1. Introduction

Cryptocurrency refers to a variety of digital currency that is distributed and maintained without the help of a bank, government, or other central authority through a computer network. It functions as a secure record for transactions including transfers, purchases, and sales and is organized and tracked via a peer-to-peer network named Blockchain. The need of third-party intermediaries is no longer necessary when using cryptographic technologies to protect online transactions [1]. The beginning of cryptocurrency value dates to the 2009 launch of Bitcoin. After releasing the white paper Bitcoin: A Peer-to-Peer Electronic Cash System in 2008, a person (or group of individuals) operating under the identity Satoshi Nakamoto invented it [2]. The initial decentralized cryptocurrency, Bitcoin, released its open-source software in 2009. Since this one, almost 4000 altcoins (alternative cryptocurrencies) have been introduced. As of August 2019, the total market value of all cryptocurrencies was $258 billion, while Bitcoin itself valued at $179 billion [3]. These days, cryptocurrencies are seen as an ideal currency for mainstream consumers and merchants by its proponents. Bitcoin is a well-known cryptocurrency because of its high liquidity, reduced cost, and increased speed of its processing system [4].

However, cryptocurrencies are known for their sharp rises and drops. Bitcoin price reach its first peak US$62971.80 (April 14, 2021), then fell to US$29796.16 (down 52.6%, July 20, 2021), and rocket to US$67554.84(up 126.7%, November 8, 2021). Therefore, how to effectively evaluate and predict cryptocurrency market values is becoming increasingly important given the market's rapid change and investors' growing interest in digital assets [5]. The typical financial market approach is no longer viable due to the cryptocurrency markets' extreme volatility and complexity. As a result, utilizing deep learning models like Long Short-Term Memory (LSTM), neural networks, has become a potential approach for predicting the value of cryptocurrency assets.

LSTM (Long Short-Term Memory) known as a recurrent neural network (RNN) variant, is renowned for its proficiency in handling time-series data and sequential dependencies. The more sophisticated algorithms' temporal nature makes the LSTM preferred over the more conventional multilayer perceptron (MLP) [6]. In cryptocurrency valuation prediction, LSTM can be employed to capture patterns in time-series data, such as historical prices and trading volumes, to forecast future price trends. By incorporating various technical indicators, market sentiment analysis, and other data into the LSTM model, prediction accuracy can be improved. Here is an example of how Rizwan, Narejo, and Javed applied deep learning techniques to predict the price of bitcoin using RNN and LSTM approaches [7]. According to their findings, the LSTM had an accuracy rating of 52% and an RMSE of 8%. Neural network models are another widely used approach in cryptocurrency valuation prediction. These models can include Multi-Layer Perceptrons (MLPs), Convolutional Neural Networks (CNNs), and more. Debra et al. argued that the term "Neural Network" broadly refers to a class of models with architectural and processing characteristics [8]: (1) these models consist of many simple processing elements or units that operate in parallel; (2) these units communicate through activations along connections with varying strengths (weights); (3) these models learn by adjusting their weights based on experiences gained in specific environments. Regarding complex abstractions, deep learning models are flexible and goal-oriented [9]. Besides, the applications of deep learning models are not limited to price prediction; they can also be used for trend identification, volatility analysis, and risk management. They can leverage a wealth of market data, including sentiment analysis from social media, trading volumes, liquidity, and other aspects, to gain a comprehensive understanding of cryptocurrency markets. Different deep learning techniques have been used to construct Bitcoin market forecasting models because of their excellent predictive potential, which was discovered in the prior research on asset pricing [10].

By investigating the use of LSTM, neural networks, and deep learning models in cryptocurrency asset valuation, this essay aims to contribute to the understanding of the potential and limitations of these technologies in the context of the rapidly evolving cryptocurrency market. At the reminder of this paper, the data source and its basic description, as well as the models, parameters and statistical test indicators used in this study will be displayed in part 2 Data and Method. Then, in part 3, some results and discussion will be shown. Afterwards, limitation and future outlooks will be discussed in part 4, following with part 5 conclusion.

2. Data and method

Cryptocmd is used to carry out the data download. The historical cryptocurrency data available on the Coinmarketcap website can be downloaded using this library. This study Chooses the main three BTC, ETH and BNB as data source for study. For data validity, this study chooses the price of Bitcoin from April 23, 2013 to September 18, 2023; the price of ETH was chosen from February 15, 2016 to September 18, 2023; for Binance coin (BNB), different from the other two above, it didn’t become popular until the last few years. So, the data record starts from 2018.

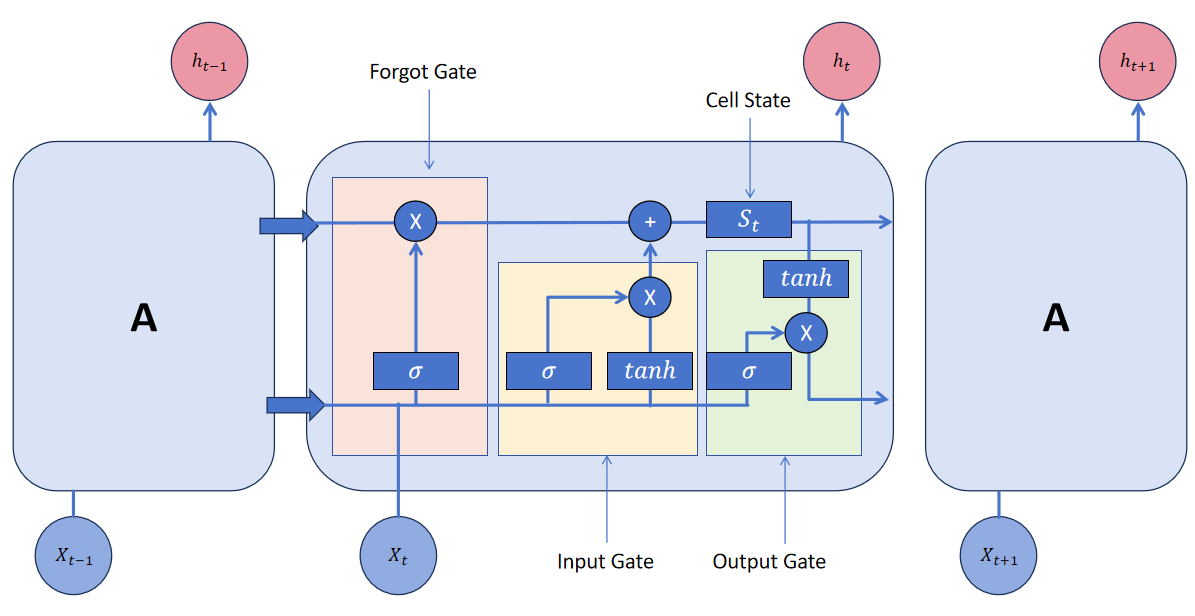

As previously stated, LSTM is expert in the ability to handle time-series data and sequential dependencies effectively. Undoubtedly, LSTM is one of the best strategies for predicting bitcoin prices due to the great volatility and intricacy of the cryptocurrency markets. Since LSTM is a variant of recurrent neural networks, it can acquire long-term dependencies throughout the sequence on the basis of RNN. Fig. 1 shows the structure of LSTM memory [5, 11]:

• The information that is erased from the memory \( {S_{t}} \) (cell state) is determined by the forget gate.

• Which data is transferred to the memory \( {S_{t}} \) (cell state) is determined by the input gate.

• The output gate determines the data to use as the output information from the memory \( {S_{t}} \) (cell state)

Figure 1. Process of LSTM [5].

Table 1. Descriptions of units and loss function.

Parameter/Statistical test index | Units |

Price of Cryptocurrency | USD |

Root Mean Squared Error | USD |

Date | Day |

Number of layers | 3 |

Loss function (MSE) | \( MSE=(\frac{1}{n})* Σ{(yᵢ - ȳ)^{2}} \) \( RMSE=\sqrt[]{(\frac{1}{n})* Σ{(yᵢ - ȳ)^{2}}} \) |

Let \( {x_{t}} \) be one observation at time t of the input vector, the LSTM cell from Figure 1 is carried out by the following equations [12]:

\( {i_{t}} \) = σ ( \( {W_{xi}}{x_{t}} \) + \( {W_{hi}}{h_{t-1}} \) + \( {W_{ci}}{c_{t-1}} \) + \( {b_{i}} \) ) (1)

\( {f_{t}} \) = σ( \( {W_{xf}}{x_{t}} \) + \( {W_{hf}}{h_{t-1}} \) + \( {W_{cf}}{c_{t-1}} \) + \( {b_{f}} \) ) (2)

\( {c_{t}} \) = \( {f_{f}}{c_{t-1}} \) + \( {i_{t}} \) tanh ( \( {W_{x}}{c_{xt}} \) + \( {W_{hc}}{h_{t-1}} \) + \( {b_{c}} \) ) (3)

\( {o_{t}} \) = σ( \( {W_{xo}}{x_{t}} \) + \( {W_{ho}}{h_{t-1}} \) + \( {W_{co}}{c_{t}} \) + \( {b_{o}} \) ) (4)

\( {h_{t}} \) = \( {o_{t}} \) tanh ( \( {c_{t}} \) ) (5)

where the activations of the input gate, forget gate, output gate, and memory cell are represented by i, f, o, and c, respectively, and is the logistic sigmoid function. The input-input gate weight matrix, hidden-input gate weight matrix, etc., which indexes are intuitive, are \( {W_{xi}} \) , \( {W_{hi}} \) , \( {W_{xf}} \) , \( {W_{hf}} \) , \( {W_{cf}} \) , \( {W_{xc}} \) \( {W_{hc}} \) , \( {W_{xo}} \) , \( {W_{ho}} \) and \( {W_{co}} \) [11]. It suggests using a neural network architecture to solve the problem of forecasting the price of cryptocurrency using sophisticated machine learning. The framework is developed in three steps using a Multi-layer Perceptron (MLP), a simple Recurrent Neural Network (RNN), and a Long Short-Term Memory (LSTM), which can acquire long dependencies. In contrast, the prediction model for this paper in addition to introducing deep learning model to the framework in order to make use of its high predictive power derived from the prior asset pricing literature to accomplish one of the study's aims. In experiment, the following parameter and statistical test index will be recorded for illustrating the feasibility and benefit of this hybrid model as shown in Table 1.

3. Results and discussion

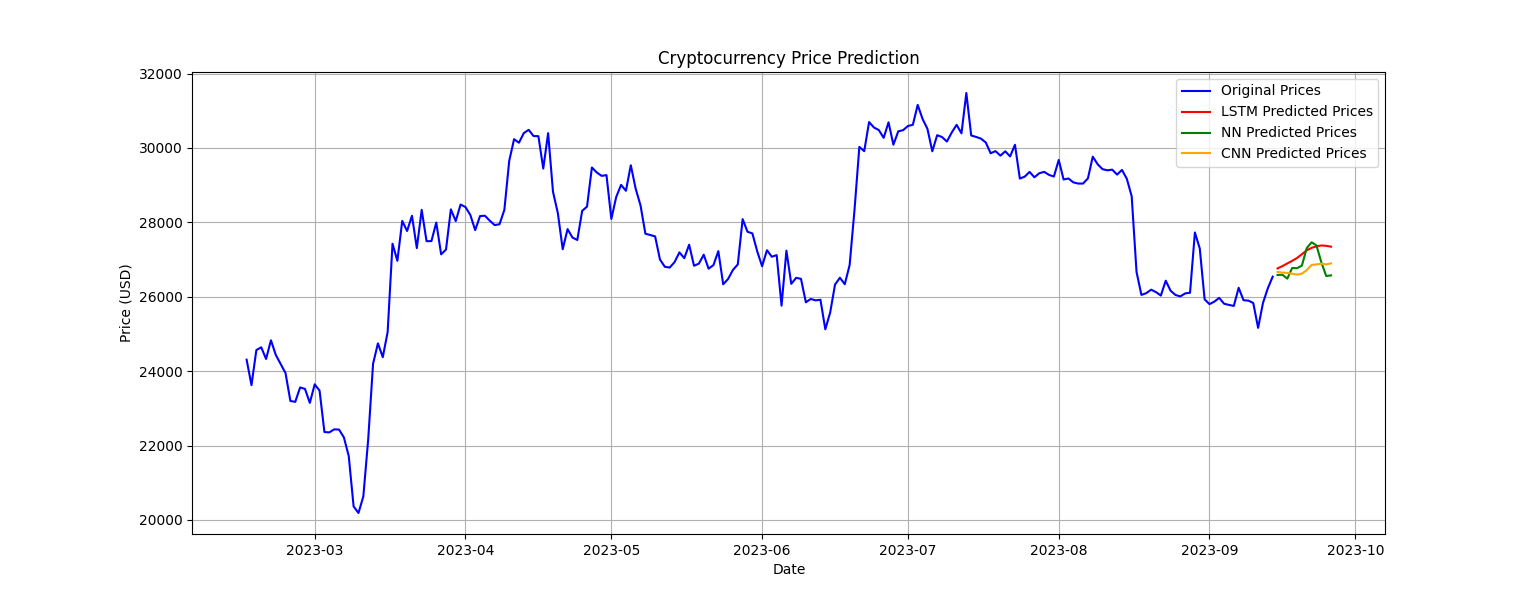

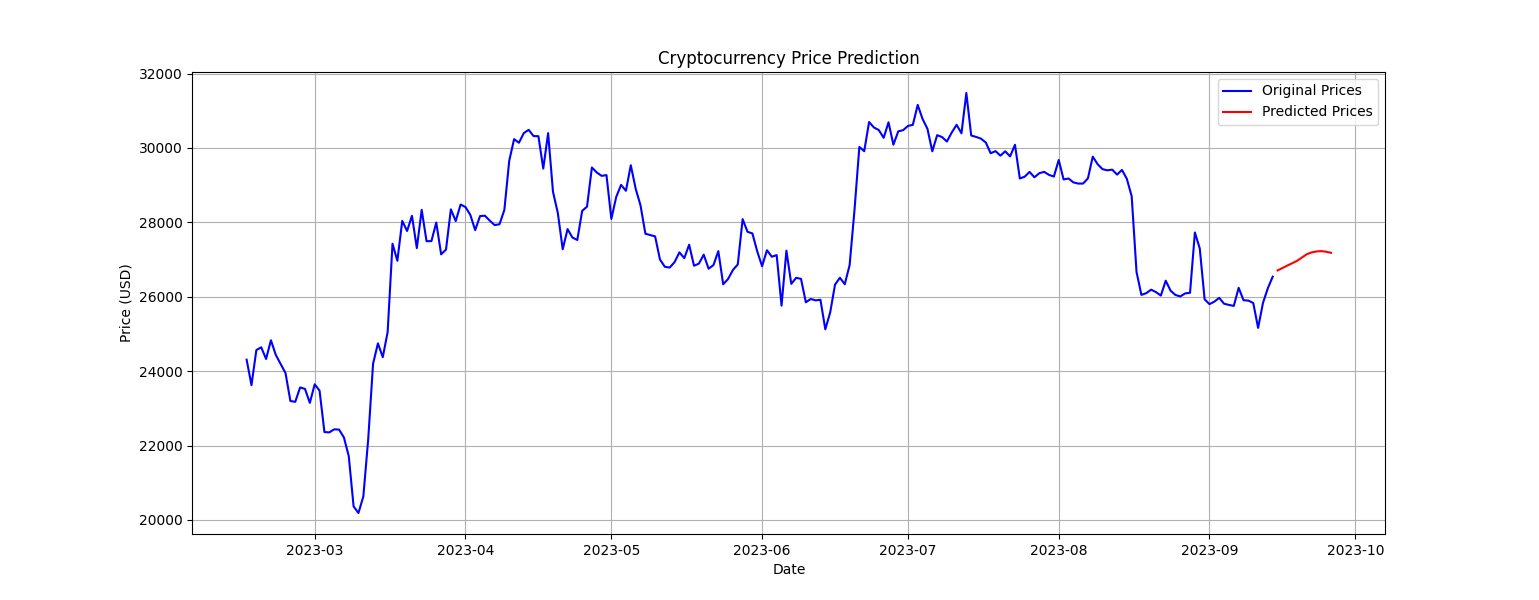

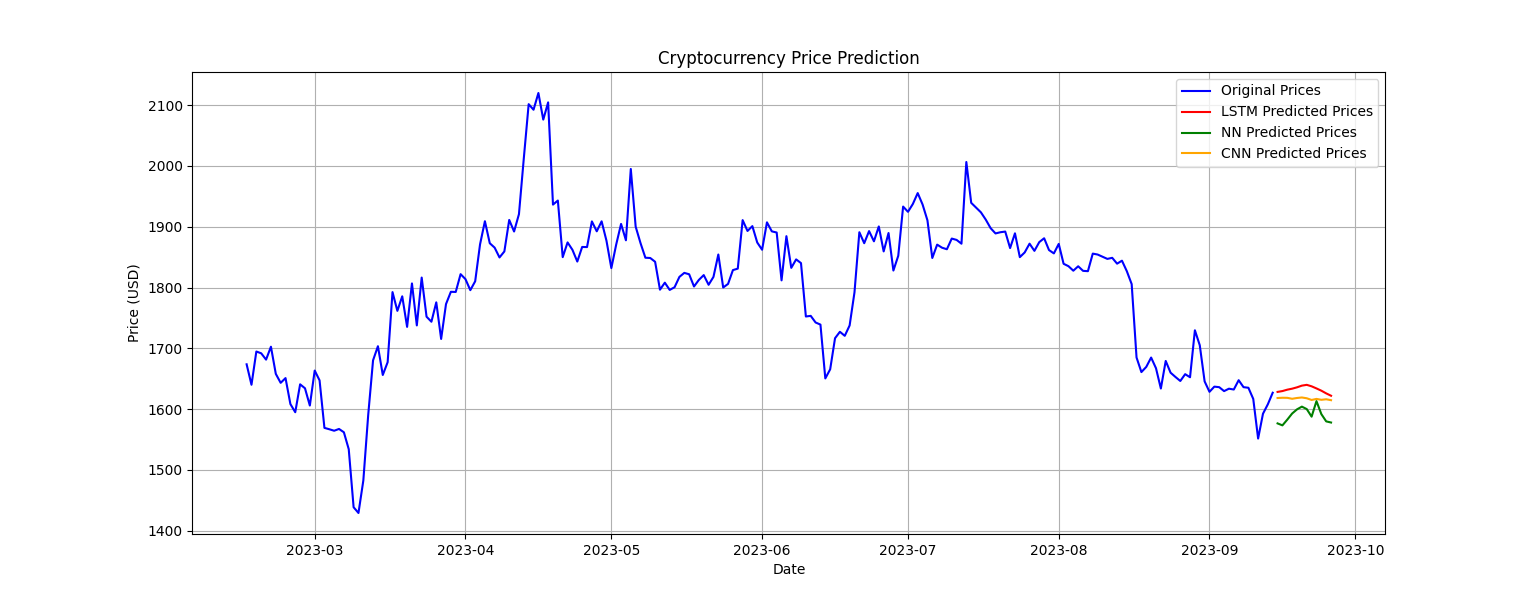

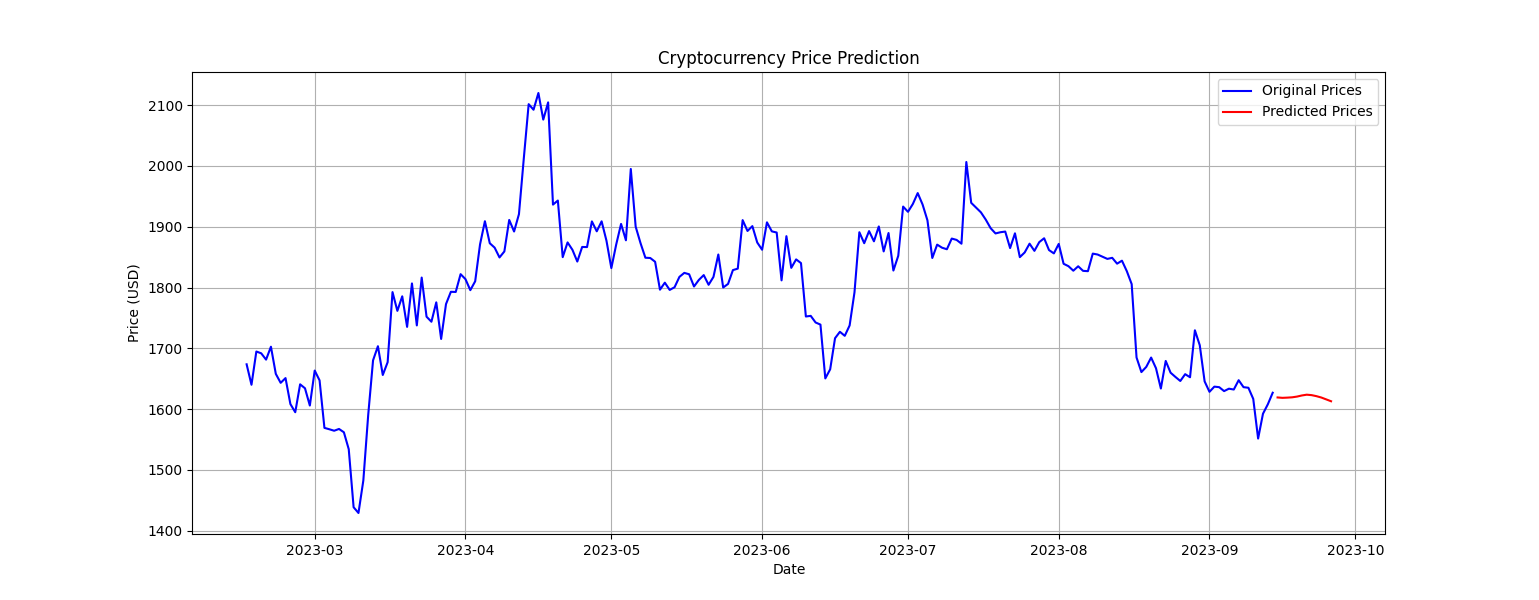

Deep Learning model based on technique of LSTM and Neural Network was applied to predict the price for BTC, ETH and BNB. Using LSTM only (seen from Fig. 2) it still has a difference with the original price when it predicted the price until September 18, and got the results listed in Table 2. After adding Neural Network and deep learning model as presented in Fig. 3. As it has been proved it’s successful in BTC price prediction using LSTM, NN, deep learning hybrid model, it’s time for the other two kind Cryptocurrency ETH and BNB to establish the problem of this model’s universality.

Table 2. Results of BTC

LSTM Root Mean Squared Error (RMSE) | 643.0198172653751 |

Neural Network RMSE | 491.5691087794117 |

CNN RMSE | 343.4941829619644 |

NN Root Mean Squared Error (RMSE) | 257.28260528431633 |

Figure 2. Prediction of BTC based on LSTM (Photo/Picture credit: Original).

Figure 3. Prediction of BTC based on NN (Photo/Picture credit: Original).

Figure 4. Prediction of ETH based on LSTM (Photo/Picture credit: Original).

Table 3. Results of ETH

LSTM Root Mean Squared Error (RMSE) | 31.833488028242545 |

Neural Network RMSE | 35.39387692448294 |

CNN RMSE | 24.20709119152702 |

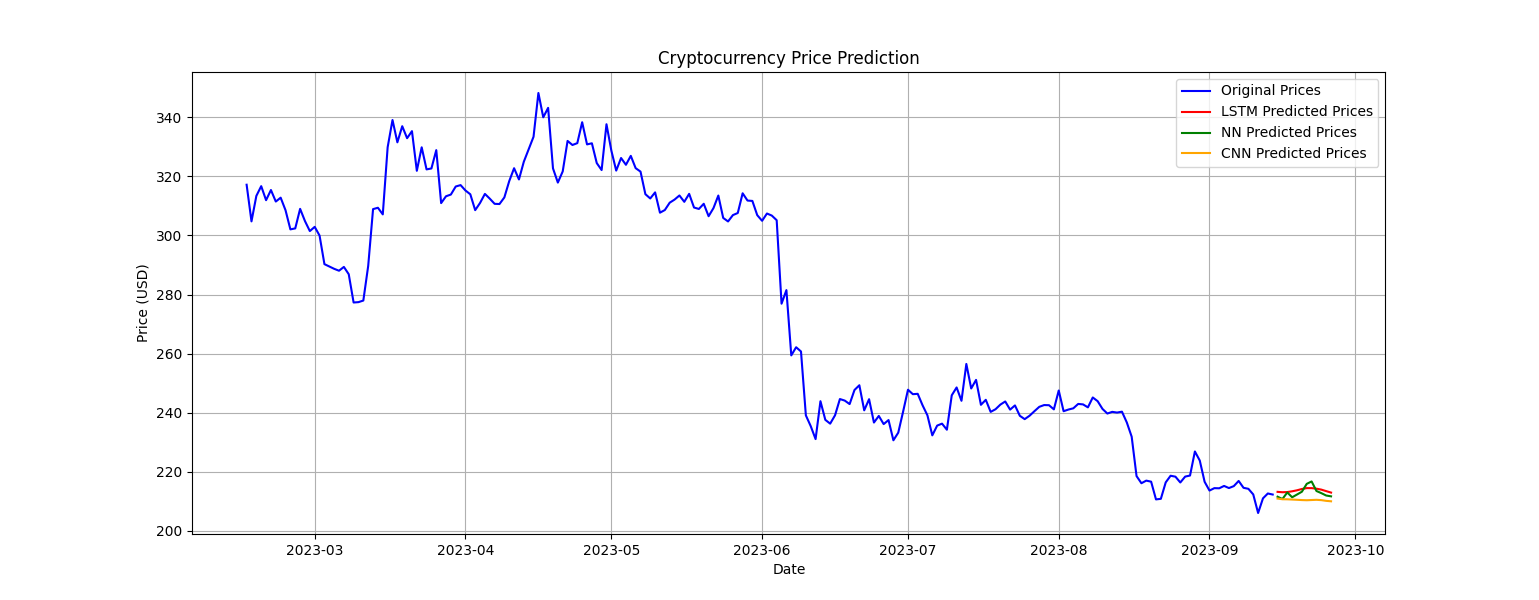

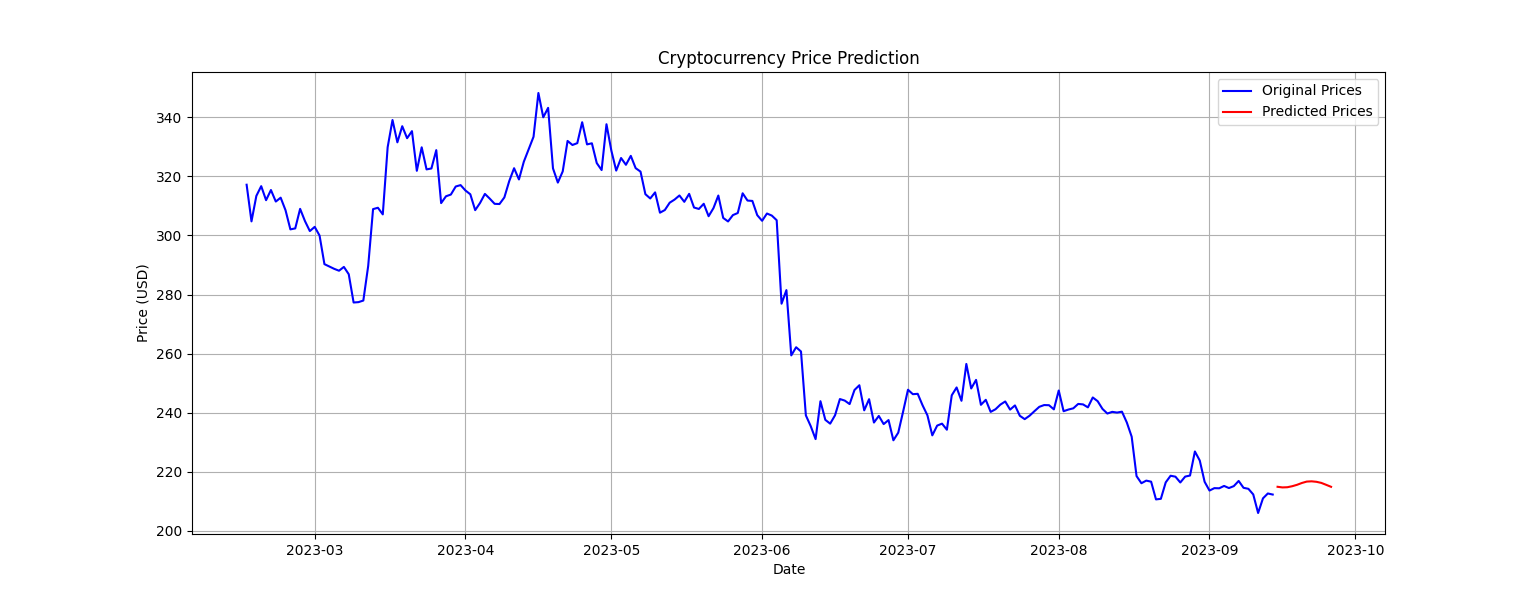

Fig. 4 is the display for ETH real price. The same as Bitcoin prediction, first operation used LSTM only and output in Fig. 5. Choosing CNN as deep learning model, the results are shown in Fig. 6. For a distinct contrast, this time LSTM, NN and CNN model were respectively implemented into the model. Table 3 lists the RMSE. After making a combination, the RMSE come to 23.704086446293193. At the time error is reducing, the prediction also become closer to the real one. Similarly, one repeated the previous steps and quickly got Fig. 7 for the difference between LSTM, NN and deep learning model (CNN) and Fig. 8 the result of hybrid model. The RMSE are given in Table 4.

Figure 5. Prediction of ETH based on NN (Photo/Picture credit: Original).

Figure 6. Prediction of ETH based on NN (Photo/Picture credit: Original).

Figure 7. Prediction of BNB based on 3 models (Photo/Picture credit: Original).

Figure 8. Prediction of BNB based on hybrid model (Photo/Picture credit: Original).

Table 4. Results of BNB

LSTM Root Mean Squared Error (RMSE) | 3.8873017731622457 |

Neural Network RMSE | 5.6289313152231655 |

CNN RMSE | 3.375349795465775 |

Ensemble RMSE | 2.8981956842802736 |

In this experiment, RMSE and the curve fitting are mainly used to evaluate the accuracy for model prediction ability. Through the results shown above, it can be found that, Neural Network model has the highest curve fitting among three models, while deep learning model generally gets the least RMSE. In contrast, most time LSTM model prediction seems to be smoother and more linear, which gives it more robustness than NN model. After comparing the RMSE for hybrid model of three dataset BTC, ETH and BNB, it was figured out that during the experiment, hybrid model took the least RMSE for most time. However, there are certainly some fluctuations that one single model may be that least one. After subsequent calculations, all three single model can sometimes reach to 90%, and the hybrid model can keep that of more than 90% in most time, which means the forecasted price of hybrid model is not so different from the actual one. This demonstrates the effectiveness of combining various deep learning techniques for cryptocurrency prediction. The results demonstrate the efficacy of combining LSTM, Neural Networks, and Deep Learning in predicting cryptocurrency prices. The hybrid model outperforms individual models, highlighting the benefits of leveraging multiple deep learning techniques. However, challenges remain, such as addressing rapid price fluctuations, "black swan" events, and data noise. By the way, the prediction price has a little contingency, it’s impossible to keep a stable output every time, so the data in table can only guarantee the most time it should be like. To make prediction curve closer to the actual one, machine learning is a good solution without the situation of high data volatility. Additionally, optimizing hyperparameters and incorporating external factors like macroeconomic indicators and news sentiment analysis could further enhance model performance.

4. Limitations and prospects

Based on the hybrid model, RMSE can be reduced to an acceptable value, the curve fitting is still a problem. When confronting a rapid price rocket or down, the technique of Neural Network and deep learning need time to study and give response. In addition, cryptocurrency markets are susceptible to unexpected events, often referred to as "black swan" events, that can have a profound and unpredictable impact on prices. The model may struggle to account for such events. Besides, the noise comes from the data, and deep learning model’s overfitting is also problem. Moreover, deep learning models have various hyperparameters, such as the number of layers, neurons, and learning rates. Tuning these hyperparameters to optimize model performance can be time-consuming and computationally expensive. Market dynamics cannot be dismissed, too. Cryptocurrency markets can exhibit unique dynamics that traditional financial markets do not have. These dynamics, such as pump-and-dump schemes and low liquidity in some assets, may not be adequately captured by the model.

As time passed by, there should be more advanced model which can also be combine with the current hybrid model, future models may incorporate more external factors such as macroeconomic indicators, news sentiment analysis, and regulatory developments. This broader view could lead to better predictions by accounting for a wider range of influences on cryptocurrency prices. And there will also be more historical available data, more data contribute to stronger robustness. Besides, cryptocurrency investors and traders can benefit from valuation prediction models as part of their risk management strategies. Improved models can help identify potential investment opportunities and risks more effectively. Relatively, the future outlooks of cryptocurrency prediction model cannot dispense with challenges. For example, the quality and reliability of historical cryptocurrency data can be questionable. Ensuring that the data used for training and testing models is accurate and representative of real market conditions is crucial. Furthermore, future advancements may require collaboration between data scientists, economists, and experts in blockchain technology to develop more holistic models that account for both market data and underlying blockchain fundamentals. The future of hybrid model holds promise for improved accuracy and usefulness. However, it also faces significant challenges related to market volatility, data quality, regulatory changes, and the need for more sophisticated modelling techniques. Researchers and practitioners in this field will continue to explore innovative approaches to address these challenges and enhance the predictive capabilities of models in the dynamic cryptocurrency landscape.

5. Conclusion

In this study, a hybrid model integrating Long Short-Term Memory (LSTM), Neural Networks (NN), and Deep Learning techniques was applied to predict cryptocurrency prices, focusing on Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). The hybrid model consistently outperformed individual models in terms of prediction accuracy, as measured by Root Mean Squared Error (RMSE). It significantly improved the accuracy of cryptocurrency price predictions for BTC, ETH, and BNB. Besides, the inclusion of LSTM, CNN, and NN models in the hybrid approach demonstrated the benefits of model diversity. LSTM exhibited smoother and more linear predictions, contributing to its robustness, while Neural Network models demonstrated superior curve fitting abilities. The hybrid model maintained high accuracy levels, even during periods of rapid price fluctuations. Each model contributed its unique strengths, enhancing the overall predictive capabilities. The hybrid model's success in predicting prices for BTC, ETH, and BNB suggests its potential universal applicability across various cryptocurrencies, making it a valuable tool for investors and traders. However, challenges remain in addressing rapid price fluctuations, unexpected "black swan" events, data noise, and the optimization of hyperparameters. The quality and reliability of historical cryptocurrency data also pose potential limitations. Future models may incorporate more external factors, such as macroeconomic indicators, news sentiment analysis, and regulatory developments, to provide a holistic view of cryptocurrency markets. Collaboration among data scientists, economists, and blockchain experts will be crucial in developing more robust models. In summary, the hybrid model combining LSTM, Neural Networks, and Deep Learning holds significant potential for enhancing cryptocurrency price prediction accuracy. It provides valuable insights for investors and traders seeking to navigate the rapidly evolving cryptocurrency market. However, ongoing research and development are essential to overcome challenges and further improve predictive capabilities in this dynamic and complex environment.

References

[1]. Rathee N, Singh A, Sharda T, et al. 2023 Knowledge and Information Systems vol 65 pp 4055–4084.

[2]. Cryptolization - cryptocurrency market cap analysis. Retrieved from: https:// cryptolization.com/.

[3]. Nakamoto S 2008 Decentralized business review vol 1 p 1.

[4]. Grinberg R 2011 Hast Sci Technol Law J vol 4 pp 160–207.

[5]. Wu C H, Lu C C, Ma Y F and Lu R S 2018 IEEE International Conference on Data Mining Workshops (ICDMW) pp 112-127.

[6]. Lei J R, and Lin Q H 2018 ISSN Reort vol 5(6) pp 95-100.

[7]. Rizwan M and Narejo S 2018 Proceedings of the 13th International Conference on Mathematics, Actuarial Science, Computer Science and Statistics (MACS) pp 140-145.

[8]. Spitzer M 2000 American Journal of Psychiatry vol 157(6) pp 1037-1038.

[9]. Saadat M N and Shuaib M 2020 Advances and Applications in Deep Learning vol 4 pp 3-4.

[10]. Fernández P L, Alaminos D, López P L and Fernández-Gámez M A 2020 Mathematics vol 8(8) p 1245.

[11]. Spilak B 2018 Deep neural networks for cryptocurrencies price prediction Master’s thesis of Humboldt-Universität zu Berlin,

[12]. Graves A 2013 arXiv preprint arXiv:1308.0850.

Cite this article

Xiang,Q. (2024). Cryptocurrency assets valuation prediction based on LSTM, neural network, and deep learning hybrid model. Applied and Computational Engineering,49,265-272.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Signal Processing and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Rathee N, Singh A, Sharda T, et al. 2023 Knowledge and Information Systems vol 65 pp 4055–4084.

[2]. Cryptolization - cryptocurrency market cap analysis. Retrieved from: https:// cryptolization.com/.

[3]. Nakamoto S 2008 Decentralized business review vol 1 p 1.

[4]. Grinberg R 2011 Hast Sci Technol Law J vol 4 pp 160–207.

[5]. Wu C H, Lu C C, Ma Y F and Lu R S 2018 IEEE International Conference on Data Mining Workshops (ICDMW) pp 112-127.

[6]. Lei J R, and Lin Q H 2018 ISSN Reort vol 5(6) pp 95-100.

[7]. Rizwan M and Narejo S 2018 Proceedings of the 13th International Conference on Mathematics, Actuarial Science, Computer Science and Statistics (MACS) pp 140-145.

[8]. Spitzer M 2000 American Journal of Psychiatry vol 157(6) pp 1037-1038.

[9]. Saadat M N and Shuaib M 2020 Advances and Applications in Deep Learning vol 4 pp 3-4.

[10]. Fernández P L, Alaminos D, López P L and Fernández-Gámez M A 2020 Mathematics vol 8(8) p 1245.

[11]. Spilak B 2018 Deep neural networks for cryptocurrencies price prediction Master’s thesis of Humboldt-Universität zu Berlin,

[12]. Graves A 2013 arXiv preprint arXiv:1308.0850.