1. Introduction

In the dynamic banking and financial market environment, efficient resource allocation is essential for banks to enhance operational efficiency and adapt to industry developments. Human resources play a vital role in banking operations. Optimizing human resource allocation not only improves efficiency and reduces costs but also enhances customer satisfaction and market competitiveness. The front office of a bank is particularly crucial as it directly influences customer experience and the bank’s reputation. This paper explores a human resource optimization model specifically designed for the front office of banks. Using mathematical modeling, it integrates job skill requirements, employee skills, and skill proficiency to create an optimized allocation model that addresses the dynamic demand for skills in different positions, thereby maximizing effectiveness.

Human resource allocation in banks and financial institutions often involves challenges related to transformation and competition. For instance, Du Shan et al. [1] studied human resource allocation during bank branch transformation by collecting data on business volume and employee numbers, using predictive algorithms to develop a ‘branch-specific’ model that enhances allocation efficiency. Ye Zhiliang [2] analyzed human resource allocation in fintech and proposed improvements in personnel structuring, training, and salary disbursement. Song et al. [3] investigated talent competition in banks, proposing a model based on ethics, capital, and human resources. Their findings suggested that high ethical standards in banks may lead to talent loss. Wu et al. [4] examined methods for improving human resource management and suggested job role constraints to better utilize personnel at different levels. Liu Yijuan [5] focused on optimizing human resource allocation in commercial banks, discussing guiding principles and potential challenges. Meng Sen et al. [6] analyzed workforce distribution under digital transformation using descriptive statistics and surveys. Wang Zheng [7] studied optimization in private banks, highlighting the need to reduce middle-office personnel, adjust credit staff, and increase multidisciplinary talent.

Artificial intelligence (AI) and algorithmic models are essential tools in solving human resource allocation problems. Yu Yue et al. [8] proposed an AI-based performance prediction model using TS-GABPNN to facilitate efficient workforce deployment. Wei Hao et al. [9] introduced a deep learning-based human resource optimization algorithm (DLSM), which significantly improved human resource distribution. Rokhforoz et al. [10] developed a decentralized Nash bargaining solution (NBS) model for task and resource allocation in banking, transforming task distribution into a game-theoretic problem.

Human resource allocation challenges extend beyond banking to other industries. Pang Changsheng [11] proposed a competency-based model to enhance allocation efficiency. Sinclair-Desgagné B [12] applied static multi-task principal-agent models to study HR management failures in SMEs. Li et al. [13] examined fairness in resource allocation using a stochastic mathematical model. Luo et al. [14] analyzed optimal NGO workforce sizes based on governance quality, while Duan [15] studied the relationship between individualism and banking financial structures.

To summarize, human resource optimization models and algorithms should integrate job demands, employee skills, innovation needs, and external factors. Based on financial resource allocation theories, this study collects real-time data to achieve precise workforce distribution. Human resource allocation in the front office of banks involves multiple objectives. This paper investigates the use of multi-objective optimization models to solve human resource allocation challenges. Section 2 provides real-world data on front office roles in the Agricultural Bank of China and their skill requirements. Section 3 establishes an optimization model based on collected data. Section 4 applies the model to a real-world case study, demonstrating its effectiveness.

2. Analysis of job requirements and skill matching in banking

2.1. Job skill requirements

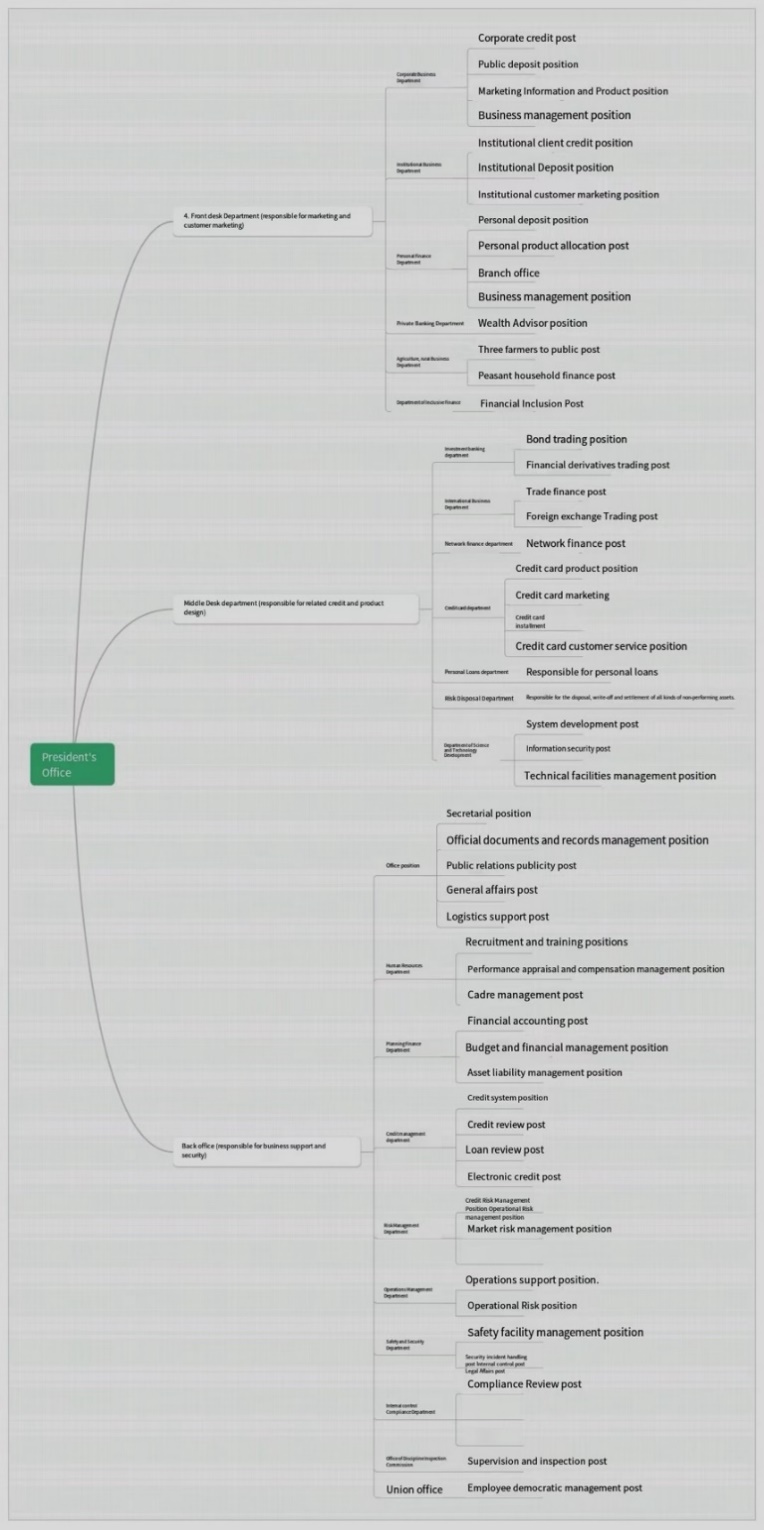

Figure 1. Structure of banking department positions

The front office of a bank can be segmented into six sub-departments, each encompassing three to four positions with diverse skill sets and staffing needs (As shown in Fig.1). The Corporate Credit Position demands proficiency in credit analysis, financial statement evaluation, and risk assessment. Meanwhile, the Corporate Deposits Position necessitates skills in risk evaluation, market expansion, data analysis, and client relationship management. The Market Information & Product Position specializes in market analysis, product conception, and business coordination, while the Business Management Position requires expertise in business coordination, management, and asset allocation. The Institutional Client Credit Position emphasizes financial statement evaluation and risk management, whereas the Institutional Deposits Position focuses on market expansion, client relationship management, and product promotion. The Government & Public Sector Marketing Position needs skills in market expansion, demand analysis, and effective communication. The Personal Deposits Position, on the other hand, requires abilities in market expansion, client relationship management, and product promotion. The Personal Product Allocation Position specializes in demand analysis. Furthermore, the Online Branch Office Position demands management, organizational coordination, and data analysis skills. The second Business Management Position (distinct from the earlier mentioned one within the Corporate context) emphasizes business coordination, management, and process optimization. The Wealth Advisor Position necessitates expertise in demand analysis, asset allocation, and a deep understanding of investment products. The Rural Corporate Banking Position demands skills in market expansion, client relationship management, and policy support project implementation. The Rural Finance Position specializes in risk control, product promotion, and demand analysis. Lastly, the Inclusive Finance Position requires abilities in market research, policy interpretation, and data analysis. Each of these positions plays a crucial role in the overall operation of the bank's front office.

2.2. Employee skill evaluation

Data analysis reveals that risk assessment and data analysis are the most sought-after skills in banking roles, serving as cornerstones for banking professionals. Collectively, essential competencies encompass ten categories: financial analysis, market & client management, product & business development, organizational management, IT support, policy & strategy formulation, communication & documentation, data optimization, legal compliance, and asset acquisition.

3. Human resource optimization model for bank front office

3.1. Problem description

This study aims to optimize human resource allocation in Chinese banks, emphasizing efficiency. It considers job roles, personnel count, and skill requirements. Assuming each position demands multiple skills with different priorities and employees possess varying skill proficiencies, the study develops a human resource-job matching model to ensure optimal staffing.

3.2. Parameters and decision variables

\( {x_{ij}}\begin{cases} \begin{array}{c} 1 the ith person goes to do the jth position \\ 0 the ith person will not do the jth position \end{array} \end{cases} \)

\( m: The quantity of abilities \)

\( n:Number of position and number of people, equal number of positions and number of people \)

\( {a_{jk}}:The jth position requires the kth ability then {a_{jk}}=1, if not, {a_{jk}}=0 \)

\( {b_{ik}}:The level at which the ith person possesses the kth ability, {b_{ik}}≥0 \)

\( {c_{ik}}:The ith person possess the kth ability then {c_{ik}}=1, if not, {c_{jk}}=0 \)

3.3. Optimization model

\( max\sum _{j=1}^{n}\sum _{i=1}^{n}\sum _{k=1}^{m}{a_{jk}}{b_{ik}}{x_{ij}} \) (1)

\( s.t.=\begin{cases} \begin{array}{c} \sum _{j=1}^{n}{x_{ij}}=1, i=1……n \\ \sum _{i=1}^{n}{x_{ij}}=1, j=1……n \\ \sum _{i=1}^{n}{a_{jk}}{c_{ik}}{x_{ij}}=1, j=1……n, k=1……m \\ {x_{ij}}=\lbrace 1,0\rbrace , i=1……n, j=1……n \end{array} \end{cases} \) (2)

Equation (1) represents the objective function, aiming to maximize allocation efficiency, while Equation (2) defines the constraint conditions.

4. Case study

This study focuses on the assessment of skills in five key positions within the Agricultural Bank of China's front office: corporate credit, corporate deposits, market information & product, business management, and institutional client credit. The evaluation examines five individuals with diverse skill sets, categorizing their abilities from A (highest) to C (lowest). The first individual demonstrates proficiency in A-level risk control, C-level client relationship management, C-level data analysis, and B-level management. The second individual excels in A-level financial statement analysis, B-level market analysis, B-level business coordination, and C-level management. The third individual showcases A-level data analysis and market expansion, B-level credit analysis, and C-level product design. The fourth individual stands out in A-level product promotion, B-level financial statement analysis, B-level process optimization, and B-level risk assessment. Lastly, the fifth individual possesses A-level financial statement and credit analysis, B-level client relationship management, and B-level product design skills.Overall, this study highlights the importance of diverse skill sets within the front office of the Agricultural Bank of China to effectively manage various tasks and responsibilities.

According to the optimization model, the most effective allocation of positions within the company is as follows. Employee 5 should be assigned the corporate credit position due to their exceptional A-level credit analysis and financial statement analysis skills, which make them the most qualified for the role. Employee 3 is the ideal candidate for the corporate deposits position, as their A-level market expansion and data analysis abilities align perfectly with the requirements of the position. Employee 2 is best suited for the market information & product position; despite lacking product design expertise they excel in B-level market analysis and business coordination skills. Employee 4 should be placed in the business management position, as their strengths in product promotion and process optimization are a great match for the responsibilities of the role. Lastly, employee 1 is the perfect fit for the institutional client credit position, given their A-level risk control skills and solid proficiency in data analysis, making up for slightly weaker data skills. By allocating positions based on individual strengths and skills, the company ensures optimal performance and success in each role.

Effective job allocation aligns employee skills with job requirements, enhancing human resource efficiency in the bank's front office. This strategic approach leads to improved performance and productivity among staff members.

5. Conclusion

This study delves into the complexities of human resource allocation in the front office of banks, recognizing that each position necessitates a unique set of skills with varying levels of proficiency among personnel. By evaluating the skill requirements for different roles and matching them with the proficiency levels of available staff, this research aims to enhance allocation efficiency. Through the development of an integer programming model, which is implemented using Excel, optimal human resource allocation strategies are formulated based on job-specific skill requirements. The model proves effective in maximizing efficiency and practicality in resource allocation decisions. While this study focuses primarily on skill requirements and proficiency levels, it acknowledges that other factors such as costs, legal policies, and employee preferences play a significant role in human resource allocation. Future research will delve further into incorporating these additional factors to provide a more comprehensive understanding of optimal resource allocation strategies in the banking sector.

References

[1]. Du, S., & Ma, W. (2021). Deepening the demand for branch transformation and developing a new model for adaptive human resource allocation. China Financial Computer, (01), 62-64.

[2]. Ye, Z. (2024). Transformation strategies for bank human resource management in the context of financial technology. Business 2.0, (36), 69-71.

[3]. Song, F., & Thakor, A. (2022). Banking ethics, capital, and talent competition. Journal of Financial Intermediation, 52, 100963.

[4]. Wu, Y., Wang, S., Wang, X., et al. (2022). [Retracted] Application Research of Particle Swarm Algorithm in Bank Human Resource Management. Security and Communication Networks, 2022(1), 8788894.

[5]. Liu, Y. (2022). Research on human resource allocation in urban commercial banks. China Industrial Economy, (23), 132-134.

[6]. Meng, S., Feng, J., Zhao, R., et al. (2022). Current status and countermeasures of human resource allocation in commercial banks under digital transformation—A case study of N Bank A Branch. Modern Finance, (02), 9-16.

[7]. Wang, Z. (2023). Analysis of human resource optimization in private banks—A case study of Chouzhou Bank. Modern Enterprise Culture, (22), 153-156.

[8]. Yu, Y., Yue, X., Zhang, G., et al. (2024). Construction of job allocation and performance prediction model based on TS-BP algorithm. Information Technology, (12), 93-100+108.

[9]. Hao, W., Li, J., Shen, N., et al. (2024). Improvement of Optimal Human Resource Allocation Algorithm Based on Deep Latent Semantic Model. Journal of Organizational and End User Computing (JOEUC), 36(1), 1-23.

[10]. Rokhforoz, P., Kebriaei, H., & Ahmadabadi, M. N. (2021). A fair task and time allocation of multiple human operators using decentralized Nash bargaining solution. Computers & Industrial Engineering, 153, 107027.

[11]. Pang, C. (2024). Improving human resource allocation efficiency in public institutions based on competency models. Human Resources, (10), 74-75.

[12]. Sinclair-Desgagné, B. (2021). Green human resource management–A personnel economics perspective. Resource and Energy Economics, 66, 101261.

[13]. Li, L., et al. (2023). On the Egalitarian–Utilitarian spectrum in stochastic capacitated resource allocation problems. International Journal of Production Economics, 262, 108900.

[14]. Luo, J., Zhuo, W., & Xu, B. (2023). The bigger, the better? Optimal NGO size of human resources and governance quality of entrepreneurship in circular economy. Management Decision.

[15]. Duan, Y., et al. (2024). Individualism and bank financial structure similarity. Journal of International Money and Finance, 148, 103151.

Cite this article

Liu,X. (2025). Optimization model for human resource allocation in the front office of banks. Journal of Applied Economics and Policy Studies,18(2),7-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Du, S., & Ma, W. (2021). Deepening the demand for branch transformation and developing a new model for adaptive human resource allocation. China Financial Computer, (01), 62-64.

[2]. Ye, Z. (2024). Transformation strategies for bank human resource management in the context of financial technology. Business 2.0, (36), 69-71.

[3]. Song, F., & Thakor, A. (2022). Banking ethics, capital, and talent competition. Journal of Financial Intermediation, 52, 100963.

[4]. Wu, Y., Wang, S., Wang, X., et al. (2022). [Retracted] Application Research of Particle Swarm Algorithm in Bank Human Resource Management. Security and Communication Networks, 2022(1), 8788894.

[5]. Liu, Y. (2022). Research on human resource allocation in urban commercial banks. China Industrial Economy, (23), 132-134.

[6]. Meng, S., Feng, J., Zhao, R., et al. (2022). Current status and countermeasures of human resource allocation in commercial banks under digital transformation—A case study of N Bank A Branch. Modern Finance, (02), 9-16.

[7]. Wang, Z. (2023). Analysis of human resource optimization in private banks—A case study of Chouzhou Bank. Modern Enterprise Culture, (22), 153-156.

[8]. Yu, Y., Yue, X., Zhang, G., et al. (2024). Construction of job allocation and performance prediction model based on TS-BP algorithm. Information Technology, (12), 93-100+108.

[9]. Hao, W., Li, J., Shen, N., et al. (2024). Improvement of Optimal Human Resource Allocation Algorithm Based on Deep Latent Semantic Model. Journal of Organizational and End User Computing (JOEUC), 36(1), 1-23.

[10]. Rokhforoz, P., Kebriaei, H., & Ahmadabadi, M. N. (2021). A fair task and time allocation of multiple human operators using decentralized Nash bargaining solution. Computers & Industrial Engineering, 153, 107027.

[11]. Pang, C. (2024). Improving human resource allocation efficiency in public institutions based on competency models. Human Resources, (10), 74-75.

[12]. Sinclair-Desgagné, B. (2021). Green human resource management–A personnel economics perspective. Resource and Energy Economics, 66, 101261.

[13]. Li, L., et al. (2023). On the Egalitarian–Utilitarian spectrum in stochastic capacitated resource allocation problems. International Journal of Production Economics, 262, 108900.

[14]. Luo, J., Zhuo, W., & Xu, B. (2023). The bigger, the better? Optimal NGO size of human resources and governance quality of entrepreneurship in circular economy. Management Decision.

[15]. Duan, Y., et al. (2024). Individualism and bank financial structure similarity. Journal of International Money and Finance, 148, 103151.