About AEMPSThe proceedings series Advances in Economics, Management and Political Sciences (AEMPS) is an international peer-reviewed open access series that publishes conference proceedings from a wide variety of methodological and disciplinary perspectives concerning economic and management issues. AEMPS is published irregularly. The series welcomes empirical and theoretical articles concerning micro, meso, and macro phenomena. Proceedings that are suitable for publication in the AEMPS cover domains on various perspectives of economics, management and political sciences and their impact on individuals, businesses and society. |

| Aims & scope of AEMPS are: · Economics · Management · Political Sciences |

Article processing charge

A one-time Article Processing Charge (APC) of 450 USD (US Dollars) applies to papers accepted after peer review. excluding taxes.

Open access policy

This is an open access journal which means that all content is freely available without charge to the user or his/her institution. (CC BY 4.0 license).

Your rights

These licenses afford authors copyright while enabling the public to reuse and adapt the content.

Peer-review process

Our blind and multi-reviewer process ensures that all articles are rigorously evaluated based on their intellectual merit and contribution to the field.

Editors View full editorial board

United Kingdom

London, UK

canh.dang@kcl.ac.uk

Leeds, UK

S.Amini@lubs.leeds.ac.uk

Cardiff, UK

EshraghiA@cardiff.ac.uk

Latest articles View all articles

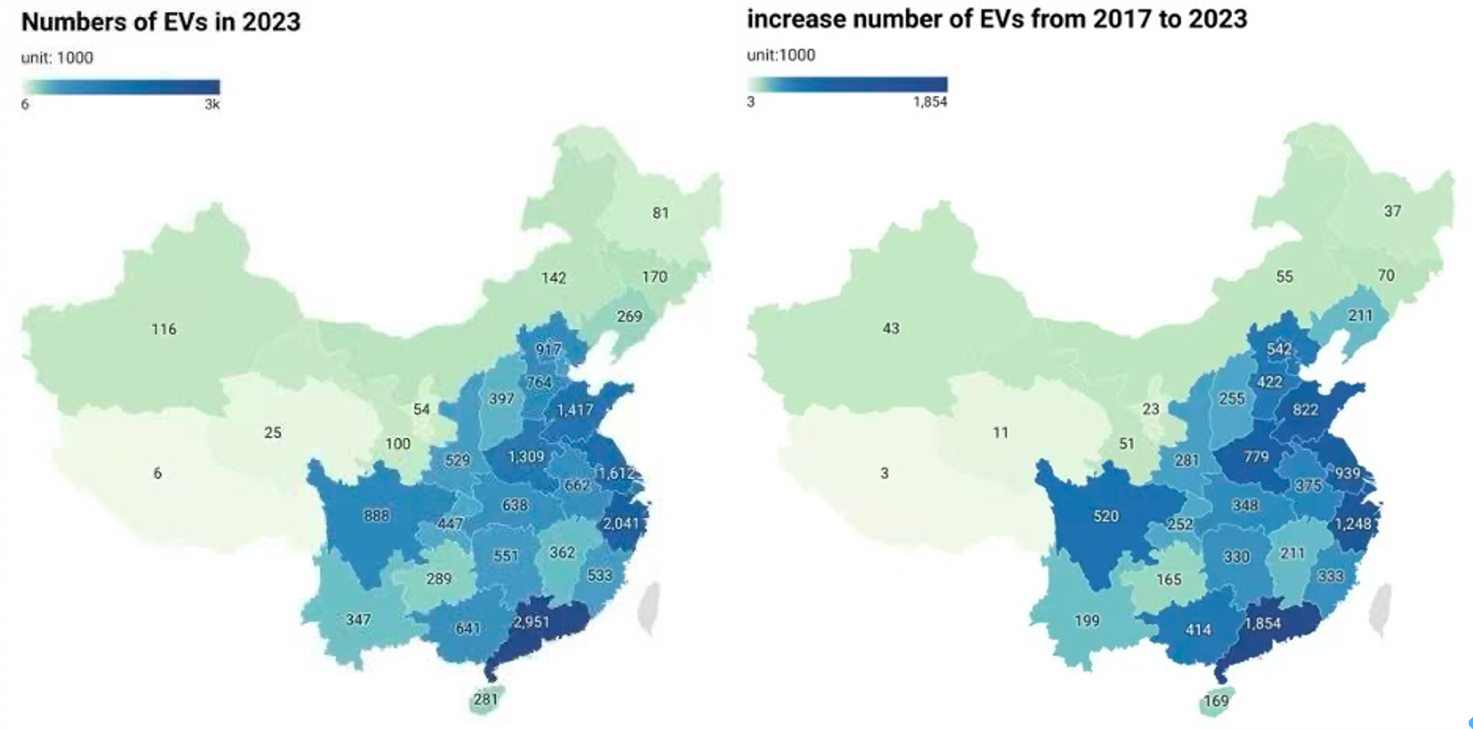

Significant variations in electric vehicle (EV) deployment exist across China. To inform policy for more balanced EV deployment, this paper performs a nationwide analysis to explore influential factors associated with EV deployment. This paper uses a comprehensive province-level dataset covering 2017-2023 on EV stock, charging infrastructure, province-level demographics and economics, and policies, and the author uses a comprehensive multi-model framework (linear, regularized, and machine learning models) that the author validates using cross-validation. Charging infrastructure density, education level, and urbanization rate are the most consistent predictors of EV deployment; Random Forest achieves the best performance in prediction, and policies and economics show limited explanatory variation. Therefore, to achieve a more balanced deployment of EVs, policymakers should focus on investments in charging infrastructure and stations, increasing public understanding of sustainable technologies, and incorporating EV deployment into urban planning, as infrastructure and socio-demographic fundamentals are more explanatory than pure economic or policy measures.

View pdf

View pdf

This paper illustrates the valuation of chooser options within the broader intellectual lineage of modern option pricing theory, providing both a theoretical and methodological framework. Our analysis is anchored in the discrete-time valuation methodology proposed by Cox, Ross, and Rubinstein, commonly known as the CRR model, which remains one of the most influential and practical approaches for demonstrating no-arbitrage pricing. While acknowledging the continuous-time paradigm of the Black–Scholes–Merton (BSM) model as a theoretical benchmark, we leverage the intuitive and adaptable nature of the binomial framework to deconstruct the chooser option’s unique structure. Furthermore, by drawing a conceptual parallel to the work on barrier options by Reiner and Rubinstein, we argue that the analytical treatment of path-dependent but contractually fixed boundaries provides a blueprint for decomposing the chooser’s distinctive payoff mechanism. The core contribution of this work lies in the systematic construction of a binomial pricing model tailored to this instrument. We conclude by outlining pathways for future research, including the extension of this framework to the more complex American-style chooser option—a challenge that requires advanced numerical methods such as the Least-Squares Monte Carlo (LSM) algorithm. Finally, this study proposes a testable hypothesis for future validation: that the structural flexibility embedded in the chooser option may justify a higher premium. Further empirical research is needed to confirm this conjecture and to highlight its potential for both practical implementation and continued academic exploration in complex financial contexts.

View pdf

View pdf

The article analyses the various fan engagement drivers in social media, in-arena experiences, and cultural symbolism across the three stages of Attention-Interest-Search- Action-Share (AISAS) in driving sports team brand equity, through the lens of the Los Angeles Clippers and comparing it to that of the legacy Los Angeles Lakers. The analysis framework is a mixed-method case study approach incorporating both qualitative content analysis and quantitative engagement metrics, and is derived from both AISAS as the engagement journey model and Value Co-Creation theory as the brand engagement driver. The research findings suggest that the global brand equity of the Lakers as a legacy brand is significantly higher in comparison to the Clippers, however the Clippers outperformed the Lakers in engagement efficiency that led to higher fan engagement per capita and subsequently resulting in strong fan identity building and incremental brand equity value, with their new immersive arena and cultural symbolism (updated logo, 'LA Our Way’ value tagline) as key identity anchors that transformed fans into co-creators that differentiates the franchise identity from its rival. The outcome of the study highlights the combination of digital engagement journeys and co-creative brand strategies and presents a strategic framework for mid-market franchises to effectively drive brand equity with authentic storytelling, immersive fan engagement, and value-aligned partnerships.

View pdf

View pdf

Against the backdrop of global health anxiety and the shift of healthy consumption to a social norm, the sugar-free beverage market has grown rapidly—China’s market scale expanded from 5.66 billion yuan in 2018 to 31.28 billion yuan in 2023 with an annual growth rate over 40%. Using Yuanqi Forest and Coca-Cola Zero as typical examples, this study investigates the factors that influence customers' purchase intentions for sugar-free beverages under health anxiety. It also looks into how consumer attitudes and behavioral intention are influenced by perceived health benefits, brand communication, and emotional assurance. The study also looks at how cultural health views, marketing narratives, and product positioning variations affect the psychological process from worry to purchase decision. Adopting systematic literature review (screening 32 core documents following PRISMA 2020) and SWOT analysis, it identifies health anxiety as a core driver, with product value and brand awareness as mediating factors. Results show both brands excel in health-aligned products and channel innovation but face homogenization, safety controversies, and price wars. Recommendations cover product innovation (e.g., allulose R&D), targeted marketing, channel diversification, and industry standardization, providing insights for sustainable market development.

View pdf

View pdf

Volumes View all volumes

Volume 247November 2025

Find articlesProceedings of CONF-BPS 2026 Symposium: GenAI, Labour Markets, and the Economics of Human and Financial Capital

Conference website: https://www.confbps.org/London.html

Conference date: 19 February 2026

ISBN: 978-1-80590-575-2(Print)/978-1-80590-576-9(Online)

Editor: Canh Thien Dang

Volume 246November 2025

Find articlesProceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

Conference website: https://2025.icftba.org/Galati.html

Conference date: 17 October 2025

ISBN: 978-1-80590-571-4(Print)/978-1-80590-572-1(Online)

Editor: Florian Marcel Nuţă Nuţă, Lukášak Varti

Volume 245November 2025

Find articlesProceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

Conference website: https://2025.icftba.org/Bratislava.html

Conference date: 12 December 2025

ISBN: 978-1-80590-569-1(Print)/978-1-80590-570-7(Online)

Editor: Lukášak Varti

Volume 244November 2025

Find articlesProceedings of ICFTBA 2025 Symposium: Strategic Human Capital Management in the Era of AI

Conference website: https://www.icftba.org/London.html

Conference date: 4 November 2025

ISBN: 978-1-80590-563-9(Print)/978-1-80590-564-6(Online)

Editor: Lukáš Vartiak, Anil Nguyen

Announcements View all announcements

Advances in Economics, Management and Political Sciences

We pledge to our journal community:

We're committed: we put diversity and inclusion at the heart of our activities...

Advances in Economics, Management and Political Sciences

The statements, opinions and data contained in the journal Advances in Economics, Management and Political Sciences (AEMPS) are solely those of the individual authors and contributors...

Indexing

The published articles will be submitted to following databases below: