1. Introduction

Central Bank Digital Currency (CBDC) is a disruptive fintech technology that has sweeping impacts on monetary policy, banking and financial stability around the world. In contrast to decentralized, private cryptocurrency, CBDCs are public property held by the state and provide a secure digital currency backed by sovereign credit rather than cash or commercial bank accounts. According to the Bank for International Settlements (BIS), CBDC research and development is already underway in more than 80% of all central banks worldwide, with pilot schemes in countries and regions from China to Sweden to the Bahamas. All of this means that the need of understanding CBDC’s larger impact on the conventional finance system more than ever before.

This article considered the disruptive impact of CBDC – starting from the conceptual frame to the technology architecture and its use case. Implications discussed in the article include financial disintermediation risk, operation complexity and privacy concerns. Imperial research into early CBDC pilot projects such as People’s Bank of China’s Digital RMB and Eastern Caribbean Central Bank’s DCash also offered insights [1]. With data-driven analysis and conceptual insights, it is designed to give tangible lessons to policymakers and banks to help them capitalize on opportunities and mitigate risk in the evolving financial environment.

2. Literature Review

2.1. Evolution of CBDC Concepts

Central bank digital currencies are a development over the past 10 years as a result of digital technological innovations and evolving consumer demands [2]. Earlier debates focused on CBDC’s potential to enhance the effectiveness of monetary policy by giving central banks the ability to directly manipulate spending and saving.Several later studies have expanded the use of CBDCs in financial intermediation (deposit erosion, pressure on commercial bank liquidity) and established the theoretical basis for the analysis of CBDC’s effects on the financial system.

2.2. CBDCs and Financial Inclusion

An important advantage of CBDC is its potential to promote financial inclusion.Research shows that CBDCs can reduce barriers to accessing financial services, especially in underserved areas.Data from the Sand Dollar pilot program in the Bahamas, for example, show a significant increase in financial service coverage in rural areas [3]. However, there are also concerns that the digital divide could exacerbate social inequality without adequate infrastructure investment and targeted policy support.

2.3. Privacy and Surveillance Concerns

Designing CBDCs involves trying to balance privacy and regulation needs. Hypothetical solutions encourage cryptography to comply with AML and CTF standards without giving the user any visibility [4]. In order to address these worries, the digital euro prototype of the European Central Bank, for example, relied on privacy-enhancing methods such as Proof of Zero Knowledge. Despite these technical advances, the ethical question remains whether the CBDC system can trigger national regulatory trespass.

2.4. Global Monetary Impacts

The impact of CBDC is not just domestic in nature but also carries far-reaching implications for the international financial system. Several studies demonstrate CBDC can reduce the need for the US dollar in international trade and foster currency diversification [5]. The digital renminbi pilot in China, for instance, proved the viability of cross-border CBDC payments, but it also triggered debate about the future of ethereal reserve currencies. However, the rise of CBDCs could exacerbate geopolitical tensions, making international coordination and governance mechanisms particularly important [6].

3. CBDCs and Financial Institutions

3.1. Financial Disintermediation

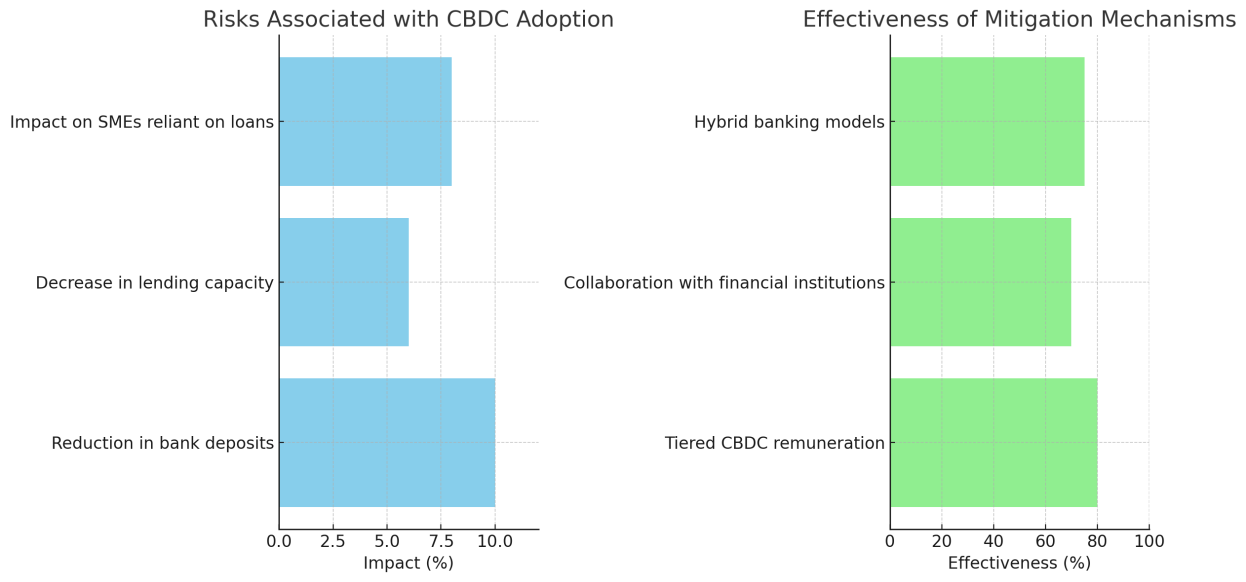

Consequences and Precautions The use of CBDCs completely transforms deposit-taking and lending processes at traditional banks. CBDCs can allow central banks and end-users to conduct transactions directly, perhaps without the need for commercial banks acting as middlemen. A report from the International Monetary Fund (IMF) estimated that even a small migration of 10% of deposits to CBDCs would erode banks’ credit capacity by 5-7% and affect small and medium enterprises (SMEs) that are heavily dependent on conventional credit sources [7]. Such threats require novel means of mitigation. For example, differential CBDC payments (lower interest rates for greater CBDC reserves) can drive users to deposit in commercial banks. Such strategies strike a balance between creativity and maintaining financial stability. Figure 1 compares the impact of the most significant risks that CBDC would bring to the conventional banking system and their respective mitigations.

Figure 1. Effectiveness of Mitigation Mechanisms

3.2. Operational and Technological Challenges

Implementing CBDC brings with it a number of operational complexities. Realizing real-time settlement requires building advanced infrastructure that can handle high transaction volumes of data while maintaining security. China’s digital RMB pilot programme, for instance, recorded more than 260 million transactions in 2023, clearly demonstrating the growing need for scale and processing capacity of CBDC systems. Meanwhile, cybersecurity threat is not a distant concern.Attack on the CBDC system will not only undermine public confidence in it, but may even affect economic stability. There are new technologies available to enhance the resilience of CBDC systems, including DLT and Secure Multi-Party Computing (SMPC). Policymakers should focus on the research, development and implementation of these technologies and on building more robust partnerships with the private sector in order to close down the operational holes in the system and keep the CBDC operating safely and securely.

3.3. Privacy Concerns and Data Governance

CBDC privacy has always been a controversial topic. CBDC payments don’t generate physical cash, so privacy concerns about eavesdropping and the abuse of personal information are raised. According to a survey conducted by the European Central Bank (ECB), 43% of respondents ranked privacy at the top of their list of CBDC features [8]. Advanced cryptography, including zero-knowledge proofs (ZKP) and homomorphic encryption, could allow transaction privacy without disrupting regulatory oversight. transparent data governance frameworks need to explicitly specify who owns, accesses and how data can be used, thereby protecting individual rights and ensuring compliance. Table 1 summarizes the key points of CBDC privacy issues and data governance.

Table 1. Privacy Concerns and Data Governance

Aspect | Details |

Privacy Concerns | CBDC payments leave digital footprints, raising concerns about surveillance and misuse of personal data. |

Importance of Privacy | 43% of ECB survey respondents consider privacy the most critical feature of CBDCs. |

Cryptographic Solutions | Techniques such as ZKP and homomorphic encryption enhance privacy without hindering oversight. |

Data Governance Frameworks | Frameworks need to define ownership, access, and usage policies to balance individual rights with regulatory compliance. |

4. Impacts on Monetary Policy

4.1. Enhanced Transmission Mechanisms

CBDCs offer central banks an alternative mechanism to manage the money supply directly and greatly accelerate the transmission of monetary policy. Standard monetary policy is based on a long line of intermediaries, and it takes a very long time for policy to become operational. CBDC, meanwhile, means that central banks can send digital assets into people’s digital wallets, accelerating policy objectives during downturns and delaying the hindrances of traditional channels. According to the Bank for International Settlements (BIS), CBDC-based direct transfers can cut the delay of monetary policy transmission by up to 30 per cent and, in doing so, dramatically improve the economy’s ability to react to policy shifts. This symbiotic transmission network offers an effective means of adapting to economic emergencies. But the actual impact of CBDC policies relies very heavily on how popular they are in the society and how digitally literate the public [9]. Thus, governments must promote and popularize the public awareness of digital currencies and increase the public’s digital literacy through education and training. Meanwhile, popularization of CBDC would require strong technical and infrastructure infrastructure so that the system could function safely, stable and successfully.

4.2. Addressing the Zero Lower Bound

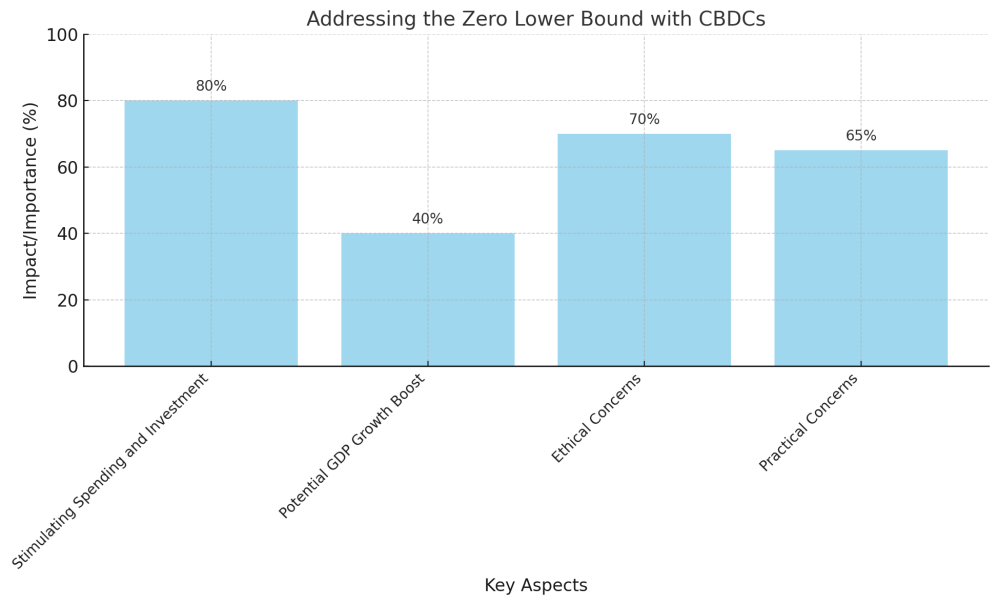

CBDCs provide a completely new mechanism for dealing with the problem of the zero lower bound on nominal interest rates. When central banks allow negative interest rates on digital assets, they can counter deflation by stimulating consumption and investment, thereby promoting economic recovery. However, such measures are accompanied by certain ethical and practical problems. Therefore, policymakers need to introduce protective measures, such as exemptions for small balances, to ensure that economic policies are fair and inclusive. Against this backdrop, the empirical model shows that the implementation of negative interest rates through CBDC can lead to a GDP growth of 0.2% to 0.4% during a recession, which suggests that such a strategy has some advantages and effects at the macroeconomic level.

Figure 2 further demonstrates a variety of CBDC responses to the zero lower bound issue, including the need to stimulate consumption and investment, the likelihood of achieving GDP growth, and the ethical and practical feasibility of negative interest rates. These data and analyses not only help us understand more clearly the potential and limitations of negative interest rate policy, but also provide important reference directions for policymakers to find a balance between economic stability and social equity.

Figure 2. Effectiveness of Mitigation Mechanisms

4.3. Global Monetary Policy Implications

The transnational use of CBDCs has implications for global monetary policy. CBDCs, for example, can streamline and accelerate global trade, removing the need for correspondent banks. Project Dunbar of the BIS Innovation Hub, for example, showed how multi-CBDC platforms could be deployed to allow direct settlement between central banks. But the proliferation of CBDCs could also drive up the level of currency competition and weaken smaller economies. In order to mitigate these risks and ensure global financial stability, coordinated international structures, like the International Monetary Fund’s proposed multi-CBDC bridge, are essential [10].

5. Regulatory Framework for CBDCs

5.1. Legal Design and Institutional Adaptation

To ensure that CBDC adoption will be successful, consumers need to be insulated from fraud and abuse. Standardization must include secure encryption, liability systems, and dispute resolution mechanisms. Finance education is just as important, ensuring that CBDC systems are available to all demographics in safe and trusted environments. For example, the RBI’s digital rupee pilot also included educational programmes for the rural communities, thus making inclusivity an essential pillar [10]. Results from these efforts show that digital transaction adoption rates increased by 12 %, which shows how successful these campaigns are. Table 2 summarises the key components of CBDC’s legal framework and institutional adaptation and effectiveness.

Table 2. CBDC Legal Design and Institutional Adaptation

Aspect | Details | Effectiveness (%) |

Fraud Prevention | Regulations must address fraud risks in CBDC adoption. | 85 |

Encryption | Secure encryption protocols are essential for transaction safety. | 90 |

Cryptographic Solutions | Establishing clear liability frameworks to handle disputes effectively. | 80 |

Data Governance Frameworks | Mechanisms for addressing grievances and resolving disputes are critical. | 75 |

Financial Literacy Campaigns | Campaigns educate users on safely using CBDC systems. | 70 |

Inclusivity Initiatives | Efforts targeting rural populations increased digital transaction adoption by 12%. | 12 |

5.2. Balancing Innovation and Stability

Balancing innovation with financial stability requires dynamic risk assessment mechanisms. The introduction of sandbox environments, like Singapore’s Project Ubin, allows regulators to try CBDC trials in an environment where it can be tested. Because they recreate situations in the real world, these sandboxes help us understand potential risks and help guide policy changes. Involving policymakers in a continual dialogue with stakeholders should also make regulatory systems more responsive to changes in technology and the market.

6. Conclusion

The potentially disruptive nature of the CBDCs demands a careful approach to its development, adoption and regulation. When CBDC can solve issues of financial disintermediation, operational risks, and privacy, it can realize a number of key benefits such as improved monetary policy transmission and financial inclusion. This research points to the need for robust, evidence-driven, internationally coordinated regulatory environments that make CBDCs fit into a stable and inclusive financial system. As central banks push the envelope of innovation, gaining public confidence and engendering widespread stakeholder engagement will be key steps in creating the future form of money. Not only will the financial system’s stability be at risk, it will also determine the global economy’s long-term viability.

Contribution

Lushan Zhou and Bowen Hu contributed equally to this paper.

References

[1]. International Monetary Fund. (2024). Central Bank Digital Currencies and Financial Stability: Balance Sheet Analysis and Policy Implications.

[2]. Wronka, C. (2023). Central bank digital currencies (CBDCs) and their potential impact on traditional banking and monetary policy: An initial analysis. Digital Finance, 5, 613–641. https://doi.org/10.1007/s42521-023-00130-2

[3]. International Monetary Fund. (2023). Central Bank Digital Currency and Financial Inclusion.

[4]. World Economic Forum. (2023). What are central bank digital currencies (CBDCs)? Retrieved from https://www.weforum.org/agenda/2023/04/what-are-central-bank-digital-currencies/

[5]. International Monetary Fund. (2023). Central Bank Digital Currency Development Enters the Next Phase.

[6]. Bank for International Settlements. (2023). Central Bank Digital Currencies. Retrieved from https://www.bis.org/cbdc/

[7]. Song, R., Zhao, T., & Zhou, C. (2024). Analysis of the impact of central bank digital currency on the demand for transactional currency. arXiv preprint arXiv:2401.06457. https://doi.org/10.48550/arXiv.2401.06457

[8]. Song, R., Zhao, T., & Zhou, C. (2023). Empirical analysis of the impact of legal tender digital currency on monetary policy: Based on China's data. arXiv preprint arXiv:2310.07326. https://doi.org/10.48550/arXiv.2310.07326

Cite this article

Zhou,L.;Hu,B.;Zheng,L. (2025). Disruptive Impacts of Central Bank Digital Currencies on the Traditional Financial System: A Regulatory Framework Perspective. Journal of Fintech and Business Analysis,2(1),29-33.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. International Monetary Fund. (2024). Central Bank Digital Currencies and Financial Stability: Balance Sheet Analysis and Policy Implications.

[2]. Wronka, C. (2023). Central bank digital currencies (CBDCs) and their potential impact on traditional banking and monetary policy: An initial analysis. Digital Finance, 5, 613–641. https://doi.org/10.1007/s42521-023-00130-2

[3]. International Monetary Fund. (2023). Central Bank Digital Currency and Financial Inclusion.

[4]. World Economic Forum. (2023). What are central bank digital currencies (CBDCs)? Retrieved from https://www.weforum.org/agenda/2023/04/what-are-central-bank-digital-currencies/

[5]. International Monetary Fund. (2023). Central Bank Digital Currency Development Enters the Next Phase.

[6]. Bank for International Settlements. (2023). Central Bank Digital Currencies. Retrieved from https://www.bis.org/cbdc/

[7]. Song, R., Zhao, T., & Zhou, C. (2024). Analysis of the impact of central bank digital currency on the demand for transactional currency. arXiv preprint arXiv:2401.06457. https://doi.org/10.48550/arXiv.2401.06457

[8]. Song, R., Zhao, T., & Zhou, C. (2023). Empirical analysis of the impact of legal tender digital currency on monetary policy: Based on China's data. arXiv preprint arXiv:2310.07326. https://doi.org/10.48550/arXiv.2310.07326