1 Introduction

In recent years, as global environmental issues have become increasingly severe, New Energy Vehicles (NEVs), as a crucial component of green transportation, have garnered significant attention from governments and enterprises worldwide. China, being the largest automotive market globally, has achieved remarkable development in its NEV industry driven by policy support, technological innovation, and market demand. According to data from the China Association of Automobile Manufacturers, in 2023, China's NEV sales surpassed 7 million units for the first time, accounting for nearly 60% of the global market share. Moreover, China is at the forefront of battery technology, charging infrastructure, and intelligent connected technologies. This rapid development trend not only reshapes the automotive industry landscape in China but also has profound impacts on the global NEV supply chain and market competition dynamics [1].

With the vigorous growth of China's NEV market, an increasing number of multinational automotive manufacturers are entering this field in search of new growth opportunities. However, operating in the Chinese market is not without challenges for these multinational enterprises. Firstly, the Chinese government has introduced a series of policies supporting the development of NEVs, such as purchase subsidies, tax incentives, and green channels for restricted areas, creating a favorable environment for multinational companies to enter and expand the market. Secondly, the acceptance of NEVs among Chinese consumers is continually rising, with steady growth in market demand providing vast market space for multinational companies. Nevertheless, multinational enterprises also face numerous challenges in the Chinese market. The NEV market in China is highly competitive, with domestic companies like BYD, NIO, and XPeng demonstrating strong competitiveness in technological innovation and market expansion. Additionally, the policy environment in China is complex and ever-changing, requiring multinational companies to flexibly respond to continuously adjusting regulations and standards. Cultural differences, supply chain management, and localized operations further elevate the demands on multinational enterprises.

Therefore, strategic adaptation and organizational change are particularly crucial for multinational companies operating in China's NEV market. Although extensive research has explored the development of the NEV market, strategic adaptation of multinational enterprises, and organizational change, there remains a significant gap in studies specifically focusing on the strategic adaptation and organizational change of multinational companies within China's NEV market. Most existing research concentrates on global or Western markets, lacking in-depth analysis of the unique and complex characteristics of the Chinese market. Furthermore, current studies often examine strategic adaptation and organizational change separately, lacking comprehensive research that organically integrates the two, thereby failing to systematically reveal the interrelationship between strategic adjustments and organizational transformations. Many studies rely on qualitative analysis without systematic empirical data support, making it difficult to fully evaluate the strategic and organizational practices of multinational enterprises in the Chinese market. The rapid development of the NEV market means that the strategic adaptation and organizational change of companies are also dynamic processes. Existing research tends to be static in nature, failing to adequately capture the strategic and organizational changes of companies at different stages of development.

Therefore, this study aims to fill the aforementioned research gaps by conducting systematic case analyses to deeply explore the processes of strategic adaptation and organizational change of multinational enterprises in China's NEV market, revealing their underlying mechanisms and impact pathways, thereby enriching the theories of strategic management and organizational change.

2 Development of the New Energy Vehicle Market

2.1 Current Development Status of the Global and Chinese New Energy Vehicle Markets

In recent years, the global New Energy Vehicle (NEV) market has experienced explosive growth, becoming a significant direction for the transformation of the automotive industry. According to a report by the International Energy Agency (IEA, 2023), global NEV sales reached 13 million units in 2023, marking a year-on-year increase of approximately 50%. The Chinese market contributed nearly 60% of these sales, holding a dominant position in the global market. Since 2015, the Chinese government has continuously promoted the development of NEVs through policy support, financial subsidies, and infrastructure construction, significantly enhancing market penetration [2].

Specifically, the development of China's NEV market can be divided into the following stages:

Initial Stage (2009-2014): The Chinese government issued the "New Energy Vehicle Industry Development Plan (2012-2020)," which clearly outlined the strategic goals for NEV development. During this period, the growth in NEV sales was primarily driven by government subsidies and policy guidance.

Rapid Development Stage (2015-2020): With technological advancements and increasing market demand, the NEV market entered a rapid growth phase. According to data from the China Association of Automobile Manufacturers (CAAM), NEV sales in China reached 1.2 million units in 2019, more than tripling compared to 2018.

Mature Stage (2021-Present): The market has matured, technology has stabilized, and competition has intensified. In 2023, NEV sales in China surpassed 7 million units for the first time, further consolidating its global leadership position. Concurrently, enterprises continue to focus on technological innovation, product diversification, and brand building.

Globally, aside from China, NEV markets in the United States, Europe, and Japan are also expanding rapidly. Multinational companies such as Tesla, Nissan, and Volkswagen hold significant market shares worldwide. However, the Chinese market, with its large scale and policy support, has become a key engine for global NEV development.

2.2 Impact of Policy and Market Demand

The development of China's NEV market heavily relies on strong government policy support. The government employs various policy tools, including financial subsidies, tax incentives, license incentives, and green channels in restricted areas, effectively stimulating consumer willingness to purchase NEVs. Notably, the issuance of the "New Energy Vehicle Industry Development Plan (2021-2035)" signifies the Chinese government's long-term support and strategic planning for the NEV industry. The plan explicitly states that by 2035, NEVs will dominate the Chinese automotive market, providing clear direction and sustained policy support for industry development. The continuity and stability of these policies offer confidence and assurance for multinational enterprises to adapt their strategies and make long-term investments in the Chinese market [3].

In addition to policy-driven factors, the growth in market demand is another crucial driver for the rapid development of the NEV market. With increasing environmental awareness and consumer demand for green transportation, NEVs are gradually becoming favored in the market. According to data from the China Passenger Car Market Association (CPCA, 2023), NEV consumers accounted for 25% of the Chinese passenger car market in 2023, with expectations of continued growth in the coming years. This trend not only boosts NEV sales but also drives innovation in related technologies and services.

Consumer behavior theory indicates that consumers' preference for eco-friendly products is influenced by environmental awareness, social norms, and personal values. In the context of enhanced environmental consciousness, Chinese consumers are more inclined to choose NEVs to reduce their carbon footprint and environmental pollution. Furthermore, technological innovations and the improvement of infrastructure (such as the widespread installation of charging stations) have also increased consumers' acceptance and convenience in using NEVs.

There exists a complex interaction between policy-driven factors and market demand. Firstly, policies not only directly affect market supply by promoting NEV production and sales through subsidies and incentives but also indirectly boost demand by shaping market expectations and enhancing consumer confidence. This policy incentive mechanism guides consumer purchasing behavior to a certain extent, leading NEVs to gain acceptance among mainstream consumers.

Simultaneously, changes in market demand also influence policy adjustments and optimizations. As consumer demand for NEVs increases, the government pays greater attention to actual market needs and feedback when formulating and adjusting policies. For instance, as NEV sales rise, the government gradually reduces reliance on subsidies and shifts focus towards supporting technological research and infrastructure development to promote the sustainable growth of the NEV industry. This bidirectional interaction between policy and market demand reflects the adaptability and dynamic adjustment capacity of policies, ensuring the healthy development of the NEV market [4].

3 Relevant Theories

3.1 Strategic Adaptation Theories for Multinational Enterprises

(1) Resource-Based View (RBV): The Resource-Based View (RBV) is one of the important theories in the field of strategic management, emphasizing the critical role of a firm's internal resources and capabilities in obtaining and sustaining competitive advantage. According to RBV, a firm's unique resources (such as technological patents, brand reputation, and talent pool) can provide lasting advantages in market competition. In the NEV market, the RBV of multinational enterprises is manifested in their strengths in technological research and development, brand building, and global supply chain management. For example, Tesla, with its advanced battery technology and independently developed autonomous driving systems, holds a leading position in the global NEV market. By continuously investing in R&D, Tesla can consistently launch innovative products, meet market demands, and maintain its competitive advantage.

(2) Dynamic Capabilities Theory: The Dynamic Capabilities Theory emphasizes that firms must continuously adjust and restructure their resources to adapt to rapidly changing environments. This theory is particularly applicable in explaining the strategic adaptation and organizational change of multinational enterprises in the highly dynamic NEV market. In the Chinese NEV market, multinational enterprises face multiple challenges such as policy changes, technological advancements, and fluctuations in market demand. The Dynamic Capabilities Theory suggests that firms need to possess the ability to perceive changes, seize opportunities, and reconfigure resources. For instance, Volkswagen, through its joint venture with FAW Group, rapidly adapts to the demands and policy environment of the Chinese market. This strategic adjustment not only enhances Volkswagen's competitiveness in the Chinese market but also demonstrates the importance of dynamic capabilities in responding to market changes [5].

(3) Balancing Localization Strategy and Global Strategy: In the process of global expansion, multinational enterprises face the challenge of balancing localization strategies with global strategies. Localization strategies emphasize customizing adjustments based on the characteristics of different markets to meet the needs of local consumers and adapt to local policy environments. In contrast, global strategies emphasize a unified brand image, standardized products, and the integration of global resources to achieve economies of scale and brand consistency. In the Chinese NEV market, multinational enterprises need to find a balance between localization and globalization. For example, Toyota, in the Chinese market, has established joint ventures with local enterprises to set up R&D centers for localized product design and production while maintaining a unified global brand image and technological standards. This strategy not only meets the specific needs of the Chinese market but also preserves Toyota's competitive advantage in the global market.

3.2 Organizational Change Theories

(1) Organizational Structure Adjustment: Organizational structure adjustment is a crucial means for firms to respond to external environmental changes and optimize internal resource allocation. According to organic and mechanistic organizational theories, firms in dynamic environments need to flexibly adjust their organizational structures to enhance responsiveness and adaptability. In the NEV market, multinational enterprises adjust their organizational structures to better respond to rapidly changing market demands and technological developments. For example, Tesla established a localized production base in China and adjusted its global supply chain management structure to improve production efficiency and market responsiveness [6].

(2) Cultural Change and Employee Adaptation: Cultural change is an important component of organizational change, involving the transformation of corporate culture, values, and work practices. Cultural differences between countries and regions can impact employee behavior and the management models of enterprises. In the Chinese market, multinational enterprises need to engage in cultural adaptation and integration to enhance employee job satisfaction and overall organizational performance. For instance, Volkswagen, in China, introduces local management teams and conducts cross-cultural training to promote the integration of multinational cultures and employee adaptation. This not only helps improve employee work efficiency and innovation capabilities but also enhances the cultural adaptability and management flexibility of the enterprise in the Chinese market.

(3) Change Management Models: Change management models provide systematic methods to guide firms in effectively implementing changes during organizational transformations. Kotter's (1996) eight-step change model includes establishing a sense of urgency, forming a guiding coalition, creating a vision and strategy, communicating the change vision, empowering broad-based action, generating short-term wins, consolidating gains and producing more change, and anchoring new approaches in the corporate culture. In the Chinese NEV market, multinational enterprises implement change management models to systematically advance strategic adaptation and organizational change. For example, during Tesla's expansion in the Chinese market, the company followed Kotter's model by first establishing a sense of urgency regarding the market potential of NEVs, forming a multinational management team, developing a strategic vision for localized production and R&D, and ensuring the smooth implementation and long-term maintenance of changes through continuous employee training and performance evaluations [7].

4 Strategic Adaptation and Organizational Change Processes of Multinational Automakers in the Chinese Market

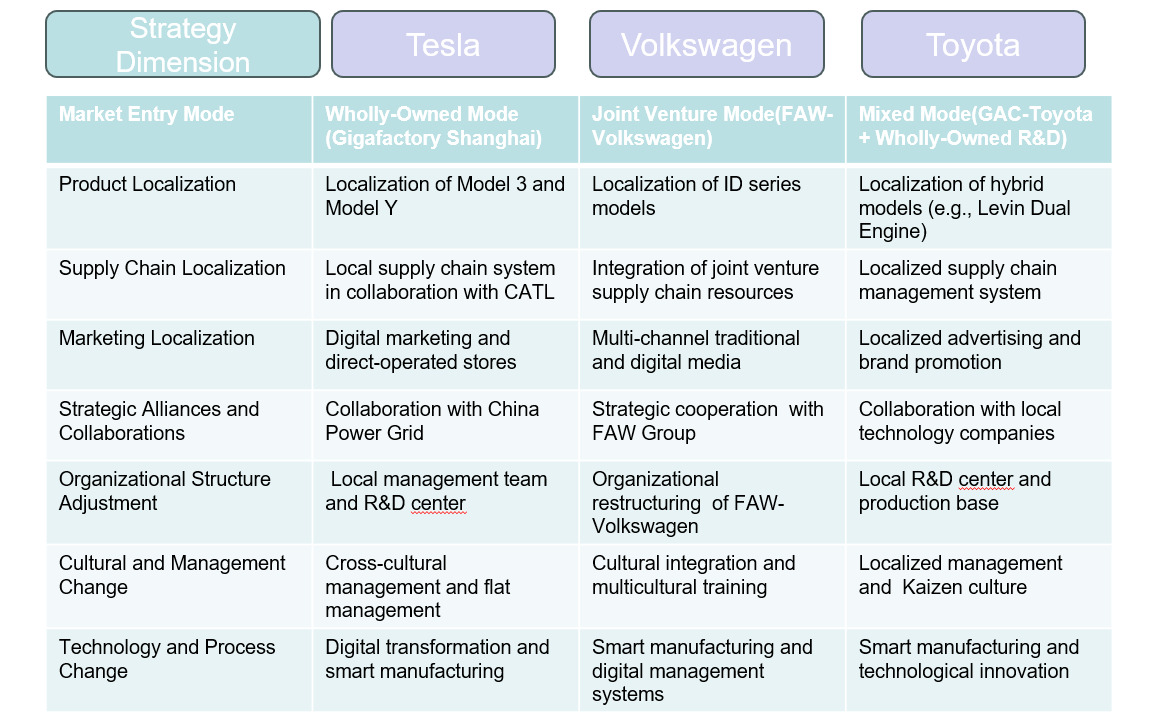

By conducting a detailed analysis of three representative multinational automotive manufacturers in the Chinese New Energy Vehicle (NEV) market—Tesla, Volkswagen, and Toyota—this section explores their strategic adaptation and organizational change processes in the Chinese market. Through comparative analysis, it reveals the strategic choices and their outcomes as different companies respond to the unique environment of the Chinese market, thereby deepening the understanding of strategic adaptation and organizational change in multinational enterprises.

4.1 Overview of Multinational Enterprises Tesla

As a global leader in NEV manufacturing, Tesla has rapidly expanded its market share in China since entering the market in 2014. In 2023, Tesla's sales in China exceeded 300,000 units, accounting for over 20% of its global sales (Tesla Annual Report, 2023). By establishing a Gigafactory in Shanghai, Tesla achieved large-scale localized production and supply chain management, significantly reducing production costs and delivery times. This move not only enhanced Tesla's competitiveness in the Chinese market but also demonstrated its leading capabilities in global supply chain optimization.

Volkswagen entered the Chinese market in 2018 by launching its first pure electric vehicle through a joint venture with FAW Group. In 2023, Volkswagen's NEV sales in China reached 150,000 units, primarily relying on its local R&D and production capabilities [8]. Through deep collaboration with local enterprises, Volkswagen improved its adaptability and competitiveness in the Chinese market, particularly achieving significant success in product localization and market channel expansion.

Toyota has been present in the Chinese NEV market since 2005, gradually enhancing its localized production and technological R&D capabilities by establishing local R&D centers and production bases. In 2023, Toyota's NEV sales in China reached 100,000 units, mainly relying on its advantages in hybrid technology and localized product design strategies (Toyota Annual Report, 2023). Toyota emphasizes environmental protection and energy efficiency, aligning with the Chinese market's demand for NEVs, while maintaining its leading position in hybrid technology through continuous technological innovation.

4.2 Strategic Adaptation Analysis

This section analyzes the strategic adaptation measures of the three multinational enterprises in the Chinese NEV market from three aspects: market entry strategies, localization strategies, and strategic alliances and collaborations.

4.2.1 Market Entry Strategies

The successful entry of multinational enterprises into the Chinese NEV market depends on their chosen market entry strategies. Tesla, Volkswagen, and Toyota have adopted wholly-owned, joint venture, and a combination of joint venture and wholly-owned models, respectively, to adapt to the unique environment and policy requirements of the Chinese market. The following analysis delves into these companies' market entry strategies, integrating strategic management theories to explore the underlying motivations and outcomes.

Tesla employs a wholly-owned subsidiary model by directly establishing Gigafactory Shanghai, enabling rapid market entry and deep penetration into the Chinese market. This strategy exemplifies the advantages of the wholly-owned model in swiftly responding to market demands and policy changes. By building the factory independently, Tesla not only localizes vehicle production but also optimizes supply chain management, significantly shortening delivery times [9]. According to the Resource-Based View (RBV) theory, Tesla enhances its competitiveness in the Chinese market by controlling key resources such as production facilities and supply chains

Furthermore, Tesla's high-end product positioning and autonomous brand image allow it to swiftly capture the high-end NEV market in China, meeting Chinese consumers' demand for high-performance and intelligent vehicles. This premium positioning not only elevates brand value but also aligns with the growing quality expectations of Chinese consumers. Tesla's wholly-owned model enables strict control over production processes and technological standards, ensuring product quality and brand consistency, thereby establishing strong market trust and brand loyalty.

Volkswagen adopts a joint venture model through its collaboration with FAW Group, establishing FAW-Volkswagen, to steadily enter the Chinese market. The joint venture not only leverages the local partner's resources and market channels but also achieves localization in product development and production. This collaborative model aligns with Localization Strategy theory, where multinational enterprises penetrate the market effectively by partnering with local firms to utilize their market knowledge, distribution networks, and government relationships.

Through joint ventures, Volkswagen builds a solid foundation in the Chinese market, implementing a multi-brand strategy that covers both high-end (Audi) and mid-to-low-end (Volkswagen) segments to meet diverse consumer needs. This multi-brand strategy not only expands Volkswagen's market coverage but also diversifies market risks, enhancing overall market share (Aaker, 1996). Additionally, the joint venture model allows Volkswagen to better adapt to China's policy environment by collaborating with local enterprises, gaining more policy support and resource sharing, thereby improving market adaptability and competitiveness [11].

Toyota employs a mixed entry mode, combining joint ventures with GAC Group and wholly-owned R&D centers, to gradually expand its influence in the Chinese market. Through the joint venture "GAC-Toyota," Toyota launches multiple hybrid models in China to meet the country's demand for environmentally friendly and energy-efficient vehicles. This strategy reflects the Mixed Entry Mode theory, where multinational enterprises flexibly choose different entry modes based on market demand and policy environment to achieve strategic goals.

Moreover, Toyota enhances its technological R&D capabilities in the local market by independently establishing R&D centers, enabling strategic gradual expansion. According to Dynamic Capabilities Theory, Toyota improves its adaptability and competitive advantage in the Chinese market through continuous technological innovation and localized R&D. Toyota's focus on hybrid technology and localized product design strategies not only aligns with China's policy direction for energy conservation and environmental protection but also satisfies consumer demand for efficient and eco-friendly vehicles [12].

4.2.2 Localization Strategies

(1) Product Localization. Tesla, based on Chinese market demands, launches models tailored to Chinese consumers, such as Model 3 and Model Y, and makes localized adjustments in design and functionalities. For instance, Tesla optimizes in-car entertainment systems and intelligent driving features to enhance user experience and market competitiveness. Volkswagen develops models that align with Chinese market preferences, combining local consumer usage habits and preferences to launch multiple NEV models. For example, Volkswagen introduces the ID series, catering to Chinese consumers' needs for space and comfort, thereby enhancing product market adaptability. Toyota, aligning with China's demand for hybrid vehicles, launches multiple hybrid models and conducts technical optimizations locally. For instance, Toyota's Levin Dual Engine (Toyota Levin Hybrid) enhances fuel efficiency and environmental performance through localized R&D, meeting China's policy directives and consumer demands.

(2) Supply Chain Localization. Tesla establishes a comprehensive local supply chain system in Shanghai, forging close partnerships with local suppliers to ensure production efficiency and cost control. For example, Tesla collaborates with CATL to supply batteries, ensuring stability and cost advantages in battery supply. Volkswagen integrates local supply chain resources through its joint venture, improving supply chain flexibility and responsiveness. The FAW-Volkswagen joint venture establishes long-term partnerships with local suppliers, ensuring timely and quality component supply. Toyota establishes a localized supply chain management system in China to ensure efficient production and supply operations. Through collaboration with local suppliers, Toyota optimizes supply chain processes, enhancing overall operational efficiency.

(3) Marketing Localization. Tesla employs a combination of online and offline marketing strategies, leveraging digital marketing platforms and directly operated stores to enhance brand awareness and consumer experience. For example, Tesla sets up experience centers in major cities, offering test drives and product demonstrations to increase brand visibility and consumer purchase intent. Volkswagen adopts a multi-channel marketing strategy, integrating traditional media and digital media to broadly cover diverse consumer groups. Volkswagen enhances brand recognition and consumer brand loyalty through television advertising, social media promotions, and offline events. Toyota strengthens its brand influence in the Chinese market through localized advertising and brand promotion activities. Toyota sponsors local sports events and community activities to enhance its social image and consumer brand recognition.

4.3 Strategic Alliances and Collaborations

Tesla primarily relies on a self-operated model, enhancing market entry and expansion efficiency through collaborations with local governments and enterprises. For instance, Tesla collaborates with China Power Grid to build a supercharging network, improving vehicle charging convenience and user experience. This collaboration not only strengthens Tesla's infrastructure support in the Chinese market but also promotes the brand's market penetration. Volkswagen forms strong strategic alliances through its joint venture with FAW Group, jointly developing NEVs and sharing resources to boost market competitiveness. For example, FAW-Volkswagen jointly develops multiple NEV models, integrating both parties' technologies and market resources, enhancing product market adaptability and competitiveness. Toyota collaborates with local enterprises to drive technological innovation and market expansion. For example, Toyota partners with Chinese technology companies to promote the application of smart connectivity technologies, enhancing the intelligence level of its NEVs. This collaboration not only fosters localized technological innovation but also strengthens Toyota's market competitiveness in the fields of smart and electric vehicles.

4.4 Organizational Change Analysis

This section analyzes the organizational change measures of the three multinational enterprises in the Chinese NEV market from three aspects: organizational structure adjustment, cultural and management change, and technology and process change.

4.4.1 Organizational Structure Adjustment

Tesla establishes a localized management team and R&D center in China to achieve autonomous decision-making and rapid market response. Additionally, Tesla adjusts its global supply chain management structure to enhance production efficiency and market responsiveness. By setting up the Gigafactory Shanghai, Tesla achieves full-process localization from design to production, improving its operational efficiency and responsiveness in the Chinese market.

Volkswagen adjusts the organizational structure of its joint venture with FAW Group to enhance localized management and operational capabilities. It establishes dedicated NEV departments responsible for market development and technological innovation. Through such organizational structure adjustments, Volkswagen can more effectively integrate resources, enhancing operational efficiency and innovation capacity in the Chinese market.

Toyota optimizes its organizational structure by establishing local R&D centers and production bases in China, enhancing localized production and R&D capabilities. Through organizational structure adjustments, Toyota improves its adaptability and flexibility in the Chinese market. For example, Toyota sets up hybrid technology R&D centers focusing on local market technological demands and innovation, enhancing its competitiveness in the NEV sector.

4.4.2 Cultural and Management Change

Tesla promotes the integration of global and local cultures through cross-cultural management and employee training. It implements a flat management model to enhance organizational flexibility and innovation capacity. In the Chinese market, Tesla conducts regular cross-cultural training to strengthen employees' identification with the corporate culture, while encouraging innovation and flexible decision-making, thereby enhancing the overall adaptability of the organization. Volkswagen fosters collaboration and communication within multinational teams through cultural integration and localized management. It implements multicultural training programs to enhance employees' cross-cultural adaptability. FAW-Volkswagen enhances the efficiency of multinational team collaboration and cultural identification through regular cultural exchange activities and team-building exercises, improving overall organizational management levels and employee satisfaction. Toyota enhances employees' identification with the corporate culture and adaptability by introducing localized management teams and conducting cross-cultural training. It promotes the Kaizen (continuous improvement) culture to enhance overall organizational performance. In the Chinese market, Toyota ensures that employees understand and practice Toyota's core values through continuous cultural training and value dissemination, promoting efficient operations and continuous improvement within the organization.

4.4.3 Technology and Process Change

Tesla promotes digital transformation and smart manufacturing to enhance production efficiency and product quality. It adopts automated production lines and intelligent supply chain management to optimize production processes. For example, Tesla's Shanghai factory employs highly automated production lines, achieving efficient and flexible production capabilities, significantly improving production efficiency and product consistency. Volkswagen introduces smart manufacturing technologies and digital management systems to enhance production efficiency and management levels. Through process optimization and technological upgrades, Volkswagen improves operational efficiency and competitiveness. FAW-Volkswagen implements advanced production management systems and smart manufacturing technologies, optimizing production processes and efficiently allocating resources, thereby enhancing overall operational efficiency and market responsiveness. Toyota implements smart manufacturing and digital management to improve production efficiency and product quality. Through technological innovation and process optimization, Toyota enhances its overall operational capabilities. In the Chinese market, Toyota adopts advanced manufacturing technologies and digital management systems to optimize production processes and improve quality control, ensuring high product quality and production efficiency.

Figure 1. Comparative Analysis of Market Entry Strategies of Multinational Corporations in the Chinese New Energy Vehicle Market

5 Comparative Analysis of Strategic Adaptation and Organizational Change Among Multinational Automakers

This section provides a comparative analysis of the strategic adaptation and organizational change processes undertaken by three leading multinational automotive companies—Tesla, Volkswagen, and Toyota—in the Chinese New Energy Vehicle (NEV) market. By examining their distinct approaches, this analysis highlights the similarities and differences in their strategies and evaluates the effectiveness of their organizational transformations. The discussion is anchored in strategic management theories, offering a deeper understanding of the mechanisms driving their success and the challenges they encounter.

5.1 Strategic Adaptation Modes

Strategic adaptation refers to the ways in which firms modify their strategies to align with the unique characteristics of the host market. Tesla, Volkswagen, and Toyota have each employed distinct market entry and adaptation strategies to navigate the competitive and regulatory landscape of China's NEV market.

5.1.1 Tesla: Wholly-Owned Mode and High-End Positioning

Tesla adopts a wholly-owned subsidiary model by establishing Gigafactory Shanghai, a fully owned manufacturing facility. This approach aligns with the Resource-Based View (RBV) theory, which emphasizes the importance of controlling key resources to sustain competitive advantage. By owning its production facilities, Tesla maintains stringent control over its manufacturing processes, quality standards, and technological innovations. This autonomy allows Tesla to rapidly respond to market demands and policy changes, ensuring swift delivery and high product quality.

Moreover, Tesla's high-end product positioning and strong brand identity leverage its global reputation for innovation and quality. According to Kotler and Keller (2016), brand positioning significantly influences consumer perception and market share. Tesla's focus on high-performance and technologically advanced vehicles caters to the preferences of affluent Chinese consumers, enabling rapid market penetration in the premium segment. However, this strategy entails substantial operational costs and supply chain risks, as Tesla must manage the complexities of setting up and maintaining a wholly-owned manufacturing operation in a foreign market.

5.1.2 Volkswagen: Joint Venture Mode and Multi-Brand Strategy

Volkswagen employs a joint venture model through its partnership with FAW Group, resulting in the establishment of FAW-Volkswagen. This strategy is underpinned by the Localization Strategy theory, which advocates for adapting products and operations to fit local market conditions. By collaborating with a well-established local partner, Volkswagen gains access to FAW's extensive distribution networks, market knowledge, and regulatory expertise. This collaboration facilitates smoother market entry and reduces the barriers associated with navigating China's complex regulatory environment.

Volkswagen's multi-brand strategy, encompassing both high-end (Audi) and mid-to-low-end (Volkswagen) brands, allows the company to cater to a broader consumer base. This diversification mitigates market risks and enhances market coverage, aligning with Aaker's (1996) brand portfolio management principles. However, maintaining multiple brands requires significant investment in marketing and brand management, and the reliance on local partners may constrain Volkswagen's ability to implement uniform technological innovations across all brands.

5.1.3 Toyota: Mixed Mode and Emphasis on Hybrid Technology

Toyota adopts a mixed entry mode, combining joint ventures with FAW Group and wholly-owned R&D centers. This hybrid approach reflects the Dynamic Capabilities Theory, which emphasizes the firm's ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments. Through joint ventures with Guangzhou Automobile Group (GAC), Toyota leverages local expertise and resources to establish a robust market presence while maintaining its global technological standards through independent R&D centers.

Toyota's focus on hybrid technology aligns with China's emphasis on environmentally friendly and energy-efficient vehicles. By investing in the development of hybrid models, Toyota meets regulatory requirements and consumer demand for sustainable transportation solutions. This strategic alignment enhances Toyota's competitive position in the Chinese NEV market. However, the dual approach of joint ventures and independent R&D requires careful coordination and substantial investment, posing challenges in terms of resource allocation and technological integration.

5.2 Organizational Change Methods

Organizational change involves modifying a company's structures, processes, and cultures to better align with its strategic objectives. The three companies have undertaken various organizational transformations to support their strategic adaptations in China.

5.2.1 Tesla: Localized Management and Flat Organizational Structure

Tesla has established a localized management team and R&D center in Shanghai, enabling swift decision-making and market responsiveness. This structural adjustment is consistent with the principles of agile organizations, which prioritize flexibility and rapid innovation (Burns & Stalker, 1961). Tesla's flat organizational structure minimizes hierarchical barriers, fostering a culture of open communication and collaborative problem-solving. This approach enhances organizational flexibility and innovation capacity, allowing Tesla to quickly implement changes in response to market dynamics.

However, Tesla's emphasis on a flat structure and cross-cultural management presents challenges. Integrating global corporate culture with local practices requires effective cultural adaptation and management strategies. The potential for cultural misunderstandings and conflicts can hinder organizational cohesion and employee satisfaction, necessitating robust cross-cultural training and management practices.

5.2.2 Volkswagen: Restructuring through Joint Venture and Multicultural Training

Volkswagen has restructured its joint venture with FAW Group to enhance local management and operational capabilities. The creation of dedicated NEV departments within FAW-Volkswagen facilitates focused market development and technological innovation. This restructuring aligns with contingency theory, which posits that organizational structures should be adapted to fit the specific demands of the environment.

Volkswagen also implements multicultural training programs to improve cross-cultural collaboration and employee adaptability. These initiatives promote cultural integration and enhance the effectiveness of multinational teams, contributing to higher management standards and employee satisfaction. However, the joint venture model can lead to slower decision-making processes due to the need for consensus between partners, potentially reducing operational efficiency.

5.2.3 Toyota: Local R&D and Continuous Improvement Culture

Toyota's establishment of local R&D centers and production bases in China optimizes its organizational structure, enhancing localized production and research capabilities. This structural optimization is supported by Toyota's adoption of the Kaizen (continuous improvement) culture, which emphasizes incremental enhancements in processes and products (Imai, 1986). Kaizen fosters a culture of continuous learning and operational excellence, improving overall organizational performance and employee productivity.

Toyota's focus on Kaizen and localized management teams strengthens its adaptability and operational efficiency. However, maintaining a continuous improvement culture requires sustained investment in employee training and development, as well as a long-term commitment to process optimization. The high costs associated with these initiatives can strain financial resources and limit the scope of technological innovations.

5.3 Effects of Organizational Change

The organizational changes implemented by Tesla, Volkswagen, and Toyota have yielded varying degrees of success in enhancing their market positions and operational efficiencies in the Chinese NEV market.

5.3.1 Tesla: Rapid Market Expansion and Technological Leadership

Tesla's organizational changes, including the establishment of a localized management team and a flat structure, have facilitated rapid market expansion and technological leadership in China. The localized production through Gigafactory Shanghai has significantly increased Tesla's market share and brand influence, allowing it to quickly scale operations and meet high consumer demand. Tesla's focus on innovation and quality has reinforced its position as a leader in the high-end NEV segment. However, Tesla faces challenges related to high operational costs and supply chain risks. The wholly-owned model requires substantial capital investment and exposes Tesla to vulnerabilities in supply chain disruptions. Additionally, maintaining a flat organizational structure in a culturally diverse environment poses ongoing challenges in managing cross-cultural teams and ensuring cohesive organizational culture.

5.3.2 Volkswagen: Steady Market Growth and Enhanced Competitiveness

Volkswagen's strategic adaptation and organizational restructuring have enabled steady growth in market share and enhanced competitiveness in the Chinese NEV market. The joint venture model with FAW Group has provided Volkswagen with access to local resources and market channels, facilitating effective market penetration and brand diversification through a multi-brand strategy. The integration of local supply chain resources and dedicated NEV departments has improved operational efficiency and responsiveness to market demands. However, Volkswagen's relatively conservative approach to technological innovation may limit its ability to compete with more agile and innovative players like Tesla. The reliance on local partnerships also means that Volkswagen's strategic decisions are influenced by the dynamics of the joint venture, potentially reducing autonomy and flexibility.

5.3.3 Toyota: Increased Market Competitiveness and Technological Innovation

Toyota's focus on hybrid technology and localized R&D has significantly boosted its market competitiveness and technological innovation in the Chinese NEV market. The establishment of local R&D centers has enabled Toyota to tailor its products to meet specific market needs, enhancing customer satisfaction and brand loyalty. The continuous improvement (Kaizen) culture has improved operational efficiency and fostered a proactive approach to innovation and quality management. However, Toyota faces challenges related to high R&D costs and the complexities of integrating continuous improvement practices within a localized context. The financial burden of sustained investment in R&D and process optimization can constrain Toyota's ability to allocate resources to other strategic initiatives. Additionally, adapting global Kaizen principles to the local organizational culture requires ongoing effort and may encounter resistance from employees accustomed to different management practices.

Table 1. Comparative Analysis of Strategic Adaptation and Organizational Change Among Tesla, Volkswagen, and Toyota in the Chinese NEV Market

Dimension |

Tesla |

Volkswagen |

Toyota |

Strategic Adaptation Modes |

Market Entry Mode |

||

Wholly-Owned Subsidiary (Gigafactory Shanghai) |

Joint Venture (FAW-Volkswagen) |

Mixed Mode (Joint Venture with GAC-Toyota + Wholly-Owned R&D Centers) |

|

Strategy |

|||

High-end product positioning and autonomous brand identity. |

Multi-brand approach covering high-end (Audi) and mid-to-low-end (Volkswagen) segments. |

Emphasis on hybrid technology and localized R&D. |

|

Advantages |

|||

Control over production and technology. |

Utilization of local resources and channels. |

Flexibility in responding to market changes and maintaining global brand consistency. |

|

Challenges |

|||

High operational costs and supply chain risks. |

Complex decision-making and relatively conservative technological innovation. |

High R&D costs and technological adaptation challenges. |

|

Organizational Structure Adjustment |

|||

Establishment of localized management teams and R&D centers. |

Restructuring within the FAW-Volkswagen joint venture to create dedicated NEV departments. |

Establishment of local R&D centers and production bases. |

|

Management Model |

|||

Flat organizational structure promoting flexibility and innovation. |

Enhanced local management and operational capabilities through multicultural training. |

Implementation of the Kaizen (continuous improvement) culture to enhance overall organizational performance. |

|

Cultural Changes |

|||

Cross-cultural management and extensive employee training to integrate global and local cultures. |

Promotion of cultural integration and multicultural collaboration to improve team cohesion and employee satisfaction. |

Introduction of localized management teams and ongoing cross-cultural training to foster employee alignment with Toyota’s core values. |

|

Market Expansion |

Market Growth |

Market Competitiveness |

|

Rapid market penetration and significant increase in market share and brand influence. |

Steady increase in market share and enhanced brand presence across multiple segments. |

Enhanced market position through hybrid technology and localized innovations. |

|

Technological Leadership |

Competitiveness |

Technological Innovation |

|

Maintained a leading position in high-performance and smart vehicle technologies. |

Improved market adaptability and resource utilization through joint ventures. |

Strengthened R&D capabilities leading to advanced hybrid models. |

|

Challenges |

|||

Persistent high operational costs and vulnerability to supply chain disruptions. |

Limited technological innovation due to a conservative approach and dependency on local partners. |

High costs associated with R&D and complexities in integrating continuous improvement practices within a localized context. |

|

The comparative analysis of Tesla, Volkswagen, and Toyota reveals distinct strategic adaptation and organizational change approaches tailored to the unique dynamics of the Chinese NEV market. Tesla's wholly-owned model and high-end positioning have driven rapid market penetration and technological leadership, albeit with higher operational risks. Volkswagen's joint venture and multi-brand strategy have facilitated steady growth and enhanced competitiveness, though with limited technological innovation. Toyota's mixed entry mode and focus on hybrid technology and continuous improvement have bolstered market competitiveness and innovation capabilities, despite the challenges of high R&D costs and cultural integration.

6 Conclusion

This paper conducts an in-depth analysis of the strategic adaptation and organizational changes of three representative multinational automotive manufacturers in China's new energy vehicle market: Tesla, Volkswagen, and Toyota. It reveals the strategic choices and their effects that different companies have adopted in response to the unique environment of the Chinese market.

Firstly, in terms of market entry strategy, Tesla adopts a wholly-owned model, rapidly entering and deeply penetrating the market by establishing a Gigafactory in Shanghai. With a high-end product positioning and a strong brand image, it quickly captured the Chinese high-end new energy vehicle market. However, this strategy also faces higher operational costs and supply chain risks. Volkswagen, through a joint venture with FAW Group, adopts a multi-brand strategy covering both high-end and mid-to-low-end markets, steadily expanding market share. Yet, it is relatively conservative in technology innovation, relying more on local partners' resources and market channels. Toyota, on the other hand, combines joint ventures with wholly-owned operations, focusing on hybrid power technology and localized R&D, gradually enhancing market competitiveness while balancing global brand consistency with local market demands, but facing higher R&D costs and technological adaptation challenges.

Secondly, in terms of organizational change, Tesla has improved organizational flexibility and innovation capabilities by establishing localized management teams and R&D centers, and implementing a flat management model, but it faces certain challenges in cross-cultural management. Volkswagen has enhanced its localization management and operational capabilities by adjusting the organizational structure of its joint venture FAW-Volkswagen, establishing a dedicated new energy vehicle department, and implementing multicultural training, which has increased the efficiency of multinational team collaboration and cultural identity. However, the joint venture model may lead to lower decision-making efficiency. Toyota has optimized its organizational structure through the establishment of local R&D centers and production bases, promoting a continuous improvement (Kaizen) culture, which has improved overall organizational performance and employee work efficiency, but it faces higher cost pressures in terms of technological innovation and process optimization.

Lastly, in terms of the effects of change, Tesla has achieved rapid market expansion and technological leadership, significantly increasing market share and brand influence, but still needs to address high operational costs and supply chain risks. Volkswagen has steadily expanded its market share and brand influence, enhancing market adaptability and competitiveness through joint ventures, but its conservative approach to technological innovation may limit its long-term competitive advantage. Toyota has improved market competitiveness and technological innovation capabilities through hybrid power technology and localized R&D, but high R&D costs and technological adaptation challenges may put pressure on its sustainable development.

In summary, different multinational companies have adopted distinctive strategic adaptations and organizational changes based on their own resources, technological advantages, and market positioning. These strategies have not only enhanced their competitiveness in the Chinese market but also provided important experience for their global strategic layout. At the same time, organizational change has played a key mediating role in the process of strategic adaptation, promoting the continuous development and enhancement of innovation capabilities.

References

[1]. Fang, S., Xue, X., Yin, G., Fang, H., Li, J., & Zhang, Y. (2020). Evaluation and improvement of technological innovation efficiency of new energy vehicle enterprises in China based on DEA-Tobit model. Sustainability, 12(18), 7509.

[2]. Sarta, A., Durand, R., & Vergne, J. P. (2021). Organizational adaptation. Journal of management, 47(1), 43-75.

[3]. Sarta A, Durand R, Vergne J P. Organizational adaptation[J]. Journal of management, 2021, 47(1): 43-75.

[4]. Wang, Z., Li, X., Xue, X., & Liu, Y. (2022). More government subsidies, more green innovation? The evidence from Chinese new energy vehicle enterprises. Renewable Energy, 197, 11-21.

[5]. Qin, S., & Xiong, Y. (2022). Innovation strategies of Chinese new energy vehicle enterprises under the influence of non-financial policies: Effects, mechanisms and implications. Energy Policy, 164, 112946.

[6]. He, J., Li, J., Zhao, D., & Chen, X. (2022). Does oil price affect corporate innovation? Evidence from new energy vehicle enterprises in China. Renewable and Sustainable Energy Reviews, 156, 111964.

[7]. Xu, X. L., & Chen, H. H. (2020). Exploring the innovation efficiency of new energy vehicle enterprises in China. Clean Technologies and Environmental Policy, 22, 1671-1685.

[8]. Liu, Y., & Kokko, A. (2013). Who does what in China’s new energy vehicle industry?. Energy policy, 57, 21-29.

[9]. Chen, S., Feng, Y., Lin, C., Liao, Z., & Mei, X. (2021). Research on the technology innovation efficiency of China’s listed new energy vehicle enterprises. Mathematical Problems in Engineering, 2021(1), 6613602.

[10]. Zhao, M., Sun, T., & Feng, Q. (2021). Capital allocation efficiency, technological innovation and vehicle carbon emissions: Evidence from a panel threshold model of Chinese new energy vehicles enterprises. Science of the total environment, 784, 147104.

[11]. Liu, Z., Hao, H., Cheng, X., & Zhao, F. (2018). Critical issues of energy efficient and new energy vehicles development in China. Energy Policy, 115, 92-97.

[12]. Jiang, Z., & Xu, C. (2023). Policy incentives, government subsidies, and technological innovation in new energy vehicle enterprises: Evidence from China. Energy Policy, 177, 113527.

Cite this article

Duan,S. (2025). Strategic Adaptation and Organizational Change of Multinational Corporations in China's New Energy Vehicle Market: A Case Study of the Automotive Manufacturing Industry. Journal of Applied Economics and Policy Studies,16,1-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fang, S., Xue, X., Yin, G., Fang, H., Li, J., & Zhang, Y. (2020). Evaluation and improvement of technological innovation efficiency of new energy vehicle enterprises in China based on DEA-Tobit model. Sustainability, 12(18), 7509.

[2]. Sarta, A., Durand, R., & Vergne, J. P. (2021). Organizational adaptation. Journal of management, 47(1), 43-75.

[3]. Sarta A, Durand R, Vergne J P. Organizational adaptation[J]. Journal of management, 2021, 47(1): 43-75.

[4]. Wang, Z., Li, X., Xue, X., & Liu, Y. (2022). More government subsidies, more green innovation? The evidence from Chinese new energy vehicle enterprises. Renewable Energy, 197, 11-21.

[5]. Qin, S., & Xiong, Y. (2022). Innovation strategies of Chinese new energy vehicle enterprises under the influence of non-financial policies: Effects, mechanisms and implications. Energy Policy, 164, 112946.

[6]. He, J., Li, J., Zhao, D., & Chen, X. (2022). Does oil price affect corporate innovation? Evidence from new energy vehicle enterprises in China. Renewable and Sustainable Energy Reviews, 156, 111964.

[7]. Xu, X. L., & Chen, H. H. (2020). Exploring the innovation efficiency of new energy vehicle enterprises in China. Clean Technologies and Environmental Policy, 22, 1671-1685.

[8]. Liu, Y., & Kokko, A. (2013). Who does what in China’s new energy vehicle industry?. Energy policy, 57, 21-29.

[9]. Chen, S., Feng, Y., Lin, C., Liao, Z., & Mei, X. (2021). Research on the technology innovation efficiency of China’s listed new energy vehicle enterprises. Mathematical Problems in Engineering, 2021(1), 6613602.

[10]. Zhao, M., Sun, T., & Feng, Q. (2021). Capital allocation efficiency, technological innovation and vehicle carbon emissions: Evidence from a panel threshold model of Chinese new energy vehicles enterprises. Science of the total environment, 784, 147104.

[11]. Liu, Z., Hao, H., Cheng, X., & Zhao, F. (2018). Critical issues of energy efficient and new energy vehicles development in China. Energy Policy, 115, 92-97.

[12]. Jiang, Z., & Xu, C. (2023). Policy incentives, government subsidies, and technological innovation in new energy vehicle enterprises: Evidence from China. Energy Policy, 177, 113527.