1 Introduction

During China's period of rapid economic growth, the process of industrialization has significantly driven economic development. [12] However, at the same time, environmental pollution, particularly industrial pollution, has become an increasingly serious problem. Industrial pollution not only threatens the ecological balance but also directly impacts residents' health and quality of life. [2] As the Chinese government places greater emphasis on sustainable development, addressing industrial pollution has become a crucial issue in achieving coordinated economic and environmental progress. [6] Numerous factors influence industrial pollution, including the formulation and enforcement of policies and regulations, environmental governance, urbanization, corporate management, and technological innovation. [4, 8-9, 11, 14] Fintech, which integrates financial services with technological innovation, offers unique advantages in providing financial support, optimizing resource allocation, and improving corporate management efficiency. [7] As other factors remain relatively stable, the impact of fintech on industrial pollution is becoming increasingly significant .

However, existing research often overlooks the combined effects of finance and technology in analyzing fintech's impact on industrial pollution, as well as the specific influence of fintech across different regions and types of cities. Moreover, there is a lack of empirical studies on how fintech, through policy pilots, affects industrial pollution. The innovation of this paper lies in systematically analyzing the impact of fintech on urban industrial pollution using a difference-in-differences model based on China's "Technology and Finance Integration" pilot policy. Additionally, it further explores the varying effects across different regions and types of cities, aiming to provide more targeted recommendations for policymakers.

2 Methodology and Empirical Analysis

This study employs a multi-period difference-in-differences (DID) model for empirical analysis. First, a basic linear regression model is used to assess the impact of fintech on urban industrial pollution, with SO₂ emissions, a common industrial pollutant, serving as the primary evaluation metric. Second, the DID model is utilized to examine the impact of the pilot policy on industrial pollution between the treatment group and the control group before and after the policy implementation. The robustness of the DID results is confirmed through a placebo test.

2.1 Model Design and Variable Presentation

The "Technology and Finance Integration" pilot policy is treated as a quasi-natural experiment, with pilot cities designated as the treatment group and non-pilot cities as the control group. A staggered DID approach is employed to evaluate the impact of fintech on industrial pollution. The annual list of "Broadband China" pilot cities is sourced from the Ministry of Industry and Information Technology of China. Due to data availability, this study selects 28 cities that were designated as pilot cities in 2011 and 7 cities in 2016, totaling 35 cities as the treatment group, while 249 cities serve as the control group. Based on the aforementioned analysis and drawing on the approach of Beck, the model is set up as follows (Model 1) [1]:

\( SO_{2ct}=α_{0}+α_{1}DID_{ct}+γ_{1}Controls_{ct}+μ_{c}+v_{t}+ε_{ct} \) (1)

The key premise of the staggered difference-in-differences (DID) model is the parallel trend assumption, which posits that before the implementation of the policy, the trend in industrial pollution should be parallel between the pilot cities and non-pilot cities. After the policy implementation, a significant divergence in trends between the pilot and non-pilot cities should be observed. To test this assumption, this study employs the event study method proposed by Jacobson, which can be expressed as follows [5]:

\( So2=\sum_{-3}^{4}DID_{ct}+λControls_{ct}+v_{t}+ε_{ct} \) (2)

In equation (2), the variable DID represent a dummy variable for cities that became pilot cities in a given year. Considering that the pilot policy was formally implemented in 2011 and 2016, the other components of the model are the same as those in the reference model. In this model, \( SO2ct \) represents the level of industrial pollution in city \( c \) in year \( t \) ; \( DIDct \) represents a dummy variable, which takes the value of 1 if city \( c \) is included in the "Technology and Finance Integration" pilot cities in year \( t \) , and 0 otherwise; \( Controlsct \) represents a series of control variables that influence industrial pollution in city \( c \) in year \( t \) , including education and science expenditures, economic structure, industrial structure, and openness to foreign trade. \( μc \) and \( vt \) represent city fixed effects and time fixed effects, respectively; \( εct \) is the random disturbance term that affects industrial pollution.

2.2 Data Description

2.2.1 Dependent Variable:

SO₂ is a primary indicator of industrial pollution, this study uses SO₂ emissions to measure the level of industrial pollution. [13]

2.2.2 Independent Variable:

Fintech. This study represents the advancement of fintech through the "Technology and Finance Integration" pilot policy, constructing the policy variable by setting a dummy variable. Specifically, the dummy variable is set to 1 for the year a city becomes a pilot city and for all subsequent years, and 0 for all other years.

2.2.3 Control Variables:

Science and Education Expenditures (SciEduc): Measured as the ratio of expenditures on science and education to GDP.

Industrial Structure (Industry): Measured as the ratio of secondary industry value added to GDP.

Openness to Foreign Trade (Open): Measured as the ratio of actual utilized foreign capital to GDP in a given year.

Economic Structure (ecs): Measured as the ratio of total retail sales of consumer goods to GDP.

Table 1 provides descriptive statistics for the main variables. The average value of SO₂ is 4.482, indicating that the average industrial SO₂ emissions in cities amount to 44,820 tons. The average value of the DID variable is 0.077, suggesting that 7.7% of the annual observations for Chinese cities were influenced by the "Technology and Finance Integration" pilot policy.

Table 1. Summary Statistics

VarName |

Obs |

Mean |

SD |

Min |

Max |

SO2 |

4215 |

4.482 |

7.167 |

0.00000 |

135.820 |

DID |

4215 |

0.077 |

0.267 |

0.00000 |

1.000 |

SciEduc |

4215 |

0.197 |

0.043 |

0.01992 |

0.387 |

Industry |

3936 |

0.469 |

0.112 |

0.10680 |

0.910 |

Open |

3963 |

0.018 |

0.018 |

0.00002 |

0.198 |

ECS |

4173 |

0.371 |

0.107 |

0.00003 |

1.013 |

2.3 Basic Regression

In Table 2, the first column (1) represents a regression model that does not include fixed city and time effects, nor any control variables. The second column (2) includes fixed city and time effects and incorporates control variables into the regression. The third column (3) builds on the second model by adding additional control variables. The results from these three models indicate that, regardless of whether control variables are included, the fintech policy has a significant negative impact on industrial pollution, as represented by SO₂ emissions. This finding suggests that the development of fintech helps reduce industrial pollution. In column (3), even after including control variables such as SciEduc, Industry, Open, and ecs, the negative impact of fintech on industrial pollution remains significant. This further confirms the effectiveness of fintech in reducing urban industrial pollution.

Tabel 2. Regression Results Showing the Impact of Fintech Policy on Industrial Pollution Across Different Model Specifications

(1) |

(2) |

(3) |

|

SO2 |

SO2 |

SO2 |

|

DID |

2.811*** |

-1.407*** |

-1.126*** |

(3.36) |

(-3.89) |

(-2.84) |

|

SciEduc |

-1.356 |

||

(-0.37) |

|||

Industry |

6.575*** |

||

(4.11) |

|||

open |

8.187 |

||

(1.22) |

|||

ecs |

2.483* |

||

(1.77) |

|||

_cons |

4.290*** |

4.578*** |

0.972 |

(42.51) |

(54.06) |

(0.76) |

|

year |

× |

√ |

√ |

id |

√ |

√ |

√ |

N |

4215 |

4215 |

3720 |

r2 |

0.010 |

0.431 |

0.443 |

t statistics in parentheses

* p < 0.1, ** p < 0.05, *** p < 0.01

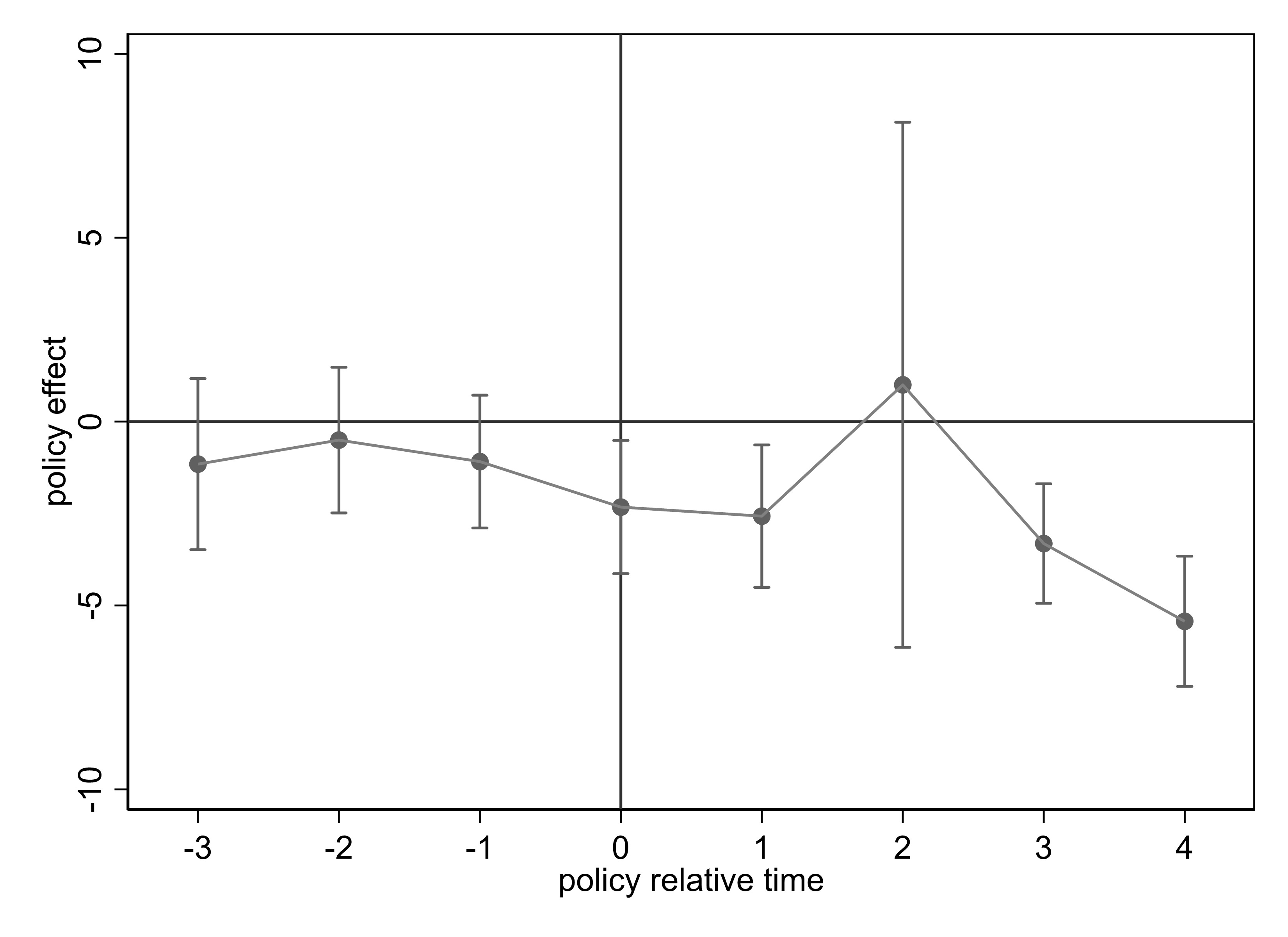

2.4 Parallel Trend Test

The results of the parallel trend test, as shown in Figure 1, indicate that the estimated coefficients for all cities in the sample were not significant before the policy implementation, and the trends were generally similar. However, after the policy implementation, the estimated coefficients for the pilot cities show a significant decline, along with a noticeable divergence in trends. This suggests that the "Technology and Finance Integration" pilot policy has a positive impact on reducing industrial pollution emissions in the pilot cities. The above analysis demonstrates that the implementation of fintech does indeed contribute to the reduction of industrial pollution to some extent.

Figure 1. Parallel Trend Test

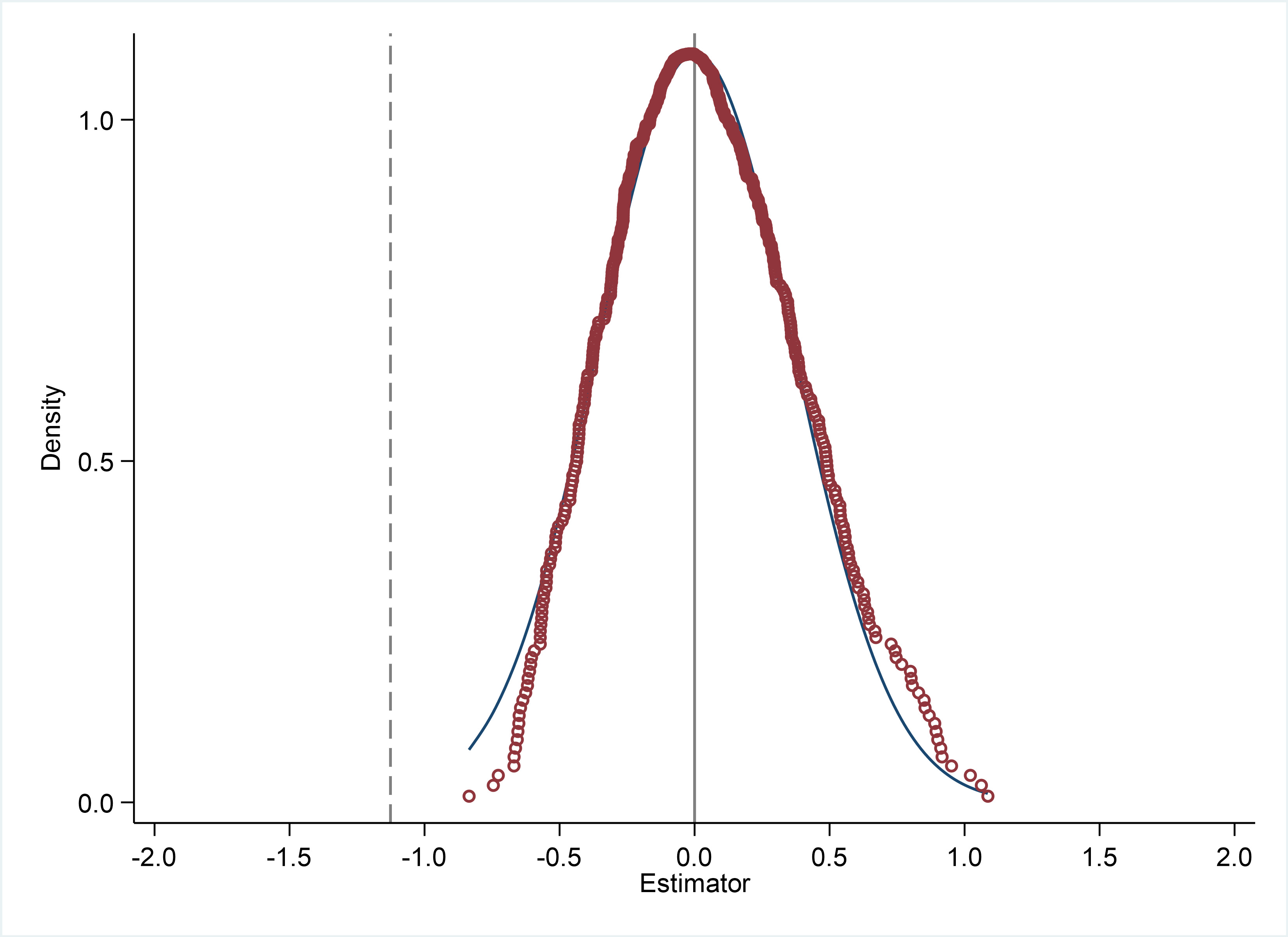

2.5 Placebo Test

The purpose of the placebo test is to check the robustness of the model estimates, ensuring that the estimated effects are not driven by random factors or model misspecification. If the estimated results, under conditions where no actual intervention occurred, are centered around zero, it indicates that the model is robust and that the effects of the actual intervention are likely to be genuine. Figure 2 further illustrates the robustness of the estimated results.

Figure 2. Placebo Test

3 Heterogeneity Analysis

3.1 Differences by City Type

Table 3, columns (1) and (2), indicates that the impact of the "Technology and Finance Integration" policy on SO₂ emissions varies significantly between resource-based and non-resource-based cities. [8] Specifically, in resource-based cities, these policies have significantly reduced SO₂ emissions, suggesting that the policy has promoted the adoption of clean technologies or improved environmental protection measures in these cities, thereby effectively reducing pollution. In contrast, in non-resource-based cities, the policy is associated with an increase in SO₂ emissions. This is likely due to the more diversified industrial structure of these cities, where the policy-supported industrial expansion has led to a short-term rise in pollutant emissions. This difference reflects the varying industrial structures, development stages, and policy needs of different city types, highlighting the need for more targeted policies that balance environmental protection with economic development in future policy design.

3.2 Regional Differences

The impact of the "Technology and Finance Integration" policy on SO₂ emissions varies significantly across the eastern, central, and western regions of China. [3] The data show that the policy has significantly reduced SO₂ emissions in the eastern region (with a DID coefficient of -0.464, which is statistically significant), while its effects in the central (DID coefficient of -1.359) and western (DID coefficient of -0.570) regions are not significant, as shown in Table 3, columns (3) to (5). These differences are primarily driven by varying levels of economic development and the effectiveness of policy implementation. First, the eastern region is economically advanced, with relatively well-developed technological and financial infrastructure. Enterprises in this region have stronger financial resources and technical capabilities, enabling them to quickly adopt environmentally friendly technologies promoted by the policy, thereby effectively reducing pollution emissions. Moreover, the government in the eastern region is more efficient in policy execution and regulation, ensuring that the policies are implemented effectively. In contrast, the central and western regions have weaker economic foundations and relatively scarce technological and financial resources. Enterprises in these areas face challenges such as insufficient funding and outdated technology when attempting to implement advanced environmental technologies, leading to less pronounced policy effects. Additionally, the enforcement and regulatory capacity in these regions may be relatively weaker, with less effective coordination mechanisms between the government and enterprises compared to the eastern region. This also limits the policy's effectiveness in reducing SO₂ emissions.

Tabel 3. Regression Analysis of the Effect of Fintech Policy on SO₂ Emissions Using Different Model Specifications

(1) |

(2) |

(3) |

(4) |

(5) |

|

SO2 |

SO2 |

SO2 |

SO2 |

SO2 |

|

DID |

-1.287*** |

1.295*** |

-0.464*** |

-1.359 |

-0.570 |

(-2.88) |

(2.99) |

(-2.93) |

(-1.58) |

(-0.58) |

|

_cons |

4.321*** |

4.867*** |

5.036*** |

3.798*** |

4.790*** |

(36.01) |

(42.79) |

(33.35) |

(26.94) |

(24.27) |

|

N |

2565 |

1650 |

1500 |

1455 |

1245 |

r2 |

0.410 |

0.492 |

0.405 |

0.311 |

0.554 |

t statistics in parentheses

* p < 0.1, ** p < 0.05, *** p < 0.01

4 Conclusion and Policy Recommendations

4.1 Conclusion

Based on data from 281 Chinese cities between 2007 and 2021, this paper employs a difference-in-differences (DID) model to thoroughly analyze the impact of fintech development on urban industrial pollution. The results indicate that the "Technology and Finance Integration" pilot policy has significantly reduced industrial pollution emissions in pilot cities, particularly sulfur dioxide (SO₂) emissions. This finding strongly demonstrates the potential of fintech in promoting green transformation and reducing industrial pollution. Additionally, the study reveals that the policy effects vary across different city types and regions. Pollution reduction is more pronounced in resource-based cities, while non-resource-based cities may experience a short-term increase in pollution due to industrial expansion. Moreover, the policy's effectiveness is greater in the eastern region compared to the central and western regions, reflecting differences in economic development levels and policy implementation capacity. Therefore, while fintech holds significant potential in driving green transformation and reducing industrial pollution, policies need to be tailored to local conditions.

4.2 Policy Recommendations

First, it is recommended to continue and deepen the implementation of the "Technology and Finance Integration" pilot policy. Given its significant positive effects on reducing industrial pollution, this policy should be promoted on a broader scale. The government should also enhance the awareness and dissemination of the policy, helping more cities and enterprises recognize the potential of fintech in environmental protection. Measures such as establishing special funds and providing tax incentives can further encourage enterprises to invest in environmental technologies, thus expanding the role of fintech in various sectors. Additionally, the government should increase support for pilot cities by offering technical guidance and financial assistance to help them better implement the policy, ensuring its long-term sustainability and effectiveness.

Second, to more effectively leverage fintech policies to control industrial pollution, the government should strengthen the regulation and guidance of fintech, ensuring that funds are directed precisely toward environmental technologies and projects. It is recommended to establish a comprehensive fintech regulatory framework that uses technologies like big data and artificial intelligence to monitor pollution emissions and the effectiveness of environmental investments in real-time. The government can also introduce green financial products to guide financial institutions in supporting the environmental industry and green technological innovation. Furthermore, policy guidance should encourage more enterprises to adopt green technologies and reduce pollutant emissions. For instance, the government could establish environmental standards requiring enterprises receiving financial support to meet specific environmental benchmarks, thereby achieving a dual promotion of environmental protection through fintech.

Finally, considering the differences in economic development levels, industrial structures, and policy needs between resource-based and non-resource-based cities as well as across the eastern, central, and western regions, it is recommended that the government adopt a location-specific approach when formulating fintech policies. In resource-based cities, efforts should be intensified to promote and apply environmental technologies, encouraging these cities to transition to a sustainable development model and reduce excessive reliance on natural resources. In non-resource-based cities, a balance between economic growth and environmental protection should be maintained, avoiding short-term industrial expansion that could exacerbate pollution. For the eastern, central, and western regions, policies should be adjusted according to local conditions. In the eastern region, the government should continue to strengthen policy support to ensure the deep application of fintech in the environmental sector; in the central and western regions, the government should increase infrastructure investment and provide more technical and financial support to help enterprises in these regions enhance their environmental capabilities, ensuring a more balanced policy effect nationwide. Through these differentiated policy designs, a better balance between economic development and environmental protection can be achieved.

Statements & Declarations

Funding

No funds, grants, or other support were received during the preparation of this manuscript.

Competing Interests

The authors have no relevant financial or non-financial interests to disclose.

Author Contributions

The first draft of the manuscript was written by Siyu Li commented on previous versions of the manuscript. Siyu Li read and approved the final manuscript.

Ethical Approval and Consent to Participate

Not applicable

Consent to Publish

Not applicable

Data Availability

The datasets used and analysed during the current study available from the corresponding author on reasonable request

References

[1]. Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1–2), 261–300. https://doi.org/10.1016/S0304-405X(00)00072-6

[2]. Bian, Z., Liu, J., Zhang, Y., Peng, B., & Jiao, J. (2024). A green path towards sustainable development: The impact of carbon emissions trading system on urban green transformation development. Journal of Cleaner Production, 442, 140943. https://doi.org/10.1016/j.jclepro.2024.140943

[3]. Deng, Y., Guang, F., Hong, S., & Wen, L. (2022). How does power technology innovation affect carbon productivity? A spatial perspective in China. Environmental Science and Pollution Research, 29(55), 82888–82902. https://doi.org/10.1007/s11356-022-21488-0

[4]. Environmental regulation and environmental productivity: The case of China—ScienceDirect. (n.d.). Retrieved March 25, 2024, from https://qh.66557.net/https/443/com/sciencedirect/www/yitlink/science/article/pii/S1364032116301587

[5]. Jacobson, L. S., LaLonde, R. J., & Sullivan, D. G. (1992). Earnings Losses of Displaced Workers. W.E. Upjohn Institute. https://doi.org/10.17848/wp92-11

[6]. Li, C., Wen, M., Jiang, S., & Wang, H. (2024). Assessing the effect of urban digital infrastructure on green innovation: Mechanism identification and spatial-temporal characteristics. Humanities and Social Sciences Communications, 11(1), Article 1. https://doi.org/10.1057/s41599-024-02787-y

[7]. Lisha, L., Mousa, S., Arnone, G., Muda, I., Huerta-Soto, R., & Shiming, Z. (2023). Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resources Policy, 80, 103119. https://doi.org/10.1016/j.resourpol.2022.103119

[8]. Liu, X., Sun, T., & Feng, Q. (2020). Dynamic spatial spillover effect of urbanization on environmental pollution in China considering the inertia characteristics of environmental pollution. Sustainable Cities and Society, 53, 101903. https://doi.org/10.1016/j.scs.2019.101903

[9]. Tang, C., Xu, Y., Hao, Y., Wu, H., & Xue, Y. (2021). What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Economics, 103, 105576. https://doi.org/10.1016/j.eneco.2021.105576

[10]. Tian, Z., & Tian, Y. (2021). Political incentives, Party Congress, and pollution cycle: Empirical evidence from China. Environment and Development Economics, 26(2), 188–204. https://doi.org/10.1017/S1355770X2000025X

[11]. Xia, Y., Lou, X., Liu, W., & Xia, Y. (2023). Does bank competition curb corporate pollution emissions? Evidence from the geographical location of bank branches. Environmental Science and Pollution Research, 30(25), 67087–67108. https://doi.org/10.1007/s11356-023-27055-5

[12]. Xiao, C., Zhou, J., Wang, X., & Zhang, S. (2021). Industrial agglomeration and air pollution: A new perspective from enterprises in Atmospheric Pollution Transmission Channel Cities (APTCC) of Beijing-Tianjin-Hebei and its surrounding areas, China. PLOS ONE, 16(7), e0255036. https://doi.org/10.1371/journal.pone.0255036

[13]. Zhang, Y., & Ran, C. (2023). Effect of digital economy on air pollution in China? New evidence from the “National Big Data Comprehensive Pilot Area” policy. Economic Analysis and Policy, 79, 986–1004. https://doi.org/10.1016/j.eap.2023.07.007

[14]. Zhao, C., & Wang, B. (2022). How does new-type urbanization affect air pollution? Empirical evidence based on spatial spillover effect and spatial Durbin model. Environment International, 165, 107304. https://doi.org/10.1016/j.envint.2022.107304

Cite this article

Li,S. (2024). The Impact of Fintech on Urban Industrial Pollution: A Quasi-Natural Experiment Based on Pilot Policies Integrating Technology and Finance. Journal of Applied Economics and Policy Studies,9,77-83.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1–2), 261–300. https://doi.org/10.1016/S0304-405X(00)00072-6

[2]. Bian, Z., Liu, J., Zhang, Y., Peng, B., & Jiao, J. (2024). A green path towards sustainable development: The impact of carbon emissions trading system on urban green transformation development. Journal of Cleaner Production, 442, 140943. https://doi.org/10.1016/j.jclepro.2024.140943

[3]. Deng, Y., Guang, F., Hong, S., & Wen, L. (2022). How does power technology innovation affect carbon productivity? A spatial perspective in China. Environmental Science and Pollution Research, 29(55), 82888–82902. https://doi.org/10.1007/s11356-022-21488-0

[4]. Environmental regulation and environmental productivity: The case of China—ScienceDirect. (n.d.). Retrieved March 25, 2024, from https://qh.66557.net/https/443/com/sciencedirect/www/yitlink/science/article/pii/S1364032116301587

[5]. Jacobson, L. S., LaLonde, R. J., & Sullivan, D. G. (1992). Earnings Losses of Displaced Workers. W.E. Upjohn Institute. https://doi.org/10.17848/wp92-11

[6]. Li, C., Wen, M., Jiang, S., & Wang, H. (2024). Assessing the effect of urban digital infrastructure on green innovation: Mechanism identification and spatial-temporal characteristics. Humanities and Social Sciences Communications, 11(1), Article 1. https://doi.org/10.1057/s41599-024-02787-y

[7]. Lisha, L., Mousa, S., Arnone, G., Muda, I., Huerta-Soto, R., & Shiming, Z. (2023). Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resources Policy, 80, 103119. https://doi.org/10.1016/j.resourpol.2022.103119

[8]. Liu, X., Sun, T., & Feng, Q. (2020). Dynamic spatial spillover effect of urbanization on environmental pollution in China considering the inertia characteristics of environmental pollution. Sustainable Cities and Society, 53, 101903. https://doi.org/10.1016/j.scs.2019.101903

[9]. Tang, C., Xu, Y., Hao, Y., Wu, H., & Xue, Y. (2021). What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Economics, 103, 105576. https://doi.org/10.1016/j.eneco.2021.105576

[10]. Tian, Z., & Tian, Y. (2021). Political incentives, Party Congress, and pollution cycle: Empirical evidence from China. Environment and Development Economics, 26(2), 188–204. https://doi.org/10.1017/S1355770X2000025X

[11]. Xia, Y., Lou, X., Liu, W., & Xia, Y. (2023). Does bank competition curb corporate pollution emissions? Evidence from the geographical location of bank branches. Environmental Science and Pollution Research, 30(25), 67087–67108. https://doi.org/10.1007/s11356-023-27055-5

[12]. Xiao, C., Zhou, J., Wang, X., & Zhang, S. (2021). Industrial agglomeration and air pollution: A new perspective from enterprises in Atmospheric Pollution Transmission Channel Cities (APTCC) of Beijing-Tianjin-Hebei and its surrounding areas, China. PLOS ONE, 16(7), e0255036. https://doi.org/10.1371/journal.pone.0255036

[13]. Zhang, Y., & Ran, C. (2023). Effect of digital economy on air pollution in China? New evidence from the “National Big Data Comprehensive Pilot Area” policy. Economic Analysis and Policy, 79, 986–1004. https://doi.org/10.1016/j.eap.2023.07.007

[14]. Zhao, C., & Wang, B. (2022). How does new-type urbanization affect air pollution? Empirical evidence based on spatial spillover effect and spatial Durbin model. Environment International, 165, 107304. https://doi.org/10.1016/j.envint.2022.107304