1. Introduction

Environmental, social, and governance (ESG) aspects have steadily gained popularity in the international investing community in recent years. As a new sector, ESG is becoming more and more influential and attracting the attention of investors, government regulators, and businesses. Sustainability (ESG) has become a crucial component of corporate strategy, particularly in industrialized nations. But when it comes to the advancement of ESG research and practice, developing nations need to catch up to industrialized ones. This disparity might result in additional ESG issues for businesses in some developing nations, like weak corporate governance, environmental contamination, and a lack of social responsibility [1]. Stakeholder theory and associated research indicate that organizations with greater capacity to address stakeholder ESG demands will outperform reckless ones. Companies that prioritize ESG will probably do better in the long run and attract more investors. This has further encouraged businesses to actively pursue advancements and innovations in this field and take ESG considerations seriously [1].

The purpose of this research is to investigate in detail the relationship between ESG parameters and company valuation. It has been demonstrated that a company's long-term viability and financial success are significantly impacted by ESG considerations [2]. By doing extensive research on how ESG affects business valuation, it hopes to understand better how crucial ESG is to the creation of enterprise value and to offer businesses advice on how to develop ESG practices. This paper will also conduct studies on investor expectations, long-term strategy, risk management, and cost-effectiveness to completely comprehend the mechanism underlying how ESG affects company valuation and offer more precise and useful suggestions for businesses.

2. Expectations of Investors

Sustainable and responsible investment has become important in today's investment industry [3]. To advance social responsibility and sustainable development, sustainable responsible investing, or SRI, is an investment technique that considers environmental, social, and governance (ESG) factors. Investors can assist companies in proactively addressing climate change, promoting social responsibility, and advancing good governance standards by choosing investment targets consistent with their ESG beliefs. Investors are seeking companies that can achieve sustainable development and a strong return on investment, and they are becoming more aware of environmental, social, and governance (ESG) aspects. Empirical analysis and case studies show that strong ESG performance has a positive impact on company valuations, which provides investors with more incentive to pay attention to and evaluate companies' ESG practices.

Research has specifically shown that companies that place a high priority on social responsibility and the environment tend to do better financially and generate higher returns for shareholders than companies that do not place the same emphasis on these areas. Furthermore, evidence supporting the notion that ESG performance has a positive impact on valuation comes from several studies showing that companies with high ESG ratings are more successful in attracting talent and minimizing financial risk.

2.1. The ESG Performance of Intel

Consider Intel, a leading global semiconductor technology company focused on chip design, manufacturing, and sales. As a major player in the technology industry, the company focuses on computer hardware and processors. According to the MSCI ESG rating, Intel's Environmental, Social, and Corporate Governance (ESG) index is AAA, which indicates that it performs exceptionally well in environmental preservation. Intel's ESG index has been rising over the last three years, moving up from Grade A in 2020 to Grade AA and then Grade AAA. Intel's valuation has increased during this period as well. Total liabilities can be subtracted from total assets to get a company's valuation. Based on information from Nasdaq, Intel's market value grew from $810,380,000 to $1,014,230,000. The upward trend in ESG has positively impacted firm valuations.

Intel is dedicated to minimizing its environmental impact in terms of risk management and sustainability, and it has established a number of goals to lower carbon emissions. They strive to cut back on waste and water consumption, encourage the use of clean energy, and enhance the energy efficiency of their goods through energy efficiency programs. These steps improve the company's sustainability and lower environmental dangers. Intel's worth has increased since investors often support companies that can operate sustainably and handle environmental hazards.

Regarding investor demand and preference, as ESG investment trends gain traction, an increasing number of investors consider these issues when making investment decisions. Due to its success in ESG, Intel has drawn the interest and capital of ESG investors. The increased market value of Intel due to the investor interest has raised the company's valuation. Being a globally recognized technology corporation, Intel's brand value and reputation are crucial factors in determining its valuation. Intel has established a strong reputation and brand image through outstanding ESG performance, including a focus on employee well-being, diversity and inclusion, human rights, and labor rights. As a result, partners, clients, and consumers are more inclined to cooperate with Intel and acknowledge its goods and services, which raises the company's valuation even more. Outstanding ESG performance contributes to recruiting and retaining top talent in terms of staffing levels. Intel is dedicated to establishing a secure, fair, and moral workplace and prioritizes the growth and well-being of its workforce. Because of this, Intel is regarded by many as the best place to work and draws in top talent. An organization's ability to innovate, grow, and maintain its valuation is greatly aided by having a strong workforce.

In conclusion, the company's valuation benefits from Intel's strong ESG performance, which takes into account elements including risk management, investor preferences, brand reputation, and staff recruitment. This underlines the significance of ESG in the enterprise value chain and highlights the advantages of ESG practices for the company's long-term viability and competitiveness in the market.

2.2. ESG Rating

ESG rating is a data-driven index that focuses on three key pillars (environmental, social, and governance), which investors use to assess the sustainability of companies and countries [4]. However, there are currently various ESG rating standards and indices in the market, and these institutions usually adopt a transparent "outside in" rating perspective, which evaluates a company's ESG performance through external observation, independent investigation, and verification, rather than relying solely on the company's own reports and statements. This rating method can more objectively reveal the actual performance of the company, avoiding information asymmetry and potential misleading [5]. They help investors better identify and evaluate companies and assets that align with their ESG investment preferences [6]. However, due to issues such as inconsistent standards, differences in data sources and calculation methods in ESG ratings, it needs to improve further and unify ESG rating standards to provide investors with more accurate and comprehensive ESG information [7]. In this context, a reasonable question is how investors interpret the correlation and consistency between different ESG ratings and how to use this data for investment decisions. Improving ESG rating standards and strengthening cross-border cooperation can promote the correlation and comparability between different ESG ratings, helping investors more accurately evaluate and compare the sustainable development performance of different companies and countries.

This paper mainly adopts the ESG rating system of MSCI. MSCI's ESG ratings use a rules-based methodology to assess a company's ability to withstand long-term industry materials ESG threats. Companies were examined and ranked on a scale of "AAA to" CCC" according to their exposure to major ESG risks in the sector and their capacity to manage those risks compared to their peers. Artificial intelligence (AI), machine learning, and natural language processing were used in this process. MSCI ratings provide a number of benefits, including the following aspects. The MSCI ESG rating methodology encompasses various sustainability variables and considers various dimensions, including environmental, social, and governance. As a result, the rating is more thorough and in-depth. Besides, MSCI has a long history of analyzing financial data, and its ESG rating system is founded on a thorough comprehension of a company's long-term performance, which is highly credible and reliable. Being a well-known provider of financial services, MSCI's ESG rating system has gained widespread acceptance in the market and among industry participants, and it is now a crucial benchmark that many institutions and investors use.

The key to unifying ESG rating standards in the future is to strengthen international cooperation and regulatory mechanisms to ensure the accuracy, comparability, and authority of ESG data. Here are some possible avenues:

The international community can strengthen cooperation to establish unified ESG rating standards and methods and be led by relevant international organizations or regulatory bodies. Such global cooperation can promote the unification and standardization of ESG rating systems for multinational companies and cross-border investments, ensuring the fairness and authority of rating methods.

To improve the data quality and transparency of ESG ratings, more stringent data collection and disclosure standards need to be established to ensure the authenticity and reliability of ESG data sources and full and transparent disclosure of data. At the same time, an independent third-party organization is established to verify and audit ESG data to ensure the accuracy and credibility of the data.

Strengthen the education and guidance of investors' ESG concepts and investment methods, improve investors' understanding and application ability of ESG rating, help them better use ESG information to guide investment decisions, and promote the unification and standardization of ESG rating standards.

Establish a sound ESG supervision mechanism, strictly supervise and manage ESG rating agencies, ensure that they comply with unified standards and norms, and improve the comparability and authority of ESG ratings. At the same time, establish the corresponding violation punishment mechanism, punish the behavior of violating standards and norms, and improve the integrity and standardization level of the industry.

Driven by these measures, it is believed that ESG rating standards can be unified and standardized in the future so as to provide investors with more accurate and comparable ESG information and promote the healthy development of ESG investment.

2.3. Summary

Companies can offer direction and advice in the following areas in order to enhance ESG performance and satisfy investor expectations. First, in order to integrate ESG considerations into corporate strategy planning and business operations, organizations should set up and enhance their ESG management systems. Second, to increase investor recognition and trust, businesses must improve stakeholder engagement and communication and openly and honestly publish ESG data and performance. Finally, businesses can support the sector's sustainable growth as a whole, increase their influence and competitiveness in the ESG space, and actively engage in industry cooperation and advocacy linked to ESG.

In conclusion, a company's valuation is positively impacted by its ESG performance, raising investor demand for businesses with excellent ESG policies. It believes that ESG investing will become a mainstream trend in the investment industry and positively impact investors' long-term returns and the sustainable development of companies in the future, thanks to the ongoing improvement of ESG investment evaluation tools and indexes and the ongoing enhancement of companies' ESG practices.

3. Risk Management

ESG risk refers to the potential impact that environmental, social, and governance factors can have on a company's valuation and performance. In risk management, the importance of analyzing and evaluating ESG risks must be addressed. This kind of risk management can help enterprises effectively deal with ESG risks and take corresponding measures to reduce the adverse impact of risks on enterprises.

3.1. ESG Risk

The first step is to do a thorough analysis of ESG risk. Businesses must be aware of the possible hazards that environmental, social, and governance issues pose to their operations and business. Climate change, resource scarcity, and pollution are examples of environmental variables; labor rights, human rights, and community relations are examples of social elements; corporate governance structure and transparency are examples of governance factors. Through in-depth comprehension and analysis of key ESG elements, firms may more effectively evaluate potential risks and formulate appropriate risk management strategies.

Secondly, case studies can serve as valuable sources of information regarding efficient risk management tactics. Other businesses can benefit from the experiences and procedures of organizations that have effectively tackled ESG issues by looking at case studies of those businesses. For instance, some businesses have invested in clean technologies and renewable energy in response to environmental hazards. This has helped them become less reliant on conventional energy sources and promote more sustainable development. Additionally, by strengthening labor standards, human rights advocacy, and social responsibility, some businesses have improved employee and community satisfaction while lessening the detrimental effects of social hazards. These case studies give other businesses direction and motivation to create and execute successful risk management plans.

Thirdly, ESG can be a valuable instrument for lowering risk. Businesses can lower numerous possible hazards by emphasizing corporate social and environmental responsibility. For instance, eco-friendly company models can lower environmental hazards to their brand and legal standing and lower resource use and pollution. Similarly, focusing on community connections and employee rights promotes a positive company image and brand reputation, which lowers losses from social risks. Furthermore, a company's internal control and decision-making process can be strengthened, and internal risks can be decreased with a strong corporate governance framework and transparency.

3.2. Management of ESG Risk

In terms of risk management tools and methodologies, organizations can utilize various tools to assess and manage ESG risk. A common tool is the ESG risk rating system, which helps companies understand their potential risks and develop corresponding risk management strategies by evaluating and rating their ESG performance. In addition, companies can use data analytics and models to identify and quantify ESG risks and take appropriate actions to manage and reduce these risks. For example, using statistical and predictive models can help organizations predict the likely impact of ESG risks and develop risk management plans accordingly.

Guidance and advice are needed to manage ESG risk effectively. Companies should develop clear ESG policies and objectives and incorporate them into corporate strategy and business decisions. In addition, companies should also strengthen internal communication and cooperation to ensure consensus and cooperation among various departments and stakeholders. At the same time, enterprises should establish positive partnerships with external stakeholders, including investors, suppliers, customers, and communities, to promote the effective implementation of ESG risk management.

3.3. Summary

Designing a portfolio based on companies that meet ESG criteria can be a prudent choice for investors. The results show that investing in ESG-compliant companies can lead to better portfolio management as it helps reduce volatility and protect against downside risk. This means that ESG factors can play an important role in investment decisions, not only helping to achieve sustainable investment goals but also helping to reduce the level of risk in the overall portfolio. As a result, investors can achieve more robust and long-term investment returns by building a portfolio that includes ESG-compliant companies [8].

In conclusion, a comprehensive analysis of ESG risks, learning from successful cases, using ESG as an important tool to reduce risks, and adopting appropriate risk management tools and methods can help enterprises effectively manage and reduce ESG risks. Companies can better manage ESG risks and achieve sustainable development with proper guidance and advice.

4. Long-Term Strategy and Branding

4.1. The Relationship between ESG-Focused Factors and Company Valuation

There is a strong relationship between ESG factors and company valuations, and considering financial importance can better inform investment decisions based on ESG performance. The results show that when financial importance is applied, a company's ESG performance score changes significantly. This means that ESG factors are not just an impact on a company's image of sustainability and social responsibility but are more directly related to a company's valuation [9].

First, ESG performance is recognized as one of the important drivers of a company's long-term value. A company's good environmental, social, and governance performance can increase its reputation and attractiveness, thus attracting more investors and funding. Investors are becoming more aware of the importance of ESG factors to a company's risk management and long-term performance, and they are more inclined to invest in companies with good ESG performance. Therefore, a company's investment and performance in ESG performance can directly affect its valuation level.

Second, the improvement of ESG performance can reduce the potential risks faced by the company. Good environmental management and social responsibility practices can help reduce the company's legal and regulatory risks and avoid losses caused by environmental accidents and social disputes. At the same time, an effective governance structure and transparency can increase a company's internal stability and compliance, reducing the likelihood of management risks and irregularities. Reducing these risks will further strengthen investors' trust in the company and increase its valuation.

Finally, existing investors can exercise due diligence guidelines at general meetings, especially when the company does not comply with ESG practices [10]. New investors may be reluctant to invest in companies that need more satisfactory ESG performance, which will affect the interests of existing investors. As a result, when companies face ESG challenges, shareholder meetings become a key venue for exercising investors' rights and overseeing corporate decisions. Through shareholder meetings, existing investors can ask management key questions about a company's ESG performance and practices, and push the company to improve its ESG performance, thereby safeguarding the interests of investors and safeguarding the company's long-term value.

In summary, the importance of ESG factors in investment decisions is increasingly widely recognized. Considering financial materiality can better inform investment decisions based on ESG performance, helping investors to assess a company's long-term value and risk fully. By deeply understanding and applying ESG performance evaluation, investors can more accurately assess the potential value of a company and thus make investment decisions more effectively.

4.2. The Relationship between Brand Reputation and Valuation

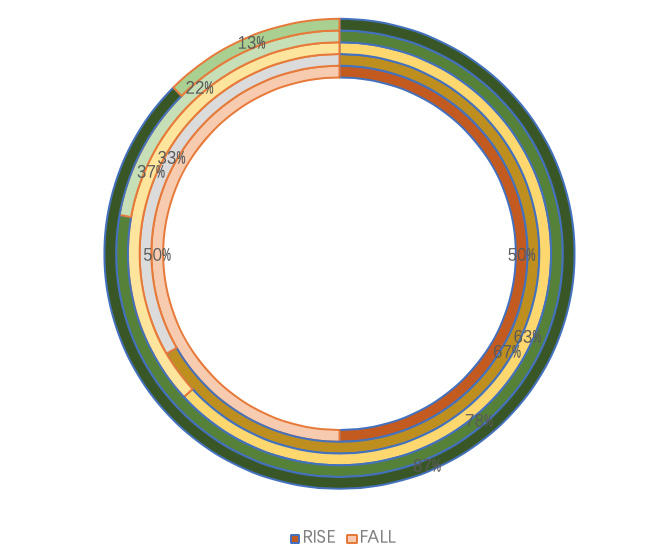

Based on the sample data of 50 international listed companies and the ESG rating of MSCI's official website, it can draw the following circular chart to show this relationship more intuitively.

Figure 1: ESG vs. Company Valuation (Picture credit: Original).

In Figure 1, it can be seen that three rings represent different ESG rating ranges. The innermost ring represents companies with an ESG rating of BB, i.e. companies with a Laggard rating in MSCI; Among them, the increase in company valuation accounts for 50%, while the decrease in valuation accounts for 50%. The second inner ring represents companies with an ESG rating of BBB, i.e. companies rated as Average in MSCI; Among them, the increase in company valuation accounted for 67%, while the decrease in valuation accounted for 33%. The middle ring represents companies with an ESG rating of A, i.e., companies rated as Average in MSCI; Among them, the increase in company valuation accounted for 63%, while the decrease in valuation accounted for 37%. The second outer ring represents companies with an ESG rating of AA, i.e., companies rated as Leader in MSCI; Among them, the increase in company valuation accounted for 78%, while the decrease in valuation accounted for 22%. The outermost ring represents companies with an ESG rating of AAA, i.e. companies rated as Leader in MSCI; Among them, the increase in company valuation accounted for 87%, while the decrease in valuation accounted for 13%.

Exclude some deviations caused by sample size issues. Based on preliminary observations of this data, companies with higher ESG scores are more likely to increase their valuation. This indicates that ESG rating has a certain positive impact on company valuation.

4.3. Brand Building and Protection

ESG factors play a crucial role in building strong and resilient brands. By actively focusing on and managing ESG matters, companies can enhance the reputation and recognition of their brands and increase the value and staying power of their brands.

First, effective management of environmental factors helps build a strong brand. By adopting sustainable development strategies that reduce carbon emissions, conserve resources and protect the ecological environment, companies can establish an environmental image and win the praise of consumers and investors. A company with a good environmental reputation can often attract consumers interested in environmentally friendly products and services, thereby increasing market share and brand value.

Secondly, fulfilling social responsibility is also one of the important factors in building a resilient brand. By focusing on employee well-being, engaging in community initiatives, and ensuring fair and transparent supply chains, companies can earn the trust and loyalty of consumers. Companies with a good social reputation can often attract and retain outstanding talents, form a stable labor resource, and thus improve production efficiency and innovation.

Finally, a good governance structure is essential for brand building and protection. Good corporate governance and a high degree of transparency and integrity will help establish the company's image of authority and win the trust of investors. This trust will translate into higher shareholder value and more favorable financing terms, thereby enhancing the company's valuation and market position. Companies can implement the following recommendations and suggestions to enhance their brand's valuation and reputation:

4.4. Summary

For companies to succeed in the domains of environmental, social, and governance, they ought to formulate and implement a thorough ESG strategy. Because of this, businesses must carefully consider, incorporate, and manage ESG issues into every facet of their business plan. To showcase their ESG performance and accomplishments to stakeholders, companies ought to enhance their external transparency by making ESG information publicly available. In the meantime, build a strong communication channel, proactively engage with all relevant parties, and foster cooperation and trust. Instead of concentrating only on short-term financial objectives, businesses should consider the long-term benefits and integrate ESG aspects into risk management and business choices. The company's ability to develop a robust and durable brand depends on its focus on long-term profit.

In conclusion, ESG is essential to creating enduring and powerful brands. Companies can improve their brands' value and longevity, gain an advantage over competitors in the market, and improve their reputation and recognition by proactively addressing and managing environmental, social, and governance (ESG) issues. Therefore, to continually improve brand reputation and valuation, organizations should adopt a long-term profit-oriented business philosophy, improve transparency and communication, and implement a comprehensive ESG strategy.

5. Cost Effectiveness

However, while improving ESG, it needs to consider the input costs involved in improving environmental, social, and governance aspects, including but not limited to the construction of environmental facilities, staff training and education, and governance structure adjustment. Empirical studies have shown that after implementing ESG initiatives, companies can achieve long-term financial gains through improved brand image, reduced risk, and improved employee productivity, which may include better shareholder returns and lower cost of capital.

Regarding the relationship between cost-effectiveness and valuation, some findings suggest that sustainable indices do not differ significantly in performance from traditional indices, suggesting that implementing ESG initiatives may only sometimes be immediately reflected in a company's valuation [2]. Furthermore, while ESG has a positive impact on firm performance, this impact depends on each stage of the firm's life cycle. Some emerging companies may need to invest more in implementing ESG initiatives in the short term, while the long-term benefits may take time to become apparent.

Therefore, when weighing short-term costs against long-term financial benefits, companies need to recognize that ESG practices are a long-term investment and need to weigh short-term costs against long-term financial benefits [11]. It is suggested that when implementing ESG measures, enterprises should formulate strategic plans in line with their own development stage, balance short-term cost input and long-term financial benefits, and ensure the consistency of sustainable development strategy and overall development goals of enterprises. At the same time, the cost-effectiveness of ESG initiatives needs to be continuously monitored and evaluated so that strategic direction can be adjusted in time to maximize the value of ESG practices.

6. Conclusion

In summary, ESG factors have an impact on company valuation. Effective ESG practices help companies manage long-term risk, enhance brand value and reputation, open up strategic opportunities, attract investors, and reduce the cost of capital. According to the research data, these factors do have a positive impact on the valuation of the company. Therefore, companies should recognize the importance of ESG and integrate it into their strategy.

In this context, enterprises can gain some enlightenment and recommend suggestions for strategically integrating ESG practices. First, companies should recognize that ESG is a moral imperative and an opportunity for value creation. By actively focusing on ESG issues, companies can improve their stability and sustainability, thereby attracting more investment and reducing the cost of capital. Second, companies need to develop clear ESG policies and actively fulfill social responsibilities to enhance brand image and reputation, thereby increasing market competitiveness.

Future research directions could further explore the impact of ESG factors on different industries and regions and the relationship between ESG and financial performance. In addition, it is possible to delve into the extent to which the quality and disclosure of ESG data affect the valuation of companies and the impact of ESG standardization on the valuation of multinational companies. Through in-depth research, the impact of ESG on company valuation can be more fully understood, and more specific practical guidance and decision support can be provided for enterprises.

References

[1]. Li, T., Wang, K., Sueyoshi, T., & Wang, D. (2021). ESG: Research progress and Future Prospects. Sustainability, 13(21), 11663.

[2]. Jain, M., Sharma, G. D., & Srivastava, M. (2019). Can sustainable investment yield better financial returns: A comparative study of ESG indices and MSCI indices. Risks, 7(1), 15.

[3]. Ioannidis, E., Tsoumaris, D., Ntemkas, D., & Sarikeisoglou, I. (2022b). Correlations of ESG Ratings: A signed Weighted network analysis. AppliedMath, 2(4), 638–658.

[4]. Marzuki, A., Nor, F. M., Ramli, N. A., Basah, M. Y. A., & Aziz, M. R. A. (2023). The influence of ESG, SRI, Ethical, and Impact investing Activities on portfolio and Financial Performance—Bibliometric Analysis/Mapping and Clustering Analysis. Journal of Risk and Financial Management, 16(7), 321.

[5]. Hughes, A. M., Urban, M., & Wójcik, D. (2021). Alternative ESG Ratings: How Technological Innovation is reshaping Sustainable investment. Sustainability, 13(6), 3551.

[6]. Yao, R., Fei, Y., Wang, Z., Yao, X., & Yang, S. (2023). The impact of China’s ETS on corporate green governance based on the perspective of corporate ESG performance. International Journal of Environmental Research and Public Health, 20(3), 2292.

[7]. Aldieri, L., Amendola, A., & Candila, V. (2023). The impact of ESG scores on risk market performance. Sustainability, 15(9), 7183.

[8]. Gupta, H., & Chaudhary, R. (2023). An analysis of volatility and Risk-Adjusted returns of ESG indices in developed and emerging economies. Risks, 11(10), 182.

[9]. Madison, N., & Schiehll, E. (2021). The effect of financial materiality on ESG Performance Assessment. Sustainability, 13(7), 3652.

[10]. Park, S. R., & Jang, J. Y. (2021). The Impact of ESG Management on Investment decision: Institutional Investors’ Perceptions of Country-Specific ESG Criteria. International Journal of Financial Studies, 9(3), 48.

[11]. Qu, W., & Zhang, J. (2023). Environmental, Social, and Corporate Governance (ESG), Life Cycle, and Firm Performance: Evidence from China. Sustainability, 15(18), 14011.

Cite this article

Li,M. (2024). A Study of the Relationship Between ESG Performance and Firm Valuation. Advances in Economics, Management and Political Sciences,74,259-267.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, T., Wang, K., Sueyoshi, T., & Wang, D. (2021). ESG: Research progress and Future Prospects. Sustainability, 13(21), 11663.

[2]. Jain, M., Sharma, G. D., & Srivastava, M. (2019). Can sustainable investment yield better financial returns: A comparative study of ESG indices and MSCI indices. Risks, 7(1), 15.

[3]. Ioannidis, E., Tsoumaris, D., Ntemkas, D., & Sarikeisoglou, I. (2022b). Correlations of ESG Ratings: A signed Weighted network analysis. AppliedMath, 2(4), 638–658.

[4]. Marzuki, A., Nor, F. M., Ramli, N. A., Basah, M. Y. A., & Aziz, M. R. A. (2023). The influence of ESG, SRI, Ethical, and Impact investing Activities on portfolio and Financial Performance—Bibliometric Analysis/Mapping and Clustering Analysis. Journal of Risk and Financial Management, 16(7), 321.

[5]. Hughes, A. M., Urban, M., & Wójcik, D. (2021). Alternative ESG Ratings: How Technological Innovation is reshaping Sustainable investment. Sustainability, 13(6), 3551.

[6]. Yao, R., Fei, Y., Wang, Z., Yao, X., & Yang, S. (2023). The impact of China’s ETS on corporate green governance based on the perspective of corporate ESG performance. International Journal of Environmental Research and Public Health, 20(3), 2292.

[7]. Aldieri, L., Amendola, A., & Candila, V. (2023). The impact of ESG scores on risk market performance. Sustainability, 15(9), 7183.

[8]. Gupta, H., & Chaudhary, R. (2023). An analysis of volatility and Risk-Adjusted returns of ESG indices in developed and emerging economies. Risks, 11(10), 182.

[9]. Madison, N., & Schiehll, E. (2021). The effect of financial materiality on ESG Performance Assessment. Sustainability, 13(7), 3652.

[10]. Park, S. R., & Jang, J. Y. (2021). The Impact of ESG Management on Investment decision: Institutional Investors’ Perceptions of Country-Specific ESG Criteria. International Journal of Financial Studies, 9(3), 48.

[11]. Qu, W., & Zhang, J. (2023). Environmental, Social, and Corporate Governance (ESG), Life Cycle, and Firm Performance: Evidence from China. Sustainability, 15(18), 14011.