1. Introduction

Predicting corporate default risk is central to financial supervision, investment risk management, and systemic stability. Traditional risk modeling approaches primarily rely on firm-level indicators such as profitability, leverage, and liquidity. While these methods have demonstrated utility in stable environments, they often fail to capture the complex, dynamic interdependencies that characterize modern corporate ecosystems. In reality, firms are embedded in intricate networks of economic relationships, linked by supply chains, ownership structures, and shared governance, that serve as channels for financial contagion and systemic amplification of localized shocks. Recent developments in graph-based learning, particularly graph neural networks (GNNs), offer powerful tools to model such relational dependencies. By encoding both node-level attributes and the structure of inter-firm connections, GNNs can learn latent representations that reflect not only internal financial health but also external exposures through the economic network. However, few applications of GNNs have extended into the domain of corporate credit risk, leaving a methodological gap in risk analytics that this study aims to address [1]. In this paper, we propose a GNN-based framework that integrates heterogeneous firm relationships into a predictive model for corporate defaults. Using a relational graph convolutional architecture and survival analysis head, we generate time-dependent probability estimates that outperform conventional machine learning and deep learning models. Our contributions include a detailed construction of the firm-level HIN, systematic performance evaluation through ablation tests, and validation across stress and non-stress periods [2]. This study demonstrates that incorporating inter-firm networks significantly improves the timeliness, accuracy, and interpretability of corporate default risk forecasts, contributing to a new generation of network-aware financial risk assessment tools.

2. Literature review

2.1. Financial-ratio–based default models

Traditional default prediction models rely on firm-level financial ratios like profitability, leverage, and liquidity. The Z-score model combines these into a single distress index but assumes firms operate independently [3]. This limits effectiveness during systemic stress and ignores interdependencies such as supply chains and shared governance. As a result, these models often overlook cascading failures and provide limited early warning, highlighting the need for approaches that incorporate relational and temporal dynamics [4].

2.2. Network perspectives on credit risk

Recent studies in applied economics show that inter-firm networks amplify default risks. Firms in tightly linked trade or equity networks are more prone to contagion from partner failures. For instance, a key supplier's collapse can disrupt multiple buyers. Ownership ties and shared directors also transmit shocks. Ignoring these structures leads to underestimating systemic risk. Incorporating network perspectives helps identify firms at elevated risk due to their position in the broader economic network, not just their own financials.

2.3. Graph neural networks in finance

Graph neural networks (GNNs) are effective for learning from relational data and have been applied to fraud detection and market prediction. Their message-passing mechanisms capture influence and shared attributes across entities [5]. However, few studies use GNNs for corporate credit risk, despite its reliance on interdependencies. Unlike traditional models, GNNs embed both firm-level and network-level features, revealing hidden vulnerabilities. Applying GNNs to credit risk provides a more realistic understanding of firm exposure within financial networks.

3. Experimental methods

3.1. Data acquisition and graph construction

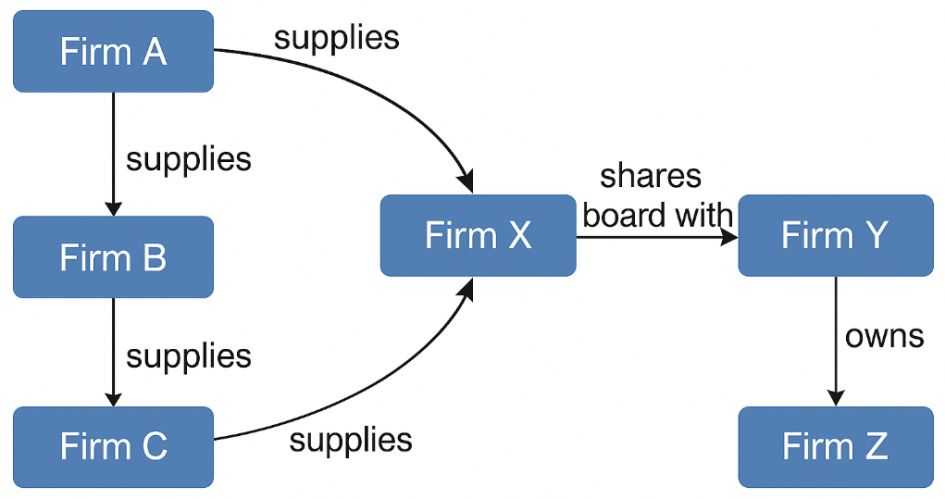

We built the model’s relational foundation using data from Compustat (financials), Thomson Reuters (ownership and board ties), and FactSet (supply chains). Firms were represented as nodes in a heterogeneous graph, with edges denoting supplier-customer links, shared directors, and ownership [6]. Data from 2014 to 2024 was aligned to ensure consistent identifiers and edge integrity. As illustrated in Figure 1, such as Firm A supplying others or Firm Y owning Firm Z—enabling the model to learn network-aware embeddings for improved default risk prediction.

3.2. GNN architecture design

We implement a three-layer Relational Graph Convolutional Network (R-GCN) to learn firm embeddings that integrate both intrinsic attributes and inter-firm relations. Each layer performs message passing conditioned on relation type, and residual connections help preserve node-specific features [7]. The resulting 128-dimensional embeddings capture both firm-level financial signals and network topology, which are subsequently fed into a survival-analysis head for time-dependent default prediction.

The forward propagation in each R-GCN layer is defined as:

where:

3.3. Evaluation metrics and baselines

We evaluated our model using metrics suited for both classification and time-to-event prediction. The Area Under the ROC Curve (AUC) measures the model’s ability to discriminate between defaulting and surviving firms, while the F1 score balances precision and recall. For temporal performance, we used Harrell’s C-index, which assesses the concordance of predicted survival times with observed defaults. As baselines, we compared our GNN against logistic regression, random forest, and LSTM-based models using the same financial variables. These non-graph models provide a benchmark for assessing the added value of network-based learning. All evaluations were conducted using a hold-out test set to ensure statistical validity [9].

4. Experimental process

4.1. Training and validation strategy

To simulate real-world forecasting conditions and avoid look-ahead bias, we employed a rolling-window strategy. The model was trained on firm data from 2014 to 2019, validated on the 2020 cohort, and tested on data from 2021 to 2024. This time-based partitioning respects the temporal order of information and mimics actual deployment scenarios. During training, we ensured that firms did not appear across multiple splits to prevent data leakage. Validation results were used to guide hyperparameter tuning and early stopping [10]. This design ensures that the model’s performance reflects its genuine ability to generalize and adapt to unseen market conditions and firm behaviors.

4.2. Hyper-parameter optimization

We used Bayesian optimization via the Optuna framework to systematically search the hyperparameter space and identify configurations that maximize predictive performance. Key parameters included learning rate, dropout rate, number of message-passing layers, and hidden embedding size [11]. The objective function was the validation C-index, which reflects the model’s ability to predict survival ordering. The search was constrained to reasonable bounds based on preliminary experiments and GNN literature. Optimal values typically included moderate dropout to mitigate overfitting and two to three convolution layers to balance expressive power and computational cost. This tuning process ensured that the final model was robust and efficient [12].

4.3. Robustness and ablation tests

To isolate the contribution of different network components, we conducted a series of ablation experiments. In each variant, we removed one type of edge—ownership, supply-chain, or board overlap—and re-evaluated model performance. The most significant drop occurred when supply-chain links were excluded, underscoring their importance in default propagation. We also tested model stability by introducing Gaussian noise to node features and replacing learned embeddings with random vectors. The performance deterioration in these tests confirmed that both the graph structure and GNN-based representation learning were essential. These robustness checks validate the integrity of the model and its reliance on real economic interdependencies.

5. Experimental results

5.1. Predictive performance comparison

Our GNN-based model achieved a mean AUC of 0.921 and a C-index of 0.887 on the test set, outperforming all baseline models by substantial margins. As shown in Table 1, traditional classifiers such as logistic regression (AUC 0.783) and random forest (AUC 0.812) lag behind, while the best non-graph deep learning baseline, the LSTM, reached only 0.850 AUC and 0.816 C-index. These results underscore the GNN’s ability to synthesize inter-firm structural data into predictive insights.

In addition to overall accuracy, we assessed model robustness under different macroeconomic conditions. Table 2 presents comparative results during the COVID-impacted fiscal year 2020. The GNN retained high discrimination power with an AUC of 0.903, while traditional models showed notable degradation, particularly the logistic model, whose AUC dropped to 0.731. These findings affirm that relational modeling not only boosts average predictive performance but also ensures stability under systemic stress, enabling more reliable early-warning systems for regulators and investors.

|

Model |

AUC |

C-index |

|

Logistic Regression |

0.783 |

0.752 |

|

Random Forest |

0.812 |

0.779 |

|

LSTM |

0.85 |

0.816 |

|

GNN (Ours) |

0.921 |

0.887 |

|

Model |

AUC |

C-index |

|

Logistic Regression |

0.731 |

0.701 |

|

Random Forest |

0.778 |

0.745 |

|

LSTM |

0.821 |

0.788 |

|

GNN (Ours) |

0.903 |

0.864 |

5.2. Ablation and sensitivity analysis

Ablation results showed that supply-chain links had the largest influence on model performance, followed by ownership ties and then shared directors. This ranking aligns with intuitive contagion channels: operational dependencies spread risk faster than governance overlaps. Sensitivity analysis revealed that the model’s performance was stable within one standard deviation of optimal hyperparameter settings, confirming robustness. Changes in dropout rates or layer depth had minor effects unless pushed to extremes. These findings suggest that while tuning is important, the GNN’s architecture inherently captures meaningful signal from the graph. The model’s resilience to small perturbations enhances its practical reliability in deployment.

5.3. Case study of high-risk firms

To illustrate the model’s interpretability and practical value, we examined a defaulted electronics supplier flagged as high-risk 18 months before bankruptcy. Visualization of message-passing attention revealed concentrated influence from several distressed upstream partners. These relationships were not captured in traditional financial metrics, yet they significantly elevated the firm’s predicted hazard rate. The GNN architecture allowed us to trace how signals propagated through multiple network hops. This transparency enables risk managers to understand not just the “what” but the “why” behind predictions. Case-level analysis demonstrates that the model can serve as both a prediction tool and a decision-support system.

6. Conclusion

This study demonstrates that incorporating inter-firm relational data through graph neural networks significantly enhances the accuracy and robustness of corporate default prediction. The GNN-based approach captures both firm-specific financial signals and systemic exposures embedded in supply-chain and ownership networks. Empirical evaluations confirm its superiority over traditional models, particularly under macroeconomic stress. By visualizing risk propagation paths, the framework also improves interpretability. These findings advocate for broader adoption of network-aware risk models in credit analytics and financial regulation. Future research may explore dynamic graph extensions and cross-border firm linkages.

References

[1]. Das, Sanjiv, et al. "Credit risk modeling with graph machine learning."INFORMS Journal on Data Science2.2 (2023): 197-217.

[2]. Martínez, Alejandro, et al. "Graph convolutional networks on customer/supplier graph data to improve default prediction." Complex Networks X: Proceedings of the 10th Conference on Complex Networks CompleNet 2019 10. Springer International Publishing, 2019.

[3]. Yıldırım, Mustafa, Feyza Yıldırım Okay, and Suat Özdemir. "Big data analytics for default prediction using graph theory."Expert Systems with Applications176 (2021): 114840.

[4]. Zhou, Binbin, et al. "Forecasting credit default risk with graph attention networks."Electronic Commerce Research and Applications62 (2023): 101332.

[5]. Morthens, Magnús Freyr. Credit rating prediction using multi-modal temporal neural networks. Diss. 2024.

[6]. Kheneifar, Mohammad Amin, and Babak Amiri. "A Novel Hybrid Model for Loan Default Prediction in Maritime Finance based on Topological Data Analysis and Machine Learning."IEEE Access(2025).

[7]. Alam, Md Nurul. "Risk prediction of loan default using knowledge graph." (2022).

[8]. Lu, Sichong, et al. "Efficient multimodal learning for corporate credit risk prediction with an extended deep belief network."Annals of Operations Research(2025): 1-38.

[9]. Brogaard, Jonathan, and Belinda Chen Chen. "Attention-based Graph Neural Networks in Firm CDS Prediction." (2024).

[10]. Nourollah, Zahra, Mohsen Rezvani, and Morteza Zahedi. "Enhancing Customer Credit Rating Prediction: A Dual Approach Using Graph Neural Networks." 2024 10th International Conference on Signal Processing and Intelligent Systems (ICSPIS). IEEE, 2024.

[11]. Minakawa, Naoto, et al. "Transaction prediction by using graph neural network and textual industry information." JSAI International Symposium on Artificial Intelligence. Cham: Springer Nature Switzerland, 2022.

[12]. Nilsson, Oskar, and Benjamin Lilje. "RNN-based Graph Neural Network for Credit Load Application Leveraging Rejected Customer Cases." (2023).

Cite this article

Chen,X. (2025). Corporate default risk prediction model based on graph neural networks. Journal of Fintech and Business Analysis,2(2),10-14.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Das, Sanjiv, et al. "Credit risk modeling with graph machine learning."INFORMS Journal on Data Science2.2 (2023): 197-217.

[2]. Martínez, Alejandro, et al. "Graph convolutional networks on customer/supplier graph data to improve default prediction." Complex Networks X: Proceedings of the 10th Conference on Complex Networks CompleNet 2019 10. Springer International Publishing, 2019.

[3]. Yıldırım, Mustafa, Feyza Yıldırım Okay, and Suat Özdemir. "Big data analytics for default prediction using graph theory."Expert Systems with Applications176 (2021): 114840.

[4]. Zhou, Binbin, et al. "Forecasting credit default risk with graph attention networks."Electronic Commerce Research and Applications62 (2023): 101332.

[5]. Morthens, Magnús Freyr. Credit rating prediction using multi-modal temporal neural networks. Diss. 2024.

[6]. Kheneifar, Mohammad Amin, and Babak Amiri. "A Novel Hybrid Model for Loan Default Prediction in Maritime Finance based on Topological Data Analysis and Machine Learning."IEEE Access(2025).

[7]. Alam, Md Nurul. "Risk prediction of loan default using knowledge graph." (2022).

[8]. Lu, Sichong, et al. "Efficient multimodal learning for corporate credit risk prediction with an extended deep belief network."Annals of Operations Research(2025): 1-38.

[9]. Brogaard, Jonathan, and Belinda Chen Chen. "Attention-based Graph Neural Networks in Firm CDS Prediction." (2024).

[10]. Nourollah, Zahra, Mohsen Rezvani, and Morteza Zahedi. "Enhancing Customer Credit Rating Prediction: A Dual Approach Using Graph Neural Networks." 2024 10th International Conference on Signal Processing and Intelligent Systems (ICSPIS). IEEE, 2024.

[11]. Minakawa, Naoto, et al. "Transaction prediction by using graph neural network and textual industry information." JSAI International Symposium on Artificial Intelligence. Cham: Springer Nature Switzerland, 2022.

[12]. Nilsson, Oskar, and Benjamin Lilje. "RNN-based Graph Neural Network for Credit Load Application Leveraging Rejected Customer Cases." (2023).