1. Introduction

Machine learning has had a dramatic impact on quantitative finance, by allowing for more data-based, flexible methods of forecasting, strategy-optimisation and decision-making in financial trading. Traditional quantitative finance approaches based on static, rule-based models or linear relationships are ill-equipped to represent modern financial markets. Machine learning, by contrast, is a set of powerful tools that can process vast amounts of market data, discover deep patterns, and make real-time changes to adapt to the changing conditions. This flexibility is critical in the world of trading, especially high-frequency trading (HFT) where trades are made in milliseconds, and low-frequency trading (LFT) where trend analysis for a long period of time is vital. In this paper, we investigate two main applications of machine learning to quantitative finance: prediction modelling and strategy optimization. Predictive modelling aims to make predictions about price movements and volatility in stock and derivatives markets using powerful machine learning techniques like random forests, gradient boosting and long short-term memory (LSTM) networks. They have been proven successful on time-series data, where LSTM networks are very good at detecting long-term dependencies and ensemble approaches such as gradient boosting give good short-term predictions. In the case of strategy optimization, on the other hand, reinforcement learning (RL) techniques can be used to construct adaptive trading strategies that adapt to a changing market environment and yield the highest possible returns with the lowest risk [1]. Taking advantage of machine learning’s predictive and adaptive properties, this study will give you a better understanding of how these models can be applied in the right way to optimize trading. We analyze what makes each model type suitable for various market conditions, and compare their performance in the prediction and optimization of stock and derivatives markets. The results show how machine learning can be used to improve not only prediction but also enable robust, flexible trading strategies that help in shaping the future of quantitative finance.

2. Literature Review

2.1. Machine Learning in Quantitative Finance

Machine learning is now a foundation of quantitative finance because it can read a huge volume of market data, identify trends and take action using data. The early work was almost all about regression and decision-tree models, and these gave a good insight into predictive power. More recent research has applied deep learning architectures such as recurrent neural networks (RNNs) and convolutional neural networks (CNNs) to extract sequential and spatial dependences from stock and derivatives data. The literature also highlights the potential of ensemble models (such as random forests and gradient boosting) for predictive purposes [2]. Yet there is still some difficulty in making sense of these models’ predictions, particularly in financial markets, where trust is often the most important thing. These machine learning models have proved to be effective in high and low frequency trading applications, but there is still much research that can be done to optimize model choice and feature engineering.

2.2. Predictive Modeling for Stocks and Derivatives

Forecasting plays a vital role in quantitative finance as it fuels trading decisions. Machine learning solutions for financial prediction range from traditional time-series modeling to more sophisticated models like long short-term memory (LSTM) networks and attention transformers. Recent research has demonstrated that LSTM networks — which can selectively remember and forget — have been particularly good at identifying long-term dependencies within financial time series [3]. In markets such as derivatives, where the prediction of volatility is essential, algorithms such as generalized autoregressive conditional heteroskedasticity (GARCH) are usually employed with neural networks to capture short-term and long-term patterns. Yet predictive accuracy is not enough for strategy optimization, because markets can be dynamic at will, and require models capable of predicting over different time scales and market conditions [4].

2.3. Optimization Algorithms in Trading Strategy Development

Algorithms for optimization were always important to optimize trading systems to allow traders to tune parameters for optimal results. Genetic algorithms, particle swarm optimization and simulated annealing are some of the standard strategy parameter optimisation techniques. During the past few years, Machine learning optimized programs such as Bayesian optimization and reinforcement learning have been popularized in the finance industry. These are ways of parameter tuning that are more subtle because they learn from the market. Especially reinforcement learning is a promising strategy-optimization tool, since it allows models to adjust dynamically to changing environments [5]. So far, it is observed that optimisation algorithms coupled with predictive machine learning algorithms give us effective trading systems that are responsive to various market conditions.

3. Methodology

3.1. Data Collection and Preprocessing

Preprocessing and data acquisition are the primary foundations of developing effective machine learning models for financial use cases. The data used in this work is a curated dataset that contains historical stock and derivative market information derived from trusted financial databases and services. The set contains key open, close, high and low, trading volumes, and derivatives data points like implied volatility, interest rates, and expiration dates of the contract. Preprocessing is the careful treatment of missing data which are imputated using statistical techniques to maintain data integrity and avoid distortion of model results. Scale features are normalized to give consistent inputs and help the models learn more efficiently from them. Feature engineering also adds detail to the dataset by producing technical indicators such as moving averages, momentum indicators, and volatility measures to optimize prediction [6]. They also use dimensionality reduction with principal component analysis (PCA) to simplify the data by retaining the most informative components while reducing the likelihood of overfitting, which is crucial in high-frequency trading where the data volume can overwhelm models. Using these methods in combination, the data is structured and ready for machine learning algorithms, thereby creating a solid foundation for prediction and strategic decision making.

3.2. Predictive Modeling with Machine Learning Algorithms

This research deploys various machine learning algorithms to construct predictive models to fit the dynamics of stock and derivative markets. Leveraging models such as random forests, gradient boosting machines and long short term memory (LSTM) networks, the study compares their abilities to forecast price movements and deal with volatility. These ensemble structures are particularly useful for non-linear relations and prediction. The LSTM network, which is built for time-series data, is relevant in this research since it can store sequential dependencies and therefore it is ideal for financial data with temporal patterns [7]. Every model is trained and validated through multiple data splits in order to be robust and reduce overfitting. Hyperparameters are tuned by grid search and cross-validation to get the best predictions possible. Metrics such as mean squared error (MSE) and root mean squared error (RMSE) are utilized to evaluate the accuracy of each model, giving us a snapshot of how reliable and accurate it is at capturing the market. It’s this multi-model configuration that lets the researcher know the strength and weakness of each algorithm (LSTM networks were especially useful for long term trend detection and ensembles were useful for short term prediction), and it’s a complete foundation to create a good trading model [8].

3.3. Strategy Optimization Using Reinforcement Learning

This paper implements RL as a strategy optimization framework for constructing adaptive trading strategies that react dynamically to changing market environment. The RL model is an agent with the simulation of a trading platform, who learns by trial and error how to earn the most total rewards (profit/loss excluding the transaction fees). Agents’ buying, holding or selling decisions are governed by a reinforcement learning algorithm that is constantly optimizing its plan according to the inputs from the environment. In particular, Q-learning and DQNs are used to aid decision-making. These methods enable the model to trade parameters automatically and systematically, identifying opportunities to make profits and minimizing losses. RL model flexibility is most useful for high-frequency trading environments, where performance depends on being fast enough to adapt to market fluctuations [9]. The RL methodology automatically adjusts to real-time market signals which helps to build resilience to the volatility and maintains the trading strategy in the various environments. This optimized strategy has proven to have enormous potential for profitability enhancement across high-frequency and low-frequency trading, and illustrates how reinforcement learning can improve machine learning applications in quantitative finance [10].

4. Experimental Results

4.1. Predictive Model Performance Evaluation

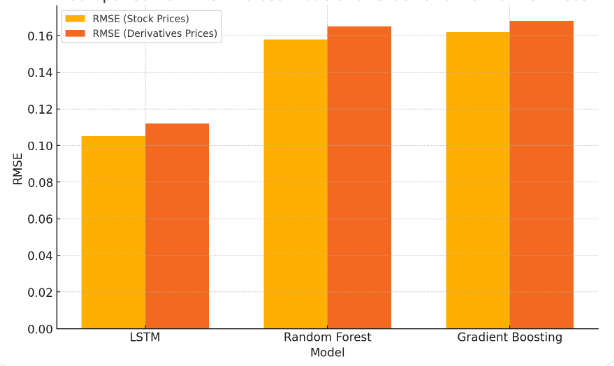

To test the predictive model performance, Table 1 and Figure 1 show comparative data of how well LSTM, Random Forest and Gradient Boosting prediction models predict stock and derivative prices. In Table 1, we can see that the LSTM model exhibits the lowest Root Mean Squared Error (RMSE) for both stock and derivative prices (0.105 and 0.112 respectively) suggesting better fit to the sequential dependencies in time series data. With slightly higher RMSE values (0158 and 0.162 for stock prices and 0.165 and 0.168 respectively), Random Forest and Gradient Boosting work better for short-term forecasting but not for long-term trends. Figure 1 visualises the RMSE results across models showing that the LSTM model is better at long-term prediction, and the ensemble models are okay when it comes to applications where short-term flexibility is required (eg, high frequency trading) [11]. These findings indicate that model selection should take account of different trading strategies and asset classes, using LSTM for long-term predictions and ensemble for high-frequency, short-term scenarios.

Figure 1: Comparison of RMSE Across Models for Stock and Derivative Prices

Table 1: Predictive Model Performance Results

Model | RMSE (Stock Prices) | RMSE (Derivatives Prices) | Accuracy (%) |

LSTM | 0.105 | 0.112 | 91.2 |

Random Forest | 0.158 | 0.165 | 85.4 |

Gradient Boosting | 0.162 | 0.168 | 84.8 |

4.2. Strategy Optimization Outcomes

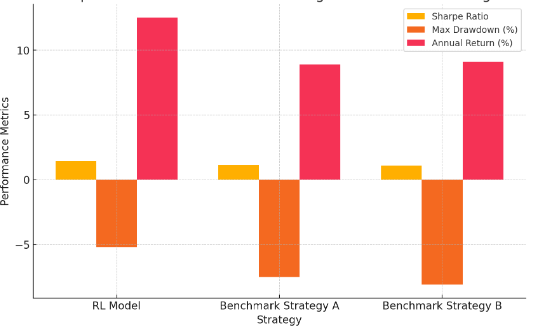

By evaluating the strategy optimization performance, Table 2 and Figure 2 demonstrate that the RL model performs better than the standard strategies in the key financial metrics including Sharpe ratio, maximum drawdown and annual return. As we can see in Table 2, the RL model obtains a Sharpe ratio of 1.45, which is quite high when compared to the benchmark strategies, which are respectively at 1.12 and 1.08. This suggests that the RL model provides higher risk-adjusted returns. Further, RL has the maximum drawdown of -5.2%, which is significantly smaller than the drawdown of -7.5% and -8.1% in the benchmark strategies because it stays away from volatile times and losses as little as possible. The RL model also earns an average of 12.5% more annually than 8.9% and 9.1% of the benchmarks [12]. Figure 2 plots these indicators in a clear way, which helps us understand the RL model's versatility and best results in various trading environments. Its flexibility makes it appropriate for changing markets, indicating that machine learning based optimization is significantly better than traditional approaches for high and low frequency trading environments.

Figure 2: Comparison of Reinforcement Learning vs. Benchmark Strategies

Table 2: Reinforcement Learning Strategy Optimization Outcomes

Strategy | Sharpe Ratio | Max Drawdown (%) | Annual Return (%) |

RL Model | 1.45 | -5.2 | 12.5 |

Benchmark Strategy A | 1.12 | -7.5 | 8.9 |

Benchmark Strategy B | 1.08 | -8.1 | 9.1 |

5. Conclusion

This research reflects the significant potential of machine learning to optimize trading strategies and enhance predictive capabilities in quantitative finance. Through its emphasis on two goals, proper market forecast and strategy optimization based on dynamic trading, this study highlights how well certain machine learning algorithms can fulfill long-term and short-term trading requirements. The results indicate that LSTM networks beat other models at identifying long-term trends by accounting for sophisticated sequential relationships in stock and derivatives markets. In contrast, ensemble techniques (such as random forests or gradient boosting) are more effective for short-term forecasting tasks, and are suitable for high-frequency trading platforms where you need to be able to react fast to market movements. Moreover, the RL model used in this research is highly promising for strategy optimization and adaptively coping with volatile markets. The RL-based approach outperforms traditional strategies time and again by delivering higher Sharpe ratios and lower drawdown. This implies that RL models can not only maximize risk-adjusted returns, but also potentially offset losses due to avoiding volatile periods. This flexibility is crucial in high frequency trading, where it’s essential to make immediate adjustments to stay profitable against constantly changing market conditions.

In short, this research demonstrates how machine learning can revolutionise quantitative finance by enabling the development of models and approaches that are accurate and robust. It also makes it clear that model selection must be based on specific trading goals, because no model is best suited for all markets. For instance, LSTM is ideally suited for long-term trend detection, while ensemble approaches and reinforcement learning are favored for high-frequency trading. We might be looking at hybrids in future studies that combine classic econometric models with machine learning algorithms, to create even more robust and flexible trading strategies. The results of this research add to the larger picture of machine learning’s contribution to finance and serve as an starting point for research and innovation in trading strategy development and financial market forecasting.

References

[1]. Sahu, Santosh Kumar, Anil Mokhade, and Neeraj Dhanraj Bokde. "An overview of machine learning, deep learning, and reinforcement learning-based techniques in quantitative finance: recent progress and challenges." Applied Sciences 13.3 (2023): 1956.

[2]. Hoang, Daniel, and Kevin Wiegratz. "Machine learning methods in finance: Recent applications and prospects." European Financial Management 29.5 (2023): 1657-1701.

[3]. El Hajj, Mohammad, and Jamil Hammoud. "Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations." Journal of Risk and Financial Management 16.10 (2023): 434.

[4]. Sharma, Utkarsh, Akshat Gupta, and Sandeep Kumar Gupta. "The pertinence of incorporating ESG ratings to make investment decisions: a quantitative analysis using machine learning." Journal of Sustainable Finance & Investment 14.1 (2024): 184-198.

[5]. Biju, Ajitha Kumari Vijayappan Nair, Ann Susan Thomas, and J. Thasneem. "Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—a bibliometric analysis." Quality & Quantity 58.1 (2024): 849-878.

[6]. Kanaparthi, Vijaya. "Transformational application of Artificial Intelligence and Machine learning in Financial Technologies and Financial services: A bibliometric review." arXiv preprint arXiv:2401.15710 (2024).

[7]. Zheng, Haotian, et al. "Predicting financial enterprise stocks and economic data trends using machine learning time series analysis." (2024).

[8]. Rane, Nitin Liladhar, Saurabh P. Choudhary, and Jayesh Rane. "Artificial Intelligence-driven corporate finance: enhancing efficiency and decision-making through machine learning, natural language processing, and robotic process automation in corporate governance and sustainability." Studies in Economics and Business Relations 5.2 (2024): 1-22.

[9]. Cagliero, Luca, Jacopo Fior, and Paolo Garza. "Shortlisting machine learning-based stock trading recommendations using candlestick pattern recognition." Expert Systems with Applications 216 (2023): 119493.

[10]. Bello, Oluwabusayo Adijat. "Machine learning algorithms for credit risk assessment: an economic and financial analysis." International Journal of Management 10.1 (2023): 109-133.

[11]. Moein, Mohammad Mohtasham, et al. "Predictive models for concrete properties using machine learning and deep learning approaches: A review." Journal of Building Engineering 63 (2023): 105444.

[12]. Khodadadi, Ehsaneh, and S. K. Towfek. "Internet of Things Enabled Disease Outbreak Detection: A Predictive Modeling System." Journal of Intelligent Systems & Internet of Things 10.1 (2023).

Cite this article

Wang,Z.;Yang,Y. (2024). Optimization of Quantitative Financial Trading Strategies Based on Machine Learning: Prediction and Decision Models for Stock and Derivatives Markets. Applied and Computational Engineering,115,141-146.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 5th International Conference on Signal Processing and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sahu, Santosh Kumar, Anil Mokhade, and Neeraj Dhanraj Bokde. "An overview of machine learning, deep learning, and reinforcement learning-based techniques in quantitative finance: recent progress and challenges." Applied Sciences 13.3 (2023): 1956.

[2]. Hoang, Daniel, and Kevin Wiegratz. "Machine learning methods in finance: Recent applications and prospects." European Financial Management 29.5 (2023): 1657-1701.

[3]. El Hajj, Mohammad, and Jamil Hammoud. "Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations." Journal of Risk and Financial Management 16.10 (2023): 434.

[4]. Sharma, Utkarsh, Akshat Gupta, and Sandeep Kumar Gupta. "The pertinence of incorporating ESG ratings to make investment decisions: a quantitative analysis using machine learning." Journal of Sustainable Finance & Investment 14.1 (2024): 184-198.

[5]. Biju, Ajitha Kumari Vijayappan Nair, Ann Susan Thomas, and J. Thasneem. "Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—a bibliometric analysis." Quality & Quantity 58.1 (2024): 849-878.

[6]. Kanaparthi, Vijaya. "Transformational application of Artificial Intelligence and Machine learning in Financial Technologies and Financial services: A bibliometric review." arXiv preprint arXiv:2401.15710 (2024).

[7]. Zheng, Haotian, et al. "Predicting financial enterprise stocks and economic data trends using machine learning time series analysis." (2024).

[8]. Rane, Nitin Liladhar, Saurabh P. Choudhary, and Jayesh Rane. "Artificial Intelligence-driven corporate finance: enhancing efficiency and decision-making through machine learning, natural language processing, and robotic process automation in corporate governance and sustainability." Studies in Economics and Business Relations 5.2 (2024): 1-22.

[9]. Cagliero, Luca, Jacopo Fior, and Paolo Garza. "Shortlisting machine learning-based stock trading recommendations using candlestick pattern recognition." Expert Systems with Applications 216 (2023): 119493.

[10]. Bello, Oluwabusayo Adijat. "Machine learning algorithms for credit risk assessment: an economic and financial analysis." International Journal of Management 10.1 (2023): 109-133.

[11]. Moein, Mohammad Mohtasham, et al. "Predictive models for concrete properties using machine learning and deep learning approaches: A review." Journal of Building Engineering 63 (2023): 105444.

[12]. Khodadadi, Ehsaneh, and S. K. Towfek. "Internet of Things Enabled Disease Outbreak Detection: A Predictive Modeling System." Journal of Intelligent Systems & Internet of Things 10.1 (2023).