1 Introduction

The United Kingdom is considered an important trading entity [6]. In the past ten years, the UK economy has gone through a series of fluctuations and changes. Besides the changes during the pandemic period, those fluctuations also include growth in GDP, expansion of services, manufacturing industries, and developments of small businesses, and so on [19]. At the same time, the UK has established many economic policies and developed many financial institutions. In this sense, the past decade is regarded as a period of research significance of changes and developments in the UK economy. In this dissertation, the UK economy over the past ten 22years will be fully studied in order to have a more comprehensive view of ‘to what extent have economic policies affected small businesses in the UK in the past 10 years.

Under the background of today's economic globalization, small business is playing an indispensable and vital role in contributing to a country’s economic development, and small enterprises and businesses are playing important roles in the economic life of all countries in the world. In speaking of their specific contribution to economic development and society, they create huge advantages for creating job opportunities, promoting economic growth, and driving technological innovation, and so on. In the UK, small businesses are vital to economic development.

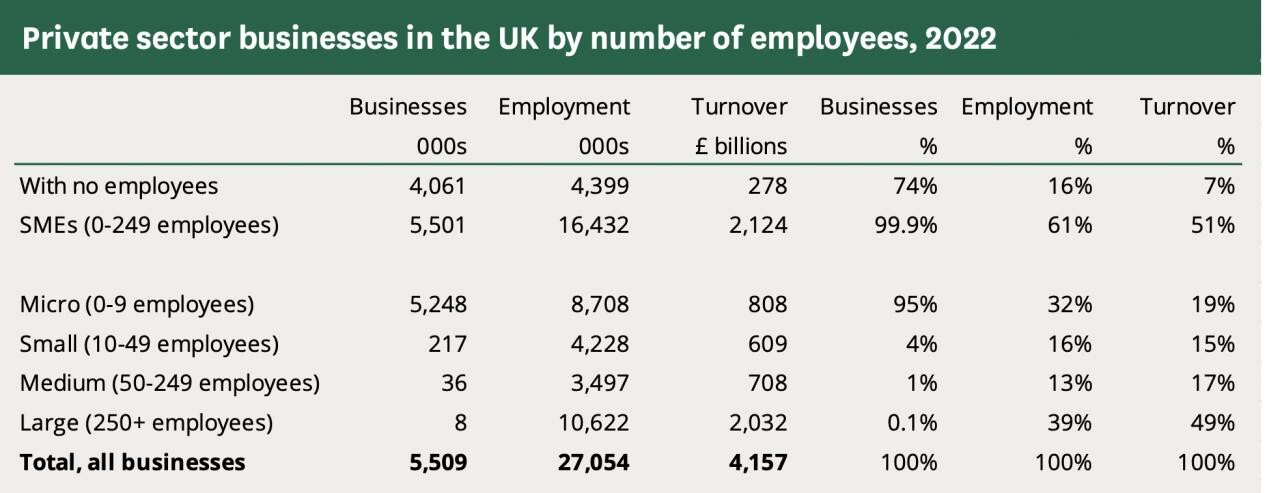

Figure 1. BEIS, Business Population Estimates, 2022 (GOV.UK, 2022)

As the figure above shows, there were 5.5 million SMEs in the UK in 2022, which was 99.9% of all businesses, indicating that more than 99% of businesses are small or medium-sized businesses (SMEs), employing 0-249 people. Hutton reports that SMEs (small or medium-sized businesses) accounted for 61% of UK employment and contributed 2.124£ in turnover.

Nevertheless, small businesses and enterprises also face many challenges and obstacles in the process of planning and developing, such as financing difficulties, high market risks, or terrible business environment. To address and alleviate these challenges or improve small businesses’ growth, governments should step up support for small businesses, providing more convenient financing channels, boosting their developments, and establishing the right and effective operating ways for them.

Generally, economic policy has an important impact on the operation and development of small enterprises and businesses. Appropriate and continuous policies make up for the shortcomings of the development of enterprises. Government support for enterprises can effectively make up for the abovementioned shortcomings of the development of small enterprises, enhance the competitiveness of enterprises, and help promote the healthy development of the regional economy for small businesses. Appropriate tax breaks and financing support policies can be effective measures to ease the operating pressure and difficulties of small enterprises, providing them with a nice and healthy development environment. At the same time, policies that are designed to encourage innovation can encourage small enterprises to upgrade technology, and product replacement, and improve their brand images or market values. As a result, policymakers should fully consider the actual needs of small enterprises, formulate economic policies conducive to the development of small enterprises, and in order to promote economic growth and the stability of social employment.

On the other hand, small businesses themselves should constantly improve their management level and innovation ability with political supports and regulations as well. However, economic policies exert negative or detrimental effects on the development and operations of small businesses as well as they exert positive effects. Those effects cannot be regarded as avoidable or negligible. To elaborate on this, when the uncertainty of economic policy has increased, small businesses will slow their operating efficiency, manage the speed and efficiency of production and operation, and control the cost of raw materials, wage costs, and management expenses of enterprises to a certain extent, accordingly for their consideration of risk avoidance. In this sense, the economic policies are

not beneficial or supportive to the development, growth, or survival of small businesses [34].

Therefore, it’s clear that the government can regulate the market competitiveness of small businesses through various economic policies, thus affecting the development of small businesses.

Economic policy is the external factor affecting the environment of enterprise development, and enterprise is the micro-subject of macroeconomic policy. The external environment is important for the development of enterprises, and a good economic policy can provide guarantee and support for the development of enterprises. This is especially true for small businesses whose scales are relatively small. As a result, it is important to research and discuss the impacts and effects of economic policies on small businesses and the extent of their effects.

In this dissertation, the importance of small businesses, the implications of economic policies, and the relationship between small businesses in the UK and the economic policies implemented by UK governments and organizations will be deeply discussed in order to explain the important position of small businesses and economic policies in the modern economy in the UK, making suggestions for future research at the same time.

2 Research Review

2.1 Economic Features of Small Business

2.1.1 Roles and Characteristics of Small Businesses

Speaking of the role of small businesses, the smaller enterprise and its role in the economy are regarded as essential by all, and smaller firms and businesses are now the focus of political, business, and management research and are popularly regarded as the preferred vehicle for the generation of the enterprise economy [30]. Small businesses, understood as groups of companies under common ownership, where personal and operational ties exist among the member firms are an important feature of the global economy [25].

A small business is a corporation, partnership, or sole proprietorship that has a lower number of employees and lower revenue than larger businesses [5] and it is defined as a business that has fewer than 500 and operates independently of larger corporations. They are typically privately owned and operated, having a single owner or a small group of owners. most small business owners are very different from the entrepreneurs that economic models and policymakers [21]. Most small businesses are concentrated in a small number and provide standard services to local customers, and they are a very large fraction of the population of employer firms. There are several examples of small businesses, including local restaurants, online stores, and bakeries. small businesses are classified into three categories: Sole Proprietorship (a business owned and operated by one person. The sole proprietor is personally responsible for all business debts and liabilities); Limited Liability Company (a type of business structure that combines features of both corporations and partnerships. It limits the personal liability of the owners and offers pass-through taxation); Corporation (a separate legal entity owned by shareholders. This type of business structure offers limited liability for its owners, but is subject to double taxation). As there are few sellers in the small businesses, the market structure of the small business is an oligopoly (a market structure with a small number of firms).

There are differences between a startup and a small business: the term startup refers to a company in the first stages of operations. When distinguishing small and large businesses, business ownership is the key factor, and the ownership of large organizations is usually distanced from its management and control [8]. The major differences have been noted by, among others, as relating to business objectives, management style, and marketing and operational practices [8]. It is now widely accepted that the particular characteristics of small firms require a different appreciation of management understanding and that the methods and techniques in the corporate sector are not applicable, valid, or relevant [13].

Speaking of the difference between large businesses and small businesses, the main difference is the way of management, These dominant and consistent psychological characteristics of the main actors in small firms have been repeatedly reported as manifesting themselves in a distinct managerial style, and the managerial style is autocratic, egocentric, impulsive and often unpredictable. It often involves personal and highly idiosyncratic [26].

The central contrast between the informal, particularistic management style of the small firm and the more formal, bureaucratic administration of many large enterprises is managing decision- making. That is, For many small firms, management decisions are made in the context of survival and operation necessity, rather than growth and business development, and the internal process and unpredictable nature of small businesses are complex and hard to explain [14].

Large firms may well be the consequence of the growth of small firms but, as discussed above, management principles developed for application in corporate contexts are unlikely to be useful in the smaller enterprise [8].

When characterizing small businesses and small firms, financial variables should be considered. It suggests that small firms (i) do not control, in the aggregate, a large volume of assets, (ii) use more debt financing (especially current debt) (iii)rely more on internal funds and loans from stockholders to finance operations, and (iv) do not use much external quality relative to larger firms [8].

2.1.2 Entrepreneurship in Small Businesses

Small businesses are frequently known for their adaptability and flexibility in the market. There is a close relationship between entrepreneurship and small business. In the entrepreneurship literature, these individuals often are characterized as being zealous champions and a product or a service they believe in, AS a result, they are more willing to take (what others would perceive as) risks than managers of larger businesses or organizations. This characterization would hold true if the structure of smaller firms permits a degree of risk-taking and that is not possible in larger enterprises. Therefore, less risk-averse managers (who is not believed to an entrepreneur) will tend to be concentrated in smaller business, with the effect that those businesses are more likely to be risky. Entrepreneurship describes conditioning on the part of both established enterprises and new businesses [22]. Some of the key determinants of entrepreneurial intention in the UK are related to policy factors, like “governmental and political factors” and “basic education and training” in entrepreneurship. In this way, the study can help politicians elaborate the policies related to entrepreneurship, implying an increase in entrepreneurial intentions in a country and consequently implications for socio-economic development.

A large number of current research findings have shed many new lights on an area regarding entrepreneurship in small businesses that have been characterized by stereotypical interpretation and anecdotal evidence [15]. Entrepreneurs are men who have failed in the traditional and highly structured roles available to them in society, and what is unique about them is that they have founded an outlet for their creativity by making out of an undifferentiated mass of circumstances a certain uniquely their own: a business firm. Usually, small business entrepreneurs regarded themselves as disadvantaged by politicians, large businesses, banks, and local authorities, and misunderstood by the public at large. To elaborate on an entrepreneur’s specific skills applied to small businesses, entrepreneurship, and ownership are largely differentiated by their skills, and entrepreneurship skills incorporate innovation, risk-taking, tactical planning, negotiation, troubleshooting, and interpersonal communication. While the ownership consists of objective setting, policy formulating, strategic planning, organizing, coordinating, formal communication, monitoring, and stabilizing [9].

2.2 Specific Economic Policies in the UK

2.2.1 Small Business Research Initiative (SBRI)

SBRI program, the policy of small business research initiative, is a government pre-commercial procurement program that was implemented in 2001 with small businesses in the UK. It is based on the Small Business Innovation Research Program (SBIR) which was established in the United States in 1982, aiming to promote innovative activities by providing solutions to the public sector and government contracts to MSMEs (micro, small, and medium-sized enterprises) and their partners. SBRI covers full costs and does not require match funding from another source, factors which are appealing to small companies. It incentivizes innovation by funding the development of products and solutions based on new technologies and commercialization. Furthermore, it provides new technical solutions for government departments and their agencies to improve the efficiency of their services and operations. Generally, in this program, SBRI offers an evaluation of the feasibility or viability of the small business program, hence providing funding for the development of technologies and providing pieces of advice or support for the commercialization of the small business [35].

2.2.2 Research and Innovation, UK (UKRI)

UKRI is a UK government agency responsible for promoting and funding innovative research and skills training. The agency was established on November 1, 2018, replacing

The original Research Councils in the UK. It aims to coordinate and integrate UK research more effectively, funding to promote innovative research in various fields [28]. First, UKRI provides financial support to small businesses that can be used to fund innovative research and development. This can help small businesses drive innovation, improve product quality and efficiency, and thus gain a greater competitive advantage in the market. Secondly, UKRI also provides skills training and support, which can help employees of small businesses improve their skills and capabilities, thereby improving the technical level and innovation capacity of the enterprise. In addition, UKRI also promotes industry-university-research cooperation, providing more cooperation opportunities and resources for small businesses, which can help small businesses better carry out innovative research and development, and achieve greater success in the market.

2.2.3 Business Finance Schemes

The UK Government, in collaboration with the private sector, has developed a series of business finance schemes, including the Small Business Loan Guarantee Scheme and the Early Growth Fund, to improve the financial environment for small businesses, helping small businesses get access to finance and promote their development. In order to reach the loan guarantee, The Small Business Loan Guarantee Program provides loan guarantees to small businesses that have a business plan but have difficulty obtaining loans, with the government providing a 75% guarantee and the borrower having to pay a guarantee fee to the government. In addition, the UK government has established venture capital funds and business incubation funds to provide financial and technical support to small businesses to help them grow. Speaking of tax incentives and financial subsidies, the UK government provides tax incentives and financial subsidies to small enterprises, such as reducing corporate income tax and providing research and development subsidies to reduce the financial pressure on small enterprises and improve their financing ability. Economic policies implemented with small businesses also focus on strengthening the cooperation between financial institutions and small enterprises: The UK government encourages the cooperation between financial institutions and small enterprises, and promotes the information exchange and business cooperation between financial institutions and small enterprises through the establishment of bank-enterprise cooperation platforms and financing training, so as to improve the financing effect of small enterprises.

2.2.4 Simplified Tax System

The tax system is simplified in the UK to a large extent. To elaborate on this, it lowered the corporate tax burden. Repealing the increase in the corporate tax rate to 25 percent plan and maintain it at its current level of 19 percent, the lowest tax rate in the G20 which is the premier forum for international economic cooperation. In addition, it unified the tax system for domestic and foreign enterprises. Britain will unify the tax rules of domestic and foreign enterprises, foreign enterprises and domestic enterprises in

Tax equality was achieved, and tax incentives for foreign-funded enterprises were eliminated. Furthermore, it adjusts the corporate income tax rate. For businesses earning under £50,000, corporation tax will remain at 19%; For businesses earning between £50,000 and £250,000, corporation tax, gradually increase to 25%; For businesses earning more than £250,000, the corporation tax rate will increase from 19% to 25% [2].

2.2.5 Entrepreneurship Education Scheme in the UK

The UK government attaches great importance to promoting entrepreneurship education and building an entrepreneurial culture. In March 2006, the UK government set up the "School Entrepreneurship Education Mechanism" to provide entrepreneurship education for primary and secondary school students and college students, so as to encourage them to start their own businesses after graduation. The UK government allocated special funds for the establishment of more than 200 text-interest pilot clubs for students between the ages of 11 and 14, funded 60 million pounds for entrepreneurship education for students between the ages of 14 and 19, established more than 20 entrepreneurship summer camps, and conducted entrepreneurship training for 1,000 students across the UK every year, and also set up entrepreneurship scholarships for UK universities [27].

2.3 Economic Policies Implemented with Small Businesses

2.3.1 Classification of Economic Policies

There are several economic policies implemented with small businesses, and these policies can be divided into different categories based on their different functions. Speaking of economic policies implemented with small businesses, there is Fiscal policy which refers to the government's policy of influencing economic growth and employment by adjusting fiscal expenditure and taxation. In addition, there are monetary policy, industrial policy, and employment policies. These policies are all affecting small businesses to a certain degree. For monetary policy, it refers to the central bank's policy of influencing economic growth and small changes by controlling the money supply and interest rates. The industrial policy refers to government policies that promote economic growth and development by supporting certain industries or industries, and the employment policy refers to the government's policies to promote employment and reduce unemployment by supporting employment, vocational training, unemployment insurance, and other measures [32].

Economic policies can also be divided into macroeconomic policy and microeconomic policy. Microeconomic policy and macroeconomic policy are different in the object of regulation, the focus of regulation, the problem to be solved, the research method, the central theory, and so on [21]. The clear message from the small firm community that comes across from so much of the research evidence is the creation of a suitable macroeconomic framework within which enterprises can prosper. Small businesses and firms seek an environment in which there are low inflation, low-interest rate, steady economic growth, and a high level of aggregate demand.

Then, it is the ability of governments to deliver these macroeconomic conditions which is the main influence on its judgment of competence by the small business sector. [8]. In addition, there is a need for government to promote greater clarity and continuity in articulating policy towards small firms that have the ambition to grow and embrace the innovation and risk- taking strategic management practice, and those that do not.

2.3.2 Distinguishing Economic Policies with Other Policies

Economic policies and other social policies implemented with small businesses are related to different issues, including different funding gaps, operating scale, or sanitation of the shops. Hence, they are designed with different purposes and distinct content. For their purposes, The purpose of economic policy is to regulate economic development and keep the national economy running successfully, while other policies are aimed at maintaining social stability, promoting cultural prosperity, and protecting the ecological environment. For their content, Economic policies mainly involve finance, taxation, currency, industry, prices, consumption reduction, and so on, but other social policies cover social, cultural, ecological, and other fields.

2.3.3 The Objectives of the Implementation of Economic Policies with Small Businesses in the UK

Most governments, irrespective of their political complexion and global position, endorse the need for a small business policy. In the UK, it is now such an established feature of the political landscape that all the main political parties were at pains to demonstrate their enthusiasm for supporting small business and enterprise development [12]. It is necessary for the government to create the right policies and incentives for the formalization of small businesses, taking into account the needs and interests of small companies and their workers. These efforts need to be further complemented by economic policies to improve inspection and raise awareness among employers and workers on the obligations and benefits of formalization. Policy initiatives designed to counteract the effects of resource and positional disadvantage may vary and have attracted considerable criticism (Storey, 1994; Deakins, 1999) Given the role of small businesses in the economy, there can be no justification for ignoring the interest of small business in the composition and legislation, it has been charged with the mandate to improve the delivery, quality, and co-ordination of small business interests, assistance, training, and support.

3 Discussion / Development

In the previous literature review section, the economic characteristics of small businesses and a series of economic policies related to small businesses implemented in the UK were reviewed, including the Small Business Research Initiative policy, the Royal Research Institute policy, corporate financing plans, and simplified tax systems. The research question is to what extent economic policies have influenced the development of small businesses in the past 10 years.

Therefore, in the discussion section, we first analyze a series of problems faced by small businesses in the development process. Next, we analyze how some economic policies implemented in the UK have affected small businesses. The third part of the discussion analyzes to what extent these policies have solved the problems faced by small businesses, has it had a positive or negative impact on the development of small businesses? Finally, the study looks forward to the future development direction of UK policies for small businesses.

It is worth mentioning that the discussions and papers focus on the impact of economic policies on small businesses over the past decade, rather than the impact of economic policies introduced over the past decade. Therefore, the policies mentioned below are older than the past decade, but they still affect small businesses because they are continuous.

3.1 The Problems Faced by Small Businesses in the Development Process in the UK

3.1.1 Funding Gap (Financial Gap) Problem

Normally, the financial gao occurs when there is a limited supply of funds and capital for the start and growth of a small business. Small firms and businesses have traditionally encountered problems when approaching providers of finance for funds to support fixed capital investment and to provide working capital for the firm’s operation [36]. The small business finance market is characterized by risk and uncertainty regarding future conditions, and one of the factors affecting the financial gap phenomenon is information asymmetry. The information is distributed asymmetrically between the bank--the financial provider-- and the firm (finance recipients) There are two types of financing gaps that mainly occurred in the small businesses' financial market. Debt financing refers to taking out a conventional loan through a traditional lender like a bank. Equity financing involves securing capital in exchange for a percentage of ownership in the business. And It appears that only a minority of small business managers encounter a debt finance gap, though a more serious problem is the presence of a significant and widespread equity financial and funding gap [36].

3.1.2 Highly Competitive Pressure Problem

With the development of globalization and digitalization, the market competition of small businesses is becoming increasingly fierce, and small businesses are facing huge and inevitable competitive pressure from both domestic and foreign counterparts. Due to their small scale, relatively weak technical level, and financial strength, small enterprises and businesses are often at a disadvantage in market competition [17]. With the increasingly tight labour market and rising wages in the UK, the labor costs for small businesses are also increasing, which makes the operation cost of small enterprises rise and reduces their market competitiveness.

3.1.3 Inadequate Intellectual Property Protection

Although the UK's intellectual property protection system is relatively complete, there are still some problems and concerns. Small enterprises may face the risk of intellectual property rights being infringed in the process of R&D and innovation, which has a certain impact on their technological progress and competitiveness. For some small enterprises, their leaders lack the scientific understanding of intellectual property rights, focusing on the management of tangible assets of enterprises, but pay insufficient attention to the management of intangible assets such as intellectual property rights, and fail to recognize the potential economic benefits brought by intellectual property rights. Moreover, small businesses have insufficient intellectual property skills. Many enterprises on the specific rights and abilities of intellectual property rights, the use of methods, protection measures and so on can really grasp, leading to the use of its intellectual property rights skills are badly lacking.

3.1.4 High Employee Turnover Rate Problem

Due to the relatively small size and benefits of small businesses, staff mobility is high. (Ding, 2021) This makes small enterprises face greater challenges in talent recruitment, training, and management and also has a certain impact on their business stability and development. Besides that, there are many reasons for the high employee turnover rate in small businesses. First, small businesses generally offer less generous pay packages than large companies, which can be unattractive to aspiring employees. Second, small businesses have limited opportunities for career development, and employees may feel unable to achieve their career plans. In addition, the corporate culture of small businesses may not be strong enough, and employees may feel that they do not fit in with the company and lack a sense of belonging. Finally, small businesses may not have a sound staff training and promotion mechanism, and employees may feel that there is no development opportunity and choose to leave [16].

3.2 How Do Some Important and Dominating Policies Affect the Development of Small Businesses in the UK?

The abovementioned economic policies can be divided into three different categories based on their different purposes and characteristics. Generally, they can be divided into financial support, innovation incentives, and planning an entrepreneurial environment. For Research and Innovation, UK (UKRI) and Small Business Research Initiative (SBRI) policies, these policies are designed to improve and facilitate innovative behaviors of small businesses. Apart from that, the business finance scheme and simplified tax system are designed to offer financial support and to improve the economic development of small businesses. The policy of the Entrepreneurship education scheme is divided into the third category which is designed to create a Full entrepreneurial environment for small businesses.

3.2.1 The Implication of the SBRI Scheme

Small Business Research Initiative scheme has achieved remarkable results: For governments, for every £1 funded by the SBRI, at least £2.40 will be returned to the UK economy. The increase in economic benefits for the funded enterprises is about 1.5 to 4 times the cost of the public sector subsidy. For the government public sector implementing the SBRI, funding has effectively improved public services and significantly reduced service costs. There are true cases of small businesses affected by SBRI policies: Through the SBRI, the health department funded a solution from a small business-- Hygiene Pro Clean to develop a system that can quickly disinfect ambulances, reducing the time and cost of the operation by 86%. Another feasible example is the Lontra business, which submitted an innovative project to the SBRI scheme, to reduce the energy consumption of a new air compressor by more than 20% through a revolutionary innovative design. After successful development, it has taken a place in a global market worth £50 billion (Padilla, 2016). Those cases indicate that the SBRI scheme plays a vital role in dominating the development of small businesses, as SBRI strengthens enterprises' continuous innovation awareness and ability. On the other hand, there are still some potential drawbacks to the implementation of the SBRI program. It is a serious concern that SBRI has been significantly underutilized. The government should improve its use of SBRI, and the lack of clarity regarding the leadership, ownership, funding, and governance of the scheme may have contributed to SBRI not fulfilling its potential. At the same time, It is notable that several SMEs within the Academy’s network were unaware (Department of Business, Energy and Industrial Strategy, 2017). The countermeasure that could be taken to improve the situation is establishing strong partnerships between the participating government departments or agencies, and small businesses. Besides that, it is essential that the necessary support and training are provided to ensure public sector participants are able to fulfill the role of intelligent leaders, hence encouraging participation and effective uses.

3.2.2 The Effects of Financing Scheme on Small Business

Small businesses often encounter financing difficulties in the process of development, which is called funding gap or financial gap. Mainly, this is caused by several factors, For first, poor financial health is the leading factor for the funding gap, as small businesses often lack adequate financial records and transparent financial statements which leads to information asymmetry, making it difficult for banks and other financial institutions to get assess to their credit, worthiness and ability to repay. Furthermore, small enterprises face greater competitive pressure and often need more financial support to enhance their competitiveness. However, due to its small scale and large risk, it is difficult to obtain sufficient financing. The UK government has introduced a variety of policies for small businesses to resolve the funding gap problem. including loan guarantees, financial subsidies, venture capital, and credit policy. provides a variety of financing channels for small businesses, including bank loans, venture capital, private equity, and so on. This gives small businesses access to the capital they need to achieve their development and growth goals; The loan Guarantee policy provides loan guarantees to small businesses, making it easier for them to obtain bank loans. This reduced financing costs and risks for small businesses to a certain extent; The UK government has set up a dedicated Small Business Investment Fund to support innovative and high- growth potential businesses (Patel, Tanwar, and Gupta, 2020). This provides more financial support to small businesses and promotes their innovation and growth. The UK Government's economic policy also increases business productivity. by providing financial subsidies and technical support, small enterprises can improve production processes, improve product quality, and reduce costs, thereby enhancing their market competitiveness. To a certain extent, UK economic policy has achieved remarkable results in helping small businesses finance and largely reduce the funding gap for small businesses in the past ten years, In the future. the UK government is expected to continue to improve economic policies, provide more financing channels and financial support for small businesses, and promote their development and growth [39].

The potential drawback of this financing scheme is that small businesses are likely to become overly dependent on government financing options, leading to the consequence of lack of awareness about government schemea and high interest rate.

3.2.3 The Effects of a Simplified Tax System

Generally, Taxes reduce profits and earnings which are the primary source of financing and development. As a result, small businesses will have insufficient capital and money for increasing wages, capital investment, and expansion opportunities. And for small business owners, profit levels are not always consistent or predictable year to year under a large tax burden. Simplifying the tax system reduces the tax burden on small businesses, reduces the amount of tax paid by taxpayers, and improves the profit level of enterprises. it also reduces administrative approval procedures for small businesses and improves their operational efficiency. In addition, the simplified tax system can improve the competitiveness of small businesses, so that enterprises have more capital to expand and invest and promote the development of enterprises.

In conclusion, simplifying the tax system has a positive impact on small businesses, which can improve their efficiency and competitiveness, and provide more opportunities for the development of small businesses. Hence dominates the development of small businesses [29].

3.3 The Effects of Economic Policies on Small Businesses

Economic policies not only play an indispensable role in resource distribution, industry scale, and even world competitiveness, but they also have impacts on the developments, scales, and survivals of small businesses, and those impacts can be divided into supportive and detrimental.

3.3.1 The Positive Effects Brought by Economic Policies

Without discussing one particular policy, there are several positive effects of economic policies on business and enterprise in the UK. First and foremost, the economic policies alleviate the difficulty of small business financing, which highly prevents the financial and funding gap for small businesses. As a result, the operating costs of small enterprises are greatly reduced, and they can better operate and develop their enterprises. The financing scheme published in the UK illustrates this point well since the financing scheme largely reduces the financing gap and difficulties for small businesses. Another general positive effect of economic policies is that with the encouragement of economic policies, small enterprises can better expand and improve the size of small enterprises. For small businesses with larger scales, they can reap the benefits of reduced general costs. The larger scale of production will reduce the cost both for goods and services, leading to a new competitive advantage for the small business; The brand effect of small enterprises will also increase rapidly, thus increasing the market share of small enterprises themselves; Through the expansion of scale supported by economic policies small enterprises can also obtain more research, investment, and technical resources, thus promoting technological innovation for the small business. The policies of the Small Business Research Initiative, UKRI conform to this advantage.

The third positive effect brought by the economic policy on the development of small businesses is that the government's economic policies can help small enterprises establish a harmonious business environment and system, helping small enterprises to reduce illegal competition pressure and unfair business operating methods. Therefore, economic policies protect the rights and interests of small enterprises. In this sense, the entrepreneur education policy in the UK has a supportive effect on small businesses.

3.3.2 The Negative Effects of Economic Policies

Apart from the positive effects brought by economic policies, there are still negative effects. Economic policies can also lead small businesses to become overly dependent on government or political support, thus leading to a lack of self-development motivation and self-regulating ability. In addition, overly-supportive economic policy leads to excessive small business expansion, intensifying market competition which causes market chaos and risks. What’s more, the uncertainty of the government's economic policies may also cause the marketing or operating strategies of small businesses to be disturbed (Saud Asaad Al-Thaqeb, Barrak Ghanim Algharabali, 2019 ). The financing scheme policy may have negative effects. Therefore, small businesses should avert being over-dependent on such financing schemes, developing their own awareness of the financing issue.

3.4 Other Influencing Factors on the Development of Small Businesses in the UK

3.4.1 Skill Shortage

The Federation of Small Businesses found that 22% of small businesses reported a shortage of skilled workers as a "stumbling block to growth in the coming year," with the information, communication, and technology industries reporting the largest skill gap. 38% of information and communication technology companies indicate that they find it difficult to find employees with the appropriate skill level to work. Many British industries said that in the past two years, with the decline in the number of EU immigrants after the Brexit and the decline in the total labor force participation rate since the COVID-19 pandemic, they are trying to cope with the shortage of labor force and skills. The Bank of England stated this month that it is difficult for workers to find jobs that match their skill levels, which will lead to an increase in unemployment rates until 2026. Bank of England rate setter Jonathan Haskel said that the deteriorating ability of the labor market to match workers with suitable jobs may mean that interest rates must remain high for a longer period of time. Tina McKenzie (2023) from FSB stated that it is difficult for companies to recruit employees with "all skill levels", and she called on the government to maintain an apprenticeship tax to cover most of the company's training costs.

3.4.2 Economic Cycle

There is fierce competition in the UK market, with different industries and companies competing for market share and consumers. For small businesses, facing fierce market competition is an important challenge. Enterprises need to differentiate themselves from competitors and attract and retain consumers through effective marketing strategies. The marketing activities of small businesses in the UK are also influenced by economic cycles. The fluctuations in economic cycles can directly affect consumer purchasing intentions and purchasing power, thereby affecting the effectiveness of marketing and sales. During periods of economic prosperity, consumer purchasing power increases and market competition intensifies; During periods of economic recession, consumer purchasing power decreases and market competition weakens.

3.5 The Outlook for Future Economic Policy in the UK

Highly developed small enterprises and businesses are an important guarantee for a country’s economic resilience and an important foundation for achieving common prosperity. It is necessary to further strengthen efforts to create a good development environment for small enterprises and form a virtuous interactive cycle between enterprise development and economic development. In the future, there are still some economic policies are needed to be improved, adjusted, or established to ensure the sound development of small enterprises

3.5.1 Help Small Businesses Expand Their Markets

UK government should set up relative policy to encourage and support large enterprises and small enterprises to establish market allocation of resources as the foundation, stable raw material supply, export, sales, technology development, and technological transformation cooperation, Hence driving and promoting the development of small enterprises and businesses [4].

3.5.2 Encourage Small Business Investment

Enterprises are encouraged to invest through preferential policies such as eliminating taxes, and refunds, reducing tax rates, and converting a certain percentage of profits into investment funds. In addition, the UK government should influence the direction and scale of investment by encouraging or restricting the development of certain industries.

3.5.3 Solve Insufficient Intellectual Property Protection Problem

In order to protect the intellectual property of small businesses, the UK government should increase penalties for violations of intellectual property rights, raise the cost of violations, and strictly investigate the responsibility of infringer. In addition, the government should encourage small enterprises to strengthen independent innovation, actively apply for patents, trademarks, and other intellectual property rights, and improve the quantity and quality of independent intellectual property rights. At the same time, the government should strengthen intellectual property service guarantee, and provide intellectual property consultation, identification, evaluation, and other services to provide comprehensive intellectual property protection support for small enterprises and businesses. Intellectual property rights create huge benefits to small businesses: First, intellectual property rights can provide legal protection for small businesses. Different types of intellectual property such as patents, trademarks, and copyrights can give small businesses exclusive rights to their innovations. This enables small businesses to safeguard their rights and interests through legal means in the face of unfair competition such as counterfeiting and piracy. Second, intellectual property rights help to enhance the market competitiveness of small enterprises. By filing a patent, a small business can protect the results of its technological innovation and gain a technological lead in the market. Trademarks and copyrights can enhance the brand image of a small business and increase market recognition of its products or services. All these will help to enhance the competitiveness of small enterprises in the fiercely competitive market environment [3].

3.5.4 Reduce Employee Turnover Rate

In order to reduce the staff turnover rate for small businesses, the government should encourage small businesses to provide a good working environment for their staff and workers, including a comfortable working place and a good working atmosphere, and reasonable working hours can improve employee satisfaction and work motivation. Meanwhile, providing career development opportunities, as well as training and promotion opportunities for employees, can increase employee loyalty to the company. A low employee turnover rate increases the creativity, flexibility, and adaptability of the workforce. New hires could provide fresh perspectives and perspectives, which can promote healthy competition in a stagnant, inflexible team [33].

4 Conclusion

The core issue of the research is to what extent economic policies have influenced small businesses in the UK over the past decade. Focusing on this research question, the literature review section reviewed the characteristics of small businesses, mainly their role and entrepreneurship.

Subsequently, the study presented specific economic policies related to small businesses in the UK, including small business research initiatives, research and innovation, business financing schemes, simplified tax systems, and the UK's entrepreneurship education program, The final section of the literature review summarizes the classification of economic policies for small businesses, as well as the differences between economic policies and other policies, while emphasizing the economic policy objectives for small businesses in the UK.

In order to better analyze the impact of economic policies on small businesses over the past decade, in the discussion section, the study first analyzed the problems faced by small businesses in the UK, and then explored to what extent economic policies have helped small businesses solve the problems they encountered. Through analysis, it was found that the main problems faced by small businesses in the UK include funding shortages, highly competitive pressure, inadequate intellectual property protection, and high employee turnover. In the second part of the discussion, three specific policies were listed and their roles in the development of small businesses were analyzed in detail. Based on the above analysis, the study summarized that economic policies have produced a series of positive impacts and a small part of inevitable negative impacts. At the same time, the study critically believes that economic policies are only one of the many factors that affect the causal development of small businesses, The development of small businesses in the UK is inevitably affected by skill shortages, while also facing many factors such as economic cycle fluctuations.

Economic policies have influenced the development of small businesses, but economic policies are not the only dominant factor. Finally, based on the above analysis, the study provides an outlook on the future economic policies for small businesses in the UK.

The main conclusions drawn from the study can be summarized as follows: the economic policies in the UK exert both negative and positive effects on small businesses depending on policies.

Generally, the economic policies have improved the financing, operating, and innovative difficulties. Moreover, the economic policies not only have such huge implications on small businesses, but they also exert effects on society and the government. For the society, the impact of economic policy on society has many aspects, such as resource allocation, economic structure, and international economic relations. Economic policy can be implemented through prices taxes, and other means to affect the allocation of resources, thus affecting the development of the social economy. Moreover, economic policies can affect international economic relations through international trade, international finance, and other means, thus affecting social and economic development. Future research should engage efforts in researching how to improve the existed economic policies, and to explore policies suitable for small businesses.

References

[1]. Acs, .J. and Audretsch, D.B. (2008) ‘Innovation in large and small firms: An empirical analysis’, Entrepreneurship, Growth and Public Policy,pp.3–15. doi:10.4337/9781035305421.00007.

[2]. Adam, S., Browne, J., Phillips, D. and Roantree, B. (2020). Frictions and taxpayer responses: evidence from bunching at personal tax thresholds. International Tax and Public Finance. doi:https://doi.org/10.1007/s10797-020-09619-0.

[3]. Ahmedova, S. (2015). Factors for Increasing the Competitiveness of Small and Medium- Sized Enterprises (SMEs) in Bulgaria. Procedia - Social and Behavioral Sciences, 195, pp.1104–1112. doi:https://doi.org/10.1016/j.sbspro.2015.06.155.

[4]. Albaz, A., Dondi, M., Rida, T. and Schubert, J. (2018). Unlocking growth in small and medium enterprises | McKinsey. [online] www.mckinsey.com. Available at: https://www.mckinsey.com/industries/public-sector/our-insights/unlocking-growth-in-small-and- medium-size-enterprises.

[5]. asq.org. (2021). What is a Small Business? | ASQ. [online] Available at: https://asq.org/quality- resources/small-business.

[6]. Britannica (2019). United Kingdom - Trade | Britannica. In: Encyclopædia Britannica. [online] Available at: https://www.britannica.com/place/United-Kingdom/Trade.

[7]. Bager, T.E. (2021) ‘The short-term bias in policy programs for small business: Exploring discontinuation of a successful growth program’, Journal of Small Business and Enterprise Development, 28(6), pp. 856–872. doi:10.1108/jsbed-12-2020-0448.

[8]. Beaver, G. and Prince, C. (2004) ‘Management, strategy and policy in the UK small business sector: A critical review’, Journal of Small Business and Enterprise Development, 11(1), pp. 34–49. doi:10.1108/14626000410519083.

[9]. Jennings, P., & Beaver, G. (1997). The Performance and Competitive Advantage of Small Firms: A Management Perspective. International Small Business Journal, 15(2), 63-75. https://doi.org/10.1177/0266242697152004

[10]. Binks, M. and Ennew, C. (1996) ‘Financing small firms’, Small Business and Entrepreneurship, pp. 110–130. doi:10.1007/978-1-349-24911-4_6.

[11]. Chen Junzhu. (2019). Research on Intellectual property financing mechanism of British smes. Chinese Patents and Inventions, 16(3), 6.

[12]. Curran, J. (2000). What is Small Business Policy in the UK for? Evaluation and Assessing Small Business Policies. International Small Business Journal, 18(3), 36-50. https://doi.org/10.1177/0266242600183002

[13]. Carson, D., & Cromie, S. (1989). Marketing planning in small enterprises: A model and some empirical evidence∗ . Journal of Marketing Management, 5, 33-49.

[14]. Freel, M. (2000). Barriers to Product Innovation in Small Manufacturing Firms. International Small Business Journal, 18, 60 - 80.

[15]. Tonge, J(2001). A review of small business literature part 1: Defining the small business.Availible at :https://www.semanticscholar.org/paper/A-review-of-small-business- literature-part-1%3A-the-Tonge/9ffea187ed7f63d741180121c7e902980e8ce093

[16]. Shi X & Tian W.(2022). European Union and British SME Rescue Policy. China Finance (15),76-78.

[17]. Shi X, Tian W, & Tan S. (2023). Fiscal and Financial rescue policies for smes in EU and UK. Journal of Guizhou Provincial Party School (3), 91-103.

[18]. Gartner, W.B. (no, date) ‘What are we talking about when we talk about entrepreneurship?’,Entrepreneurship as Organizing,pp.94–107. doi:10.4337/9781783476947.00013.

[19]. Gagnon, J., Kamin, S. and Kearns, J. (2023). The Impact of the COVID-19 Pandemic on Global GDP Growth. Journal of the Japanese and International Economies, 68, p.101258. doi:https://doi.org/10.1016/j.jjie.2023.101258.

[20]. GOV.UK (2022). Business Population Estimates for the UK and Regions 2022: Statistical Release (HTML). [online] GOV.UK. Available at: https://www.gov.uk/government/statistics/business-population-estimates-2022/business-population- estimates-for-the-uk-and-regions-2022-statistical-release-html.

[21]. Hanley, M. and O’Gorman, B. (2004) ‘Local interpretation of national micro‐enterprise policy’, International Journal of Entrepreneurial Behavior & Research, 10(5), pp. 305– 324. doi:10.1108/13552550410554302.

[22]. Hisrich, R.D. and Drnovsek, M. (2002). Entrepreneurship and small business research – a European perspective. Journal of Small Business and Enterprise Development, 9(2), pp.172–222. doi:https://doi.org/10.1108/14626000210427348.

[23]. Hurst, E. and Pugsley, B.W. (2011). What Do Small Businesses Do? doi:https://doi.org/10.3386/w17041.

[24]. Kirchherr, J., Hartley, K. and Tukker, A. (2023). Missions and mission-oriented innovation policy for sustainability: A review and critical reflection. Environmental Innovation and Societal Transitions, p.100721. doi:https://doi.org/10.1016/j.eist.2023.100721

[25]. Lechner, C. and Leyronas, C. (2009). Small-Business Group Formation as an Entrepreneurial Development Model. Entrepreneurship Theory and Practice, 33(3), pp.645–667. doi:https://doi.org/10.1111/j.1540-6520.2009.00320.x.

[26]. Lobonţiu, G. and Lobonţiu, M. (2014). The Owner-manager and the Functional Management of a Small Firm. Procedia - Social and Behavioral Sciences, [online] 124, pp.552–561. doi:https://doi.org/10.1016/j.sbspro.2014.02.519.

[27]. Matlay, H. (2005) ‘Entrepreneurship education in UK business schools’:, Journal of Small Business and Enterprise Development, 12(4), pp. 627–643. doi:10.1108/14626000510628270. reliability: the reading is reliable because the author of thsi reading is the professor of entrepreneurship, adn thsi reading is cied for more than 200 times.

[28]. McLaren, J. and Kattel, R. (2023) Policy capacities for mission-oriented innovation policy - a case study of UKRI and the Industrial Strategy Challenge Fund [Preprint]. doi:10.2139/ssrn.4471741.

[29]. OECD (2017). SME Tax Compliance and Simplification Background note prepared by the OECD Centre for Tax Policy and Administration. [online] Available at: https://www.oecd.org/global-relations/41873897.pdf.(2), pp.172–222. doi:https://doi.org/10.1108/14626000210427348.

[30]. Pedraza, J.M. (2021). The Micro, Small, and Medium-Sized Enterprises and Its Role in the Economic Development of a Country. Business and Management Research, 10(1), p.33. doi:https://doi.org/10.5430/bmr.v10n1p33.

[31]. Pettit, R. and Singer, F. (1985) ‘Small business finance: A research agenda’, Financial Management, 14(3), p. 47. doi:10.2307/3665059.

[32]. Ruiz Estrada, M.A. (2021). How much unemployment and inflation is going to be generated by COVID-19? Transnational Corporations Review, 13(2), pp.202–210. doi:https://doi.org/10.1080/19186444.2021.1912991.

[33]. Suraihi, W.A.A., Samikon, S.A., Suraihi, A.-H.A.A. and Ibrahim, I. (2021). Employee Turnover: Causes, Importance and Retention Strategies. European Journal of Business and Management Research, [online] 6(3), pp.1–10. Available at: https://www.researchgate.net/publication/352390912_Employee_Turnover_Causes_Importance_an d_Retention_Strategies.

[34]. Surya, B., Menne, F., Sabhan, H., Suriani, S., Abubakar, H. and Idris, M. (2021). Economic Growth, Increasing Productivity of SMEs, and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, [online] 7(1), p.20. doi:https://doi.org/10.3390/joitmc7010020.

[35]. Selviaridis, K. (2020) ‘Effects of public procurement of R&D on the Innovation Process: Evidence from the UK small business research initiative’, Journal of Public Procurement, 21(3), pp. 229–259. doi:10.1108/jopp-12-2019-0082.

[36]. Tucker, J. and Lean, J. (2003) ‘Small firm finance and public policy’, Journal of Small Busi ness and Enterprise Development,10(1),pp.50–61. doi:10.1108/14626000310461367.

[37]. Tredgett, E. and Coad, A. (2013) ‘The shaky start of the UK small business research initiative (SBRI) in comparison to the US Small Business Innovation Research Programme (SBIR)’, SSRN Electronic Journal [Preprint]. doi:10.2139/ssrn.2205156.

[38]. Ward M, Rhodes C. (2014) ‘Small businesses and the UK economy’

[39]. Xu H.(2011). Taking six measures to encourage the development of Small and medium-sized enterprises: the British experience of international comparison of small and medium-sized enterprise development policies. References in Economic Research (37),63-66.

Cite this article

Ding,X. (2024). To What Extent Have Economic Policies Affected Small Businesses in the UK in the Past 10 Years?. Journal of Applied Economics and Policy Studies,9,1-12.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Acs, .J. and Audretsch, D.B. (2008) ‘Innovation in large and small firms: An empirical analysis’, Entrepreneurship, Growth and Public Policy,pp.3–15. doi:10.4337/9781035305421.00007.

[2]. Adam, S., Browne, J., Phillips, D. and Roantree, B. (2020). Frictions and taxpayer responses: evidence from bunching at personal tax thresholds. International Tax and Public Finance. doi:https://doi.org/10.1007/s10797-020-09619-0.

[3]. Ahmedova, S. (2015). Factors for Increasing the Competitiveness of Small and Medium- Sized Enterprises (SMEs) in Bulgaria. Procedia - Social and Behavioral Sciences, 195, pp.1104–1112. doi:https://doi.org/10.1016/j.sbspro.2015.06.155.

[4]. Albaz, A., Dondi, M., Rida, T. and Schubert, J. (2018). Unlocking growth in small and medium enterprises | McKinsey. [online] www.mckinsey.com. Available at: https://www.mckinsey.com/industries/public-sector/our-insights/unlocking-growth-in-small-and- medium-size-enterprises.

[5]. asq.org. (2021). What is a Small Business? | ASQ. [online] Available at: https://asq.org/quality- resources/small-business.

[6]. Britannica (2019). United Kingdom - Trade | Britannica. In: Encyclopædia Britannica. [online] Available at: https://www.britannica.com/place/United-Kingdom/Trade.

[7]. Bager, T.E. (2021) ‘The short-term bias in policy programs for small business: Exploring discontinuation of a successful growth program’, Journal of Small Business and Enterprise Development, 28(6), pp. 856–872. doi:10.1108/jsbed-12-2020-0448.

[8]. Beaver, G. and Prince, C. (2004) ‘Management, strategy and policy in the UK small business sector: A critical review’, Journal of Small Business and Enterprise Development, 11(1), pp. 34–49. doi:10.1108/14626000410519083.

[9]. Jennings, P., & Beaver, G. (1997). The Performance and Competitive Advantage of Small Firms: A Management Perspective. International Small Business Journal, 15(2), 63-75. https://doi.org/10.1177/0266242697152004

[10]. Binks, M. and Ennew, C. (1996) ‘Financing small firms’, Small Business and Entrepreneurship, pp. 110–130. doi:10.1007/978-1-349-24911-4_6.

[11]. Chen Junzhu. (2019). Research on Intellectual property financing mechanism of British smes. Chinese Patents and Inventions, 16(3), 6.

[12]. Curran, J. (2000). What is Small Business Policy in the UK for? Evaluation and Assessing Small Business Policies. International Small Business Journal, 18(3), 36-50. https://doi.org/10.1177/0266242600183002

[13]. Carson, D., & Cromie, S. (1989). Marketing planning in small enterprises: A model and some empirical evidence∗ . Journal of Marketing Management, 5, 33-49.

[14]. Freel, M. (2000). Barriers to Product Innovation in Small Manufacturing Firms. International Small Business Journal, 18, 60 - 80.

[15]. Tonge, J(2001). A review of small business literature part 1: Defining the small business.Availible at :https://www.semanticscholar.org/paper/A-review-of-small-business- literature-part-1%3A-the-Tonge/9ffea187ed7f63d741180121c7e902980e8ce093

[16]. Shi X & Tian W.(2022). European Union and British SME Rescue Policy. China Finance (15),76-78.

[17]. Shi X, Tian W, & Tan S. (2023). Fiscal and Financial rescue policies for smes in EU and UK. Journal of Guizhou Provincial Party School (3), 91-103.

[18]. Gartner, W.B. (no, date) ‘What are we talking about when we talk about entrepreneurship?’,Entrepreneurship as Organizing,pp.94–107. doi:10.4337/9781783476947.00013.

[19]. Gagnon, J., Kamin, S. and Kearns, J. (2023). The Impact of the COVID-19 Pandemic on Global GDP Growth. Journal of the Japanese and International Economies, 68, p.101258. doi:https://doi.org/10.1016/j.jjie.2023.101258.

[20]. GOV.UK (2022). Business Population Estimates for the UK and Regions 2022: Statistical Release (HTML). [online] GOV.UK. Available at: https://www.gov.uk/government/statistics/business-population-estimates-2022/business-population- estimates-for-the-uk-and-regions-2022-statistical-release-html.

[21]. Hanley, M. and O’Gorman, B. (2004) ‘Local interpretation of national micro‐enterprise policy’, International Journal of Entrepreneurial Behavior & Research, 10(5), pp. 305– 324. doi:10.1108/13552550410554302.

[22]. Hisrich, R.D. and Drnovsek, M. (2002). Entrepreneurship and small business research – a European perspective. Journal of Small Business and Enterprise Development, 9(2), pp.172–222. doi:https://doi.org/10.1108/14626000210427348.

[23]. Hurst, E. and Pugsley, B.W. (2011). What Do Small Businesses Do? doi:https://doi.org/10.3386/w17041.

[24]. Kirchherr, J., Hartley, K. and Tukker, A. (2023). Missions and mission-oriented innovation policy for sustainability: A review and critical reflection. Environmental Innovation and Societal Transitions, p.100721. doi:https://doi.org/10.1016/j.eist.2023.100721

[25]. Lechner, C. and Leyronas, C. (2009). Small-Business Group Formation as an Entrepreneurial Development Model. Entrepreneurship Theory and Practice, 33(3), pp.645–667. doi:https://doi.org/10.1111/j.1540-6520.2009.00320.x.

[26]. Lobonţiu, G. and Lobonţiu, M. (2014). The Owner-manager and the Functional Management of a Small Firm. Procedia - Social and Behavioral Sciences, [online] 124, pp.552–561. doi:https://doi.org/10.1016/j.sbspro.2014.02.519.

[27]. Matlay, H. (2005) ‘Entrepreneurship education in UK business schools’:, Journal of Small Business and Enterprise Development, 12(4), pp. 627–643. doi:10.1108/14626000510628270. reliability: the reading is reliable because the author of thsi reading is the professor of entrepreneurship, adn thsi reading is cied for more than 200 times.

[28]. McLaren, J. and Kattel, R. (2023) Policy capacities for mission-oriented innovation policy - a case study of UKRI and the Industrial Strategy Challenge Fund [Preprint]. doi:10.2139/ssrn.4471741.

[29]. OECD (2017). SME Tax Compliance and Simplification Background note prepared by the OECD Centre for Tax Policy and Administration. [online] Available at: https://www.oecd.org/global-relations/41873897.pdf.(2), pp.172–222. doi:https://doi.org/10.1108/14626000210427348.

[30]. Pedraza, J.M. (2021). The Micro, Small, and Medium-Sized Enterprises and Its Role in the Economic Development of a Country. Business and Management Research, 10(1), p.33. doi:https://doi.org/10.5430/bmr.v10n1p33.

[31]. Pettit, R. and Singer, F. (1985) ‘Small business finance: A research agenda’, Financial Management, 14(3), p. 47. doi:10.2307/3665059.

[32]. Ruiz Estrada, M.A. (2021). How much unemployment and inflation is going to be generated by COVID-19? Transnational Corporations Review, 13(2), pp.202–210. doi:https://doi.org/10.1080/19186444.2021.1912991.

[33]. Suraihi, W.A.A., Samikon, S.A., Suraihi, A.-H.A.A. and Ibrahim, I. (2021). Employee Turnover: Causes, Importance and Retention Strategies. European Journal of Business and Management Research, [online] 6(3), pp.1–10. Available at: https://www.researchgate.net/publication/352390912_Employee_Turnover_Causes_Importance_an d_Retention_Strategies.

[34]. Surya, B., Menne, F., Sabhan, H., Suriani, S., Abubakar, H. and Idris, M. (2021). Economic Growth, Increasing Productivity of SMEs, and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, [online] 7(1), p.20. doi:https://doi.org/10.3390/joitmc7010020.

[35]. Selviaridis, K. (2020) ‘Effects of public procurement of R&D on the Innovation Process: Evidence from the UK small business research initiative’, Journal of Public Procurement, 21(3), pp. 229–259. doi:10.1108/jopp-12-2019-0082.

[36]. Tucker, J. and Lean, J. (2003) ‘Small firm finance and public policy’, Journal of Small Busi ness and Enterprise Development,10(1),pp.50–61. doi:10.1108/14626000310461367.

[37]. Tredgett, E. and Coad, A. (2013) ‘The shaky start of the UK small business research initiative (SBRI) in comparison to the US Small Business Innovation Research Programme (SBIR)’, SSRN Electronic Journal [Preprint]. doi:10.2139/ssrn.2205156.

[38]. Ward M, Rhodes C. (2014) ‘Small businesses and the UK economy’

[39]. Xu H.(2011). Taking six measures to encourage the development of Small and medium-sized enterprises: the British experience of international comparison of small and medium-sized enterprise development policies. References in Economic Research (37),63-66.