1. Introduction

This study focuses on how emotional states, especially sadness and happiness, can influence decision-making behaviours under risky situations. Past researchers have demonstrated the role of emotion in altering risk preferences which sadness often linked to a higher risk-seeking behaviour whereas happiness often had a risk-averse tendency. Based on the theories like Prospect Theory and the impact of emotional framing on decision-making, this experiment used emotion manipulation through short film clips to elicit either a sad or a happy state in participants. Then, using a gamble game to measure risk-seeking and risk-averse behaviour across various scenarios. This research aims to solidify the understanding of emotion-driven decision-making and intends to offer insights into how different emotional states can impact choices in risk-related contexts, which can contribute to the field involving high-stake risk-assessments, like finance and healthcare.

2. Literature Review

2.1. Theoretical Framework

The decision-making under risk is a pivotal area of study that is not only in psychology but also spans across economics, management, and various subjects. This literature review aims to dissect the intricate landscape of how individuals make decisions when the outcomes is uncertain and sometimes the stakes are high. This review investigates a range of theoretical frameworks explored by previous researchers which have deeply shaped our understanding of the contemporary decision-making process as a distinct area of research. Notably, Kahneman and Tversky’s seminal studies in 1979 introduced the prospect theory which have provided a significant and serve as cornerstones in the research area of decision-making under risk. Their studies illustrate profound into how individuals evaluate their potential losses and their gains. Based on their foundational works, further studies have continuously examined the role of psychological and social factors in influencing the decision-making under risk. For instance, Fisher’s study [1] explores the implication of risky choice framing on the rational decision-making, while Spohn et al.’s work [2] investigates the impact of social contexts on individual’s risk-taking behaviours. Additionally, practical applications and decision support systems discussed by Damghani et al. [3] in their empirical research demonstrate how the theoretical models are implemented to guide the real-world decisions. This review synthesizes the key findings from the literature which to highlight the integration of interdisciplinary perspectives and discuss the application for the future research and practice in decision-making under risk. According to the insights gained from foundational and contemporary research, this review aims to provide a deep understanding of the decision-making processes under risk and illuminates the diversity of human behaviour under uncertain contexts.

Before exploring the topic of decision-making under risk, it is necessary to examine an exploration of various theoretical framework which provides insights into how decisions are made when outcomes are uncertain. These frameworks offer foundational knowledge that helps to explain the rationale behind decision choices in conditions of risk.

First, the classical decision theories such as Expected Utility Theory (EUT) [4] have played a crucial role in shaping people’s understanding of the risk-based decision-making. The EUT suggests that individuals tend to act rationally by selecting options which maximize their expected utility based on a utility function representing their preferences [5]. However, empirical evidence often indicates deviations from the EUT which showing that individuals do not always follow the rationality assumed in the classical theories. Thus, Kahneman and Tversky’s studies critically evaluate these assumptions and hypotheses and trying to illustrate that real-life choices often contradict with the rational decision-making model proposed by EUT.

In response to the limitations observed in EUT, Kahneman and Tversky introduced the prospect theory, which is a pivotal alternative that describes how people actually make their decisions under the risk situations [6]. Unlike EUT, the prospect theory is in responsible for how people value their potential gains and losses differently and this will lead to decisions that deviate from those behaviours predicted by the traditional utility theories. This prospect theory suggests a new concept of loss aversion which the losses have disproportionately more significant influence on individual’s utility than an equivalent number of gains. This finding helps to explain the reason that why individuals may reject the favourable bets and demonstrates the impact of reference points and framing on decision-making [7].

Additionally, the framing of decisions is a concept further explored by Tversky and Kahneman in their study “The Framing of Decisions and Psychology of Choice” [7]. It plays a crucial role in influencing the decision outcomes. The method and the way that a decision or a problem is presented can have a significant impact on the potential choices made by individuals, indicating the non-linear function of human rationality in decision-making. Tversky and Kahneman use the framework of loss-aversion to challenge the tradition utility theory, which assumes the rational decision-making. Their findings indicate that individuals’ choices are systematically influenced by how choices are framed, which can lead to different decisions even though the objective information remains the same. This study significantly impacts both theoretical understanding of economic behaviours and the practical approach where strategic framing can largely influence outcomes, for instance, policymaking, marketing, and management.

Adding to the complexity of the decision-making models, Mishra combines perspectives from biology, economics, and psychology to provide a broader understanding of the decision-making under risk [8]. This interdisciplinary approach examines the biological foundations that impact economic behaviours, including the influence of neurological and genetic factors on risk preferences and decision-making processes. According to the insights from her study, it suggests that decision-making is influenced by an interplay of cognitive functions, emotional responses, and contextual factors which broadens the scope beyond the purely economic or psychological models.

2.2. Behavioural Influences on Decision Making

Behavioural and social factors can significantly influence decision-making under risk. Psychological traits such as fear, overconfidence, and other biases profoundly affect the assessment of risks and how decisions are made. Furthermore, the social context, including the influence of peers and close others, add another degree of complexity of how decisions are made in risky situations.

Research into psychological biases like overconfidence reveals that individuals tend to underestimate the potential risks and overestimate their own abilities in which leads to riskier behaviours. This phenomenon has been demonstrated in controlled experiments where participants are asked to make predictions about tehri performance on various tasks [9]. Similarly, studies on the influence of fear show that the individuals in heightened states of fear will be more likely to opt for safer choices, especially when these emotions are triggered by a vivid and immediate threat [10]. These two experiments typically manipulate emotional states through exposure to different stimuli and then measure changes in risk preference, providing insights into how specific emotions affect decision-making.

Thaler et al. in their study conducted experiments to test the effects of the myopic loss aversion and found that more frequent evaluations of investment resulted in increased risk-averse behaviours [11]. They manipulated the frequency of feedback given to participants on their investment returns and observed how this will affect their willingness to take further risk behaviours. Participants who received less frequent updates about their portfolio performance exhibited a higher tolerance for risk behaviours which indicating that the temporal aspect of information processing acts a crucial role in risk-taking behaviours. This study used a simulated investment environment to provide the controlled but also realistic decision-making contexts in a lab setting.

Toubia et al. explored in their study about how different settings can impact individuals’ decision-making under risk by varying the conditions under which participants made choices about the hypothetical investments [12]. Their method involved changing the frequency and type of feedback that participants received about their investment performance. In one experiment, participants were divided into groups which receiving either annual or quarterly feedback on their mock stock portfolio. The results showed that those who received less frequent feedback exhibited higher risk tolerance, suggesting that the interval between feedback could significantly impact the investment decisions. This approach highlighted the importance of the setting in decision-making processes and indicated the ways to design environments which could promote healthier risk-taking behaviours.

In the study by Spohn et al., the influence of social context on risky decision-making was thoroughly examined by exploring the scenarios which involved making decisions alone or in the presence of friends or acquaintances [2]. The participants were given a series of decision-making tasks that simulated everyday life choices. For instance, deciding whether to engage in recreational activities that involve risks situations. The results showed that the presence of friends significantly increased the risk0taking behaviours, a finding which underscoring the influence of social norms and peer pressure on individual decisions. This study done by Spohn et al. carefully controlled for the presence of peers and competitive elements to isolate their specific impacts on decision-making and provided a clear demonstration of the social dimensions of the risk behaviours.

2.3. Practical Applications and Decision Support Systems

The practical applications of decision-making under risk are crucial in numerous industries where stakes are high, and decisions must be precise. The decision support systems (DSS) play an essential role in structuring these decisions which ensuring they are based on the systematic approaches and reliable data.

The decision support systems (DSS) are complex frameworks which are designed to assist in sophisticated decision-making situations which the risk and uncertainty are significant. These systems use the probabilistic models and Bayesian approaches to manage and interpret the uncertainty, which allowing decision-makers to operate more confidently under different conditions. In Tversky and Kahneman’s study [13], they underscore the importance of framing in decision-making which indicate the significance of how decision frameworks can significantly impact the choices made by individuals and organizations-it often directs them toward more rational and objective decision outcomes.

Damghani et al.’s study introduces a decision-making model that combines the Bayesian methods in order to enhance the handling of uncertainty by quantifying the probabilities in decision-making processes [3]. This integration allows for a more detailed approach to risk which accommodating a range of possible outcomes and their respective probabilities. Thus, it can facilitate a more informed and confident decision-making in sectors such as industries like finance and healthcare where the risk assessment is crucial in an everyday manner.

In the financial sector, the DSS are essential in exploring investment decisions under risk by predicting market behaviours and aiding in portfolio management. Similarly, in the sector of healthcare, these systems also support the treatment decisions by analyzing statistical data and patient outcomes in order to apply theoretical models to practical situations effectively and reliably. These applications show that how decision-making under risk is not only a theoretical concept but also a practical necessity across various high-stakes industries. For instance, the application of DSS in financial and healthcare institutions and facilities is shown in risk assessment tools to evaluate and manage the risks of investment portfolio which optimizing returns by balancing the potential data to recommend personalized treatment plans. Thus, they can improve patient outcomes by considering both the effectiveness of treatment and the associated risks.

Each example and case study emphasizes the critical role of the theoretical insights in improving the accuracy, effectiveness, and reliability of decision-making in practice. The combination of probabilistic models and Bayesian approaches within DSS framework not only increases the capability to manage uncertainty but also makes sure that the decision-making processes are grounded in a strong analysis of the available data and risk assessments. These practical applications underscore the significant impact of the decision support systems in tremendous industries and further demonstrate their value in exploring the complex decision-making situations effectively.

This literature review has critically examined the landscape of decision-making under risk and pointed out the significance of theoretical and practical insights from empirical studies, while also provide directions for future research. The key theoretical frameworks like Prospect Theory have strengthened our understanding of human risk-taking behaviours, yet gaps remain in fully grasping the complexities of decision-making influenced by psychological and social factors.

Future studies and research should continue to explore the integration of interdisciplinary perspectives especially from neuroeconomics and behavioural genetics to deepen our understanding of the biological nature and psychological drivers of decision-making under risk. Additionally, the application of decision support systems (DSS) in real-world scenarios has demonstrated their utility in managing complex decisions. However, there is a crucial need to refine these systems to handle dynamic and unpredictable environments more effectively and reliably, especially in rapidly changing industries like finance and healthcare.

All of the findings from this review indicate the significance role of framing in decision-making and the impact of probabilistic models and Bayesian approaches in enhancing decision support systems. As we move forward, it will be essential to develop more robust DSS that are not only theoretically informed but also practically effectively in numerous settings. This endeavor will need ongoing collaboration between researchers and practitioners to make sure that the theoretical advancements are reliably transformed into practical tools which can significantly improve the decision outcomes in high-stakes environments.

3. Method

3.1. Participants

This study aims to recruit around 60 participants from announcements that were posted from WeChat groups, courses groups from University of Toronto, and word of mouth from friends and families. Most of the participants will be undergraduate students or have completed undergraduate education in their past. As well, most of the participants’ age will range from 18-25. All the participants will be Chinese residents or Chinese race but are other countries’ citizens.

3.2. Materials

A consent form is given to the participants at the beginning of the study (c.f. Appendix A). All of the terms of conditions, along with the potential risks, uncomfortable situations that the participants may feel or encounter during the research, and the contact information of the researcher are all presented on the consent form.

A demographic questionnaire for collecting anonymous personal information of the participants (c.f. Appendix B). The questionnaire involves asking the participants about their age, gender, ethic, educational status, location, and their marital status. Noted that each of the question has a choice of prefer to not say and participants always have the choice to not providing any of their personal information.

Two 4 minutes short clips from YouTube. The first clip is an excerpt from Mr. Bean [14] which is intended to elicit emotion of happiness of the participants in the happy group. The second clip is an excerpt from the film The Basketball Dairies which is intended to elicit emotion of sadness of the participants in the sad group [15].

A questionnaire asking participants about their emotion before and after the clip they watch to verify the validity of the two clips. (c.f. Appendix C) The questionnaire has three questions in total. The first is asking the participants if they are at a stable emotion stage. Second question includes six basic emotions: happy, sad, fear, disgust, anger, and surprise. The last question is a Likert Scale asking them how strong the emotion is, in a five points scale, from no feeling to extreme emotion.

The gamble game which consists of 12 trails to collect risk-seeking/risk-averse behaviours of the participants (c.f. Appendix D). The choices and outcomes that participants face in each trail are different in terms of the risk-seeking and risk-averse behaviours. In each trail, the expectations in two decisions that faced by participants are the same, yet the utilities are different. The currency earning and losing in the gamble game are all hypothetical under this circumstance. In the beginning six trails, participants earn points based on their choices. For example, the first trail of the gamble game is 100% for getting $10 and 50% for getting $20. The first choice has no expectation, and it is risk-averse behaviour whereas the second choice has an expectation, and it is the risk-seeking behaviour: participants have 50% chance getting 20 points and another 50% chance getting nothing. In later trails, the chance of risking-seeking and risk-averse behaviours is changed. In the second trial, it is 100% for getting $20 and 40% for getting $50. In the third trail, it is 80% for getting $30 and 40% for getting $60. In the fourth trail, it is 90% for getting $40 and 60% for getting $60. In the fifth trail, it is 100% for getting $10 and 20% for getting $50. In the last trial of gaining section, it is 80% for getting $30 and 20% for getting $120. In contrary, starting from the seventh trail, the gamble game changes to the version of losing which participants start to lose. In the seventh trail, the participants face a gamble condition of 100% for losing $10 and 50% for losing $20. As same as the previous condition, another 50% of the second choice will be lose nothing in this trail. In the eighth trail, it is 80% for losing $20 and 40% for losing $40. In the ninth trail, it is 90% for losing $20 and 30% for losing $60. In the tenth trail, it is 100% for losing $30 and 50% for losing $60. In the eleventh trail, it is 100% for losing $10 and 20% for losing $50. In the last trail, it is 100% for losing $18 and 20% for losing $90. The 12 trails of the gamble game are displayed in the below charts.

A laptop to create the survey, questionnaire, and the gamble game, to access all the results and data from the study. Then, use excel, data collection tools that online survey platforms automatically have on the laptop, to analyze the data and come up with the final results for analysis.

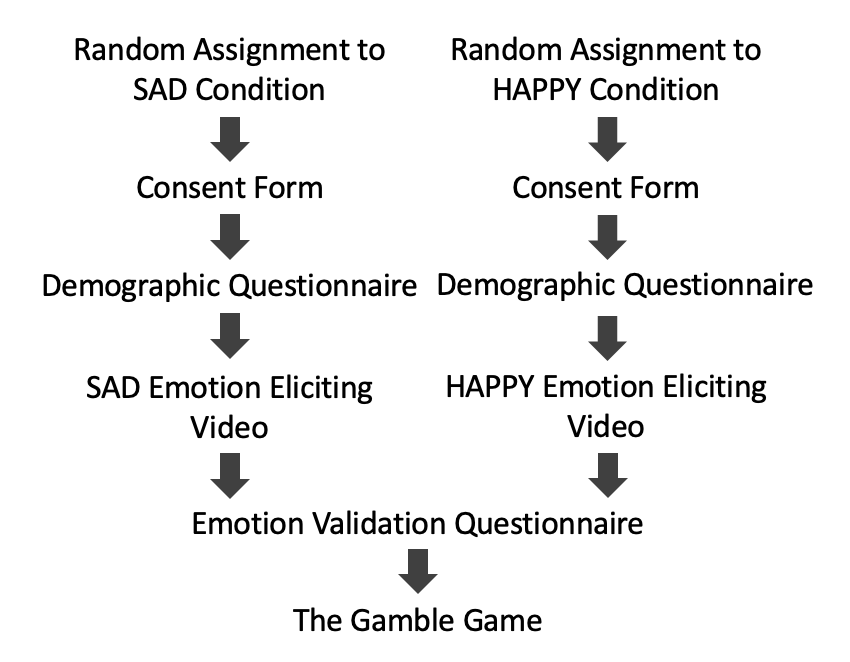

3.3. Procedure

First, the participants will randomly get one of the versions of the research survey for data collection. The researcher doesn’t know which participants is completing which version of the survey. Then, all participants will sign the consent form at the beginning of the survey which clearly stated that there might be potential psychological distress and uncomfortable feelings during the experiment and the participants have the rights of quit the study at any point or withdraw their data they provide by contacting the researcher.

Once they agree to take part in the upcoming decision-making study, they will start to complete six demographic questions for personal information collection and analysis. It includes asking about your age, gender, ethic, educational background, location, and your marital status. All questions contain a choice of “Prefer Not to Say” for all participants in the two versions of the survey.

After that, they will answer the first question of the emotion verification questionnaire, which asking them whether they are at a stable emotion stage. Then, the participants that assigned to sad condition group (Version 1 indicated on the top of the survey) will watch the sad clip from movie The Basketball Dairies [15], happy condition group (Version 2 indicated on the top of the survey) will watch the happy clip from Mr. Bean [14]. After they watch the clip, they will answer the two questions in the emotion verification questionnaire to see if they are in the right emotion after watching the clips. They are only valid if the sad condition group selects the emotion of sadness, or the happy condition group selects the emotion of happiness.

Then, they enter the last phase of the survey which is the gamble game. The gamble game lasts 12 trails and participants need to complete all of the trails in order to finish the survey. Every time participants make a risky choice (choice 1 in two versions of the survey), their risk-seeking rate will increase 8.3%. If participants make 12 risky choice, their risk-seeking rate will be 99.9% which will be rounded to 100%. If participants make 0 risky choice, their risk-seeking rate will be 0%. After the data collection, the experiment part is over, and the data analysis part starts. Researcher will use personal laptop to calculate all the statistics for later analysis of results by mainly using Excel and SPSS.

Figure 1. The Procedure

4. Results

4.1. Demographic Statistics

The study included 53 Chinese participants, with a gender distribution of 24 males and 29 females. Around 79% of the participants are between 18-25 years old and the rest of them are over 30 years old. There are 83% of the participants completing or have completed an education higher than bachelor’s degree. Also, there are 60% of the participant are based in China and 32% of them are based in Canada. At last, 74% of participants are single and 17% are married.

4.2. Impact of Emotion Manipulation

To examine the emotional states of the participants on risk-seeking behaviours, participants were divided into two groups based on the emotion elicited before the gamble game. The participants were first asked about their current emotional status to see if they are at a stable emotion stage. The sad group exhibited an 85% of stable emotion among 26 samples whereas the happy group exhibited a 93% of stable emotion among 27 samples. After watching the video, the two groups of participants reported the basic emotion(s) they feel and the ratings toward the video regarding the strength of the emotion they experienced. All of the 53 participants were correct identified the right emotion that the study wanted to elicit: the sad group all successfully chose the sad option and the happy group all successfully chose the happy option. Some participants chose more emotions but all of them had included the right elicited emotion within their choices. The sad group reported an average of 3.12/5 of strength of the clip from The Basketball Dairies whereas the happy group reported an average of 2.78/5 of strength of the clip from Mr. Bean.

4.3. Gamble Game Statistics

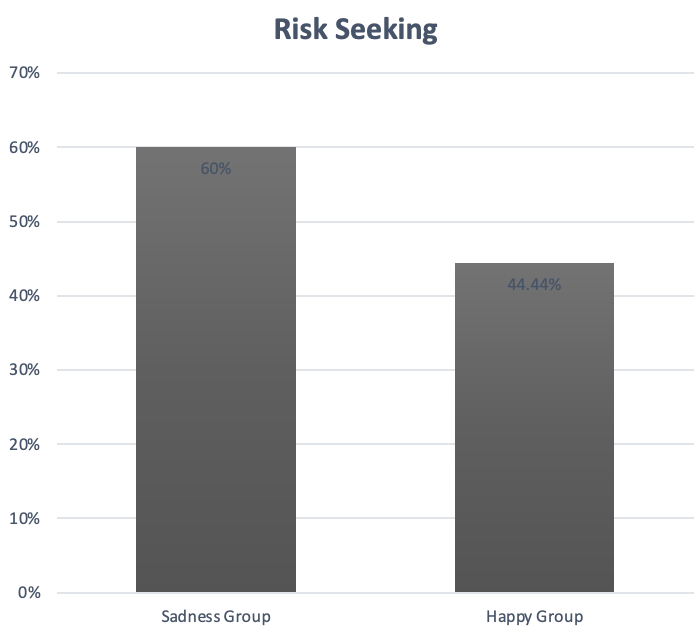

The result of the T-test indicated that t statistics is around 2.66 and the p value is about 0.0104, which is less than 0.5. Also, the effect size indicates that d=0.76, which the results of the gamble game have a large effect. There is a statistically significant difference between the two groups and successfully reject the null hypothesis of there is no risk-seeking difference between the emotions of sad and happy.

Across all participants, the average rate of selecting the risk-seeking choices in the gamble game was calculated. In general, the sad group had an average risk-seeking possibility of 60% whereas the happy group had an average risk-seeking possibility of 44.44%. This 15% of difference indicated the significance impact that emotion has done to the human decision-making process. More specifically, the results of sad group exhibited that the gain section (first six trails) had a relative lower risk-seeking possibility of 57.69%, compared to the loss section (the last six trails) which is 62.18%. (These results are found by calculating the average risk-seeking possibility of all of the responses in two sections. For example, there are 90 risk-seeking choice in the gain section of the sad group, and the sad group will have 26 participants x 6 trails = 156 responses in total. So, the risk-seeking possibility of the gain section of the sad group will be 90/156 = 57.69%) On the other hand, the happy group didn’t show this pattern which they showed a same risk-seeking possibility in two sections which is 44.45%. Moreover, the sad group (in both gain section and the lost section) indicated that the third trail is the highest risk-seeking trail in the section, which are trail 3 (69.23%) and trail 9 (80.77%). The happy group still didn’t show this pattern of strongest risk-seeking trail as at the third trail in each section. Furthermore, the individual differences in the study are strong, especially in the happy condition. The riskiest participant in happy condition showed a 100% of risk-seeking in both gain and lost sections. In contrary, the least risky participant in happy condition showed a 0% of risk-seeking in both gain and lost sections.

Figure 2. Risk-Seeking Chance

5. Discussion

5.1. Summary of Key Findings

This study aimed to explore how emotional status, such as happiness and sadness, influence decision-making under risk. The experiment revealed that participants in the sad condition exhibited a higher probability for risk-seeking behaviour (60%) compared to those in the happy condition (44.44%). Furthermore, within the sad group, participants showed a significantly greater tendency to engage in the risk-seeking behaviour in the loss scenarios compared to the gain scenarios. The t-test results (t=2.66, p=0.0104) provided strong statistical evidence for the influence of emotional states on risk-taking. This finding further leads to the conclusion of sadness led to more risk-seeking decisions. These findings showed a meaningful relationship between emotional states and decision-making which supports the hypothesis of sadness promotes greater risk-seeking behaviour.

5.2. Interpretation of Results

The results align with the existing literature on the emotion-driven decision-making. For instance, findings by Lerner and Keltner [10] suggest that fear and sadness have their special impacts on risk preference. In this study, sadness increased risk-seeking behaviour which testified the previous research that emotional states can override rational risk assessments. The results are also aligned and serve as an example of the Prospect Theory [6]. It points out that people tend to be risk-seeking in the domain of losses. In this case, participants in the sad condition exhibited a pronounced risk-seeking tendency especially in the loss section of the gamble game. In contrast, participants in the happy condition demonstrated more stable risk-seeking preferences with no significant variation between the gain and loss section.

It is worth to mention that even though the sad group showed a higher risk-seeking possibility overall, this was particularly pronounced in the third trail of each section (69.23% in the third trail in the gain section and 80.77% in the third trail in the loss section). This indicates that as participants became more engaged in the gamble game, sadness may have intensified their willingness to take risk. This finding may be due to the emotional regulation processes where individuals in a sad emotional state may seek greater reward to compensate for their negative affect as proposed by the Mood Maintenance Hypothesis [16]. On the other hand, the happy group didn’t show such a marked pattern which mean that happiness may promote a more stable and cautious approach to risk. This finding is also in line with the previous findings that positive emotions generally lead to risk aversion [17].

5.3. Theoretical Implications

These findings provide valuable insights into the relationship between emotions and decision-making under risk which have contributed to the understanding of how emotions alter the rational processes predicted by the classical decision theories. Prospect Theory’s framing of decisions in terms of gains and losses is supported by this study especially in the sad group’s divergent behaviour between the gain and loss sections. This further testifies the idea of emotional states interact with cognitive evaluations of risk which shaping decision outcomes in predictable ways.

The data gathered for this study also raise questions about the interaction between emotional intensity and decision-making. Participants in the sad condition reported a stronger emotional response to the sad clip compared to the happy group’s response to the happy clip (3.12/5 vs. 2.78/5). This might be the reason to conclude that the intensity of sadness could be driving the increased risk-seeking behaviour. The future theoretical models should consider the factor of how the strength of emotional states might affect the degree of risk aversion or risk-seeking behaviour. For example, future research could expand on the existing framework of Prospect Theory to incorporate emotional intensity as a moderating variable in their research study.

5.4. Practical Implications

The practical implication of these findings in this study are significant, especially in the fields where emotional states may play a role in decision-making under risk, such as finance, healthcare, and risk management. For example, financial advisors may need to account for clients’ emotional states when advising on high-risk investments, as sadness may influence their willingness to take risks that they might otherwise avoid when making decisions. Similarly, in healthcare industry, patients facing emotionally charged decisions, such as significant risk treatment options, may make different choices based on their emotional state at the time.

Decision support systems (DSS) used in high-stakes industries could also benefit from integrating emotional state assessments into their risk analysis frameworks. Current DSS models primarily focus on probabilistic and statistical factors but incorporating emotional feedback could provide a more holistic approach to decision-making. For instance, in environments like stock trading or medical decision-making, emotion can significantly influence outcomes. The findings from this study suggest that such systems might improve their predictions and recommendations by accounting for emotional influences, especially in situations involving loss aversion.

6. Conclusion

In conclusion, this study highlights the significant role that emotional states play in decision-making under risk, with sadness promoting greater risk-seeking behaviour. These findings contribute to the growing body of literature on emotion and decision-making, which emphasizing the need to account for emotional factors in both theoretical models and practical applications. Further research is necessary to explore the full picture of emotional influences on risk behaviour and to develop more detailed decision-making frameworks that integrate both cognitive and emotional processes.

6.1. Limitations of the Study

Despite its contributions, this study has limitations. First, the sample size (53 participants) is relatively small which limiting the generalizability of the findings. Future studies should include a larger and more diverse sample to determine if the observed effects hold across different populations and cultural backgrounds. Second, the sample consisted entirely of Chinese participants which may introduce cultural biases in risk preferences that are not representative of other groups. Cross-cultural research would help clarify whether the influence of emotions on decision-making under risk is universal or culture-specific. Last, another limitation is the use of hypothetical gambling scenarios which may not fully capture the complexities of the real-world decision-making under risks. While the gamble game has provided a controlled environment for measuring risk-seeking behaviour, participants’ responses may differ in real-life situations where the stakes are tangible. Future research could explore decision-making in more realistic and complex settings which could potentially using economic simulations or real monetary incentives to enhance ecological validity.

6.2. Future Research Directions

Based on the findings of this study, future research should explore the impact of other emotional states, such as anger or fear, on decision-making under risk. Even though sadness and happiness were the focus in this study, other emotions may have distinct effects on risk preferences. For example, anger has been associated with increased risk-taking in some studies [10], and it would be valuable to examine how different negative emotions influence risk behaviour compared to positive emotions.

Additionally, further investigation is needed to understand the long-term effects of emotional states on decision-making. This study captured immediate responses to emotional manipulation, but further research could examine whether these effects persist over time or whether individuals’ risk preferences revert to baseline as their emotional states stabilize. Longitudinal studies would provide more significant insights into the temporal dynamics of emotion-driven decision-making.

References

[1]. Fisher, S. A., & Mandel, D. R. (2021). Risky-choice framing and rational decision-making. Wiley Compass Journals. https://doi.org/10.31234/osf.io/xugaz

[2]. Spohn, D. L., Devore‐Suazo, I. F., Bernarding, M. L., & Güss, C. D. (2022). The role of social context in risky decision‐making: Presence of friend and low resistance to peer influence increase risky decision‐making. International Journal of Psychology, 57(6), 717–726. https://doi.org/10.1002/ijop.12864

[3]. Damghani, K. K., Taghavifard, M. T., & Moghaddam, R. T. (2009). Decision making under. uncertain and risky situations. Society of Actuaries, 1-31.

[4]. Morgenstern, O. (1979). Some Reflections on Utility. In: Allais, M., Hagen, O. (eds) Expected Utility Hypotheses and the Allais Paradox. Theory and Decision Library, vol 21. Springer, Dordrecht. https://doi.org/10.1007/978-94-015-7629-1_6

[5]. von Neumann, J., & Morgenstern, O. (2007). Chapter I. Formulation of the economic problem. Theory of Games and Economic Behavior (60th Anniversary Commemorative Edition). SpringerLink, 1–45. https://doi.org/10.1515/9781400829460.1

[6]. Tversky, A., & Kahneman, D. (1977). Prospect theory. an analysis of decision making under risk. ProQuest. https://doi.org/10.21236/ada045771

[7]. Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211(4481), 453–458. https://doi.org/10.1126/science.7455683

[8]. Mishra, S. (2014). Decision-making under risk. Personality and Social Psychology Review, 18(3), 280–307. https://doi.org/10.1177/1088868314530517

[9]. Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502–517. https://doi.org/10.1037/0033-295x.115.2.502

[10]. Lerner, J. S., & Keltner, D. (2001). Fear, anger, and risk. Journal of Personality and Social Psychology, 81(1), 146–159. https://doi.org/10.1037/0022-3514.81.1.146

[11]. Thaler, R. H., Tversky, A., Kahneman, D., & Schwartz, A. (1997). The effect of myopia and loss aversion on risk taking: An experimental test. The Quarterly Journal of Economics, 112(2), 647–661. https://doi.org/10.1162/003355397555226

[12]. Toubia, O., Johnson, E., Evgeniou, T., & Delquié, P. (2013). Dynamic experiments for estimating preferences: An adaptive method of eliciting time and risk parameters. Management Science, 59(3), 613–640. https://doi.org/10.1287/mnsc.1120.1570

[13]. Tversky, A., & Kahneman, D. (1988). Rational choice and the framing of decisions. JSTOR, 167–192. https://doi.org/10.1017/cbo9780511598951.011

[14]. Classic Mr. Bean. (2018, August 29). Morning Routine | Funny Clip | Classic Mr Bean [Video]. YouTube. https://www.youtube.com/watch?v=1a7CzFpZtUo&t=1s

[15]. Svmblz. (2020, February 9). "Mom, I'm in pain!" | The Basketball Diaries. [Video]. YouTube. https://www.youtube.com/watch?v=7Bvuqog963w&t=5s

[16]. Isen, A. M., & Patrick, R. (1983). The effect of positive feelings on risk taking: When the chips are down. Organizational Behavior and Human Performance, 31(2), 194–202. https://doi.org/10.1016/0030-5073(83)90120-4

[17]. Nguyen, Y., & Noussair, C. N. (2014). Risk aversion and emotions. Pacific Economic Review, 19(3), 296–312. https://doi.org/10.1111/1468-0106.12067

Cite this article

Peng,C. (2024). Emotion-impacted Decision-making under Risks. Advances in Social Behavior Research,13,68-76.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Advances in Social Behavior Research

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fisher, S. A., & Mandel, D. R. (2021). Risky-choice framing and rational decision-making. Wiley Compass Journals. https://doi.org/10.31234/osf.io/xugaz

[2]. Spohn, D. L., Devore‐Suazo, I. F., Bernarding, M. L., & Güss, C. D. (2022). The role of social context in risky decision‐making: Presence of friend and low resistance to peer influence increase risky decision‐making. International Journal of Psychology, 57(6), 717–726. https://doi.org/10.1002/ijop.12864

[3]. Damghani, K. K., Taghavifard, M. T., & Moghaddam, R. T. (2009). Decision making under. uncertain and risky situations. Society of Actuaries, 1-31.

[4]. Morgenstern, O. (1979). Some Reflections on Utility. In: Allais, M., Hagen, O. (eds) Expected Utility Hypotheses and the Allais Paradox. Theory and Decision Library, vol 21. Springer, Dordrecht. https://doi.org/10.1007/978-94-015-7629-1_6

[5]. von Neumann, J., & Morgenstern, O. (2007). Chapter I. Formulation of the economic problem. Theory of Games and Economic Behavior (60th Anniversary Commemorative Edition). SpringerLink, 1–45. https://doi.org/10.1515/9781400829460.1

[6]. Tversky, A., & Kahneman, D. (1977). Prospect theory. an analysis of decision making under risk. ProQuest. https://doi.org/10.21236/ada045771

[7]. Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211(4481), 453–458. https://doi.org/10.1126/science.7455683

[8]. Mishra, S. (2014). Decision-making under risk. Personality and Social Psychology Review, 18(3), 280–307. https://doi.org/10.1177/1088868314530517

[9]. Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502–517. https://doi.org/10.1037/0033-295x.115.2.502

[10]. Lerner, J. S., & Keltner, D. (2001). Fear, anger, and risk. Journal of Personality and Social Psychology, 81(1), 146–159. https://doi.org/10.1037/0022-3514.81.1.146

[11]. Thaler, R. H., Tversky, A., Kahneman, D., & Schwartz, A. (1997). The effect of myopia and loss aversion on risk taking: An experimental test. The Quarterly Journal of Economics, 112(2), 647–661. https://doi.org/10.1162/003355397555226

[12]. Toubia, O., Johnson, E., Evgeniou, T., & Delquié, P. (2013). Dynamic experiments for estimating preferences: An adaptive method of eliciting time and risk parameters. Management Science, 59(3), 613–640. https://doi.org/10.1287/mnsc.1120.1570

[13]. Tversky, A., & Kahneman, D. (1988). Rational choice and the framing of decisions. JSTOR, 167–192. https://doi.org/10.1017/cbo9780511598951.011

[14]. Classic Mr. Bean. (2018, August 29). Morning Routine | Funny Clip | Classic Mr Bean [Video]. YouTube. https://www.youtube.com/watch?v=1a7CzFpZtUo&t=1s

[15]. Svmblz. (2020, February 9). "Mom, I'm in pain!" | The Basketball Diaries. [Video]. YouTube. https://www.youtube.com/watch?v=7Bvuqog963w&t=5s

[16]. Isen, A. M., & Patrick, R. (1983). The effect of positive feelings on risk taking: When the chips are down. Organizational Behavior and Human Performance, 31(2), 194–202. https://doi.org/10.1016/0030-5073(83)90120-4

[17]. Nguyen, Y., & Noussair, C. N. (2014). Risk aversion and emotions. Pacific Economic Review, 19(3), 296–312. https://doi.org/10.1111/1468-0106.12067