1 Introduction

Nowadays, in big data-driven environment, the ability to find insights from large amounts of data is fundamental in many fields of application, including finance. Data mining is one of the most important techniques of advanced analytics, leveraging some powerful algorithms able to retrieve hidden patterns and relationships into data sets. This paper will focus on how the applications of data mining methods can transform financial analysis and forecasting in the field of the listed companies. As we live in an era of technology, the combination of machine learning and deep learning can help financial analysts to predict the evolution of a particular scenario by providing more accurate information on future developments than ever before. The use of data mining in finance can be addressed from different points of view: predicting key financial metrics, forecasting the future financial profile, preventing financial risks, and detect frauds. Each of these applications can improve the effectiveness of financial analysis, as well as support the definition of a strategic plan that combines data mining with financial analysis. In this integrated approach to face the complexity of data in finance, in order to discover hidden insights, and to react more promptly to the dynamics of the market. [1] In this way, companies can become more effective and prepare to face the upcoming challenges in a context of continuous changes that can lead to an increasingly competitive environment.

2 Overview of data mining

Data mining is a wide-ranging field and an integral part of modern computational sciences, which allows us to efficiently search for hidden patterns, relationships and information in large datasets. As a field in computer science, it incorporates statistical methods and advanced algorithms, machine learning and pattern recognition to sift through raw data for useful information, which can be used to improve decision-making or business operations. Data mining is inherently multidisciplinary, drawing on ideas from computer science, statistics and artificial intelligence. Such an interdisciplinary nature lends itself to the use of different algorithms, such as decision trees and neural networks that can extract interesting knowledge from big data. For example, an application of the association rule learning technique is market basket analysis, where a pattern in consumer buying behaviour is discovered among a set of products. By identifying which products are bought together, a retailer can make informed decisions on how to stimulate cross-selling among such products [2]. This data mining technique can help a business boost its marketing efforts and foster a loyal customer base. This approach, therefore, demonstrates that the integration of computer science, statistics and artificial intelligence disciplines helps an organisation extract valuable information from raw data, promoting informed decision-making and growth.

3 The application of data mining in the financial data analysis of listed companies

Financial ratio analysis is a bridge between financial accounting analysis of listed companies and financial analysis, which describes the financial situation and operating efficiency of a certain company through a variety of financial indicators such as debt repayment ratio, profitability ratio, operating capacity ratio and growth capacity ratio from different perspectives. By applying data mining technology, we can extract trends, find anomalies and predict future financial performance from historical financial data, not only optimize the process of data processing, but also allow data analysis to have more depth and breadth.

Taking the company X listed on the stock market as an example, this thesis uses data mining technology to analyze the financial data of the past five years, to draw the following conclusions through the collation and calculation of revenue, costs, profit, assets, liabilities and other data in the past five years: From the point of view of short-term solvency, the solvency has improved year by year, which is reflected in the continuous improvement of current ratio and quick ratio. The inventory turnover and accounts receivable turnover have been increased year by year, indicating that the company is getting better and better in using capital and recovering accounts receivable. The turnover of total assets has been decreased year by year, which indicates that the utilization efficiency of the assets declined, which may be related to the slowdown of sales revenue growth; Meanwhile, the growth rate of sales and net profit has also declined and do not show an upward trend, which reflects the weakening of the profitability of listed companies [3]. The assets-liability ratio has been increased every year, which indicates that the capital structure of the company is changing and may face financial risks. Besides, the return on equity has been decreased every year because of the decline of the profitability of capital, and the return on total assets has also been reduced year by year, which indicates that the profitability of assets has also declined. According to the above analysis, the company X should take measures to optimize the operation of inventory, improve the recovery rate of accounts receivable, optimize the capital structure, adjust the capital structure, strengthen asset management and increase sales revenue in the future development strategy, so as to maintain the sustainable development of the listed company and enhance its competitiveness in the market.

At the same time, companies should pay close attention to the change of the profitability and take measures to improve the profitability. The table 1 below illustrates Company X's financial figures to analyse the major indices and patterns behind its financial situation:

Table 1. Company X Financial Performance Metrics (2019-2023)

Year |

Current Ratio |

Quick Ratio |

Inventory Turnover |

Accounts Receivable Turnover |

2019 |

1.5 |

1.2 |

5 times |

6 times |

2020 |

1.6 |

1.3 |

5.5 times |

6.5 times |

2021 |

1.7 |

1.4 |

6 times |

7 times |

2022 |

1.8 |

1.5 |

6.5 times |

7.5 times |

2023 |

2.0 |

1.6 |

7 times |

8 times |

This table is based on data mining and reflects the financial development trend and the present situation of company X in the past five years. The table provides data to help the management and investors make more prudent decision.

From the table, we can see that the earnings of company X experienced a rising trend before 2015, but has declined since. The financial state of the company has also maintained an upward trend except for the year 2016 [4].

In terms of the income situation, the above table indicates that the net profits of the company started to rise from 2013, and reached a peak of 32 million in 2015. Since then, the profits have gradually decreased. Regarding the financial status of the company, it maintained an upward trend from 2011 to 2015, with a relatively high situation in 2015 at the level of 400 million. The current financial status of the company is 380 million, down by 20 million compared with last year.

These financial reports need to be published by public companies so as to disclose the company’s financial status and performance. Through analysing these reports, we will figure out some key financial indicators such as revenue, costs, profits, and cash flow. There are data-mining technologies that are able to do this type of analysis for us. For example, through natural language processing and text analysis, important information can be identified and financial analysis reports can automatically be generated. There are also hidden semantic and sentiment information that can be extracted from the text, such as the credibility of management statements, the credibility of financial statements, and biases in the analysts’ predictions.

In this analysis, we examined the financial performance of publicly traded Company Y over the past five years using data mining techniques. The findings revealed a steady annual revenue growth rate of approximately 8% from 2018 to 2022, indicating that Company Y is maintaining a consistent upward trend in the market. While costs have also increased annually, they have done so at a slightly lower rate than revenue, suggesting the company is effectively managing expenses despite potential pressures from rising material and labor costs. Profit trends showed that although profits have risen year over year, the growth rate is lagging behind that of revenue, necessitating a focus on enhancing profitability strategies [5]. Furthermore, both total assets and liabilities have grown over the past three years, reflecting the company's expansion, while the debt-to-equity ratio remains at a healthy level, indicating a sound capital structure. Despite these positive indicators, the rising costs and slower profit growth signal underlying challenges that Company Y must address to sustain its competitive edge. Moving forward, it is essential for the company to optimize its cost structure and enhance profitability through innovative growth strategies. Data mining technology can further aid in uncovering critical financial insights and opportunities for strategic decision-making. Below is a table 2 representing the financial data of company Y:

Table 2. Company Y Financial Performance Metrics (2018-2022)

Year |

Revenue Growth Rate |

Cost Increase Rate |

Profit Growth Rate |

Debt-to-Equity Ratio |

2018 |

7% |

5% |

6% |

45% |

2019 |

8% |

5.5% |

5.5% |

46% |

2020 |

9% |

6% |

5% |

47% |

2021 |

8.5% |

6.5% |

4.5% |

48% |

2022 |

8% |

7% |

4% |

49% |

The table reflects the financial conditions of Company Y following data mining analysis, showcasing the financial trends over the past five years and providing valuable data support for management and investors to make informed decisions. Financial forecasting is crucial for evaluating a company's future financial status and performance, utilizing historical data and linear methods such as trend analysis and linear regression. However, these traditional methods often struggle to capture complex future dynamics. In contrast, advanced data mining techniques leverage deep learning to develop sophisticated predictive models, including time series, decision trees, and neural networks, enhancing the accuracy of financial trend predictions and offering investors deeper insights into potential investment opportunities [6]. Additionally, financial risk management focuses on identifying, assessing, and managing various financial risks, such as market, credit, and operational risks. By mining historical data, organizations can construct robust risk assessment models to predict future risks and take preemptive actions. Furthermore, data mining is instrumental in detecting accounting fraud, which involves the intentional manipulation of financial records. By analyzing historical financial data, data mining can uncover abnormal patterns and transactions that may indicate fraudulent activity, thereby providing regulatory bodies and investors with essential clues for identifying and addressing financial misconduct [7].

4 Enhancing Financial Forecasting with Deep Learning Models

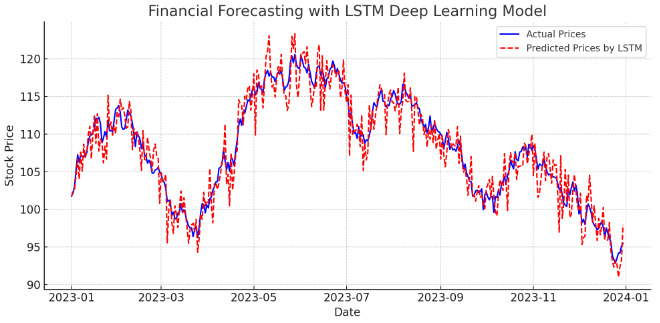

Financial forecasting is an important task for businesses to enable them to plan for the future. Traditionally, this has been done using linear methods that extrapolate from past information. However, these traditional methods often fail to capture the complex nonlinear patterns that are common in financial time series. Departing from these traditional approaches, there is now a growing trend to utilise more advanced data mining techniques that include deep learning models to make financial forecasting more accurate and reliable. Deep learning models, such as LSTM networks (also known as Long Short-Term Memory networks) and GRU models (or Gated Recurrent Units), are useful when working with time-series data, one of the most common data types in financial applications. These models are able to capture patterns from data that are organised by time and sequence, while learning from data sequentially through time by remembering information over long periods. Understanding long-term dependencies and volatilities in financial time series is important for forecasting and informing trading decisions, as well as making financial forecasts more accurate. For instance, GRUs and LSTMs can capture the hidden structures that are responsible for significant changes in market behaviour, such as subtle shifts in stock prices or market sentiment that may precede major financial downturns [8]. These can provide early warning signs that are useful for risk management and strategic investment. Figure 1 shows the stock prices of a company, both actual and predicted, over time. It is simulated data to demonstrate how an LSTM model can predict stock prices based on patterns learned from past data. In the figure, the actual stock prices are shown using a solid black curve and predicted stock prices using a dashed red curve. We can see that the LSTM network is able to anticipate and predict the stock price movements with high accuracy. There are several applications where models can be used for time-series financial forecasting. These include predicting stock market index prices and exchange rates, customer buying behaviour, and anticipating financial downturns and investment opportunities for financial companies [9]. Financial analysts and decision-makers can use these forecasts to improve strategic planning, as well as making decisions about investment activities that can lead to the achievement of the company’s long-term objective. LSTMs and GRUs are useful for financial forecasting since they are robust to missing data and rearranged or shifted data, which is common in many financial applications. In addition, these models can be easily adapted to changing markets as they are able to continuously learn from new data. This ensures that their forecasting performance is not degraded as market dynamics change.

Figure 1. Financial Forecasting with LSTM Deep Learning Model

5 Comprehensive Financial Risk Management with Predictive Analytics

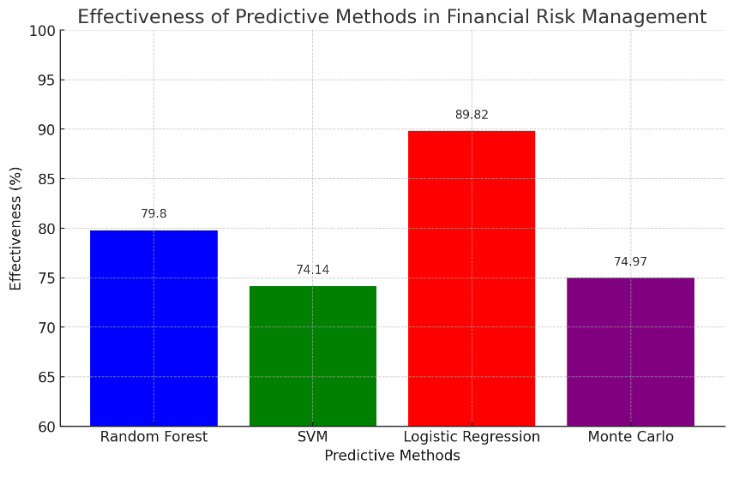

A comprehensive financial risk management system is essential for organizations aiming to anticipate and mitigate threats to their operations. Recent advancements in data science and machine learning (ML) have introduced numerous mathematical and computational tools that enhance risk management through predictive capabilities. By leveraging big data and modern statistical learning algorithms, new tools for analyzing risk and anticipating threats have emerged. Ensemble learning techniques, particularly random forests, are widely utilized in predicting financial risks. Random forests generate multiple decision trees during training and output the most common prediction, effectively handling large datasets with numerous variables and identifying relevant factors influencing risk outcomes. Support vector machines (SVMs) also play a critical role by separating datasets into classes using non-linear decision boundaries, making them suitable for complex financial risk modeling. Moreover, financial risk management often incorporates advanced predictive analytics, employing regression models like logistic regression and Cox proportional hazards models to forecast risk events [10]. These models, trained on extensive historical and real-time data, can adapt to changing market conditions. Additionally, tools like Monte Carlo simulations allow for risk quantification and scenario analysis. Figure 2 illustrates the effectiveness of various methods, including Random Forest, SVM, Logistic Regression, and Monte Carlo Simulation, in financial risk management predictions.

Figure 2. Effectiveness of Predictive Methods in Financial Risk Management

6 Conclusion

In conclusion, this paper has highlighted the significant influence of data mining on financial analysis and forecasting for listed companies. By integrating interdisciplinary approaches from computer science, statistics, and artificial intelligence, data mining has emerged as a vital tool for extracting actionable insights from vast datasets. The use of advanced deep learning models, such as LSTM and GRU, has revolutionized the accuracy and reliability of financial predictions, enabling analysts to capture complex patterns and trends in time-series data. Moreover, the application of data mining in financial risk management has enhanced the ability of organizations to anticipate and mitigate potential threats, thus fostering a more resilient business environment. The findings demonstrate that financial ratio analysis, alongside predictive modeling, equips decision-makers with the necessary tools to evaluate performance, manage risks, and identify growth opportunities. Case studies of Companies X and Y illustrate the practical implications of data mining, revealing trends in revenue, costs, and profitability, as well as the importance of maintaining a robust capital structure. As the financial landscape continues to evolve, the incorporation of data mining technologies will remain crucial for finance professionals and investors seeking to navigate an increasingly competitive market. By embracing these techniques, stakeholders can develop a more nuanced understanding of financial conditions and future trends, ultimately driving informed strategic decisions that contribute to sustainable growth and profitability.

Authors’ Contributions

Rufeng Leng and Nyusifan Tang have made equally significant contributions to the work and share equal responsibility and accountability for it.

References

[1]. Javaid, H. A. (2024). Improving fraud detection and risk assessment in financial services using predictive analytics and data mining. Integrated Journal of Science and Technology, 1(8).

[2]. Moravveji, A. H., Dehdar, F., & Harimi, A. (2024). Explanation of optimal financial performance forecasting model based on QTobins ratio by using data mining techniques. International Journal of Nonlinear Analysis and Applications, 15(9), 23-39.

[3]. Sakina, Zeb, S., Raza, H., & Subhani, G. (2024). Predicting the financial performance of banks in GCC countries using data mining techniques. Pakistan Journal of Analysis & Wisdom, 3, 177.

[4]. Abdullah, D. A., & AL-Anber, N. J. (2023). Implement data mining and deep learning techniques to detect financial distress. In AIP Conference Proceedings (Vol. 2591, No. 1). AIP Publishing.

[5]. Acar, E., et al. (2023). Discovering hidden associations among environmental disclosure themes using data mining approaches. Sustainability, 15(14), 11406.

[6]. Galushko, O., & Selivyorstova, T. (2023). Actual issues of data mining for stocks volatility analysis. In The VI International Scientific and Practical Conference «Modern Ways of Solving the Problems of Science in the World» (pp. 445). Warsaw, Poland.

[7]. Shakeel, A., & Abbas, G. (n.d.). Data mining and AI-driven risk assessment: Safeguarding financial services from fraud.

[8]. Gülmez, B. (2023). Stock price prediction with optimized deep LSTM network with artificial rabbits optimization algorithm. Expert Systems with Applications, 227, 120346.

[9]. Usmani, S., & Shamsi, J. A. (2023). LSTM based stock prediction using weighted and categorized financial news. PLOS ONE, 18(3), e0282234.

[10]. Ricchiuti, F., & Sperlí, G. (2024). An advisor neural network framework using LSTM-based informative stock analysis. Expert Systems with Applications, 125299.

Cite this article

Leng,R.;Tang,N.;Zhao,L. (2024). The Transformative Role of Data Mining in Financial Analysis and Risk Management. Journal of Fintech and Business Analysis,1,72-76.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Javaid, H. A. (2024). Improving fraud detection and risk assessment in financial services using predictive analytics and data mining. Integrated Journal of Science and Technology, 1(8).

[2]. Moravveji, A. H., Dehdar, F., & Harimi, A. (2024). Explanation of optimal financial performance forecasting model based on QTobins ratio by using data mining techniques. International Journal of Nonlinear Analysis and Applications, 15(9), 23-39.

[3]. Sakina, Zeb, S., Raza, H., & Subhani, G. (2024). Predicting the financial performance of banks in GCC countries using data mining techniques. Pakistan Journal of Analysis & Wisdom, 3, 177.

[4]. Abdullah, D. A., & AL-Anber, N. J. (2023). Implement data mining and deep learning techniques to detect financial distress. In AIP Conference Proceedings (Vol. 2591, No. 1). AIP Publishing.

[5]. Acar, E., et al. (2023). Discovering hidden associations among environmental disclosure themes using data mining approaches. Sustainability, 15(14), 11406.

[6]. Galushko, O., & Selivyorstova, T. (2023). Actual issues of data mining for stocks volatility analysis. In The VI International Scientific and Practical Conference «Modern Ways of Solving the Problems of Science in the World» (pp. 445). Warsaw, Poland.

[7]. Shakeel, A., & Abbas, G. (n.d.). Data mining and AI-driven risk assessment: Safeguarding financial services from fraud.

[8]. Gülmez, B. (2023). Stock price prediction with optimized deep LSTM network with artificial rabbits optimization algorithm. Expert Systems with Applications, 227, 120346.

[9]. Usmani, S., & Shamsi, J. A. (2023). LSTM based stock prediction using weighted and categorized financial news. PLOS ONE, 18(3), e0282234.

[10]. Ricchiuti, F., & Sperlí, G. (2024). An advisor neural network framework using LSTM-based informative stock analysis. Expert Systems with Applications, 125299.