1. Introduction

In the context of global warming, the issue of greenhouse gas emissions has become the focus of attention of the international community, and reducing carbon emissions has become a global consensus [1].As a key pillar of global trade, the shipping industry is responsible for about 90% of the world's cargo movements [2],And it accounts for a significant proportion of the world's total emissions, making the shipping industry a key focus area in carbon reduction actions [3].

The European Union Emissions Trading System (EU ETS) is an important policy tool for the EU to actively respond to climate change and effectively reduce carbon dioxide emissions [4]. According to EU Regulation 2023/957, the shipping industry will be officially included in the EU ETS in 2024, requiring the greenhouse gas emissions generated by merchant fleets calling at EU ports of more than 5,000 gross tons to call at EU voyages. In this situation, China's shipping industry urgently needs to make a scientific response and accelerate the low-carbon transformation.

Recently, the EU has formulated a systematic strategy in three stages to promote carbon emission reduction in shipping, of which the third stage focuses on the introduction of market mechanisms for medium and long-term control [5]。As an important part of the market mechanism, carbon emission trading works on the principle that enterprises buy less or sell more than enough in the carbon market according to carbon emission allowances and their own emission needs, so as to achieve the goal of internalizing external environmental costs. Once the mechanism is fully implemented, it will undoubtedly have a far-reaching impact on the business model and economic benefits of shipping enterprises.

Based on this, this paper will conduct an in-depth study on the strategic choices of traditional shipping companies and sustainable shipping companies in carbon allowance trading in the context of EU carbon emission trading reform, aiming to provide a scientific theoretical basis for the shipping industry to cope with this change and help the shipping industry achieve low-carbon and sustainable development.

2. Model building

2.1. Problem description

This paper analyzes the incentives and profits of the two shipping companies in the baseline scenario before the implementation of the EU ETS and in the two scenarios after the implementation of the EU ETS, so as to obtain the optimal solutions of the two scenarios and analyze and compare them. The first scenario is called the "baseline scenario", in which shipping companies are not subject to the EU ETS and the arm's length scenario. Without ETS and emissions premiums, traditional shipping companies can compete with sustainable shipping companies in the market. The second scenario is the "co-operative scenario", where traditional shipping companies enter into cooperative arrangements with sustainable shipping companies by purchasing EUAs and impose restrictions on EUS transactions between shipping companies. In summary, industry pooling agreements within the shipping industry are not mutually exclusive with the EU ETS in general.

2.2. Description of the symbol

Table 1: Main parameters and their basic meanings

symbol | description |

\( B \) | Baseline scenario |

\( C \) | Collaborative scenarios |

\( T \) | Traditional shipping companies |

\( E \) | Sustainable shipping company |

\( i \) | Shipping companies \( i∈\lbrace T,E\rbrace \) |

\( {q_{T}} \) | Demand from traditional shipping lines |

\( {q_{E}} \) | Demand from sustainable shipping companies |

\( {π_{T}} \) | The profit function of a traditional shipping company |

\( {π_{E}} \) | The profit function of a sustainable shipping company |

\( a \) | The market potential of shipping companies |

\( b \) | Customer demand is price sensitive to shipping lines, |

\( {c_{i}} \) | Unit shipping costs for shipping lines |

\( P \) | The shipping price per unit of demand |

\( K \) | Free EUA for sustainable shipping companies |

\( ρ \) | Free EUA for traditional shipping companies |

\( δ \) | The market price of the EUA |

\( λ \) | EUA rates between shipping lines |

2.3. Baseline scenario

In this paper, we have the following inverse demand functions for traditional shipping companies and sustainable shipping companies, which are expressed as:

\( P=a-b({q_{T}}+{q_{E}}) \) (1)

\( Q={q_{T}}+{q_{E}} \) (2)

where \( b \gt 0 \) represents the reciprocal of the price elasticity of demand, and \( \frac{1}{b} \) represents the sensitivity of the demand for shipping services to price changes.

The unit transportation costs of traditional and sustainable shipping companies are \( {c_{T}} \) and \( {c_{E}} \) , respectively, and their fixed costs are ignored. The two shipping companies operate independently, constituting an oligopoly with Gounod competition. The profit function of the two shipping companies has the following form:

\( π_{T}^{B}=(P-{c_{T}}){q_{T}} \) (3)

\( π_{E}^{B}=(P-{c_{E}}){q_{E}} \) (4)

Let \( \frac{∂π_{E}^{B}}{∂{p_{E}}}=0,\frac{∂π_{T}^{B}}{∂{p_{T}}}=0 \) , obtain the equilibrium volume of the two shipping companies:

\( q_{T}^{B}=\frac{a+{c_{E}}-2{c_{T}}}{3b} \) (5)

\( q_{E}^{B}=\frac{a+{c_{T}}-2{c_{E}}}{3b} \) (6)

Substituting the above equation into the inverse demand function, the market equilibrium freight rate of the two shipping companies is obtained:

\( {P^{B}}=\frac{a+{c_{T}}+{c_{E}}}{3} \) (7)

As a result, the profits for both traditional and sustainable shipping companies are:

\( π_{T}^{B}=\frac{(a+{c_{E}}-2{c_{T}}{)^{2}}}{9b} \) (8)

\( π_{E}^{B}=\frac{(a+{c_{T}}-2{c_{E}}{)^{2}}}{9b} \) (9)

2.4. Collaborative scenarios

In the cooperation scenario, sustainable shipping companies have a surplus of carbon allowances, while traditional shipping companies have a deficit of allowances. As a result, sustainable shipping companies can sell their surpluses to traditional shipping companies. Traditional shipping companies buy EUAs from sustainable shipping companies. To strengthen emissions reduction efforts within the industry, it is assumed that shipping companies should first purchase EUAs from other shipping lines. Only when all of the sustainable shipping company's quota surplus has been bought can a traditional shipping company buy EUAs from other sectors of the ETS market. As a result, this cooperation agreement between shipping companies helps to pool emissions and reduce the average carbon emissions of the industry.

In addition to paying a premium to compensate for excess carbon emissions, traditional shipping companies can also purchase EUAs from sustainable shipping companies and then from the ETS market to neutralize their excess emissions that exceed EU ETS standards. This can reduce greenhouse gas emissions across the industry. To construct this corresponding market structure, the profit function of traditional and sustainable shipping companies is expressed as follows:

\( π_{T}^{C1}=(P-{c_{T}}){q_{T}}-λ({q_{T}}-ρ) \) (10)

\( π_{E}^{C1}=(P-{c_{E}}){q_{E}}+λ({q_{T}}-ρ) \) (11)

where \( λ \) is the EUA price between shipping lines and \( δ \) is the market price of the EUA in the ETS market. Note that shipping companies can only trade EUAs, i.e., \( λ≥δ \) , at prices equal to or higher than the market price, which prevents shipping lines from exchanging EUAs at lower prices and charging higher prices. After purchasing \( K-{q_{E}} \) from this sustainable shipping company, the traditional shipping company still has an \( ({q_{T}}-ρ-K+{q_{E}}) \) -unit EUA deficit. In this case, the sustainable shipping company must buy the EUA deficit on the ETS market at the market price. The equilibrium result is:

\( q_{T}^{C1}=\frac{a+{c_{E}}-2{c_{T}}-2λ}{3b} \) (12)

\( q_{E}^{C1}=\frac{a+{c_{T}}-2{c_{E}}+λ}{3b} \) (13)

\( {P^{C1}}=\frac{a+{c_{E}}+{c_{T}}+λ}{3} \) (14)

\( π_{T}^{C1}=\frac{(a+{c_{E}}-2{c_{T}}-2λ{)^{2}}}{9b}+λρ \) (15)

\( π_{E}^{C1}=\frac{(a-2{c_{E}}+{c_{T}}+λ{)^{2}}+3λ(a+{c_{E}}-2{c_{T}}-2λ)-9bλρ}{9b} \) (16)

3. Numerical analysis

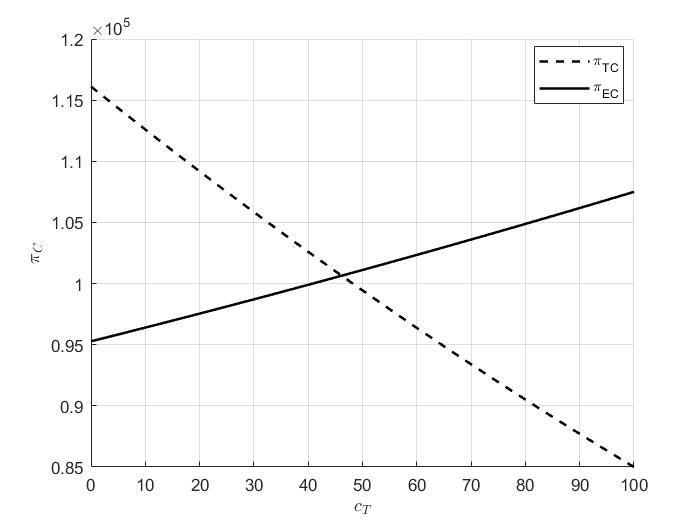

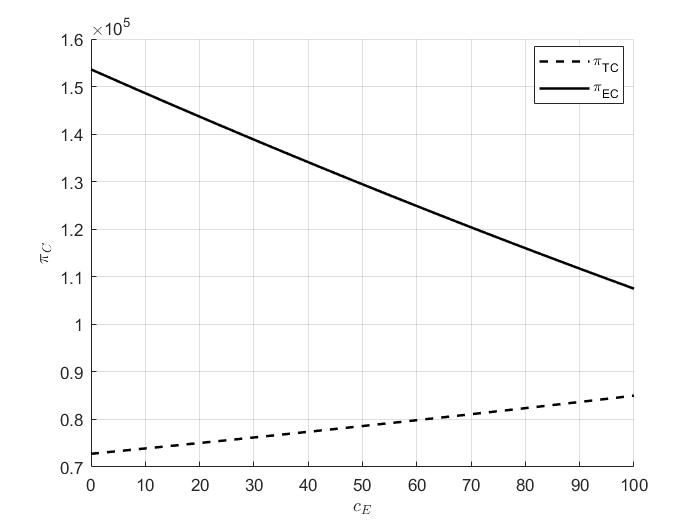

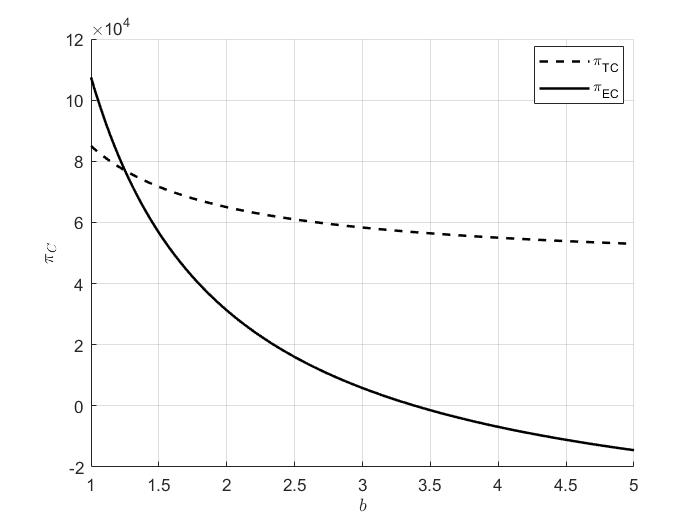

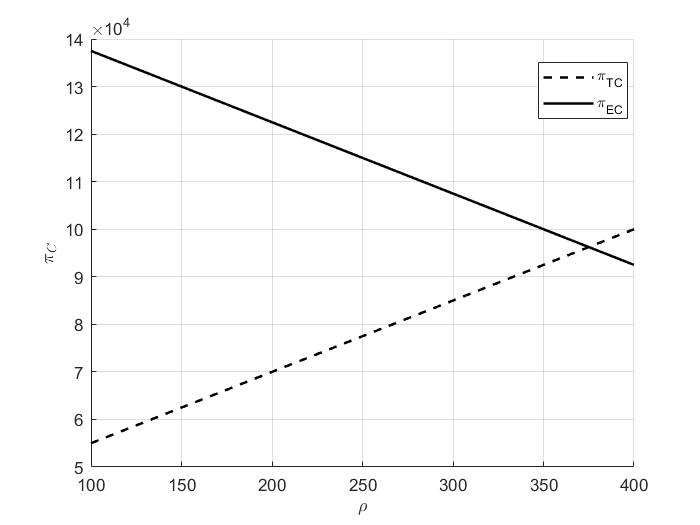

The numerical simulation analysis of the decision variables in the game model was carried out by MATLAB to further verify the correctness of the model parameter analysis results and analyze the potential impact of EU ETS on the shipping industry.

Before the numerical analysis, the values need to be initialized and assigned according to the constraints of the two game strategies:

\( a=100,b=1,{c_{T}}=100,{c_{E}}=100,δ=100,λ=150,ρ=300 \) .Sensitivity analysis is then performed on variable \( b∈(1,5) \) separately, where the sensitivity of customer demand to shipping company prices \( {c_{T}}∈(0,100) \) , the unit transportation cost of traditional shipping companies \( {c_{E}}∈(0,100) \) , the unit transportation cost of sustainable shipping companies \( λ∈(0,150),ρ∈(100.400) \) , and the EUA price E between shipping companies are assumed.

Next, we will focus on the impact of each parameter under the cooperation strategy on the equilibrium profit of the two shipping companies. As shown in Figure 1, parameters such as the price of EUA and the free carbon allowance \( ρ \) of traditional shipping companies are particularly critical to the impact of the two shipping companies under the cooperation strategy. When within a certain range, there are different mechanisms of action for the volume and profits of traditional and sustainable shipping companies. For traditional shipping companies, a higher \( λ \) will increase the cost of purchasing EUA, thereby reducing the volume and profits; For sustainable shipping companies, under certain conditions (iwhen \( 0 \lt λ≤\frac{5a-{c_{E}}+4{c_{T}}-9bρ}{10} \) ), the increase may lead to an increase in profits, as they can make more money by selling EUAs. In practice, this requires both parties to reach a reasonable agreement on the price of the EUA transaction to achieve the sustainability of the cooperation.

The change in \( ρ \) also has an important impact on both sides. The increase in free carbon allowances for traditional shipping companies will reduce their carbon emission costs and increase profits, but at the same time, it may reduce the incentive to cooperate with sustainable shipping companies. For sustainable shipping companies, the increase in traditional shipping companies may reduce their EUA sales revenue, impacting profits. This is reflected in the actual operation, policymakers need to comprehensively consider the impact on cooperation and competition in the industry when allocating free carbon allowances, promote the overall low-carbon transformation and healthy development of the shipping industry, guide traditional shipping companies and sustainable shipping companies to achieve optimal allocation and coordinated development of resources under the carbon emission trading system, and promote the shipping industry towards a green and sustainable future.

|

|

|

|

Figure 1: Impact of \( {c_{T}},{c_{E}},b,ρ \) on \( π_{T}^{C} \) and \( π_{E}^{C} \) in cooperative scenarios

4. Conclusion

This article focuses on the impact of the reform of the EU ETS on the shipping industry and its countermeasures, with the core purpose of helping China's shipping industry to respond to the reform scientifically and achieve low-carbon transformation. This study analyzes the business decisions and profit changes of shipping companies through benchmark scenarios, marketization scenarios and cooperation scenario models. The study finds that after the implementation of the carbon emission trading policy, the profits of traditional shipping companies generally decrease under the marketization and cooperation scenarios, which is mainly attributed to the increase in operating costs of purchasing emission allowances. In contrast, sustainable shipping companies are significantly more profitable due to lower carbon emissions and the benefits they can benefit from carbon trading. Especially in the cooperation scenario, when the market price of EUA and the transaction price between shipping companies meet certain conditions, the cooperation strategy of traditional shipping companies and sustainable shipping companies will change significantly, which highlights the key role of price factors in cooperation decisions.

For China's shipping industry, the reform of the EU ETS is both a serious challenge and a rare opportunity. In the short term, traditional shipping companies can adapt their operations, but in the long term, they must accelerate the pace of transition to low carbon. Specifically, we should actively cooperate with sustainable shipping companies to learn from their advanced emission reduction technologies and experience to reduce carbon emissions; Increase investment in technology research and development, explore alternative fuel applications such as liquefied natural gas (LNG) and energy-saving technology innovations to improve energy efficiency; The government and industry associations should also play an important role in improving the formulation of relevant policies and regulations, promoting the construction of the carbon trading market in the shipping industry, strengthening international cooperation and exchanges, jointly responding to the challenges of global climate change, realizing the green and sustainable development of the shipping industry, enhancing the competitiveness and influence of China's shipping industry in the international market, and contributing to the global carbon emission reduction cause.

References

[1]. Ye Z W. Discussion on the Methods of Greenhouse Gas Emission Reduction and Carbon Sequestration[J]. Leather Manufacture and Environmental Technology, 2024,5(09):91-92+104.

[2]. “MICHAIL N A,MELAS K D.Covid-19 and the energy trade:evidence from tanker trade routes[J].The Asian Journal of Shipping and Logistics,2022,38(2):51-60.

[3]. Wang X G,Yin M. Research on Two-Stage Pricing of Shipping Supply Chain Under Blockchain Platform[J]. Computer Engineering and Applications, 2023,59(07):319-327.

[4]. Karmaker, Shamal Chandra, et al. "Innovation under Cap-and-Trade: How emission trading systems propel decarbonization." Next Energy 7 (2025): 100220.

[5]. Zhu M, Zhen H, Gan A P. Optimization of Liner Ship Fleet Mix Strategy under Emission Trading System[J]. Journal of Transportation Systems Engineering and Information Technology, 2016,16(01):202-208+23

Cite this article

Wang,X.;Leng,Q. (2025). Research on the Selection of Carbon Quota Trading Modes for Shipping Enterprises under the EU Emissions Trading System. Applied and Computational Engineering,148,8-13.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Mechatronics and Smart Systems

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ye Z W. Discussion on the Methods of Greenhouse Gas Emission Reduction and Carbon Sequestration[J]. Leather Manufacture and Environmental Technology, 2024,5(09):91-92+104.

[2]. “MICHAIL N A,MELAS K D.Covid-19 and the energy trade:evidence from tanker trade routes[J].The Asian Journal of Shipping and Logistics,2022,38(2):51-60.

[3]. Wang X G,Yin M. Research on Two-Stage Pricing of Shipping Supply Chain Under Blockchain Platform[J]. Computer Engineering and Applications, 2023,59(07):319-327.

[4]. Karmaker, Shamal Chandra, et al. "Innovation under Cap-and-Trade: How emission trading systems propel decarbonization." Next Energy 7 (2025): 100220.

[5]. Zhu M, Zhen H, Gan A P. Optimization of Liner Ship Fleet Mix Strategy under Emission Trading System[J]. Journal of Transportation Systems Engineering and Information Technology, 2016,16(01):202-208+23

(a)Effect of

(a)Effect of  (b)Effect of

(b)Effect of  (c)Effect of

(c)Effect of  (d)Effect of

(d)Effect of