1. Introduction

In recent years, venture capital (VC) has become a central force in global innovation systems. The foundational understanding of VC conceptualized its role primarily through a financial lens. In canonical accounts, VC is professionally managed equity invested in young, high-growth private firms, typically as equity or equity-linked stakes [1]. In the traditional view, VCs operate as specialized financial intermediaries that select and screen ventures, structure cash-flow and control rights—most commonly via convertible preferred securities and staged financing—and actively monitor to mitigate information asymmetries and enable value-realizing exits [1-4]. In this traditional view, venture capitalists were seen as sophisticated financial intermediaries who provided capital to startups, mitigating information asymmetries and funding constraints in exchange for equity. Their value was intrinsically linked to staged financing, risk absorption, and engineering lucrative exit events, such as initial public offerings (IPOs) or strategic acquisitions [1, 3, 4].

However, this finance-centric perspective of VC is insufficient to capture the complexities of contemporary entrepreneurship. As the global economic landscape has evolved, marked by heightened uncertainty, rapid technological cycles, and the primacy of intangible assets, the function of VC has necessarily expanded. A substantial body of evidence demonstrates that VCs contribute far more than capital alone, acting as strategic partners deeply engaged in governance, resource orchestration, and management development [2,5]. Empirical studies also show that VC-backed firms disproportionately lead in patenting rates, successful market entry, and innovation outcomes compared to their non-VC-backed counterparts particularly in technology-intensive industries [6-8]. Therefore, modern VCs are not merely capital providers; consistent with firm-level evidence comparing governmental and independent VC investments, their involvement extends into governance and value-creation activities [9].

Despite this evolution being significant in practice, the understanding of VC’s dynamic and multifaceted roles remains limited. Most existing studies examined VC functions in isolation, focusing on governance mechanisms [2-5], network brokerage [10-13], or exit strategies [5,9,14,15]. Moreover, there is limited analysis of how VC roles are contingent upon key factors like investor type (e.g., independent vs. corporate), investment stage (e.g., seed vs. growth), and institutional context (e.g., developed vs. emerging markets). Besides, literature has yet to systematically chart how these advanced roles evolve and reshape the entrepreneurial firm.

To fill these gaps, this paper conducts an up-to-date systematic review of 109 studies published between 2000 and 2025. By analyzing two and a half decades of theoretical and empirical works, this paper makes contributions in three ways. First, we construct a typology of VC roles, moving beyond a simple financial-versus-non-financial dichotomy to identify distinct governance-oriented, resource-enabling, and strategic-collaborative archetypes. Second, we delineate the evolutionary trajectory of these roles, tracing their transformation from a primary focus on financial guardianship in the early 2000s toward ecosystem integration and cognitive partnership in the 2020s. Third, we synthesize the empirical evidence on the firm-level impacts of these varied roles, systematically accounting for the heterogeneity introduced by VC type and timing of entry. This paper not only clarifies how and why VC functions have expanded and intensified but also provides a theoretical lens to understand these shifts across different institutional and industry contexts.

The remainder of the paper is structured as follows: Section 2 details the review methodology, including the search strategy and inclusion criteria. Section 3 presents a typological and evolutionary analysis of VC roles. Section 4 examines the empirical evidence on VC impacts across different firm outcomes and contexts. Section 5 concludes with a summary of key findings, identifies theoretical and empirical gaps, and suggests directions for future research.

2. Review methods and literature collection

To investigate the role of VCs within entrepreneurial firms and to map the evolutionary pathways of their involvement, this study adopts a systematic literature review approach grounded in the conceptual foundations of VC research summarized by [1], which emphasize the evolution of VC practices, investment decision-making processes [4,11], and their impact on entrepreneurial firm development.

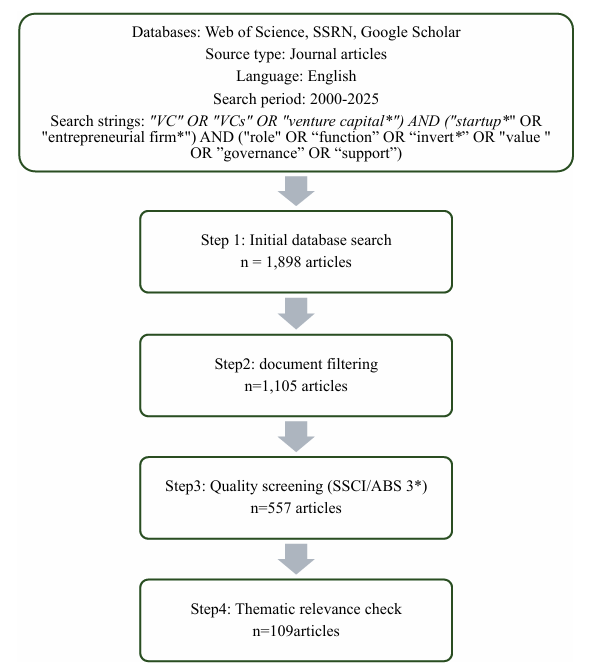

Literature collection and review involve three core steps: (1) defining a search protocol, (2) establishing screening and eligibility criteria, and (3) conducting a classification and analysis for the resulting literature. Figure 1 shows the core steps in the literature search and selection.

2.1. Literature search and selection

This study focuses on the role of VCs in startups and their evolutionary pathways. Therefore, the search strategy was designed to capture the relevant academic literature on the topic of VC entities, entrepreneurial enterprises, and their roles. VC-related keywords include “venture capital*”, “VC”, or “VCs”. The entrepreneurial-enterprise keywords include “startup*” or “entrepreneurial firm*”. The role of VCs is captured by the keywords “role”, “function”, “invest*”, “value”, “governance”, or “support”. Using these keywords, the comprehensive Boolean search query is formulated as: ("VC" OR "VCs" OR "venture capital") AND ("startup*" OR "entrepreneurial firm*") AND ("role" OR "function" OR "invest*" OR "value" OR "governance" OR "support").

To ensure comprehensive coverage, the search was conducted across the Web of Science Core Collection, SSRN, and Google Scholar. Then, the literature search was bound by a specific set of inclusion and exclusion criteria to ensure the relevance and quality of the reviewed articles. The scope was limited to peer-reviewed academic journal articles published in English between January 2000 and August 2025.

The initial search yields 1,898 publications. Following the Preferred Reporting Items for Systematic reviews and Meta-Analyses (PRISMA) protocol [16], these publications were systematically selected according to predefined inclusion criteria. First, after limiting the results to peer-reviewed English-language journal articles and removing duplicates, 1,105 articles remained. A subsequent quality appraisal retained only those articles from journals indexed in the Social Sciences Citation Index (SSCI) or rated 3* or higher by the ABS, reducing the pool to 557 studies. Finally, we screened the abstract of the literature and excluded articles focused solely on financial metrics or those lacking a direct analysis of VC roles. This multi-stage screening process yielded the final set of 109 core studies for this review.

2.2. Literature description and classification

The studies on the role of VCs within enterprises are concentrated in a few top-tier journals. As detailed in Table 1, the Journal of Financial Economics (36 articles), the Journal of Business Venturing (23 articles), and the Review of Financial Studies (16 articles) are the most prominent venues for this topic. An analysis of the publication timeline reveals a consistent and recently accelerating interest. While the volume of articles remained stable across the first two decades (43 from 2000-2009 and 41 from 2010-2019), the 26 articles published since 2020 indicate an increased annual publication rate, signaling sustained scholarly attention in the field.

|

Journal |

2000-2009 |

2010-2019 |

2020-2025 |

Total |

|

Journal of Financial Economics |

13 |

13 |

10 |

36 |

|

Journal of Business Venturing |

7 |

10 |

6 |

23 |

|

Review of Financial Studies |

6 |

7 |

3 |

16 |

|

Journal of Corporate Finance |

2 |

4 |

2 |

8 |

|

Journal of Finance |

3 |

1 |

0 |

4 |

|

Others |

12 |

5 |

5 |

22 |

|

Total |

43 |

41 |

26 |

109 |

3. The evolving role of VC

VCs have evolved into critical governance agents within entrepreneurial ecosystems, operating well beyond the traditional role of capital provision. This functional expansion arises from structural deficiencies of early-stage ventures—limited collateral, volatile performance expectations, and acute information asymmetries—that render conventional financing channels ineffective. According to [17], affiliation with reputable VCs generates certification effects that improve valuation terms in subsequent financing, evidencing value beyond capital. Building on financial contracting theory[3], shows that staged financing and milestone-based governance mitigate agency problems by aligning incentives between entrepreneurs and investors. Using 213 venture-capital contracts [4], documents the systematic use of contingent control rights—board representation, liquidation preferences, and vetoes on critical decisions—that together constitute an external governance architecture [2]. urther documents post-investment value-added, illustrating how venture capitalists pool technical and organizational resources to support capability building and commercialization.

3.1. The classification of VC

A central premise in VC research is the inherent heterogeneity of its actors, shaped by organizational attributes and behavioral strategies that influence screening, governance, and broader strategic contributions [1,4,18]. Building on this premise, this study adopts a two-dimensional typology. The first dimension, firm attributes, comprises capital source and organizational form, fund size and internal governance structure, investment stage preference, geographical and cultural background, and investor reputation. The second dimension, investment behavior, comprises strategy specialization, the depth of post-investment involvement, decision logic with either a strategic orientation or a financial orientation, and exit orientation and timing. Investor reputation functions as a certification mechanism that reduces information frictions and shapes selection, pricing, and monitoring intensity, with stronger effects in weaker legal environments

The most fundamental distinction begins with firm attributes, where funding background separates independent VCs (IVCs) from corporate VCs (CVCs). IVCs are typically structured as limited partnerships driven by financial returns, whereas CVCs prioritize strategic synergies, often investing in technologically complementary startups to facilitate innovation absorption within the parent firm’s ecosystem [18]. This strategic orientation, financial maximization versus strategic upgrading, is the primary cleavage from which many other differences emerge [19].

The firm differences are also reflected in a VC’s structure. As [1] distinguished, the landscape includes both large institutional VCs and smaller, independent funds. Large institutional investors often deploy layered decision processes [11]; post-investment value-added through pooling technical and organizational resources has been documented [2]. In contrast, smaller VCs rely on more flexible governance and concentrated decision rights, a structure that facilitates agility but often limits their capacity for large-scale, capital-intensive investments.

A VC’s structural characteristics and fund base directly influence its appetite for risk, which is most clearly expressed in its preferred investment stage. Early-stage VCs, often smaller and more agile, play a pivotal role in shaping the foundational layers of new ventures, especially in emergent fields where they must bear significant technological and market risk in exchange for greater influence [11]. Conversely, late-stage VCs, which include many CVCs and larger institutional funds, typically engage once product-market fit is more defined. They leverage board control and equity milestones to secure returns while minimizing downside exposure [4].

Geographical and cultural positioning also matters. Based on survey data of 885 institutional VCs across 681 firms[11], while VCs broadly prioritize management team quality, there are systematic differences in evaluation criteria across geographies. For example, Western VCs are observed to emphasize team execution and formal governance structures, viewing active monitoring as a key mechanism for strategic alignment [20]. In contrast, evidence suggests some Asian VCs may place greater weight on technological maturity and exhibit longer investment horizons, reflecting different regional capital market structures and institutional logics [21,22].

Investor reputation also represents a critical firm-level attribute that influences both investment behavior and firm outcomes. As [17] shows, entrepreneurs often accept a meaningful valuation discount to affiliate with reputable VCs—a certification effect that reduces information frictions. This reputational effect is especially pronounced in institutional environments with weaker legal protections, where cross-country evidence indicates that VC reputation can play a critical role in alleviating financing frictions [21].

Behavioral heterogeneity is evident in investment strategies and intervention depth [17] finds that affiliation with reputable VCs is associated with lower offered valuations in financing rounds. VC involvement accelerates professionalization and commercialization [2]. Active investors, by contrast, engage deeply in board governance and strategic oversight, which is associated with better outcomes [2,20].

Finally, this entire chain of attributes and behaviors converges on the ultimate dimension of heterogeneity: decision logic and exit strategy. This final classification brings the analysis full circle, directly linking back to the foundational IVC-CVC divide. Financial-oriented VCs (primarily IVCs) logically pursue governance structures designed to facilitate timely and lucrative liquidity events like IPOs, with evidence showing their involvement significantly increases IPO success rates [23]. In contrast, strategic-oriented VCs (primarily CVCs) focus on long-term innovation outcomes, timing M&A-driven exits to coincide with innovation milestones that ensure both knowledge transfer and financial return [14,18].

This multidimensional classification illustrates that VCs are not a monolithic entity. They are a diverse set of actors whose strategic logic, resource configurations, and governance approaches are deeply intertwined and vary significantly across institutional contexts. Understanding the heterogeneity of VCs is fundamental to explaining how different VCs interact with entrepreneurial ventures and, ultimately, how they drive firm-level innovation and market evolution.

|

Dimensions |

subcategories |

Classification Criteria and Subdimensions Descriptions |

Reference |

|

Firm attributes |

funding background (capital sources) |

Independent VCs (IVCs, financially returns-oriented) Corporate VCs (CVCs, strategically synergy-focused)—as [18] noted, CVCs invest in entrepreneurial ventures to enhance learning and innovation, often targeting technologically complementary firms. |

[18,5] |

|

Fund Size and Organizational Form |

Large institutional VCs (with strong resource integration capabilities, as [24] validated modular strategies in deep tech sectors) Small independent VCs (characterized by flexible decision-making) |

[1] | |

|

Investment Stage Preference |

Early-stage VC as [24] analyzed in deep tech VCs' early-stage technology layering) Late-stage VC (CVCs exercising board control in late stages, as studied by [5] |

[5, 24] | |

|

Geographical and Cultural Backgrounds |

Western VCs (prioritize management teams, as evidenced by Bernstein et al., 2016's analysis of VC monitoring and board engagement) Asian VCs (emphasize technological maturity) |

[11, 20] | |

|

Investor reputation |

criteria and subdimensions: Track record of successful exits and fund sequences; network centrality and syndication standing; reputation signal strength affecting access to high-quality deals, pricing, and acceptance rates; effects amplified in weaker legal environments |

[21, 17] | |

|

Investment behavior |

Investment Strategies (Active vs. Passive) |

Specialized VC [23]: Quality Certification Effect, Valuation Premium 15%-20%) ,Generalist VC (with Limited Post-Investment Intervention) |

[23,24] |

|

Post-Investment Intervention Depth (Active vs. Passive) |

Active VCs (with board participation— (Bottazzi et al., 2008) are associated with higher funding success) |

[5] | |

|

Decision Logic: Strategic Orientation vs. Financial Orientation |

Strategic-oriented (CVCs serving parent companies' innovation learning and technological positioning— (Dushnitsky & Lenox, 2005) Financial-oriented (IVCs focusing on exit strategies— [1] |

[1,18] | |

|

Exit Strategy Preference – Timing |

[1] showed that governance optimization improves IPO outcomes. M&A-oriented (CVCs leveraging exit strategies to enhance learning and innovation outcomes— [18] |

[25,18] |

3.2. The role of VC

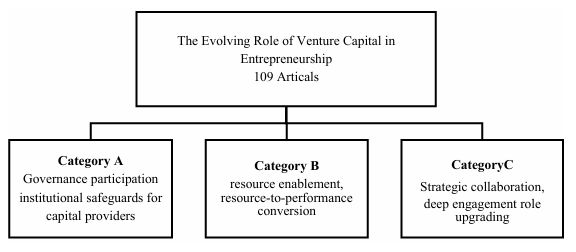

Existing literature reveals significant differences among the roles of VCs. Many studies confirm that VCs primarily act as financial supporters, providing essential capital supply and risk-bearing capacity that enable startups to overcome financing constraints [1, 3, 8, 17]. Beyond capital provision, some scholars emphasize VCs’ governance participation, where they embed institutional safeguards through board involvement, staged financing, and contractual mechanisms to reduce agency costs and enhance firm discipline [20, 2, 4, 5]. More recent research extends these functions further, showing that VCs can also operate as strategic partners, engaging in deep collaboration to shape firm strategy, enhance innovation, and co-create entrepreneurial ecosystems [6, 18, 26, 27]. These findings demonstrate that VCs perform a diverse set of roles, including financial support, governance participation, and strategic collaboration, reflecting the multidimensional nature of their contribution to entrepreneurial ventures.

Building upon this established understanding, our paper synthesizes these functions into a formal, three-tiered classification framework (see Figure 2). Each tier corresponds to a distinct level of VC involvement: Category A focuses on the fundamental roles of governance and safeguarding; Category B addresses resource enablement and its conversion to performance; and Category C captures the most advanced role of strategic partnership and deep engagement.

Category A (Governance and Control Mechanisms, 42 articles) corresponds to the "institutional participation of capital providers", defining VCs as capital providers embedding in corporate governance structures through mechanisms like board seats, contractual rights, and supervisory systems to ensure capital security and management standardization, with research focusing on VCs’ role positioning in corporate governance, the shaping of governance structures by financing contracts, and how governance mechanisms regulate principal-agent relationships.

Category B (Performance and Value Creation Impact, 13 articles) corresponds to the "result-oriented output of resource enablers", illustrating VCs’ evolution from pure capital providers to resource enablers directly influencing enterprise innovation capacity, market performance, and growth pathways through financial and non-financial resources, with research exploring mechanisms of resource integration for innovation, conversion pathways of resource input into market performance, and the shaping of enterprise growth trajectories.

Category C (Strategic Evolution and Enterprise Engagement, 54 articles) corresponds to the "deep collaboration of strategic partners", highlighting VCs' transition from financial investors to strategic partners deeply engaging in strategic planning, operational management, and ecosystem construction, with research focusing on drivers of VC role transformation, the shaping of enterprise strategic evolution by deep VC involvement, and resource integration models under strategic collaboration.

The evolution in this classification system involves two key dynamic features. First, it maps an evolutionary progression of VC involvement (A to B to C). Effective governance (Category A) provides the stable foundation necessary for meaningful resource deployment (Category B). In turn, the successful conversion of resources into performance builds the trust and material basis for deep strategic collaboration (Category C). This progression reflects a deepening of the VC-firm relationship over time. Second, the categories operate within a virtuous cycle of mutual reinforcement. Effective governance (A) legitimizes and structures resource integration (B). Strong performance outcomes (B) enhance the VC's strategic authority and influence (C). Deep strategic engagement (C), such as ecosystem co-creation, necessitates more sophisticated and adaptive governance mechanisms (A), thus completing and elevating the cycle.

This interplay ensures that the framework is not merely linear but a dynamic system where each role enhances the efficacy of the others. For example, the strategic need to build an ecosystem (C) may drive the VC to introduce new network resources (B) and establish an ecosystem-wide governance committee (A).

3.3. The evolution of VC

Building on the functional classification outlined in Section 3.2, the roles of venture capitalists also exhibit clear patterns of evolution over time. While early studies emphasized VCs primarily as financial guardians and resource providers (Category A), subsequent research shows a progressive expansion toward multi-functional actors that simultaneously combine governance, resource orchestration, and strategic collaboration (Categories A+B+C). From a temporal perspective, VC research documents a trajectory of transformation: from capital supply and certification in the early 2000s, to deeper governance and professionalization during the 2010s, and more recently to cognitive collaboration and ecosystem co-creation in the 2020s [2, 3, 4, 11,20]. This temporal framework highlights how the complexity of VC roles has grown in tandem with changes in entrepreneurial ecosystems and institutional environments.

Early literature positioned VCs as "financial backers," with their functions realized through three mechanisms: [28] found that VC endorsement can increase firm valuation by providing certification effects in early-stage financing. VC's transition to “strategic shapers” is driven by the complexity of entrepreneurial ecosystems. Organizational learning theory [29] and dynamic capabilities theory [30] provide cross-validation, while [18] highlights how corporate VC investments can enhance incumbents' innovation rates, reinforcing the role of VCs in driving technological advancement within their portfolios. [20] provides evidence on active VC monitoring, demonstrating how VCs engage in portfolio firms’ governance and operational planning.

Governance interventions exhibit “bounded rationality” [31] referring to the deliberate yet limited decision-making capacity of VCs under uncertain conditions. This bounded rationality becomes especially salient in early-stage ventures operating in rapidly shifting technological frontiers. Under such conditions, venture capitalists are forced to make strategic decisions with incomplete information, relying on heuristics derived from prior investment experience, sector-specific knowledge, and syndicate signals. This view aligns with [31], who demonstrate that venture capitalists use heuristics, such as pattern recognition and prior entrepreneurial experience, in lieu of hard data during early-stage evaluations. Such reliance on soft information is particularly pronounced in the formative stages of venture development, where standard financial metrics are often unavailable. These heuristics manifest in due diligence procedures, lead-lag investment behaviors, and milestone-based monitoring, all of which influence long-term firm trajectory without requiring continuous direct intervention. [3] show how governance structures in VC-backed firms can support decision-making efficiency. Analysis of 213 VC investment contracts by [3] showed that anti-dilution and liquidation preference clauses are widely used to align incentives and protect investor interests, supporting effective governance without deterring entrepreneurial motivation. Further [3], demonstrated how these contractual features in VC align with financial contracting theory to reduce agency costs and mitigate information asymmetry, thereby facilitating more efficient investment decision-making processes.

Synthesis of prior work indicates a three-axis shift. Evidence from financial contracting and monitoring documents a progressive deepening of governance in VC practice [3,4,20]. Research on organizational form, stage focus, and syndication behavior shows increasing functional heterogeneity across investor types and strategies [1,10,11,18].

From 2000 to 2010, the role of VC deepened with a stronger emphasis on resource orchestration rather than pure financial intermediation. [18] show that corporate venture investments facilitate the capture of innovation from technologically complementary start-ups, indicating systematic knowledge transfer beyond financing. In international contexts, evidence documents capability upgrading and learning consistent with coordinated use of outside knowledge and market access [21,22]. Post-investment value creation is further amplified by syndication, which enables expertise sharing and risk pooling across investors [10]. In parallel, governance instruments—staged financing, milestone-based monitoring, and contingent control rights—were used to align incentives and structure oversight [3,4]. At the firm level, venture capitalists contributed to team professionalization and faster commercialization [2]. Taken together, these findings portray the decade-long shift from contractual risk-sharing toward the coordinated mobilization of technological, managerial, and organizational resources, a pattern that aligns with perspectives from organizational learning and dynamic capabilities [19, 29, 30].

From the late 2000s through the 2010s, evidence points to stronger VC monitoring and broader operational support. [20] provide causal evidence on monitoring improving performance; [11] document operational and strategic support in survey data. Complementing this evidence, [12] show that greater VC network centrality is associated with superior fundraising and investment performance. Taken together, these findings characterize the transition toward VCs acting as strategic partners with refined judgment capabilities.

From the late 2000s through the 2010s, accumulating evidence indicates an expansion of the venture capitalist’s role toward cognitive collaboration. [20] documents investor participation in strategy formulation, organizational design, and product timing. Survey evidence from [11] Survey evidence from [12] show that greater connectedness in syndication networks enhances innovation outcomes, though with diminishing returns beyond a density threshold. Viewed through the lenses of organizational learning and dynamic capabilities [29, 30], these findings support framing venture capitalists as emergent cognitive collaborators in high-uncertainty and deep-tech contexts.

This historical framework introduces a dynamic, longitudinal perspective to the literature through static analyses. We chart the evolution of VC roles over time, explaining how they have adapted to maturing institutions, increasing market complexity, and shifting technological paradigms. Our analysis reveals a clear trajectory: over the past two decades, the central function of VC has transformed from financial guardianship to active strategic cognition. Crucially, this evolution is not presented as a simple linear progression but as a layered adaptation to the changing demands of the entrepreneurial ecosystem.

4. The impact of VC on firms

A substantial body of research has established that VC has a significant impact on firms. However, the nature and magnitude of this impact are not uniform; instead, impacts are highly contingent upon factors such as the timing of VC entry, the specific type of investor, and the investment strategies employed. This section reviews the literature on the impact of VCs, exploring this impact heterogeneity and the key factors that moderate these impacts.

4.1. The diverse impacts of VCs

Existing literature has examined the multifaceted impacts of VC on firms, including governance, resource allocation, innovation, and exit strategies. VCs play a crucial role in shaping corporate governance structures. Prior research has demonstrated that VC involvement influences startups to adopt governance structures aligned with product market strategies, facilitating structured decision-making and promoting effective oversight mechanisms to reduce agency conflicts [2,32]; [3] pointed out that VC contracts can effectively resolve agency and transaction cost issues, ensuring more efficient firm operations. [4] further showed that VCs can design appropriate contracts to control and influence firm decision-making, safeguarding investor interests while promoting firm development.

Prior studies have demonstrated that VC involvement influences startups to adopt governance structures aligned with product market strategies, facilitating structured decision-making and promoting effective oversight mechanisms to reduce agency conflicts [2,32]. [3] pointed out that VC contracts can effectively resolve agency and transaction cost issues, ensuring more efficient firm operations. [4] further showed that VCs can design appropriate contracts to control and influence firm decision-making, safeguarding investor interests while promoting firm development.

Prior research has shown that VC involvement influences startups to adopt governance structures aligned with product market strategies, facilitating structured decision-making and promoting effective oversight mechanisms to reduce agency conflicts [2,32]. [3] pointed out that VC contracts can effectively resolve agency and transaction cost issues, ensuring more efficient firm operations[4]. further showed that VCs can design appropriate contracts to control and influence firm decision-making, safeguarding investor interests while promoting firm development.

In terms of resource utilization, VCs play a pivotal role by not only injecting capital but also mobilizing a broader array of strategic assets. These include managerial expertise, industry-specific knowledge, business development support, and access to key stakeholders such as potential clients, suppliers, or later-stage investors. Such resources are often beyond the reach of nascent firms but are critical for navigating early-stage operational challenges and scaling effectively. This multidimensional contribution from VCs goes beyond passive funding and reflects their active engagement in shaping firm trajectories across markets and growth phases. [23] explored this relationship, indicating that VCs help firms gain a competitive edge. [17]shows that, in first-round financings with competing offers, entrepreneurs accept about 10–14% lower pre-money valuations to partner with high-reputation VCs, i.e., reputable VCs acquire start-up equity at a 10–14% discount. [33] show that VC international knowledge and reputation positively relate to new venture internationalization.

VCs are important drivers of innovation within firms. Corporate venture capital is associated with higher innovation outputs in portfolio firms—measured by patents and citations [6]. [13] examined how VC syndication networks influence investment patterns and knowledge flow, showing that these networks facilitate information sharing and resource access among VCs, thereby enhancing the spread of innovation and investment efficiency within the industry, which indirectly benefits portfolio firms.

4.2. The influencing factors

The diverse impacts of VC on firms stem from variations in investor types, entry stages, strategic objectives and the surrounding institutional context. The most fundamental driver of this variation is the VC’s organizational archetype, as different types of investors, including IVCs, CVCs, government-affiliated funds, and university seed investors, operate with distinct mandates and resource endowments. University seed investors, for instance, function at the research-to-commercialization boundary, leveraging academic networks and intellectual property to incubate breakthrough innovations in science-based fields. Similarly, government-affiliated VCs pursue broader policy objectives like regional development or strategic autonomy, often de-risking foundational technologies in sectors overlooked by private capital. In contrast, CVCs serve a dual mission, acting as both financial investors and strategic enablers. They provide startups with invaluable access to proprietary R&D, market channels, and specialized expertise—a strategic advantage that is particularly critical in deep-tech sectors characterized by high uncertainty and long development cycles [18, 27].

A VC’s identity and mandate shape its preferred stage of entry and thus the nature of its influence. Early-stage entry can steer a firm’s direction under high technological uncertainty, as documented in industry overviews of venture financing dynamics [1, 2, 32]. Evidence from the corporate VC literature shows that early relationships with incumbents are associated with learning and innovation linkages, suggesting potential channels through which experimentation may be supported Dushnitsky and Lenox (2005) Mid-stage entry typically follows initial validation and is often associated with larger follow-on investments aimed at expansion and coordination [3, 4]; this emphasis is consistent with stage-differentiated investment patterns reported in prior work. Regarding timing, the effects of VC involvement vary across the life cycle; VC tends to be relatively patient early on, so very-early entry is not always dominant in every setting [8].

Beyond these structural factors, behavioral compatibility between entrepreneurs and investors is increasingly important. [26] identify mutual trust and iterative learning as key behavioral mediators of VC impact. Their findings challenge the view of VCs as purely transactional agents, revealing a relational mechanism that underlies performance differentials by enhancing the deployment of value-added services, particularly under conditions of high uncertainty.

Furthermore, these investor-firm dynamics are deeply embedded within broader contextual and sectoral environments. Cross-country comparative studies reveal that the quality of legal and institutional infrastructures significantly shapes VC behavior. As evidenced by [15], factors like investor protection and judicial efficiency directly affect the intensity of VC monitoring and the scope of governance support provided. In weak-rule-of-law environments, VCs naturally prioritize downside protection, which can constrain a firm's innovative autonomy. This institutional influence is compounded by sectoral characteristics. In knowledge-intensive industries like AI and biotechnology, where information asymmetry is high, the VC role must expand beyond finance to include resource orchestration and network brokerage, functions whose effectiveness is itself contingent upon ecosystem maturity and regulatory frameworks. Research by [22] demonstrates that national legal environments directly influence the choice of exit route (e.g., IPO vs. M&A), its timing, and the resulting firm valuation, illustrating a final pathway through which external context shapes VC impact.

Therefore, the analysis of VC impact must move beyond broad categorizations to examine how specific operational mechanisms interact with contextual contingencies. [10] reveal that VC syndication is a critical mechanism that shapes portfolio selection and support. Yet, a significant gap remains in understanding how these syndication-driven resource configurations translate into specific innovation outcomes across different technological environments. [20] demonstrate that governance intensity significantly shapes firm performance, as excessive monitoring can stifle the very agility required in high-uncertainty sectors. This finding calls for a more nuanced governance model that moves beyond simple intervention thresholds. Finally, these firm-level dynamics are themselves embedded within broader institutional contexts. [15] found that European VCs’ reliance on relational governance, compared to their U.S. counterparts, results in longer investment horizons but lower exit efficiency. This underscores the critical need to unpack how specific institutional logics shape VC-firm dynamics, moving beyond surface-level geographical comparisons.

5. Conclusion and discussion

This systematic review analyzed 109 peer-reviewed journal articles published between 2000 and 2025 to construct a unifying framework for understanding the evolving role of VC. Our analysis maps the landscape across three core dimensions: the classification of VC roles, their historical evolution, and their heterogeneous firm-level impacts.

The central contribution of this review is the development of a tripartite framework that organizes VC functions into three archetypes: Capital Providers, Resource Enablers, and Strategic Partners. This classification resolves persistent definitional ambiguities by aligning a VC's identity with its primary mode of engagement. Applying this lens, our analysis reveals a clear evolutionary trajectory in the literature: over the past two decades, the dominant perception of the VC role has progressed from that of a passive financial guardian toward that of a deeply engaged strategic partner. Furthermore, this framework clarifies the heterogeneity of firm-level impacts, showing how outcomes are contingent on investor type and entry stage. For instance, corporate VCs often excel as Resource Enablers by providing technological support, while mature independent VCs may act as Strategic Partners enforcing rigorous governance, with mid-stage entry frequently correlating with optimal scaling, particularly in technology-intensive settings.

The utility of this framework is threefold. For researchers, it provides a progressive analytical model: from institutional foundation, resource enablement, to strategic collaboration, which systematically unpacks the logic of VC value creation. For practitioners, it offers a clear decision-making heuristic: entrepreneurs can select VCs based on their primary need (governance, resources, or strategy), while VCs can use it as a roadmap for their own capability development. For policymakers, it enables the design of targeted interventions, such as fostering strategic-collaboration VCs to enhance innovation ecosystems.

While this framework provides a structured overview, it also illuminates critical gaps in existing studies. First, existing studies often treat governance, resources, and strategy in silos, neglecting their crucial interdependence. Second, the internal learning mechanisms and organizational capabilities that drive a VC’s own evolution remain a black box, especially in response to technological disruptions or cross-border investments. Third, a significant geographic bias toward U.S. and European data persists, limiting our understanding of VC dynamics in emerging economies with different institutional logics. Consequently, while foundational studies (e.g., [10, 15]) highlight mechanisms like syndication and relational governance, the field has yet to fully explore how these mechanisms translate into differentiated innovation trajectories across diverse industries and contexts.

This review is not without limitations. First, although the article selection process followed rigorous criteria, inclusion bias may exist due to language constraints and database coverage. Second, while the evolution analysis focused on external forces shaping VC behavior, it did not systematically account for VCs’ internal organizational dynamics, such as fund lifecycle stages, partner expertise, or incentive structures. Third, although our search protocol did not restrict industries, the included evidence base is skewed toward technology-intensive sectors due to data availability, which may limit the generalizability of findings to low-tech or service-oriented ventures. Additionally, multi-method approaches combining network analysis, field interviews, and experimental designs could better illuminate how VC strategies adapt in different entrepreneurial ecosystems. A deeper understanding of VC heterogeneity and its strategic alignment with firm needs remains crucial for refining both academic theory and practical guidance.

References

[1]. Gompers, P. A., & Lerner, J. (2001). The Venture Capital Revolution. .Journal of Economic Perspectives, 15(2), 145-168. https: //doi.org/10.1257/jep.15.2.145

[2]. Hellmann, T., & Puri, M. (2002). Venture Capital and the Professionalization of Start-Up Firms.The Journal of Finance, 57(1), 169–197 (2002). https: //doi.org/10.1111/1540-6261.00419

[3]. Kaplan, S. N., & Strömberg, P. (2003). Financial Contracting Theory Meets the Real World.Review of Economic Studies, 70(2), 281-315. https: //doi.org/10.1111/1467-937X.00245

[4]. Kaplan, S. N., & Strömberg, P. (2004). Characteristics, Contracts, and Actions: Evidence from Venture Capitalist Analyses. .Journal of Finance, 59(5), 2177–2210. https: //doi.org/10.1111/j.1540-6261.2004.00696.x

[5]. Cumming, D. J., & MacIntosh, J. G. (2003). A cross-country comparison of full and partial venture capital exits.Journal of Banking & Finance27(3), 511–548 (2003). https: //doi.org/10.1016/S0378-4266(02)00389-8

[6]. Chemmanur, T. J., Loutskina, E., & Tian, X. (2014). Corporate Venture Capital, Value Creation, and Innovation.The Review of Financial Studies, 27(8), 2434–2473. https: //doi.org/10.1093/rfs/hhu033

[7]. Kortum, S., & Lerner, J. (2000). Assessing the Contribution of Venture Capital to Innovation.RAND Journal of Economics. http: //www.jstor.org/stable/2696354

[8]. Puri, M., & Zarutskie, R. (2012). On the Life cycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms. .The Journal of Finance, 67(6), 2247–2293 (2012). https: //doi.org/10.1111/j.1540-6261.2012.01786.x

[9]. Cumming, D. J., Grilli, L., & Murtinu, S. (2017). Governmental and independent venture capital investments in Europe: A firm-level performance analysis. .Journal of Corporate Finance, 42, 439–459. https: //doi.org/10.1016/j.jfineco.2007.09.003

[10]. Brander, J. A., Amit, R., & Antweiler, W. (2002). Venture-capital syndication: Improved venture selection vs. the value-added hypothesis.Journal of Economics & Management Strategy, 11(3), 423–452. https: //doi.org/10.1111/j.1430-9134.2002.00423.x

[11]. Gompers, P. A., Gornall, W., Kaplan, S. N., & Strebulaev, I. A. (2020). How do venture capitalists make decisions?Journal of Financial Economics, 135(1), 169–190. https: //doi.org/10.1016/j.jfineco.2019.06.011

[12]. Hochberg, Y. V., Ljungqvist, A., & Lu, Y. (2007). Whom you know matters: Venture capital networks and investment performance. .Journal of Finance, 62(1), 251–301. https: //doi.org/10.1111/j.1540-6261.2007.01207.x

[13]. Sorenson, O., & Stuart, T. E. (2001). Syndication networks and the spatial distribution of venture capital investments.American Journal of Sociology, 106(6), 1546–1588. https: //doi.org/10.1086/321301

[14]. David, B., & Ziedonis, R. H. (2010). Corporate venture capital and the returns to acquiring portfolio companies.Journal of Financial Economics. https: //doi.org/10.1016/j.jfineco.2010.07.003

[15]. Schwienbacher, A. (2007). Venture Capital Governance Structures in Europe and the U.S.Journal of Corporate Finance, 13(1), 61-79. https: //doi.org/10.1016/j.jcorpfin.2006.11.001

[16]. Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., & Group, T. P. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement.Academic Journal Guide. https: //doi.org/10.1371/journal.pmed.1000097

[17]. Hsu, D. H. (2004). What do entrepreneurs pay for venture capital affiliation? .Journal of Finance, 59(4), 1805–1844. https: //doi.org/10.1111/j.1540-6261.2004.00680.x

[18]. Dushnitsky, G., & Lenox, M. J. . (2005). When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates.Research Policy, 34(5), 615–639. https: //doi.org/10.1016/j.respol.2005.01.017

[19]. Maula, M. V. J., Autio, E., & Murray, G. C. (2009). Corporate venture capital and the balance of risks and rewards for portfolio companies.Journal of Business Venturing, 24(3), 274–286. https: //doi.org/10.1016/j.jbusvent.2008.10.012

[20]. Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The Impact of Venture Capital Monitoring.Journal of Finance.The Journal of Finance, 71(4), 1591–1622 (2016). https: //doi.org/10.1111/jofi.12370

[21]. Ahlstrom, D., & Bruton, G. D. (2006). Venture Capital in Emerging Economies: Networks and Institutional Change.Entrepreneurship Theory and Practice30(2): 299–320 (2006). https: //ideas.repec.org/a/sae/entthe/v30y2006i2p299-320.html

[22]. Lockett, A., Wright, M., Sapienza, H. J., & Pruthi, S. (2002). Venture capital investors, valuation and information: A comparative study of the US, Hong Kong, India and Singapore. Venture Capital:An International Journal of Entrepreneurial Finance4(3): 237–252 (2002). https: //ideas.repec.org/a/taf/veecee/v4y2002i3p237-252.html

[23]. Bottazzi, L., Da Rin, M., & Hellmann, T. (2008). Who are the active investors? Evidence from venture capital.Journal of Financial Economics, 89(3), 488–512. https: //doi.org/10.1016/j.jfineco.2007.09.003

[24]. Schertler, A., & Tykvová, T. (2011). Venture capital and internationalization.International Business Review, 20(4), 423–439. https: //doi.org/10.1016/j.ibusrev.2010.07.009

[25]. Gompers, P. A., Kaplan, S. N., & Mukharlyamov, V. (2016). What do private equity firms say they do?Journal of Financial Economics, 121(3), 449–476. https: //doi.org/10.1016/j.jfineco.2016.06.003

[26]. Colombo, M. G. A., & Shafi, K. (2016). Swimming with sharks: Post-investment value-added, behavioral homophily, and venture capital investment performance.Strategic Management Journal, 2016, 37(11): 2307–2322. https: //doi.org/10.1002/smj.2572

[27]. Maula, M. V. J., Keil, T., & Zahra, S. A. (2013). Top management’s attention to discontinuous technological change: Corporate venture capital as an alert mechanism.Organization Science, 24(3), 926–947. https: //doi.org/10.1287/orsc.1120.0775

[28]. Lee, P. M., & Wahal, S. (2004). Grandstanding, certification and the underpricing of venture capital backed IPOs.Journal of Financial Economics. https: //doi.org/10.1016/j.jfineco.2003.09.003

[29]. Zollo, M., & Winter, S. G. (2002). Deliberate learning and the evolution of dynamic capabilities. .Organization Science, 13(3), 339–351. https: //doi.org/10.1287/orsc.13.3.339.2780

[30]. Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance.Strategic Management Journal, 28(13), 1319–1350. https: //doi.org/10.1002/smj.640

[31]. Zacharakis, A. L., & Shepherd, D. A. (2001). The nature of information and overconfidence on venture capitalists’ decision making.Journal of Business Venturing, 16(4), 311–332 (2001). https: //doi.org/10.1016/S0883-9026(99)00052-X

[32]. Hellmann, T., & Puri, M. (2000). The interaction between product market and financing strategy: The role of venture capital. .The Review of Financial Studies, 13(4), 959–984. https: //doi.org/10.1093/rfs/13.4.959

[33]. Fernhaber, S. A., & McDougall-Covin, P. P. (2009). Venture capitalists as catalysts to new venture internationalization: The impact of their knowledge and reputation resources.Entrepreneurship Theory and Practice, 33(1), 277–295. https: //doi.org/10.1111/j.1540-6261.2004.00680.x

Cite this article

Zhang,M. (2025). The evolving role of venture capital in entrepreneurship lifecycle: a literature review. Journal of Fintech and Business Analysis,2(3),1-10.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Fintech and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gompers, P. A., & Lerner, J. (2001). The Venture Capital Revolution. .Journal of Economic Perspectives, 15(2), 145-168. https: //doi.org/10.1257/jep.15.2.145

[2]. Hellmann, T., & Puri, M. (2002). Venture Capital and the Professionalization of Start-Up Firms.The Journal of Finance, 57(1), 169–197 (2002). https: //doi.org/10.1111/1540-6261.00419

[3]. Kaplan, S. N., & Strömberg, P. (2003). Financial Contracting Theory Meets the Real World.Review of Economic Studies, 70(2), 281-315. https: //doi.org/10.1111/1467-937X.00245

[4]. Kaplan, S. N., & Strömberg, P. (2004). Characteristics, Contracts, and Actions: Evidence from Venture Capitalist Analyses. .Journal of Finance, 59(5), 2177–2210. https: //doi.org/10.1111/j.1540-6261.2004.00696.x

[5]. Cumming, D. J., & MacIntosh, J. G. (2003). A cross-country comparison of full and partial venture capital exits.Journal of Banking & Finance27(3), 511–548 (2003). https: //doi.org/10.1016/S0378-4266(02)00389-8

[6]. Chemmanur, T. J., Loutskina, E., & Tian, X. (2014). Corporate Venture Capital, Value Creation, and Innovation.The Review of Financial Studies, 27(8), 2434–2473. https: //doi.org/10.1093/rfs/hhu033

[7]. Kortum, S., & Lerner, J. (2000). Assessing the Contribution of Venture Capital to Innovation.RAND Journal of Economics. http: //www.jstor.org/stable/2696354

[8]. Puri, M., & Zarutskie, R. (2012). On the Life cycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms. .The Journal of Finance, 67(6), 2247–2293 (2012). https: //doi.org/10.1111/j.1540-6261.2012.01786.x

[9]. Cumming, D. J., Grilli, L., & Murtinu, S. (2017). Governmental and independent venture capital investments in Europe: A firm-level performance analysis. .Journal of Corporate Finance, 42, 439–459. https: //doi.org/10.1016/j.jfineco.2007.09.003

[10]. Brander, J. A., Amit, R., & Antweiler, W. (2002). Venture-capital syndication: Improved venture selection vs. the value-added hypothesis.Journal of Economics & Management Strategy, 11(3), 423–452. https: //doi.org/10.1111/j.1430-9134.2002.00423.x

[11]. Gompers, P. A., Gornall, W., Kaplan, S. N., & Strebulaev, I. A. (2020). How do venture capitalists make decisions?Journal of Financial Economics, 135(1), 169–190. https: //doi.org/10.1016/j.jfineco.2019.06.011

[12]. Hochberg, Y. V., Ljungqvist, A., & Lu, Y. (2007). Whom you know matters: Venture capital networks and investment performance. .Journal of Finance, 62(1), 251–301. https: //doi.org/10.1111/j.1540-6261.2007.01207.x

[13]. Sorenson, O., & Stuart, T. E. (2001). Syndication networks and the spatial distribution of venture capital investments.American Journal of Sociology, 106(6), 1546–1588. https: //doi.org/10.1086/321301

[14]. David, B., & Ziedonis, R. H. (2010). Corporate venture capital and the returns to acquiring portfolio companies.Journal of Financial Economics. https: //doi.org/10.1016/j.jfineco.2010.07.003

[15]. Schwienbacher, A. (2007). Venture Capital Governance Structures in Europe and the U.S.Journal of Corporate Finance, 13(1), 61-79. https: //doi.org/10.1016/j.jcorpfin.2006.11.001

[16]. Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., & Group, T. P. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement.Academic Journal Guide. https: //doi.org/10.1371/journal.pmed.1000097

[17]. Hsu, D. H. (2004). What do entrepreneurs pay for venture capital affiliation? .Journal of Finance, 59(4), 1805–1844. https: //doi.org/10.1111/j.1540-6261.2004.00680.x

[18]. Dushnitsky, G., & Lenox, M. J. . (2005). When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates.Research Policy, 34(5), 615–639. https: //doi.org/10.1016/j.respol.2005.01.017

[19]. Maula, M. V. J., Autio, E., & Murray, G. C. (2009). Corporate venture capital and the balance of risks and rewards for portfolio companies.Journal of Business Venturing, 24(3), 274–286. https: //doi.org/10.1016/j.jbusvent.2008.10.012

[20]. Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The Impact of Venture Capital Monitoring.Journal of Finance.The Journal of Finance, 71(4), 1591–1622 (2016). https: //doi.org/10.1111/jofi.12370

[21]. Ahlstrom, D., & Bruton, G. D. (2006). Venture Capital in Emerging Economies: Networks and Institutional Change.Entrepreneurship Theory and Practice30(2): 299–320 (2006). https: //ideas.repec.org/a/sae/entthe/v30y2006i2p299-320.html

[22]. Lockett, A., Wright, M., Sapienza, H. J., & Pruthi, S. (2002). Venture capital investors, valuation and information: A comparative study of the US, Hong Kong, India and Singapore. Venture Capital:An International Journal of Entrepreneurial Finance4(3): 237–252 (2002). https: //ideas.repec.org/a/taf/veecee/v4y2002i3p237-252.html

[23]. Bottazzi, L., Da Rin, M., & Hellmann, T. (2008). Who are the active investors? Evidence from venture capital.Journal of Financial Economics, 89(3), 488–512. https: //doi.org/10.1016/j.jfineco.2007.09.003

[24]. Schertler, A., & Tykvová, T. (2011). Venture capital and internationalization.International Business Review, 20(4), 423–439. https: //doi.org/10.1016/j.ibusrev.2010.07.009

[25]. Gompers, P. A., Kaplan, S. N., & Mukharlyamov, V. (2016). What do private equity firms say they do?Journal of Financial Economics, 121(3), 449–476. https: //doi.org/10.1016/j.jfineco.2016.06.003

[26]. Colombo, M. G. A., & Shafi, K. (2016). Swimming with sharks: Post-investment value-added, behavioral homophily, and venture capital investment performance.Strategic Management Journal, 2016, 37(11): 2307–2322. https: //doi.org/10.1002/smj.2572

[27]. Maula, M. V. J., Keil, T., & Zahra, S. A. (2013). Top management’s attention to discontinuous technological change: Corporate venture capital as an alert mechanism.Organization Science, 24(3), 926–947. https: //doi.org/10.1287/orsc.1120.0775

[28]. Lee, P. M., & Wahal, S. (2004). Grandstanding, certification and the underpricing of venture capital backed IPOs.Journal of Financial Economics. https: //doi.org/10.1016/j.jfineco.2003.09.003

[29]. Zollo, M., & Winter, S. G. (2002). Deliberate learning and the evolution of dynamic capabilities. .Organization Science, 13(3), 339–351. https: //doi.org/10.1287/orsc.13.3.339.2780

[30]. Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance.Strategic Management Journal, 28(13), 1319–1350. https: //doi.org/10.1002/smj.640

[31]. Zacharakis, A. L., & Shepherd, D. A. (2001). The nature of information and overconfidence on venture capitalists’ decision making.Journal of Business Venturing, 16(4), 311–332 (2001). https: //doi.org/10.1016/S0883-9026(99)00052-X

[32]. Hellmann, T., & Puri, M. (2000). The interaction between product market and financing strategy: The role of venture capital. .The Review of Financial Studies, 13(4), 959–984. https: //doi.org/10.1093/rfs/13.4.959

[33]. Fernhaber, S. A., & McDougall-Covin, P. P. (2009). Venture capitalists as catalysts to new venture internationalization: The impact of their knowledge and reputation resources.Entrepreneurship Theory and Practice, 33(1), 277–295. https: //doi.org/10.1111/j.1540-6261.2004.00680.x