1 Introduction

Due to smoking tobacco, over 8 million people worldwide die each year. More than 7 million people died due to direct tobacco use, while the remaining 1 million died due to exposure to second-hand smoke [45]. According to the World Health Organization (2023), tobacco is by far the largest public health threat the world faces, and its economic costs are enormous. This organization also shows that tobacco not only has human health impacts and environmental health issues but also incurs additional medical costs and human losses related to tobacco consumption.

In 1954, the Board of Directors of the American Cancer Society announced that there was evidence to suggest a link between smoking and lung cancer. In the same year, some Nordic countries also reached the same conclusion (Robert, 2023). In 1964, a report by the Director of the United States Department of Health recognized smoking as a cause of male lung cancer, which is often considered a turning point in recognizing the health hazards of smoking [36].

In response to the problems caused by cigarette consumption, nowadays, countries take measures to reduce smoking. The World Health Organization member states adopted the World Health Organization Framework Convention on Tobacco Control in 2003, which includes taxing cigarettes. So far, 182 countries have become parties to the Convention for seeking a solution to reduce the consumption of cigarettes [45].

However, as an important smoking control measure, it is important to consider whether cigarette taxes are effective in reducing cigarette consumption. Multiple studies have shown that taxation can effectively reduce the number of people using cigarettes, especially in low-income countries or households [18, 24, 26]. However, some studies have found that taxes are not very effective at reducing smoking, and furthermore, some people manage to avoid taxation through different means, such as individual suppliers, overseas cigarettes, and smuggling [19, 23, 31, 32, 40].

2 Research Review

2.1 The Consequences of Smoking

Countries around the world are taxing cigarettes in an attempt to reduce consumption, as the use of cigarettes has been discovered to incur significant economic costs [45]. A research paper, published by the U.S. Department of Health and Human Services in 2014, pointed out that smokers are 2 to 4 times more likely to suffer from heart disease, stroke, and 25 to 26 times more likely to suffer from lung cancer than non-smokers. Another of their studies published in 2010 discovered that smokers have a higher risk in 3.5 times of developing cardiovascular disease. The government, therefore, needs to increase spending on health care services to help treat the above-mentioned diseases, and the increase in the morbidity and mortality caused by smoking will also cause a loss of labor resources. At the same time, research by the Centers for Disease Control and Prevention (2017) showed that the manufacturing and consumption of cigarettes also have negative influences on the environment. Tobacco manufacturing creates three main environmental hazards: water and energy depletion, the generation of hazardous waste, and greenhouse gases. Data shows that the annual emissions generated by tobacco manufacturing are approximately the same as the emissions from 3 million transatlantic flights. Cigarette smoke relates cancer-causing chemicals, other toxins, and greenhouse gases into the nearby area, thus leading to the issue of second-hand smoking. These consequences will force the government to spend more money on dealing with the pollution caused by cigarette consumption.

2.2 The History of Tobacco Taxation

In Lain Gately's [25] 'La Diva Nicotina' and Asa Briggs's (2015) 'A Social History of England', the first country in history to implement tobacco tax control was mentioned - the UK. In the 16th century, tobacco was considered beneficial to the body by many countries. The first person to oppose tobacco was King James I of England, who mentioned in his paper that cigarette was harmful to the brain and lungs. Because he was a Christian, filled with hatred towards tobacco, and believed it to be an evil habit, he began the first-ever tobacco control taxation in history. Due to the ineffective religious persuasion, he increased the tobacco tax by 40 times, hoping to achieve the goal of banning smoking. Not only that, James I also took other measures to reduce cigarette consumption. He restructured the tobacco industry in the form of a royal monopoly, prohibited the cultivation of tobacco in the UK, and attempted to solve the problem of cigarette smuggling by making relative laws.

Other countries have also begun to implement policies to tax tobacco. After the establishment of the Republic of China, in 1912, the tobacco and alcohol tax became a specialized tax item in China. In the United States, in 1952, the Internal Revenue Service established the Alcohol and Tobacco Tax Division, which merged all internal responsibilities related to tobacco and alcohol.

2.3 The Current Status of Tobacco Taxation

Nowadays, tobacco taxes are an important policy for controlling cigarette consumption globally. The WHO Framework Convention on Tobacco Control recognizes that taxation is an important means of reducing tobacco demand [45]. According to an article released by the UN News (2023), due to the promotion of MPower measures, 5.6 billion people are currently protected by at least one MPower tobacco control measure, an increase of 4.5 billion from 2007. At the same time, the number of countries implementing measures has also increased to 151, more than double the number in 2007. MPower cigarette control measures include monitoring tobacco use and prevention policies; protecting people from the harm of tobacco smoke; providing smoking cessation assistance; warning of tobacco hazards; Ensuring the prohibition of tobacco advertising, promotion, and sponsorship; and raising tobacco taxes. These policies have helped reduce the impact of secondhand smoke on the public, incentivize people to quit smoking, and prevent smoking. Therefore, it can help reduce the economic burden on the government.

2.4 The Debate

There is a debate among researchers over the effectiveness of taxation as a policy measure to reduce smoking. Some have discovered tax avoidance methods will reduce the likelihood of people smoking less [14]. Therefore, this will have an impact on whether the policy can achieve its expected effect. The following discussion will introduce some of the key studies that tried to analyze this question and summarize the biggest debate among researchers.

2.5 Evidence of The Effectiveness of Tax Policies

Some studies have found that taxation greatly helps reduce the number of people who consume cigarettes, which will be discussed below. Corne van Walbeek [13] found that increasing the excise tax on cigarettes not only reduces tobacco consumption but also increases government revenue. The results of the simulation model proposed by him show the calculation result that for a representative low-income or middle-income country, a 20% increase in consumption tax can reduce tobacco consumption and industry income by 5%, provided that the post-tax price remains unchanged. At the same time, the government's excise tax revenues increased by 14%. He found that the Jamaican government increase the special consumption tax to raise more government revenues. Since the increase in excise tax typically encourages the industry to increase post-tax prices, the impact of tobacco control will also be more effective. Although nicotine can make people addicted, research by Van Walbeek CP [43] and Chaloupka FJ [10] suggests that people reduce smoking intensity and thus consumption when facing higher prices, since some are not able to afford the high price of cigarettes.

Taiwan has benefited from the policy of increasing cigarette taxes mentioned above. Lin HS [30] discussed the impact of Taiwan's tobacco tax policy resulting in that tobacco consumption has significantly decreased. He pointed out that the health issues caused by smoking tobacco have led to the government spending approximately NT $20 billion on medical expenses, which has caused significant losses to Taiwan's gross domestic product and impacted the cash flow of the government. In recent years, Taiwan has made great progress in tobacco control. The model proposed by J-M Lee et al [27] shows that under the influence of the 2002NTS5 Health and Welfare cigarette tax, the total per capita cigarette consumption decreased by 18%. They found that cigarette prices in Taiwan are much lower than those in other Asian countries, meaning that even with relatively low tax increases, there is a significant reduction in cigarette consumption. The government also banned all advertising and promotion of imported cigarettes, which helped to reduce the demand for cigarettes. As long as taxes are significantly increased, non-smokers can be prevented from smoking, and teenagers will also lose the ability to buy cigarettes. The anti-smoking groups share the same opinion, believing that raising cigarette prices is the best way to persuade people to reduce smoking or even quit smoking [27].

Evidence also shows cigarette taxes can be particularly effective at reducing smoking amongst lower-income groups. Chaloupka et al. [11] believe that price-related tobacco policies can help reduce smoking disparities, as they found that this policy is more effective for people with lower socio-economic status as their disposable income is low and therefore, they cannot react to the rise in tobacco prices. Meanwhile, Lee et al. [26] and Kong et al. [24] discovered a correlation between higher tobacco retail density and lower tobacco prices, especially in communities with higher proportions of black, Hispanic, Latino, and low-income populations. In other words, high- priced tobacco is usually not in demand among this group of people as they cannot afford it. It is necessary to mention the actions of third-party sellers here. Apollo and Glantz [3] found that tobacco companies are involved in the differential changes between tobacco taxes and consumer prices to maintain their profitability. Raising wholesale tobacco prices and excessively transferring taxes to consumers means they need to bear higher taxes than the amount of tax increases by the government. [37] Therefore, this phenomenon makes the cigarette tax policy more effective in reducing cigarette use among low-income groups.

Furthermore, Gallet and List [18] reviewed 500 studies and found that low-income countries are more sensitive to the price change in cigarettes than high-income countries. Seng Eun Choi [39] conducted a study on the response of low-income smokers in South Korea to cigarette taxes. He found that in many countries, including South Korea, poor people usually smoke more than rich people, so he believes that increasing cigarette taxes and prices may reduce the regression of existing cigarette taxes based on the price elasticity of different income groups.

In South Korea, the smuggling and substitution of illegal tobacco products are more limited than in European and American countries, which means that Koreans usually can only purchase high-tax cigarettes for use. Therefore, due to the inability to avoid cigarette taxes, low-income Koreans are more sensitive to changes in cigarette prices than high-income Koreans. It may force them to reduce smoking and change their consumption patterns, despite the addictive nature of nicotine. Since low- income groups have higher smoking rates, they are usually unable to pay exorbitant cigarette taxes, meaning that when taxes increase, most of the government’s cigarette tax revenue comes from the rich. Since they can pay for the expensive cigarettes, meaning that it may not reduce their demand for cigarettes. Therefore, he believes that increasing cigarette taxes and prices may reduce the regression of existing cigarette taxes based on the price elasticity of different income groups.

Besides reducing cigarette consumption, tobacco taxes can also help people quit smoking through their impact on the sales of smoking cessation products. Cotti et al. [9] collected data on three different types of tobacco: cigarettes, chewing tobacco, and snuff and smoking cessation products. This household panel data shows that cigarette taxes have reduced monthly cigarette usage by 17% in households, and this result is consistent with data obtained from other research studies [1, 14, 16, 20, 33, 42]. In addition, they also found that cigarette taxes can increase the likelihood of purchasing smoking cessation products to some extent, especially the snuff tax. The tax effects of snuff and chewing tobacco are more reflected in changing the demand for smoking cessation products. Compared to other groups, families who occasionally smoke, low- income families, and young families have a stronger response to the snuff tax and chewing tobacco tax. This is because snuff and chewing cigarettes are substitutes for cigarettes, and when their prices rise, people can easily switch to using cigarettes. Meanwhile, the group that occasionally smokes is not highly addicted, making it easy to reduce their demand for them. The low-income and young groups are unable to afford high-priced cigarettes and are forced to reduce demand.

2.6 Evidence of The Ineffectiveness of Tax Policies

However, some evidence suggests that cigarette taxes are not an effective way to reduce cigarette consumption. There is a body of research that analyses the effect of tax on cigarette consumption in the US, particularly the impact of online sales, tax rate divergence across states, and duty-free cigarette sales in Native American reservations. Carpenter and Mathes [12] found that Native American reservations and online sales are two sources of tax competition. Sullivan and Dutkowsky [38] suggest that lower cigarette taxes in nearby states will bring downward pressure on the prices of local cigarettes. Residents may choose to purchase cigarettes from neighboring states as a result, leading to a decrease in sales for local sellers. To maintain profits, they may also be forced to lower the price of cigarettes to improve competitiveness. Carpenter and Mathes [12] used a bidirectional fixed effects method to study quarterly data on cigarette prices in over 700 cities over 30 years. Since these two purchasing channels provide consumers with cheaper cigarettes, and reduce the impact of cigarette taxes on them, there is no motivation to reduce demand for cigarettes.

They obtained evidence that internet penetration and Native American casinos can significantly reduce cigarette prices. Harding, Leibtag, and Lovenheim [20] found that the pass-through rate of stores near lower-tax border states is generally lower, indicating that this can also reduce retailers' ability to pass on cigarette consumption tax to consumers, which means similar to tax competition, it cannot let cigarette taxes affect the consumption of smokers. Similar results can also be found in other studies of health economics [32, 40].

DeCicca Kenkel and Liu [15] conducted a specific study on how Native American reservations save duty-free cigarettes and found that the price difference between individuals purchasing cigarettes at the reservation and the tax increase price was almost the same, meaning that people can purchase tax-free cigarettes through this method. Goolsbee, Lovenheim, and Slemrod [19] found that internet penetration is directly proportional to the tax elasticity of taxable sales, indicating that individuals are more willing to use online sales as a means of tax avoidance. Therefore, both Native American reservations and online sales can effectively help consumers avoid the impact of cigarette taxes. Therefore, consumers are not affected and may increase their addiction to cigarettes as they keep smoking. In addition, the government is neither able to reduce cigarette consumption nor receive more taxes.

Multi research has all investigated in different geographical locations due to differences in local and state cigarette consumption taxes. Orzechowski, Bill, and Walker [34] found that over 500 cities in the United States not only levy cigarette consumption tax and federal tax but also local tax, which customers and retailers’ bear. Therefore, for retailers to ensure their profits, excessive conversion will occur, which means that cigarette prices will be higher than in other cities without local taxes. Therefore, people are more likely to choose to purchase cross-border smuggled cigarettes to find affordable ones, as cigarette prices are lower elsewhere. Sullivan and Dutkowsky (2012) analyzed boundary effects using GIS software and demonstrated that excessive transfer was caused by taxation by state and local governments. They also used ACCRA and TBT databases to study the price differences of local cigarettes, and the results showed that the price of cigarettes one mile from the state border was 14 times the average in the database. This indicates that cigarette prices may vary depending on geographical location, especially in areas near states with lower cigarette taxes. The demand for cigarettes in areas with lower cigarette taxes is less influenced, and on the contrary, areas with higher tobacco and alcohol taxes are more prone to smuggling problems. Multiple studies have shown that [19, 31, 32, 40] when local cigarette taxes increase, the transportation cost of choosing to smuggle cigarettes across borders is relatively lower, allowing consumers to obtain a pack of cigarettes at a lower price, thereby reducing the impact of cigarette taxes on cigarette consumption. The government not only cannot control the smoking population but also needs to deal with the problems caused by smuggling. For example, it cannot guarantee the quality of cigarettes and is much more harmful than regular cigarettes.

Jennifer Cantrell et al. [23] found that heavier smokers are less likely to reduce smoking due to their addictive nature despite the increased taxes. They also found that purchasing cigarettes from private suppliers or overseas is the most commonly reported tax avoidance strategy. Consumers are very familiar with these two tax avoidance methods since they are already familiar with local low- tax or non-tax branches. This increases their choices, and consumers can use these channels to help reduce the impact of taxes on them, so as not to affect their consumption. This may be because they are already familiar with local low-tax or non-tax branches. Hyland et al. [22] analyzed the cigarette consumption patterns of heavy smokers in 20 communities in the United States and concluded that 34% of smokers would purchase cigarettes from low or even non-tax locations. In addition, increasing evidence suggests that tax avoidance may reduce smokers' motivation to reduce consumption or quit smoking due to high prices because these methods encourage consumers to change their purchasing patterns rather than demand for cigarettes [14]. This means that cigarette taxes cannot play their role as consumers can find cigarettes with lower taxes. In particular, Frieden et al. [17] found that the results of a multivariate logistic regression analysis showed that students and unemployed smokers are more likely to choose to purchase duty-free cigarettes overseas. Both types of people are considered to be the low-income group with lower disposable income. Therefore, they choose to purchase overseas cigarettes to reduce their income expenses. Overseas duty-free cigarettes do not have the effect of controlling smoking and cannot increase government revenue, so consumption of them will impose an economic burden on the government due to the consequences of smoking.

Chiou and Muehleger [28] studied two other strategies for consumers to mitigate tax impacts. One is to stock up on goods before raising taxes, and the other is to choose substitutes and use discounted cigarettes. They found evidence of a large hoard of discounted cigarettes. In the first few months of the tax change, sales of low-level cigarettes increased significantly while sales of high- end cigarettes remained unchanged. Similarly, in the short-term after-tax increases, consumers have shifted from high-end cigarettes to lower-priced cigarettes. This is because some low-income consumers may not be able to purchase cigarettes after tax increases, and they will switch to cheaper substitutes, which are discounted cigarettes.

In addition, there are papers from various countries that demonstrate different consumer reactions to tobacco taxes. Brown A [6] found that in some countries in Europe, such as the UK and France, the use of lower-cost cigarettes has significantly increased over the past two decades, while the majority of these cigarette users are low-income and have low levels of education. Similarly, Chinese people tend to use cheaper brands due to the significant price difference caused by the taxation of cigarettes at different prices. At the same time, it has been found that low-income and less educated groups are more likely to use this method than those with higher socio-economic status. It also indicates that although low-priced cigarettes in the market can increase government revenue, they cannot reduce the consumption of low-income smokers. In contrast, Park E. et al [35] proposed that people with higher levels of education and younger ages need higher prices to control smoking. Therefore, the government can combine different tobacco control policies, rather than just increasing taxes to control consumption. Corne van Walbeek [44] cited communities as an example. In Mexico, a middle-income country with severe income inequality, relatively poor communities have lower levels of smoking intensity, while the contrast is the opposite. This can also indicate that cigarette taxes can to some extent reduce the number of cigarettes purchased by low-income groups, but cannot effectively reduce the frequency of smoking among high-income groups. That is to say, high-income consumers are usually less affected by changes in cigarette taxes than low-income consumers. This is because high-income individuals do not care about price changes, and the addictive nature of cigarettes also makes it difficult for them to reduce demand.

There are also opposite examples here. Huang J et al [21] found that low-income individuals are also insensitive to changes in cigarette prices, which may be due to the huge fluctuations in cigarette prices, which greatly reduces the impact of cigarette taxes on low-income individuals.

There is a large body of research that analyses and evaluates the effectiveness of taxes to reduce smoking intensity. In the following discussion section, the following section will draw insight from existing evidence, and dive deeper into my analysis of this important policy question.

3 Discussion / Development

3.1 Why Should Cigarettes Be Taxed

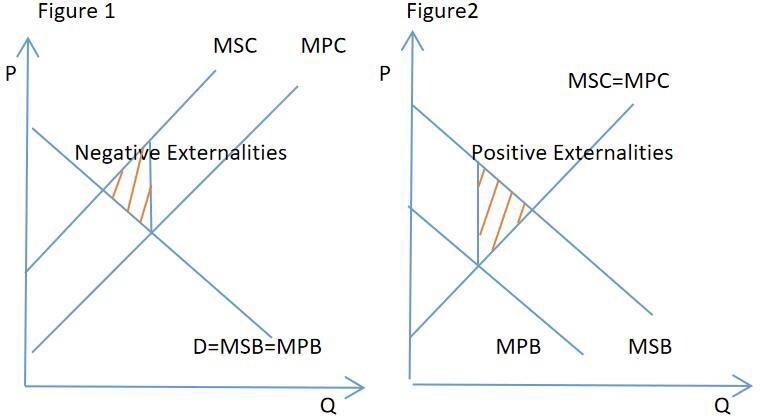

In order to fully understand the economic arguments for and against cigarette taxation, we must first understand to the idea of externalities. Externalities are a key reason why the government wants to reduce cigarette consumption. Externalities are the negative impacts when consuming or producing a good which are borne by a third party. Social costs refer to the costs resulting from the consumption or production of a good or service that are faced by society as a whole, including third parties who are not directly involved in the transaction [2]. Meanwhile private costs refer to the costs resulting from the consumption or production of a good or service that are borne by those directly involved in the transaction. Externalities are their differences, meaning that social costs are equal to externalities plus private costs, which are considered negative externalities. (Figure 1) However, not all externalities are negative, and when social benefits outweigh private benefits, there will be positive externalities. (Figure 2)

Figure 1. Negative Externalities Figure 2. Positive Externalities

In addition, externalities can be further divided into production externalities and consumption externalities. For cigarettes, both production and consumption bring negative externalities. From a production perspective, the hazardous waste and pollutants generated during the manufacturing of cigarettes create both negative externalities. The pollution it causes to the environment, the consumption of natural energy, and the government's expenditure on treating pollutants are all social costs. From a consumption perspective, when people use cigarettes, the cancer-causing chemicals, other toxins, and greenhouse gases generated by cigarette smoke are all negative externalities. Its social costs include the intensification of the greenhouse effect, as well as the physical health problems caused by second-hand smoke among cigarette consumers and non- smokers. People are prone to developing heart disease, lung cancer, and other diseases due to smoking. The government needs to spend funds to deal with pollution and provide health resources, so the expenditure on other facilities, such as education resources, is reduced. In addition, the morbidity caused by smoking will increase the loss of human resources and reduce output, and economic growth will slow down.

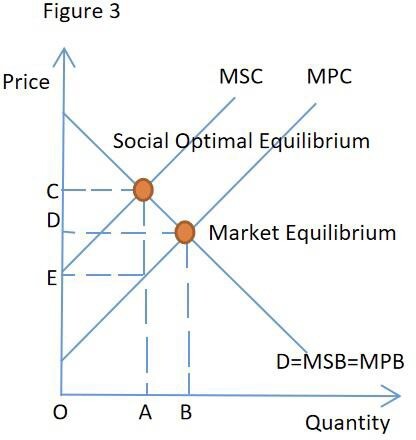

Externalities may cause market failure, which means that resources cannot be effectively allocated due to imperfect market operating mechanisms. Due to people only considering private costs and private benefits, rather than social costs and social benefits, the marginal private cost is greater than the marginal social curve (Figure 3). At this point, the quantity is in market equilibrium, which is greater than the quantity in socially optimal equilibrium, leading to the overconsumption of cigarettes, also known as market failure. Market failure can be divided into two types: partial market failure where the market provides too much or too little, and complete market failure where goods or services are unproductive. For cigarettes, it is considered a partial market failure, that is an oversupply. This may lead to unfair distribution of resources, thereby exacerbating the wealth gap in society. The reason is due to the negative externalities brought about by cigarettes, which is also the reason why cigarettes are considered excessive consumption. The government should reduce the use of cigarettes to reduce the externalities brought by cigarettes and correct the problem of market failure. The greater the externality, the greater the market failure. Therefore, market prices provide less accurate signals for the optimal allocation of resources. So, the government needs to intervene to reduce excessive consumption of cigarettes, such as issuing relevant smoking control policies.

Taxation is one way to internalize the negative externalities brought by cigarettes and equalizes marginal social costs with marginal social welfare. As shown in figure 3, the output quantity is B and the price is D. At this point, marginal private cost equals marginal private benefit since the quantity demand is equal to the quantity supply. However, the optimal level of output is A, which means that marginal social cost equals marginal social benefit. To achieve this position, the government imposes taxes to transform the marginal private cost curve (MPC) into the marginal social cost curve (MSC), and the tax is CE. The tax will be borne by consumers and producers depending on CE, CD represents the tax paid by consumers, and DE represents the tax paid by producers.

Figure 3. Illustration of market failure due to externalities

The cigarette tax mainly includes two types of taxes: value-added tax and consumption tax. Value- added tax is a tax levied on the value-added amount achieved by units that process, repair, and import and export goods sold [2]. That is to say, value-added tax is a tax levied on the difference in buying and selling prices. It is an extra price tax, which means the tax is not included in the price of the goods. Therefore, the value-added tax is usually paid by the seller, but in reality, the seller will add this tax to the product price, which is transferred to the consumer to bear. This means that buyers need to spend more money on cigarettes. For the wealthy, this may only account for a small proportion of their income and will not have a significant impact on them. They may still maintain the consumption frequency of cigarettes before the tax increase. However, for the poor, this additional tax may greatly reduce the affordability of cigarettes or even prevent them from purchasing, which is unfair for groups with different income levels. In order to restore purchasing power before tax increases, they may take measures to avoid taxation. Consumption tax is a general term for taxation that takes the turnover of consumer goods as the object of taxation.

This tax will eventually become a part of the price of goods paid by consumers, which means that the consumption tax is considered an intra-price tax. Like value-added tax, consumption tax is regressive and can also have an impact on low-income groups. Due to its failure to allocate tax burden reasonably, low-income groups need to face greater tax pressure.

The negative externalities brought about by the production and consumption process of cigarettes have led to market failure, which means that excessive consumption of cigarettes is detrimental to society. Therefore, the government needs to forcefully intervene in market failure, for example, by imposing taxation or providing smoking cessation assistance, to reduce the smoking population and then the impact of negative externalities.

3.2 How price elasticity of demand determines the impact of cigarette taxes

In this section, the factors that influence the price elasticity of demand of cigarettes will be studied, and we will discuss how the price elasticity of cigarettes changes the effectiveness of taxation.

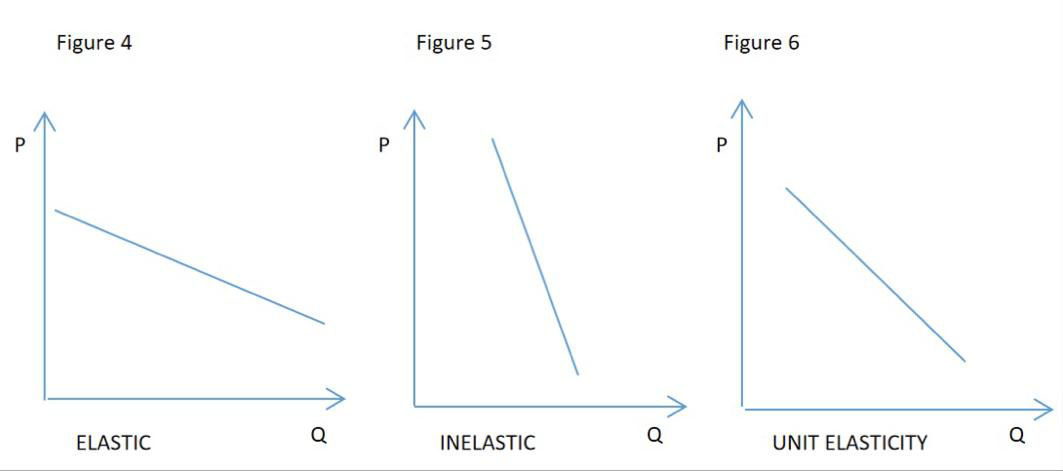

Different goods have different levels of elasticity, which measures the degree to which demand is influenced by changes in price, income, or other factors. Among them, price elasticity of demand refers to the response of changes in demand to price changes [2]. The elasticity of a good can be found by dividing the percentage change in demand quantity by the percentage change in price. If the elasticity of a product is greater than 1, it is price elastic, and so when there is a price change, it will have a relatively larger impact on demand, as shown in Figure 4. On the contrary, if the elasticity of a product is less than 1, it means that the product is price inelastic, and so demand for that product is less responsive to changes in price, as shown in Figure 5. If the elasticity of a product is exactly 1, it is called unit elasticity, meaning that a percentage change in commodity prices will lead to an exact opposite change in demand. (Figure 6)

Figure 4. Elastic Figure 5. Inelastic Figure 6. Unit Elasticity

The value of price elasticity of demand for a good is determined by multiple factors. An important factor to consider is the availability of alternatives. Substitutes refer to goods that have similar functions and can bring similar benefits. The better the product substitute, the higher the demand price elasticity it often has. The situation is due to the buyer's pursuit of quality, functionality, and effectiveness of the product.

In addition, the width of the market definition can be affected. The broader the product definition, the fewer substitutes it may have. If a product has many substitutes, it means people have more choices, and when its price rises, people can easily switch to substitutes. Time is also a very important factor to consider. In the short term, consumers may consume due to habits, lack of information, or other reasons. However, in the long run, people may change these patterns, and there is also an increase in the probability of substitutes. Sometimes people believe that the price elasticity of essential goods is lower than that of luxury goods, as people need to rely on them to survive, but there is no evidence to suggest that an increase in luxury goods prices will lead to a significant decrease in demand.

Cigarettes can be considered a relatively price-inelastic product. The reason is that the nicotine contained in cigarettes is addictive, making consumers dependent on it. Considering long-term factors, buyers may find it difficult to quit smoking, which means they have a small probability of changing their consumption patterns. For consumers who are addicted to smoking, the increase in cigarette prices may not impact their demand. Therefore, both high-income and low-income smokers are not sensitive to cigarette price changes.

At the same time, there are no substitutes similar to cigarettes to choose from in the market, and people cannot turn to consuming other products, which is also the reason for the inelastic price of tobacco. Due to the insensitivity of demand for price inelastic goods to price changes, consumers are unlikely to easily change their consumption patterns, which means that when taxes increase, the demand for goods may not fluctuate significantly. This means the government must impose higher of taxes on this product, as low taxes cannot effectively reduce consumers' consumption of it.

Therefore, compared to elastic goods, inelastic goods are less responsive to price changes caused by taxes.

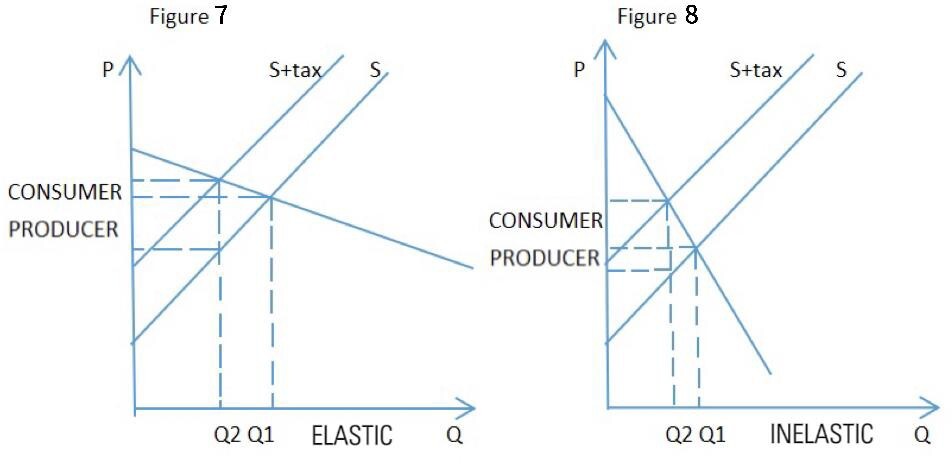

When the government levies taxes on a product, the burden of taxation must be borne by consumers and/or producers. The price elasticity of a product can affect the proportion of taxes borne by buyers and sellers. For relatively elastic goods, producers bear the majority of taxes. The reason is that once the price rises, the demand for this product may significantly decrease. To ensure product sales, manufacturers will choose to actively bear taxes. For relatively inelastic goods, consumers bear the majority of taxes. Since buyers will not reduce their consumption due to the increase in product prices, sellers' profits will be less affected, so most of the taxes will be borne by buyers.

Therefore, it can be concluded that the tax burden will fall more on the consumer side. As shown in Figures 5 and 6, it can be seen that the tax burden borne by consumers in Figure 7 is smaller than that of producers. In Figure 8, consumers bear much more taxes than producers.

Figure 7. Tax burden borne by consumers Figure 8. Tax burden borne by Producers

Both high-income and low-income groups can become addicted to cigarettes. Therefore, for both groups, cigarettes are considered an inelastic product, which may result in cigarette taxes not effectively reducing cigarette consumption in both the rich and the poor. Furthermore, according to the theory that most of the taxes on inelastic goods are usually borne by consumers, the same applies to cigarettes. Some existing research [3] found that sometimes there is an issue of excessive transfer of cigarette taxes, which means that businesses may add all cigarette taxes to the price of goods, and consumers will bear all the taxes. For low-income buyers, due to various reasons mentioned above, they are forced to spend more money on cigarette consumption. This could widen inequality and damage the standard of living as their disposable income become less and the amount they spend on other daily supplies decline.

3.3 Impact of Cigarette Tax on High VS Low- income

In the first two sections of the discussion, the role of cigarette taxation and the impact of cigarette elasticity on its effectiveness were discussed. In this section, the focus will be on the two groups of high-income consumers and low-income consumers, particularly whether the cigarette tax has had an effective impact on their behavior.

First, we will discuss the regressive nature of cigarette taxes and it’s differing impacts on low and high-income consumers. Consumption tax, including cigarette tax, is a regressive tax. Regressive refers to the tax burden of taxpayers being inversely proportional to their income. Because the same tax rate accounts for a higher proportion of the total income of low-income individuals compared to high-income individuals, it appears that the higher the income, the lower the tax burden, and is therefore considered regressive. For example, if the price of a product is 1050 yuan, its tax is 5%, which is 50 yuan. For people with an income of 1000 yuan, 5% of their salary needs to be used to pay taxes; For people with an income of 10000 yuan, only 0.5% of the salary needs to be paid.

Regressive taxes do not take into account the economy and affordability of to consumers and the resulting a lack of reasonable distribution of tax burden, which conflicts with the principle of fairness in taxation.

An example of a regressive tax is in the United States, where most cigarette taxes levied at the state and local levels are regressive. Since cigarettes are an inelastic commodity, most of the cigarette tax is transferred to consumers, which is unfair for buyers with different incomes as low-income individuals spend a higher proportion of their income than high-income individuals to pay for it, which may exacerbate the problem of income inequality. In addition, the wealth gap in society may widen, and when the tax share of the poor is higher than that of the rich, it may harm society and the economy. It is specifically shown in the decrease in disposable income of low-income groups leads to a decrease in expenditure, reduces economic mobility, and slows down economic growth, which may result in a decrease in employment opportunities. Therefore, when poor people lack the economic ability to purchase essential goods, they may need to rely on government subsidies and benefits, which will increase government spending. The US government provides specialized welfare websites for the unemployed, and as long as they meet the requirements, the government will provide temporary economic assistance to them [5].

Therefore, it can be concluded that high-income individuals are rarely likely to reduce consumption due to taxation. This is because cigarettes are an inelastic commodity, and the regressive taxes may not have a significant impact on high-income smokers, as they only account for a small proportion of their income. Therefore, the wealthy may become less sensitive to changes in cigarette prices, and they will not reduce their use of cigarettes or change their consumption patterns, which means that cigarette taxes have not played a role in high-income groups. Even in the short term, it cannot be effective because high-income consumers do not need to look for other alternatives. Since the wealthy will not reduce their purchase of cigarettes, the social costs caused by cigarettes, such as pollution and second-hand smoke, will still not decrease. Moreover, the cigarette tax has exacerbated inequality and triggered a series of other issues.

On the contrary, in the short term, low-income individuals may be forced to pay high cigarette taxes because they do not have enough money and time to react in the short term. However, in the long run, taxes may force low-income smokers to find other ways of buying cigarettes that avoid the higher tax rates. Like high-income earners, the externalities brought by cigarettes will still arise, and the government needs to increase spending to address these issues, which are the environmental and health problems.

In the literature review, some tax avoidance methods have been discussed. Low-income individuals may find low or even no tax outlets in the local area and purchase low-priced cigarettes, which is known as the black market. Because poor people can find cheaper products, their motivation to reduce consumption and quit smoking will decrease. This usually requires low-income smokers to spend time understanding and familiarizing relevant places. It is worth noting that some studies suggest that early inventory before cigarette tax is also a method used by smokers, which means that low-income groups do not need to spend time finding ways to avoid taxes, and the effectiveness of taxation in reducing the consumption of low-income smokers will also decrease. Converting to substitute discounted cigarettes will also have the same effect.

In addition, considering that different regions have different tax rates, tax competition may occur. Merchants in high-tax areas may feel competitive pressure due to the low tax rates in surrounding areas, so they may choose to bear some of the taxes themselves to reduce cigarette prices. So that low-income consumers can obtain low-priced cigarettes without seeking tax avoidance measures. However, some businesses may also be afraid that high taxes will damage profits and increase prices, so smuggling is also a way to avoid taxes. Due to the lower cost of cross-border transportation compared to cigarette taxes, people are more willing to take the risk of choosing to smuggle cigarettes to help them reduce costs. Therefore, it not only fails to reduce the externalities of cigarettes but also disrupts the economic order of the market, as people choose to purchase cigarettes from other regions instead of local ones. These two situations may only be suitable for tax-specific places like the United States, as state and federal taxes are implemented in the United States, so there may be significant differences in tax rates in very similar regions. The method of smuggling is also commonly used internationally, and people can choose to purchase duty-free cigarettes online or overseas.

It is worth noting that there may be a large amount of counterfeit cigarettes in smuggling and the black market, and consumers cannot determine the authenticity of cigarettes. The harm caused by unqualified cigarettes to people is far greater than the impact of regular cigarettes on the human body. In other words, morbidity and mortality will increase, leading to greater human losses and output reduction. This also means that the negative externalities of cigarette consumption may not decrease due to the increase in taxes, as mentioned in the first section.

Therefore, it can be concluded that whilst higher taxes represent a big cost for lower income consumers, ultimately cigarette taxes may not reduce the smoking levels amongst low-income smokers. This is because low-income individuals can reduce the impact of taxation by changing the way in which they purchase cigarettes. Meanwhile, the government must also consider the potential impact of cigarette taxes, such as the smuggling and black market mentioned above, which may lead to a worse outcome for society as a whole.

4 Conclusion

This study set out to establish to what extent are taxes on cigarettes effective and how does the impact of these taxes affect across income groups. These are important issues to analyse because this study can demonstrate the effectiveness of cigarette taxes and identify the underlying causes, thereby improving smoking control policies. Considering this issue from the perspective of consumer income levels, it can be understood how consumers at different levels respond to tax changes. Therefore, it can serve as a reference factor for the government when adjusting cigarette tax rates. In addition, it can also be observed that cigarette taxes bring some potential risks, and the government can consider the negative impact of these risks when adjusting cigarette tax rates.

Firstly, in the literature review we analysed the existing debate amongst academics over the effectiveness of cigarette taxes and also discussed the evidence base for the impact of smoking and the historical context of cigarette taxes. The analysis presented this paper focus on three main areas: the impact of cigarette taxes on high-income and low-income groups, and the risks of cigarette taxes.

For high-income groups, the impact of cigarette taxes is not significant. There are several reasons: firstly, cigarettes contain nicotine, which is addictive. This makes it difficult for consumers to quit smoking. Secondly, cigarettes are a price-inelastic good, and price changes have little impact on the demand for this good. In addition, due to the regressive nature of cigarette taxes, cigarette prices account for a relatively small proportion of their income, which means that wealthy people will not have difficulty paying for high-priced cigarettes. Therefore, most high-income smokers have a relatively low level of response to changes in tax rates, which means it is difficult to change their consumption patterns, and cigarette taxes are not working well in reducing consumption by the rich of cigarettes. Therefore, this means that cigarette taxes are ineffective in reducing cigarette consumption among high-income groups.

For low-income groups, the increase in cigarette prices caused by taxation has a certain degree of impact on them. Especially in the short term, consumers do not have time to respond to this. However, cigarettes are also addictive to poor groups, so they will start looking for ways to mitigate the impact of taxation. Over time, tax avoidance methods such as discounted cigarettes, smuggling, and the black market have reduced the impact of cigarette taxes on low-income smokers. Their demand for cigarettes may also rebound to the level before the tax rate increases, and the effectiveness of cigarette taxes will also decrease. Therefore, this means that cigarette taxes are ineffective in reducing cigarette consumption among low-income groups.

When studying the impact of cigarette tax on consumers at different income levels, I discovered some of the issues it may bring. One issue is its regressive nature, which can exacerbate the wealth gap and negatively impact the social economy. This leads to an increase in unemployment rate and government spending. The second issue is tax avoidance methods. Since irregular channels such as smuggling and the black market cannot guarantee the authenticity of cigarettes, it results in greater negative externalities. This leads to increased government spending and loss of human resources.

Furthermore, some of the limitations in this article will be evaluated in the following paragraph, whether they are suitable for a wider range of fields, and their impact on other stakeholders.

Given more time and resources it would be interesting to explore the changes in tax rates at different times, regions, and degrees, reflecting the current trend of cigarette prices. In addition, the findings presented in this study could really benefit from further work on the issues brought about by smuggling and the black market, such as which groups will be influenced and how they will influence them. Meanwhile, one area for further work could be the specific benefits of cigarette taxes as the literature review mentioned the evidence of the effectiveness of cigarette taxes. It would be interesting to see how the benefits of cigarette taxes specifically impact the consumer, government, and the whole economy.

This study only considered consumer groups related to income levels. It could be more comprehensive to explore various groups of customers, based on factors such as age, gender, nationality and education level, all of which may affect consumers' sensitivity to cigarette prices. Each factor can be considered separately like the income level, and then combined all these factors to study whether there are similarities or differences between them. One should also consider about stakeholders other than consumers. For example, what benefits or losses the government will gain from cigarette taxes, and how will retailers and producers be affected by the increased price of cigarettes? They can be linked to consumer groups to see if their reactions to tax changes will affect other stakeholders.

References

[1]. Adda, Jérôme, and Francesca Cornaglia. (2013) 'Taxes, Cigarette Consumption, and Smoking Intensity: Reply.' American Economic Review 103 (7): 3102-14.

[2]. Alan Hewison, Tracy Joad (2018) Pearson Edexcel International AS/A LEVEL Economics Student Book. London: Pearson Education Limited.

[3]. Apollonio, D. E., & Glantz, S. A. (2020) 'Tobacco industry promotions and pricing after tax increases: An analysis of internal industry documents.' Nicotine and Tobacco Research: Official journal of the Society for Research on Nicotine and Tobacco, 22(6), pp. 967–974.

[4]. Asa Briggs (2015) A Social History of England, Penguin Books Ltd; 3rd edition (May 27, 1999)

[5]. Benefit.Gov. (2023) Unemployment assistance. Available at: https://www.benefits.gov/categories/Unemployment%20Assistance (Accessed: 9 Dec 2023)

[6]. Brown A, Nagelhout G, van den Putte B, et al.(2015) Trends and socioeconomic differences in roll-your- own tobacco use: findings from the ITC Europe surveys. Tob Control 2015:24:1i11-16.

[7]. Centers for Disease Control and Prevention (2010) Health Effects of Cigarette Smoking, Available at: https://www.cdc.gov/tobacco/data_statistics/fact_sheets/health_effects/effects_cig_smoking/ (Accessed: 30 Aug 2023)

[8]. Centers for Disease Control and Prevention (2017) Environmental Impacts of the Tobacco Lifecycle. Available at: https://www.cdc.gov/globalhealth/infographics/tobacco/tobacco- lifecycle.html (Accessed: 30 Aug 2023)

[9]. Chad Cotti, Erik Nesson and Nathan Tefft (2016) The Effects of Tobacco Control Policies on Tobacco Products, Tar, and Nicotine Purchases among Adults: Evidence from Household Panel Data. American Economic Journal: Economic Policy, 8(4), pp. 103-123. Available at: doi: 10.1257/pol.20150268

[10]. Chaloupka F.J, Wamer KE(1998) 'The economics of smoking.' Working paper 7047, national growth of economic research,Cambridge, MA: NBER,1999

[11]. Chaloupka, F. J., Yurekli, A., and Fong, G. T. (2012) Tobacco taxes as a tobacco control strategy. Tobacco Control. 21(2), pp.172–180. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2011-050417

[12]. Christopher S. Carpenter and Michael T. Mathes (2016) New Evidence on the Price Effects of Cigarette Tax Competition. Public Finance Review, 44(3), pp.291-310.

[13]. Corné van Walbeek (2010) A simulation model to predict the fiscal and public health impact of a change in cigarette excise taxes. Tobacco Control. 19(1), pp. 31-36. Available at: https://tobaccocontrol.bmj.com/content/19/1/31

[14]. Davis K, Farrelly M, Li Q, Hyland A. (2006) Cigarette purchasing patterns among New York smokers: implications for health, price, and rev- enue. Albany (NY): New York State Department of Health, Tobacco Control Program.

[15]. DeCicca, Philip, Donald Kenkel, and Feng Liu. (2015) ‘‘Reservation Prices: An Eco- nomic Analysis of Cigarette Purchases on Indian Resevations.’’ National Tax Journal 68:93–118. doi: 10.1177/1091142115605375

[16]. Evans, William N., and Matthew C. Farrelly. (1998) 'The Compensating Behavior of Smokers: Taxes, Tar, and Nicotine.' RAND Journal of Economics 29 (3): 578-95.

[17]. Frieden TR, Mostashari F, Kerker BD, Miller N, Hajat A, Frankel M. (2005) Adult tobacco use levels after intensive tobacco control measures: New York City, 2002–2003. Am J Public Health 2005;95:1016-23.

[18]. Gallet CA, List JA (2003) 'Cigarette demand: a meta-analysis of elasticities,' Health Econ 2003;12:821-3

[19]. Goolsbee, Austin, Michael F. Lovenheim, and Joel Slemrod. (2010) ‘‘Playing with Fire: Cigarettes, Taxes and Competition from the Internet.’’ American Economic Journal:Economic Policy 2:131–54.

[20]. Harding, Matthew, Ephraim Leibtag, and Michael F. Lovenheim. (2012). 'The Heterogeneous Geographic and Socioeconomic Incidence of Cigarette Taxes: Evidence from Nielsen Homescan Data.' American Economic Journal: Economic Policy 4 (4): 169-98.

[21]. Huang J, Zheng R, Chaloupka F, et al.(2015) Differential responsiveness to cigarette price by education and income among adult urban Chinese smokers. Tob Control 2015:24:176-82.

[22]. Hyland A, Bauer JE, Li Q, Abrams SM, Higbee C, Peppone L, et al. (2005) Higher cigarette prices influence cigarette purchase patterns. Tob Control 2005;14:86-92.

[23]. Jennifer Cantrell, Dorothy Hung, Marianne C. Fahs, Donna Shelley(2008) Purchasing Patterns and Smoking Behaviors After a Large Tobacco Tax Increase: A Study of Chinese Americans Living in New York City. Public Health Reports.123. pp.135-146. Available at: doi: 10.1177/003335490812300206

[24]. Kong, A. Y., Delamater, P. L., Gottfredson, N. C., Ribisl, K. M., Baggett, C. D., & Golden, S. D. (2021). 'Sociodemographic inequities in tobacco retailer density: Do neighboring places matter?' Health and Place, 71, 102653.

[25]. Lain Gately (2004) La Diva Nicotina, Simon & Schuster (Trade Division); First Edition (September 3, 2001)

[26]. Lee, J. G. L., Henriksen, L., Rose, S. W., Moreland-Russell, S., & Ribisl, K. M. (2015). 'A systematic review of neighborhood disparities in point-of-sale tobacco marketing.' American Journal of Public Health, 105(9), Article e8–18.

[27]. Lee, J-M, Liao, D-S, Ye, C-Y and Liao, W-Z (2005) Effect of cigarette tax increase on cigarette consumption in Taiwan. Journal of Tobacco Control. 14(1): Forcing Open the Market in Taiwan: Lessons for Tobacco Control (June 2005), pp. i71-i75. Available at: http://dx.doi.org/10.1136/tc.2004.008177

[28]. Lesley Chiou, Erich Muehlegger (2014) CONSUMER RESPONSE TO CIGARETTE EXCISE TAX CHANGES. National Tax Journal. 67(3), pp. 621-650.

[29]. Li J, White JS, Hu TW, et al. The heterogenous effects of cigarette prices on brand choice in China: implications for tobacco control policy. Tob Control 2015;24:1125-32.

[30]. Lin HS, Wen CP, Hou CC, et al.(2002) Research on tobacco litigation in Taiwan. In: WenChi-Pang, et al, eds. Collection of research papers on tobacco health in Taiwan 2002. Taiwan: Division of Health Policy Research, National Health Research Institutes, 2002:68-90.

[31]. Lovenheim Michael F.(2008). ‘‘How Far to the Border? The Extent and Impact of Cross-Border Casual Cigarette Smuggling.’’ National Tax Journal 61:7–33.

[32]. Merriman, David. (2010). ‘‘The Micro-geography of Tax Avoidance: Evidence from Littered Cigarette Packs in Chicago.’’ American Economic Journal: Economic Policy 2:61–84.

[33]. Nesson, Erik. Forthcoming. 'Heterogeneity in Smokers' Responses to Tobacco Control Policies.' Health Economics.

[34]. Orzechowski, Bill, and Rob Walker. (2010). ‘‘Tax Burden on Tobacco, Historical Compilation. Vol. 45.

[35]. Park E, Park S, Cho S, et al. What cigarette price is required for smokers to attempt to quit smoking? Tob Control 2015:24:l48-55.

[36]. Robert N Proctor (2012) The history of the discovery of the cigarette–lung cancer link: evidentiary traditions, corporate denial, global toll. Tobacco Control. 21(1), 87-91. Available at: https://tobaccocontrol.bmj.com/content/21/2/87 (Accessed: 9 Sept 2023)

[37]. Ross, H., Tesche, J., & Vellios, N. (2017). 'Undermining government tax policies: Common legal strategies employed by the tobacco industry in response to tobacco tax increases.' Preventive Medicine, 105S(Suppl), S19–S22.

[38]. Ryan S. Sullivan, Donald H. Dutkowsky (2012) The Effect of Cigarette Taxation on Prices: An Empirical Analysis Using Local-Level Data. Public Finance Review. 40(6) 687-711. Available at: https://doi.org/10.1177/1091142112442742

[39]. Seng Eun Choi (2016) Are lower income smokers more price sensitive?: the evidence from Korean cigarette tax increases. Journal of Tobacco Control. 25(2), pp.141-146. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2014-051680

[40]. Stehr, Mark. (2005). ‘‘Cigarette Tax Avoidance and Evasion.’’ Journal of Health Economics 24:277– 97.

[41]. Tauras, John A. (2006). 'Smoke-Free Air Laws, Cigarette Prices, and Adult Cigarette Demand.' Economic Inquiry 44 (2): 333-42.

[42]. UN News (2023) The Road to a 'smokeless society: Seven adults worldwide are protected by at least one tobacco control measure. Available at : https://news.un.org/zh/story/2023/07/1120272 (Accessed: 13 Sept 2023)

[43]. Van Walbeek CP (2005) 'The economics of tobacco control in south atica.' University cf Cape Town.

[44]. Walbeek, Corné van (2015) The Economics of Tobacco Control (Part 2): Evidence from the International Tobacco Control (ITC) Project.Tobacco Control. 24(Supplement 3), pp. iii1-iii3. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2015-052425

[45]. World Health Organization (2023), Tobacoo. Available at: https://www.who.int/news- room/fact-sheets/detail/tobacco (Accessed: 2 Nov 2023)

Cite this article

Peng,Q. (2024). To What Extent Are Taxes on Cigarettes Effective and How Does the Impact of These Taxes Affect Across Income Groups?. Journal of Applied Economics and Policy Studies,9,44-55.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Adda, Jérôme, and Francesca Cornaglia. (2013) 'Taxes, Cigarette Consumption, and Smoking Intensity: Reply.' American Economic Review 103 (7): 3102-14.

[2]. Alan Hewison, Tracy Joad (2018) Pearson Edexcel International AS/A LEVEL Economics Student Book. London: Pearson Education Limited.

[3]. Apollonio, D. E., & Glantz, S. A. (2020) 'Tobacco industry promotions and pricing after tax increases: An analysis of internal industry documents.' Nicotine and Tobacco Research: Official journal of the Society for Research on Nicotine and Tobacco, 22(6), pp. 967–974.

[4]. Asa Briggs (2015) A Social History of England, Penguin Books Ltd; 3rd edition (May 27, 1999)

[5]. Benefit.Gov. (2023) Unemployment assistance. Available at: https://www.benefits.gov/categories/Unemployment%20Assistance (Accessed: 9 Dec 2023)

[6]. Brown A, Nagelhout G, van den Putte B, et al.(2015) Trends and socioeconomic differences in roll-your- own tobacco use: findings from the ITC Europe surveys. Tob Control 2015:24:1i11-16.

[7]. Centers for Disease Control and Prevention (2010) Health Effects of Cigarette Smoking, Available at: https://www.cdc.gov/tobacco/data_statistics/fact_sheets/health_effects/effects_cig_smoking/ (Accessed: 30 Aug 2023)

[8]. Centers for Disease Control and Prevention (2017) Environmental Impacts of the Tobacco Lifecycle. Available at: https://www.cdc.gov/globalhealth/infographics/tobacco/tobacco- lifecycle.html (Accessed: 30 Aug 2023)

[9]. Chad Cotti, Erik Nesson and Nathan Tefft (2016) The Effects of Tobacco Control Policies on Tobacco Products, Tar, and Nicotine Purchases among Adults: Evidence from Household Panel Data. American Economic Journal: Economic Policy, 8(4), pp. 103-123. Available at: doi: 10.1257/pol.20150268

[10]. Chaloupka F.J, Wamer KE(1998) 'The economics of smoking.' Working paper 7047, national growth of economic research,Cambridge, MA: NBER,1999

[11]. Chaloupka, F. J., Yurekli, A., and Fong, G. T. (2012) Tobacco taxes as a tobacco control strategy. Tobacco Control. 21(2), pp.172–180. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2011-050417

[12]. Christopher S. Carpenter and Michael T. Mathes (2016) New Evidence on the Price Effects of Cigarette Tax Competition. Public Finance Review, 44(3), pp.291-310.

[13]. Corné van Walbeek (2010) A simulation model to predict the fiscal and public health impact of a change in cigarette excise taxes. Tobacco Control. 19(1), pp. 31-36. Available at: https://tobaccocontrol.bmj.com/content/19/1/31

[14]. Davis K, Farrelly M, Li Q, Hyland A. (2006) Cigarette purchasing patterns among New York smokers: implications for health, price, and rev- enue. Albany (NY): New York State Department of Health, Tobacco Control Program.

[15]. DeCicca, Philip, Donald Kenkel, and Feng Liu. (2015) ‘‘Reservation Prices: An Eco- nomic Analysis of Cigarette Purchases on Indian Resevations.’’ National Tax Journal 68:93–118. doi: 10.1177/1091142115605375

[16]. Evans, William N., and Matthew C. Farrelly. (1998) 'The Compensating Behavior of Smokers: Taxes, Tar, and Nicotine.' RAND Journal of Economics 29 (3): 578-95.

[17]. Frieden TR, Mostashari F, Kerker BD, Miller N, Hajat A, Frankel M. (2005) Adult tobacco use levels after intensive tobacco control measures: New York City, 2002–2003. Am J Public Health 2005;95:1016-23.

[18]. Gallet CA, List JA (2003) 'Cigarette demand: a meta-analysis of elasticities,' Health Econ 2003;12:821-3

[19]. Goolsbee, Austin, Michael F. Lovenheim, and Joel Slemrod. (2010) ‘‘Playing with Fire: Cigarettes, Taxes and Competition from the Internet.’’ American Economic Journal:Economic Policy 2:131–54.

[20]. Harding, Matthew, Ephraim Leibtag, and Michael F. Lovenheim. (2012). 'The Heterogeneous Geographic and Socioeconomic Incidence of Cigarette Taxes: Evidence from Nielsen Homescan Data.' American Economic Journal: Economic Policy 4 (4): 169-98.

[21]. Huang J, Zheng R, Chaloupka F, et al.(2015) Differential responsiveness to cigarette price by education and income among adult urban Chinese smokers. Tob Control 2015:24:176-82.

[22]. Hyland A, Bauer JE, Li Q, Abrams SM, Higbee C, Peppone L, et al. (2005) Higher cigarette prices influence cigarette purchase patterns. Tob Control 2005;14:86-92.

[23]. Jennifer Cantrell, Dorothy Hung, Marianne C. Fahs, Donna Shelley(2008) Purchasing Patterns and Smoking Behaviors After a Large Tobacco Tax Increase: A Study of Chinese Americans Living in New York City. Public Health Reports.123. pp.135-146. Available at: doi: 10.1177/003335490812300206

[24]. Kong, A. Y., Delamater, P. L., Gottfredson, N. C., Ribisl, K. M., Baggett, C. D., & Golden, S. D. (2021). 'Sociodemographic inequities in tobacco retailer density: Do neighboring places matter?' Health and Place, 71, 102653.

[25]. Lain Gately (2004) La Diva Nicotina, Simon & Schuster (Trade Division); First Edition (September 3, 2001)

[26]. Lee, J. G. L., Henriksen, L., Rose, S. W., Moreland-Russell, S., & Ribisl, K. M. (2015). 'A systematic review of neighborhood disparities in point-of-sale tobacco marketing.' American Journal of Public Health, 105(9), Article e8–18.

[27]. Lee, J-M, Liao, D-S, Ye, C-Y and Liao, W-Z (2005) Effect of cigarette tax increase on cigarette consumption in Taiwan. Journal of Tobacco Control. 14(1): Forcing Open the Market in Taiwan: Lessons for Tobacco Control (June 2005), pp. i71-i75. Available at: http://dx.doi.org/10.1136/tc.2004.008177

[28]. Lesley Chiou, Erich Muehlegger (2014) CONSUMER RESPONSE TO CIGARETTE EXCISE TAX CHANGES. National Tax Journal. 67(3), pp. 621-650.

[29]. Li J, White JS, Hu TW, et al. The heterogenous effects of cigarette prices on brand choice in China: implications for tobacco control policy. Tob Control 2015;24:1125-32.

[30]. Lin HS, Wen CP, Hou CC, et al.(2002) Research on tobacco litigation in Taiwan. In: WenChi-Pang, et al, eds. Collection of research papers on tobacco health in Taiwan 2002. Taiwan: Division of Health Policy Research, National Health Research Institutes, 2002:68-90.

[31]. Lovenheim Michael F.(2008). ‘‘How Far to the Border? The Extent and Impact of Cross-Border Casual Cigarette Smuggling.’’ National Tax Journal 61:7–33.

[32]. Merriman, David. (2010). ‘‘The Micro-geography of Tax Avoidance: Evidence from Littered Cigarette Packs in Chicago.’’ American Economic Journal: Economic Policy 2:61–84.

[33]. Nesson, Erik. Forthcoming. 'Heterogeneity in Smokers' Responses to Tobacco Control Policies.' Health Economics.

[34]. Orzechowski, Bill, and Rob Walker. (2010). ‘‘Tax Burden on Tobacco, Historical Compilation. Vol. 45.

[35]. Park E, Park S, Cho S, et al. What cigarette price is required for smokers to attempt to quit smoking? Tob Control 2015:24:l48-55.

[36]. Robert N Proctor (2012) The history of the discovery of the cigarette–lung cancer link: evidentiary traditions, corporate denial, global toll. Tobacco Control. 21(1), 87-91. Available at: https://tobaccocontrol.bmj.com/content/21/2/87 (Accessed: 9 Sept 2023)

[37]. Ross, H., Tesche, J., & Vellios, N. (2017). 'Undermining government tax policies: Common legal strategies employed by the tobacco industry in response to tobacco tax increases.' Preventive Medicine, 105S(Suppl), S19–S22.

[38]. Ryan S. Sullivan, Donald H. Dutkowsky (2012) The Effect of Cigarette Taxation on Prices: An Empirical Analysis Using Local-Level Data. Public Finance Review. 40(6) 687-711. Available at: https://doi.org/10.1177/1091142112442742

[39]. Seng Eun Choi (2016) Are lower income smokers more price sensitive?: the evidence from Korean cigarette tax increases. Journal of Tobacco Control. 25(2), pp.141-146. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2014-051680

[40]. Stehr, Mark. (2005). ‘‘Cigarette Tax Avoidance and Evasion.’’ Journal of Health Economics 24:277– 97.

[41]. Tauras, John A. (2006). 'Smoke-Free Air Laws, Cigarette Prices, and Adult Cigarette Demand.' Economic Inquiry 44 (2): 333-42.

[42]. UN News (2023) The Road to a 'smokeless society: Seven adults worldwide are protected by at least one tobacco control measure. Available at : https://news.un.org/zh/story/2023/07/1120272 (Accessed: 13 Sept 2023)

[43]. Van Walbeek CP (2005) 'The economics of tobacco control in south atica.' University cf Cape Town.

[44]. Walbeek, Corné van (2015) The Economics of Tobacco Control (Part 2): Evidence from the International Tobacco Control (ITC) Project.Tobacco Control. 24(Supplement 3), pp. iii1-iii3. Available at: http://dx.doi.org/10.1136/tobaccocontrol-2015-052425

[45]. World Health Organization (2023), Tobacoo. Available at: https://www.who.int/news- room/fact-sheets/detail/tobacco (Accessed: 2 Nov 2023)