1 Introduction

The formation of the global market has driven the globalization of supply chains. Influenced by geopolitical factors, supply chain stability has increasingly become a highly prioritized issue worldwide. As one of the crucial raw materials in the upstream supply chain, mineral resources form an essential material basis for the economic and social development of a country [1]. However, their supply stability is susceptible to economic fluctuations, national conflicts, geopolitical factors, and other influences. Once the supply of mineral resources faces risks and disruptions, it can significantly impact the entire economic system. Therefore, the continuous and stable supply of mineral resources directly affects a country’s political stability and the smooth progress of economic development. With the rapid development of China’s economy, particularly under the Belt and Road Initiative, China’s demand for overseas mineral resources has sharply increased, expanding China’s overseas interests in the process of globalization [2]. Despite the increasingly prominent role of mineral resource trade in China’s manufacturing sector, research in this field remains relatively insufficient [3].

China is a major consumer of resources, with a self-sufficiency rate in mineral resources far below its consumption capacity, and a high external dependency on various mineral products [5]. India, with its abundant mineral resources, ranks among the world’s top in terms of reserves and production for many minerals, making it one of China’s important import partners. Additionally, India benefits from a strong geographical advantage due to its relatively close proximity to China via sea routes [6], thereby holding a significant share in China’s imports of mineral resources.

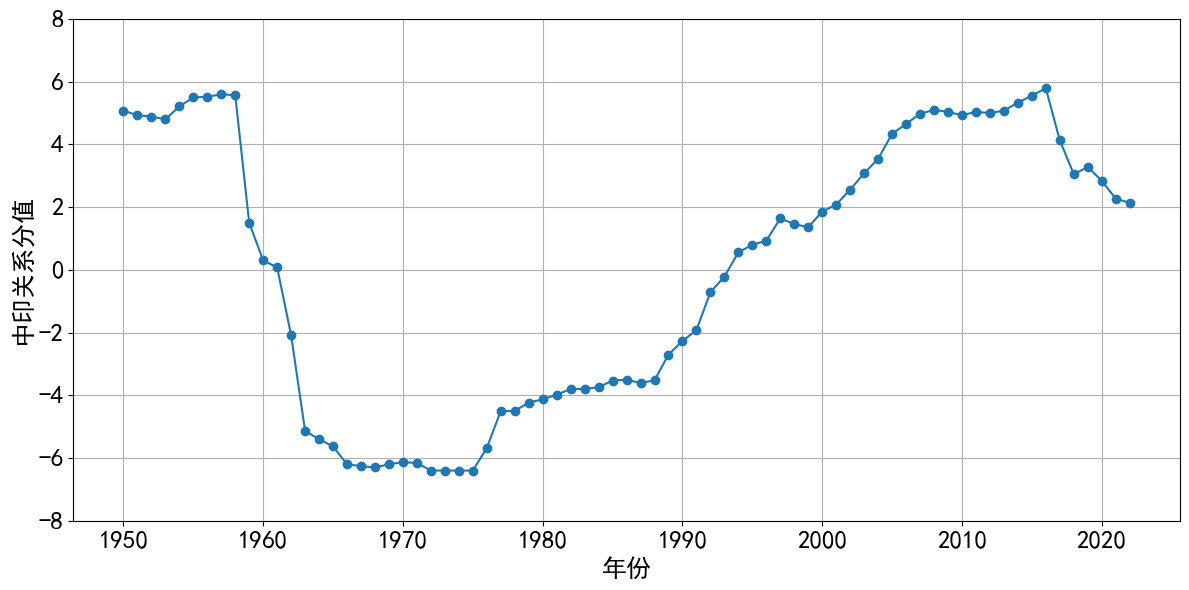

State relations can be considered as a crucial indicator of trade stability. Strong bilateral relations often promote trade cooperation between two countries, while conversely, strained relations can adversely affect trade stability and even threaten a nation’s strategic security concerning mineral resources. As two rapidly developing emerging economies and populous developing countries, China and India share a unique “four-in-one” relationship framework, encompassing neighborly relations, major power relations, relations among developing countries, and significant partnerships on the multilateral stage [4]. This relationship not only affects the two countries themselves but also has profound implications for the Asia-Pacific region and the world at large. Since the establishment of diplomatic relations between China and India, their relationship has experienced significant fluctuations, which can be categorized into four distinct periods. The first period spans from 1950 to 1959, characterized by close ties and comprehensive development of bilateral relations. The second period, from 1959 to 1976, saw a deterioration in relations, reaching a nadir in the early 1970s. The third period, from 1976 to 2000, witnessed gradual easing and normalization of relations in the early phase, followed by a downturn due to India’s nuclear tests in 1999. The fourth period, post-21st century, has been marked by gradual improvement and steady development, entering a phase of comprehensive growth. However, the Doklam incident in 2017 had a negative impact on bilateral relations, which have since cooled again in recent years, particularly due to border issues.

(Data source: Institute of International Relations, Tsinghua University)

http://www.imir.tsinghua.edu.cn/publish/iis/index.html

Figure 1. Trend of China-India Relations (1950-2022)

International politics’ impact on economic trade and their relationship has long been a topic of concern and debate among scholars in the field of international political economy. Initially, scholars examining the impact of political relations on international trade often categorized political relations as political conflicts between nations, negative political events, or wars, leading to traditional views that deteriorating political relations between countries would negatively affect bilateral trade, causing trade declines or even interruptions. This approach focused solely on the impact of events related to deteriorating political relations on bilateral trade while overlooking the continuous changes in political relations and their impact on international trade. Since the beginning of the 21st century, scholars have engaged in discussions surrounding the relationship between international trade and politics, attempting to analyze their correlation in greater depth. Xu Qiyuan and Chen Sichong (2014) empirically analyzed the tense economic and trade relations between China and Japan from 2002 to 2012 [7]. Wei Yunyan and Fan Xiufeng (2017), based on a triadic marginal perspective and expanding factors on the basis of gravity models, analyzed the growth of China’s exports to Asian and European countries concerning bilateral political relations [8]. Yang Hui (2019) reviewed the development history of political and trade relations between China and South Korea, integrating political relations between China and South Korea into trade gravity models and suggesting that political relations between China and South Korea can positively influence bilateral trade relations [9]. Tao Yitao and Wang Yuren (2023), using gravity models and event data from the GDELT global events, language, and tone database, explored the impact of fluctuations in bilateral relations between China and ASEAN countries on trade under the context of the Belt and Road Initiative [10]. In the field of trade, many scholars utilize random frontier gravity models to analyze international trade. Pan Ziyan (2024), based on panel data of China’s digital service trade with 13 RCEP partner countries from 2005 to 2021, analyzed the current status of China’s digital service trade with RCEP partner countries. Furthermore, using the random frontier gravity model, Pan analyzed export efficiency, potential, and influencing factors [11]. Chen Jiyong and Yan Yichen (2019), using relevant data from China and India with their major trading partners from 2007 to 2016, constructed random frontier gravity models and inefficiency models to study the trade potential between China and India based on trade competition and complementarity [12].

While scholars both domestically and abroad have made certain achievements in related fields, there are still some limitations. Firstly, the scope of research is limited. Existing literature predominantly focuses on the study of political relations and trade relations between China and the United States, China and Japan, China and South Korea, and China with several other countries, with insufficient attention given to India. Secondly, existing research on trade-related topics has not delved deeply into specific trade product levels, particularly inadequately researching trade in mineral resources. Therefore, drawing inspiration from existing literature, this paper aims to provide references and insights for safeguarding China’s upstream industrial supply chain and strategic mineral resource security under new circumstances. From the perspective of international trade, this study focuses on the impact of Sino-Indian bilateral political relations on China’s upstream industrial supply chain. Utilizing data on China-India relations provided by the Institute of International Relations at Tsinghua University, the study employs a comprehensive analysis method combining qualitative and quantitative approaches, particularly using the random frontier gravity model. Based on import and export data of five types of minerals between China and India from 2008 to 2023, the study analyzes trends in mineral imports and exports, explores the extent to which political relations between the two countries affect China-India mineral resource trade, identifies potential impacts of current Sino-Indian relations on China’s upstream industrial chain, and proposes relevant recommendations for the production and export of Indian steel and other mineral resources in conjunction with the needs of China’s industrial supply chain.

2 Theoretical Foundation

The gravity model is a commonly used statistical tool for studying international trade flows [18], capable of effectively analyzing the impact of various factors on trade between countries. However, traditional gravity models often treat unobservable human factors as random disturbance terms, which can lead to persistent trade resistance [11]. Based on this, Kalirajan combined the stochastic frontier analysis method with the traditional gravity model, proposing the stochastic frontier gravity model. This model decomposes the random disturbance term in the traditional model into trade inefficiency and random error terms, effectively reducing estimation errors in trade potential [15]. The stochastic frontier gravity model can be represented as follows:

Tijt=f(xijt,β)exp(vijt)exp(-uijt), uijt≥0 (1)

lnTijt=lnf(xijt,β)+vijt-uijt (2)

Equation (2) represents the logarithmic form of Equation (1). Here, i and j represent countries, t represents time. Tijt represents the trade volume from country i to country j at time t, the dependent variable. xijt represents natural factors influencing trade between two countries, such as per capita GDP, geographic distance, and shared borders. vijt represents random disturbances following a normal distribution with a mean of 0. uijt represents trade inefficiency, typically assumed to follow a normal, truncated, or lognormal distribution. β represents the parameter to be estimated.

3 Model Construction

The main factors influencing trade between two countries can be categorized into natural factors including shared borders and cultural factors including bilateral relations. This study refers to Armstrong’s classification [17], using natural factors as explanatory variables in the stochastic frontier gravity model, and cultural factors as explanatory variables in the trade inefficiency model, comprehensively considering the impact of different factors on bilateral trade.

India primarily impacts China’s industrial supply chain by exporting minerals and raw materials. Therefore, using China’s imports of Indian goods trade data as the dependent variable can effectively reflect the impact of changes in Sino-Indian relations on China’s industrial supply chain. Due to the different trade attributes of various minerals and raw materials, the same factors will have different impacts on the trade of different minerals and raw materials. Therefore, this paper constructs multiple models with the trade volume of five types of minerals and raw materials as separate dependent variables, aiming to understand comprehensively the impact of Sino-Indian relations on the trade of minerals and raw materials, and thereby reflecting the overall impact on the industrial supply chain.

The stochastic frontier gravity model is set as follows:

lnTYPEit=β0+β1lnGDPPCt+β2lnGDPPIt+β3lnEXRt+vt-uit (3)

Here, TYPEit represents the import value of type i minerals and raw materials from India to China in year t; βk represents the parameters to be estimated; GDPPCt and GDPPI represent the per capita GDP of China and India in year t, reflecting the economic development levels of both countries; EXRt represents the exchange rate of Renminbi against the Rupee in year t, reflecting the trade balance between the two countries; vt represents external random disturbances, including constant factors such as geographical distance and shared borders in this study, combined into vt.

Trade Inefficiency Model is set as follows:

uit=α0+α1RELt+α2 CBIt+α3CLIt+α4 CCIt+α5CTIt+α6IBIt+α7ILIt+α8ICIt+α9ITIt+εit (4)

Where, uit represents the trade inefficiency of type i minerals and raw materials imported from India to China in year t. αk represents the parameters to be estimated. REL is the China-India relations index in year t, reflecting the relationship status between China and India, serving as the core explanatory variable in this study. A higher value indicates better bilateral relations. CBIt and IBIt represent the commercial freedom index of China and India respectively in year t. A higher value indicates greater commercial freedom in the respective country. CLIt and ILIt represent the labor freedom index of China and India respectively in year t. A higher value indicates greater labor freedom in the respective country. CCIt and ICIt represent the monetary freedom index of China and India respectively in year t. A higher value indicates greater monetary freedom in the respective country. CTIt and ITIt represent the trade freedom index of China and India respectively in year t. A higher value indicates greater trade freedom in the respective country.

4 Research Data and Description

Considering the representativeness of the dependent variables and the completeness of the data, this study selects the top five mineral products and raw materials from the Ministry of Commerce of the People’s Republic of China’s 2019 list of major export commodities from India to China as the dependent variables. These include mineral fuels, mineral oils and their products, asphalt, steel, copper and its products, zinc and its products, and steel products, with corresponding HS codes of 27, 72, 74, 79, 73, respectively. Below, the dependent variables are distinguished by the format “HS + HS code.” The trade data comes from one of the most authoritative international trade databases, UN Comtrade, which aligns more closely with data in the Chinese Customs database [1].

The GDPPC, GDPPI, and EXR data in Equation (3) are sourced from the World Bank database. The REL data in Equation (4) comes from the China-India relations data provided by the Institute of International Relations at Tsinghua University [14]. This data is monthly and covers 74 years from 1950 to 2023. The China-India relations data ranges from -10 to 10, with positive values indicating good relations between the two countries, negative values indicating negative relations, and larger absolute values indicating more extreme relations. The CBI, CLI, CCI, CTI, IBI, ILI, ICI, and ITI data come from the annual Economic Freedom Index reports published by The Wall Street Journal and the Heritage Foundation.

4.1 Applicability Test

Due to the high requirements of the stochastic frontier method for equation form, before conducting model regression, the maximum likelihood ratio (LR) test method using the frontier package in R language is first employed. The hypothesis of non-existence of trade inefficiency is sequentially tested. LR statistics are calculated based on the logarithm likelihood values of constrained and unconstrained models, and compared with the critical value of the χ2 distribution at the 1% significance level, in order to draw conclusions to reject or accept the null hypothesis.

As shown in Table 1, the LR statistics values for all five models exceed the critical values, indicating that the hypothesis of trade efficiency non-existence did not pass the significance test. Therefore, trade inefficiency exists.

Table 1. LR Test Results

Null Hypothesis |

Dependent Variable |

Constrained Model |

Unconstrained Model |

LR Statistic |

1% Critical Value |

Conclusion |

Trade Inefficiency Does Not Exist |

HS27 |

-15.53 |

-5.22 |

20.62 |

2.09 |

Reject |

Trade Inefficiency Does Not Exist |

HS72 |

-18.39 |

1.18 |

39.15 |

2.09 |

Reject |

Trade Inefficiency Does Not Exist |

HS73 |

-1.59 |

4.48 |

12.73 |

2.09 |

Reject |

Trade Inefficiency Does Not Exist |

HS74 |

-19.02 |

-10.81 |

16.43 |

2.09 |

Reject |

Trade Inefficiency Does Not Exist |

HS79 |

-29.37 |

-4.98 |

48.78 |

2.09 |

Reject |

4.2 Model Regression and Results Analysis

To ensure the robustness and scientific validity of the results, the models with each type of mineral product and raw material as the dependent variable were estimated using Ordinary Least Squares (OLS) and time-invariant models. Table 2 shows that for HS27, HS73, and HS79 as dependent variables, the parameter γ is close to 0. The variable γ measures the proportion of total error attributed to inefficiency, indicating that inefficiency plays a minor role in these three models. This suggests that factors including cultural aspects such as Sino-Indian relations are not the main influences on China’s imports of these types of minerals and raw materials from India. For HS72 and HS74 as dependent variables, γ is close to 1, indicating that trade inefficiency is the primary factor affecting imports of these mineral products and raw materials. However, σ2 for the latter is large and insignificant, suggesting significant errors and limited explanatory power. Therefore, the next step will focus on a detailed analysis of the trade inefficiency model estimation results for HS72.

Table 2. Estimation Results of the Random Frontier Gravity Model

Dependent Variable |

HS27 |

HS72 |

HS73 |

HS74 |

HS79 |

GDPPC |

7.476(4.945) |

-2.296(0.999)** |

0.585(1.288)* |

4.054(0.709)*** |

-5.161(1.881)*** |

GDPPI |

-11.528(5.184)** |

0.351(2.008) |

1.468(1.666) |

-3.179(9.150)*** |

6.007(2.136)*** |

EXR |

-1.148(3.811) |

0.438(0.943) |

5.630(1.247) |

-3.395(0.661)*** |

6.859(1.988)*** |

Constant Term |

13.906(2.775)*** |

25.777(1.721)*** |

15.017(1.253)*** |

22.542(0.894)*** |

10.662(2.281)*** |

σ2 |

0.105(0.035)*** |

0.053(0.019)*** |

0.0344(0.011)*** |

1.254(0.926) |

0.102(0.033)*** |

γ |

0.003(0.001)** |

1.000(0.040) |

0.000(0.000)*** |

1.000(0.000)*** |

0.003(0.000)*** |

Log-Likelihood |

-5.223 |

1.185 |

4.775 |

-10.806 |

-4.979 |

LR Test Value |

20.620 |

39.153 |

12.726 |

16.429 |

48.778 |

Note: *, **, *** indicate significance at the 10%, 5%, and 1% levels, respectively. Numbers in parentheses are standard errors, rounded to three decimal places.

According to Table 3, in the regression results of the trade inefficiency model with HS72 as the explanatory variable, the coefficient of the core explanatory variable, the China-India Relationship Index (REL), is positive and highly significant. This indicates a clear positive correlation between the China-India relationship and the import status of this type of minerals and raw materials. The improvement in China-India relations is expected to significantly promote China’s import of such minerals and raw materials from India. This is because India’s abundant mineral resources can meet China’s demand for these types of minerals. Therefore, with the improvement of China-India relations, there is potential for both sides to further strengthen trade and cooperation in the mineral resources sector. Increased bilateral trade in this area will be more frequent and closer, thereby greatly promoting China’s imports of such minerals from India.

The coefficients of China’s Business Freedom (CBI), China’s Labor Freedom (CLI), and China’s Trade Freedom (CTI) are all negative and highly significant, indicating a significant negative correlation with the import of such minerals and raw materials. This is because as these freedoms increase, China’s choice of import destinations for these products increases, leading to a more complex import destination structure and a more diversified composition of import countries. This increased competition between Indian products and products from other origins reduces India’s exports of such minerals and raw materials to China. However, the diversification of import sources due to these increased freedoms helps reduce the risk of dependency on a single country like India, thereby stabilizing China’s industrial supply chain and positively impacting the country.

India’s Business Freedom (IBI) shows a significant positive correlation with trade inefficiency, while India’s Currency Freedom (ICI) also shows a positive correlation but is not significant. This indicates that improvements in India’s business and trade freedoms are beneficial for China’s imports of such minerals and raw materials. The improvement in India’s business freedom promotes the development of India’s domestic production market, increasing the production of export products. Simultaneously, increased business freedom enhances competition in the domestic market, prompting Indian enterprises to shift more from domestic sales to exports. Increased currency freedom in India reduces domestic capital controls and foreign exchange restrictions, facilitating easier capital movement for enterprises, thus promoting India’s domestic exports.

India’s Trade Freedom (ITI) shows significantly negative coefficients, indicating that India’s open domestic market attracts imports from more countries, leading to market substitution. Furthermore, relaxed trade policies in India may lead to a shift of resources, capital, and labor from resource-intensive industries to more technologically intensive industries, thereby reducing India’s exports of minerals and raw materials to China.

China’s Currency Freedom (CCI) and India’s Labor Freedom (ILI) have some impact on the import of such minerals and raw materials, but their influence is not significant and they are not the primary factors affecting China’s industrial supply chain.

Table 3. Estimation Results of Trade Inefficiency Model

Time-Invariant Model |

27 |

72 |

73 |

74 |

79 |

REL |

0.701(0.280)** |

0.686(0.169)*** |

0.691(0.387)* |

-0.011(0.946) |

2.426(0.372)*** |

CBI |

0.150(0.051)*** |

-0.088(0.002)*** |

-0.037(0.024 |

-0.067(0.106) |

0.417(0.091)*** |

CLI |

0.124(0.072)* |

-0.094(0.020)*** |

-0.277(0.162)* |

0.042(0.148) |

-0.358(0.087)*** |

CCI |

0.050(0.099) |

0.060(0.042) |

0.173(0.161) |

-0.003(0.244) |

-0.123(0.109)*** |

CTI |

0.072(0.101) |

-0.019(0.009)** |

0.496(0.304) |

-0.044(0.083) |

-1.325(0.134)*** |

IBI |

-0.054(0.035) |

0.064(0.017)*** |

0.144(0.076)* |

0.166(0.146) |

0.079(0.086) |

ILI |

0.053(0.017)*** |

0.014(0.009) |

-0.091(0.055)* |

-0.008(0.055) |

0.682(0.044)*** |

ICI |

0.035(0.071) |

0.041(0.022)* |

-0.087(0.061) |

-0.055(0.158) |

1.379(0.130)*** |

ITI |

-0.033(0.035) |

-0.018(0.008)** |

0.004(0.048) |

-0.002(0.074)) |

0.568(0.098)*** |

Constant Term |

-27.121(17.712) |

1.506(1.297) |

-28.824(17.345)* |

-0.000(0.100) |

-6.246(1.231)*** |

Note: *, **, *** indicate significance at the 10%, 5%, and 1% levels, respectively. Numbers in parentheses are standard errors, rounded to three decimal places.

5 Research Results

Based on the import and export data of five mineral commodities from 2008 to 2023, this study employs a stochastic frontier gravity model to analyze the impact of Sino-Indian relations on China’s import of Indian mineral resources. After excluding the import data with significant errors for copper and its products, the study draws the following conclusions: For mineral fuels, mineral oils and their products, asphalt, zinc and its products, and steel products, the influence of Sino-Indian relations on China’s import of these mineral products and raw materials is minimal. However, for steel resources, Sino-Indian relations show a significant positive correlation with their import status. Steel resources are critical strategic needs for China’s steel industry [15]. Currently, China has a high dependence on imported iron ore for upstream ore sands, with a large consumption volume. In 2022, China’s iron ore consumption accounted for 60.5% of global total consumption, with an external dependence rate still as high as 81% [14]. Therefore, the stability of the supply of steel resources significantly impacts China’s upstream industrial supply chain. As the world’s second-largest steel producer, the stability of India-China relations directly affects the development of China’s steel industry and poses significant challenges to the healthy and sustainable development of China’s economy [15]. Against this backdrop, maintaining stable trade relations is of great significance for ensuring the supply of raw materials for China’s steel industry and promoting sustained and healthy economic development.

6 Policy Recommendations

This paper, through an in-depth analysis of the interaction between Sino-Indian trade and political relations, explores the impact of Sino-Indian relations on China’s upstream industrial supply chain from an international trade perspective. Based on the analysis of model results, the following recommendations are proposed to safeguard China’s supply chain security in Sino-Indian trade:

Firstly, for mineral resources less affected by national relations, China should focus on enhancing economic and trade cooperation. Since these mineral resources are primarily influenced by economic and trade factors, joining relevant trade organizations, establishing trade agreements, and strengthening economic and trade cooperation can create a more favorable environment for bilateral trade.

Secondly, for mineral resources significantly affected by national relations, such as steel resources, China should strengthen diversified trade cooperation with different countries to mitigate risks associated with fluctuations in bilateral relations. For instance, given the significant positive correlation between Sino-Indian relations and China’s import of steel resources, deterioration in bilateral relations could potentially restrict China’s import of steel resources from India, thereby impacting the security of related industrial supply chains upstream. Therefore, China should enhance cooperation with various countries in the steel resources sector, explore diversified import channels, and negotiate more favorable trade conditions to meet domestic demand for steel resources. It is advisable to continue expanding diversified sources of mineral resource imports to mitigate potential geopolitical risks.

Thirdly, China should optimize the bilateral trade structure with India by appropriately increasing imports of advantageous mineral resources from India to balance trade relations. China is India’s largest source of trade deficits, and this significant trade deficit has led to ongoing trade frictions initiated by India [16]. China should uphold a comprehensive national security perspective, balance security with development, reassess India’s strategic position and role in major power games, and use trade in critical Indian mineral products as an entry point to enhance cooperation in key mineral resources between China and India. This includes accelerating the improvement of top-level designs for cooperation, strengthening institutional guarantees, guiding enterprises to operate in compliance, increasing information supply, and accelerating the planning of trilateral cooperation.

In conclusion, from an international trade perspective, Sino-Indian relations have complex and profound effects on China’s upstream industrial supply chain. In the future, the development of Sino-Indian relations will continue to be a key factor in safeguarding China’s industrial supply chain security. This study not only provides a new perspective on understanding bilateral Sino-Indian relations but also offers valuable policy recommendations for safeguarding China’s upstream industrial supply chain security in a globalized context.

References

[1]. Wang, S. (2021). The impact of changes in Sino-Indian political relations on bilateral trade (Doctoral dissertation). Jilin University. https://doi.org/10.27162/d.cnki.gjlin.2021.001280

[2]. Ji, B. (2019). Risk management of HM Geological Exploration Company under the background of the Belt and Road Initiative (Doctoral dissertation). North China University of Water Resources and Electric Power. https://doi.org/10.27144/d.cnki.ghbsc.2019.000037

[3]. Wang, W., He, C., & Ren, Z. (2021). Evolution of China’s mineral resource trade network. Journal of Natural Resources, 36(07), 1893-1908.

[4]. Li, T. (2015). Research on Sino-Indian relations. South Asian Research Quarterly, (04), 109.

[5]. Wang, P. (2022). Research on the international trade market environment of Chinese mineral products—Review of China Mineral Resource Development Report (2016). Nonferrous Metals (Smelting Section), (02), 128-129.

[6]. Liu, X. (2004, September 1). India’s mineral resources and China’s steel industry development: New trends and opportunities. International Business Daily, (002).

[7]. Xu, Q., & Chen, S. (2014). The impact of Sino-Japanese tensions on bilateral trade. Journal of International Political Science, (1), 1-24.

[8]. Wei, Y., & Fan, X. (2017). Analysis of the growth of China’s export trade to Asia-Europe countries under bilateral political relations—Based on the triple marginal perspective. Explorations in International Economic & Trade, 33(07), 60-73. https://doi.org/10.13687/j.cnki.gjjmts.2017.07.005

[9]. Yang, H. (2019). The mutual influence of international political relations and economic and trade relations between China and South Korea (Doctoral dissertation). Yanbian University.

[10]. Tao, Y., & Wang, Y. (2023). Research on the impact of state relations on trade: A case study of China and ASEAN. Special Zone Practice and Theory, (06), 25-33. https://doi.org/10.19861/j.cnki.tqsjyll.20231127.001

[11]. Pan, Z. (2024). Efficiency and potential of China’s digital service trade exports to RCEP partner countries—Based on stochastic frontier gravity model. China Business and Market, 38(02), 105-116. https://doi.org/10.14089/j.cnki.cn11-3664/f.2024.02.010

[12]. Chen, J., & Yan, Y. (2019). Competitiveness, complementarity, and trade potential between China and India—Based on stochastic frontier gravity model. Asia-Pacific Economic Review, (01), 71-78+155. https://doi.org/10.16407/j.cnki.1000-6052.2019.01.009

[13]. Wang, W., He, C., & Ren, Z. (2021). Evolution of China’s mineral resource trade network. Journal of Natural Resources, 36(07), 1893-1908.

[14]. Zhu, Q., Zhu, H., & Zou, X. (2024, May 5). Analysis of global strategic mineral industry chain and supply chain. China Land and Resources Economy, 1-14. https://doi.org/10.19676/j.cnki.1672-6995.001001

[15]. Yang, G., Su, X., Ma, Z., et al. (2021). Research progress on beneficiation technology of Dong’anshan complex iron ore. Mineral Conservation and Utilization, 41(05), 140-148. https://doi.org/10.13779/j.cnki.issn1001-0076.2021.05.020

[16]. Wang, S., & Zheng, Y. (2022). Analysis of potential and influencing factors of Sino-Indian bilateral trade. Economic Perspectives, (11), 98-105. https://doi.org/10.16528/j.cnki.22-1054/f.202211098

[17]. Kalirajan, K., & Shand, R. T. (1999). Frontier production functions and technical efficiency measures. Journal of Economic Surveys, 13, 149-172.

[18]. Tinbergen, J. (1962). Shaping the world economy: Suggestions for an international economic policy. Twentieth Century Fund.

Cite this article

Wang,Y. (2024). Study on the Impact of State Relations on China’s Industrial Supply Chain Upstream from the Perspective of International Trade: A Case Study of Mineral Resources. Journal of Applied Economics and Policy Studies,7,32-38.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, S. (2021). The impact of changes in Sino-Indian political relations on bilateral trade (Doctoral dissertation). Jilin University. https://doi.org/10.27162/d.cnki.gjlin.2021.001280

[2]. Ji, B. (2019). Risk management of HM Geological Exploration Company under the background of the Belt and Road Initiative (Doctoral dissertation). North China University of Water Resources and Electric Power. https://doi.org/10.27144/d.cnki.ghbsc.2019.000037

[3]. Wang, W., He, C., & Ren, Z. (2021). Evolution of China’s mineral resource trade network. Journal of Natural Resources, 36(07), 1893-1908.

[4]. Li, T. (2015). Research on Sino-Indian relations. South Asian Research Quarterly, (04), 109.

[5]. Wang, P. (2022). Research on the international trade market environment of Chinese mineral products—Review of China Mineral Resource Development Report (2016). Nonferrous Metals (Smelting Section), (02), 128-129.

[6]. Liu, X. (2004, September 1). India’s mineral resources and China’s steel industry development: New trends and opportunities. International Business Daily, (002).

[7]. Xu, Q., & Chen, S. (2014). The impact of Sino-Japanese tensions on bilateral trade. Journal of International Political Science, (1), 1-24.

[8]. Wei, Y., & Fan, X. (2017). Analysis of the growth of China’s export trade to Asia-Europe countries under bilateral political relations—Based on the triple marginal perspective. Explorations in International Economic & Trade, 33(07), 60-73. https://doi.org/10.13687/j.cnki.gjjmts.2017.07.005

[9]. Yang, H. (2019). The mutual influence of international political relations and economic and trade relations between China and South Korea (Doctoral dissertation). Yanbian University.

[10]. Tao, Y., & Wang, Y. (2023). Research on the impact of state relations on trade: A case study of China and ASEAN. Special Zone Practice and Theory, (06), 25-33. https://doi.org/10.19861/j.cnki.tqsjyll.20231127.001

[11]. Pan, Z. (2024). Efficiency and potential of China’s digital service trade exports to RCEP partner countries—Based on stochastic frontier gravity model. China Business and Market, 38(02), 105-116. https://doi.org/10.14089/j.cnki.cn11-3664/f.2024.02.010

[12]. Chen, J., & Yan, Y. (2019). Competitiveness, complementarity, and trade potential between China and India—Based on stochastic frontier gravity model. Asia-Pacific Economic Review, (01), 71-78+155. https://doi.org/10.16407/j.cnki.1000-6052.2019.01.009

[13]. Wang, W., He, C., & Ren, Z. (2021). Evolution of China’s mineral resource trade network. Journal of Natural Resources, 36(07), 1893-1908.

[14]. Zhu, Q., Zhu, H., & Zou, X. (2024, May 5). Analysis of global strategic mineral industry chain and supply chain. China Land and Resources Economy, 1-14. https://doi.org/10.19676/j.cnki.1672-6995.001001

[15]. Yang, G., Su, X., Ma, Z., et al. (2021). Research progress on beneficiation technology of Dong’anshan complex iron ore. Mineral Conservation and Utilization, 41(05), 140-148. https://doi.org/10.13779/j.cnki.issn1001-0076.2021.05.020

[16]. Wang, S., & Zheng, Y. (2022). Analysis of potential and influencing factors of Sino-Indian bilateral trade. Economic Perspectives, (11), 98-105. https://doi.org/10.16528/j.cnki.22-1054/f.202211098

[17]. Kalirajan, K., & Shand, R. T. (1999). Frontier production functions and technical efficiency measures. Journal of Economic Surveys, 13, 149-172.

[18]. Tinbergen, J. (1962). Shaping the world economy: Suggestions for an international economic policy. Twentieth Century Fund.