1. Introduction

The US dollar is one of the world's most important reserve currencies and the main currency for international trade and investment. The Euro is a common currency among major European countries, guaranteeing and supporting EU integration. Its usage in international trade is second only to the US dollar [1]. The significance of studying the exchange rate between the U.S. dollar and the U.S. dollar is mainly reflected in two aspects. First, the exchange rate between the Euro and the U.S. dollar can reflect the strength of the European economy and the U.S. economy [2]. Using neural network models to predict exchange rate trends plays a significant role in a country's economic development; secondly, the Euro's exchange rate against the US dollar affects global trade and financial stability [3, 4]. Using neural network models to predict exchange rates can help investors make decisions.

In the global economy, currency exchange rates are vital [5]. In particular, the US dollar and the Euro, as the currencies of the two largest economies in the world, exchange rate changes have a profound impact on the global economy [6].

After analysis and research, the main factors affecting the US dollar/euro exchange rate mainly include the following aspects:

(1). International trade (US-EU import and export data). From 2000 to 2010, the Euro generally rose against the US dollar. During this period, the eurozone transitioned from a trade deficit to a trade surplus, while the United States has maintained a trade deficit [7].

(2). Interest rate differences (US/EU interest rate data). There is a high correlation between interest rates, inflation, and exchange rates. By manipulating interest rates, central banks can impact inflation and exchange rates, and changing interest rates affects inflation and the value of the currency [5].

(3). Economic growth (GDP data). Economic growth is also an important factor affecting exchange rates. If a country's economic growth is strong, the value of that country's currency is likely to rise (Erik, 2021). To sum up, the USD/EUR exchange rate is affected by multiple factors, and the formation process is complex and involves a considerable amount of data. The advantage of deep learning algorithms in predicting exchange rates lies in their ability to process large amounts of data, capture complex nonlinear relationships, and continuously adapt to market changes through automatic learning. Therefore, we use the backpropagation algorithm (BP) of deep learning to process numerous market data and form an exchange rate prediction model.

Using deep learning algorithms to predict the USD/EUR exchange rate can help us understand and predict global economic trends more accurately, thereby providing a valuable decision-making basis for investors, policymakers, and enterprises:

(1). Meaning for investors. Investors can predict exchange rate trends based on these factors and make more informed investment decisions [8]. For example, investors may purchase U.S. dollar assets if the U.S. dollar is expected to appreciate. Conversely, investors may sell dollar assets if the dollar is expected to depreciate [8].

(2). Meaning for policymakers. Policymakers can influence the exchange rate by adjusting these factors to achieve economic goals [9, 10]. For example, if policymakers want to increase the value of their currency, they may raise interest rates to attract foreign investment. In addition, policymakers can also use monetary policy tools (such as buying or selling foreign exchange reserves) to directly influence the exchange rate [9].

(3). Significance to enterprises. Based on these factors, enterprises can predict future exchange rate movements to better plan their global business [11]. For example, if a company expects the U.S. dollar to appreciate in the future, it may choose to buy U.S. dollars now to pay its U.S. dollar debt at a lower cost. In addition, exchange rate changes may also affect the company's competitiveness. For example, if a company's products are primarily sold in Europe and the Euro rises against the dollar, the company's products may become more competitive [11].

Overall, understanding the factors influencing the USD/EUR exchange rate and making predictions and decisions based on these factors is critical for investors, policymakers, and businesses.

2. Method and result

2.1. Data sources

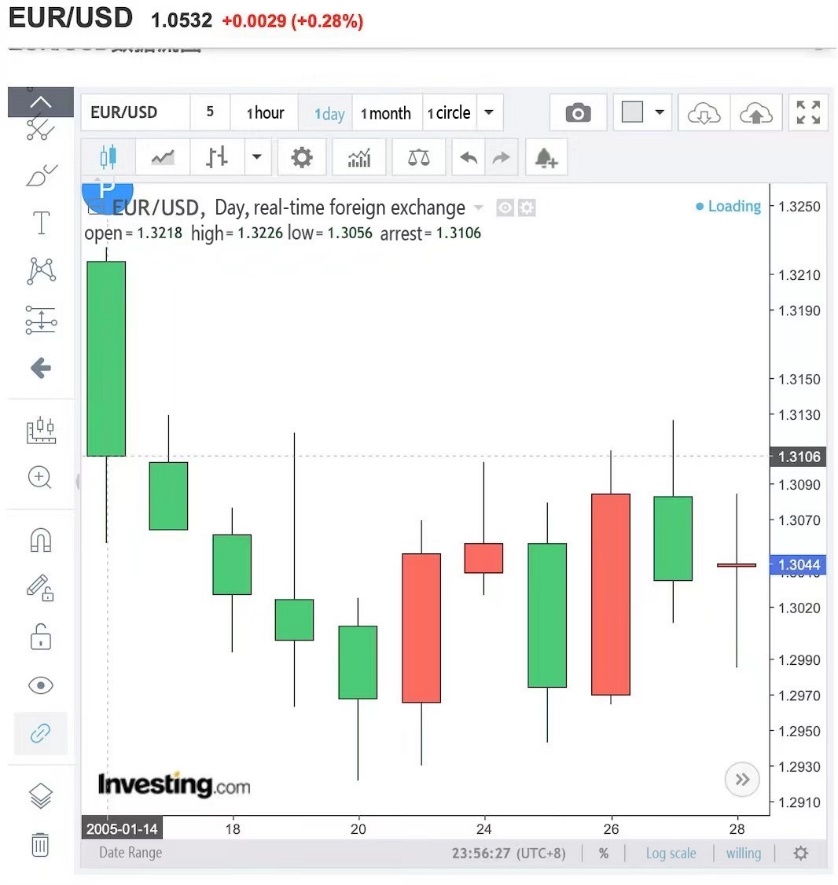

In this study, 5,000 pieces of historical closing price data of the EUR/USD from September 8, 2002 were downloaded from https://cn.investing.com/ and imported into MATLAB (Fig.1).

Figure 1. EUR/USD exchange rate data from January 14, 2005, to January 28, 2005.

2.2. Data preprocessing

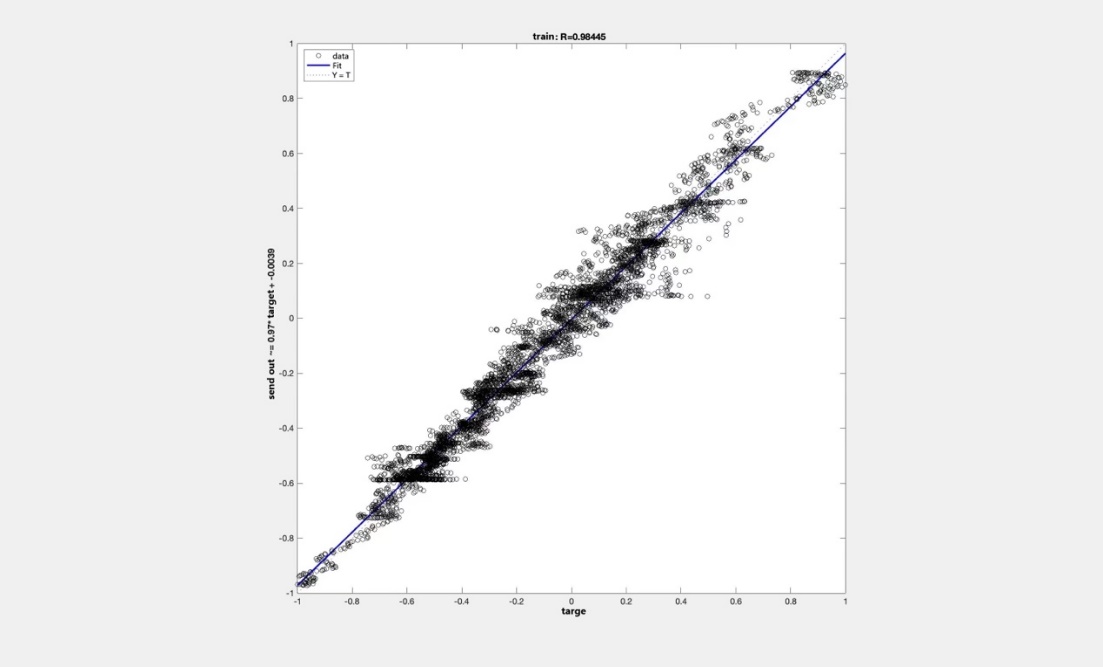

As shown in Fig. 2, normalizing the imported data to between -1 and 1 reduces the dimensions spanned by the data, improves the speed of finding the optimal solution, and is helpful for the calculation and training of neural networks.

Figure 2. Normalized function image.

2.3. Establish BP neural network model

BP neural network is a Multi-layer Feed-Forward Neural Network that uses error backward propagation algorithm training to adjust the weight of the neural network to minimize the gap between the model's output and the actual target. The BP neural network model was first proposed by scientists led by Rumelhart and McClelland in 1986 and has since gradually become one of the most widely used neural network models. The model has three layers: the input layer, the hidden layer, and the output layer. One neuron node in the input layer is only used to receive data, does not perform any operations on the data, and then passes it to the hidden layer. The hidden layer has twenty neuron nodes, each node is connected to the nodes of the previous and subsequent layers, processes and converts the data of the input layer, and then passes it to the output layer. The output layer has only one neuron node, which produces the final output, the model’s predicted value for the input data. Each neuron has an associated weight. Weights represent the strength of connections between neurons and can make model predictions more accurate. The bias is an additional input to the neuron, with a value of 1, and is used to control the activation state of the neuron. Activation functions introduce nonlinear properties into neural networks, mapping inputs to outputs. This study uses the hyperbolic tangent as a sigmoid activation function, effectively summoning the input value to the output value.

2.4. Model training

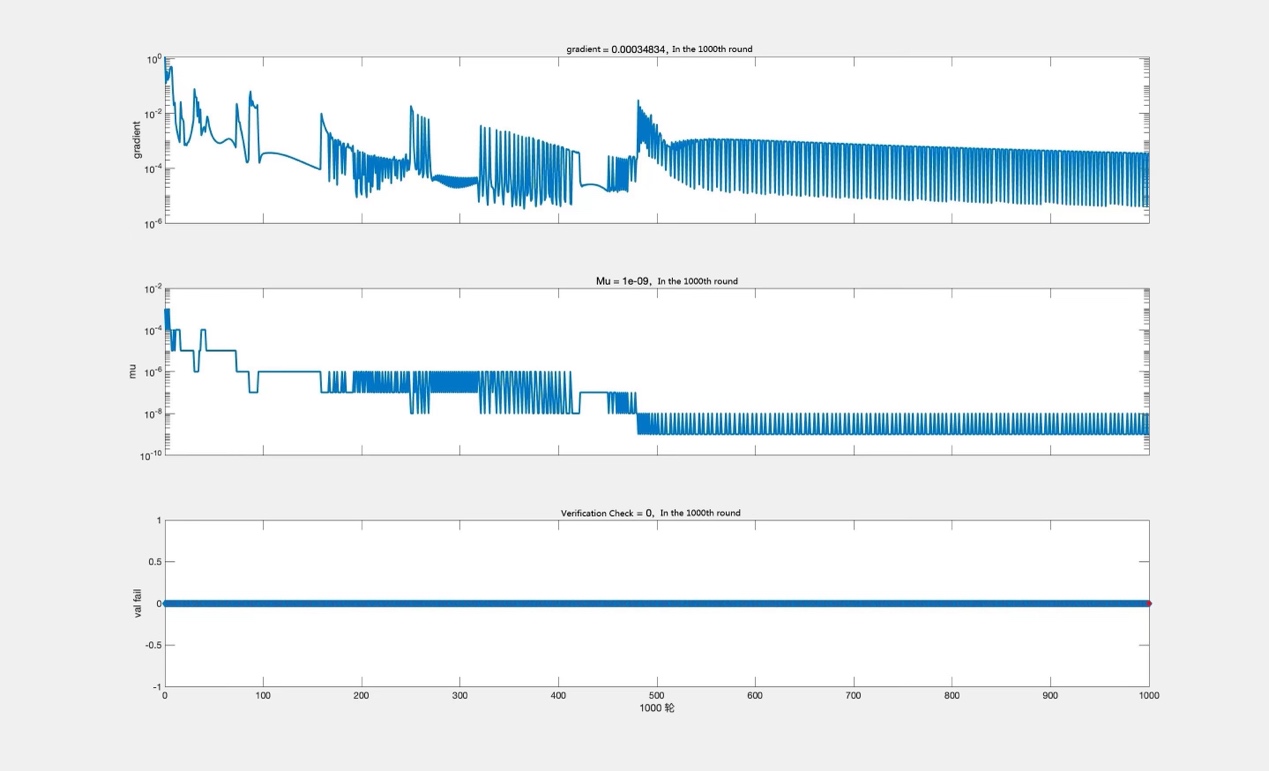

The training algorithm uses the Levenberg-Marquardt algorithm-based training function, which has the fastest convergence speed for medium-sized BP neural networks. Set the display interval to 50 and the learning rate to 0.01, which can control the training time of the model and prevent the model from oscillating. The momentum factor is set to 0.9 to avoid falling into a local minimum during model training. The number of learning times and learning goals are 1000 and 1e-7, respectively (Fig.3).

Figure 3. Training status of the model.

2.5. Model testing and evaluation

The mean square error is the loss function used in the BP algorithm. The mean square error can be used to measure the accuracy of the algorithm's prediction. The smaller the value, the higher the prediction accuracy of the model.

During the training process, the error accuracy of the neural network gradually decreases as the training iterations proceed. After 1000 iterations, the error accuracy of the model remains relatively stable.

3. Conclusion

This article uses the BP neural network algorithm based on the time series model to analyze and train the EUR/USD exchange rate sample data, aiming to accurately fit historical exchange rate values and predict future exchange rate trends. Through the experimental results, this article draws the following four conclusions:

First, the prediction ability of the neural network model: the model based on the BP neural network can effectively predict the price changes of the euro-dollar exchange rate. We can achieve high prediction accuracy by tuning the model activation function and learning rate.

Second, the reliability of the prediction results: the neural network model shows high reliability in predicting price changes in the EUR/USD exchange rate. However, it should be noted that since the exchange rate is affected by many factors, such as economic indicators, government policies, international trade, etc., changes in these external factors will have a more significant impact on the exchange rate.

Third, the importance of model optimization: tuning the model activation function and learning rate is crucial to improving prediction accuracy.

Fourth, suggestions for investors: Fluctuations in the euro's exchange rate against the U.S. dollar will affect foreign exchange transactions by multinational investors. The exchange rate trends predicted by the model can provide investors with trading references.

The above results show that the BP neural network model's prediction results for exchange rates are accurate, have minor errors, and can effectively help people judge exchange rate trends. However, the BP neural network model only uses a large amount of historical data for prediction and does not consider the economic, political, and other factors that affect the exchange rate, nor does it quantify them into the model. Therefore, it can only make short-term predictions when the external environment is relatively stable. The BP neural network model also has algorithmic flaws, such as slow convergence, easy fall into local minimums, unstable training results, etc., and its performance needs improvement. Further research can consider incorporating external factors into the model to improve the accuracy of predictions. It can explore other optimization methods, such as introducing more feature variables or using other neural network models. For investors, the prediction results of this model can be used as a reference factor in the decision-making process. The exchange rate market is complex and uncertain. It is recommended to consider multiple factors comprehensively, maintain a rational and calm mind, regularly evaluate the model's performance, and adjust and optimize investment strategies at any time to adapt to market changes. At the same time, seeking professional advice, such as that of an investment advisor, is recommended to help formulate a more comprehensive and personalized investment strategy.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Siddiqui K 2020 The US dollar and the world economy The US dollar and the world economy: Siddiqui Kalim

[2]. Chen F, Hao T 2023 The degree of RMB as an international anchor currency and its driving factors: an exchange rate perspective Applied Economics 1-21

[3]. Alonso-Monsalve S, Suárez-Cetrulo A L, Cervantes A, Quintana, D 2020 Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators Expert Systems with Applications 149 113250

[4]. Alameer Z, Abd Elaziz M, Ewees A A, Ye H, Jianhua Z 2019 Forecasting gold price fluctuations using improved multilayer perceptron neural network and whale optimization algorithm Resources Policy 61 250-260

[5]. Akbar M 2023 Effects of inflation uncertainty and exchange rate volatility on money demand in Pakistan: Bayesian econometric analysis International Journal of Finance & Economics 28 2 1470-1487

[6]. Konstantakis K N, Melissaropoulos I G, Daglis T, Michaelides P G 2023 The euro to dollar exchange rate in the Covid‐19 era: Evidence from spectral causality and Markov‐switching estimation International Journal of Finance & Economics 28 2 2037-2055

[7]. Erik N 2021/8/26 2023/10/10 Macroeconomic Drivers of the U.S. Dollar-Euro Exchange Rate CME Group https://www.cmegroup.com/education/featured-reports/macroeconomic-drivers-of-the-us-dollar-euro-exchange-rate.html

[8]. Tim V 2023/10/1 2023/10/15 EUR/USD Currency Cross, Corporate Finance Institute https://corporatefinanceinstitute.com/resources/foreign-exchange/euro-to-dollar-exchange-rate/

[9]. Herman A, Harris M, Hall D 2021 Global Exchange Rate Assessment Framework Methodology.

[10]. Christine L 2021 The international role of the euro European Central Bank

[11]. Alexander J 2019/11/9, 2023/10/10, How Do Exchange Rates Affect a Business? Market Business News https://marketbusinessnews.com/exchange-rates-affect-business/220335/

Cite this article

Deng,C.;Hu,Y.;Peng,C. (2024). A neural network model for predicting price changes of the exchange rate EUR/USD. Applied and Computational Engineering,51,231-236.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Signal Processing and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Siddiqui K 2020 The US dollar and the world economy The US dollar and the world economy: Siddiqui Kalim

[2]. Chen F, Hao T 2023 The degree of RMB as an international anchor currency and its driving factors: an exchange rate perspective Applied Economics 1-21

[3]. Alonso-Monsalve S, Suárez-Cetrulo A L, Cervantes A, Quintana, D 2020 Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators Expert Systems with Applications 149 113250

[4]. Alameer Z, Abd Elaziz M, Ewees A A, Ye H, Jianhua Z 2019 Forecasting gold price fluctuations using improved multilayer perceptron neural network and whale optimization algorithm Resources Policy 61 250-260

[5]. Akbar M 2023 Effects of inflation uncertainty and exchange rate volatility on money demand in Pakistan: Bayesian econometric analysis International Journal of Finance & Economics 28 2 1470-1487

[6]. Konstantakis K N, Melissaropoulos I G, Daglis T, Michaelides P G 2023 The euro to dollar exchange rate in the Covid‐19 era: Evidence from spectral causality and Markov‐switching estimation International Journal of Finance & Economics 28 2 2037-2055

[7]. Erik N 2021/8/26 2023/10/10 Macroeconomic Drivers of the U.S. Dollar-Euro Exchange Rate CME Group https://www.cmegroup.com/education/featured-reports/macroeconomic-drivers-of-the-us-dollar-euro-exchange-rate.html

[8]. Tim V 2023/10/1 2023/10/15 EUR/USD Currency Cross, Corporate Finance Institute https://corporatefinanceinstitute.com/resources/foreign-exchange/euro-to-dollar-exchange-rate/

[9]. Herman A, Harris M, Hall D 2021 Global Exchange Rate Assessment Framework Methodology.

[10]. Christine L 2021 The international role of the euro European Central Bank

[11]. Alexander J 2019/11/9, 2023/10/10, How Do Exchange Rates Affect a Business? Market Business News https://marketbusinessnews.com/exchange-rates-affect-business/220335/