1.Introduction

The advent of Artificial Intelligence (AI) and its integration into various fields has heralded a new era of innovation and efficiency, significantly impacting the way data is analyzed and interpreted. In the realm of economics, traditional macroeconomic models have long served as the backbone for understanding and predicting economic trends. However, the complexity and interconnectivity of the global economy have revealed the limitations of these traditional models, necessitating a paradigm shift towards more advanced, dynamic, and flexible analytical tools. The integration of AI into macroeconomic modeling presents a compelling solution to these challenges, leveraging the power of machine learning to enhance the accuracy, reliability, and relevance of economic forecasts. AI's role in macroeconomic modeling is multifaceted, addressing critical shortcomings of traditional models by incorporating a broader array of variables, both structured and unstructured, to capture the full spectrum of factors influencing economic trends. This includes real-time economic indicators, social media sentiment, and global economic events, which are often overlooked or inadequately represented in conventional models. Furthermore, AI algorithms, particularly machine learning models such as Random Forests and Neural Networks, are adept at identifying and interpreting non-linear relationships among economic variables, a task that traditional linear models frequently mishandle. The dynamic nature of AI-enhanced models, capable of learning from new data and adjusting predictions accordingly, represents a significant advancement over static traditional models. This adaptability is crucial for keeping pace with the rapid changes and unforeseen events characterizing today's economic landscape. By offering a more nuanced and comprehensive view of economic dynamics, AI integration promises not only to improve the precision of forecasts but also to facilitate the development of more effective economic policies and interventions [1]. This paper delves into the transformative impact of AI on macroeconomic modeling, examining the methodologies, benefits, and implications of this integration. Through a detailed analysis of AI's application in enhancing economic forecasts and understanding complex economic phenomena, we highlight how AI is reshaping the field of economics, paving the way for a more informed and responsive approach to economic research and policy-making.

2.Economic Forecasting with Machine Learning

2.1.Predictive Accuracy of ML Models

Machine learning models have revolutionized economic forecasting by their unparalleled ability to digest and learn from vast datasets. In particular, regression analysis, neural networks, and time series forecasting models stand out for their capacity to predict future economic trends with a level of precision previously unattainable with traditional econometric approaches. For example, neural networks, with their deep learning capabilities, are adept at identifying non-linear relationships within economic data, a common characteristic of economic indicators that traditional linear models struggle with. By training on decades of GDP growth data, neural networks can uncover underlying patterns that influence future growth, such as the intricate relationships between consumer confidence, fiscal policy, and global economic conditions [2].

Figure 1. LSTM Model for Economic Forecasting (Unemployment Rate Prediction)

A notable application of machine learning in economic forecasting is the use of time series forecasting models like ARIMA (AutoRegressive Integrated Moving Average) and LSTM (Long Short-Term Memory) networks. These models excel in analyzing sequential data, making them particularly suited for predicting trends in unemployment rates and inflation. For instance, an LSTM model can account for the time-dependent nature of unemployment rates, learning how past rates influence future trends while adjusting for seasonal effects and policy changes. This capability enables the model to forecast future unemployment rates with a degree of accuracy that accounts for both short-term fluctuations and long-term trends, as shown in Figure 1.

Moreover, the integration of machine learning models with traditional econometric methods has led to the development of hybrid models that leverage the strengths of both approaches. These models combine the econometric understanding of causal relationships with the pattern recognition capabilities of machine learning, offering a comprehensive tool for economic forecasting. By incorporating a wide range of variables, from interest rates to international trade figures, these hybrid models provide a detailed picture of the economic landscape, enabling more accurate and nuanced forecasts.

2.2.Challenges in Economic Forecasting

Despite the advancements brought by machine learning to economic forecasting, several challenges persist, primarily related to data quality and model interpretability. The accuracy of ML predictions heavily relies on the quality and comprehensiveness of the historical data fed into them. In many cases, economic data can be noisy, incomplete, or subject to revision, which can lead to inaccuracies in the model's predictions. Moreover, the availability of long-term, consistent economic data is crucial for training reliable models. In developing economies, where such data may be sparse or less reliable, the effectiveness of ML models can be significantly compromised. Another challenge is the inherent difficulty in predicting the impact of unforeseen events, such as sudden political upheavals or natural disasters [3]. While machine learning models excel at identifying patterns based on historical data, their ability to anticipate events that have no precedent is limited. This limitation underscores the importance of integrating expert judgment and qualitative analysis with ML predictions to provide a more holistic view of potential economic futures. Furthermore, the black-box nature of many ML models, particularly deep learning algorithms, poses a challenge to their adoption in policy-making. The complexity and lack of transparency of these models can make it difficult for economists and policymakers to understand the basis of their predictions, leading to skepticism and resistance to their use. Addressing this challenge requires ongoing efforts to develop more interpretable ML models and to foster collaboration between machine learning experts and economic policymakers to ensure that ML predictions are both accurate and understandable.

2.3.Policy Implications

The enhanced predictive capabilities of machine learning models hold profound implications for economic policy-making. By providing more accurate and timely forecasts of economic trends, policymakers are better equipped to make informed decisions on a wide range of issues, from adjusting interest rates to planning fiscal expenditures. For example, accurate predictions of GDP growth can inform government budgeting processes, enabling more effective allocation of resources to areas such as infrastructure, education, and healthcare. Moreover, the ability of ML models to anticipate economic downturns can be a crucial tool in implementing preemptive measures to mitigate their impact. For instance, by predicting a significant rise in unemployment, policymakers can proactively introduce job creation programs or adjust unemployment benefits to cushion the blow to affected populations [4]. Additionally, the insights gained from machine learning models can guide the development of targeted economic policies that address specific challenges. For example, if ML models identify a potential inflation spike driven by rising food prices, policymakers could intervene early in the supply chain to prevent such spikes from occurring. However, leveraging ML in policy-making also requires a nuanced understanding of the models' limitations and a commitment to ethical considerations, particularly regarding data privacy and the potential for algorithmic bias. As such, the integration of machine learning into economic forecasting and policy-making must be approached with a balance of enthusiasm for its potential benefits and caution for its ethical and practical challenges.

3.Financial Market Analysis through AI

3.1.AI in Stock Market Predictions

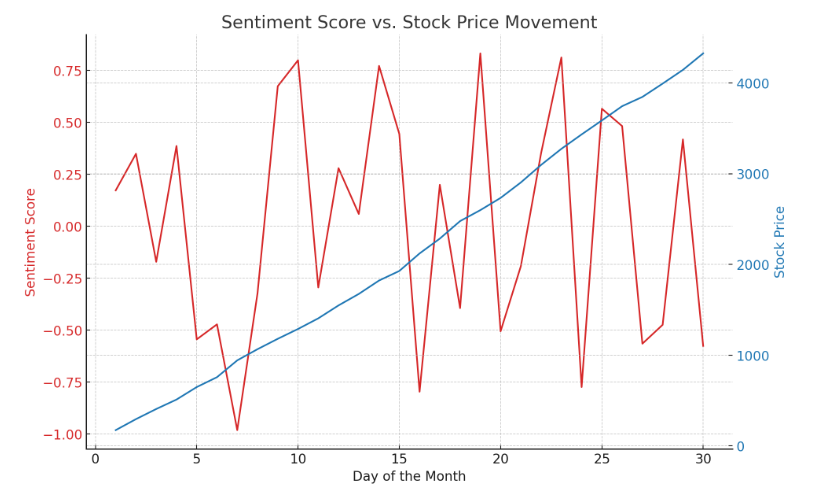

The application of Artificial Intelligence (AI) in stock market predictions has transcended traditional analysis methods by leveraging complex algorithms to process and interpret vast datasets. One of the most notable advancements in this area is the use of Natural Language Processing (NLP) and sentiment analysis to gauge market sentiment from various data sources including news articles, financial reports, and social media. NLP algorithms, for example, parse through textual data to identify relevant financial events, news sentiment, and market opinions, translating unstructured data into actionable insights. Sentiment analysis further refines this process by assessing the positive or negative tone of the data, providing a sentiment score that correlates with potential market movements. An illustrative case of AI in stock market predictions involves the utilization of machine learning models like Long Short-Term Memory (LSTM) networks, a type of recurrent neural network that is particularly adept at recognizing patterns in time series data. By inputting historical stock price data along with sentiment scores derived from NLP analysis, LSTMs can predict future stock price movements with a significant degree of accuracy [5]. These models account for the temporal dependencies of stock prices and are capable of adjusting their predictions based on real-time data inputs, making them invaluable for short-term trading strategies. Moreover, AI-driven models have the capability to integrate and analyze data from disparate sources, including economic indicators, company financial statements, and even geopolitical events, to provide a holistic view of the factors influencing stock prices. This comprehensive approach allows for the identification of complex, non-linear relationships between variables that traditional statistical models might overlook. Figure 2 illustrates the relationship between sentiment scores and stock price movements over a period, showcasing how sentiment analysis and AI can play a crucial role in predicting stock market trends [6].

Figure 2. Analyzing the Impact of Market Sentiment on Stock Prices: An AI Approach

3.2.Investment Strategies and AI

AI-driven investment strategies represent a paradigm shift in asset management, where quantitative investment funds, or "quant funds," leverage AI algorithms to unearth investment opportunities and navigate risks. These funds employ a diverse array of machine learning models to analyze market data, identify patterns, and execute trades at optimal times. For instance, reinforcement learning, a type of AI that learns optimal actions through trial and error, has been applied to develop dynamic trading strategies that adapt to changing market conditions, optimizing returns while managing risk. High-frequency trading (HFT) strategies, enabled by AI, exploit minute price discrepancies across different markets or securities, conducting a vast number of transactions at high speeds. By analyzing market data in real-time, AI algorithms can execute trades milliseconds before other market participants, capturing small profit margins that accumulate to significant returns over time. However, the aggressive nature of HFT and its potential impact on market stability necessitates careful regulatory oversight to prevent manipulation or excessive volatility [7]. Furthermore, AI-enhanced portfolio management tools are revolutionizing how investors manage risk and diversify investments. By analyzing historical performance data and market conditions, AI algorithms can recommend asset allocations that align with an investor's risk tolerance and investment goals, dynamically adjusting the portfolio in response to market changes.

4.The Integration of AI in Macroeconomic Models

4.1.Enhancing Macroeconomic Models with AI

Integrating AI into traditional macroeconomic models transforms their capabilities by introducing advanced computational techniques to analyze and interpret complex datasets. One pivotal area where AI significantly augments macroeconomic models is in the forecasting of inflation rates. Traditionally, predicting inflation involved linear regression models that considered a few variables, such as money supply and unemployment rates, based on the Phillips Curve or Quantity Theory of Money. However, these models often failed to capture the intricate dynamics and non-linear interactions within a global economy.

AI, particularly through machine learning algorithms like Random Forests and Neural Networks, enables the inclusion of a broader array of variables, including unstructured data such as social media sentiment and news analysis. For example, sentiment analysis algorithms can evaluate consumer confidence and expectations regarding inflation by analyzing trends in social media discussions, which are then incorporated into inflation forecasts [8]. Furthermore, machine learning models can process real-time data on supply chain disruptions, commodity prices, and geopolitical events, offering a granular view of potential inflationary pressures. Moreover, AI-enhanced models adapt and learn from new data, refining their predictions over time. Unlike static traditional models, these dynamic models use recursive algorithms to update their parameters as new data becomes available, ensuring that the models remain relevant and accurate even as economic conditions change. This adaptability is crucial in today's fast-paced economic environment, where traditional models may quickly become outdated [9].

4.2.Addressing Non-Linearities and Model Robustness

The global economy is characterized by complex, non-linear interactions among variables. Traditional macroeconomic models often apply linear assumptions to these relationships, which can oversimplify and misrepresent economic dynamics. AI models excel in identifying and modeling these non-linear relationships, uncovering intricate patterns within vast datasets that traditional analyses might overlook. For instance, Deep Learning models, a subset of machine learning, utilize layers of artificial neurons to process data, allowing them to capture complex, non-linear relationships between economic indicators. These models can identify hidden patterns in data, such as how shifts in consumer sentiment on social media can impact consumption patterns, which in turn affect inflation rates in non-linear ways. The robustness of AI models lies in their ability to continually adjust to new data, enhancing their predictive accurac. For example, as an AI model processes more data on consumer behavior during economic downturns, it learns and adjusts its forecasts accordingly, improving its reliability and robustness over time.

5.Conclusion

The integration of Artificial Intelligence (AI) into macroeconomic models signifies a groundbreaking shift in economic forecasting and analysis. By transcending the limitations of traditional macroeconomic models, AI offers a dynamic, adaptable, and sophisticated approach to understanding complex economic phenomena. This paper has demonstrated how AI, particularly through machine learning algorithms, enhances the predictive power and analytical depth of macroeconomic models, enabling them to process vast arrays of data and uncover intricate, non-linear relationships among economic variables. The adaptability of AI-enhanced models to learn from new data and refine their forecasts accordingly is crucial in an ever-changing economic environment. The implications of this integration are profound, not only for economic research but also for policy formulation and implementation. Policymakers equipped with AI-enhanced forecasts can make more informed decisions, tailoring their interventions to effectively address economic challenges and opportunities. The potential of AI to simulate various policy scenarios further aids in identifying optimal strategies for managing economic crises and promoting sustainable growth. In conclusion, the integration of AI into macroeconomic models represents a pivotal development in economic analysis, offering a more accurate, nuanced, and comprehensive tool for deciphering the complexities of the global economy. As we continue to refine these AI-enhanced models and explore their applications, the potential for more precise economic forecasts and more effective policy interventions becomes increasingly evident, marking a new frontier in economic research and policy-making.

References

[1]. Gomes, Bruna, and Euan A. Ashley. "Artificial intelligence in molecular medicine." New England Journal of Medicine 388.26 (2023): 2456-2465.

[2]. Salvagno, Michele, Fabio Silvio Taccone, and Alberto Giovanni Gerli. "Can artificial intelligence help for scientific writing?." Critical care 27.1 (2023): 75.

[3]. Holzinger, Andreas, et al. "AI for life: Trends in artificial intelligence for biotechnology." New Biotechnology 74 (2023): 16-24.

[4]. Aoujil, Zakaria, and Mohamed Hanine. "A Review on Artificial Intelligence and Behavioral Macroeconomics." The Proceedings of the International Conference on Smart City Applications. Springer, Cham, 2024.

[5]. Al Ahmad, Ana Shohibul Manshur, et al. "Integration of Artificial Intelligence and Macro-Economic Analysis: A Novel Approach with Distributed Information Systems." EAI Endorsed Transactions on Scalable Information Systems 11.2 (2023).

[6]. Mishra, Renu, et al. "Unlocking Economic Potential: The Role of Technological Change in Macroeconomic Development." European Economic Letters (EEL) 13.5 (2023): 529-534.

[7]. Atashbar, Tohid, and Rui Aruhan Shi. "AI and macroeconomic modeling: Deep reinforcement learning in an RBC model." (2023).

[8]. Mutascu, Mihai, and Scott W. Hegerty. "Predicting the contribution of artificial intelligence to unemployment rates: an artificial neural network approach." Journal of Economics and Finance 47.2 (2023): 400-416.

[9]. Guliyev, Hasraddin. "Artificial intelligence and unemployment in high-tech developed countries: New insights from dynamic panel data model." Research in Globalization 7 (2023): 100140.

Cite this article

Chen,Z. (2024). Advancing macroeconomic models through artificial intelligence integration. Applied and Computational Engineering,77,43-48.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Software Engineering and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gomes, Bruna, and Euan A. Ashley. "Artificial intelligence in molecular medicine." New England Journal of Medicine 388.26 (2023): 2456-2465.

[2]. Salvagno, Michele, Fabio Silvio Taccone, and Alberto Giovanni Gerli. "Can artificial intelligence help for scientific writing?." Critical care 27.1 (2023): 75.

[3]. Holzinger, Andreas, et al. "AI for life: Trends in artificial intelligence for biotechnology." New Biotechnology 74 (2023): 16-24.

[4]. Aoujil, Zakaria, and Mohamed Hanine. "A Review on Artificial Intelligence and Behavioral Macroeconomics." The Proceedings of the International Conference on Smart City Applications. Springer, Cham, 2024.

[5]. Al Ahmad, Ana Shohibul Manshur, et al. "Integration of Artificial Intelligence and Macro-Economic Analysis: A Novel Approach with Distributed Information Systems." EAI Endorsed Transactions on Scalable Information Systems 11.2 (2023).

[6]. Mishra, Renu, et al. "Unlocking Economic Potential: The Role of Technological Change in Macroeconomic Development." European Economic Letters (EEL) 13.5 (2023): 529-534.

[7]. Atashbar, Tohid, and Rui Aruhan Shi. "AI and macroeconomic modeling: Deep reinforcement learning in an RBC model." (2023).

[8]. Mutascu, Mihai, and Scott W. Hegerty. "Predicting the contribution of artificial intelligence to unemployment rates: an artificial neural network approach." Journal of Economics and Finance 47.2 (2023): 400-416.

[9]. Guliyev, Hasraddin. "Artificial intelligence and unemployment in high-tech developed countries: New insights from dynamic panel data model." Research in Globalization 7 (2023): 100140.