1. Introduction

The "Green Development in the New Era of China" white paper, issued by the State Council in 2023, emphasizes the construction of a green, low-carbon, and circular development production system, vigorously promoting green innovation. However, an increasing number of scholars realize that the lag in the construction of ecological civilization behind economic and social development is not only due to policies and regulations but also because enterprises still have a very weak sense of responsibility towards ecological civilization [1], leading to generally low output of corporate green innovation [2]. Compared with traditional innovation, it is not easy for enterprises, as independent market entities, to engage in green innovation activities voluntarily. Therefore, clarifying the driving factors of corporate green innovation is key to promoting the construction of ecological civilization and high-quality development of enterprises.

Since innovation requires breaking traditions and norms, the impact of female managers, who are characterized by low-risk preference and pro-social characteristics, on corporate green innovation has become a focal point for scholars. Some scholars believe that compared to men, women are more risk-averse [3], more conservative towards high-risk innovation decisions [3,4], which is not conducive to enterprise innovation activities. Thus, how CEO gender differences affect corporate green innovation is significant for deeply understanding the impact of executive gender differences on corporate strategic decisions.

This paper, from the perspective of executive individual characteristics, studies the impact of CEO gender differences on corporate green innovation, potentially contributing in two areas: (1) It expands the research on the factors affecting the performance of corporate green innovation. This paper, based on CEO individual characteristics, studies the impact of CEO gender differences on green innovation performance, addressing the gap in previous research that focused only on CEO experiences and psychological traits while overlooking gender, a fundamental demographic characteristic. (2) It constructs an "executive characteristics - innovation investment - green innovation performance" analysis framework, revealing the impact path of CEO gender differences on green innovation performance and clarifying the transmission mechanism of how executive characteristics influence organizational performance.

2. Theoretical Analysis and Research Hypotheses

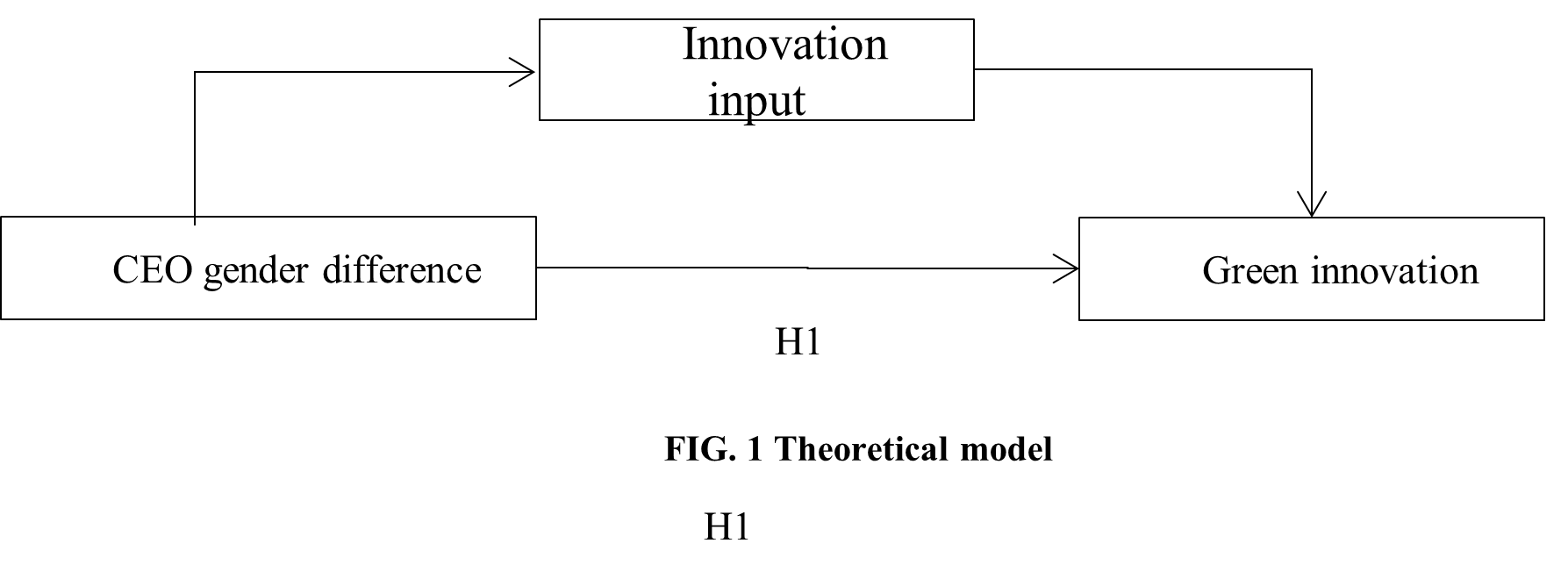

Studies have found that compared to men, women possess a more intrinsic trait of risk aversion [5]. According to upper echelon theory, this gender trait directly influences the decision-making style of CEOs with gender differences, prompting them to avoid high-risk and uncertain decisions. Research indicates that CEOs with gender differences become more cautious in complex investment environments and when facing risky investment opportunities [6,7,8], thereby diminishing the willingness for green innovation investment and adversely affecting the company’s green innovation activities. Furthermore, the risk-averse character trait of CEO gender differences indirectly influences the risk preference of the entire executive team. Studies have shown that an increased proportion of women in the executive team allows female perspectives to be more fully expressed [9,10], and the conservative decision-making style of women significantly impacts team strategic decisions [11,12]. It is not difficult to deduce that the gender differences of CEOs make the decision-making style of the executive team more conservative and cautious, actively avoiding the high risks and uncertainties that innovative decisions may bring, thus suppressing the enthusiasm for undertaking green innovation activities, which is not conducive to the green innovation output of the company. Therefore, under the hypothesis of CEO gender differences and risk-averse gender traits, this paper proposes the following hypothesis:

H1: CEO gender differences have a negative impact on corporate green innovation performance.

Companies need to invest corresponding funds and resources to ensure the continuous progress of green innovation, which helps companies gain competitive advantages and ensures their long-term success [12]. As the precursor to a company's innovation activities such as the development of new technologies and products, the importance of corporate innovation investment is self-evident. The more a company invests in innovation, the more it helps to improve corporate green innovation performance. However, the risk-averse gender trait of CEO gender differences suppresses the enthusiasm for innovation investment in their companies. Based on upper echelon theory, women are generally considered more conservative and cautious [13,14], having a reserved attitude towards high-risk innovation and R&D investments, therefore the willingness for innovation investment is relatively lower among CEOs with gender differences. It is apparent that R&D investment may be an important channel through which the risk aversion of CEO gender differences operates. Hence, this paper examines the relationship between CEO gender differences, R&D investment, and green innovation performance.

H2: Innovation investment mediates the relationship between CEO gender differences and green innovation performance

Based on the above theoretical analysis, this paper constructs the following theoretical model:

Figure. 1 Theoretical model

3. Sample Selection and Research Design

3.1 Data Description

This study selects China's A-share listed companies from 2010 to 2021 as research samples. The data on CEO gender differences were sourced from the CSMAR database; data on green innovation performance come from the National Patent Statistics Bureau; other financial and governance data were also collected from the CSMAR database. The research samples were processed as follows: (1) excluding samples from the financial and insurance service industries; (2) excluding samples labeled as ST or *ST; (3) excluding samples with missing or abnormal data; (4) to reduce the impact of outliers, all continuous variables were winsorized at the 1% level. After screening, a total of 8,819 valid samples were obtained.

3.2. Definition of Main Variables

Independent variable: CEO gender differences. Following the research by Xue Kunkun et al. [12], the CEO's gender is coded as 1 for females, and 0 otherwise.

Dependent variable: Green innovation performance. Referring to the research by Li Huiyun et al. [13], this study measures corporate green innovation performance using the natural logarithm of the total number of green patent applications plus one.

Mediating variable: Innovation input. Based on the research by Zhang Yuming et al. (2023) [14], this paper measures innovation input as R&D intensity, i.e., R&D expenditure divided by total assets.

Control variables: Following the research by Lu Chao and Zhu Tianqi [15], the following control variables were selected. At the corporate level: company size, board size, proportion of independent directors, ownership nature, debt ratio, years listed, and concentration of equity; at the individual level: CEO duality, CEO age, and CEO tenure. In addition to the above control variables, industry and year variables were also controlled. The definitions and calculations of the variables are shown in Table 1.

Table 1. List of variables

Code of variables |

Variable definition |

Independent Variable |

Female |

If the gender of the CEO is female, the value is 1; otherwise, it is 0 |

Dependent Variable |

GI |

Natural logarithm of total green patent applications plus one |

Control Variable |

Size |

Natural logarithm of the firm's total assets |

Bsize |

Natural logarithm of the number of directors |

Indep |

Proportion of the number of independent directors to the total number of directors |

Soe |

The value is 1 for soes and 0 otherwise |

Lev |

Total liabilities/total assets |

Listage |

Natural logarithm of the number of years a firm has been listed |

Top1 |

share proportion of the largest shareholder |

Dual |

If the chairman and general manager are held by the same person, the value is 1; otherwise, the value is 0 |

Age |

Natural logarithm of CEO age |

Tenure |

The CEO's tenure |

Ind |

Industry dummy variable |

Year |

Year dummy variable |

3.3 Model Design

Based on the research hypotheses and variable design, the following model was constructed:

GI=α0+α1Female+α2controls+ε (1)

RD=b0+b1Female+b2controls+ε (2)

\( Green\_PT \) =c0+c1Female+c2RD+c2controls+ε (3)

Where controls represent the control variables and ε represents the random error term.

Model (1) is used to test the relationship between CEO gender differences and Green innovation performance.;Model (2) and Model (3) are used to verify the mediating effect.

4. Empirical Analysis

4.1 Descriptive Statistics

Table 2 presents the results of the descriptive statistics. It is noted from Table 2 that within the sample period, the average value for CEO gender difference is 0.060, with a minimum of 0 and a maximum of 1, indicating that the proportion of female CEOs in the sample is 5.9%, which is relatively low. The average value for green innovation performance is 0.985, with a maximum of 3.736 and a minimum of 0, and a variance of 0.893, suggesting that the overall level of corporate green innovation is low, with significant differences between companies.

Table 2. Descriptive statistics

Number of observations |

Average number |

Standard deviation |

Median number |

Minimum value |

Maximum value |

Female |

8819 |

0.059 |

0.207 |

0 |

0 |

1.000 |

GI |

8819 |

0.958 |

0.893 |

0.099 |

0 |

3.736 |

RD |

8819 |

2.423 |

2.083 |

2.030 |

0.009 |

11.542 |

Size |

8819 |

7.924 |

1.092 |

7.044 |

3.357 |

10.280 |

Bsize |

8819 |

2.039 |

0.188 |

2.003 |

1.089 |

2.763 |

Indep |

8819 |

0.296 |

0.064 |

0.457 |

0.338 |

0.601 |

Soe |

8819 |

0.189 |

0.451 |

0 |

0 |

1.000 |

Lev |

8819 |

0.381 |

0.211 |

0.389 |

0.050 |

0.877 |

Number of observations |

Average number |

Standard deviation |

Median number |

Minimum value |

Maximum value |

Listage |

8819 |

1.983 |

0.683 |

2.279 |

0 |

3.532 |

Dual |

8819 |

0.350 |

0.468 |

0 |

0 |

1.000 |

Age |

8819 |

3.795 |

0.235 |

3.812 |

3.597 |

4.000 |

Tenure |

8819 |

3.818 |

2.943 |

3.633 |

0.089 |

13.480 |

4.2 Correlation Analysis

This study employs the Pearson correlation coefficient to test the correlation between variables. According to the results of the correlation test, there is a significant negative correlation between CEO gender differences and green innovation performance, which is consistent with the expected hypothesis, laying the foundation for subsequent empirical analysis. The correlation coefficient between the main variables of this study is less than 0.7, and the VIF (Variance Inflation Factor) test for multicollinearity shows that all variables in the model have a VIF value of less than 3. This indicates that there are no severe multicollinearity issues between the variables, and the model is suitable for regression analysis.

4.3 Baseline Regression

To test the relationship between CEO gender differences and green innovation performance, a mixed OLS regression analysis was conducted based on the established model (1). The regression results, as shown in column (1) of Table 3, indicate that the estimated coefficient for CEO gender differences is -0.154, significant at the 1% level and negative. This suggests that CEO gender differences, when making green innovation decisions, are more likely to be influenced by a risk-averse gender trait, thereby having a negative impact on corporate green innovation, confirming H1.

4.4. Mediating Effect Test

The results are shown in Table 3, which shows that the impact of CEO gender difference on green innovation performance is negative, and Column (2) of Table 3 shows that the estimated coefficient for CEO gender difference is -0.137, significant at the 1% level, confirming that CEO gender difference has a significant negative impact on innovation input. In Column (3), after introducing the mediating variable of innovation input, the estimated coefficient of CEO gender difference remains negatively significant, with the impact coefficient decreasing from -0.154 to -0.145. Additionally, the estimated coefficient for innovation input is positively significant, suggesting that the willingness to invest in innovation partially mediates the relationship between CEO gender difference and green innovation performance. The study also conducted a Sobel test to further validate the mediating role of internal control, with a Sobel Z statistic of -2.897 significant at the 1% level, confirming the mediating effect of innovation input. These results imply that CEO gender differences, due to their risk-averse characteristics, are reluctant to engage in activities such as R&D investment, which are high-risk and have uncertain returns, thereby negatively affecting the firm’s green innovation performance.

Table 3. Benchmark regression and mediating effect

Variables |

(1) GI |

(2) RD |

(3) GI |

Female |

-0.154*** |

-0.137*** |

-0.145*** |

(-3.590) |

(-3.300) |

(-2.910) |

RD |

0.208*** |

(20.270) |

Size |

0.198*** |

0.051*** |

0.197*** |

(22.960) |

(3.430) |

(20.530) |

Bsize |

0.020 |

-0.214*** |

0.078 |

(0.240) |

(-3.850) |

(1.090) |

Indep |

-0.391* |

-0.710*** |

-0.333 |

(-1.590) |

(-3.750) |

(-0.880) |

Soe |

0.229*** |

0.039 |

0.345*** |

(10.590) |

(0.680) |

(10.670) |

Lev |

0.374*** |

-0.750*** |

0.370*** |

(13.710) |

(-11.190) |

(14.240) |

Listage |

-0.025 |

-0.248*** |

0.044* |

Variables |

(1) GI |

(2) RD |

(3) GI |

(-0.720) |

(-13.860) |

(1.810) |

Top1 |

-0.004*** |

-0.006*** |

-0.003*** |

(-5.440) |

(-8.290) |

(-4.600) |

Dual |

0.094*** |

0.087*** |

0.076*** |

(3.290) |

(3.590) |

(2.500) |

Age |

0.141 |

-0.187** |

0.182** |

(1.410) |

(-2.360) |

(2.120) |

Tenure |

0.002 |

0.015*** |

-0.002 |

(0.480) |

(4.930) |

(-0.460) |

Ind |

YES |

YES |

YES |

Year |

YES |

YES |

YES |

_cons |

-3.431*** |

-4.109*** |

-2.675*** |

(-8.330) |

(-10.600) |

(-6.470) |

N |

8819 |

8819 |

8819 |

F |

110.776 |

200.684 |

123.636 |

R2 |

0.2830 |

0.406 |

0.309 |

Sobel Z Value |

-2.897*** |

Note: *, **, *** indicate the significance level of 10%, 5%, and 1%

Table 4. Robustness test

Variables |

PSM GI |

Female |

-0.196*** |

(-3.220) |

Size |

0.179*** |

(5.650) |

Bsize |

-0.163 |

(-1.160) |

Indep |

-0.901 |

(-1.420) |

Soe |

0.049 |

(1.350) |

Lev |

0.319*** |

(5.670) |

Listage |

-0.049 |

(-1.060) |

Top1 |

-0.003 |

(-1.580) |

Dual |

0.063 |

(1.060) |

Age |

0.390* |

(1.740) |

Tenure |

-0.001 |

(-0.149) |

Ind |

YES |

Year |

YES |

_cons |

-2.732** |

(-2.300) |

N |

1434 |

F |

10.542 |

R2 |

0.230 |

Note: *, **, *** indicate the significance level of 10%, 5%, and 1%

4.5 Endogeneity and Robustness Test

To address the potential endogeneity problem caused by sample selection bias, this study follows the methodology of Zhang Shaozhe and Shi Haoyue [16] by employing a propensity score matching (PSM) method. Companies with female CEOs were selected as the treatment group, and those with male CEOs as the control group, to isolate the difference in green innovation performance. Subsequent regression analysis using the matched samples is presented in Table 4, where the estimated coefficient for CEO gender difference is significantly negative, indicating that H1 still holds.

5. Conclusions and Policy Recommendations

This paper, based on green innovation data from listed companies in Shanghai and Shenzhen A-shares from 2010 to 2021, examines the relationship between CEO gender differences and green innovation performance, as well as the moderating roles of the external institutional environment, internal executive team, and individual CEO level. The findings indicate that compared to pro-social gender traits, CEO gender differences are more likely to be influenced by risk-averse gender traits when making green innovation decisions, thereby negatively affecting the firm’s green innovation performance. Mediation effect tests reveal that innovation input plays a partial mediating role, meaning CEO gender differences primarily inhibit green innovation performance by suppressing the firm's innovation investment.

Based on these findings, the following suggestions are offered: Recognize scientifically the role of female executives in corporate decision-making and actively guard against the adverse impact of female executives' risk-averse gender traits on corporate innovation strategies. Companies can mitigate the adverse effects brought by the risk-averse gender traits of female executives and thus promote green development through measures such as establishing diverse decision-making teams, cultivating executives’ awareness and ability for risk management, encouraging an open and inclusive cultural atmosphere, and setting up incentive mechanisms.

This study has some limitations that warrant further investigation in the future. First, it only explores the impact of CEO gender differences on green development from the perspective of green innovation performance. Future research could explore other more specific variables of green innovation performance, such as green process innovation and green product innovation, for a deeper understanding. Second, while this paper tests the transmission path of innovation investment between CEO gender differences and green innovation, future steps could involve exploring and testing additional transmission paths.

References

[1]. Li, J.C., Peng, Y.C., & Yang, L. (2023). Informal institutions, Confucian culture, and corporate green innovation. Journal of Wuhan University (Philosophy & Social Sciences), 76(5), 125-135.

[2]. Fang, X.M., & Na, J.L. (2020). Research on the green innovation premium of companies listed on the GEM board. Economic Research, 55(1), 106-123.

[3]. Hoang T T,Nguyen C V,Van Tran H T.Are Female CEOs more Risk Averse than Male Counter Parts? Evidence from Vietnam[J]. Economic Analysis&Policy,2019,63:57-74.

[4]. Xie, F., & Hou, Q.S. (2017). Female executives and R&D innovation. Modern Management, 37(5), 44-46.

[5]. Qiu, R.G. (2021). How female chairpersons affect R&D investment in listed companies: A corporate lifecycle perspective. Science and Technology Progress and Policy, 38(5), 87-96.

[6]. Barber B M, Odean T.Boys Will Be Boys:Gender, Overconfidence, and Common Stock Investment[J].The quarterly journal of economics,2001,(4):261-292.

[7]. Eckel,Catherine C.,Sascha C.,Füllbrunn.Thar She Blows?Gender,Competition,and Bubbles In Experimental Asset markets[J].American Economic Review,2015,105(2):906-920.

[8]. Jiménez JMR,Fuentes MDMF.Management Capabilities,Innovation,and Gender Diversity in The Top Management Team:An Empirical Analysis in Technology-based SMEs [J].Business Research Quarterly,2016(19)107-121.

[9]. Du, X.Q., Lai, S.J., & Pei, H.M. (2017). Can female executives always curb earnings management? Empirical evidence from the Chinese capital market. Accounting Research, (1), 39-45. Beijing.

[10]. Lv, Y., Wang, Z.B., & An, S.M. (2014). Theoretical foundations and empirical research review on the impact of female directors on corporate social responsibility. Foreign Economics & Management, 36(8), 14-22+32.

[11]. Li, G.P., Li, Y.G., & Quan, J.M. (2018). Environmental regulation, R&D investment, and corporate green technological innovation capability. Studies in Science of Science and Science and Technology Management, 39(11), 61-73.

[12]. Xue, K.K., Wu, Y.Y., & Wang, Z.Y. (2022). Female CEOs, risk-taking, and corporate strategic transformation. Soft Science, 36(11), 123-128.

[13]. Li, H.Y., Liu, Q.Y., Li, S.Y., et al. (2022). Environmental, social, and governance information disclosure and corporate green innovation performance. Statistical Research, 39(12), 38-54.

[14]. Zhang, Y., Liu, H. & Li, S. Information transparency, environmental concern and green innovation of heavy polluting enterprises [J]. Science and Technology Progress and Policy,2023,40(08):118-129.

[15]. Lu, C., & Zhu, T.Q. (2023). Can overseas returnee executives promote corporate green innovation? Empirical evidence from Chinese A-share listed companies. Journal of Guizhou University of Finance and Economics, 222(1), 81-90.

[16]. Zhang, S.Z., & Shi, H.Y. (2022). The academic background of CEOs and corporate green technology innovation. Research on Science and Technology Management, 42(3), 135-144.

Cite this article

Xiang,H. (2024). Research on the Impact of CEO Gender Differences on Green Innovation Performance. Journal of Applied Economics and Policy Studies,4,44-49.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, J.C., Peng, Y.C., & Yang, L. (2023). Informal institutions, Confucian culture, and corporate green innovation. Journal of Wuhan University (Philosophy & Social Sciences), 76(5), 125-135.

[2]. Fang, X.M., & Na, J.L. (2020). Research on the green innovation premium of companies listed on the GEM board. Economic Research, 55(1), 106-123.

[3]. Hoang T T,Nguyen C V,Van Tran H T.Are Female CEOs more Risk Averse than Male Counter Parts? Evidence from Vietnam[J]. Economic Analysis&Policy,2019,63:57-74.

[4]. Xie, F., & Hou, Q.S. (2017). Female executives and R&D innovation. Modern Management, 37(5), 44-46.

[5]. Qiu, R.G. (2021). How female chairpersons affect R&D investment in listed companies: A corporate lifecycle perspective. Science and Technology Progress and Policy, 38(5), 87-96.

[6]. Barber B M, Odean T.Boys Will Be Boys:Gender, Overconfidence, and Common Stock Investment[J].The quarterly journal of economics,2001,(4):261-292.

[7]. Eckel,Catherine C.,Sascha C.,Füllbrunn.Thar She Blows?Gender,Competition,and Bubbles In Experimental Asset markets[J].American Economic Review,2015,105(2):906-920.

[8]. Jiménez JMR,Fuentes MDMF.Management Capabilities,Innovation,and Gender Diversity in The Top Management Team:An Empirical Analysis in Technology-based SMEs [J].Business Research Quarterly,2016(19)107-121.

[9]. Du, X.Q., Lai, S.J., & Pei, H.M. (2017). Can female executives always curb earnings management? Empirical evidence from the Chinese capital market. Accounting Research, (1), 39-45. Beijing.

[10]. Lv, Y., Wang, Z.B., & An, S.M. (2014). Theoretical foundations and empirical research review on the impact of female directors on corporate social responsibility. Foreign Economics & Management, 36(8), 14-22+32.

[11]. Li, G.P., Li, Y.G., & Quan, J.M. (2018). Environmental regulation, R&D investment, and corporate green technological innovation capability. Studies in Science of Science and Science and Technology Management, 39(11), 61-73.

[12]. Xue, K.K., Wu, Y.Y., & Wang, Z.Y. (2022). Female CEOs, risk-taking, and corporate strategic transformation. Soft Science, 36(11), 123-128.

[13]. Li, H.Y., Liu, Q.Y., Li, S.Y., et al. (2022). Environmental, social, and governance information disclosure and corporate green innovation performance. Statistical Research, 39(12), 38-54.

[14]. Zhang, Y., Liu, H. & Li, S. Information transparency, environmental concern and green innovation of heavy polluting enterprises [J]. Science and Technology Progress and Policy,2023,40(08):118-129.

[15]. Lu, C., & Zhu, T.Q. (2023). Can overseas returnee executives promote corporate green innovation? Empirical evidence from Chinese A-share listed companies. Journal of Guizhou University of Finance and Economics, 222(1), 81-90.

[16]. Zhang, S.Z., & Shi, H.Y. (2022). The academic background of CEOs and corporate green technology innovation. Research on Science and Technology Management, 42(3), 135-144.