1 Introduction

On December 12, 2019, the first case of novel corona-virus pneumonia was reported in Wuhan, China. Then on February 7, 2020, China's National Health Commission decided to officially name the pneumonia caused by the virus as"COVID-19". Since the n, the novel coronavirus pneumonia began to break out on a large scale in China, and the country officially entered a state of lockdown on that day. (China Daily).

According to CNBC, the U.S. consumer news and business channel, COVID-19 has plunged many countries into their deepest recessions in recent history. According to the data released by the National Bureau of Statistics of China, in terms of tourism, compared with before COVID-19, COVID-19 has caused an average annual loss of 2,852.6 billion yuan in China's domestic tourism revenue and a decrease of 2.71 bill ion yuan in the average annual number of tourists in China, Tourism is the representative of the tertiary industry. So COVID-19 undoubtedly has a great negative impact on China's tertiary industry. So, the research topic of this paper is “What were the most important impacts of COVID-19 on Chinese tertiary industry and how might they change its future trajectory?”

In 1985, the National Bureau of Statistics of China defined the production industry, which involves the primary industry, the secondary industry and the tertiary industry. The primary industry mainly produces natural resources and the economic sectors that meet the basic needs of human beings, such as agriculture, livestock, fishery, forestry, etc.; the secondary industry refers to the economic sector that produces the products and the processing process, such as manufacturing, mining, construction, etc.; the tertiary industry refers to the industry that provides services for more advanced needs than the needs of human material products, that is, all departments except for the first and second industries, such as transportation, transportation, commerce, finance, insurance, tourism, etc. In this epidemic, each industry of the tertiary industry was affected to varying degrees. These effects occur from various factors such as the change of consumption supply and demand, export and import restrictions, and the change of consumer consumption behavior.

With the progress of society, the tertiary industry plays an increasingly important role in the development of the economy and society. The tertiary industry can increase employment opportunities and alleviate employment pressure. Compared with the primary and secondary industries, the tertiary industry can utilize advanced technology to provide consumers with richer services, including online shopping, smart homes, and so on. The most important thing is that the tertiary industry also has significant social benefits, including improving the quality of education, improving the level of medical services, increasing public resources, and promoting social equity. Therefore, exploring the important impact of the COVID-19 on the tertiary industry and predicting its future development trajectory can better promote the development of the tertiary industry and promote the comprehensive and sustainable development of society, which has important practical significance.

In order to better explore the impact of the COVID-19 on China's tertiary industry and its future development trajectory, the research will be carried out from the following aspects: First, in the literature review section, the research reviewed the development of different industries in the tertiary industry since the COVID-19 epidemic, and divided them into struggling industries and profitable industries according to their development. Next, the study analyzed the problems caused by the COVID-19. In the last part of the literature review, the study reviewed the solutions to the COVID-19 epidemic from the perspective of enterprises and the government.

In the discussion part, the research deeply analyzed the positive and negative impacts of the COVID-19 on the tertiary industry. As a public health emergency, the COVID- 19 has brought many adverse impacts on the development of the tertiary industry, such as the restriction of people's outdoor consumption behavior, the lack of disposable goods and food supply. Nevertheless, the COVID-19 epidemic is also a double- edged sword, which brings a series of opportunities while having negative effects, such as more emerging consumer groups, more leisure time and viewing opportunities for people, and thus more demand for goods, which undoubtedly drives the development of emerging industries to a certain extent and promotes the development of the tertiary industry. Based on this analysis, the study predicted the development trend of industries in the post pandemic era and summarized relevant conclusions.

2 Literature Review

Over the past years, many different factors have had an impact on the development of China's banking industry and its industrial structure. According to Niu [16], the epi demic, as an exogenous shock, will have a short-term impact on China's economic growth. The outbreak of COVID-19 and lockdown policies have inevitably brought restrictions on the mobility of people. Shen [20] argued that countries were forced to take quarantine measures due to the highly contagious nature of COVID-19. These measures have a large negative impact on aggregate demand, especially on consumption and exports, he used the financial data of listed Chinese companies from 2013 to 20 19 to predict corporate performance in a period, increasing the accuracy of his theory. Therefore, according to the studies of many scholars, it is shown that the epidemic does have a profound impact on the tertiary industry, and these effects are divided into positive and negative effects.

2.1 A Comparison of Different Industries during COVID-19

A key lens through which to consider different industries success or failure, is through their characteristics, especially given that Phan, Sharma, and Narayan [17] found strong evidence that return predictability has links to certain industry characteristics. Therefore, the supply-demand relationship varies with the characteristics of the industry, such as deology, business model, production mode during the pandemic.

2.1.1 Struggling Industries

The lockdown policy has had negative impacts on many industries, and many academics and data indicate that the most struggling companies are the hospitality and real estate industries. Nancai Net (Nov9th 2022) one of the authoritative financial websites in China, announced the industries that struggled the most during COVID 19. Among all the industries, the industries that struggled the most are in the real estate industry. The factors included personnel liquidity difficulties, debt defaults. Zhao [4] Zhao also believed that the real estate industry is one of the severely struggling industries. Zhao [4] was able to show her findings through the modelling using up to date data from the Chinese statistics bureau, improving the reliability of his findings. From the perspective of sellers, COVID 19 has closed most sales offices, and housing demand has been suppressed by government policies. China's State Council issued "Further Optimizing COVID-19 Prevention and Control Measures" (Nov11th 2022), which stipulates that people are prohibited from going out at will. Therefore, people who have ho using demand are restricted and cannot go out to understand the real estate information, which leads to the reduced demand for real estate. In terms of buyers, average disposable income has fallen. While people's daily expenses are at a high level, the purchase funds will also decrease, and the residents' ability and willingness to buy houses will decline. This shows that COVID 19 has had a big negative impact on real estate.

Lu, Peng, Wu, Lu [12] found some evidence to prove that changes in consumer behavior may lead to many uncertainties in the long and short term. Consumers and potential consumers are restricted from going out, so producers are unsure how many items to produce. More producers choose to reduce the supply of goods to reduce the possibility of poor sales. This could eventually lead to a lower supply situation. They found some data which were extracted from an online survey given to 6034 enterprises, to increase the accuracy of their findings. According to them, they used the hotel industry for their research. According to China's National Bureau of Statistics, the hotel industry is the most affected, and daily hotel traffic is difficult to predict. In the short t erm, based on Maslow's hierarchy of needs, Consumers' demand for health and safety is more urgent than that for social contact during the pandemic, resulting in a shrinking demand [7]. Lu, Peng, Wu, Lu [12] found that with the government's COVID 19 lockdown policy, consumers' personal enthusiasm for travel has been greatly hit. And consumers' ordering hotels are also restricted by government policies. This situation reduces the number of consumers and potential consumers, greatly reduces the market demand, and ultimately leads to the profits received by merchants are uncertain, so it is impossible to set the minimum income for the hotel industry. And the hotel industry is under great financial pressure in terms of rent payments, fixed costs, and employee salaries. The worst could be that the hotel does not receive a single consumer order for 24 hours a day, but the hotel still has to pay its staff, water and electricity. On the other hand, the hotel industry is protected by some government policies during the COVID 19 period, but the benefits given to the hotel industry by the government are also limited. If the hotel cannot make a profit, the investors may no longer invest or the bank will not lend money. Therefore, the COVID-19 crisis has brought internal capital and external market pressure to the hotel industry. Many small and medium-sized enterprises have had to scale back or even stop their normal operations during the whole period. The economical approach of closing hotels reduces supply to the market. The main reason why most SMEs are unable to resume work is a lack of staff. Most of them are strictly restricted by government regulations, and employees will not be allowed to work in the workplace. This will lead to a shortage of labor in the market, and eventually lead to a decline in market supply.

2.1.2 Profitable Industries

Sun [21] investigated the impact of COVID-19 on small and medium-sized firms (S MEs) in China with textual and empirical analyses. According to his findings, SMEs involved in digital issues such as medical and personal protective materials manufacturing, smart device production, online business, and digital transformation have been less affected by the pandemic. Even in some cases, the profits had an increase. Chen [2] collected some data from The National Bureau of Statistics of China to prove that the e-commerce industry is growing in COVID-19 in some aspects. In 2019, the total value of China's cross-border e-commerce retail sales continued to rise to 186.21 billion yuan, increasing 38.3% from the previous year. Chen said cross-border e-commerce has also been negatively affected during the epidemic. The decline of supply chain efficiency, hoarding of goods and obstruction of international logistics are the main factors affecting cross-border e-commerce. But Chinese e-commerce companies have issued some innovative policies and have overcome these problems very well. So that the e-commerce industry in the COVID 19 period showed a growth trend. Chen took Ali international station which Sell imported goods as a case analysis, which improved the reliability of his findings. During the COVID 19 period, Alibaba made use of live broadcast marketing to visually present merchants' capabilities and commodity advantages. Alibaba also offers free video conferencing for both sellers and buyers. This method improves the buyers' understanding of the goods, and improves the efficiency of online communication. During the COVID 19 period, e-commerce transform ed the crisis into an opportunity and further developed the e-commerce economy, which showed the opposite trend with the real estate industry.

2.2 Problems Arising from COVID-19

2.2.1 Traffic Accessibility Obstructed

According to the analysis above, the COVID-19 has greatly hindered the transportation. In this case, the location of businesses will be particularly important. The traffic accessibility caused by the COVID-19 is hindered, which will not only affect the location of businesses due to the passenger flow, but more importantly, it will also have a very adverse impact on the supply chain and logistics chain. Lin Hongxiao, Sun Hui, Zhong Shaopeng [11] used the theoretical method of four large business strategy in northeast China, the results show that the epidemic prevention and control from consumption habits and social distance high consumption behavior, from operating costs and expected earnings affect business scale, impact on the urban large business district development model. The location of retail stores is crucial, and the location of retail stores is one of the most critical factors in explaining business success. Consumers prefer to choose well-known and convenient transportation places, which also produces the phenomenon of large pedestrian traffic.[9]

2.2.2 A significant Reduction in Profitability

The COVID-19 epidemic at the end of 2019 has cast a shadow over China's economic development, and the development of supply and profits in all industries has been affected to varying degrees. Huang, Li, Ru [10] illustrate Gree electric appliances, haier intellectual home, to explore the influence of COVID-19 outbreak of white goods enterprise profitability, through the enterprise in 2018-2020 years in the first three quarters of the profitability index analysis about the conclusion, and make Suggestion s for the improvement of profitability.

Huang, Li and Gong (2021) used the data of Sina Finance and found that in 2020, the year affected by COVID-19, the gross profit margin of the three enterprises had a large gap. Specifically, Midea decreased by 3.8%, Gree by 6.8%, and Haier by 1.06%. Huang [10] used the data of Sina Finance and found that the factors affecting enterprise profit restriction are mainly attributed to several problems: COVID19 Limited sales channels, poor cost control and low added value of products. Li [10] believes that a good way to solve the problem of enterprise profit is to formulate a salary incentive system to mobilize the enthusiasm of employees to complete production, marketing and other tasks. Small and medium-sized enterprises should take a positive attitude to deal with, establish a sense of crisis, start to adjust their development mode, trans form business and growth mode. Small and medium-sized enterprises should actively negotiate with employees to adjust salary, job rotation, shorten working hours, waiting for posts and other ways. [19]

2.3 Solutions to Overcome the Epidemic

2.3.1 Enterprise Self-help

On the one hand, companies must respond to the most immediate and pressing challenges posed by the COVID-19 pandemic to ensure continued business operations among all members of the supply chain. Cai and Luo [1] used statistics from China's Ministry of Industry and Information to demonstrate the success of the "ensuring business continuity" measures. Luo [1] also believes that the supply chain operations are expected to gradually recover to some extent by ensuring the safety of its employees, supporting their supply chain partners, and maximizing the use of the preferential policies implemented in the current period. On the other hand, Cai and Luo [1] argued that COVID-19 amplified the shortcomings of a complex and closely cooperative global manufacturing supply chain, indicating resilience. Supply chain resilience should be enhanced to improve its responsiveness to unforeseen shocks.

2.3.2 Reform of Government Policy

During COVID 19, enterprises could develop themselves by ensuring the continuous operation of the supply chain [1], enhancing the elasticity of the supply chain [1] and changing the location of the business district [9], so as to better prepare for the recovery and prosperity after COVID 19. At the same time, the assistance of the state and the government to SMEs is also essential, because the sudden COVID-19 at the end of 2019 has brought a huge impact on small and medium-sized private enterprises. The central government and local governments recognize the seriousness of the problem and have formulated various supportive policies. However, Rosie [19] believes that most policies have great problems. The existing supporting policies generally lack local characteristics, lack of effective supervision mechanism, the publicity and implementation is not in place, and the policy formulation and implementation are too careless. From the central government to various provinces and cities, many policies have been introduced to enable small and medium-sized enterprises to grow steadily and tide over difficulties. However, on the one h and, the policies on supporting small and medium-sized enterprises formulated by various regions are much the same, and the lack of targeted measures combining the characteristics of local industries and industry structure: on the other hand, there is a lack of policy publicity, many small and medium-sized enterprises do not know what the specific support policies are at present, and the implementation effect is worrying [19]. Rosie [18] also expressed her opinion, arguing that the government can use some means to determine the current situation. Zhang Dawei [3] put forward some suggestions: Local governments can classify and accurately implement policies according to the characteristics and difficulties of different regions, industries and enterprises to ensure the feasibility of policies. And the government needs to strengthen supervision and management, to ensure that policy support in place, more need small and medium-sized enterprises to develop ideas, innovation, always change, enhance the internal power to make the survival crisis into development business opportunities. Studies by many scholars have shown that the epidemic has affected differently in the tertiary industry, including the negatively affected hotel industry and real estate industry and the positively affected e-commerce industry. In view of these negative effect s, scholars have put forward reasonable solutions, including enterprise self-rescue and government policy assistance. In the discussion section, we will also analyze these influencing factors and predict the future trajectory of the tertiary industry.

3 Discussion

3.1 The Positive Impact of COVID-19 on the Industry

In 2020, due to the emergence of COVID-19, there were varying degrees of impact on various industries. According to China's National Bureau of Statistics, the profits in the tertiary industry fell 38.8 percent, and the losses of enterprises reached 36.4 percent. Most of them have had a negative impact on the industry, with the most serious even leading to corporate bankruptcy and debt. However, everything has two sides. It is worth mentioning that the epidemic has also had a positive impact on some industries, creating a good development and sales environment, most notably in the live broadcasting industry. We all know that the temporary suspension of physical store sales has led to the limitation of people mobility and the reduction of import supply of goods, but webcast has achieved better development at this time. Due to the COVID-19, most small and medium-sized enterprises have encountered the problem of capital chain tension and supply chain fracture. At this time, most small and medium-sized manufacturers regard live streaming as their way out. As long as the funds allow, they will invest a lot of money to buy anchor resources with a large number of fans, hoping to use instant sales to reduce their funds, storage and other related pressure, through the establishment of online sales channels, so that enterprises can operate normally. As one of the industries with the most significant development during the epidemic period, the live broadcasting industry has a distinct representative and has all the characteristics of other profitable industries. I will use the live streaming industry as a case to analyze the positive impact of the epidemic.

As can be seen from the chart, the market size of the live broadcasting industry in 2016 and 2017 was not very large, and the growth rate was also very slow. However, it is worth mentioning that since 2019, due to the impact of the epidemic, the live broadcasting industry has gradually become well-known and began to become popular. We can clearly see that from 2019 to 2020, the market size of the live broadcasting industry has a huge growth rate from 84.34 billion yuan to 164.46 billion yuan. The growth rate of 63.4% to 95.0% has almost doubled the market size of the live streaming industry. Therefore, with the evidence of these data, we can believe that the epidemic has had a huge positive impact on the live broadcasting industry. From my personal point of view, the live streaming industry that have benefited may during the pandemic should be attributed to the three most important factors that the pandemic has provided more customer groups, more free time and more commodity demand for these industries.

3.1.1 More Consumer Groups

Before 2019, according to China's National Bureau of Statistics, 70 percent of people chose to buy in physical stores and online in their daily lives, and 50 percent of all those surveyed said that most of their shopping activities were in brick-and-mortar stores in the past year. Despite the growing popularity of multi-channel shopping, physical stores still dominate the position. This is mainly due to several reasons. Although online shopping consumers buy goods from China's authoritative shopping platforms Taobao and Jingdong, they often have problems such as wrong goods and poor quality. When consumers buy goods on these platforms, they can often only see a few pictures, so they cannot understand these goods information well. In the end of the quality and other problems, consumers can only choose to refund or return processing, which will cost unnecessary time and money. To sum up, the main reason why people don't like online shopping is that they can't see the goods. But the emergence of live-streaming sales has made the problem completely solved. By watching the live broadcast, people can get the most intuitive feeling of use and all the information, which helps to increase people's understanding of the product. But after 2019, the outbreak began, and China's lockdown policy required people not to go out. So, people can't go to physical stores, such as shopping malls and supermarkets. This situation has brought a lot of consumer groups to the live broadcasting industry, not only young people began to buy goods in the broadcast room. Older people who are less good at using mobile phones must also learn how to buy goods on their phones to supplement daily necessities. The live streaming industry made a lot of profit and ac- quire a lot of benefits because of COVID-19.

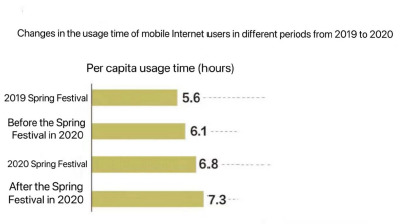

3.1.2 More Free Time and Opportunities for People to Watch

The lockdown policy of the epidemic has caused people to stay at home every day, whether they study, work, and even entertainment activities have been affected and restricted. Students changed from eight hours of school study to taking online classes on a computer. Some employees went from office work to online meetings and did their work on electronic devices. Entertainment activities have also changed from shopping and visiting scenic spots to watching movies and playing games on mobile phones. As you can see from the table below, people spent time using their mobile phones every day during the outbreak. During the outbreak in 2020, the average human mobile phone usage time saw a significant increase, with the daily mobile phone APP usage time changing from 6.1 hours to 6.8 hours. All of this evidence indicates the increasing daily contact with electronic devices. When they are free, the time to go shopping and watch movies becomes their time to watch their phones. As a new way of entertainment, network live broadcast and shopping have been loved by most young people and middle-aged people. Therefore, the epidemic has provided people with more time and opportunities to watch live streaming, and promoted the development of the live streaming industry. Thus, we can see that the epidemic has indeed produced some benefits to the tertiary industry.

Figure 1. Changes in the usage time of mobile Internet users in different periods from 2019 to 2020 Available at: https://mp.weixin.qq.com/s?__biz=MzU2MzA2ODk3Nw==&mid=2247552019&idx=3&sn=25dd4482abf294b34b0bae36d193bb49&chksm=fc5da54dcb2a2c5b51a89a 55d21404dab1b2b7778e81f2a81a6749ac5caad13438db8da6cbce&scene=27(Accesse d: 31August 2023)

3.1.3 More Commodity Demand

Because of the epidemic, people choose to stay at home to prevent the spread of the virus. As a result, people consume daily necessities and medical supplies very quickly than before the outbreak, such as convenience food, disinfectants and masks. It is also because the discounts and novel promotion methods brought by the studio arouse consumers' desire to buy, making them want to buy items that they cannot use or use. These two situations have undoubtedly brought more potential consumers to the live streaming industry. Take the beauty brand, the Perfect Diary. Li Jiaqi and Weiya, two TikTok head anchors are the brand referees of Perfect Diary, they recommend the beauty products of Perfect Diary in the broadcast room, and have achieved good sales. For example, in the boom of live broadcast with goods, the animal eye shadow plate of Perfect Diary successfully reached the top of TikTok eye shadow, and has been on the list for a long time. During the "Double 11" in 2019, Weiya successfully helped the presale of Perfect Diary in the live broadcast, and successfully brought hundreds of thousands of eye shadow products with only one live broadcast. The data in this case clearly indicate the impact of the epidemic on consumer behavior and the significant boost to sales of goods sold on live streaming.

3.2 The Negative Impact of COVID-19 on the Industry

Since the outbreak of COVID-19, China has changed in many ways. COVID-19 not only poses a serious threat to people's life safety, but also has a great impact on the emergency development of various industries in China. In the section we mentioned before, I detailed the positive impact of COVID-19 on some industries, such as in-creasing the consumer group, increasing the time of people's daily exposure to some industries, and increasing the demand for goods. However, there is no doubt that although the epidemic has two sides, it has more negative impact on industry than positive impact. China's GDP has been growing since 2017, according to China's National Bureau of Statistics. Especially in the three years of the epidemic, the GDP can still maintain the continuous growth, which is also called the last miracle among the major economies of the world. But we cannot ignore the decline in the GDP growth rate from 6.0% to 2.2% from 2019 to 2020. Therefore, we must admit that in the past three years, China's economy has indeed faced great challenges despite the severe external environment and repeated epidemics. Many industries and enterprises have also encountered various difficulties, and some enterprises have even faced life-and-death challenges. But personally, I think this should be attributed to some factors, such as people's limited behaviour, people lack disposable capital, and some industries lack the supply of goods.

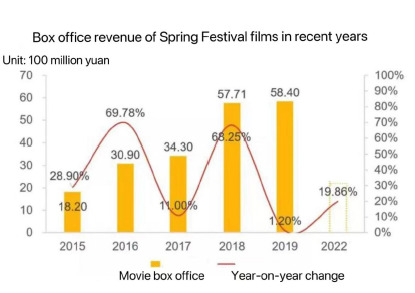

3.2.1 The Limitation of People's Outdoor Consumption Behavior

Because of the lockdown policy, people have to stay at home according to the relevant policy, which not only restricts people from going to work, but also limits all kinds of recreational activities. In terms of China's economic development, entertainment activities will show significant short-term growth during large holidays such as China's National Day and Chinese New Year. Compared with weekdays and weekends, more film companies are willing to release films on National Day or Spring Festival to attract more consumers, increase the box office and increase the profits of film companies. As usual, in the 2019 Spring Festival season, nine films will be released at the same time, which was originally expected. But as the outbreak escalated, residents became so immobile that most people were restricted from staying at home, forcing the films to be removed collectively. We can see very clearly from the icon that the box office growth rate of films shown during the Spring Festival holiday from 2015 to 2018 is rising. Even in 2018, the year before the outbreak, the box office growth rate reached a terrifying 68.25 percent. But to our great surprise, we was that in 2019, due to the epidemic, the growth rate of the box office was only 1.20%. We can even say that the box office revenue barely changed from 2018 to 2019. As a result, the 2019 Spring Festival film box office will also fail for the first time. The poor situation has left many actors losing their jobs, and studios have fallen into debt or go bankrupt to afford their salaries and the costs of making movies. To sum up, these data prove that the limitation of people's outdoor consumption behavior caused by the epidemic has a serious negative impact on some industries such as the film industry.

Figure 2. Box office revenue of Spring Festival films in recent years

Funds Available at: https://baijiahao.baidu.com/s?id=1729512643967563258&wfr=spider&for=pc(Accessed: 31August 2023)

3.2.2 A Lack of Disposable

From this chart, both investment in real estate development and housing sales gradually increased from 2015 to 2019. However, with the outbreak of the epidemic, we can clearly see that investment and housing sales saw a huge decline to about one trillion yuan from 2019 to 2022. According to statistics, since the end of January 2020, the turnover of most developers has plunged by 95% compared with the Spring Festival in previous years, and the sales data of real estate in the week before and after the Spring Festival is basically close to zero. The main reason for this is that during the epidemic, people's disposable funds and income decreased so much so that they could not afford the cost of buying a house. The reason for the decrease in income during the epidemic is mainly due to the great economic and social impact of the epidemic. Due to the impact of the epidemic, some enterprises have been forced to close down, employees have lost their income sources or reduced wages, and some free-lancers have also encountered the inability to work in an orderly manner. In addition, due to the economic slowdown and reduced demand, the order volume and production volume of many industries have decreased significantly, which also leads to the reduction of enterprise expenses, operating difficulties, and difficult to pay employees. At the same time, it also leads to a large number of employees' unemployment and income decline. There are also some industries affected by the epidemic, such as manufacturing and film industries, which have almost zero income, and many people have also lost income in these industries. In short, the decline in income during the epidemic is caused by a variety of reasons, and both economic and social difficulties have had an impact on people's income. So the decrease in per capital disposable capital does have a big impact on the real estate industry. Money plays a very important role in people's daily life. If people lack funds, it will also lead to the negative impact of many industries, such as the film industry, tourism and so on. So in my personal point of view, the lack of disposable capital has the most serious negative impact on the industry.

Figure 3. Real estate development and sales in the first quarter of recent years Available at: https://baijiahao.baidu.com/s?id=1729512643967563258&wfr=spider&for=pc(Acces sed: 31August 2023)

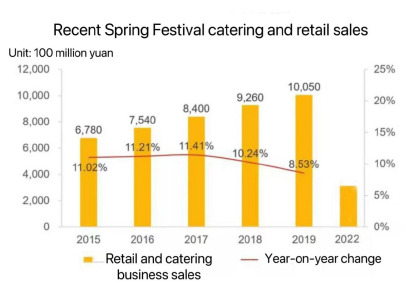

3.2.3 Lack of Food Supplies

From the chart, we can clearly see that under the impact of the epidemic, the catering industry has a huge gap from 2019 to 2022, decreasing from 1005 billion yuan to about 300 billion yuan. This phenomenon is very real, and it usually appears around us. During the epidemic period, the originally busy catering streets were completely closed, and only a few catering businesses were still open. The reason for this is not only the government's blockade policy, but also an important reason, the lack of sup-plies in restaurants. China's economy is recovering, and the global supply shock from the pandemic could mean that China's catering industry will lack high-quality food overseas. Spain and Italy have become new epicenters rest of the epidemic. Australia and New Zealand have imposed severe lockdown measures. But it is these countries that offer high-end pork, beef and mutton, cheese and seafood to Chinese tables and restaurants. Imports and exporters said China's imports of foreign ingredients had been severely hindered as more flights were canceled, so there could be a further shortage of such imports in the future. Restaurants without imported food may close restaurants such as western restaurants and Japanese restaurants.

Figure 4. Recent Spring Festival catering and retail sales

Available at: https://baijiahao.baidu.com/s?id=1729512643967563258&wfr=spider&for=pc(Acces sed: 31August 2023)

3.3 Forecast of Industrial Development Trend in the Post-Epidemic Era

3.3.1 A Miserable Future Trajectory

The impact of the epidemic on each industry is different, and these factors may lead to positive or negative effects. Not only the effects that have occurred, but the epidemic also leads to some potential factors that affect the future development and trajectory of different industries. These potential factors also have two sides, which will have a positive or negative impact on the future of the industry. Of all industries, the least dog for the next decade is retail. According to the National Bureau of Statistics, total retail sales of consumer goods in the first half of 2022 fell 1.5 percent year on year, according to the National Bureau of Statistics. Among them, the national online retail sales increased by 2.9 percent year on year. Obviously, the development of physical retail is not optimistic.

The alarming decline of brick-of-mortar stores has left many people and academics worried about the future trajectory of offline retail. Many people even say that physical stores have been completely lost to e-commerce. The retail industry will reach an unprecedented trough in the next decade. In the first half of 2022 alone, 4,700 physical stores were closed. For example, 351 stores were closed, 860, and the most severely damaged is supermarket chain giant onghui, with 388 stores. Moreover, it is estimated that the stores will be closed in the next two years, with the market value of more than 70 billion yuan. All of these data suggest that the retail industry will be hit hard in the next decade. The factor contributing to this is that people have to stay at home due to lockdown policies during the outbreak. Therefore, the epidemic has promoted the development of live streaming and e-commerce shopping, greatly reducing the status of the retail industry in the industry.

3.3.2 A Considerable Future Trajectory

According to China's National Bureau of Statistics, tourism has the greatest growth potential in the first 10 years after the end of the outbreak. And in other words, the potential impact of the epidemic has the biggest positive impact on the future trajectory of tourism. But as we all know, due to the impact of the epidemic, tourists can travel only only, most of whom stay at home or take short trips. Long-distance travel, overseas travel, inter-provincial tour and other tourism types are limited to a certain extent, so the Qingming holiday, Labor Day holiday, Dragon Boat Festival and other holidays of the tourism market recovery is good. However, with the adjustment of the COVID-19 control policy, the lockdown policy has been cancelled or the control in-tensity has been reduced. After the epidemic prevention and control entered a new stage, the holiday tourism market has gradually recovered. For example, the number of tourists during the Spring Festival holiday in 2023 was 308 million, compared with 415 million in the same period in 2019. The Spring Festival tourism market has been significantly recovered. The market during the Qingming Festival, May Day holiday and Dragon Boat Festival holiday also recovered well. In 2023, domestic tourists reached 274 million, compared with only 195 million in the same period in 2019. From the perspective of tourists, the holiday tourism market has basically recovered to the pre-epidemic level.

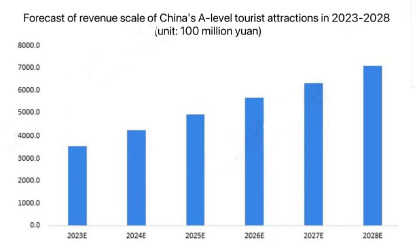

It is foreseeable that as the epidemic prevention and control enters a new stage, tour-ism activities such as long-distance, inter-provincial and outbound travel will gradually resume in an orderly and orderly manner. As we can see from the icon, the revenue of China's tourist attractions in the next five years is expected to increase year by year. For the analysis of the future trajectory of the tertiary industry, we can predict according to the data of the chart. And in five years, we can conduct an industry survey or consult the data released by the National Bureau of Statistics to confirm this guess. In 2023, China's tourist attractions are forecast to earn about 350 billion yuan, while in 2028 they could reach 700 billion yuan. This phenomenon shows that the tourism industry has entered a stable development track after the end of the epidemic, and the future tourism industry has a considerable future development trajectory.

This paper can better enable producers in the tertiary industry to be aware of the ad-vantages and disadvantages of the epidemic, and to formulate policies for the encountered situation in the post-epidemic era. At the same time, this paper enables the producers of the tertiary industry to have a clearer planning and cognition of the future, and create a stable trajectory of future development.

Figure 6: Forecast of revenue scale of China's A-level tourist attractions in 2023-2028 (unit:100 million yuan)

Available at: https://c.m.163.com/news/a/IC6IR1BK051480KF.html(Accessed: 4Sepetember 2023)

4 Conclusion

The study deeply explored the impact of the COVID-19 epidemic on China's tertiary industry, and reached the following main conclusions. The main factors with positive effects are more consumer groups, more time to use electronic devices, and more product demand. In the tertiary industry, the live broadcasting industry has had a positive impact and promoted its rapid development. Due to the limited sales in physical stores, online broadcasting has become an alternative, and the live broadcasting industry has risen rapidly. The epidemic has caused small and medium-sized enterprises to face financial and supply chain problems, and live broadcasting has become the way out. The live broadcasting industry has become one of the most significantly developed industries during the epidemic period, with distinct representativeness and has all the characteristics of other profitable industries. Before 2019, despite the in- creasing popularity of multi-channel shopping, physical stores still dominated the shopping market. The main reason is that online shopping has problems such as wrong goods and poor quality, consumers often need to return and exchange goods, waste time and money. The emergence of live sales solves this problem. Through live sales, people can intuitively understand the product information and increase their understanding of products. However, after the outbreak of the epidemic in 2019, China implemented the blockade policy, and people could not go out to shop in physical stores, which brought a large number of consumer groups to the live broadcasting industry, so the live broadcasting industry made rich profits during the epidemic.

The pandemic lockdown policy has led to widespread use of mobile phones and other electronic devices for study, work and entertainment. The use time of mobile APP has increased significantly, and new entertainment methods such as online live streaming and shopping have become popular among young and middle-aged people, which has promoted the development of the live streaming industry. As a result, people are increasingly exposed to electronic devices, and the time and opportunity to watch live broadcasts increases.

Because of the outbreak, people chose to stay at home to prevent the spread of the virus. This led to a rapid consumption of everyday items and medical supplies, such as convenience foods, disinfectants, and face masks. In addition, the paper also shows that the discounts and novel promotion methods brought by the studio stimulate consumers' desire to buy, so that they buy goods that they do not need or use. These situations have brought more potential consumers to the live-streaming industry.

The COVID-19 outbreak has had a broad impact on China. Although the epidemic has had a positive effect on some industries, such as increasing consumer groups, people's daily contact time and demand for goods. However, the negative impact of the epidemic on the industry is more significant. Many industries and enterprises have encountered various difficulties, with some even facing survival challenges.

The dissertation also shows that the epidemic has limited people's outdoor consumption behavior, leading to serious negative effects on industries such as film. Many ac- tors lost their jobs and the studios went into debt or bankruptcy. This shows the impact of the epidemic on economic development.

During the outbreak, the catering industry has suffered a huge impact. The restaurant industry saw a huge gap from 2019 to 2022 due to government lockdown and a lack of restaurant supplies. China's economy is recovering, but the global supply shock could mean that China's restaurant industry will lack high-quality food overseas. In the future, such imports could see further shortages, causing some restaurants to close.

The pandemic has had a negative impact on retail sales, leading to a decline in the number of physical stores and mass closures. The development of the retail industry is not optimistic, and the next decade may fall into a trough. The epidemic has promoted the development of live streaming and e-commerce shopping, and reduced the position of the retail industry in the industry. These factors will have a positive or negative impact on the future of the retail industry.

Finally, this paper illustrates that tourism in the tertiary industry is predicted to have the greatest growth potential in the first 10 years after the outbreak. Although the short-term impact of the epidemic on tourism is obvious, as the epidemic prevention and control enters a new stage, long-distance, inter-provincial and outbound tourism activities will gradually resume in an orderly manner. It is expected that the revenue of China's tourist attractions will increase year by year in the next five years.

So, our assumption is established, and the epidemic has indeed had a big impact on the tertiary industry. Both the positive and negative effects of COVID-19 will change the future development trajectory of the tertiary industry.

References

[1]. Cai, M., Luo, J. (2020) ‘Corresponding Countermeasures from Supply Chain Per- spective’. J. Shanghai Jiao Tong Univ. (Sci.), 25(4): 409-416

[2]. Chen, L. (2020). ‘Research on the development path of China's cross-border e- commerce industry under the COVID-19 pandemic’, Business exhibition economy, (08), pp. 29-31.

[3]. D, Zhang. (2020) Together in times of trouble, to rescue small and micro enterprises. Economic Daily, 13 Feb, p.006.

[4]. D, Zhao. (2020) ‘Analysis of the impact and trend of COVID-19 on China's real estat e market. ’China's Real Estate, (12), pp: 29-31. doi:10.13562/j.china.real.estate.2020. 12.006.

[5]. Fang, Y.,Meng, J.,& Zhang, Y.(2022).The state of China's economic growth jumps in place(1979—2020)—Research based on the perspective of complex systems, China's social sciences,(05),pp.4-26+204.

[6]. Gil-Alana, L., Monge, M. (2020) Crude oil prices and COVID-19: Persistence of the shock. Energy Research Letters, 1 (1), pp :13200. DOI:10.46557/001c.13200

[7]. Hagerty, S.& Williams, L. (2020). The impact of COVID-19 on mental health: The interactive roles of brain biotypes and human connection. Brain, Behavior, & Immun- ity-Health, 5, p. 100078. doi:10.1016/j.bbih.2020.100078.

[8]. Hahm, Y., Yoon, H., & Choi, Y. (2019). The effect of built environments on the walking and shopping behaviors of pedestrians; A study with GPS experiment in Sin- chon retail district in Seoul, South Korea. Cities, 89, pp:1-13.

[9]. HAHM Y, YOON H, JUNG D, et al. (2017) Do built environments affect pedestri- ans' choices of walking routes in retail districts? a study with GPS experiments in Hongdae retail district in Seoul, South Korea [J]. Habitat international, (70), pp: 50- 60.

[10]. Huang, Y., Li, A.& Gong, X.(2021)‘The impact of COVID-19 on the profitability of white goods enterprises in China ’.Small and medium-sized enterprise management and technology(Pentecostal), (03),pp: 94-95+98.

[11]. Lin, H., Sun, H., Zhong, S. (2021) ‘Business model innovation and policy research in large urban business areas in the post-epidemic era’, China's Soft Science, (06), pp.165-174.

[12]. Lu, L., Peng, J., Wu, J.& Lu, Y.(2021) 'Perceived impact of the Covid-19 crisis on S MEs in different industry sectors: Evidence from Sichuan, China. International Journ al of Disaster Risk Reduction, 55, p.102085. Available at: https://doi.org/10.1016/j.ijd rr.2021.102085

[13]. Lyu, L. (2022) ‘Lyu Lin point of view’. Available at: http://news.nancai.net/sy2/2022/ 1109/6882.html (Access:9 Nov 2022).

[14]. Narayan, P. (2020). ‘Oil price news and COVID-19 - Is there any connection?’ Ener- gy Research Letters, 1 (1), p. 13176. doi:10.46557/001c.13176

[15]. Narayan, P., Phan, D.(2020) ‘Country responses and the reaction of the stock market to COVID-19 – A preliminary exposition’. Emerging Markets Finance and Trade. 56 (10), pp: 2138–2150. doi:10.1080/1540496X.2020.1784719

[16]. Niu,H. (2020) ‘The impact of the epidemic on the Chinese economy and the world economy,’ Science and Wealth, (16).

[17]. Phan, D., Sharma, S., & Narayan, P. (2015). Stock return forecasting: Some new evi- dence. International Review of Financial Analysis, 40, pp: 38-51.

[18]. Rosie. (2019) ‘Under the background of economic downturn, private enterprises will spend the winter. — Take private enterprises in Guangxi as an example’, Chinese business theory, (11), pp:152-153. doi:10.19699/j.cnki.issn2096-0298.2019.11.152.

[19]. Rosie. (2021) ‘Research on the problems existing and countermeasures of sme assis- tance policies under the influence of COVID-19’, Modern Business,(02), pp.147-149. doi:10.14097/j.cnki.5392/2021.02.047.

[20]. Shen, H. et al. (2020) The Impact of the COVID-19 Pandemic on Firm Performance, Emerging Markets Finance and Trade, 56(10), pp: 2213-2230, DOI: 10.1080/154049 6X.2020.1785863

[21]. Sun, Y. (2022) ‘The impact of COVID-19 on SMEs in China: Textual analysis and e mpirical evidence’. Finance Research Letters, 45, p. 102211.Available at:https://doi. org/10.1016/j.frl.2021.102211

[22]. Zhu, X., Deng, B.(2013). ‘An empirical analysis of the influence of industrial structur e on economic growth’. Enterprise Economy, (07), pp.132-136. doi:10.13529/j.cnki.e nterprise.economy.2013.07.010.

Cite this article

Xu,Z. (2024). What Were the Most Important Impacts of COVID-19 on Chinese Tertiary Industry and How Might They Change Its Future Trajectory?. Journal of Applied Economics and Policy Studies,9,23-33.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cai, M., Luo, J. (2020) ‘Corresponding Countermeasures from Supply Chain Per- spective’. J. Shanghai Jiao Tong Univ. (Sci.), 25(4): 409-416

[2]. Chen, L. (2020). ‘Research on the development path of China's cross-border e- commerce industry under the COVID-19 pandemic’, Business exhibition economy, (08), pp. 29-31.

[3]. D, Zhang. (2020) Together in times of trouble, to rescue small and micro enterprises. Economic Daily, 13 Feb, p.006.

[4]. D, Zhao. (2020) ‘Analysis of the impact and trend of COVID-19 on China's real estat e market. ’China's Real Estate, (12), pp: 29-31. doi:10.13562/j.china.real.estate.2020. 12.006.

[5]. Fang, Y.,Meng, J.,& Zhang, Y.(2022).The state of China's economic growth jumps in place(1979—2020)—Research based on the perspective of complex systems, China's social sciences,(05),pp.4-26+204.

[6]. Gil-Alana, L., Monge, M. (2020) Crude oil prices and COVID-19: Persistence of the shock. Energy Research Letters, 1 (1), pp :13200. DOI:10.46557/001c.13200

[7]. Hagerty, S.& Williams, L. (2020). The impact of COVID-19 on mental health: The interactive roles of brain biotypes and human connection. Brain, Behavior, & Immun- ity-Health, 5, p. 100078. doi:10.1016/j.bbih.2020.100078.

[8]. Hahm, Y., Yoon, H., & Choi, Y. (2019). The effect of built environments on the walking and shopping behaviors of pedestrians; A study with GPS experiment in Sin- chon retail district in Seoul, South Korea. Cities, 89, pp:1-13.

[9]. HAHM Y, YOON H, JUNG D, et al. (2017) Do built environments affect pedestri- ans' choices of walking routes in retail districts? a study with GPS experiments in Hongdae retail district in Seoul, South Korea [J]. Habitat international, (70), pp: 50- 60.

[10]. Huang, Y., Li, A.& Gong, X.(2021)‘The impact of COVID-19 on the profitability of white goods enterprises in China ’.Small and medium-sized enterprise management and technology(Pentecostal), (03),pp: 94-95+98.

[11]. Lin, H., Sun, H., Zhong, S. (2021) ‘Business model innovation and policy research in large urban business areas in the post-epidemic era’, China's Soft Science, (06), pp.165-174.

[12]. Lu, L., Peng, J., Wu, J.& Lu, Y.(2021) 'Perceived impact of the Covid-19 crisis on S MEs in different industry sectors: Evidence from Sichuan, China. International Journ al of Disaster Risk Reduction, 55, p.102085. Available at: https://doi.org/10.1016/j.ijd rr.2021.102085

[13]. Lyu, L. (2022) ‘Lyu Lin point of view’. Available at: http://news.nancai.net/sy2/2022/ 1109/6882.html (Access:9 Nov 2022).

[14]. Narayan, P. (2020). ‘Oil price news and COVID-19 - Is there any connection?’ Ener- gy Research Letters, 1 (1), p. 13176. doi:10.46557/001c.13176

[15]. Narayan, P., Phan, D.(2020) ‘Country responses and the reaction of the stock market to COVID-19 – A preliminary exposition’. Emerging Markets Finance and Trade. 56 (10), pp: 2138–2150. doi:10.1080/1540496X.2020.1784719

[16]. Niu,H. (2020) ‘The impact of the epidemic on the Chinese economy and the world economy,’ Science and Wealth, (16).

[17]. Phan, D., Sharma, S., & Narayan, P. (2015). Stock return forecasting: Some new evi- dence. International Review of Financial Analysis, 40, pp: 38-51.

[18]. Rosie. (2019) ‘Under the background of economic downturn, private enterprises will spend the winter. — Take private enterprises in Guangxi as an example’, Chinese business theory, (11), pp:152-153. doi:10.19699/j.cnki.issn2096-0298.2019.11.152.

[19]. Rosie. (2021) ‘Research on the problems existing and countermeasures of sme assis- tance policies under the influence of COVID-19’, Modern Business,(02), pp.147-149. doi:10.14097/j.cnki.5392/2021.02.047.

[20]. Shen, H. et al. (2020) The Impact of the COVID-19 Pandemic on Firm Performance, Emerging Markets Finance and Trade, 56(10), pp: 2213-2230, DOI: 10.1080/154049 6X.2020.1785863

[21]. Sun, Y. (2022) ‘The impact of COVID-19 on SMEs in China: Textual analysis and e mpirical evidence’. Finance Research Letters, 45, p. 102211.Available at:https://doi. org/10.1016/j.frl.2021.102211

[22]. Zhu, X., Deng, B.(2013). ‘An empirical analysis of the influence of industrial structur e on economic growth’. Enterprise Economy, (07), pp.132-136. doi:10.13529/j.cnki.e nterprise.economy.2013.07.010.