1. Introduction

The main method of investing is to buy low and sell high, value investing is a way to help us find companies that are undervalued by the market and is now being widely used in life. Value investing entails a meticulous search for stocks that the market has potentially mispriced, with a strong emphasis on their long-term prospects [1]. This compelling statistic underscores the potential for value investing to yield favourable outcomes. One of the driving forces behind value investing lies in the behavioural biases exhibited by investors, such as the tendency to overvalue assets based on past gains [2]. This practice highlights the significance of adopting a value-oriented approach that seeks out opportunities that might have been overlooked or undervalued. When two firms share equivalent profits or book values, the value investor leans towards acquiring the lower-priced option [3].

Warren Buffett, who is considered as one of the best investors in history, adopted the strategy of value investing [4]. From 1976 to 2006, his Berkshire stock portfolio beat the S&P 500 index in 27 of 31 years, with an average annual return of 11.14 percent [5]. The belief in value investing, that the market will eventually rectify any mispricing, potentially resulting in substantial rewards.

In the following section, we will investigate the potential of value investing in more detail by analysing the performances of a set of chosen companies. By understanding the core principles of value investing, individuals can make informed decisions that align with their long-term financial goals.

2. Case Study

We will illustrate the use and potential of value investing by analyzing the average annual growth rate of each company in different segments over four years. Microsoft, Apple, Pfizer, and Merk are the four companies to be analyzed.

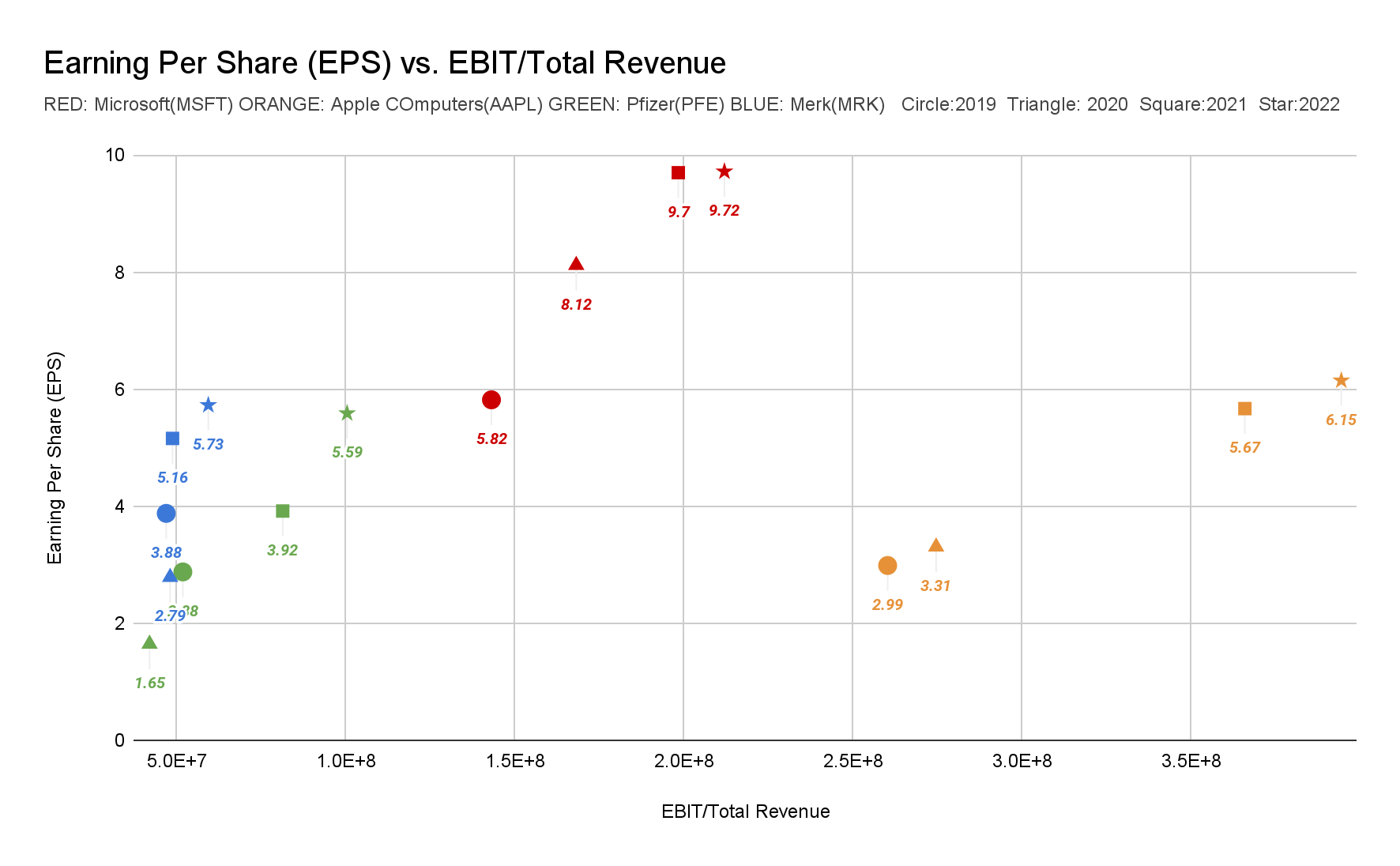

As a measure of business performance, we look at the EBIT/Total Revenue ratio and the Earnings per Share (EPS) ratio. EPS and Total Revenue are key metrics commonly used when analyzing stock data. Total Revenue gives information about a company's size and market share, while EPS shows a company's profitability per share of stock and growth patterns. Investors can judge a stock's price and earnings quality by using these criteria, which are also used in valuation research.

Microsoft and Apple are highly regarded and well-known huge technological corporations. Their EPS and total revenue are high.

Pfizer and Merk are selected to represent the pharmaceutical segment, with historically low EPS and overall sales.

These four companies have very different historical trading figures but are top-tier companies in their own field, a potentially undervalued price might happen.

As shown in Figure 1, The EBIT/Total Revenue and Earnings Per Share (EPS) ratios for the four corporations Microsoft, Apple, Pfizer, and Merk are on the rise between 2019 and 2022.

The company with the greatest earnings per share throughout time has been Microsoft. While Microsoft's EPS is heading upward from 5.82 to 9.72, its total revenue ratio has increased from 143 million to 211 million, showing some degree of stability. With 134 million, Apple's overall revenue is increasing very swiftly, and its EPS is rising upward from 2.99 to 6.15.

Apple has the biggest total revenue overall and has had the largest increase from 260 million to 394 million. Among them, the years 2020 to 2021 have the biggest number of growth, and those same years also have the highest number of growth in EPS.

Pfizer had the lowest earnings per share in the first and the previous year, but its stock price is rising. Pfizer's total revenue swings between 51 and 100 million, with a decline in 2020 and a rebound in growth in 2021, while its earnings per share (EPS) fluctuates more between 2019 and 2020, falling from 2.88 to 1.65 and then rising to 1.65 between 2021 and 2022. Between 2021 and 2022, there is an increase, reaching 5.59.

Figure 1: The comparison of EPS and Total revenue between Microsoft, Apple, Pfizer, and Merk from 2019 to 2022

3. Comparison of growth rates and interpretation:

We compared the growth rate of each company section based on the basic analysis, which provides a more accurate representation of each firm's growth.

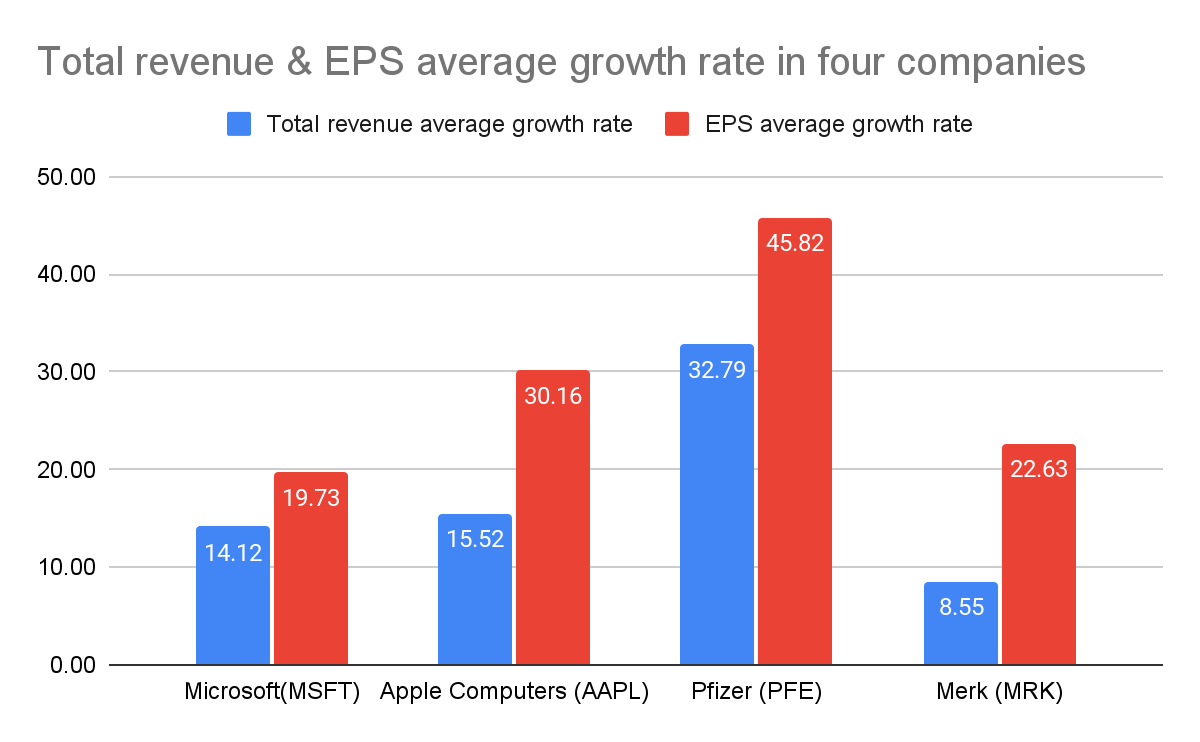

Overall, all four companies are trending upward with growth in EPS and Total Revenue from 2019 to 2022. Microsoft and Apple, which belong to the technology category, have more four-year growth in Total Revenue compared to healthcare companies Pfizer and Merk, but the growth rate is rather larger due to the smaller base figure of the first year of the healthcare companies. Microsoft's four-year average growth rate is 14.12%, and Apple's is 15.52%. Pfizer's growth rate, though declined midway through the year, is still as high as 32.79% as total revenues almost doubled in 2021 compared to 2020, and Merk's growth rate is as low as 8.55%. Healthcare companies Pfizer and Merk's EPS are very consistent with declining in 2020, while technology companies continue to grow well. Microsoft and Apple's four-year average EPS growth rates are not too far off from Pfizer's and Merk's, at 19.73% and 30.16% for tech companies and 45.82% and 22.63% for healthcare companies, respectively.

The difference in growth A rates between technology and healthcare companies can be attributed to inherent differences in industry dynamics, company-specific factors, and external events. While technology companies benefit from rapid innovation and changing consumer preferences, resulting in relatively stable growth, healthcare companies operate in a more regulated environment where growth is driven by factors such as research and development and changes in healthcare policy. The healthcare industry has a smaller initial revenue base that can inflate growth percentages. Company specifics, such as Pfizer's role in vaccine development during a pandemic, can also affect growth rates. Just as vaccination was not prevalent in 2019 and 2020 when the new crown epidemic first began, and Pfizer was not trusted by the public. Instead, it will become a popular vaccine brand in 2021 so the growth rate in 2021 is particularly impressive. These multiple factors highlight the complexity and variability of assessing growth rates in different industries.

Figure 2: The differences between Total revenue and EPS four year’s average growth rate in four companies

4. Conclusion

Looking at the examples given, it can be seen that both Pfizer and Merk, which had relatively low EPS values and Total revenue in 2019, have grown rapidly in four years leading to nearly doubled growth rates. In contrast, while Microsoft and Apple started out with high values and grew at a high rate, they did not grow as fast as the smaller companies. This suggests that buying a stock with a smaller base at the right time in the stock market may have a higher probability of yielding a higher multiple. According to Pfizer's metrics, it represents the investment philosophy of "value investors favoring options with lower acquisition price" [3]. Due to their emphasis on purchasing assets below their real worth, value investors choose choices with lower purchase costs. This offers a cushion of protection and room for expansion. They are slow and methodical in their approach, keep an eye out for possibilities others disregard, and have had success with this strategy in the past.

Unsurprisingly, the highest average growth rates in EPS and total revenue among value investors. This shows that value investing is an important investment strategy for investors. When investing, it's crucial to give a stock's worth greater thought. On the other hand, Value investing is not always profitable, thus, for this approach to continue to be effective in the future, it will need to have a more dynamic view of value and a stronger readiness to deal with uncertainty [6].

Value investing will probably become more popular in the future, but there are still a lot of unanticipated factors such as advances in the financial industry and shifts in regulatory policy. Overall, it is critical to consider some potential negatives and determine whether this strategy is appropriate for future life.

References

[1]. Lee, Charles MC. "Value investing: Bridging theory and practice." China Accounting and Finance Review 16 (2014): 1-29.

[2]. Dobni, Dawn M., and Marie D. Racine. "Stock market image: The good, the bad, and the ugly." Journal of Behavioral Finance 16.2 (2015): 130-139.

[3]. Petrova, Elitsa. "Value investing–essence and ways of finding undervalued assets." The 21st International Conference the Knowledge-Based Organization. 2015.

[4]. Roca, Florencia. "What is New in Value Investing? A Systematic Literature Review." Journal of New Finance 2.2 (2021): 2.

[5]. Martin, Gerald S., and John Puthenpurackal. "Imitation is the sincerest form of flattery: Warren Buffett and Berkshire Hathaway." Available at SSRN 806246 (2008).

[6]. Cornell, Bradford, and Aswath Damodaran. "Value Investing: Requiem, Rebirth or Reincarnation?." NYU Stern School of Business Forthcoming (2021).

Cite this article

Guo,Y. (2024). Value Investing, a Modern Approach. Advances in Economics, Management and Political Sciences,73,132-135.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lee, Charles MC. "Value investing: Bridging theory and practice." China Accounting and Finance Review 16 (2014): 1-29.

[2]. Dobni, Dawn M., and Marie D. Racine. "Stock market image: The good, the bad, and the ugly." Journal of Behavioral Finance 16.2 (2015): 130-139.

[3]. Petrova, Elitsa. "Value investing–essence and ways of finding undervalued assets." The 21st International Conference the Knowledge-Based Organization. 2015.

[4]. Roca, Florencia. "What is New in Value Investing? A Systematic Literature Review." Journal of New Finance 2.2 (2021): 2.

[5]. Martin, Gerald S., and John Puthenpurackal. "Imitation is the sincerest form of flattery: Warren Buffett and Berkshire Hathaway." Available at SSRN 806246 (2008).

[6]. Cornell, Bradford, and Aswath Damodaran. "Value Investing: Requiem, Rebirth or Reincarnation?." NYU Stern School of Business Forthcoming (2021).