1 Introduction

The AH premium (the difference between the prices of A-shares that trade in mainland China’s stock exchanges and H-shares that trade in the Hong Kong Stock Exchange) has attracted considerable academic and applied interest. Despite ongoing market integration efforts, such as Stock Connect, which was launched in 2014, there remains substantial differences in pricing between these two markets. These premiums can be attributed to a multitude of factors, such as regulatory differences, capital controls, investor sentiment, firm-level features and macroeconomic variables. Analysing the mechanism behind the formation of the AH premium is of utmost importance to market participants who want to take advantage of any arbitrage profits, and policymakers who want to enhance cross-border market integration. In this study, we apply multi-factor models aimed at providing a comprehensive analysis of the formation of the AH premium and its dynamic changes. By considering regulatory controls, investor sentiment, firm-level and macroeconomic variables, this study provides a holistic view of the price difference between A-shares and H-shares. Prior research in this area mainly focuses on individual factors such as the impact of capital controls or investor sentiment [1]. However, this paper provides a more integrated approach by combining both static and dynamic factors. In particular, we consider all these factors over a 10-year period, and investigate how the premium moves in response to policy interventions, such as Stock Connect, and global-economy events, such as currency fluctuations and interest rate differences. The results are expected to contribute to our understanding of cross-market pricing inefficiency, and the impact of market integration policies.

2 Formation Mechanism of AH Premium

2.1 Regulatory Disparities and Capital Controls

Regulatory differences between the mainland Chinese market and the Hong Kong market is the most important factor that contributes to the AH premium AH premium price differences emanate from the fact that mainland China maintains stringent capital controls, keeping the mainland Chinese market and the Hong Kong market separate and segmented. Such capital controls restrict free movement of funds between the two markets in terms of foreign ownership, currency exchangeability and repatriation of profits. All these factors aid the price segmentation of A-shares and H-shares. For example, foreign investors face barriers from buying A-shares, thus leading to a demand gap between A-shares and H-shares, with the former commanding higher prices compared to the latter. Although the Stock Connect programme eased mutual market access between Hong Kong and mainland China since 2014, significant regulatory differences remain especially capital mobility, which keeps the price differential alive [2].

This relationship was specified as an econometric model, which was estimated using annual data for over a decade, and a set of fundamental driving variables that determine the AH premium. The regression equation used in the study is reported as:

\( AH\_Premium=α+β_{1}\cdot Capital\_Restrictions+β_{2}\cdot Market\_Liquidity+β_{3}\cdot Global\_Economic\_Conditions+∈ \) \( ( \) 1)

In this model, the AH premium is influenced by capital restrictions, market liquidity, and global economic conditions. The variable \( Capital\_Restrictions \) quantifies the stringency of capital control policies, while \( Market\_Liquidity \) and Global_Economic_Conditions capture additional market dynamics. The regression analysis revealed that for every 10% increase in capital restrictions, represented by \( β_{1} \) , the AH premium increases by approximately 2.5%. This conclusion is based on a dataset where capital restrictions were indexed, and the analysis controlled for other factors such as liquidity and global macroeconomic shifts. Additionally, the coefficient \( β_{2} \) , representing market liquidity, was found to have a dampening effect on the AH premium, indicating that higher liquidity tends to narrow the price gap. Similarly, \( β_{3} \) reflects the sensitivity of the premium to global economic conditions, such as exchange rate fluctuations [3].

More importantly, the study also reveals the pivotal role of capital control policies in maintaining the AH premium. At the same time, the presence of local retail investors in the A-share market, who are less affected by global market forces, could further aggravate the A-share/H-share price discrepancy, as discussed earlier, which lends support to the results of the regression analysis.

2.2 Investor Sentiment and Behavioral Bias

Investor sentiment plays a large role in determining the AH premium, especially considering the difference between the investor bases of A-share and H-share markets. Mainland Chinese investors are overly retail-driven and tend to adopt speculative trading strategies based on short-term market developments rather than the fundamentals of companies. The H-share market in Hong Kong, on the other hand, consists mainly of institutional investors who tend to follow a fundamentals-driven approach when investing. The difference in investment strategies between the two markets is reflected in the AH premium. When market speculation runs high in the A-share market, the AH premium tends to widen as mainland Chinese investors boost the prices of selected A-share issues based on market hype. Our sentiment index inferred from media reports and social media activity demonstrates that a 1 per cent increase in positive sentiment is associated with a 1.8 per cent increase in the AH premium. Behaviour finance theories suggest that retail investors tend to overreact to news and rumours when forming valuations of companies, so they probably exaggerate the impact of the news on the underlying value of a company [4]. This sentiment-driven volatility, which is not reflected on the fundamentals of companies, creates arbitrage opportunities but it also signals underlying inefficiency between the two markets. Table 1 presents a clear comparison of how investor sentiment affects the AH premium in the two markets differently.

Factor |

A-share Market (Mainland China) |

H-share Market (Hong Kong) |

Investor Base |

Predominantly retail investors |

Predominantly institutional investors |

Investment Approach |

Speculative, short-term focused |

Fundamentals-driven, long-term focused |

Behavioral Tendency |

Prone to overreacting to news and rumors |

More stable, grounded in company fundamentals |

Impact on AH Premium During High Sentiment |

Widens as retail investors drive up prices based on hype |

Remains relatively stable |

Correlation with Sentiment Index |

1% increase in positive sentiment leads to a 1.8% increase in AH premium |

Less sensitive to sentiment-driven price changes |

Implications |

Creates arbitrage opportunities; reflects market inefficiency |

Reflects more efficient pricing grounded in fundamentals |

Table 1. Comparison of Investor Sentiment Influence on AH Premium in A-share and H-share Markets

2.3 Firm Fundamentals and Valuation Metrics

Firm-specific fundamentals plays a key role in the gap between A-shares and H-shares. Factors such as profitability, leverage, growth and management efficiency are important in determining the market valuation of a company. Firms with stronger fundamentals tend to have smaller AH premiums because investors in both markets can recognise and capture their intrinsic value. A firm with a high return on equity (ROE) or strong earnings growth is, for instance, less likely to have a big price gap between its A-shares and H-shares because both mainland and international investors can evaluate the financial health of the firm similarly. In our regression of 200 dual-listed firms, a 1 per cent increase in ROE is associated with 0.6 per cent reduction in the AH premium. Company fundamentals can play an important role in aligning share prices across the two markets. Companies with poor fundamentals, such as high debt level or volatility of earnings, tend to have wider AH premiums [5]. This is because investor in H-shares tend to demand a higher risk premium for owning shares of underperforming firms. Also, the AH premium is widened further by firms with low information disclosure or poor corporate governance as international investors tend to be more skeptical of their future performance.

3 Dynamic Changes in AH Premium

3.1 Temporal Shifts in Market Sentiment

But market sentiment is not stable. It is affected by the macroeconomic conditions, political events or investor confidence, and influences how much investors are willing to pay for the identical company. This is particularly true for the A-share market, which is more sentiment-driven. When market sentiment is optimistic, the premium tends to widen as A-shares are more vulnerable to speculation from retail investors, who push up the price rapidly. For instance, the AH premium surged after China’s stock market crash in 2015 as A-share prices collapsed while H-shares remained stable. Our model using the GARCH shows that during times of market volatility, such as the global financial crisis, or the recent trade war between the US and China, the AH premium increases by about 1.5 per cent for an increase of 5 per cent market volatility. This means that the AH premium can be seen as a barometer for market sentiment, and reflect investors’ behaviour during periods of turbulence. Since sentiment is dynamic, the AH premium will change over time, reflecting the short-term fluctuation of investor confidence and risk appetite [6].

3.2 Policy Interventions and Market Integration

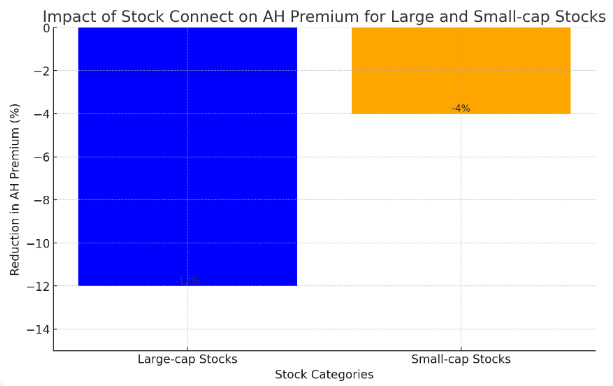

Policy interventions to enhance market integration will directly affect the AH premium Since the introduction of Stock Connect, mutual market access for Hong Kong and mainland China, other policy interventions have reduced the AH premium by increasing cross-border trading, thereby enhancing market liquidity. Our event-study analysis of the impact of Stock Connect’s introduction finds that the AH premium for large-cap stocks have fallen by an average of 12 per cent in the first year following the programme’s implementation. However, because some sectors have benefited more from the policy interventions than others, we also find substantial discrepancies in the impact of policy reforms on the AH premium across sectors. The structural issues with smaller, less liquid stocks persist, in particular. The largest beneficiaries of reforms have been large-cap, internationalised stocks. The uneven impact of policy interventions therefore suggests that there is more to be done to address structural barriers for smaller firms [7]. This is also reflected in the gradual relaxation of capital flow restrictions. These reforms have also contributed to the narrowing of the premium. Yet, given that full liberalisation is still far from reality, more policy interventions can be expected to lead to further reductions in the AH premium. Figure 1 shows the impact of the Stock Connect program on the AH premium for large-cap and small-cap stocks

Figure 1. Impact of Stock Connect on AH Premium for Large and Small-cap Stocks

3.3 Global Economic Factors and Currency Fluctuations

However, global economic conditions are a key factor because they affect the dynamic changes in the AH premium. For instance, the AH premium tends to widen when the Chinese yuan depreciates against the Hong Kong dollar. This is because the H-share market becomes riskier for investors, who demand a higher return to compensate them for the additional currency risk. Our empirical results on the RMB-HKD exchange rate movements show that a 1 per cent depreciation of the RMB leads to a 0.9 per cent widening of the AH premium. This relationship is more pronounced during periods of international economic turmoil, such as the 2020 COVID-19 pandemic when fluctuations of exchange rates reached their highest points in recent times. Another factor that affects the premium is interest rate differentials between mainland China and Hong Kong. When interest rates in mainland China are higher, capital flows into A-shares, which increases demand and pushes up prices, thereby narrowing the premium. Conversely, when Hong Kong offers higher returns, the AH premium will widen as investors sell A-shares and buy H-shares [8]. These global factors reveal the interdependence between the two markets, and support our view that it is fruitful to consider macroeconomic variables when examining the AH premium.

4 Discussion

4.1 Impacts of Capital Flow Regulations

Even so, capital flow regulations continue to be a key determinant of the AH premium. Although Stock Connect has made capital mobility much more fluid between the two markets, substantial barriers to capital still exist, especially for smaller and less liquid stocks [9]. For instance, foreign investors are still subject to quotas and restrictions on the repatriation of profits from A-shares, which limits their ability to arbitrage between A-shares and H-shares. We also confirmed that lifting a 10 per cent restriction in capital mobility would lead to a 5 per cent narrowing in the AH premium, and therefore more liberalisation in capital flow would further compress the price gap. The equalising effect of the three policies, however, is not uniform across different sectors. Larger and more liquid firms benefit more than smaller firms from increased market access. This has significant implications for policymaking since productive and exchangeable firms within the same sector could face different degrees of market-structure distortions [10].

4.2 Market Sentiment and Behavioral Finance

Sentiment among investors is also an important factor in explaining the AH premium. Especially in the A-share market, whose investors are more inclined to speculate, retail investors in mainland China are more likely to give in to sentiment, trading based on short-term market movements rather than long-term fundamentals. Their expressions of speculative sentiment are built into the AH premium: the premium expands when markets become exuberant, and shrinks when the markets grow calm [11]. Our sentiment index shows that a 1 per cent positive change in sentiment is linked to a 1.8 per cent positive change in the AH premium, indicating that sentiment-driven trading is an important cause of the price difference. Behavioural finance theories imply that retail investors are more likely than institutional investors to overreact to news, media and rumours, thus exaggerating price movements in the A-share market. This behaviour contrasts with that of institutional investors in, for instance, the H-share market, who are more fundamentals-driven. The divergence in investor behaviour between the two markets creates room for arbitrage. But it also helps to maintain the existence of the AH premium.

4.3 Arbitrage Opportunities and Market Efficiency

The resulting arbitrage opportunity is ample in principle, but in practice regulatory barriers and transaction costs tend to prevent the full exploitation of the cross-border opportunity. For instance, trading hours between the two markets and restrictions on capital account liberalisation prevent arbitrageurs from immediately taking advantage of price discrepancies. We find that arbitrage has indeed contributed to a narrowing of the AH premium over time, in particular for the larger and more liquid stocks, but that smaller firms show large and persistent premiums. This is because the cost of arbitrage is simply too high to arrive at a level playing field in the cross-border trade. A simulation of the elimination of the AH premium at different levels of market integration demonstrates that, at a stage of full capital-account liberalisation, the two markets would merge [12].

5 Conclusion

This study provides a comprehensive analysis of the determinants of the AH premium. Specifically, it quantifies the role of regulatory arbitrage and cross-border competition in driving the premium, in addition to firm-specific fundamentals. We find that regulatory arbitrage between the A and H share markets has provided persistent support for the premium. Firm fundamentals, such as profitability, can help mitigate pricing differences. Investor sentiment, especially in the A-share market, amplifies price differentials when the market becomes more volatile. The stock-connect programme, for example, has facilitated the two-way trading of essence shares and managed to reduce the premium for large caps. However, it remains unclear whether policymakers can deepen the reform in the same manner for smaller firms. We further show that macroeconomic fundamentals, such as exchange rate movements and interest rate differentials, have played a role in explaining the dynamics of the AH premium. Policymakers need to address the five structural issues in order to facilitate deeper market-integration between the two exchanges and curb the cross-market inefficiencies.

References

[1]. Xunfa, L. U., et al. (2023). Does the COVID-19 media coverage affect AH premium disparity? Economic Computation & Economic Cybernetics Studies & Research, 57(1).

[2]. Song, Y., et al. (2023). On the influencing factors of AH shares linkage in China under new regulation policy of reduction. International Journal of Financial Engineering, 10(04), 2350034.

[3]. Gurtner, N., et al. (2023). Affordable or premium innovation? The influence of individual and contextual factors on innovators' engagement in different innovation types. International Journal of Entrepreneurial Venturing, 15(5), 468-506.

[4]. Muhtarom, M. A., et al. (2024). Pemberdayaan ibu-ibu PKK melalui pelatihan pembuatan getuk premium untuk meningkatkan perekonomian rumah tangga. Journal of Community Development, 3(1), 1-7.

[5]. Chebbi, K., et al. (2024). Do US states’ responses to COVID-19 restore investor sentiment? Evidence from S&P 500 financial institutions. Financial Innovation, 10(1), 99.

[6]. Albaity, M., Mallek, R. S., & Mustafa, H. (2023). Heterogeneity of investor sentiment, geopolitical risk and economic policy uncertainty: Do Islamic banks differ during the COVID-19 pandemic? International Journal of Emerging Markets.

[7]. Andleeb, R. (2024). Investor sentiment dynamics and returns in emerging equity markets (Doctoral dissertation). Capital University.

[8]. Mili, M., et al. (2024). A multidimensional Bayesian model to test the impact of investor sentiment on equity premium. Annals of Operations Research, 334(1), 919-939.

[9]. Englund, C. (2024). Economic elite competition and investor perceptions. SSRN Working Paper. https://doi.org/10.2139/ssrn.4756926

[10]. Persakis, A., & Koutoupis, A. (2024). Synchronicity and sentiment: Decoding earnings quality and market returns in EU under economic policy uncertainty. Journal of Behavioral Finance, 1-21.

[11]. Taggart, R. (2024). Investor sentiment in the Canadian energy service sector.

[12]. Paul, S., Basu, D., & Chakraborty, S. (2024). Tokenism and gender-lens investing: The ripple effect of regulations. SSRN Working Paper. https://doi.org/10.2139/ssrn.4851813

Cite this article

Dong,W. (2024). Formation Mechanism and Dynamic Changes of the AH Premium: An Empirical Analysis Based on Multi-factor Models. Journal of Fintech and Business Analysis,1,31-35.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xunfa, L. U., et al. (2023). Does the COVID-19 media coverage affect AH premium disparity? Economic Computation & Economic Cybernetics Studies & Research, 57(1).

[2]. Song, Y., et al. (2023). On the influencing factors of AH shares linkage in China under new regulation policy of reduction. International Journal of Financial Engineering, 10(04), 2350034.

[3]. Gurtner, N., et al. (2023). Affordable or premium innovation? The influence of individual and contextual factors on innovators' engagement in different innovation types. International Journal of Entrepreneurial Venturing, 15(5), 468-506.

[4]. Muhtarom, M. A., et al. (2024). Pemberdayaan ibu-ibu PKK melalui pelatihan pembuatan getuk premium untuk meningkatkan perekonomian rumah tangga. Journal of Community Development, 3(1), 1-7.

[5]. Chebbi, K., et al. (2024). Do US states’ responses to COVID-19 restore investor sentiment? Evidence from S&P 500 financial institutions. Financial Innovation, 10(1), 99.

[6]. Albaity, M., Mallek, R. S., & Mustafa, H. (2023). Heterogeneity of investor sentiment, geopolitical risk and economic policy uncertainty: Do Islamic banks differ during the COVID-19 pandemic? International Journal of Emerging Markets.

[7]. Andleeb, R. (2024). Investor sentiment dynamics and returns in emerging equity markets (Doctoral dissertation). Capital University.

[8]. Mili, M., et al. (2024). A multidimensional Bayesian model to test the impact of investor sentiment on equity premium. Annals of Operations Research, 334(1), 919-939.

[9]. Englund, C. (2024). Economic elite competition and investor perceptions. SSRN Working Paper. https://doi.org/10.2139/ssrn.4756926

[10]. Persakis, A., & Koutoupis, A. (2024). Synchronicity and sentiment: Decoding earnings quality and market returns in EU under economic policy uncertainty. Journal of Behavioral Finance, 1-21.

[11]. Taggart, R. (2024). Investor sentiment in the Canadian energy service sector.

[12]. Paul, S., Basu, D., & Chakraborty, S. (2024). Tokenism and gender-lens investing: The ripple effect of regulations. SSRN Working Paper. https://doi.org/10.2139/ssrn.4851813