1. Introduction

In the realm of corporate governance and sustainability, the fusion of Artificial Intelligence (AI) with Environmental, Social, and Governance (ESG) frameworks is forging new pathways for enhancing business strategies and operational efficiencies. This innovative integration is propelled by the need for companies to address increasingly stringent sustainability requirements and stakeholder expectations regarding corporate responsibility. AI technologies, especially deep learning and machine learning, are at the forefront of transforming the collection, analysis, and application of vast amounts of data to inform and improve ESG performance.

The application of AI in ESG models enables a multi-dimensional analysis of complex datasets, ranging from satellite imagery for environmental monitoring to sentiment analysis of social media for gauging public opinion. Such capabilities allow businesses to not only track and manage their ESG impacts more effectively but also predict future trends and challenges, enabling proactive rather than reactive strategies. This paper explores the significant advantages that AI-enhanced ESG models offer over traditional methods, including increased accuracy, speed, and scalability of data processing and analysis.

Through detailed discussions on the roles of convolutional neural networks in environmental analysis, natural language processing in social governance, and deep learning in compliance monitoring, this paper delves into how AI technologies are reshaping the ways in which corporate ESG efforts are strategized and implemented. This integration not only helps in adhering to regulatory requirements but also in fostering corporate innovation and sustainability, ultimately contributing to a stronger alignment between business operations and global sustainability goals [1]. This introduction sets the stage for a comprehensive analysis of the transformative impact of AI on ESG models, outlining the empirical data supporting AI's superiority and discussing the operational and ethical challenges encountered in its implementation.

2. Foundations of AI in ESG Models

2.1. The Role of Deep Learning in Environmental Analysis

Deep learning, particularly through the use of convolutional neural networks (CNNs), has revolutionized the field of environmental analysis within ESG frameworks, enabling more precise and predictive environmental management. CNNs are adept at interpreting complex image data from satellites and drones to monitor and analyze environmental phenomena such as deforestation rates, the spread of wildfires, or changes in water bodies. For example, CNNs can differentiate between various types of land use in satellite images, allowing for accurate monitoring of illegal deforestation activities or encroachments on protected areas [2]. Moreover, these networks can be trained on historical data to identify patterns and predict future environmental conditions, providing businesses with the capability to foresee and mitigate potential environmental risks. Advanced algorithms can process time-series data from sensors to predict pollution trends, which is crucial for industries like manufacturing and agriculture to comply with environmental regulations proactively. By integrating these predictive models into their operational strategies, enterprises not only adhere to environmental responsibilities but also optimize their resource use and reduce costs associated with environmental damage and subsequent remediations.

2.2. Enhancing Social Governance with Machine Learning

Machine learning, particularly through the use of natural language processing (NLP), plays a critical role in enhancing the social governance aspects of ESG. NLP techniques enable the automated analysis of vast amounts of unstructured textual data from social media feeds, news articles, and internal communications, providing insights into public sentiment and employee perceptions. This capability allows organizations to continually monitor and assess the social impact of their operations and public image. For instance, sentiment analysis algorithms can evaluate changes in public opinion following company announcements or during crisis events, enabling quicker and more effective response strategies [3]. Predictive analytics can also forecast potential social unrest or public relations crises by identifying patterns in sentiment trajectories. Furthermore, machine learning models analyze diversity and inclusivity metrics within organizations by processing HR data, helping to ensure fairness and equity in employment practices. These insights are invaluable for companies aiming to enhance their corporate social responsibility profiles and foster a positive workplace environment.

2.3. AI-Driven Governance and Compliance Monitoring

In governance and compliance monitoring, deep learning offers trans-formative capabilities that enhance the accuracy and efficiency of regulatory compliance checks and ethical audits. By employing deep neural networks trained on extensive databases of regulatory documents, legal precedents, and past compliance reports, AI systems can automatically monitor and analyze every transaction or communication for potential compliance issues or ethical breaches. For instance, anomaly detection models can identify irregular financial transactions that may indicate bribery or fraud, while classification models assess compliance of corporate actions against a changing regulatory landscape. These AI-driven systems provide continuous, real-time oversight, drastically reducing the lag between a compliance breach and its detection. Such capabilities are particularly important in industries heavily regulated or those that operate across multiple legal jurisdictions, where the complexity and volume of compliance requirements are substantial. The automation of these processes not only reduces the risk of penalties and legal challenges but also frees up resources that can be redirected towards strategic business initiatives.

3. Quantitative Analysis and Empirical Data

3.1. Data-Driven Insights for Strategic Planning

The integration of artificial intelligence into Environmental, Social, and Governance (ESG) models facilitates the transformation of vast arrays of raw data into actionable, strategic insights, crucial for informed decision-making at the corporate level. As figure 1 showing below, advanced statistical techniques, such as multiple regression analyses and decision trees, are utilized to dissect and quantify the relationships between various business strategies and their impacts on ESG performance indicators. For instance, regression models can reveal the strength and nature of the impact of renewable energy adoption on the environmental score of a company. Furthermore, scenario analysis employing Monte Carlo simulations offers a robust method for predicting the probabilistic outcomes of different strategic decisions under varying conditions [4]. This predictive capability enables companies to simulate numerous possible futures and select strategies that offer an optimal balance between enhancing ESG performance and achieving financial goals. The strategic use of these quantitative analyses not only assists in immediate tactical adjustments but also aids in long-term planning by forecasting future trends and preparing for potential regulatory changes and market demands.

Figure 1. Environmental, Social, and Governance Model (Source: corporatefinanceinstitute.com)

3.2. Model Accuracy and Validation Technique

Ensuring the accuracy and reliability of AI-driven ESG models is paramount for their successful implementation and acceptance within the business and regulatory communities. Various validation techniques are employed to attest to the predictive power and stability of these models. As table 1 showing below, cross-validation, particularly k-fold cross-validation, is extensively used to assess how the AI models generalize to an independent data set. This method involves partitioning the data into complementary subsets, training the models on one subset, and validating the results on another. Backtesting, another critical validation technique, involves testing the model using historical data to verify its predictive accuracy over time. This retrospective analysis helps in identifying overfitting issues and adjusting the model parameters accordingly. Moreover, continuous model tuning and updating are essential to adapt to dynamic market conditions, emerging ESG concerns, and new regulatory requirements. These processes ensure that the AI-driven ESG frameworks remain relevant and effective, thereby maintaining their integrity and utility in strategic decision-making [5].

Table 1. K-fold Cross-validation Process used to Validate the Performance of AI-driven ESG Models

Fold Number |

Training Set Size |

Validation Set Size |

Model Accuracy (%) |

Overfitting Detected |

1 |

800 |

200 |

92 |

No |

2 |

800 |

200 |

89 |

Yes |

3 |

800 |

200 |

91 |

No |

4 |

800 |

200 |

90 |

No |

5 |

800 |

200 |

88 |

Yes |

3.3. Benchmarking AI-Enhanced ESG Models Against Traditional Methods

To establish the superiority of AI-enhanced ESG models over traditional assessment methods, comprehensive bench-marking studies are conducted. These studies compare the newly developed AI models against conventional methods on several fronts, including time-to-insight, predictive accuracy, and cost efficiency. For example, the time-to-insight metric measures the speed at which insights are generated from data, a crucial factor for timely decision-making. AI models, known for their rapid data processing capabilities, significantly reduce the time-to-insight compared to manual methods. Predictive accuracy is evaluated through statistical tests that measure the closeness of the model predictions to actual outcomes, with AI models often surpassing traditional methods due to their ability to learn complex patterns in large datasets. Cost efficiency analyses consider the total cost of employing AI models, including development, implementation, and maintenance, against the savings and improvements they bring to ESG assessments [6]. These bench marking studies not only provide empirical evidence of the benefits of adopting AI-driven methods but also serve as a valuable guide for companies planning to transition from traditional ESG assessment techniques to more advanced AI-enhanced systems, highlighting the improvements in efficiency, accuracy, and scalability that AI technologies offer.

4. Implementation Challenges and Solutions

4.1. Addressing Data Quality and Integration Issues

One of the primary obstacles in deploying AI-enhanced ESG models efficiently is the challenge associated with the quality and integration of data from multiple sources. The integrity and reliability of data inputs directly influence the accuracy of AI predictions and insights. To mitigate issues of data inconsistency, incompleteness, and inaccuracy, sophisticated data preprocessing techniques are crucial. Data cleansing involves identifying and correcting errors and inconsistencies, while normalization adjusts the data attributes to a common scale without distorting differences in the ranges of values. Furthermore, data transformation, such as aggregation or disaggregation, enhances the usability of the data in modeling. Advanced data warehousing solutions are also essential, enabling the consolidation of data from disparate sources into a unified format. These technologies not only support large-scale data handling but also ensure that data remains coherent across the enterprise. Implementing such comprehensive data management strategies allows for the development of a robust foundation for AI models, enhancing the reliability and effectiveness of AI-driven ESG assessments.

4.2. Overcoming Computational Constraints

The computational intensity of deep learning models, especially those required for detailed ESG analytics, presents significant challenges. These models often require substantial computational power to process and learn from large datasets effectively. Cloud computing has emerged as a pivotal solution by providing scalable and on-demand computational resources. Utilizing cloud services allows enterprises to access advanced GPU architectures that are crucial for the accelerated training of deep learning models. Moreover, distributed computing techniques can distribute the computational load across multiple machines, further enhancing processing efficiency [7]. To optimize the models' computational demands, techniques such as model pruning, which reduces the complexity of deep learning networks by trimming non-critical network parameters, and quantization, which reduces the precision of the numerical parameters, can be applied. These strategies decrease the computational load while maintaining performance, ensuring that deep learning models are both effective and efficient in real-world applications.

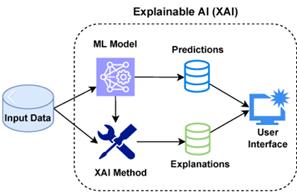

4.3. Ethical AI and Transparency

As AI technologies play an increasingly central role in ESG decision-making, ethical considerations and transparency become critical. The opaque nature of some AI models can obscure the rationale behind their predictions, complicating efforts to validate and trust AI-driven decisions. To counteract this, the adoption of explainable AI (XAI) techniques is crucial. As figure 2 explaining below, XAI helps clarify the decision-making processes within AI models, providing stakeholders with understandable and interpretable explanations of the models’ operations. This transparency is vital for maintaining stakeholder trust and for meeting regulatory compliance standards that demand clear documentation of decision-making processes. Moreover, maintaining ethical AI practices requires regular audits of AI models to ensure they do not inadvertently perpetuate biases or result in unfair outcomes, particularly in managing social governance. Regular ethical reviews and the development of governance frameworks focused on AI use are essential for guiding AI deployment in a manner that aligns with corporate social responsibility and ethical standards [8]. These measures ensure that AI-driven initiatives within ESG frameworks are not only effective and efficient but also equitable and transparent, fostering trust and facilitating broader acceptance and integration of AI solutions in corporate strategies.

Figure 2. Explainable AI Input Mechanism (Source: mdpi.com)

5. Conclusion

The integration of AI with ESG models provides significant advantages in terms of enhanced analytical capabilities, improved predictive accuracy, and increased operational efficiency. This paper has demonstrated that AI technologies not only facilitate a deeper understanding of ESG factors but also enable businesses to respond more effectively to environmental and social challenges. By addressing the computational and ethical challenges associated with AI implementation, companies can leverage these technologies to foster greater transparency, compliance, and corporate responsibility. The future of corporate sustainability lies in the strategic integration of AI, as it holds the potential to transform traditional ESG assessment methods into dynamic, efficient, and ethically sound decision-making tools. As AI continues to evolve, its application in ESG frameworks is expected to become more nuanced and indispensable, offering a competitive edge to companies committed to sustainable and responsible business practices.

References

[1]. Škapa, S., Bočková, N., Doubravský, K., & Dohnal, M. (2023). Fuzzy confrontations of models of ESG investing versus non-ESG investing based on artificial intelligence algorithms. Journal of Sustainable Finance & Investment, 13(1), 763-775.

[2]. Xu, J. (2024). AI in ESG for Financial Institutions: An Industrial Survey. arXiv preprint arXiv:2403.05541.

[3]. Del Vitto, A., Marazzina, D., & Stocco, D. (2023). ESG ratings explainability through machine learning techniques. Annals of Operations Research, 1-30.

[4]. de Souza Barbosa, A., da Silva, M. C. B. C., da Silva, L. B., Morioka, S. N., & de Souza, V. F. (2023). Integration of Environmental, Social, and Governance (ESG) criteria: their impacts on corporate sustainability performance. Humanities and Social Sciences Communications, 10(1), 1-18.

[5]. Pu, X., Zeng, M., & Zhang, W. (2023). Corporate sustainable development driven by high-quality innovation: Does fiscal decentralization really matter?. Economic Analysis and Policy, 78, 273-289.

[6]. Duman, G. M., & Kongar, E. (2023). ESG Modeling and Prediction uncertainty of electronic waste. Sustainability, 15(14), 11281.

[7]. Costantiello, A., & Leogrande, A. (2023). The Role of Political Stability in the Context of ESG Models at World Level. Available at SSRN 4406997.

[8]. Gazman, V. D. (2023). A new criterion for the ESG model. Green and Low-Carbon Economy, 1(1), 22-27.

Cite this article

Feng,S. (2024). Leveraging artificial intelligence to enhance ESG models: Transformative impacts and implementation challenges. Applied and Computational Engineering,69,37-42.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Computing and Data Science

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Škapa, S., Bočková, N., Doubravský, K., & Dohnal, M. (2023). Fuzzy confrontations of models of ESG investing versus non-ESG investing based on artificial intelligence algorithms. Journal of Sustainable Finance & Investment, 13(1), 763-775.

[2]. Xu, J. (2024). AI in ESG for Financial Institutions: An Industrial Survey. arXiv preprint arXiv:2403.05541.

[3]. Del Vitto, A., Marazzina, D., & Stocco, D. (2023). ESG ratings explainability through machine learning techniques. Annals of Operations Research, 1-30.

[4]. de Souza Barbosa, A., da Silva, M. C. B. C., da Silva, L. B., Morioka, S. N., & de Souza, V. F. (2023). Integration of Environmental, Social, and Governance (ESG) criteria: their impacts on corporate sustainability performance. Humanities and Social Sciences Communications, 10(1), 1-18.

[5]. Pu, X., Zeng, M., & Zhang, W. (2023). Corporate sustainable development driven by high-quality innovation: Does fiscal decentralization really matter?. Economic Analysis and Policy, 78, 273-289.

[6]. Duman, G. M., & Kongar, E. (2023). ESG Modeling and Prediction uncertainty of electronic waste. Sustainability, 15(14), 11281.

[7]. Costantiello, A., & Leogrande, A. (2023). The Role of Political Stability in the Context of ESG Models at World Level. Available at SSRN 4406997.

[8]. Gazman, V. D. (2023). A new criterion for the ESG model. Green and Low-Carbon Economy, 1(1), 22-27.