1. Introduction

Kweichow Moutai Co., Ltd. is a leading enterprise in China's liquor industry and one of the most valuable spirits brands globally. Headquartered in Moutai Town, Renhuai City, Guizhou Province, the company leverages the region's unique natural environment and centuries-old brewing techniques to produce premium sauce-aroma baijiu (jiangxiangxing baijiu), with "Flying Moutai" (Feitian Moutai) as its flagship product. Renowned for its exceptional quality and profound cultural heritage, Moutai is hailed as the "National Liquor" (Guojiu). The brand enjoys an unparalleled reputation in both domestic and international markets, maintaining a dominant position in China's premium baijiu segment.

This paper examines Kweichow Moutai, focusing on the core characteristics of its business model and profitability model, as well as its financial performance. Specifically, it explores how Moutai constructs competitive barriers through its business model and achieves an ultra-high gross profit margin exceeding 91% through its profitability model. Additionally, the study analyzes the company's strategic responses during the industry's deep adjustment phase, including challenges such as declining inventory turnover and a homogeneous product portfolio. By dissecting the Moutai case, this research enriches the theoretical framework of luxury consumer goods business models, examining its moat-building strategies and profit retention mechanisms. Furthermore, it provides insights into how Moutai and similar enterprises can adapt to evolving consumption trends to achieve sustainable long-term growth.

2. Business model analysis

The business model of Kweichow Moutai is characterized by the triad of "scarcity + brand moat + channel control," which collectively constructs an inimitable competitive barrier. Derived from the unique terroir of the Chishui River and an extended five-year production cycle, Moutai's constrained output intensifies supply-demand imbalance, underpinning its "limited-quantity premium pricing" strategy. Anchored in its centuries-old heritage and status as the "National Liquor", Moutai has become synonymous with high-end social capital, granting it exceptional pricing power and consumer stickiness. By rationalizing its distributor network and expanding direct-to-consumer (DTC) sales (e.g., flagship stores, e-commerce platforms), Moutai tightens its grip on end-market pricing. Simultaneously, it leverages policy-guided market interventions (e.g., anti-speculation measures) to stabilize price volatility and maintain brand equity. Moutai’s products exhibit store-of-value attributes, with aged inventory appreciating over time—effectively functioning as inflation-hedging assets. This intrinsic characteristic blurs the line between consumable goods and investment vehicles.

2.1. Value proposition

The core value proposition of Kweichow Moutai revolves around premium positioning and engineered scarcity. The core value proposition of Kweichow Moutai is centered around high-endness and scarcity. High-end is mainly reflected in the fact that Moutai's value has transcended the product itself and become a social consensus and class identity, which is the ultimate moat of its business model. The scarcity of Kweichow Moutai is mainly reflected in three points. The first is the scarcity of the natural environment, because Kweichow Moutai relies on the unique climate, water quality and microbial communities in Moutai town. Even if the same process is used in other places, it is not possible to replicate the same sense of Moutai wine. Secondly, Kweichow Moutai adopts the “12987” complex process, which results in a long production cycle. Finally, Guizhou Maotai also uses artificial control of scarcity behavior to create a sense of hunger in the market by “controlling the quantity and keeping the price”, limited release of Chinese zodiac wine, vintage wine and other ways.

2.2. Customer groups

The customer base of Kweichow Moutai exhibits a distinct stratification, primarily comprising three major categories: individual consumers, corporate clients, and distributors. Among individual consumers, high-net-worth individuals constitute the core customer segment. For this group, Moutai is regarded as a symbol of social status and refined lifestyle. Their purchasing behavior is characterized by long-term consistency, often involving personal collections or use in high-end banquets and private receptions. In contrast, ordinary consumers tend to purchase Moutai during significant traditional festivals or important occasions. This type of consumption displays clear seasonality and a strong sense of ritual. Corporate clients represent another key segment of Moutai’s customer structure. These clients primarily use Moutai for business banquets and gift-giving, leveraging the brand’s premium image to demonstrate corporate strength and maintain client relationships. Additionally, the nationwide network of liquor distributors plays a critical role in Moutai’s distribution system. These distributor functions both as purchasers of Moutai products and as key agents in market expansion. This diversified customer structure not only ensures stable market demand for Moutai but also provides a broader foundation for its future development.

2.3. Customer relationships

Kweichow Moutai places great emphasis on customer relationship management, deepening engagement with consumers through the establishment of a comprehensive membership service system. Its membership program offers not only core privileges such as priority access to premium products and exclusive quotas for limited-edition items—particularly targeted at high-net-worth clients—but also creatively integrates a variety of value-added services. In offline channels, Moutai equips its flagship stores and authorized retailers with professional tasting consultants who provide one-on-one product introductions and customized service solutions tailored to customer needs. In addition, Moutai regularly organizes a series of high-profile events, inviting core customers to visit Moutai Town and experience its traditional brewing techniques firsthand, thereby reinforcing brand identity and cultural resonance. Through these differentiated customer engagement strategies, Moutai has not only enhanced customer loyalty, but also elevated the traditional buyer-seller relationship into a deeper emotional connection rooted in shared values—laying a solid customer foundation for the brand’s sustained development.

2.4. Channel pathways

Kweichow Moutai’s distribution strategy can be summarized as “scarcity control + profit maximization.” As a core component of its business model, the company’s premium resources are safeguarded through meticulous channel planning and stringent price control. This not only preserves the scarcity and high-end image of its products but also enables Moutai to maintain strong market dominance. Although the traditional distributor-based system remains the backbone of Moutai’s channel structure, it has gradually been de-emphasized due to issues such as stockpiling and speculative trading. In response, Moutai has strategically shifted its focus toward expanding its self-operated channels to strengthen pricing control and enhance profit retention. Moutai sells its products through a multi-channel approach encompassing distributor networks, exclusive retail stores, and online platforms—covering both domestic and international markets. For instance, it has established exclusive stores across various regions to ensure product authenticity and provide a premium shopping experience. Meanwhile, online sales are conducted via its official website, third-party e-commerce platforms, and the proprietary “iMoutai” app.

As the first step in Kweichow Moutai’s digital transformation, the “iMoutai” platform has had a significant impact on the company’s development. As a digital platform, iMoutai primarily operates through several key sales channels. The most direct is the iMoutai mobile app itself, which serves as an effective medium for communicating the brand’s value proposition to consumers. In addition to the app, sales are also conducted through Moutai’s authorized distribution partners and via the official “iMoutai” WeChat public account [1].

In addition, Kweichow Moutai has adopted specialized channels such as customized orders, group purchasing, and emerging digital and cross-industry collaboration channels.

2.5. Core resources and businesses

Moutai’s core resources primarily include its unique brewing ecosystem—comprising specialized microbial flora, high-quality water from the Chishui River, and locally sourced sorghum—as essential raw materials. Additionally, its brand equity, built through its renowned brand name, trademark, and reputation, serves as a vital intangible asset. The preservation of traditional, time-honored craftsmanship and the expertise of professional technicians are also key to ensuring consistent product quality.

Kweichow Moutai’s key business activities focus on liquor production, brand management, and sales and distribution. These operations are designed to ensure superior product quality, enhance brand value, and expand market share.

3. Profit model analysis

A profit model refers to the way in which a business or organization generates earnings through the sale of goods or services. It lies at the heart of business operations, determining both revenue streams and profitability levels. Kweichow Moutai’s profit model can be summarized as a combination of “scarcity-driven premium pricing + extreme cost control + channel profit restructuring.” At its core, this model relies on brand monopoly, supply regulation, and refined operational management to achieve sustained, near-excessive profit growth.

3.1. Revenue sources

Kweichow Moutai adopts a tiered product pricing strategy to meet diverse consumer demands, enhance brand value, and strengthen market competitiveness. The commonly known “Feitian Moutai” represents the core flagship product within the Moutai portfolio. In contrast, the “series liquors” differ from the main Moutai product in terms of production location and brewing techniques. Therefore, implementing a tiered pricing strategy helps optimize the company’s profit structure. Since products at different tiers have varying gross profit margins— with high-end and ultra-premium products enjoying significantly higher margins—this approach allows Moutai to increase the sales proportion of high-margin products. By doing so, the company improves its overall profitability, refines its profit structure, and moves toward maximizing total profit.

3.2. Cost control

Moutai’s cost structure is considered “exceptionally optimized” within the fast-moving consumer goods (FMCG) industry due to several key factors. First, raw material costs account for only about 1% of total costs. Thanks to geographic advantages in sourcing sorghum and wheat, and reliance on local agriculture, the raw material cost per bottle of Moutai is less than 20 yuan. Additionally, the company employs a centralized procurement model, using a centralized bidding and tendering platform to drive down purchasing costs. Moutai has also established a supplier evaluation system. In 2025, it eliminated ten suppliers that failed to meet cost-control standards, resulting in a direct 5% reduction in raw material procurement costs. Moreover, while labor costs are relatively rigid due to the reliance on skilled technicians required by traditional brewing methods, Moutai maintains extremely high labor efficiency—with average revenue per employee exceeding 4 million yuan. Depreciation and amortization also present structural advantages. With long depreciation cycles for fixed assets such as warehouses and production facilities, the cost allocated per ton of liquor continues to decrease year by year.

3.3. Channel profit

Moutai has redirected profits from distributors back to itself through channel reform, which includes both the traditional distributor model and a self-operated (direct sales) model. However, the traditional distributor model has significant profit distribution inefficiencies. For example, a distributor may purchase a bottle at 969 yuan and resell it at 2,800 yuan, generating a profit of approximately 1,800 yuan per bottle, while Moutai itself earns only about 700 yuan. This imbalance in profit allocation under the traditional model has led to issues such as excessive distributor profits, stockpiling, and price manipulation within the market.

During the transition to a direct sales model, Kweichow Moutai has leveraged channels such as the iMoutai app and direct supply to supermarkets, resulting in a 10% increase in net profit margin attributed to the growth of direct sales. Therefore, Moutai’s channels can generally be divided into distributor sales and direct sales. With ongoing marketing system reforms, Moutai’s direct sales channels have become increasingly diversified. Through direct sales, the company gains greater pricing control, forming a direct sales ecosystem led by the iMoutai platform, supported by flagship stores, e-commerce channels, and large corporate group purchases. The rise in the proportion of direct sales has driven overall revenue growth, as well as rapid increases in Moutai’s per-ton selling price and overall business performance.

4. Profitability analysis

4.1. Vertical comparison

Profitability refers to a company’s ability to generate profits, which not only affects investors’ returns but also the protection of creditors’ interests. From the financial data perspective, Kweichow Moutai demonstrated strong and stable profitability during the period from 2020 to 2024. Its core financial indicators consistently achieved double-digit growth, reflected specifically in sustained high growth in operating revenue and net profit, alongside maintaining a high gross profit margin and excellent earnings quality [2].

4.1.1. Sustained high growth in revenue and net profit

As shown in Table 1, Kweichow Moutai’s operating revenue increased from RMB 97.993 billion in 2020 to RMB 170.899 billion in 2024, with a compound annual growth rate (CAGR) of 15.8%, indicating strong market demand and robust pricing power. Net profit grew from RMB 46.697 billion to RMB 86.228 billion over the same period, with a CAGR of 16.57%, slightly outpacing revenue growth, which reflects continuous improvements in cost control and operational efficiency. The total asset growth rate is a financial indicator used to evaluate the expansion of a company’s asset base. A positive rate indicates an increase in asset scale, while a negative rate signals a reduction. The net profit growth rate reflects the speed at which a company maximizes its value through expansion and serves as an important measure of operational effectiveness—the higher this rate, the stronger the company’s profitability. Although there have been fluctuations in these two growth rates for Kweichow Moutai in recent years, the company has maintained a high asset scale and profitability level thanks to its strong brand advantage and market position [3].

4.1.2. Higher gross profit ratio, excellent earnings quality

As shown in Table 1, Kweichow Moutai’s gross profit margin remained consistently above 91% from 2020 to 2024, significantly higher than the industry average, maintaining its leadership position in the liquor sector. The company’s high gross margin is closely linked to recent price increases and sales volume growth of Moutai products, reflecting the strong profitability driven by brand premium and high-end market positioning [4]. In 2022, the gross profit margin peaked at 92.11%, the highest in the past five years. This was attributed to product mix optimization, including increasing the proportion of direct sales and launching higher value-added products to boost profitability.

|

Financial Indicators |

2020 |

2021 |

2022 |

2023 |

2024 |

Compound Annual Growth Rate |

|

Operating Revenue (billion RMB) |

979.93 |

1094.61 |

1275.54 |

1495.97 |

1706.99 |

15.8% |

|

Net Profit (billion RMB) |

466.97 |

524.60 |

627.16 |

746.42 |

862.28 |

16.57% |

|

Total Assets (billion RMB) |

2130.42 |

2580.64 |

2840.42 |

3111.15 |

3383.17 |

10.8% |

|

Net Assets (billion RMB) |

1643.50 |

1995.17 |

2204.11 |

2473.96 |

2814.11 |

13.1% |

|

Gross Profit Margin (%) |

91.41 |

91.64 |

92.11 |

91.87 |

91.32 |

4.2. Horizontal comparison

The high gross profit margin of Kweichow Moutai is the result of multiple accumulated factors. In terms of raw materials, the unique geographical environment and climatic conditions of Moutai Town provide irreplaceable natural resources essential for brewing high-quality liquor. Regarding production techniques, Moutai strictly follows the traditional “12987” brewing process, making its products difficult to surpass. In comparison, Wuliangye’s 2024 financial report shows a gross profit margin of 82%. This is primarily due to Wuliangye’s broader product portfolio; the inclusion of mid- and low-end products lowers the overall gross margin. Therefore, leveraging its profit model of “scarcity-driven premium pricing + extreme cost control + channel profit restructuring,” Kweichow Moutai holds a competitive advantage in both product strategy and cost management, enabling it to sell products at higher prices and achieve superior profitability [6,7].

5. Existing problems

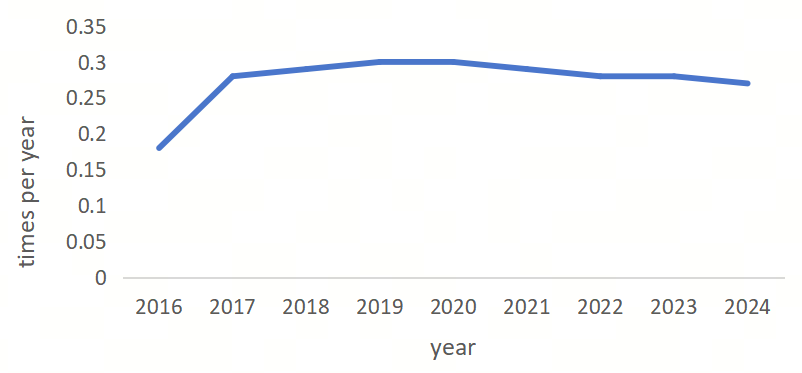

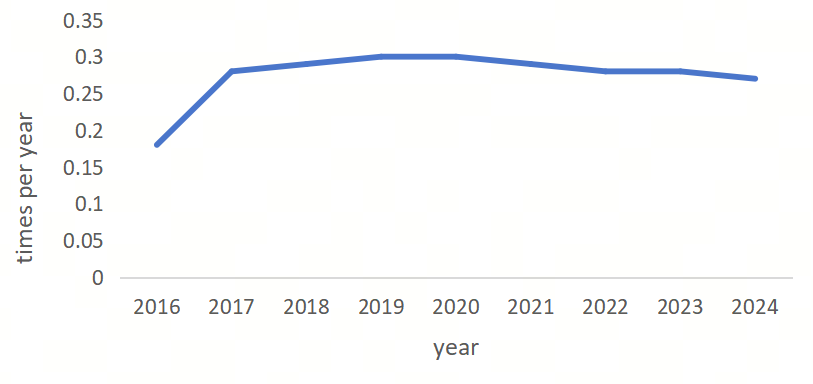

5.1. Decline in inventory turnover

As shown in Figure 1, Kweichow Moutai’s inventory turnover ratio exhibited a continuous upward trend from 2016 to 2019. However, during the period from 2020 to 2024, the inventory turnover ratio declined steadily, indicating that the frequency of unsold stock accumulating has increased, and the liquidity of inventory has weakened. Currently, Moutai’s inventory turnover is relatively low, with slower turnover speed. Although this is typical within the liquor industry—for example, as shown in Figure 2, Luzhou Laojiao has also experienced a year-on-year decline in inventory turnover in recent years—Moutai’s longer aging periods and higher prices mean that a lower inventory turnover rate is expected. Nevertheless, this trend can still negatively impact the company’s operational capacity and long-term business development. An analysis of Kweichow Moutai’s inventory management system reveals shortcomings in handling the time intervals between production and shipment, which slows inventory turnover and contributes to the low turnover ratio [8].

5.2. Cyclical risks of the white wine industry

5.2.1. Macro-economic fluctuations

When the market is in an economic upturn, consumer incomes rise, leading to increased demand for high-end liquor. As a representative of premium baijiu, Kweichow Moutai typically experiences growth in both sales volume and pricing during such periods. Conversely, during economic downturns, consumers reduce high-end expenditures, which suppresses consumption scenarios such as business banquets and gift-giving involving Moutai, thereby dampening overall demand for baijiu.

5.2.2. Evolution of the competitive pattern of the industry

The liquor industry is highly competitive. When other brands launch similar high-end products or adopt more effective marketing strategies, they may seize Moutai's market share. In the case of industry overcapacity, where supply exceeds demand, prices are vulnerable to shocks. In recent years, the overall production capacity of the liquor industry has shown an upward trend. If market digestion capacity is insufficient, Moutai will also face pressure on prices and sales.

5.3. Single product structure

High Proportion of Core Products. Moutai liquor is Kweichow Moutai’s core product, dominating the company’s revenue. Although product lines such as the series liquors have developed in recent years, their overall share remains relatively small, making the company’s performance heavily reliant on Moutai liquor.

Concentrated Consumer Base and Price Segment. The flagship Feitian Moutai consistently occupies the ultra-premium market segment, with a consumer base concentrated among high-income groups, resulting in a relatively homogeneous consumption structure. While demand remains stable, significant price speculation is prevalent. Consequently, any volatility in the ultra-premium segment can easily impact the company’s performance.

5.4. Challenges of brand rejuvenation

Differences in Preferences Among Young Consumers. The drinking habits and consumption concepts of the younger generation differ significantly from those of traditional consumers. They tend to prefer low-alcohol beverages, fruit wines, cocktails, and other innovative alcohol products, showing lower acceptance of high-proof baijiu. Moutai’s traditional brand image and product positioning lack appeal among younger consumers, posing challenges for the brand’s efforts to modernize and attract a younger demographic.

Competition in Emerging Consumption Scenarios. With the diversification of consumption scenarios, the market share of baijiu—especially high-end baijiu—is relatively small in these new contexts. Moutai needs to adapt to these emerging consumption environments by innovating marketing strategies and product formats to increase its market share among younger consumers.

6. Solutions

6.1. Optimization of product structure

Kweichow Moutai must fully leverage the advantages of debt-financed operations by adjusting the degree of financial leverage to a reasonable level, which can optimize the overall development status of the company and ultimately enhance its profitability [11]. By adjusting the product mix and building a diversified product matrix, the company can enrich its product categories. This involves appropriately increasing the production and promotion of non-core products such as series liquors to raise their proportion within the company’s product portfolio and reduce reliance on the core Moutai liquor.

Centering on Moutai liquor, the company should develop a product matrix that spans different price segments, packaging specifications, and consumption scenarios. Additionally, introducing low-alcohol baijiu and products with various aroma profiles can attract a broader consumer base, including younger and female consumers, thereby further diversifying the product range.

6.2. Channel system optimization strategy

Refined distributor management. Core distributors can be incentivized through the allocation of scarce products such as Zodiac Edition and premium Moutai, encouraging active sales efforts. Additionally, management can be strengthened via digital control methods; for example, using blockchain technology to track distributor inventory to prevent stockpiling and speculative trading.

Enhancing direct sales channel efficiency. Optimize the iMoutai APP by organizing various types of activities to better satisfy and retain consumers. For instance, adding a “vintage liquor buyback” feature allows consumers to monetize their collectible bottles through official channels. Establishing “Moutai Cultural Experience Stores” in first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen can offer tasting and customization services.

Furthermore, exploring new retail models by adopting innovative concepts and actively leveraging internet resources is also recommended.

6.3. Stabilized price control risk

Dynamically adjust market supply. Utilize big data to monitor prices and track real-time retail prices nationwide, allowing for timely adjustment of product release volumes when abnormal fluctuations are detected, thereby curbing scalper stockpiling behavior. Strengthen supervision against counterfeit activities by implementing QR code scanning on Moutai bottles, enabling consumers to verify authenticity at any time. Collaborate with relevant internet companies to develop AI-powered tools for authenticity recognition, enhancing consumer trust.

6.4. Brand extension and internationalization

Develop sub-brands and brand collaborations. Launch sub-brands targeting different consumer groups and price segments, and engage in co-branding partnerships with other well-known brands to enhance product visibility. However, particular attention should be paid to the potential dilution effect that the expansion of series liquor brands may have on the company’s flagship brand. An excessive number of series brands could ultimately weaken the overall brand influence, especially damaging the brand strength of key flagship products [12].

Expand international markets. Increase promotional and sales efforts in international markets by localizing products to cater to the tastes and cultural characteristics of consumers in different countries and regions, thereby boosting market share abroad.

Focus on young consumers. Study the consumption habits and preferences of younger consumers, and attract their attention and purchases through innovative marketing approaches and product design.

7. Conclusion

This paper systematically analyzes the financial data and business strategies of Kweichow Moutai from 2020 to 2024, revealing its unique business and profit models. The study finds that Moutai has successfully built a business model centered on “scarcity + brand moat + channel control,” creating a competitive barrier that is difficult to replicate. Its scarcity stems not only from the unique natural environment of Moutai Town and traditional craftsmanship but is further reinforced through proactive “supply control and price maintenance” strategies. The brand moat is established on its status as the national liquor and rich historical heritage, elevating its products beyond mere consumption to symbols of social identity. In terms of channel control, Moutai is transitioning from the traditional distributor system to a “direct sales + digitalization” model, enhancing end market control through platforms, such as iMoutai. Regarding the profit model, Moutai exhibits distinctive features of “scarcity premium + extreme cost control + channel profit restructuring.” However, the study also identifies challenges faced by Moutai, including the continuous decline in inventory turnover rates impacting profitability; the risk of a product structure overly reliant on the core Feitian Moutai, which accounts for over 80% of revenue; cyclical industry pressures due to macroeconomic fluctuations; and the generational gap challenge posed by younger consumers’ lower acceptance of high-alcohol baijiu.

To address these issues, this paper proposes corresponding solutions: optimizing the product structure through series liquor development and low-alcohol innovations; strengthening distributor management via blockchain technology while expanding the direct sales channel share; establishing a big data price monitoring system to stabilize the end-market; and implementing brand rejuvenation and international expansion strategies.

As a benchmark enterprise in China’s baijiu industry, Kweichow Moutai, through continuous innovation and prudent management, is expected to maintain its high-end brand value while exploring broader growth opportunities, continuing to lead the high-quality development of China’s baijiu industry.

References

[1]. Xingyu Nie. Research on the Business Model Optimization of Moutai Group's Digital Marketing Platform "Imoutai" [D]. Guizhou University, 2024. DOI: 10.27047/d.cnki.ggudu.2024.000855.

[2]. Song Tan. Financial Statement Analysis of Listed Alcohol Companies in China: A Case Study of Kweichow Moutai and Wuliangye [J].Business Accounting, 2011, (30): 33-35.

[3]. Wei Fan. Analysis and Understanding of Financial Reports of Listed Companies: A Case Study of Guizhou Moutai Liquor Co., LTD. [J].Huazhang, 2023, (01): 105-107.

[4]. Yilin Du. Financial Analysis of the Food Industry under the Harvard Framework: A Case Study of Kweichow Moutai [J].China's Food industry, 2024, (03): 51-54.

[5]. Guizhou Moutai Liquor Co., LTD. Guizhou Moutai's 2024 Annual Report [EB/OL] (2025-04-03). https: //www.moutaichina.com/mtgf/tzzgx/cwbg/index.html

[6]. Kaixin Wu, Chun Liu. Analysis of the Financial Capacity of Kweichow Moutai [J].Science and Technology Vision, 2020, (04): 218-219. DOI: 10.19694/j.cnki.issn2095-2457.2020.04.86.

[7]. Rui Huang. Analysis of the Financial Situation of Wuliangye Group [J].Marketing World, 2023(19): 158-160.

[8]. Huating Lu. Financial Problems and Solutions in the Operation and Management of Kweichow Moutai [J].Investment and Cooperation, 2025(01): 107-109.

[9]. Caibaopai. Inventory turnover rate of Guizhou Moutai (600519) [EB/OL] [2025-06-21]. https: //caibaopai.com/600519/inventories_turnover_ratio

[10]. Caibaopai. Inventory turnover rate of Wuliangye (000858) [EB/OL] [2025-06-21]. https: //caibaopai.com/000858/inventories_turnover_ratio

[11]. Li Zhou. Analysis of the Profitability of Kweichow Moutai and Discussion on Strategy Improvement [J].Accounting of Township Enterprises in China, 2022, (11): 62-64.

[12]. Tieyuan Cheng. Analysis of the Future Development Trend of the Liquor Industry Based on Listed Liquor Companies [J].Brewing technology, 2019 (04): 128-134+140. DOI: 10.13746/j.njkj.2018319.

Cite this article

Qiao,Y. (2025). Analysis of the business model and profitability model of Kweichow Moutai. Journal of Fintech and Business Analysis,2(2),19-26.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xingyu Nie. Research on the Business Model Optimization of Moutai Group's Digital Marketing Platform "Imoutai" [D]. Guizhou University, 2024. DOI: 10.27047/d.cnki.ggudu.2024.000855.

[2]. Song Tan. Financial Statement Analysis of Listed Alcohol Companies in China: A Case Study of Kweichow Moutai and Wuliangye [J].Business Accounting, 2011, (30): 33-35.

[3]. Wei Fan. Analysis and Understanding of Financial Reports of Listed Companies: A Case Study of Guizhou Moutai Liquor Co., LTD. [J].Huazhang, 2023, (01): 105-107.

[4]. Yilin Du. Financial Analysis of the Food Industry under the Harvard Framework: A Case Study of Kweichow Moutai [J].China's Food industry, 2024, (03): 51-54.

[5]. Guizhou Moutai Liquor Co., LTD. Guizhou Moutai's 2024 Annual Report [EB/OL] (2025-04-03). https: //www.moutaichina.com/mtgf/tzzgx/cwbg/index.html

[6]. Kaixin Wu, Chun Liu. Analysis of the Financial Capacity of Kweichow Moutai [J].Science and Technology Vision, 2020, (04): 218-219. DOI: 10.19694/j.cnki.issn2095-2457.2020.04.86.

[7]. Rui Huang. Analysis of the Financial Situation of Wuliangye Group [J].Marketing World, 2023(19): 158-160.

[8]. Huating Lu. Financial Problems and Solutions in the Operation and Management of Kweichow Moutai [J].Investment and Cooperation, 2025(01): 107-109.

[9]. Caibaopai. Inventory turnover rate of Guizhou Moutai (600519) [EB/OL] [2025-06-21]. https: //caibaopai.com/600519/inventories_turnover_ratio

[10]. Caibaopai. Inventory turnover rate of Wuliangye (000858) [EB/OL] [2025-06-21]. https: //caibaopai.com/000858/inventories_turnover_ratio

[11]. Li Zhou. Analysis of the Profitability of Kweichow Moutai and Discussion on Strategy Improvement [J].Accounting of Township Enterprises in China, 2022, (11): 62-64.

[12]. Tieyuan Cheng. Analysis of the Future Development Trend of the Liquor Industry Based on Listed Liquor Companies [J].Brewing technology, 2019 (04): 128-134+140. DOI: 10.13746/j.njkj.2018319.