1. Introduction

With the acceleration of global economic integration, multinational enterprises (MNEs) increasingly rely on strategic frameworks like the Resource-Based View (RBV) to leverage internal resources for competitive advantage in international markets. RBV emphasizes firm-specific capabilities as sources of sustainable superiority, with the VRIO framework operationalizing this analysis. Yet, RBV’s effectiveness varies across contexts, particularly when external factors—such as market dynamics, cultural nuances, and economic conditions—intervene. This gap is exemplified by Haagen-Dazs, a premium ice cream brand that achieved remarkable success in the U.S. market, where its luxurious image resonates with affluent consumers. However, its performance in the Chinese market has faced notable challenges, reflecting the varying effectiveness of RBV strategies across different contexts.

Existing literature extensively applies RBV to MNE strategies but often neglects its limitations in explaining failures attributable to external environments. While studies highlight RBV’s role in identifying valuable, rare, and inimitable resources [1], few critically examine how macro-level forces—such as income disparities or local competition—can erode these advantages. This oversight is particularly relevant for emerging markets like China, where rapid socioeconomic shifts reshape competitive landscapes.

This study addresses this gap by interrogating RBV’s applicability through a comparative analysis of Haagen-Dazs’s U.S. and China operations. We ask: Why do RBV-driven advantages succeed in some markets but fail in others? Using VRIO, we dissect Haagen-Dazs’s internal resources (e.g., brand heritage, omnichannel model) to explain its U.S. dominance. Concurrently, we demonstrate how external factors—including China’s price sensitivity and domestic brand rise—neutralized these advantages. By integrating empirical data on market share, consumer behavior, and income gaps, this research reveals RBV’s blind spots and advocates for complementary analytical frameworks.

The ensuing analysis not only refines RBV theory but also provides MNEs with actionable insights for balancing internal capabilities with external contingencies. Subsequent sections detail the VRIO assessment, comparative market analysis, and implications for MNE strategy.

2. Theory and company introduction

The Resource-Based View (RBV), a cornerstone of strategic management theory, posits that sustained competitive advantage stems from a firm’s internal resources and capabilities rather than external market conditions. Central to RBV is the premise that resources must be Valuable (exploiting opportunities/neutralizing threats), Rare (scarce among competitors), Inimitable (difficult to replicate), and Organized (supported by organizational processes) to generate sustainable superiority. The VRIO framework operates this analysis by systematically evaluating whether resources and capabilities can provide a company with a sustainable competitive advantage against these four criteria [1].

Additionally, the case company used is Haagen-Dazs, which is a premium ice cream brand, renowned for its unique flavors and premium ingredients. It has established its brand across multiple countries. Among these countries, Haagen-Dazs as achieved remarkable success in the U.S. market, where its luxurious image resonates with affluent consumers. However, its performance in the Chinese market has faced notable challenges, reflecting the varying effectiveness of RBV strategies across different contexts.

3. Internal resource advantage-sustainable competitive advantage

3.1. Brand culture

Haagen-Dazs’s brand culture exemplifies a sustainable competitive advantage under the VRIO framework, as its long-established heritage, premium positioning, and emotional resonance create a rare and inimitable resource that competitors struggle to replicate. Since its founding in 1960, the brand has cultivated a luxury identity that transcends mere product attributes, embedding itself in global consumer consciousness as a symbol of indulgence and sophistication [2]. This cultural capital is reinforced by its 60-year legacy, which contrasts sharply with younger competitors such as Ben & Jerry’s (1978) and COLD STONE (1988) (Table 1). The historical depth of Haagen-Dazs’s branding allows it to command premium pricing and foster deep consumer loyalty, evidenced by its ranking among the top three U.S. ice cream brands in customer retention [3].

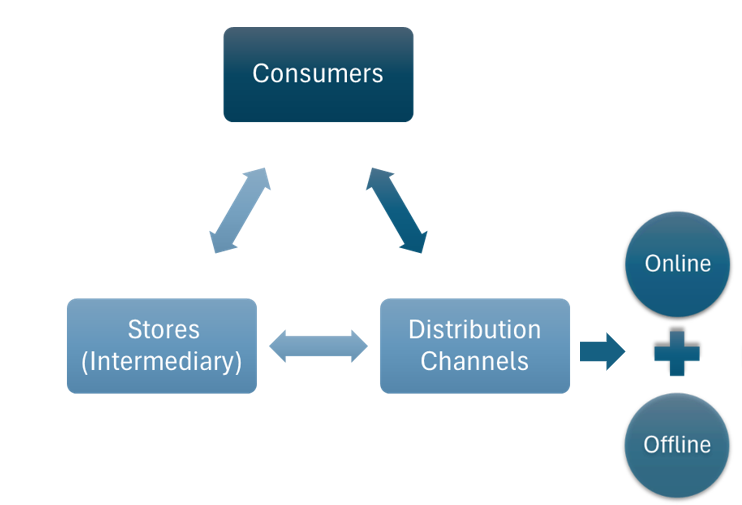

Critically, Haagen-Dazs has strategically amplified this advantage through its omni-channel operational model, launched in 2020 (Figure 1). By integrating digital marketing, e-commerce, and experiential retail, the brand ensures consistent global messaging while adapting to local consumer behaviors [4]. For instance, its U.S. campaigns emphasize artisanal craftsmanship, whereas in Asia, it highlights gifting culture through limited-edition packaging. This glocalized approach—global consistency with local nuance—enhances the brand’s organizational capability (the "O" in VRIO), making its culture not just valuable but operationally embedded.

|

Summary of the Establishment Years of Globally Renowned Ice Cream Brands (Partial List) |

|

|

Brands |

Establishment Years |

|

Dairy Queen |

1940 |

|

Haagen-Dazs |

1960 |

|

Ben & Jerry’s |

1978 |

|

COLD STONE |

1988 |

|

Dippin' Dots |

1988 |

|

MAGNUM |

1989 |

|

Yili |

1993 |

|

Mengniu |

1999 |

3.2. Direct operating model

Another sustainable competitive advantage is Haagen-Dazs’s direct operating model. By 2024, Haagen-Dazs operates 208 own stores in the U.S and nearly 300 in China, which is a value foundation [5]. Besides, it collaborates with various shopping malls and convenience stores to sell its products to achieve diverse distribution channels. These range from exclusive malls like Plaza 66, which features world-renowned brands, to convenience stores found globally like 711. Unlike Dairy Queen, which also represents a premium ice cream, focuses on its own offline store and rarely collaborates with other businesses and Wall's, which has a comparable brand history to Haagen-Dazs and began its global expansion around the similar time, lacks fixed stores in any location worldwide, Haagen-Dazs has diversified direct operating model that is quite rare in the ice cream market. Haagen-Dazs’s early global expansion and substantial financial backing are difficult to imitate. In 2002, Nestle acquired the trademark rights for Haagen-Dazs in the U.S and leveraged its strong financial capacity to accelerate the brand's globalization. As a result, Häagen-Dazs has opened over 900 stores across 54 countries [5].

Based on the advantages mentioned afforded by its direct management model, Haagen-Dazs can effectively organize customized activities and periodically launch new products in its global stores to attract local consumers [6]. Ultimately, this direct management model has evolved into a sustainable competitive advantage.

4. Internal resource advantage-temporary competitive advantage

4.1. Premium ingredients

Additionally, inadequate and ineffective internal resources will result in firm failures in specific markets. As for Haagen-Dazs again, while it possesses sustainable competitive advantages based on some internal resources across global markets, some deficiencies within certain resources may result in low performances in Chinese market. For instance, the internal resource that premium ingredients provide a temporary competitive advantage in China. The premium ingredients align well with the unique desires of consumers in both markets for high premium ice cream, which show clear value. Moreover, many of the ingredients used by Haagen-Dazs are exceedingly rare on a global scale. Taking its classic vanilla flavor as an example, Haagen-Dazs claims that its vanilla is sourced from the rainforests of Madagascar, a resource that few competitors can hold [2].

However, unlike intellectual property, similar premium ingredients accessible to local competitors like GEMICE and Chicecream also access similar premium ingredients through comparable domestic suppliers. In China, the increasing availability of comparable resources among competitors has diminished the inimitability of this internal resource, thereby weakening their organizational advantage. Because this resource alone is insufficient to rely on global supply chain and special operating model to create a comprehensive competitive effect in the Chinese market. Therefore, based on Table 2, the Resource-Based View theory can effectively explain the success or failure of a MNE in certain markets to some extent.

|

VRIO Framework |

||||||

|

1. Haagen-Dazs in the U.S market (success) |

||||||

|

Resources |

V Is it valuable? |

R Is it rare? |

I Is it hard to imitate? |

O Is it organized well? |

Competitive Implication |

|

|

brand culture |

YES |

YES |

YES |

YES |

sustainable competitive advantage |

|

|

direct operating model |

YES |

YES |

YES |

YES |

sustainable competitive advantage |

|

|

premium ingredients |

YES |

YES |

YES |

YES |

sustainable competitive advantage |

|

|

2. Haagen-Dazs in the Chinese market (failure) |

||||||

|

Resources |

V Is it valuable? |

R Is it rare? |

I Is it hard to imitate? |

O Is it organized well? |

Competitive Implication |

|

|

brand culture |

YES |

YES |

YES |

YES |

sustainable competitive advantage |

|

|

direct operating model |

YES |

YES |

YES |

YES |

sustainable competitive advantage |

|

|

premium ingredients |

YES |

YES |

NO |

NO |

temporary competitive advantage |

|

5. External environmental factors

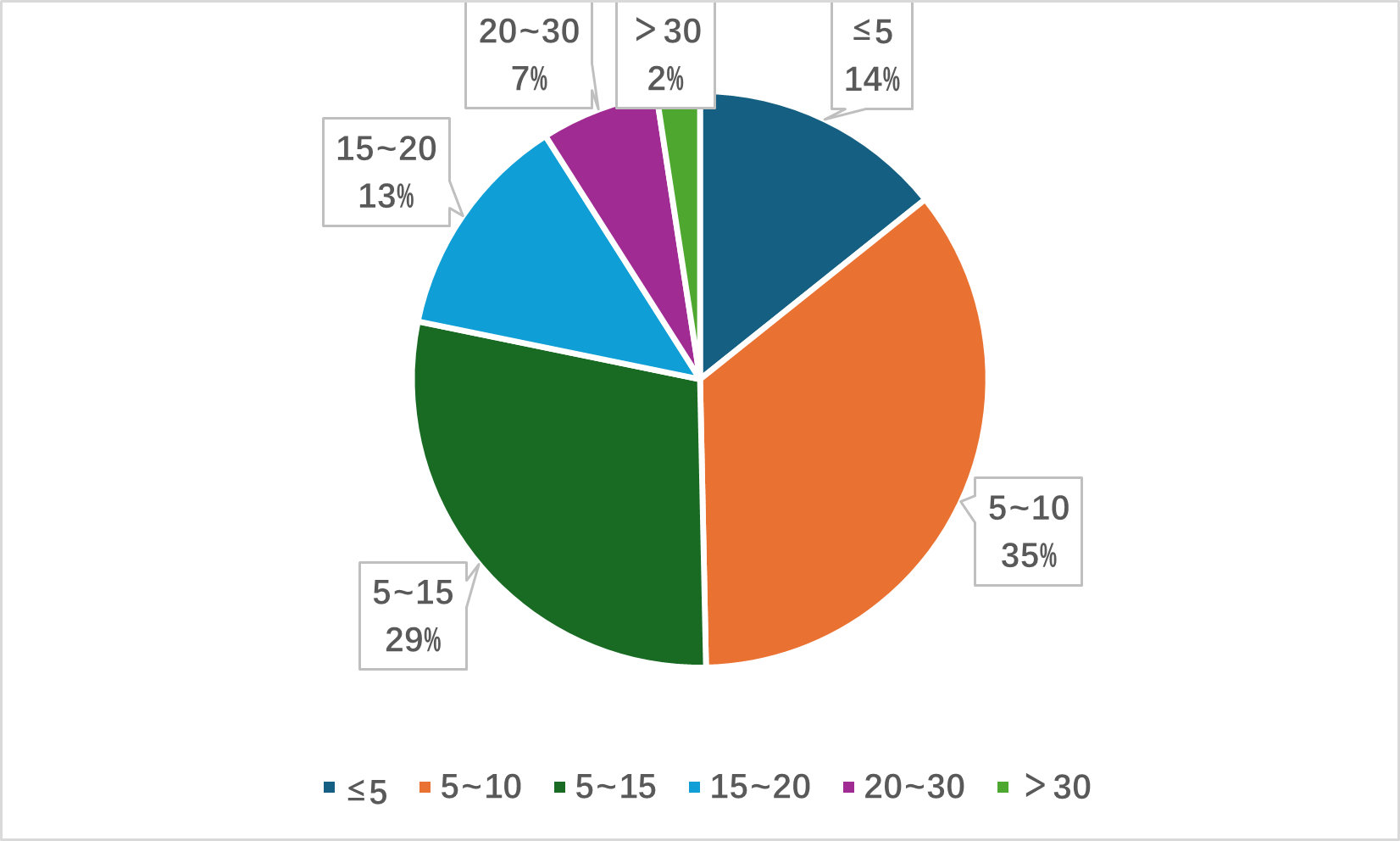

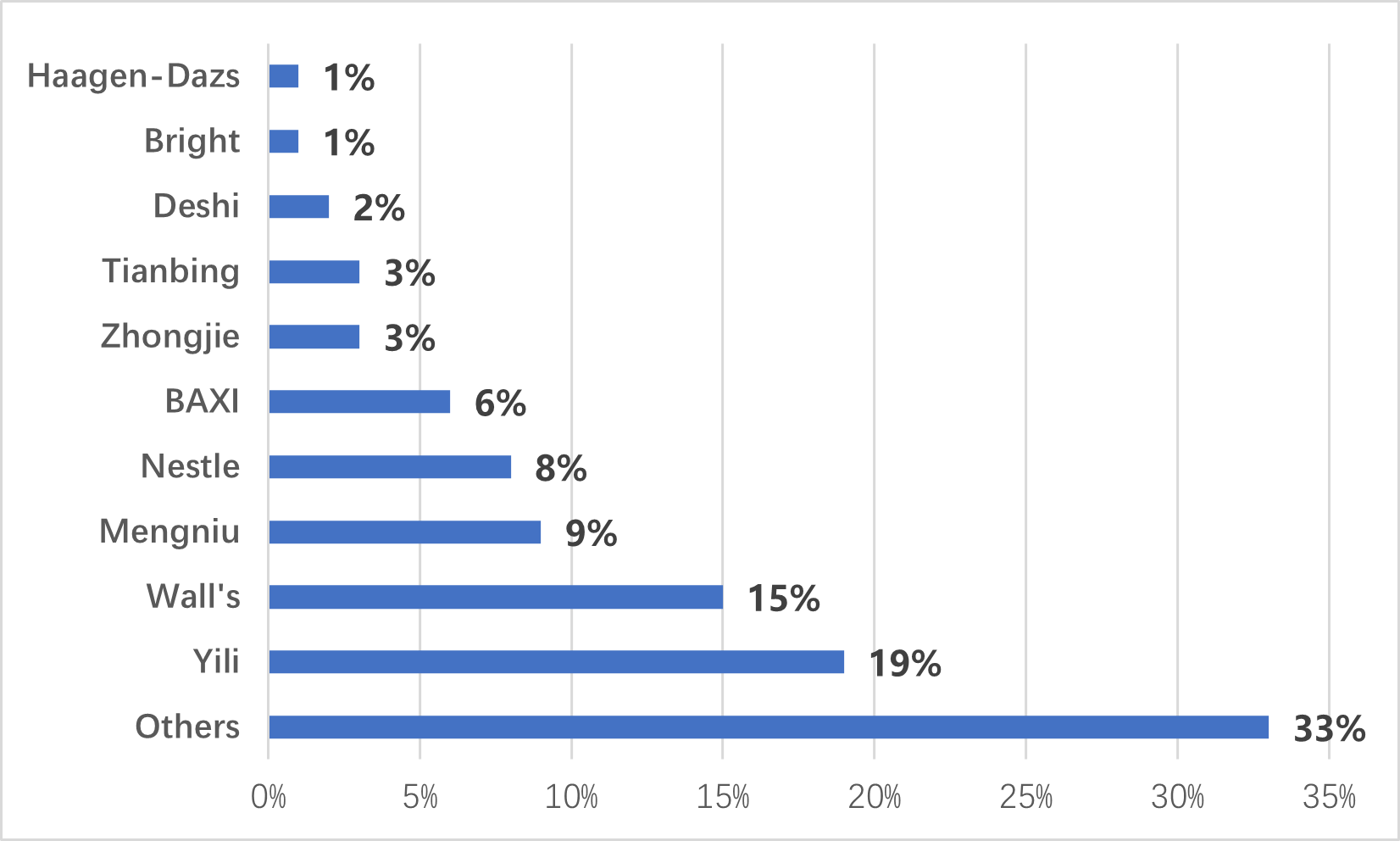

Furthermore, it is also worth noting that the success or failure of MNEs is also heavily influenced by external environmental factors, which RBV theory cannot explain. One major factor challenging for Haagen-Dazs in the Chinese market is the relatively low per capita income of Chinese residents. As shown in Table 3, compared with U.S, China lags in various indicators [7]. As a premium ice cream brand, Haagen-Dazs struggles to attract price-sensitive Chinese consumers, with only a small demographic accepting high-priced ice cream (Table 4) [8]. Therefore, its sales and popularity in China have declined in recent years. Another factor is the significant difference in the competitive landscape of the ice cream market between China and U.S. Although Haagen-Dazs faces competitors like Dairy Queen and Ben & Jerry's in the U.S, the ice cream market there has maintained a relatively stable structure over time and has not impacted Haagen-Dazs’s position. In contrast, Chinese market is increasingly competitive due to local influences and the emergence of domestic brands such as Chicecream, which rely on Chinese CSAs-residents’ strong awareness of traditional culture. According to iiMedia Research, Haagen-Dazs holds only 1% market share in the Chinese ice cream industry as of 2022, ranking tenth overall (Table 5) [8].

|

Wage/Income Gap Correlation Summary |

||

|

Measurement |

China |

U. S |

|

Minimum |

1.7% |

2.7% |

|

Maximum |

60.0% |

69.8% |

|

Range |

58.3% |

67.1% |

|

Mean |

26.2% |

30.2% |

|

Median |

27.3% |

28.7% |

6. Suggestion

The analysis of Haagen-Dazs's international performance through the RBV lens reveals critical insights for MNEs navigating global markets. While internal resources remain fundamental to competitive advantage, their effectiveness is ultimately contingent upon alignment with external market conditions. This suggests that successful international strategies must adopt a more holistic perspective that bridges internal capabilities with environmental realities. MNEs would benefit significantly from developing integrated assessment frameworks that systematically evaluate both resource portfolios and market-specific factors before market entry and during ongoing operations.

A key imperative emerging from this study is the need for dynamic resource reconfiguration in response to market evolution. The Haagen-Dazs case demonstrates how even well-established competitive advantages can be undermined by changing market conditions, particularly in emerging economies experiencing rapid socioeconomic transformation. This necessitates establishing dedicated market intelligence functions within MNEs to continuously monitor competitive developments, consumer behavior shifts, and macroeconomic changes. Such capabilities enable proactive strategy adjustments rather than reactive responses to market challenges. Furthermore, MNEs should consider implementing phased market entry approaches that allow for iterative learning and strategic refinement based on real-time market feedback.

The importance of strategic partnerships emerges as another critical consideration. In markets where internal resources prove insufficient to overcome external barriers, collaboration with local entities can provide crucial complementary assets and market knowledge. This might take various forms including joint ventures with established domestic players, strategic alliances with complementary businesses, or local supply chain partnerships. Such collaborations can help bridge the gap between MNEs' global capabilities and local market requirements, while potentially reducing operational risks and entry costs. However, the development of these partnerships should be guided by careful due diligence to ensure alignment with the MNE's strategic objectives and brand positioning.

7. Conclusion

7.1. Research overview

This study critically examines the applicability of the Resource-Based View (RBV) theory in analyzing multinational enterprises' (MNEs) international strategies, using Haagen-Dazs as a case study. The research explores how internal resources contribute to competitive advantage in different markets, while also identifying the limitations of RBV in addressing external environmental factors. Through a comparative analysis of Haagen-Dazs's performance in the U.S. and China, the study evaluates the effectiveness of RBV-driven strategies and highlights the role of market-specific conditions in shaping outcomes. The VRIO framework is employed to assess Haagen-Dazs's sustainable and temporary competitive advantages, providing a nuanced understanding of the theory's strengths and gaps in international business contexts.

7.2. Main findings

The analysis reveals that Haagen-Dazs's success in the U.S. market stems from sustainable advantages such as its strong brand culture and direct operating model, which align with affluent consumer preferences and market stability. However, these same advantages faltered in China due to external factors, including price sensitivity, intense local competition, and income disparities. While premium ingredients provided a temporary competitive edge, their inimitability diminished as local competitors accessed similar resources. Empirical data show that Haagen-Dazs holds only 1% of China's ice cream market, underscoring the disconnect between internal resources and external market realities. The findings demonstrate that RBV's internal focus alone cannot fully explain MNE performance, as macro-environmental factors play a decisive role in shaping competitive outcomes.

7.3. Implications and significance

This study offers important theoretical and practical insights. Theoretically, it bridges RBV with macro-environmental analysis, proposing a more holistic framework for understanding international competitiveness. For practitioners, the findings emphasize the need for MNEs to complement RBV-based strategies with thorough market assessments, adapting to local economic and competitive conditions. Future research should explore how digital transformation and cross-industry dynamics influence the RBV's applicability, particularly in emerging markets. While this study focuses on the ice cream industry, its implications extend to other sectors where internal resources interact with external contingencies. By integrating these perspectives, MNEs can develop more resilient and adaptive international strategies, ensuring sustainable growth in diverse global markets.

References

[1]. Creately.com. (2024). ‘VRIO Analysis Explained with Steps, Examples, and Templates’. [EB/OL]. Retrieved June 3, 2025, from https: //creately.com/guides/vrio-analysis/

[2]. Haagen-Dazs Website. (2025). Brand Story [EB/OL]. Retrieved June 10, 2025, from https: //www.haagendazs.com.cn/

[3]. Statista. (2024, October 12) ‘Brand loyalty of ice cream consumers in the United States in 2023.’ [Database] Retrieved June 10, 2025, from https: //www.statista.com/statistics/1462338/ice-cream-brand-loyalty-us/

[4]. FoodTalks. (2023). Lu Longhai, general manager of Haagen-Dazs: Create a global ecosystem with consumers as the center’. [EB/OL]. Retrieved June 12, 2025, from https: //www.foodtalks.cn/news/42423

[5]. ScrapeHero. (2024, January 18) ‘Number of Haagen-Dazs stores in the United States in 2024.’ [Database] Retrieved June 10, 2025, from https: //www.scrapehero.com/location-reports/Haagen-Dazs-USA/

[6]. Campaignlive.com. (2024). Search results for “Häagen-Dazs”. [EB/OL]. Retrieved June 12, 2025, from https: //www.campaignlive.com/search/articles?KeyWords=H%C3%A4agen-Dazs

[7]. Zipatlas.com. (2024) ‘Chinese vs American Wage/Income Gap.’ [EB/OL]. Retrieved June 12, 2025, from https: //zipatlas.com/us/income-comparison/chinese-vs-americans-wage-income-gap.htm

[8]. Iimedia. (2022, February 12). ‘Consumption trend monitoring and case study report of China ice cream Industry in 2022-2023.’ [Report]. Retrieved June 10, 2025, from https: //www.iimedia.cn/c400/87625.html

Cite this article

Cheng,Y. (2025). Critical assessment of resource-based view theory-take Haagen-Dazs as the case company. Journal of Fintech and Business Analysis,2(2),45-50.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Creately.com. (2024). ‘VRIO Analysis Explained with Steps, Examples, and Templates’. [EB/OL]. Retrieved June 3, 2025, from https: //creately.com/guides/vrio-analysis/

[2]. Haagen-Dazs Website. (2025). Brand Story [EB/OL]. Retrieved June 10, 2025, from https: //www.haagendazs.com.cn/

[3]. Statista. (2024, October 12) ‘Brand loyalty of ice cream consumers in the United States in 2023.’ [Database] Retrieved June 10, 2025, from https: //www.statista.com/statistics/1462338/ice-cream-brand-loyalty-us/

[4]. FoodTalks. (2023). Lu Longhai, general manager of Haagen-Dazs: Create a global ecosystem with consumers as the center’. [EB/OL]. Retrieved June 12, 2025, from https: //www.foodtalks.cn/news/42423

[5]. ScrapeHero. (2024, January 18) ‘Number of Haagen-Dazs stores in the United States in 2024.’ [Database] Retrieved June 10, 2025, from https: //www.scrapehero.com/location-reports/Haagen-Dazs-USA/

[6]. Campaignlive.com. (2024). Search results for “Häagen-Dazs”. [EB/OL]. Retrieved June 12, 2025, from https: //www.campaignlive.com/search/articles?KeyWords=H%C3%A4agen-Dazs

[7]. Zipatlas.com. (2024) ‘Chinese vs American Wage/Income Gap.’ [EB/OL]. Retrieved June 12, 2025, from https: //zipatlas.com/us/income-comparison/chinese-vs-americans-wage-income-gap.htm

[8]. Iimedia. (2022, February 12). ‘Consumption trend monitoring and case study report of China ice cream Industry in 2022-2023.’ [Report]. Retrieved June 10, 2025, from https: //www.iimedia.cn/c400/87625.html