1. Introduction

In today’s increasingly globalized world, international economic and political interactions have become more complex, and China faces growing concerns about the security of its industrial supply chains. General Secretary Xi Jinping has explicitly pointed out that, “The impact of the pandemic has also exposed the risks and hidden dangers in our industrial and supply chains” [1]. The Overall National Security Concept, an integral part of Xi Jinping’s Thought on Socialism with Chinese Characteristics for a New Era, emphasizes the integration and coordination of various aspects of security, including economic, political, and cultural security. As a crucial component of national security, industrial supply chain security directly relates to the country’s economic sustainability, social stability, and long-term development.

With the ongoing advancement of the green and low-carbon development agenda, lithium resources have become a key strategic material in global industrial competition, especially due to their core role in battery production and energy storage. Nearly 70% of the world’s lithium reserves are located in the “Lithium Triangle” of South America—comprising Chile, Bolivia, and Argentina [2]. As the third-largest lithium producer globally, Argentina’s lithium carbonate exports are a critical raw material for China’s new energy vehicles and high-tech industries. With China’s demand growing annually, the stable supply of this resource has become a major issue affecting the long-term development of China’s new energy sector. However, political changes, economic policy adjustments, and social instability in Argentina pose risks to the security of China’s lithium carbonate resources. Based on the theoretical framework of the Overall National Security Concept, this paper thoroughly analyzes the impact of political changes in Argentina on the security of China’s lithium resource supply, considering political, policy, and economic factors. It also offers strategies and recommendations to safeguard the security and stability of China’s industrial supply chain, providing valuable insights into the further understanding of the Overall National Security Concept.

2. Overall National Security Concept and resource security

General Secretary Xi Jinping first introduced the strategic concept of the Overall National Security Concept at the inaugural meeting of the Central National Security Commission in 2014. Its core lies in the word “overall,” which extends the concept of security from a singular military focus to multiple domains, including economics, society, culture, ecology, and resources, thus constructing a complex and expansive “national security net.”

Within this framework, resource security pertains to the sustainable utilization of national resources and the strategic reserve of key resources, which are crucial to the country’s economic development level and international competitiveness, serving as a guarantee for long-term national development. China shares 21 strategic critical minerals with the United States. Among them, chromium, lithium, cobalt, and other minerals are scarce in China and have significant supply risks, posing substantial potential competition and “chokehold” risks [3]. Under the Overall National Security Concept, the security of mineral resources, especially critical mineral resources, is particularly critical [4].

In terms of lithium resource security, the main risks include: disruption of resource supply, instability of the supply chain, fluctuations in international market prices, and competition from other countries. For China, Argentina’s lithium carbonate resources are a vital strategic resource, and the stability of their supply is crucial to the sustainable development of China’s new energy vehicle and energy storage industries.

3. Overview of Argentina’s lithium resources

3.1. Distribution and reserves of lithium mines in Argentina

Argentina is a major global player in lithium resource reserves. According to the 2021 data from the U.S. Geological Survey, the country’s confirmed lithium reserves account for 21% of the global total, forming the “Lithium Triangle” together with Bolivia and Chile, and holding over 50% of the world’s lithium resources. Data from the China Geological Survey indicates that global lithium reserves are approximately 12,828×10⁴t LCE, with Argentina’s reserves around 1,693×10⁴t (13.2%), nearly twice the lithium reserves of China (810×10⁴t) during the same period.

Lithium deposits are primarily concentrated in the northwest of Argentina, in the Puna Plateau region. Currently, over 60 lithium brine projects are underway in this area. The lithium ore is mainly in the form of salt lake brines, with the average concentration of lithium ions in the brine ranging from 200 mg/L to 1,000 mg/L, and several deposits have lithium ion concentrations exceeding 500 mg/L, significantly higher than those in China’s Qinghai region [5].

3.2. Current status and development trends of Argentina’s lithium industry

Thanks to abundant resources and strong international demand, Argentina’s lithium mining industry is developing at a rapid pace. The country currently has the largest number of lithium brine resource projects in the world. According to the U.S. Geological Survey, Argentina’s lithium production in 2023 reached 50,700 tons, a 45.7% increase compared to 34,800 tons in 2022. To date, the planned lithium extraction capacity from salt lakes has reached over 500,000 tons.

On one hand, Argentina has reached broad political consensus at the national level, recognizing that the development of the mining industry is key to unlocking the country’s economic potential. With the commissioning of Eramine’s new plant, Rio Tinto’s acquisition of Arcadium Lithium, and Ganfeng Lithium’s latest investments, the cooperation between Chinese enterprises and local Argentine companies in developing lithium projects is experiencing a boom. By 2023, according to data released by the European Union, China has established seven lithium brine extraction projects in Argentina, with a total investment of $3.2 billion. According to Bloomberg’s analysis of official data, once these projects are fully operational, Argentina’s annual production will increase by 79%.

On the other hand, Professor Jennifer from the University of Augusta in Government and International Affairs stated that Argentina’s lithium industry has unique complexities [6]. Argentina’s current president, Javier Milei, advocated for liberalism during his campaign but did not fully follow this path after taking office. Instead, he has encouraged foreign investment at the national level and implemented a series of measures to relax regulations and ensure contract stability. However, Argentina’s complex tax system and logistical challenges related to the import of mining equipment have slowed down the industry’s development.

4. Changes in Argentina’s political landscape and their impact on the security of China’s lithium carbonate resources

4.1. Political instability

4.1.1. Government changes and party disputes

In 1943, after a coup by Juan Perón, Argentina implemented left-wing policies, including dictatorial rule, nationalism, and military support, and pushed for the nationalization of the central bank and several major companies. In 1976, a new military government came to power, insisting on a “national restructuring process” and purging the domestic left wing while suppressing dissenting voices. Throughout the 1990s, Argentina was embroiled in political turmoil [7].

During the 20th century, Argentine politics was largely dominated by the Justice Party and the Radical Civic Union. The former advocated for increased economic intervention, reduced dependence on foreign economies, and pursued economic independence. The latter, however, consistently opposed the rule of the Justice Party [8].

In 2023, the far-right libertarian party, led by Javier Milei, came to power, with the newly formed La Libertad Avanza party becoming the focal point of Argentine politics, advocating for free-market policies. Additionally, several smaller political parties have emerged and re-emerged in political alliances, such as the growing left-wing Workers’ Front – Unity Party, Trotskyist small alliances, and centrist parties like the Civic Coalition ARI [9].

The continual changes in government lead to fluctuating policies, posing a significant challenge to Chinese companies investing in Argentina. The mining sector, in particular, requires substantial upfront investment for exploration, equipment procurement, and infrastructure development. If mining activities fail to pass re-evaluations or are impacted by policy changes, not only can the initial investment be lost, but companies also face debt risks. This makes it difficult for Chinese companies to initiate long-term, foundational, and large-scale construction projects.

4.1.2. National system and structure

As a federal country, Argentina’s federal government and provincial governments both hold authority over the mining industry, but the relatively fragmented political system and underdeveloped rule of law make it difficult to ensure a stable and unified market investment environment.

Since the constitutional reform of 1994, mineral resources have been owned by the provinces, and each province has a dedicated department responsible for managing its own mining activities. To this day, the Federal Mining Council is responsible for formulating, implementing, and overseeing national mining policies, while specific mining matters are still managed by provincial departments such as the provincial mining bureaus. These bodies have broad powers: they grant exploration and exploitation rights, impose mining royalty fees, and collect other non-fiscal contributions.

Moreover, mining activities nationwide must adhere to the National Mining Law as well as provincial procedural laws. For example, in the province of Catamarca, mining companies must meet certain labor standards when hiring locally or face penalties. With one federal government and 23 provincial governments, each having its own policies, foreign companies must invest heavily in the initial stages and conduct detailed research to navigate the varied policy environments across provinces. This intricate governance system increases companies’ policy compliance costs.

4.2. Policy changes and resource development

4.2.1. Mineral ownership

Argentina’s Foreign Investment Law (Law No. 21382) stipulates that foreign investors enjoy the same treatment as domestic investors and establishes a principle of non-discrimination by the state. The legal environment for mining investment encourages both domestic and foreign capital, with no restrictions on foreign investment or ownership in companies engaged in mineral exploration and extraction. However, the Agricultural Land Law prohibits foreign enterprises from directly holding mining rights in their own name. Foreign investors must invest through local companies or acquire stakes in local businesses. Therefore, unpredictable factors such as political changes, international relations shifts, and policy adjustments could lead to foreign investors losing ownership of related assets. Moreover, as the number of stakeholders increases, the complexity of management also rises, and conflicts of interest or disputes may lead to legal risks.

4.2.2. Mining rights

Article 225 of the National Mining Law explicitly states that if a mineral resource remains idle for more than four years, the mining authorities have the right to request that the concessionaire submit a “reactivation plan” within six months, or the concession will be revoked. If exploration, preparation, or production work is not carried out within four years and no corrective measures are taken after the mining authorities issue a notification, the mine will be considered “inactive.” This regulation grants the government the power to reclaim mining rights, thus exposing companies to the risk of having their mining and sales activities terminated. This poses a challenge for long-term investments and localization development by Chinese companies in Argentina and, in turn, impacts the stability of China’s lithium resource imports and supply chain.

4.3. Geopolitical risks

4.3.1. Milei Government’s pro-American policies and the dollarization binding policy

Since Milei assumed power, Argentina has increasingly embraced pro-American policies. Despite the global trend of “de-dollarization,” Argentina has deepened its binding to the US dollar in order to tackle inflation. Moreover, Milei has undertaken large-scale economic and political restructuring, re-adjusting Argentina’s foreign policy to emphasize strengthening cooperation with Western countries such as the United States. This could potentially lead to a strain in Argentina’s relations with its second-largest trading partner—China.

4.3.2. US capital dominance

In the economic sphere, Argentina and the United States have continued to expand bilateral commercial cooperation, improving and fostering public-private partnerships in trade, investment, energy, and infrastructure. As of 2022, over 265 US companies were operating in Argentina, and the United States remains Argentina’s largest investor, with foreign direct investment reaching 12.6 billion USD [10]. As Argentina’s largest trade and investment partner, the United States holds significant sway and influence. While relations between China and the Argentine government have recently softened, the Milei administration has maintained close ties with the United States and pursued pro-American policies. Meanwhile, the escalating tensions between China and the United States may further affect Argentina’s stance and foreign policy.

4.3.3. Complex capital markets

Argentina’s investment and trade policies include: (1) with the exception of the aviation and media sectors, foreign capital is allowed to hold majority control in most Argentine enterprises; (2) in order to resolve its debt crisis, the Argentine government has sold off assets from many state-owned enterprises. These factors have attracted a large influx of foreign capital into Argentina, particularly in the competition for lithium resources, thus making the capital environment in Argentina more complex. As a result, changes in international relations can easily impact market investments.

4.4. Social unrest and resource extraction risks

4.4.1. Economic dilemma

Argentina is facing severe economic difficulties. According to data released by the International Monetary Fund, Argentina’s actual budget deficit amounts to 10% of GDP, and its national debt exceeds 400 billion USD, accounting for over 80% of nominal GDP. Inflation is expected to reach 62.7% in 2025 [11]. In addition, currency controls, multiple exchange rates, and import barriers, which have been implemented in response to the economic crisis, have made it more difficult for international companies to operate. Argentina also faces increasing poverty and a thriving informal currency market. As a result, Argentina’s domestic economic situation is quite dire, and it is unable to provide favorable market conditions or policy support for foreign-invested enterprises. On the contrary, the protectionist trade policies born out of the economic crisis will directly limit foreign capital inflows, increase tariff costs, and reduce expected returns.

4.4.2. Unemployment surge and public protests

In 2015, Argentina’s national debt accounted for 52.13% of GDP [12], while sovereign debt made up 88% of GDP [11]. To address this crisis, the Milei government has sold off public assets and reduced public spending. The president’s spokesperson stated that the number of government layoffs would be 20% of Milei’s original plan (which intended to cut 70,000 jobs) [13]. The layoffs have triggered a wave of unemployment, which in turn has sparked protests, strikes, and regional conflicts.

Additionally, cuts to public works, social projects, and subsidies to the provinces have also faced similar reductions. These policies have been met with strong opposition from the public. On April 23, hundreds of thousands of Argentinians took to the streets to protest the government’s austerity measures. The social unrest and economic crisis caused by these radical policies not only affect the operating environment for Chinese companies in Argentina but may also disrupt the mineral resource supply chain, thereby escalating investment risks for Chinese enterprises.

4.4.3. Environmentalism

Opposition from environmentalists has led the Argentine government to pay more attention to environmental protection during resource development, imposing stricter restrictions on resource extraction and exports. Argentina’s Environmental Protection Law (Law No. 25675) and Law No. 24585 stipulate that individuals or entities wishing to conduct exploration, surveying, or mining activities in specific regions must submit an environmental impact assessment to the provincial authorities. The report is valid for two years, and after preliminary approval, it must be updated every two years. These cumbersome legal requirements and validity periods increase the investment costs for relevant companies. More importantly, environmentalism may trigger waves of social opposition, which could have far-reaching effects on mining activities and domestic supply chains.

5. China’s strategies for addressing political risks in Argentina

5.1. Diversification of resource supply sources

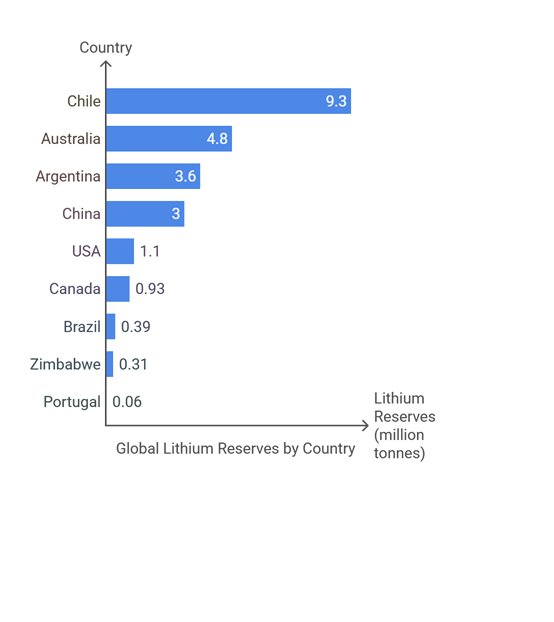

According to the latest data from Statista, the total global lithium reserves have reached a historic peak of 28 million tons. Meanwhile, innovations in lithium extraction technologies from salt lakes have not only altered the geographical distribution of lithium resources but also had a profound impact on the supply capabilities of various countries and the international competitive landscape. The lithium reserves of the world’s leading producers in 2024 are shown in Figure 1.

Figure 1. Lithium reserves by country

Note: The vertical axis in the figure represents lithium reserves (in 10,000 tons), while the horizontal axis represents countries. From left to right, the countries listed are Chile, Australia, Argentina, China, the United States, Canada, Brazil, Zimbabwe, and Portugal.

As seen in Figure 1, in addition to Argentina, countries such as Australia and Chile are also major global producers of lithium resources. Chile, in particular, holds over one-third of the world’s lithium reserves, while Australia ranks second with reserves of 4.8 million metric tons of lithium. These countries are expected to become supplementary sources of lithium for China.

In the past, countries such as Namibia, Rwanda, and South Africa have also developed lithium resources [14]. China should closely monitor the progress of development in regions like Africa and actively seek diversified supply channels. By strategically developing lithium resources worldwide and establishing stable cooperation with numerous resource-rich countries, China can not only diversify its lithium imports but also effectively mitigate supply risks in the event of political instability in countries like Argentina, thereby ensuring national energy security and the stable operation of industrial chains.

5.2. Strengthening strategic cooperation with the Argentine government

At the beginning of his tenure, Milei attempted to distance Argentina from China, but as his term progressed, his stance towards China gradually softened. In November 2024, President Xi Jinping met with Milei, expressing willingness to continue advancing the high-quality development of the “Belt and Road Initiative” and deepening cooperation in energy, minerals, and other fields. Milei also stated that Argentina hopes to further strengthen cooperation with China in various areas [15]. To promote Chinese investment in Argentina, the two countries established an economic cooperation and coordination strategic dialogue mechanism and a “Cooperation Plan between the Government of the People’s Republic of China and the Government of the Argentine Republic on Jointly Advancing the Belt and Road Initiative” [16]. High-level dialogues and related cooperation mechanisms lay a foundation for long-term strategic cooperation between the two nations.

China and Argentina should jointly establish the goal of enhancing political mutual trust and strengthening high-level dialogue mechanisms while adopting diversified economic assistance measures. Specifically, China can offer loans, underwrite Argentine bonds, and provide other financial instruments to inject necessary financial liquidity into Argentina. China can also offer technical assistance to improve the efficiency and quality of lithium carbonate resource extraction and processing, thereby promoting resource development. Additionally, joint training programs and other human resource development initiatives can be implemented to cultivate versatile talent with both technical and managerial skills. These strategic collaborations will not only help Argentina overcome its current economic difficulties but will also further solidify China’s important position in Argentina.

5.3. Investing in Argentina’s local economy to enhance corporate influence

Argentina has significant development potential in the transportation, energy, and telecommunications infrastructure sectors, providing ample investment opportunities. Chinese companies need to thoroughly understand Argentina’s laws and regulations and closely monitor any changes. They should leverage local human resources and capital, deeply explore the market, and ensure robust support for business operations [17]. In addition, given the strong influence of labor unions in Argentina, companies must carefully manage their relations with unions, reduce labor disputes, and maintain normal operations. This will enable more precise market positioning and product strategies for lithium carbonate resource development [18], promoting industrial complementarity and mutual support, and ensuring a stable and high-quality supply of lithium resources.

Beyond pursuing economic benefits, Chinese companies should also actively take on social responsibility and enhance their social image. During business operations, companies should support the welfare of local communities, including public facilities such as schools and hospitals, and offer assistance where possible. By utilizing local media, companies can promote their employment policies, environmental initiatives, and social contributions, thereby fostering a positive public perception of Chinese enterprises in Argentina [19]. This will enhance local residents’ recognition of Chinese businesses and lay a solid foundation for their continued development in the Argentine market.

5.4. Improving supply chain management and risk prevention mechanisms

China should establish a comprehensive and efficient supply chain management system, carefully optimize supplier selection, enhance inventory management, and strengthen after-sales service coordination. Companies should develop a scientifically sound supplier evaluation framework, considering product quality, profitability, on-time delivery reliability, responsiveness, and innovation capacity. Based on this, data analysis tools should be used to monitor and analyze key indicators such as inventory turnover rates and sales forecasts, allowing for more accurate inventory decisions and optimized supply strategies. Furthermore, the flow of information between supply chain enterprises should be strengthened [20].

Chinese companies should also improve risk prevention and management mechanisms, including risk assessment, early warning, and response strategies. Given Argentina’s frequent political changes, Chinese companies need to form research teams of professionals or cooperate with third-party research institutions to deeply analyze Argentina’s political situation, policy direction, economic status, and legal framework, systematically evaluating investment risks. Additionally, a regular review mechanism should be established to adjust strategies in a timely manner. Companies should also fully utilize insurance tools to effectively transfer the overseas investment risks caused by political instability, labor disputes, war, public health crises, natural disasters, and other factors, thereby building a robust safety net for multinational operations [21].

6. Conclusion

The concept of overall national security is an important part of China’s national security strategy, breaking through traditional concepts with a comprehensive and systematic approach. Against the backdrop of global climate change, resource security has become particularly critical. Strategic resource reserves are among the guarantees for long-term national development, and the secure control of certain strategic resources has significant implications for a country’s economic security, military security, and political stability. This paper, based on the concept of overall national security, explores how Argentina’s political, policy, and economic factors impact China’s lithium industry supply chain, with the hope of providing reference for related industries and enriching research on the concept of overall national security.

Fund project

This research is part of the Jiangsu Province Social Science Applied Research Excellence Project in the field of Foreign Languages (Project No. 23SWB-16), and represents a stage achievement of the undergraduate national and provincial-level innovation and entrepreneurship training program at Nanjing University of Science and Technology.

References

[1]. Xi, J. (2020). Several major issues in the medium and long-term economic and social development strategy of the country. Qiushi.

[2]. Wang, Q., Yuan, C., & Xu, H. (2015). Analysis of global lithium mineral resource distribution and potential. China Mining.

[3]. Wang, A., & Yuan, X. (2022). Strategic thinking on the security of China’s critical mineral resources in the context of great power competition. Bulletin of the Chinese Academy of Sciences.

[4]. Wu, Q., Zhou, N., & Cheng, J. (2023). National logic of critical mineral resource security governance under the overall national security concept. Journal of Central China Normal University.

[5]. Xing, K., Zhu, Q., Ren, J., Zou, X., Niu, M., Liu, J., & Xiao, Y. (2023). Global lithium resource characteristics and market development trends. Geological Bulletin.

[6]. Díaz, J. C., Seefeldt, J. L., Monzon, D., Tahil, W., & Hofer, J. (2024). How will lithium shape Argentina’s economic recovery? The Dialogue. https://thedialogue.org/analysis/how-will-lithium-shape-argentinas-economic-recovery/

[7]. UNDP. (2014). Human development report 2014: Sustaining human progress: Reducing vulnerabilities and building resilience. Human Development Report. https://hdr.undp.org/content/human-development-report-2014

[8]. Herrera, L. C. (2023). Six months till the election: The potential presidential candidates so far. Buenos Aires Herald. https://buenosairesherald.com/politics/200-days-to-the-election-the-potential-presidential-candidates-so-far

[9]. Di Teodoro, J. M. (2023). Boleta única: aportes para un debate político y jurídico sobre los procesos de reforma electoral en Argentina. Cuadernos De Derecho Electora.

[10]. U.S. Department of State. (2024). 2024 investment climate statements: Argentina. https://www.state.gov/reports/2024-investment-climate-statements/argentina/

[11]. International Monetary Fund. (2024). Argentina. https://www.imf.org/external/datamapper/profile/ARG

[12]. Delivorias, A. (2023). Argentina’s debt restructuring and economy ahead of the 2023 elections. Member’s Research Service.

[13]. Liu, M. (2023). New officials bringing major changes! Argentina’s president may fire 5,000 civil servants. Global Daily. https://world.huanqiu.com/article/4Fw270X3rMl

[14]. Lin, D. (2004). The uses of lithium and its resource development. Journal of China Safety Science. 14(9), 72-76.

[15]. Xinhua News Agency. (2024). Xi Jinping meets Argentine President Javier Milei. https://www.gov.cn/yaowen/liebiao/202411/content_6988241.htm

[16]. He, L. (2024). China is Argentina’s friend and partner. People’s Daily Overseas Edition.

[17]. He, X. (2015). A study on the historical impact of foreign investment on the development of Argentina’s railways (Master’s thesis). University of International Business and Economics.

[18]. Huang, X. (2014). China’s oil investment in Argentina: Status, reflections, and prospects (Master’s thesis). Zhejiang University.

[19]. Kang, L. (2024). A study on the investment environment in Argentina (Master’s thesis). Shanxi Normal University.

[20]. Tian, Y., & Ding, C. (2024). Research on risk control and prevention mechanisms in the e-commerce supply chain of agricultural products: A case study of the S region. Logistics Technology, 47(19), 138–142.

[21]. Meng, P. L., & Li, L. Y. (2021). Risks faced by Chinese enterprises investing in Argentina and coping strategies. Jiangsu Business Review, 3, 46 - 48, 53. https://doi.org/10.3969/j.issn.1009 - 0061.2021.03.015

Cite this article

Song,C.;Li,J.;Gu,Q.;Deng,Y. (2025). The impact of Argentina’s political landscape on China’s industrial supply chain from the perspective of the Overall National Security Concept. Advances in Social Behavior Research,16(1),16-22.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Advances in Social Behavior Research

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xi, J. (2020). Several major issues in the medium and long-term economic and social development strategy of the country. Qiushi.

[2]. Wang, Q., Yuan, C., & Xu, H. (2015). Analysis of global lithium mineral resource distribution and potential. China Mining.

[3]. Wang, A., & Yuan, X. (2022). Strategic thinking on the security of China’s critical mineral resources in the context of great power competition. Bulletin of the Chinese Academy of Sciences.

[4]. Wu, Q., Zhou, N., & Cheng, J. (2023). National logic of critical mineral resource security governance under the overall national security concept. Journal of Central China Normal University.

[5]. Xing, K., Zhu, Q., Ren, J., Zou, X., Niu, M., Liu, J., & Xiao, Y. (2023). Global lithium resource characteristics and market development trends. Geological Bulletin.

[6]. Díaz, J. C., Seefeldt, J. L., Monzon, D., Tahil, W., & Hofer, J. (2024). How will lithium shape Argentina’s economic recovery? The Dialogue. https://thedialogue.org/analysis/how-will-lithium-shape-argentinas-economic-recovery/

[7]. UNDP. (2014). Human development report 2014: Sustaining human progress: Reducing vulnerabilities and building resilience. Human Development Report. https://hdr.undp.org/content/human-development-report-2014

[8]. Herrera, L. C. (2023). Six months till the election: The potential presidential candidates so far. Buenos Aires Herald. https://buenosairesherald.com/politics/200-days-to-the-election-the-potential-presidential-candidates-so-far

[9]. Di Teodoro, J. M. (2023). Boleta única: aportes para un debate político y jurídico sobre los procesos de reforma electoral en Argentina. Cuadernos De Derecho Electora.

[10]. U.S. Department of State. (2024). 2024 investment climate statements: Argentina. https://www.state.gov/reports/2024-investment-climate-statements/argentina/

[11]. International Monetary Fund. (2024). Argentina. https://www.imf.org/external/datamapper/profile/ARG

[12]. Delivorias, A. (2023). Argentina’s debt restructuring and economy ahead of the 2023 elections. Member’s Research Service.

[13]. Liu, M. (2023). New officials bringing major changes! Argentina’s president may fire 5,000 civil servants. Global Daily. https://world.huanqiu.com/article/4Fw270X3rMl

[14]. Lin, D. (2004). The uses of lithium and its resource development. Journal of China Safety Science. 14(9), 72-76.

[15]. Xinhua News Agency. (2024). Xi Jinping meets Argentine President Javier Milei. https://www.gov.cn/yaowen/liebiao/202411/content_6988241.htm

[16]. He, L. (2024). China is Argentina’s friend and partner. People’s Daily Overseas Edition.

[17]. He, X. (2015). A study on the historical impact of foreign investment on the development of Argentina’s railways (Master’s thesis). University of International Business and Economics.

[18]. Huang, X. (2014). China’s oil investment in Argentina: Status, reflections, and prospects (Master’s thesis). Zhejiang University.

[19]. Kang, L. (2024). A study on the investment environment in Argentina (Master’s thesis). Shanxi Normal University.

[20]. Tian, Y., & Ding, C. (2024). Research on risk control and prevention mechanisms in the e-commerce supply chain of agricultural products: A case study of the S region. Logistics Technology, 47(19), 138–142.

[21]. Meng, P. L., & Li, L. Y. (2021). Risks faced by Chinese enterprises investing in Argentina and coping strategies. Jiangsu Business Review, 3, 46 - 48, 53. https://doi.org/10.3969/j.issn.1009 - 0061.2021.03.015