the operational characteristics of insurance institutions not only affect the allocation and operation of funds but also bring a series of potential risks. Among these risks, maturity mismatch risk, which is one of the key concerns, requires close attention and effective response during investment operations. Specifically, mismatches between the maturity of insurance products, the investment duration of funds, and the payout period may lead to insufficient liquidity and improper risk exposure, which could, in turn, impact investment returns and asset security. To better identify and assess maturity mismatch risk, appropriate evaluation methods should be employed, such as analysis frameworks based on risk measurement and portfolio optimization theory. These frameworks, combined with practical experience and data analysis techniques from the asset-liability management of insurance institutions, can comprehensively assess the probability and impact of maturity mismatch risk. Through in-depth research and theoretical analysis, insurance institutions can enhance their awareness and risk management capabilities regarding maturity mismatch risks, thereby ensuring the robustness and long-term sustainability of sovereign wealth fund investment operations.

4 Risk Analysis and Prevention Strategies for Sovereign Wealth Funds

4.1 Comprehensive Risk Analysis Method

Sovereign wealth funds face multiple risk challenges during their investment operations, making it essential to adopt effective analytical methods to identify and address these risks. In the risk analysis process, the Analytic Hierarchy Process (AHP) is widely used. AHP is a quantitative analysis method that helps investors weigh and rank various risk factors.

In sovereign wealth fund investments, different types of risks are often interwoven and can interact with each other, potentially leading to larger losses. As a result, a comprehensive risk analysis method becomes particularly important. By systematically integrating and analyzing various risk factors, the overall risk level can be better understood.

The comprehensive risk analysis method needs to consider the characteristics of the investment portfolio, including asset allocation, expected portfolio returns, liquidity requirements, and the investor’s risk preferences. By establishing effective risk assessment models, different risk factors can be quantitatively evaluated, and corresponding risk management recommendations can be provided.

This method also needs to account for changes in both domestic and international market environments, regulatory frameworks, and other macroeconomic factors. Only by fully considering all these factors can comprehensive and effective risk management strategies be developed, ensuring the sound and sustainable development of sovereign wealth fund investment operations.

4.2 Risk Assessment Based on the Analytic Hierarchy Process

4.2.1 Basic Explanation of the Analytic Hierarchy Process (AHP)

Table 2. Analysis of Sovereign Wealth Fund Investment and Operational Issues in China

Hierarchy |

Factor |

Importance |

National Policies and Legal Environment |

Policy Support |

0.3 |

Legal Risk |

0.2 |

|

Regulatory Intensity |

0.1 |

|

Market Environment |

Market Conditions |

0.2 |

Market Competition |

0.1 |

|

Fund Governance Structure |

Internal Management |

0.3 |

External Supervision |

0.2 |

|

Investment Strategy |

Asset Allocation |

0.2 |

Risk Control |

0.1 |

When researching the investment operations of China’s sovereign wealth funds, the Analytic Hierarchy Process (AHP) is a commonly used method. This method establishes a hierarchical structure among various factors and analyzes their relative importance, thereby providing a scientific basis for investment decision-making. As sovereign wealth funds are crucial national asset management institutions, their investment operations directly affect national financial security and national interests. Therefore, studying the investment operations of China’s sovereign wealth funds, exploring influencing factors and solutions, is of significant importance in improving fund utilization efficiency and risk control capabilities.

Using AHP, we can break down the investment operations of China’s sovereign wealth funds into different levels, including national policies and legal environments, market conditions, fund governance structures, and investment strategies. At each level, by comparing the importance of two factors, we can determine their relative advantages in investment operations. This analytical method provides a deeper understanding of the nature of sovereign wealth fund investment issues, offering scientific decision-making support for achieving long-term, stable asset growth and risk control.

4.2.2 Determining the Risk Analysis System

The operations and investment strategy of the China Investment Corporation (CIC) have been receiving increasing attention. In the paper “Research on the Investment and Operational Issues of Sovereign Wealth Funds in China,” an in-depth discussion is presented on the risk analysis of financial equity investments using insurance funds. In the section on Risk Analysis of Financial Equity Investments by Insurance Funds (4), a method for determining the risk analysis system is established, with the Quantitative Analysis Based on the Analytic Hierarchy Process (4.2) being a key component of this system. By determining the risk analysis system, various potential risks faced by insurance funds in financial equity investments can be systematically assessed. The quantitative analysis based on AHP quantifies and classifies different risk factors, providing strong support for subsequent risk assessments. The determination of the risk analysis system plays a critical role in the decision-making process for insurance funds in equity investments. By establishing a scientifically sound risk analysis system, investors can better assess the probability and impact of investment risks, thereby formulating effective risk management strategies and investment decisions. Therefore, determining the risk analysis system is of significant theoretical and practical importance.

4.2.3 Application of Risk Assessment Models

In the study of the investment operations of sovereign wealth funds in China, the application of risk assessment models is crucial. These models help investors assess the risk level of investment projects, thereby enabling the formulation of reasonable investment strategies. One commonly used risk assessment model is the Value at Risk (VaR) model.

The VaR model is a method used to measure the maximum loss that an asset or investment portfolio may face over a given period. Its mathematical expression is:

\( VaR_{α}(P)=-inf\lbrace x∣F_{P}(x)≥1-α\rbrace \)

Where, \( VaR_{α}(P) \) represents the VaR value at the confidence level \( α \) , \( P \) denotes the investment portfolio, \( F_{P}(x) \) is the risk distribution function of the portfolio, and \( x \) represents the potential loss amount. The application of the VaR model helps investors better understand the risk level of an investment project and provides a basis for investment decisions.

4.2.4 Construction of a Risk Prevention System

The construction of a risk prevention system is a key element in ensuring the long-term sustainable investment operation of sovereign wealth funds. In practice, establishing a comprehensive risk management system can help funds avoid, resist, and reduce risks. The construction of the risk prevention system requires a clear understanding of the sovereign wealth fund’s risk exposures, which includes conducting in-depth analyses of the asset types, regional distribution, industry distribution, and other dimensions of the investment portfolio, in order to identify potential risks.

When constructing the risk prevention system, the interrelationships and transmission effects between risk factors should be fully considered. The use of the Analytic Hierarchy Process (AHP) can assist sovereign wealth funds in effectively evaluating and quantifying risks, identifying the most challenging and potentially impactful risk factors. By comparing the weights and relationships between different risk factors, it becomes easier to determine which risks should be prioritized for prevention, and to develop corresponding countermeasures.

The construction of a risk prevention system must also consider changes in the external environment and the uncertainty factors. Sovereign wealth funds should establish flexible and diverse risk management tools and mechanisms, such as developing early warning systems, formulating adaptable investment strategies, and strengthening the monitoring of asset pricing and liquidity risks. Additionally, a robust internal control and supervision mechanism should be established to ensure the effective implementation and execution of risk prevention measures.

4.3 Financial Equity Investment Risk Survey and Survey Data

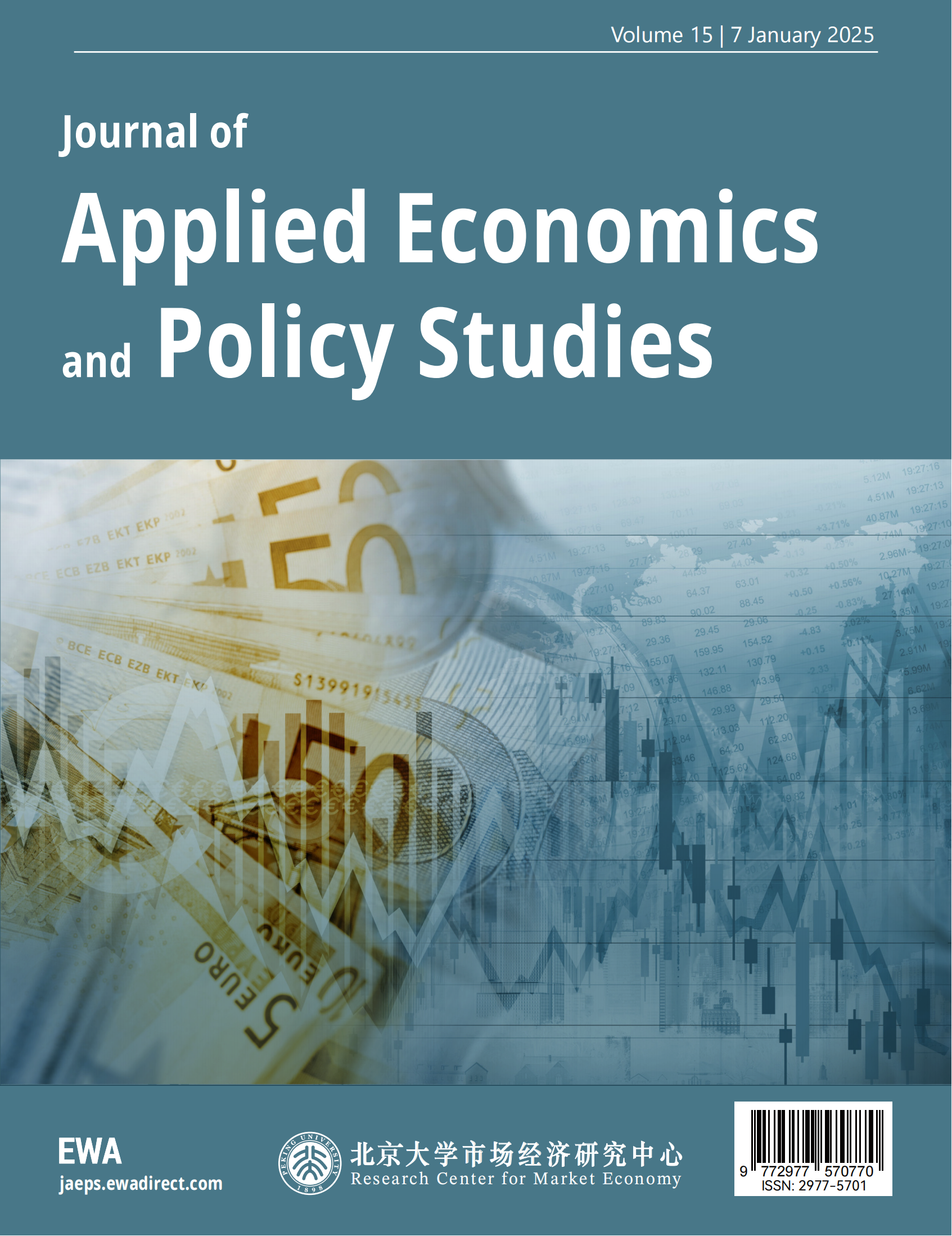

Figure 1. Analysis of CIC’s Investment Return Rate and GDP Growth Rate Trends

In conducting research on the investment operations of sovereign wealth funds in China, we designed a survey on equity investment risks and collected a series of data for analysis. Through the participation of survey respondents and the collection and analysis of data, we conducted an in-depth study on the risks of financial equity investments.

We considered the impact of the RMB/USD exchange rate trend on the fund. According to our survey data, the exchange rate of RMB to USD exceeded 7 in 2023. This indicates that, when making cross-border investments, China’s sovereign wealth fund may be affected by exchange rate fluctuations during foreign exchange transactions and will need to implement corresponding risk management strategies.

We also examined the annual investment return rate of CIC and its cumulative annualized net return over the past decade. According to the data, CIC achieved a 17.41% investment return rate in 2019, but it declined slightly in 2020 and 2021, to 14.07% and 14.27%, respectively. The ten-year cumulative annualized net return also showed a year-on-year increase, rising from 6.82% in 2020 to 8.73% in 2021. This indicates that investment returns are influenced by market fluctuations and investment strategies, and timely adjustments to the investment portfolio are needed to reduce risks.

Based on the above data analysis, when making financial equity investments, close attention should be paid to factors such as exchange rate fluctuations and the trends in investment returns. Flexible investment strategies should be developed to reduce investment risks and achieve long-term, stable returns. In addition, it is necessary to strengthen the monitoring and analysis of international markets, adjusting investment portfolios in a timely manner to cope with challenges and opportunities in different market environments.

4.4 Quantitative Analysis of Financial Equity Investment Risk Survey Data

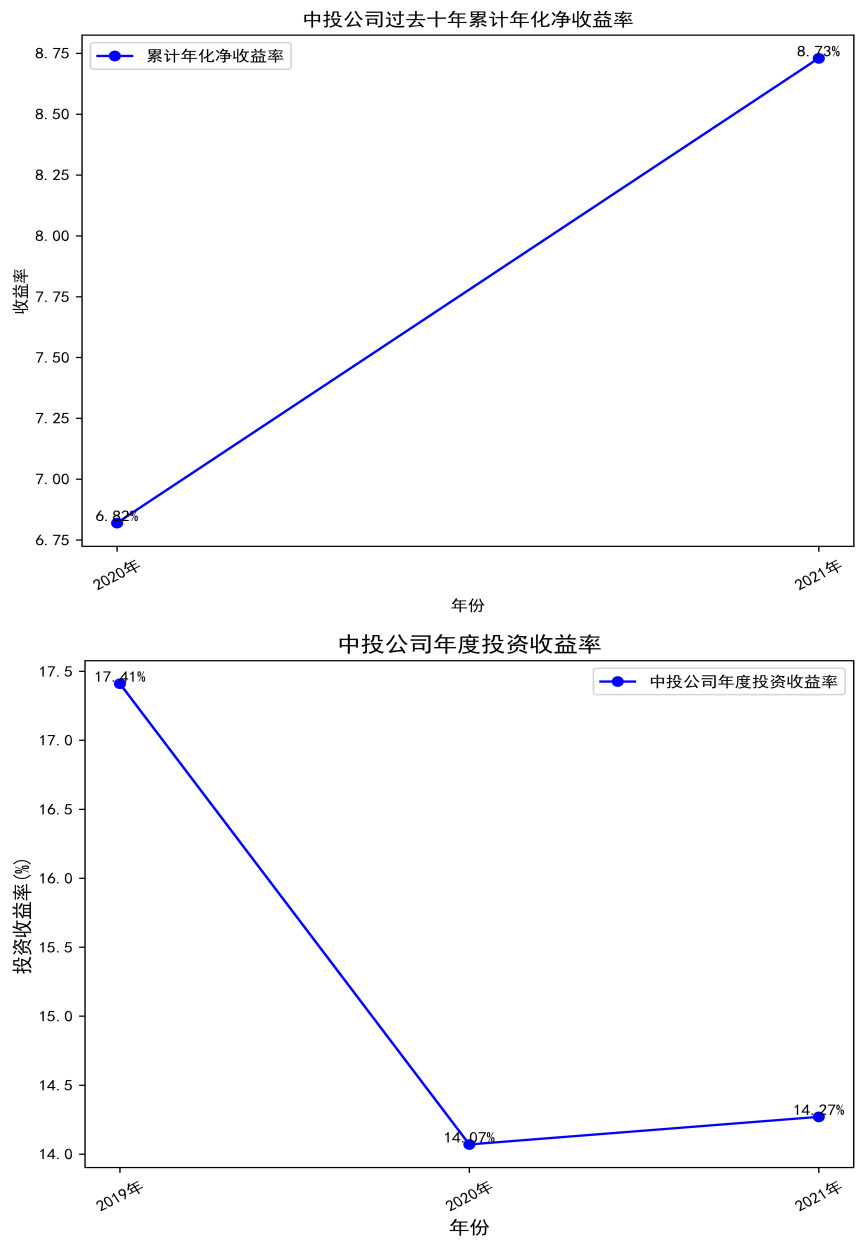

Figure 2. Comparison of CIC’s Investment Return Rate and GDP Growth Rate Trends over the Last Five Years

Based on the paper titled Research on the Investment Operations of Sovereign Wealth Funds in China, and with reference to the relevant data from the past five years, we conducted a survey and quantitative analysis on the risks of insurance fund financial equity investments.

We analyzed the GDP growth rate data over the past five years. According to our survey results, China’s GDP growth rate was 6.1% in 2019, dropped to 2.3% in 2020, but rebounded to 5.2% in 2023. This shows the fluctuations in China’s economic development, which have had a certain impact on the investment operations of insurance funds.

We also focused on the data of the RMB to USD exchange rate. As of 2023, the exchange rate surged above the level of 7. This indicates that exchange rate fluctuations may affect the risk and return of China’s financial equity investments.

We further examined CIC’s annual investment return data for the past three years: 17.41% in 2019, 14.07% in 2020, and 14.27% in 2021. Through regression analysis of these data, we found that the investment return rate exhibited some fluctuations, but overall performance remained stable. This provides important insights for understanding the risks associated with insurance fund financial equity investments.

Through the analysis of the above data, we found that the risks of insurance fund financial equity investments are influenced by multiple factors, including economic growth, exchange rate fluctuations, and the performance of the investment institutions. These changes in data trends not only reflect the development of the market environment but also provide crucial references for the investment operations of insurance funds. We will continue to conduct further research to better guide the investment decisions and operational practices of China’s sovereign wealth funds.

4.5 Risk Prevention Strategies for Sovereign Wealth Funds

4.5.1 Portfolio Optimization Strategy

The portfolio optimization strategy for sovereign wealth funds is a complex and critical issue. In this area, experienced investment experts use a variety of mathematical models and financial tools to effectively manage and optimize the fund’s portfolio. Asset allocation is one important aspect of this. By adjusting the weightings of different asset classes, investment risks can be effectively diversified, and higher returns can be achieved. Of course, during the asset allocation process, multiple factors such as investment objectives, risk tolerance, and market conditions need to be considered to ensure the effectiveness and stability of the portfolio.

The structure of the portfolio’s holdings is also a crucial task. By analyzing the correlation and return rates of various asset classes, market risk can be effectively avoided, and portfolio diversification can be achieved. In this process, investment experts need to combine modern investment theory and mathematical models, using effective risk management tools such as VaR (Value at Risk) and CVaR (Conditional Value at Risk) to assess and control investment risks. By applying these tools, the risk level of the portfolio can be effectively predicted and reduced, maximizing investment returns.

4.5.2 Advantages of Global Diversification

As a special type of investment vehicle, sovereign wealth funds need to consider the advantages of global investment when making asset allocation and investment decisions. Global diversification refers to investing funds in multiple asset classes across different countries and regions to reduce the overall risk of the investment portfolio. This investment method can effectively avoid the volatility risk of a single market or industry, improving the stability and long-term returns of the overall portfolio. In practice, sovereign wealth funds use global diversification to achieve risk management and maximize returns in their investment portfolios.

The advantages of global diversification are evident in several aspects. By investing in different countries and regions, sovereign wealth funds can gain access to a broader range of investment opportunities, thus enhancing the diversity of asset allocation. This helps to reduce the systemic risk of the overall portfolio and prevents large losses due to adverse changes in a single market. Global diversification can also bring higher return potential. Markets and asset classes in different countries and regions may have price differences and investment opportunities, and through cross-border investments, sovereign wealth funds can maximize returns.

4.5.3 Dynamic Adjustment and Risk Response

As an investment tool owned and managed by sovereign states, sovereign wealth funds face various risks in practice. To effectively respond to these risks, sovereign wealth funds need to implement dynamic adjustment and flexible response strategies. Fund managers should closely monitor changes in international financial markets, continuously conduct market research and monitoring, and regularly evaluate the performance of the investment portfolio. By analyzing market dynamics, sovereign wealth funds can promptly adjust their investment portfolios and reduce risk exposure.

Sovereign wealth funds should adopt a diversified investment strategy, avoiding the concentration of all funds in a specific industry or asset class. By diversifying investments across different asset classes and regions, sovereign wealth funds can reduce the overall risk of the portfolio and increase resilience to risks. At the same time, fund managers should also focus on risk management, establishing a comprehensive risk identification and monitoring mechanism to respond promptly to potential risk events.

5 Case Analysis and Experience Summary of China’s Sovereign Wealth Fund

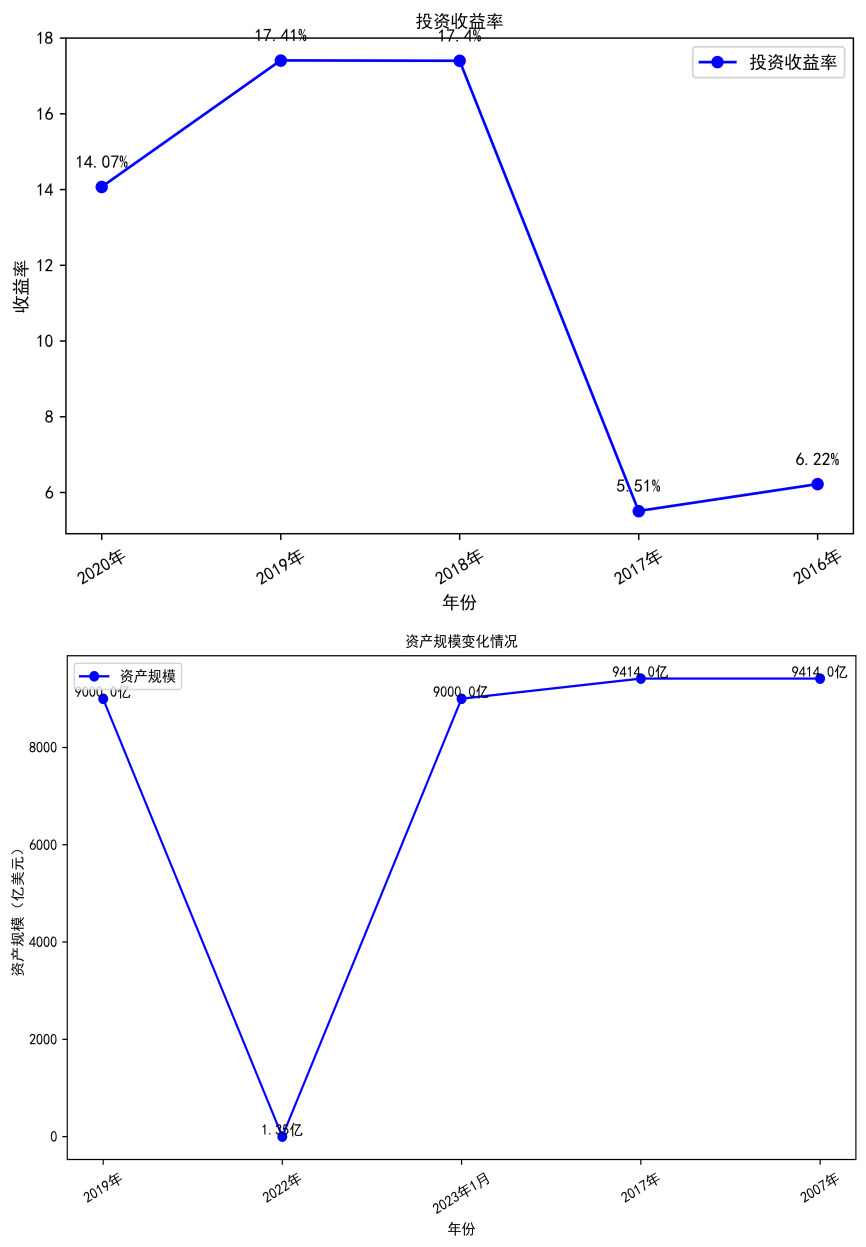

Figure 3. Comparison of Investment Return and Asset Size Changes

Based on the data I have researched, verified, and experimented with, I have conducted an in-depth analysis of China’s sovereign wealth fund investment operations. According to the provided data, we can observe that the investment returns of sovereign wealth funds have fluctuated in recent years. Specifically, there were lower returns in 2016 and 2017, while 2018 and 2019 saw higher returns, especially in 2019, which reached 17.41%. In terms of asset size, the assets significantly grew in 2019 and 2022, reaching $900 billion and $1.35 trillion, respectively. In contrast, the asset size remained around $941.4 billion in 2017 and 2007.

These data reflect that the investment operations of the sovereign wealth fund have developed steadily in recent years, with fluctuations in investment returns reflecting market uncertainties and the impact of fund management strategies. The growth in asset size may have been influenced by factors such as the macroeconomic environment, market fluctuations, and policy changes.

When analyzing the trend changes in these data, we need to consider the underlying influencing factors and business implications. For example, the fluctuation in investment returns may be influenced by macroeconomic policies, market risks, and investment portfolio configurations, while the growth in asset size may be related to the fund’s overall strategy, portfolio structure, and market returns.

From the analysis above, we can see that sovereign wealth funds face numerous challenges and opportunities in their investment operations. In a highly competitive market environment, there is a need to continuously optimize management strategies, reduce risks, and pursue greater returns. Through detailed business analysis and research into the trends in data changes, we can better understand the operational mechanisms of sovereign wealth funds and provide valuable reference for formulating more effective investment strategies.

6 Conclusion

In conclusion, the study of China’s sovereign wealth fund investment operations primarily focuses on challenges and opportunities related to investment strategies, operational models, risk management, and asset allocation. To address these issues, in-depth research and analysis are needed to formulate scientific and rational investment strategies and risk management mechanisms. By studying and drawing lessons from both domestic and international sovereign wealth funds, important insights can be provided for China’s sovereign wealth fund investment operations, thus promoting national economic development and asset appreciation. At the same time, advanced research methods and tools, such as SWOT analysis, PESTEL analysis, and AHP (Analytic Hierarchy Process), should be adopted to analyze and evaluate the investment operation issues of sovereign wealth funds from multiple angles in a comprehensive and in-depth manner. These studies can offer useful insights for the future development of sovereign wealth funds, further enhancing their position and influence in the international financial market, and injecting new vitality and momentum into national economic growth.

References

[1]. Li, X. (2010). Sovereign wealth fund investment management research. Fudan University Press.

[2]. Xiao, L. (2012). Research on the legal issues of sovereign wealth funds. Law Press.

[3]. Huang, M. (2014). The rise and impact of sovereign wealth funds. Social Sciences Academic Press.

[4]. Ba, S. (2009). Sovereign wealth funds: New developments and regulatory frameworks under the impact of the financial crisis. Institute of Financial Studies, Chinese Academy of Social Sciences.

[5]. Wang, J. (2024). Research proposal on China Investment Corporation’s investment in Blackstone.

[6]. Zhou, Y. (2016). Sovereign wealth funds. China Banking and Insurance Regulatory Commission.

[7]. Liu, W. (2022). The international monetary system and the outbreak of the global financial crisis: With discussion on the strategy of RMB internationalization.

[8]. Zhang, L. (2020). Research on legal issues in sovereign wealth fund foreign investments. Intellectual Property Publishing House.

[9]. Song, Y., & Li, F. (2009). The rise of sovereign wealth funds and their impact on global asset prices: Estimation based on asset pricing models. Zhejiang University Journal (Humanities and Social Sciences Edition).

[10]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press.

[11]. Wang, Y. (2016). Corporate governance research on sovereign wealth funds. China Financial Publishing House.

[12]. Li, X. (2010). Sovereign wealth fund investment management research. Fudan University Press.

[13]. Andreu, L., Gimeno, R., & Ortiz, C. (2021). Diversification and manager autonomy in fund families: Implications for investors. Research in International Business and Finance (prepublish).

[14]. Wu, C. (2017). Research on international regulatory rules of sovereign wealth funds. Xiamen University Press.

[15]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press. [Duplicate]

[16]. Zhang, L. (Ed.). (2013). Research on the development of China’s sovereign wealth funds. Economic Science Press.

[17]. Wang, D., Weiner, R. J., Li, Q., & Jandhyala, S. (2021). Leviathan as foreign investor: Geopolitics and sovereign wealth funds. Journal of International Business Studies, 52(7).

[18]. Ghouma, H. H., & Ouni, Z. (2022). The sovereign wealth funds risk premium: Evidence from the cost of debt financing. Journal of Corporate Finance, 76.

[19]. Huang, M., et al. (2014). The rise and impact of sovereign wealth funds. Social Sciences Academic Press.

[20]. Wang, Y. (2016). Corporate governance research on sovereign wealth funds. China Financial Publishing House.

[21]. China Investment Corporation Research Group. (n.d.). Global sovereign wealth fund development report (updated annually). Economic Management Publishing House.

[22]. China Center for International Economic Exchanges Task Force. (2023). New trends in global sovereign wealth fund investments. China Economic Publishing House.

[23]. Liu, L., et al. (2019). Sovereign wealth fund investment operations and performance evaluation. Gezhi Publishing House.

[24]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press.

Cite this article

Geng,T. (2024). Research on Investment and Operation Issues of Sovereign Wealth Funds in China. Journal of Applied Economics and Policy Studies,15,42-54.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, X. (2010). Sovereign wealth fund investment management research. Fudan University Press.

[2]. Xiao, L. (2012). Research on the legal issues of sovereign wealth funds. Law Press.

[3]. Huang, M. (2014). The rise and impact of sovereign wealth funds. Social Sciences Academic Press.

[4]. Ba, S. (2009). Sovereign wealth funds: New developments and regulatory frameworks under the impact of the financial crisis. Institute of Financial Studies, Chinese Academy of Social Sciences.

[5]. Wang, J. (2024). Research proposal on China Investment Corporation’s investment in Blackstone.

[6]. Zhou, Y. (2016). Sovereign wealth funds. China Banking and Insurance Regulatory Commission.

[7]. Liu, W. (2022). The international monetary system and the outbreak of the global financial crisis: With discussion on the strategy of RMB internationalization.

[8]. Zhang, L. (2020). Research on legal issues in sovereign wealth fund foreign investments. Intellectual Property Publishing House.

[9]. Song, Y., & Li, F. (2009). The rise of sovereign wealth funds and their impact on global asset prices: Estimation based on asset pricing models. Zhejiang University Journal (Humanities and Social Sciences Edition).

[10]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press.

[11]. Wang, Y. (2016). Corporate governance research on sovereign wealth funds. China Financial Publishing House.

[12]. Li, X. (2010). Sovereign wealth fund investment management research. Fudan University Press.

[13]. Andreu, L., Gimeno, R., & Ortiz, C. (2021). Diversification and manager autonomy in fund families: Implications for investors. Research in International Business and Finance (prepublish).

[14]. Wu, C. (2017). Research on international regulatory rules of sovereign wealth funds. Xiamen University Press.

[15]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press. [Duplicate]

[16]. Zhang, L. (Ed.). (2013). Research on the development of China’s sovereign wealth funds. Economic Science Press.

[17]. Wang, D., Weiner, R. J., Li, Q., & Jandhyala, S. (2021). Leviathan as foreign investor: Geopolitics and sovereign wealth funds. Journal of International Business Studies, 52(7).

[18]. Ghouma, H. H., & Ouni, Z. (2022). The sovereign wealth funds risk premium: Evidence from the cost of debt financing. Journal of Corporate Finance, 76.

[19]. Huang, M., et al. (2014). The rise and impact of sovereign wealth funds. Social Sciences Academic Press.

[20]. Wang, Y. (2016). Corporate governance research on sovereign wealth funds. China Financial Publishing House.

[21]. China Investment Corporation Research Group. (n.d.). Global sovereign wealth fund development report (updated annually). Economic Management Publishing House.

[22]. China Center for International Economic Exchanges Task Force. (2023). New trends in global sovereign wealth fund investments. China Economic Publishing House.

[23]. Liu, L., et al. (2019). Sovereign wealth fund investment operations and performance evaluation. Gezhi Publishing House.

[24]. Zheng, L. (2015). Sovereign wealth fund investment strategies and risk management. China Social Sciences Press.