1. Introduction

Dynamic pricing is an indispensable tool for businesses operating in volatile markets, enabling them to adjust prices in response to real-time demand fluctuations and competitive pressures. The essence of dynamic pricing lies in leveraging sophisticated analytical techniques to predict demand accurately and optimize pricing strategies. This paper examines the convergence of demand forecasting methods, such as time-series analysis, regression models, and machine learning, with competitive analysis frameworks to enhance dynamic pricing efficacy. Time-series analysis provides a foundation for understanding past trends and predicting future demand by decomposing data into trend, seasonality, and random fluctuations. ARIMA models are central to this approach, offering robust predictions based on historical data patterns. Regression models extend this analysis by incorporating multiple variables and their interactions, moving beyond simple linear relationships to capture the complexities of market dynamics. Techniques like Ridge, Lasso, and Elastic Net regression address issues of multicollinearity and improve model generalizability. Machine learning algorithms have transformed demand forecasting, uncovering intricate patterns in vast datasets that traditional methods might overlook. Decision trees, random forests, gradient boosting, and neural networks offer powerful tools for capturing non-linear relationships and temporal dependencies, enhancing the precision of demand predictions. By integrating machine learning with traditional forecasting methods, businesses can achieve a more nuanced understanding of demand drivers. Competitive analysis further informs dynamic pricing strategies by providing insights into market behaviors and competitor actions. Market scanning techniques gather real-time data on competitors’ pricing strategies, while price elasticity analysis and competitor behavior modeling help businesses anticipate market reactions and adjust their strategies accordingly [1]. Optimization algorithms, such as linear programming, genetic algorithms, and simulated annealing, refine pricing decisions, ensuring that they align with business goals and market conditions. Revenue management techniques like yield management and overbooking are crucial for industries with perishable goods and services, balancing supply and demand to maximize revenue. This paper aims to provide a comprehensive framework for integrating these diverse methodologies into a cohesive dynamic pricing strategy, enabling businesses to respond swiftly to market changes and maintain a competitive edge.

2. Time-Series Analysis

2.1. Theoretical Foundations and Technological Advancements

Time-series analysis in demand forecasting is not just about observing past trends but involves rigorous statistical methods to predict future demand accurately. The fundamental technique involves decomposing time-series data into its constituent components: trend, seasonality, and random fluctuations. Trends indicate the long-term movement in data, which could be upward or downward, reflecting growth or decline in demand. Seasonality captures periodic fluctuations influenced by external factors such as seasons, holidays, or cyclical events. Random fluctuations account for irregular variations that cannot be attributed to trend or seasonality. Autoregressive Integrated Moving Average (ARIMA) models are a cornerstone in time-series analysis. These models function by considering the relationship between an observation and a number of lagged observations (autoregressive part), as well as the relationship between an observation and a lagged forecast error (moving average part) [2]. The integrated part of ARIMA allows for differencing the data series to achieve stationarity, which is crucial for making reliable predictions. Businesses use ARIMA models to fit historical data and then project future values. For instance, a retailer might use ARIMA to forecast monthly sales, adjusting for seasonal spikes during holidays. The model’s accuracy depends on the appropriate selection of parameters (p, d, q), representing autoregressive order, differencing degree, and moving average order respectively. Advanced applications might integrate ARIMA with other models or machine learning techniques to enhance predictive power, addressing the limitations of linear assumptions inherent in traditional ARIMA models.

2.2. Regression Models

Regression models in demand forecasting extend beyond simple linear relationships, delving into complex interactions between multiple variables. Linear regression, while foundational, provides a baseline understanding of how changes in one variable, such as price, impact demand. However, real-world scenarios often exhibit non-linearities and interactions that linear models cannot capture. For instance, the effect of a price change might be different at various levels of marketing expenditure. To address these complexities, businesses often employ multiple regression models, incorporating various independent variables like price, advertising spend, and economic indicators (e.g., GDP growth, inflation rates). Interaction terms in these models allow the effect of one variable to depend on the level of another variable [3]. Polynomial regression extends this by fitting a non-linear equation to the data, which can better capture the curvature in relationships between variables. For example, a polynomial regression model might reveal that moderate price increases boost demand up to a certain point, after which further increases lead to a decline. Beyond polynomial terms, advanced regression techniques such as Ridge, Lasso, and Elastic Net regression incorporate regularization to handle multicollinearity and improve model generalizability. These techniques penalize large coefficients, thus preventing overfitting and enhancing the model’s predictive accuracy. In practice, businesses use regression models to forecast demand under various scenarios, optimizing pricing and marketing strategies based on the predicted outcomes. These models can be integrated into decision support systems, providing dynamic recommendations as new data becomes available.

3. Competitive Analysis

3.1. Price Elasticity

Price elasticity of demand is a pivotal metric in pricing strategy, measuring the responsiveness of demand to price changes. To estimate price elasticity accurately, businesses typically analyze historical sales data using econometric models. The basic formula for price elasticity of demand (PED) is:

\( PED=\frac{\%change in quantity demanded}{\%change in price} \) (1)

This calculation helps businesses understand whether their products are elastic (sensitive to price changes) or inelastic (insensitive to price changes). For example, if a 10% price decrease leads to a 20% increase in quantity demanded, the product has an elasticity of -2, indicating high sensitivity. To deepen the analysis, businesses might employ advanced methods such as panel data analysis, which accounts for both cross-sectional and time-series variations [4]. This method allows for the differentiation between short-term and long-term elasticity, providing a more nuanced understanding of demand behavior. Additionally, controlled experiments, such as A/B testing, can be conducted where different pricing strategies are applied to comparable customer segments to observe variations in demand. For instance, an e-commerce platform might randomly offer a 5% discount to half of its users and a 10% discount to the other half, analyzing the resultant changes in purchase volumes. Consumer surveys and conjoint analysis are also valuable tools for estimating price elasticity. These methods involve collecting primary data directly from consumers about their purchasing preferences and price sensitivity. Conjoint analysis, in particular, helps in understanding how consumers value different attributes of a product, including price. By presenting consumers with various product profiles and price combinations, businesses can derive the utility values associated with each attribute, leading to precise elasticity estimates. Understanding price elasticity enables businesses to optimize their pricing strategies, ensuring that price adjustments maximize revenue without adversely affecting demand. For instance, if a product is found to be highly elastic, a slight reduction in price could significantly boost sales volumes, enhancing overall profitability. Conversely, for inelastic products, businesses might raise prices with minimal impact on demand, thus increasing margins. These insights are crucial for implementing effective dynamic pricing strategies that adapt to market conditions while optimizing financial performance.

3.2. Competitor Behavior Modeling

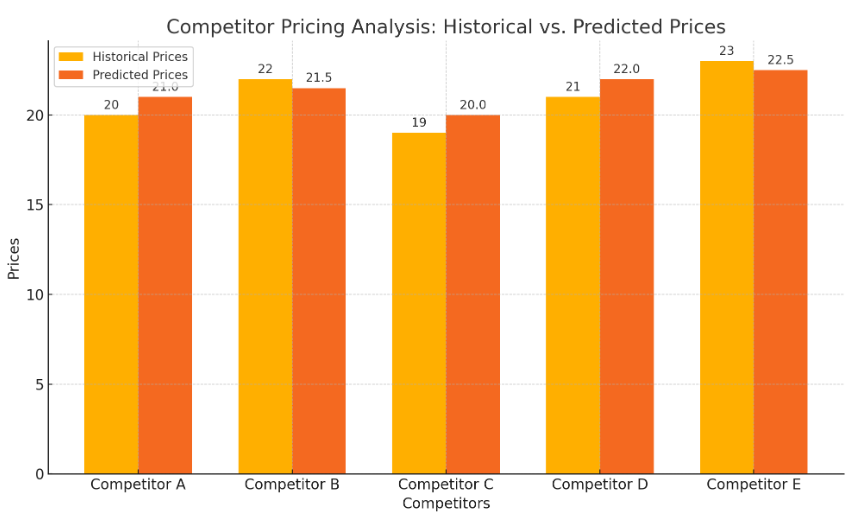

Competitor behavior modeling involves sophisticated techniques to predict competitors' pricing actions and strategize accordingly. Game theory provides a theoretical framework for analyzing competitive interactions, where businesses are seen as players in a game, making strategic decisions based on the anticipated actions of others. Key concepts such as Nash Equilibrium and dominant strategies help businesses understand stable states in competitive markets where no player can unilaterally change their strategy for better outcomes. For practical implementation, businesses might use agent-based modeling (ABM), which simulates interactions of autonomous agents (competitors) to assess their collective impact on the market. Each agent in the model operates under a set of rules derived from historical data and strategic assumptions. For example, an ABM might simulate a scenario where multiple retailers adjust their prices in response to a market leader's price cut, analyzing the ripple effects on market share and profitability. These models can incorporate machine learning techniques to enhance predictive accuracy. Historical pricing data and competitive behaviors are fed into machine learning algorithms such as neural networks or support vector machines, which learn complex patterns and interactions. For instance, a neural network might be trained to predict competitors' pricing moves based on past behaviors and external factors like economic indicators or promotional events. By integrating competitor behavior modeling with market scanning data, businesses can anticipate potential price wars and identify market gaps.

Figure 1. Competitor Pricing Analysis: Historical vs. Predicted Prices

Table 1. Competitor Pricing Analysis: Historical vs. Predicted Prices

Competitor | Historical Prices | Predicted Prices |

Competitor A | 20 | 21 |

Competitor B | 22 | 21.5 |

Competitor C | 19 | 20 |

Competitor D | 21 | 22 |

Competitor E | 23 | 22.5 |

Figure 1 visually compares the historical prices of each competitor with their predicted prices in Table 1, based on sophisticated modeling techniques such as agent-based modeling and machine learning [5].

4. Price Optimization

4.1. Optimization Algorithms

Optimization algorithms are integral to the development and implementation of effective dynamic pricing strategies. These algorithms include linear programming, genetic algorithms, and simulated annealing, each offering unique advantages in solving complex pricing problems. Linear programming (LP) is used to achieve the best outcome in a mathematical model whose requirements are represented by linear relationships. In the context of pricing, LP can be used to maximize revenue or profit while adhering to constraints such as production capacity, budget limits, and market demand. The objective function, which needs to be maximized or minimized, could represent the total profit or revenue, while constraints ensure that pricing strategies do not violate practical limitations. For example, a company might use LP to determine the optimal prices for a portfolio of products, ensuring that the combined prices maximize overall profit while meeting production and budget constraints. Genetic algorithms (GAs) are search heuristics inspired by the process of natural selection. They are particularly useful for optimization problems with a large search space and complex, non-linear relationships. In dynamic pricing, GAs can be employed to explore various pricing strategies, evolving solutions over successive generations to find the most effective pricing model. The algorithm starts with a population of potential solutions (pricing strategies) and applies crossover, mutation, and selection operators to evolve these solutions. For instance, a retailer could use GAs to optimize pricing across multiple products and time periods, continuously improving the pricing strategy to adapt to changing market conditions [6].

4.2. Revenue Management

Table 2. Hotel Overbooking Analysis: Balancing Bookings, No-Shows, and Cancellations to Maximize Occupancy

Date | Total Bookings | Expected No-Shows | Expected Cancellations | Available Rooms | Overbooked Units |

2024-05-01 | 100 | 10 | 5 | 90 | 5 |

2024-05-02 | 120 | 12 | 8 | 100 | 8 |

2024-05-03 | 150 | 15 | 10 | 130 | 10 |

2024-05-04 | 140 | 14 | 9 | 120 | 11 |

2024-05-05 | 160 | 16 | 11 | 140 | 9 |

2024-05-06 | 110 | 11 | 6 | 95 | 9 |

2024-05-07 | 130 | 13 | 7 | 110 | 10 |

2024-05-08 | 180 | 18 | 12 | 150 | 12 |

2024-05-09 | 170 | 17 | 11 | 145 | 12 |

2024-05-10 | 200 | 20 | 15 | 170 | 15 |

Revenue management is a strategic approach that uses dynamic pricing to maximize revenue from perishable goods and services, such as airline seats, hotel rooms, and event tickets. The key techniques employed in revenue management include yield management and overbooking, both of which balance supply and demand to optimize revenue. Yield management involves adjusting prices in real-time based on demand forecasts and market conditions. This technique is widely used in industries with fixed capacities and perishable inventory, such as airlines and hotels. By analyzing booking patterns, historical data, and market trends, businesses can adjust prices to maximize revenue. For instance, an airline might increase prices for popular flights during peak travel times while offering discounts for off-peak periods to fill seats. Advanced yield management systems leverage machine learning algorithms to predict demand more accurately and adjust prices accordingly. These systems analyze vast amounts of data, including booking trends, competitive pricing, and external factors such as economic indicators, to optimize pricing decisions in real-time. Overbooking is a strategy used to compensate for no-shows and cancellations, ensuring that capacity is utilized to its fullest potential. Businesses analyze historical data on no-show rates and cancellations to determine the optimal number of overbooked units. Table 2 showcases an overbooking analysis for a hotel A. This table includes data on historical booking rates, no-show rates, cancellations, and the final overbooked units to ensure maximum capacity utilization [7].

5. Conclusion

In conclusion, the integration of time-series analysis, regression models, machine learning algorithms, and competitive analysis provides a robust framework for enhancing dynamic pricing strategies. By leveraging these advanced analytical techniques, businesses can achieve more accurate demand forecasts, optimize pricing decisions, and maintain competitiveness in rapidly changing markets. Time-series analysis and ARIMA models offer foundational insights into past trends and future demand, while regression models capture the complexities of variable interactions. Machine learning algorithms uncover intricate patterns in large datasets, providing a deeper understanding of demand drivers. Competitive analysis informs strategic decisions by anticipating market behaviors and competitor actions. Optimization algorithms refine pricing strategies, ensuring alignment with business goals and market conditions. Finally, revenue management techniques like yield management and overbooking maximize revenue from perishable goods and services.

Contribution

Qinxia Ma and Shujie Feng: Conceptualization, Methodology, Data curation, Writing- Original draft preparation, Visualization, Investigation.

References

[1]. Shin, Dongwook, Stefano Vaccari, and Assaf Zeevi. "Dynamic pricing with online reviews." Management Science 69.2 (2023): 824-845.

[2]. Sarkar, Malay, et al. "Optimizing E-Commerce Profits: A Comprehensive Machine Learning Framework for Dynamic Pricing and Predicting Online Purchases." Journal of Computer Science and Technology Studies 5.4 (2023): 186-193.

[3]. Varma, Sushil Mahavir, et al. "Dynamic pricing and matching for two-sided queues." Operations Research 71.1 (2023): 83-100.

[4]. Sanders, Robert Evan. "Dynamic pricing and organic waste bans: A study of grocery retailers’ incentives to reduce food waste." Marketing Science 43.2 (2024): 289-316.

[5]. Aparicio, Diego, and Kanishka Misra. "Artificial intelligence and pricing." Artificial intelligence in marketing (2023): 103-124.

[6]. Schittekatte, Tim, et al. "Electricity retail rate design in a decarbonizing economy: an analysis of time-of-use and critical peak pricing." The Energy Journal 45.3 (2024): 25-56.

[7]. Sarfarazi, Seyedfarzad, et al. "An optimal real-time pricing strategy for aggregating distributed generation and battery storage systems in energy communities: A stochastic bilevel optimization approach." International Journal of Electrical Power & Energy Systems 147 (2023): 108770.

Cite this article

Ma,Q.;Feng,S.;Liu,J. (2024). Dynamic pricing and demand forecasting: Integrating time-series analysis, regression models, machine learning, and competitive analysis. Applied and Computational Engineering,93,149-154.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Machine Learning and Automation

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shin, Dongwook, Stefano Vaccari, and Assaf Zeevi. "Dynamic pricing with online reviews." Management Science 69.2 (2023): 824-845.

[2]. Sarkar, Malay, et al. "Optimizing E-Commerce Profits: A Comprehensive Machine Learning Framework for Dynamic Pricing and Predicting Online Purchases." Journal of Computer Science and Technology Studies 5.4 (2023): 186-193.

[3]. Varma, Sushil Mahavir, et al. "Dynamic pricing and matching for two-sided queues." Operations Research 71.1 (2023): 83-100.

[4]. Sanders, Robert Evan. "Dynamic pricing and organic waste bans: A study of grocery retailers’ incentives to reduce food waste." Marketing Science 43.2 (2024): 289-316.

[5]. Aparicio, Diego, and Kanishka Misra. "Artificial intelligence and pricing." Artificial intelligence in marketing (2023): 103-124.

[6]. Schittekatte, Tim, et al. "Electricity retail rate design in a decarbonizing economy: an analysis of time-of-use and critical peak pricing." The Energy Journal 45.3 (2024): 25-56.

[7]. Sarfarazi, Seyedfarzad, et al. "An optimal real-time pricing strategy for aggregating distributed generation and battery storage systems in energy communities: A stochastic bilevel optimization approach." International Journal of Electrical Power & Energy Systems 147 (2023): 108770.