1.Introduction

Artificial intelligence (AI), cloud computing and big data have influenced the development of financial services and direct inventions such as digital investment advisors, also known as Robo Advisor (RA). This advanced technology incorporates investment proficiency with automation to convey modified support at a minimum cost. RA are comparable to traditional financial analysts concerned with investors who identify their choices and advance investment approaches that are standardised with their detailed requirements. Digital Investment Advisors (DIA) have progressed in the current era to study strategic understandings since DIA has been established as a valuable tool for automating banking actions, profitability, return on investment, and increased performance with the help of AI and Machine Learning (ML) algorithms. A DIA platform was formed to conduct investor self-assessments using AI and other innovative technologies. This platform became popular due to its low costs and fast results. Knowledge in personal finance enables the investors to assess the DIA, and more experience in investment strengthens their belief in applying the technologies in investing. DIA use AI and ML algorithms to guide investors with intelligent user-assistance attributes and cooperative instruments [1]. DIA is an evolving field of investment management that aims to promote investment advisory services by automating all the involved services. AI and ML algorithms are employed on DIA to propose investment advice and attain assets on behalf of investors' choices because AI is considered more beneficial for managerial decision-making, which is influenced mainly by its level of management accuracy. Algorithmic trading empowers financial literacy as a crucial component that allows investors to understand specific techniques and increase trust in this technology.

Financial literacy is a significant factor that helps to analyse DIA adoption and determine its trustworthiness. Financial literacy incorporates numerous additional thoughts, such as the significance of individual financial skills, understanding investment portfolios, products and companies offering investment services, and fundamental financial concepts. People with financial knowledge can discern the processes behind DIA, creating trust in the functionality of such systems. However, negative attitudes increase from inexperienced and financially illiterate investors, leading to a lack of confidence in the operation of DIA [2]. Moderate to high financial literacy among millennials increases the tendency to rely on DIA, while low levels of financial literacy make them reluctant. Aside from increasing the general literacy level, incorporating interactive educational tools in DIA platforms can erase this gap and make DIAs more welcoming.

The worth of DIA is directly determined by their response interface and the level of individualisation in the suggestions provided. It was also found that innovative financial technology expertise plays a highly significant role in improving DIA usability. It can lower the dependency on conventional advisors and improve the use rate among the less-served population [3]. It is more attainable for Millennials as they understand technology and would support cost-effective tools. The strategies that will be developed to enhance adoption should consider the demographics of the people. By adopting such measures, financial institutions also improve the prospects of DIA as future-proof investment management models that democratise DIA services [4-15]. The present work performs a thematic literature review to analyse how these factors, financial literacy, investment experience, and DIA, are connected. The study aims to address the following research questions (RQs):

RQ.1 How does financial literacy affect the adoption of DIA?

RQ.2 How does prior investment experience shape the effective use of DIA?

Based on ten primary papers, the present synthesis provides a systematic map of investor proficiency and its effects on DIA, with both affirmed and potential findings, research limitations, and practical implications.

2.Methodology

The methodology of this review study is quantitative, with an observed approach by analysing different studies. This research aims to examine the impact of investor literacy on the usage of DIAs. The literature review was narrowed down to ten highest-impact papers to increase the credibility of the identified findings. The articles used in this review were retrieved from Science Direct, Emerald, Research Gate, and Springer. The inclusion criteria: the primary step ensures that the quality and standard of articles are good. The following keywords are used to search papers: digital investment advisor, Robo advisor, investment experience, and financial literacy. Articles are based on the publication date and are in peer-reviewed journals from 2019 to 2024. Concentrate on financial knowledge, investing background, and DIA acceptance—representing various demographic and cultural settings. Keywords were Al financial advisory, financial literacy, investment experience, and DIA. This study used the subject area filters AI, Finance and Technology, Computer Science and Business, English, and article-only publishing.

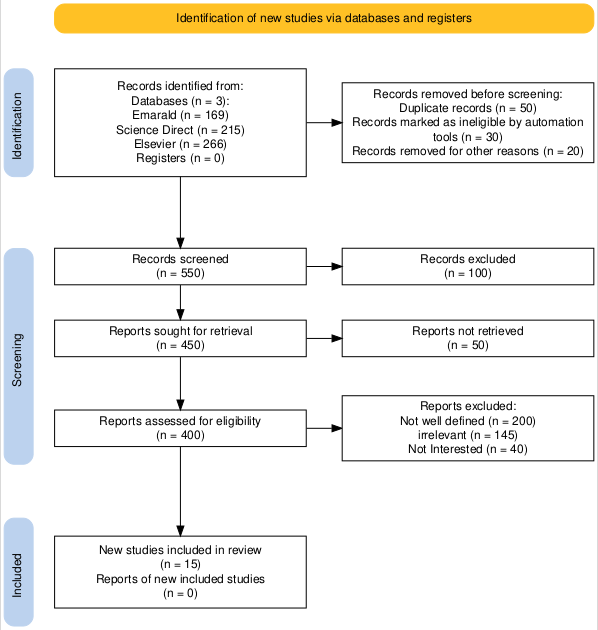

Figure 1 shows the selection process of papers reviewed in this study that were created using PRISMA. The selected studies were organised into two thematic clusters: First, role of financial literacy in DIA Adoption; Second, impact of investment experience on DIA use.

In the diagram, the first step is the identification selection of journals and papers. The second is screen levels, which involve the filter papers, such as removing duplicates, low-quality papers, unclear described papers, irrelevant articles, report retrieval, and assessed papers from consideration for review. After the exclusion, 46 papers were reviewed, and the last step was the inclusion of 15 selected articles used in this review paper.

3.Results and Discussion

The results are organised into two key themes: This study responds to the ability of financial literacy to influence DIA adoption and the effect of investment experience on DIA use. This review systematically identifies connections and behavioural impact while focusing on these themes with accessible and inclusive articles, as shown in Figure 1.

Figure 1: Flow chart of PRISMA.

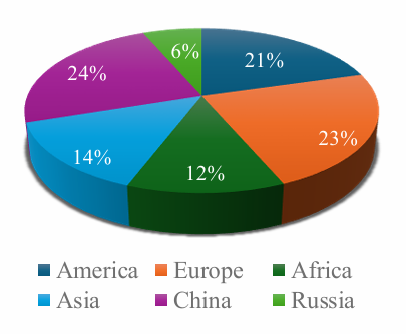

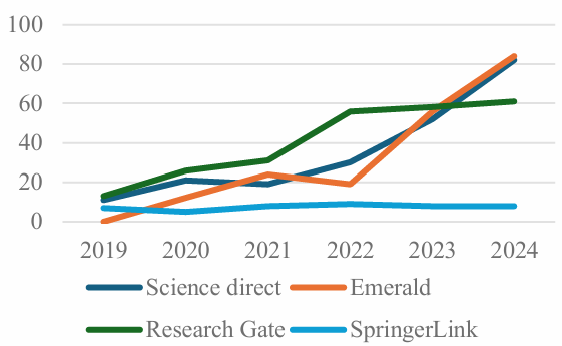

A thematic investigation organises the subjects and subtopics being researched. This method recognises, investigates, and reports outline inside data. Figure 2 includes a pie chart comprising regionally based data that presents the number of publications in different world regions. Figure 3 specifies the line graph of published papers. It specifies the DIA adoption expansion from 2019 to 2024 and how this topic became the most innovative and discussed by investors and researchers.

3.1.Adoption of DIA

Adopting digital advisors significantly influences investment decisions, revenue, and customer satisfaction. The adoption defines how investors accept, adopt, and use DIAs to manage their investments or make efficient decisions. AI-enhanced automated processes are now developed as necessary for financial growth and investment decisions in economic sectors [5]. The developing variety and quantity of securities investments boost the financial market's offerings and assist as an essential dynamic force, contributing prominently to the market's stable development. A DIA provides an online platform for dealing with buyer portfolios and implementing self-evaluations. Specifically, the DIA development and optimisation significantly impact investment decisions that use AI methods to facilitate investors and describe digital platforms prepared with intelligent user-assistance attributes [6]. This enhances users’ confidence because there is a combination of knowledge and technology, bringing adoption to the broader stage.

|

Figure 2: Regional research on DIA adoption from 2019 to 2024. |

Figure 3: Number of publications on DIA adoption from 2019 to 2024. |

3.2.The Role of Financial Literacy

The interaction between finance literacy and investment confidence indicates that financially literate people can trust DIA [7]. Integrated with awareness, financial literacy determines investment intention and investors' interest, including perceptions like helpful assistance, handling or taking financial decisions, and the capability to decide effective financial behaviour [8]. This research found that more financially adequate and skilled persons are more predisposed to participate in DIAs and to take advantage of all related features. This enhances users’ confidence because there is a combination of knowledge and technology, bringing adoption to the broader stage. Financial literacy includes understanding investment standards, how organisations or individuals contribute to these services, and becoming proficient in basic economic concepts. In contrast, low financial literacy is a constraint against adopting DIA among different investors [4]. It also includes essential abilities like managing the development of money, financial management plans, and estimating simple or composite interests. This study demonstrates that investors consider DIAs accurate in predictions as they reconcile their algorithms and effectiveness to the financial targets. Similarly, digital financial literacy stimulates the capacity of an individual to learn and shift to DIAs.

3.3.Impact of Investment Experience

Investment experience helps investors operate in complicated financial environments and reveals the specific functionalities of DIA and their risk potential. Understanding the core features of DIA and the optimised investment portfolio construction following the investor’s risk profile enhances the competency level of experienced investors [9]. Researchers found that such investors can rely on DIA for minor activities while remaining in charge of major decisions, which shows the suitable function that DIA can offer to the profile of experienced investors. The investor’s trust in DIA platforms is analysed, and results show that trust plays a significant role in investors using DIA [10]. The finding suggests that expert investors trust human guidance and may be suspicious of software in unusual market conditions. It was proposed that hybrid advisory models, where human advisors fill the gaps, might answer this trust deficit. Another significant study specifies that using the DIA in financial institutions offers automated and unbiased investment advice and maintains profit [11-12]. Another study specifies that using the DIA in financial institutions offers automated and unbiased investment advice and maintains profit. However, some of the issues that came out of the research include overconfidence and anchoring biases that may reduce optimal use. The DIA consumers who contribute to short-term investment and have low-risk acceptance are likelier to become supportable investors [11]

4.Contribution of the Research

This research offers a better insight into determining a systematic review of the existing literature on the features influencing DIA adoption, financial literacy, and investment experience. The results specify that the COVID-19 pandemic has enhanced digitalisation across numerous divisions of the economic sectors. Study findings indicated that combining financial literacy and technology increases the adoption of DIA among investors [8]. This study describes the impact of the investors on DIA adoption, investment experience, and financial literacy by monitoring control variables such as (trust, age, and risk-taking ability). The main contribution is the percentage of research conducted on this topic in different regions on DIAs by analysing the variables of financial literacy and investment experience. Investment experience helps investors manage investment portfolios in complicated financial environments and highlights the specific aspects of DIA and their risk potentialities. However, some issues from the research include overconfidence and anchoring biases that may reduce optimal use [9]. Similarly, demographic variables such as age, income, and culture influence users’ adoption behaviours because younger people are more responsive to increased technology acceptance [13].

5.Limitations

Primarily, the reviewed studies include variable RA adoption effect on all other dependent variables. In the future, different moderators could be added and analysed to check the impact of other variables on DIA, such as (income, portfolio management, and prediction accuracy). Secondly, the most observed issue in the previous research studies is that the data includes information from a single country. Hence, future research will consist of data from different regions. Consequently, international research could contribute knowledge of cultural variations and features that impact investors' acceptance of DIA. This study is conducted in developed countries, so it needs to be introduced in developing countries so that investors can expand their advisory services and check their awareness of adopting DIA. These reviews present a vast area of knowledge, and the fast pace of development in the financial technology industry can be seen as a problem for the traditional advisor's relevance of the present research outcomes.

6.Implications of the Research

The implications of this research will be helpful to financial institutions, policymakers, professionals, and technology developers in terms of the perception of investment. For financial institutions, the study points out the necessity of integrating educational instruments within DIA systems to promote users’ financial and digital competence. This review is also helpful in strengthening trust and functionality, particularly among inexperienced investors, so increasing the consumers’ concept and knowledge relevant to financial investment [13]. The outcomes of this assessment deliver insightful evidence to increase the adoption of DIA, sustain investment portfolios, rebalance portfolios, performance measurement, minimise risk, and maximise profit using AI and ML [14]. Cultural and demographic complexities must be considered when developing DIA interfaces, which should be user-friendly [10,13]. Such implications lead to the further democratisation of the financial market and more efficient working of financial systems, which promote financial inclusion and stability in a constantly changing economic environment.

7.Conclusion

This study highlights the importance of financial literacy and investment experience in using DIA. The review presented that AI-based RA directly affected the decision-making process, economic complexities and made more profitable investment decisions. The findings show that DIA users participating in short-term investment and low-risk acceptance are more likely to become supportable investors. The features of DIAs are coordinated with the investor's risk tolerance, preferences, and decision-making processes. Altogether, these aspects are the prerequisites for the action and usage of DIA among different investors.

Investment experience positively relates to adopting DIA and awareness and knowledge of financial sectors. The DIA contributed significantly to banks, trading, wealth management, and innovations in the financial sector. Secondly, in the financial industry, trust may directly and indirectly influence the acceptance, adoption, and use of DIA and the influence of investment experience on DIA's performance and profitability. Financial literacy is positively related to the DIA because educational involvement and awareness can raise the acceptance of DIAs. When these gaps are bridged, DIA has the potential for financial institutions to turn it into a revolutionary mass instrument for adjusting financial advice. This is socially desirable since it helps equalise the playing field for different investors. In addition, it makes DIA easier to use and more credible, setting the stage for DIA to become an essential part of modern portfolio management.

References

[1]. Barile, D., Secundo, G., & Bussoli, C. (2024). Exploring artificial intelligence robo-advisor in banking industry: a platform model. Management Decision. https://doi.org/10.1108/MD-08-2023-1324

[2]. Weixiang, S., Qamruzzaman, M., Rui, W., & Kler, R. (2022). An empirical assessment of financial literacy and behavioral biases on investment decision: Fresh evidence from small investor perception. In Frontiers in Psychology (Vol. 13). Frontiers Media SA. https://doi.org/10.3389/fpsyg.2022.977444

[3]. Wang, G., Zhang, M., & He, B. (2024). Financial literacy and investment returns: The moderating effect of education level. Finance Research Letters, 67. https://doi.org/10.1016/j.frl.2024.105781

[4]. Aristei, D., Gallo, M., & Vannoni, V. (2024). Preferences for ethical intermediaries and sustainable investment decisions in micro-firms: The role of financial literacy and digital financial capability. Research in International Business and Finance, 71. https://doi.org/10.1016/j.ribaf.2024.102483

[5]. Haddad, C., & Hornuf, L. (2019). The emergence of the global fintech market: economic and technological determinants. Small Business Economics, 53(1), 81–105. https://doi.org/10.1007/s11187-018-9991-x

[6]. Bai, Z. (2024). Examining the association between robo-advisory and perceived financial satisfaction. Review of Behavioral Finance, 16(4), 668–681. https://doi.org/10.1108/RBF-10-2023-0268

[7]. Gan, L. Y., Khan, M. T. I., & Liew, T. W. (2021). Understanding consumer’s adoption of financial robo‐advisors at the outbreak of the COVID ‐19 crisis in Malaysia . FINANCIAL PLANNING REVIEW, 4(3). https://doi.org/10.1002/cfp2.1127

[8]. Karundeng, M., Siagian, K., Hutabarat, V., & Pangaribuan, F. (2024). The Impact of Financial Literacy and Digital Awareness on Investment Intentions. Ilomata International Journal of Tax Anad Accounting, 5(1), 280–291. https://doi.org/10.52728/ijtc.v5i1.1014

[9]. Boreiko, D., & Massarotti, F. (2020). How Risk Profiles of Investors Affect Robo-Advised Portfolios. Frontiers in Artificial Intelligence, 3. https://doi.org/10.3389/frai.2020.00060

[10]. Glaser, F., Iliewa, Z., Jung, D., & Weber, M. (2019). Towards designing robo-advisors for unexperienced investors with experience sampling of time-series data. In Lecture Notes in Information Systems and Organisation (Vol. 29, pp. 133–138). Springer Heidelberg. https://doi.org/10.1007/978-3-030-01087-4_16

[11]. Cheong, S. F., Keikhosrokiani, P., & Fadilah, S. I. (2023). A Concise Review for Exploring Behaviors To Embrace Investment Robo-advisors. 2023 13th International Conference on Information Technology in Asia, CITA 2023, 100–105. https://doi.org/10.1109/CITA58204.2023.10262612

[12]. Back, C., Morana, S., & Spann, M. (2023). When Do Robo-Advisors Make Us Better Investors? The Impact of Social Design Elements on Investor Behavior. Journal of Behavioral and Experimental Economics, 101984. https://doi.org/10.1016/j.socec.2023.101984

[13]. Kasemharuethaisuk, H., & Samanchuen, T. (2023). Factors Influencing Behavior Intention in Digital Investment Services of Mutual Fund Distributors Adoption in Thailand. Sustainability (Switzerland), 15(3). https://doi.org/10.3390/su15032279

[14]. Nguyen, T. P. L., Chew, L. W., Muthaiyah, S., Teh, B. H., & Ong, T. S. (2023). Factors influencing acceptance of Robo-Advisors for wealth management in Malaysia. Cogent Engineering, 10(1). https://doi.org/10.1080/23311916.2023.2188992

[15]. AbouGrad, H., Chakhar, S., & Abubahia, A. (2023). Decision Making by Applying Machine Learning Techniques to Mitigate Spam SMS Attacks. Lecture Notes in Networks and Systems, 670 LNNS, 154–166. https://doi.org/10.1007/978-3-031-30396-8_14

Cite this article

Qadoos,A.;AbouGrad,H.;Wall,J.;Sharif,M.S. (2025). AI Investment Advisory: Examining Robo-Advisor Adoption Using Financial Literacy and Investment Experience Variables. Applied and Computational Engineering,125,201-207.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Mechatronics and Smart Systems

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Barile, D., Secundo, G., & Bussoli, C. (2024). Exploring artificial intelligence robo-advisor in banking industry: a platform model. Management Decision. https://doi.org/10.1108/MD-08-2023-1324

[2]. Weixiang, S., Qamruzzaman, M., Rui, W., & Kler, R. (2022). An empirical assessment of financial literacy and behavioral biases on investment decision: Fresh evidence from small investor perception. In Frontiers in Psychology (Vol. 13). Frontiers Media SA. https://doi.org/10.3389/fpsyg.2022.977444

[3]. Wang, G., Zhang, M., & He, B. (2024). Financial literacy and investment returns: The moderating effect of education level. Finance Research Letters, 67. https://doi.org/10.1016/j.frl.2024.105781

[4]. Aristei, D., Gallo, M., & Vannoni, V. (2024). Preferences for ethical intermediaries and sustainable investment decisions in micro-firms: The role of financial literacy and digital financial capability. Research in International Business and Finance, 71. https://doi.org/10.1016/j.ribaf.2024.102483

[5]. Haddad, C., & Hornuf, L. (2019). The emergence of the global fintech market: economic and technological determinants. Small Business Economics, 53(1), 81–105. https://doi.org/10.1007/s11187-018-9991-x

[6]. Bai, Z. (2024). Examining the association between robo-advisory and perceived financial satisfaction. Review of Behavioral Finance, 16(4), 668–681. https://doi.org/10.1108/RBF-10-2023-0268

[7]. Gan, L. Y., Khan, M. T. I., & Liew, T. W. (2021). Understanding consumer’s adoption of financial robo‐advisors at the outbreak of the COVID ‐19 crisis in Malaysia . FINANCIAL PLANNING REVIEW, 4(3). https://doi.org/10.1002/cfp2.1127

[8]. Karundeng, M., Siagian, K., Hutabarat, V., & Pangaribuan, F. (2024). The Impact of Financial Literacy and Digital Awareness on Investment Intentions. Ilomata International Journal of Tax Anad Accounting, 5(1), 280–291. https://doi.org/10.52728/ijtc.v5i1.1014

[9]. Boreiko, D., & Massarotti, F. (2020). How Risk Profiles of Investors Affect Robo-Advised Portfolios. Frontiers in Artificial Intelligence, 3. https://doi.org/10.3389/frai.2020.00060

[10]. Glaser, F., Iliewa, Z., Jung, D., & Weber, M. (2019). Towards designing robo-advisors for unexperienced investors with experience sampling of time-series data. In Lecture Notes in Information Systems and Organisation (Vol. 29, pp. 133–138). Springer Heidelberg. https://doi.org/10.1007/978-3-030-01087-4_16

[11]. Cheong, S. F., Keikhosrokiani, P., & Fadilah, S. I. (2023). A Concise Review for Exploring Behaviors To Embrace Investment Robo-advisors. 2023 13th International Conference on Information Technology in Asia, CITA 2023, 100–105. https://doi.org/10.1109/CITA58204.2023.10262612

[12]. Back, C., Morana, S., & Spann, M. (2023). When Do Robo-Advisors Make Us Better Investors? The Impact of Social Design Elements on Investor Behavior. Journal of Behavioral and Experimental Economics, 101984. https://doi.org/10.1016/j.socec.2023.101984

[13]. Kasemharuethaisuk, H., & Samanchuen, T. (2023). Factors Influencing Behavior Intention in Digital Investment Services of Mutual Fund Distributors Adoption in Thailand. Sustainability (Switzerland), 15(3). https://doi.org/10.3390/su15032279

[14]. Nguyen, T. P. L., Chew, L. W., Muthaiyah, S., Teh, B. H., & Ong, T. S. (2023). Factors influencing acceptance of Robo-Advisors for wealth management in Malaysia. Cogent Engineering, 10(1). https://doi.org/10.1080/23311916.2023.2188992

[15]. AbouGrad, H., Chakhar, S., & Abubahia, A. (2023). Decision Making by Applying Machine Learning Techniques to Mitigate Spam SMS Attacks. Lecture Notes in Networks and Systems, 670 LNNS, 154–166. https://doi.org/10.1007/978-3-031-30396-8_14