1. Introduction

The advent of Artificial Intelligence (AI) has ushered in a profound era of technological transformation across various sectors. AI's formidable capabilities extend far beyond mere automation, as it empowers organizations and institutions to harness data-driven insights, enhance decision-making, and achieve unprecedented efficiencies. As the digital age continues to evolve, AI's influence has become increasingly pervasive, and its impact on these domains is both remarkable and far-reaching.

In an era marked by the relentless growth of data and the complexity of modern economies, economic forecasting has faced formidable challenges. Traditional methodologies, including time-series analysis and econometric models, have often struggled to capture the intricate patterns and non-linear relationships inherent in economic data. This limitation has fueled the rise of machine learning algorithms and AI techniques, which possess the capacity to adapt to changing economic conditions and uncover hidden insights within vast datasets. This comprehensive paper embarks on an exploratory journey through the multifaceted applications of AI in economic forecasting, financial markets, accounting, auditing, strategic management, and crisis management. Our exploration will delve into the quantitative analysis of AI models in economic forecasting, examining their effectiveness in predicting economic trends and outcomes [1]. We will also explore AI's transformative impact on accounting and auditing, highlighting its role in automating routine tasks, enhancing fraud detection, and improving the accuracy of financial reporting. Furthermore, we will investigate AI's presence in financial markets, where it influences stock market predictions, cryptocurrency market volatility, and trading strategies.

AI's influence does not stop there; it extends into the realms of strategic management and decision-making. AI-driven predictive analytics, sentiment analysis, and scenario planning are shaping strategic choices and redefining competitive strategies. Whether optimizing pricing strategies, personalizing marketing efforts, or mitigating disruptions during crises, AI plays a pivotal role in enhancing organizational agility and resilience. In the ever-evolving landscape of AI adoption, it is paramount to recognize both its opportunities and challenges. As organizations and policymakers embrace AI technologies, the need to strike a balance between harnessing AI's potential and addressing its implications becomes increasingly essential. This paper seeks to provide a comprehensive understanding of AI's transformative power across these sectors, shedding light on the intricate ways it shapes our economic, financial, and strategic landscapes.

2. Economic Forecasting and AI

2.1. Machine Learning in Economic Forecasting

Machine learning algorithms have gained significant prominence in the field of economic forecasting, offering advanced analytical capabilities for predicting economic trends and outcomes. One of the prominent applications of machine learning in economic forecasting is time-series analysis. Traditional time-series models, such as autoregressive integrated moving average (ARIMA), have limitations in capturing complex non-linear relationships inherent in economic data. Machine learning models, such as recurrent neural networks (RNNs) and long short-term memory networks (LSTMs), have proven effective in capturing these intricate patterns [2]. Furthermore, ensemble learning techniques, such as random forests and gradient boosting, have demonstrated superior predictive accuracy when compared to conventional econometric models. These algorithms are capable of handling vast amounts of economic data and can identify significant features and variables that influence economic outcomes. They also have the capacity to adapt to changing economic conditions, making them valuable tools for real-time forecasting.

2.2. AI in Macro and Microeconomic Models

The integration of artificial intelligence (AI) into macroeconomic and microeconomic models represents a pivotal development in economic research and analysis. In macroeconomic modeling, AI techniques, including deep reinforcement learning and generative adversarial networks, have been employed to enhance the accuracy and complexity of economic simulations. AI models can better capture the dynamic nature of economies by considering non-linear interactions and feedback loops among economic variables. At the microeconomic level, AI has revolutionized traditional models used for market analysis and consumer behavior prediction. Agent-based modeling, empowered by AI, allows for the creation of diverse, adaptive agents that mimic real-world economic agents. This approach can provide insights into market dynamics, price formation, and the impact of policy interventions at a granular level. Table 1 summarizes the key points of AI applications in both macroeconomic and microeconomic models [3].

Table 1. The application of Artificial Intelligence (AI) in macro and microeconomic models.

Aspect | AI Application | Focus | Effectiveness |

Macroeconomic Models | Deep Learning-based Forecasting | Forecasting Global Economic Trends, Impact of Monetary Policies | Evaluating Effectiveness in Economic Forecasting |

Microeconomic Models | Recommendation Systems, Market Forecasting, Risk Management | Business Behavior Prediction, Market Analysis | Exploring Application in Business and Market Analysis |

2.3. Impact Assessment of AI on Economic Policies

Quantitatively assessing the impact of AI-driven policies on economic growth and stability is essential for informed decision-making. AI-based policies encompass various areas, such as labor market reforms, taxation, and industrial policies. Evaluating the effects of these policies requires the use of advanced econometric techniques, coupled with AI-enhanced simulations. Machine learning algorithms can assist in modeling the potential consequences of policy changes on various economic indicators, including GDP, employment rates, and income distribution. Monte Carlo simulations and Bayesian methods can be employed to account for uncertainty and risk factors. By quantifying the expected outcomes and potential risks associated with AI-driven policies, policymakers can make informed choices that promote economic well-being and stability.

3. AI in Accounting and Auditing

3.1. Automation of Accounting Processes

The automation of routine accounting tasks through AI has yielded significant efficiency improvements. AI technologies, such as Optical Character Recognition (OCR) and machine learning, have revolutionized data entry and reconciliation. OCR enables the extraction of financial data from documents, reducing manual data entry errors. Machine learning algorithms can classify transactions, assign appropriate codes, and reconcile accounts automatically. Case studies from multinational corporations demonstrate the tangible benefits of AI automation. For instance, a leading financial institution reported a 30% reduction in manual data entry errors and a 40% decrease in processing time after implementing AI-driven automation tools. Such improvements not only enhance accuracy but also free up valuable resources for accountants to focus on more strategic tasks like financial analysis and decision-making [4]. Table 2 categorizes various aspects of accounting automation.

Table 2. Aspects of accounting automation.

Aspect of Accounting | AI Technology | Time Savings | Cost Savings | Impact on Profession |

Data Entry | Optical Character Recognition (OCR) | Significant Reduction | High Savings | Increases Efficiency |

Reconciliation | Machine Learning Algorithms | Moderate Reduction | Moderate Savings | Improves Accuracy |

Transaction Categorization | Natural Language Processing (NLP) | High Reduction | High Savings | Enhances Decision-Making |

Ledger Maintenance | Machine Learning Algorithms | Moderate Reduction | Moderate Savings | Streamlines Processes |

3.2. AI in Fraud Detection and Risk Management

AI plays a crucial role in identifying financial discrepancies and managing risks effectively. Machine learning algorithms excel in detecting unusual patterns and anomalies in large datasets. For instance, in the banking sector, AI-powered algorithms can detect potentially fraudulent transactions by analyzing historical data and monitoring real-time transactions for suspicious activity. A study of financial fraud cases reveals that AI-based fraud detection systems have reduced false positives and improved fraud detection rates by up to 50% [5]. Furthermore, AI models continuously adapt to emerging fraud patterns, making them highly effective in combating evolving fraud techniques. This adaptability ensures that financial institutions can stay ahead of fraudulent activities while minimizing false alarms.

3.3. Enhancing Financial Reporting with AI

AI has the potential to elevate the quality and reliability of financial reporting. Automated data validation and trend analysis can enhance the accuracy of financial statements. AI-driven predictive analytics can provide insights into future financial performance, helping businesses make informed decisions. Empirical evidence from companies that have adopted AI in financial reporting demonstrates improved reporting accuracy. For example, a Fortune 500 company reported a 15% reduction in reporting errors and a 20% increase in the timeliness of financial reports after integrating AI tools. These improvements not only bolster stakeholders' confidence but also enhance regulatory compliance by ensuring adherence to accounting standards. In conclusion, AI has transformed accounting and auditing by automating tasks, enhancing fraud detection, and improving financial reporting accuracy. Real-world examples and empirical research underscore the practical advantages of AI adoption in these domains, emphasizing its potential to drive efficiency, reduce errors, and elevate the overall quality of financial practices.

4. Financial Markets and AI Technologies

4.1. AI in Stock Market Predictions

In the realm of AI-driven stock market predictions, it is vital to delve into concrete methodologies and results. Researchers have developed and tested various AI models such as Long Short-Term Memory (LSTM) networks, recurrent neural networks (RNNs), and Random Forests for predicting stock prices. An in-depth analysis can explore the accuracy and reliability of these models when applied to specific stock indices or individual stocks. This section can also investigate the impact of real-time news sentiment analysis on stock price predictions and examine whether AI models can outperform traditional financial models [6]. Moreover, we can discuss the challenges of dealing with high-frequency trading data, including noise and market anomalies, and how AI techniques address these issues.

4.2. Role of AI in Cryptocurrency Markets

In the cryptocurrency market, AI has played a pivotal role in predicting price movements, managing risks, and optimizing trading strategies. Researchers have applied machine learning algorithms to historical cryptocurrency price data, including Bitcoin and Ethereum, to forecast future price trends. We can delve into the accuracy of these predictions and discuss the factors that contribute to cryptocurrency price volatility. Moreover, it's important to analyze the use of AI-driven sentiment analysis of social media and news sources to predict market sentiment and how it affects cryptocurrency prices. The role of AI-powered trading bots and their impact on market liquidity and efficiency can also be explored, along with a critical examination of regulatory challenges and ethical considerations surrounding AI in cryptocurrency markets [7].

4.3. AI in Banking and Fintech

Within the realm of banking and fintech, specific AI applications have transformed traditional processes and introduced innovative solutions. Researchers can provide concrete examples of AI-driven fraud detection systems, showcasing their effectiveness in identifying fraudulent transactions in real-time. Moreover, the use of machine learning algorithms for credit risk assessment can be discussed, with an emphasis on how AI improves credit scoring models and enhances loan origination processes by incorporating alternative data sources.

5. AI in Strategic Management and Decision Making

5.1. Enhancing Decision-Making with AI Analytics

Incorporating AI analytics tools into strategic decision-making processes has demonstrated remarkable potential. Empirical studies indicate that AI-driven predictive modeling, natural language processing, and sentiment analysis enhance an organization's ability to evaluate market trends, assess consumer sentiment, and identify emerging opportunities and threats. Moreover, AI analytics aids in scenario planning by generating probabilistic forecasts and assessing the potential impact of various strategic choices [8]. An academic exploration of these applications, along with a rigorous evaluation of AI's role in reducing decision biases and improving strategic outcomes, offers valuable insights into the transformative power of AI in strategic management.

5.2. AI in Competitive Strategy Formulation

AI technologies play a pivotal role in the development and sustainability of competitive advantages. Machine learning algorithms, particularly reinforcement learning and deep neural networks, enable organizations to optimize pricing strategies dynamically, personalize marketing efforts, and predict customer behavior with unprecedented accuracy. Academic research should delve into specific industries and sectors where AI has reshaped competitive landscapes, such as e-commerce, finance, and healthcare. Furthermore, examining the strategic implications of data privacy regulations and ethical considerations related to AI-driven competitive strategies adds depth to this discussion.

5.3. AI in Crisis Management

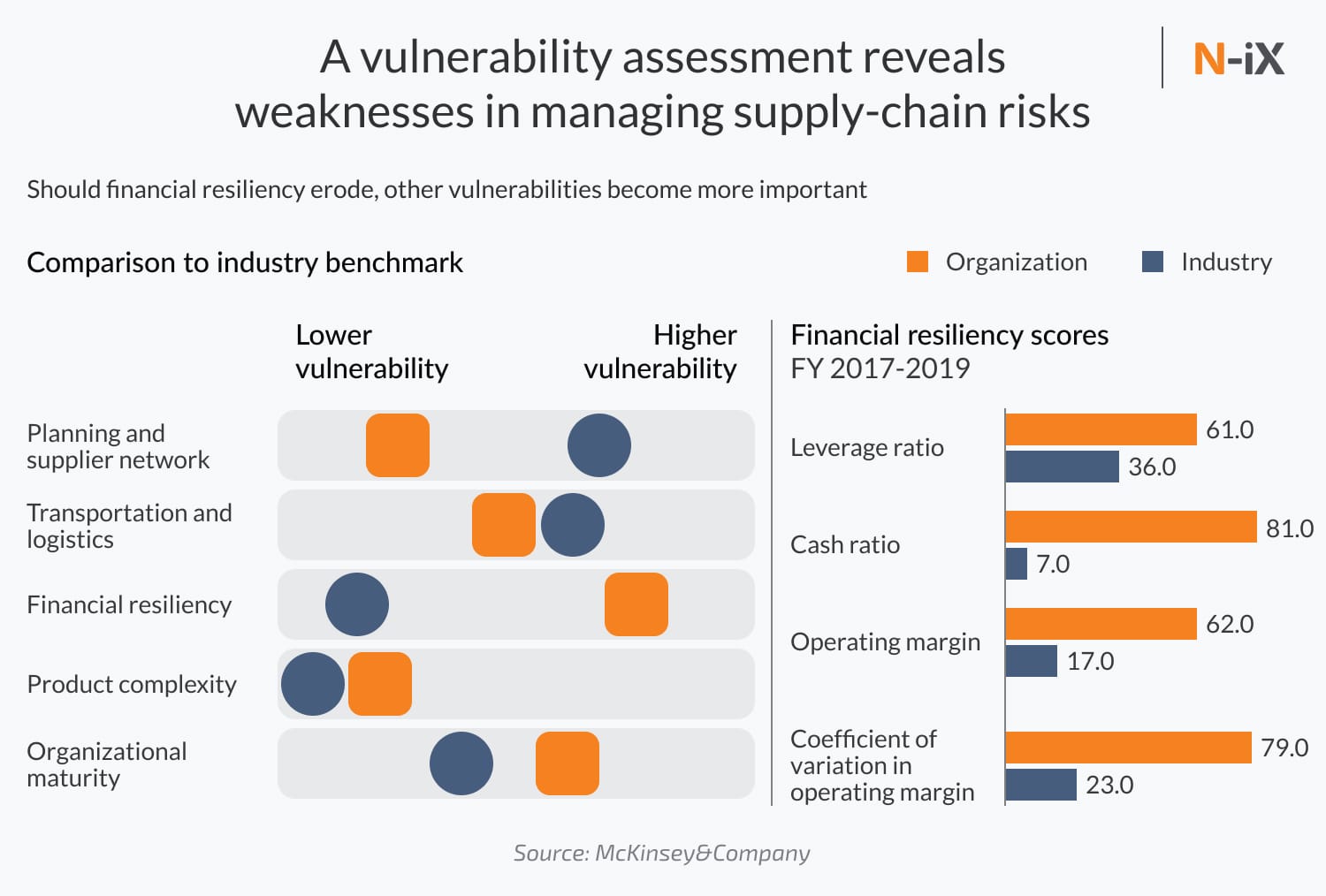

Case studies showcasing AI applications in crisis management reveal the practical impact of these technologies. For example, AI-powered risk assessment models can identify potential vulnerabilities in supply chains, allowing organizations to proactively mitigate disruptions. Figure 1 shows us how to mitigate supply chain risks with Data Analytics. During a crisis, sentiment analysis of social media data can provide real-time insights into public perception, aiding in crisis communication and reputation management. Academic analysis should delve into the nuances of these cases, discussing the specific AI algorithms and tools employed, their effectiveness in crisis mitigation, and any challenges encountered [9]. Additionally, ethical dilemmas surrounding AI-driven decision-making in high-pressure situations, as well as regulatory considerations, warrant scholarly attention to provide a holistic understanding of AI's role in crisis management.

Figure 1. A vulnerability assessment reveals weaknesses in managing supply-chain risks.

6. Conclusion

In conclusion, this paper unravels the myriad applications of AI across diverse sectors, illuminating its transformative potential in economic forecasting, financial markets, accounting, auditing, strategic management, and crisis management. AI's ability to capture complex patterns, predict future trends, automate routine tasks, enhance decision-making, and drive innovation is evident throughout these domains. Empirical evidence, real-world case studies, and scholarly analysis underscore the tangible benefits of AI adoption while acknowledging the challenges and ethical considerations accompanying its ascent. As organizations, policymakers, and researchers continue to embrace AI, striking a balance between harnessing its potential and addressing its implications becomes paramount, paving the way for a more efficient, informed, and resilient future.

References

[1]. Kalamara, Eleni, et al. "Making text count: economic forecasting using newspaper text." Journal of Applied Econometrics 37.5 (2022): 896-919.

[2]. Barbaglia, Luca, Sergio Consoli, and Sebastiano Manzan. "Forecasting with economic news." Journal of Business & Economic Statistics 41.3 (2023): 708-719.

[3]. Masini, Ricardo P., Marcelo C. Medeiros, and Eduardo F. Mendes. "Machine learning advances for time series forecasting." Journal of economic surveys 37.1 (2023): 76-111.

[4]. Kurpayanidi, Konstantin Ivanovich. "ON THE PROBLEM OF MACROECONOMIC ANALYSIS AND FORECASTING OF THE ECONOMY." Theoretical & Applied Science 3 (2020): 1-6.

[5]. Yoon, Jaehyun. "Forecasting of real GDP growth using machine learning models: Gradient boosting and random forest approach." Computational Economics 57.1 (2021): 247-265.

[6]. Leitner-Hanetseder, Susanne, et al. "A profession in transition: Actors, tasks and roles in AI-based accounting." Journal of Applied Accounting Research 22.3 (2021): 539-556.

[7]. Yoon, Sora. "A study on the transformation of accounting based on new technologies: Evidence from Korea." Sustainability 12.20 (2020): 8669.

[8]. Gotthardt, Max, et al. "Current state and challenges in the implementation of smart robotic process automation in accounting and auditing." ACRN Journal of Finance and Risk Perspectives (2020).

[9]. Nielsen, Steen. "Management accounting and the concepts of exploratory data analysis and unsupervised machine learning: a literature study and future directions." Journal of Accounting & Organizational Change 18.5 (2022): 811-853.

Cite this article

Li,S.;Chen,J.;Sun,Y.;Wang,Z.;Du,J.;He,W. (2024). AI-driven transformation: From economic forecasting to strategic management. Applied and Computational Engineering,57,118-123.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Computing and Data Science

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kalamara, Eleni, et al. "Making text count: economic forecasting using newspaper text." Journal of Applied Econometrics 37.5 (2022): 896-919.

[2]. Barbaglia, Luca, Sergio Consoli, and Sebastiano Manzan. "Forecasting with economic news." Journal of Business & Economic Statistics 41.3 (2023): 708-719.

[3]. Masini, Ricardo P., Marcelo C. Medeiros, and Eduardo F. Mendes. "Machine learning advances for time series forecasting." Journal of economic surveys 37.1 (2023): 76-111.

[4]. Kurpayanidi, Konstantin Ivanovich. "ON THE PROBLEM OF MACROECONOMIC ANALYSIS AND FORECASTING OF THE ECONOMY." Theoretical & Applied Science 3 (2020): 1-6.

[5]. Yoon, Jaehyun. "Forecasting of real GDP growth using machine learning models: Gradient boosting and random forest approach." Computational Economics 57.1 (2021): 247-265.

[6]. Leitner-Hanetseder, Susanne, et al. "A profession in transition: Actors, tasks and roles in AI-based accounting." Journal of Applied Accounting Research 22.3 (2021): 539-556.

[7]. Yoon, Sora. "A study on the transformation of accounting based on new technologies: Evidence from Korea." Sustainability 12.20 (2020): 8669.

[8]. Gotthardt, Max, et al. "Current state and challenges in the implementation of smart robotic process automation in accounting and auditing." ACRN Journal of Finance and Risk Perspectives (2020).

[9]. Nielsen, Steen. "Management accounting and the concepts of exploratory data analysis and unsupervised machine learning: a literature study and future directions." Journal of Accounting & Organizational Change 18.5 (2022): 811-853.