1. Introduction

1.1. Research Background and Significance

The non-alcoholic beverage market is an enormous industry, with powerhouses like The Coca-Cola Company, PepsiCo, Monster Beverage Corporation, etc., fiercely fighting to get a slice of the consumer market [1]. Coca-Cola has been a leader in the industry for over a century, with its brand being globally famous. Nevertheless, the firm faces the rising challenge of competition from consumers who prefer healthier drinks and uncertainty in the supply chains amidst the volatile global economic environment.

This paper aims to provide a comprehensive Analysis of Coca-Cola Company regarding its financial performance, operational effectiveness, competitive landscape, and future trajectory. It has incorporated numerous metrics and indicators to form an opinion on the company’s financial health and prospects.

This study offers a detailed examination of the prevailing financial condition, efficiency of operations, competition strength and future vision of the Coca-Cola Company. Understanding the company's strengths, weaknesses, opportunities, and threats is the key for investors, industry analysts, and those with a stake in the beverage market. The results may tell how the Coca-Cola Company may need to undertake specific strategic measures that will enable it to maintain growth, market share, or both in the future.

1.2. Literature Review

Several studies shed light on the financial and strategic positioning of major beverage companies like Coca-Cola. A 2020 paper published by the Journal of Beverage Research investigated the diversification strategy of Coca-Cola, and according to researchers, while it was wise to branch out into non-carbonated beverages, the irony is that the company may need to be bolder in its product innovation [2]. Another study by Kroesen focused on the supply chain and sustainability initiatives of Coca-Cola [3]. It was determined that the company has made progress, but more still needs to be done to mitigate the total environmental impact of the supply chain. A research paper published by Bai highlighted the product marketing strategies of Coca-Cola and PepsiCo and how both have responded to the changing consumer trends [4]. In addition, Duan analysed the financial performance of Coca-Cola, PepsiCo and other major beverage companies [5]. They found that Coca-Cola maintained higher profit margins while PepsiCo showed more robust revenue growth by diversifying into snack foods and other offerings. Likewise, to Coca-Cola, the researchers suggested that the company diversify its business to reduce the risk.

In addition, a study made by Prasad and Patil offered an overview of the Coca-Cola Company, including its history, position in the market and a SWOT analysis, which identified the company's strengths, weaknesses, opportunities and risks [6]. The authors identify Coca-Cola's substantial brand equity as a significant competitive advantage. In addition, Chowdhury et al. looked at how COVID-19 and digital marketing campaigns challenged the food and beverage sector utilised by companies to keep sales up, especially during lockdowns and restrictions [7]. The research showed that Instagram and online shopping like Shopee were efficient marketing tools for food/beverage products. With the existing research as a solid basis for this paper, another look into Coca-Cola’s performance into 2023 and suggest addressing the changing competitive dynamic and consumer preferences towards healthier lifestyles will be provided.

1.3. Research Contents

To begin, this paper will provide brief background information and the current portfolio of operations of The Coca-Cola Company. Then, it will drill into the company's financial statements, profitability metrics, stock performance, and Coca-Cola's competitive environment when measuring its performance relative to PepsiCo and Monster Beverage Corporation and their operations in the marketplace. In addition to this, strategic moves and future positioning will be investigated. Finally, an action plan will be recommended to overcome the company's challenges.

2. Comprehensive Analysis of Coca-Cola Company

2.1. Company Background

The Coca–Cola Company was established almost 140 years ago, in 1892, and since its humble beginnings, it has evolved into a global powerhouse in the beverage industry [8]. The organisation operates in more than 200 regimes and is characterised by its flagship product, Coke. Today, the company has accumulated a total market capitalisation of nearly $ 270 billion and has a formidable workforce of nearly 80,000 global employees. The company is headquartered in Atlanta and listed on the NYSE under the KO ticker.

2.2. Financial Performance

The Coca–Cola Company has demonstrated robust financial performance with consistent profitability over the past five years. The Net profit margin has depicted marginal variation within the 23%- 26% range. Considering the competitive nature of the beverage industry, such profitability speaks volumes about the operational efficiency of the management [9]. However, the company’s operating profit margin (EBITDA) declined from 27% in 2019 to 24.72% in 2023. Table 1 presents the company's profitability performance.

Table 1: Coca-Cola Co. Profitability Ratios (2019-2023).

Ratio | 31-12-2019 | 31-12-2020 | 31-12-2021 | 31-12-2022 | 31-12-2023 |

Gross Profit Margin | 60.77% | 59.31% | 60.27% | 58.14% | 59.52% |

Operating Profit Margin | 27.06% | 27.25% | 26.67% | 25.37% | 24.72% |

Net Profit Margin | 23.94% | 23.47% | 25.28% | 22.19% | 23.42% |

Return on Equity (ROE) | 46.99% | 40.14% | 42.48% | 39.59% | 41.30% |

Return on Assets (ROA) | 10.33% | 8.87% | 10.36% | 10.29% | 10.97% |

The operating margin does not vary both ways but has consistently declined. While the variation appears marginal, the continuing trend for the next five years can deplete its profitability. The ROA has remained relatively stable, close to 11% during the five-year term, but the ROE has declined from 47% to 41%, a notable dip in the returns for equity stockholders. The overall performance in terms of profitability has remained satisfactory.

2.3. Impact of Economic Indicators

The company’s performance is closely connected with vital macroeconomic indicators, such as consumer spending power, disposable income, inflation rates, and broader economic conditions. Pleasingly, the company has demonstrated impressive flexibility in its pricing strategy, where it has run promotional discounts during periods of high inflation to maintain its turnover and its grip on the market. Another critical factor is the shift in consumer preferences, particularly during economic downturns characterized by reduced spending on non-essential items, which includes beverages [10]. However, the company maintains a diverse portfolio of products, which makes up for the loss of revenue during these downturns. Therefore, a diversified revenue stream is attractive from the perspective of the typical risk-averse investor in the market.

2.4. Stock Performance

KO stock has experienced impressive growth over the years and has, on numerous occasions, outperformed market indices like the S&P 500. Such stock performance manifests robust managerial acumen and investor confidence in the company. It is crucial to evaluate the stock price against a relative measure of financial performance, typically known as valuation ratios (Table 2).

Table 2: Coca-Cola Co. Historical Price Multiples (2019-2023)

Ratio | 31-12-2019 | 31-12-2020 | 31-12-2021 | 31-12-2022 | 31-12-2023 |

Price to Earnings (P/E) | 28.21 | 27.91 | 27.63 | 27.12 | 24.43 |

Price to Operating Profit (P/OP) | 24.95 | 24.03 | 26.19 | 23.72 | 23.14 |

Price to Sales (P/S) | 6.75 | 6.55 | 6.99 | 6.02 | 5.72 |

Price to Book Value (P/BV) | 13.26 | 11.2 | 11.74 | 10.73 | 10.09 |

Ideally, the lower the valuation ratio, the more attractive the stock is from a value perspective. The following table highlights the company's relative valuation performance. From the table above, the company’s P/E has declined, which is an encouraging factor for potential investors. The stock price relative to operating profit, turnover, and book value has also declined, which are all impressive from an investment perspective.

2.5. Operational Effectiveness

The company has demonstrated robust operational efficiency via three tools relevant to modern business conditions. First, the diversified global supply chain makes the company resilient despite adversity, especially during extraordinary events like the recent pandemic. Second, the company’s logistics and financial strategy are well aligned, securing a cohesive and coordinated advantage for the entire organisation globally. Finally, the company has prudently committed physical, financial, and human resources to sustainable business practices to maintain its appeal to the increasingly environmentally sensitive consumer sectors.

3. Comparative Analysis

3.1. The Competitive Landscape

The company has operated in a long-standing competitive rivalry with PepsiCo, a significant beverage sector player with vested interests in numerous food items. PepsiCo has also accumulated a strong brand image and loyal customer bases over decades of financial performance and strategic maneuvering. Another significant competitor is Monster Beverage Corporation, which specialises in manufacturing and distributing energy drinks. It has carved out a niche within the sector with focused differentiation on energy drinks.

3.2. Financial Comparison

The selected competitors provide a unique perspective on scalability when comparing financial performance. PepsiCo operates on a larger scale than Coca-Cola, whereas Monster Beverage is a smaller organisation relative to Coca-Cola [11]. This place the subject company in the middle of the market to neutralise stability and incorporate meaningful comparisons of financial performance [9]. The following table represents the profitability performance of the three companies for the most recent reported fiscal year (Table 3).

Table 3: Comparison of Profits and Returns: Coca-Cola, PepsiCo, and Monster Beverage

Ratio | Coca-Cola | PepsiCo | Monster Beverage |

Gross profit margin | 59.52% | 54.21% | 50.30% |

Operating profit margin | 24.72% | 13.10% | 25.11% |

Net profit margin | 23.42% | 9.92% | 18.88% |

Return on equity (ROE) | 41.30% | 49.04% | 16.96% |

Return on assets (ROA) | 10.97% | 9.03% | 14.37% |

It is evident from the profitability analysis that the company has comprehensively outperformed its competitors in terms of the reported net profit. The company has also secured a better gross margin than its competitors. The ROE of the company trails its Rival, PepsiCo; however, the ROE is also a function of financial leverage. PepsiCo employs a riskier capital structure than Coca-Cola Cola, which in turn enhances the reported ROE of the company. This notion is asserted premised on the DuPont Formula, which presents the ROE as a multiple of Net Profit, the Asset Turnover, and the Financial Leverage. Since PepsiCo has reported a lower Net Profit but a higher ROE than Coca-Cola, it is evident that the ROE is improved due to increased leverage, which translates into increased risk and uncertainty.

3.3. Evaluation of Stock Performance

The stock performance of Coca-Cola and PepsiCo depict similar trends of steady growth, whereas Monster Beverages has depicted increased relative volatility. However, the returns on Monster Beverages were higher, subject to increased risk accepted by the market participants. The overall returns profile of all three competitors reflects the optimistic market view of the snacks and beverage sector.

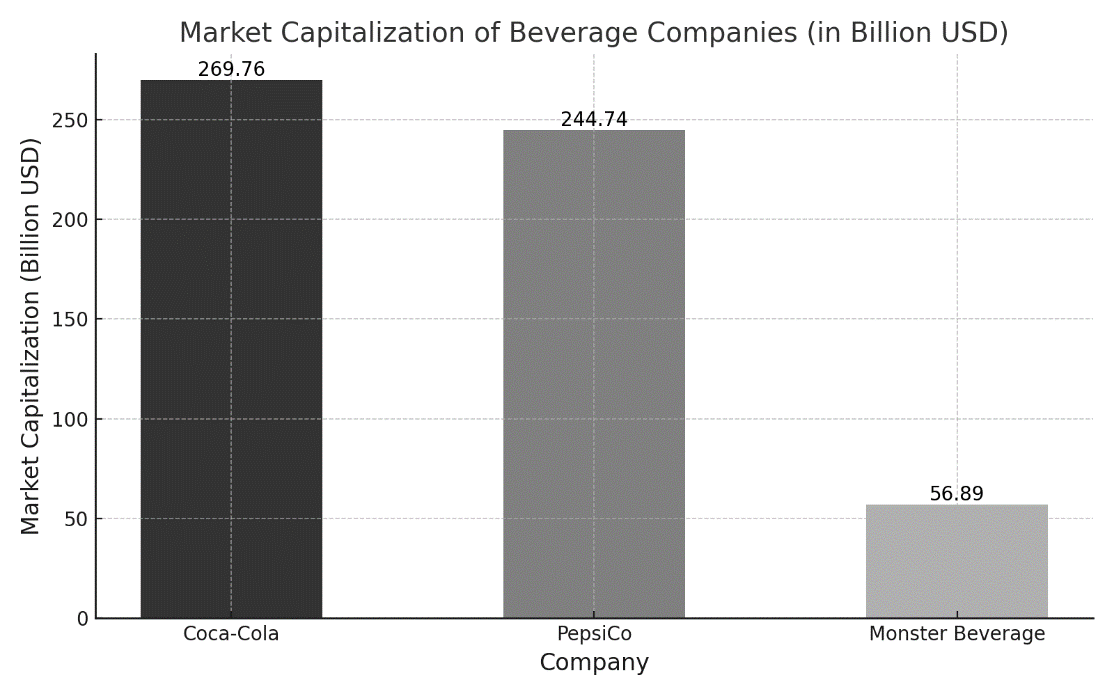

3.4. Market Capitalization

The companies have accumulated substantial market capitalisation through their lifecycles. However, PepsiCo and Coca-Cola are comparable, whereas Monster Beverages is still an emerging player in scale. The discrepancy makes sense and is likely to persist since Monster Beverages only ventures within a niche, whereas the other two companies target a broader sector [12]. The following interactive chart represents these organisations' market stature in the industry (Figure 1).

Figure 1: Market Capitalization Comparison

3.5. Analysis of Strengths and Weaknesses

Within the competitive landscape of the beverage sectors, organisations have peculiar strengths and weaknesses. The subject company, Coca-Cola, has accumulated substantial brand value over years of performance excellence and a robust distribution network that is difficult to replicate. The company's weakness lies in product diversification and adaptability to changing consumer preferences, which are becoming more inclined toward healthier consumption methods.

Coca-Cola's weakness has been leveraged by PepsiCo's diverse range of products and healthier snacks. This diversification, however, has come at the cost of increased investment needs and yielded reduced profitability. The product diversification of PepsiCo, however, acts as a buffer against sudden shifts in consumer preferences or extraordinary events like economic downturns [13]. Monster Beverages has a strong branding profile and relates well with the younger population. It is the aura around the brand that is its most valuable strength. Its weaknesses, however, are on a smaller scale, making it susceptible to takeovers and mergers by more prominent players in the sector.

4. Analysis of Current Economic Challenges

4.1. Current Economic Challenges

Amidst the company's numerous broader economic challenges, given its nature as a global brand, its steepest challenge is managing the risk of global supply chain disruption. Supply chain disruptions can, in turn, result in an excessive bottleneck in production, leading to inflated costs and loss of revenue generation for the company. Moreover, the company operates in regimes that are often geopolitical rivals. The recent conflict in the Middle East has also caused revenue disruptions for the company due to widespread boycott movements amongst Muslim nations. Such geopolitical uncertainty creates a tricky situation for the company to navigate.

Another critical challenge for the company is the continuous evolution of market and consumer preferences, leading to an incline toward healthy food consumption practices. With published research in medical journals highlighting the risk of excessive sugar consumption, the company has faced backlash from medical experts as consumers now opt for reduced or no-sugar drinks. Such emerging trends pose a significant challenge to the traditional Coca-Cola Formula.

4.2. Stock Market Challenges

The equity sector is inherently exposed to risk and uncertainty resulting from macroeconomic shifts and changes in regulatory or legal policies. Ideally, businesses should be independent of political changes; however, the nature of global business results in excessive interdependence and connectivity between varying influences [14]. After the COVID-19 pandemic, many investors have become increasingly risk-averse and skeptical of the company's ability and willingness to evolve and adapt to changes in the market and consumer preferences.

4.3. Strategic Implications

The company must integrate social, environmental, and health issues into its core strategy. Information and misinformation spread rapidly in the digital age, which can severely dent the company’s reputation and profitability. The company must also integrate exciting new technology like AI, Machine Learning, Neural Networks, and Big Data Analytics to improve its supply chain and logistics efficiency and robustness.

5. Recommendations

In the conclusive section of this study, targeted and objective recommendations have been made, premised on the above discussion and analysis of the company. While there are numerous actions that the company may need to take, this study within its cope has identified the three most pressing concerns to address for the company.

Firstly, the Coca–Cola Company should diversify its product portfolio and venture into untapped sectors to reduce dependence on limited product lines. There is no harm in learning from a competitor, and PepsiCo is the best example of diversifying its product range and variety. Replication is not recommended. However, the management and leadership must appreciate the significance of diversification from a risk and strategic perspective.

Secondly, the Coca–Cola Company should also diversify its supply chain components to secure a more resilient global supply chain. With increasing geopolitical uncertainty and changing environmental conditions, any extraordinary event can disrupt the organisation's growth and threaten its survival without diversification.

The third and final recommendation is for the company to engage more frequently and transparently with its stakeholders. With adequate disclosures and changes to its product profile, the company can consolidate its market stature and ensure that the stakeholders are given confidence and authority in its affairs.

6. Conclusion

This in-depth review reveals that while The Coca-Cola Company has enjoyed consistent profitability during the past five years, the recurrent dipping operating margins and return on equity will be a red flag if this trend continues. Having outperformed its big competitors, such as PepsiCo and Monster Beverage, on some financial measures, this company seems to be smarter when it comes to the moment where it needs to diversify its product portfolio towards the favourite healthy option avenues chosen by consumers. Besides, investors and financial analysts can benefit from these data points to evaluate if Coca-Cola is on the right track and whether it will keep growing or somebody else might take over the market share. In the end, the company will likely have to embrace the idea of creative innovation in terms of products and operations models if it is to remain on top for the next 100 years due to the changing tastes of consumers and the ever-changing global economic landscape.

The primary constraint for the research is that it focused solely on historical data and positioning that were in place until 2023’s year-end. The beverage industry's terrain is dynamic, and economic factors are subject to change; therefore, forecasting for the future may be unwise. Nevertheless, the report has created an enabling environment upon which the company can rely to assess the prevailing position and make strategic moves for the near future. The importance of this research is reflected in the fact that the findings can help the company's top management with ideas for diversification away from more traditional sugary carbonated beverages and for improving supply chain resilience. Following the above analysis, future research will examine how well Coca-Cola has done with its strategic strategies to counteract the challenges enumerated.

References

[1]. Henry, C. (2022). Financial Analysis of Accountancy in America Today through Collective Case Studies. University of Mississippi.

[2]. Okpara, K. K. (2020). Customer-Driven Strategies and Performance of Carbonated Soft Drink Company in Southern Nigeria (Doctoral dissertation, Kwara State University (Nigeria)).

[3]. Kroesen, J. O. (2020) What Is the Effect of the Coca-Cola Sustainability Initiative on Production? Basil Al-Halil 4780930.

[4]. Bai, Z. (2023). Business Analysis of PepsiCo and Coca-Cola Companies. Highlights in Business, Economics and Management, 22, 114-118

[5]. Duan, J.(2022) Analysis of Coca-Cola's Characteristics and Financial Indicators. BCP Business & Management

[6]. Prasad, M. R., & Patil, L. (2021). A Study on Analysis of Coca-Cola Company. Post Covid 19-Economic Opportunities & Challenges in India, 93.

[7]. Chowdhury, M. T., Sarkar, A., Paul, S. K., & Moktadir, M. A. (2022). A case study on strategies to deal with the impacts of the COVID-19 pandemic in the food and beverage industry. Operations Management Research, 15(1), 166-178.

[8]. Opait, G. (2020). The Coca-Cola and Pepsi-Cola Businesses, Fizzy Meeting” in the Management of the Pole Position. Economics and Applied Informatics, (1), 167-176.

[9]. Mace, T., & Stretcher, R. (2003). The Coca-Cola Company. In Allied Academies International Conference. International Academy for Case Studies. Proceedings, 10(1). 71.

[10]. Bai, Z. (2023). Business Analysis of PepsiCo and Coca-Cola Companies. Highlights in Business, Economics and Management, 22, 114-118.

[11]. Jallow, A. (2021). A strategic case study on PepsiCo. Available at SSRN 3828353.

[12]. Callahan, S. J. (2023). Monster Energy Makes Big Move to Challenge Coke and Pepsi. Retrieved from https://www.thestreet.com/retail/monster-steps-into-bang-deal#:~:text=Monster%20Takes%20Over,and%20minority%20owner%20Coca%20Cola.

[13]. Li, Y. (2024). Business Principles and Corporate Strategies of the Coca-Cola Company and PepsiCo, Inc. Journal of Education, Humanities and Social Sciences, 27, 227-234.

[14]. Alcorn, T. (2023). Big Soda’s Alcohol Drinks Worry Health Experts. The New York Times.

Cite this article

Zhuang,J. (2024). Analysis of Investment Value of Beverage Industry Enterprises: Evidence from Coca-Cola Company. Advances in Economics, Management and Political Sciences,98,29-36.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Henry, C. (2022). Financial Analysis of Accountancy in America Today through Collective Case Studies. University of Mississippi.

[2]. Okpara, K. K. (2020). Customer-Driven Strategies and Performance of Carbonated Soft Drink Company in Southern Nigeria (Doctoral dissertation, Kwara State University (Nigeria)).

[3]. Kroesen, J. O. (2020) What Is the Effect of the Coca-Cola Sustainability Initiative on Production? Basil Al-Halil 4780930.

[4]. Bai, Z. (2023). Business Analysis of PepsiCo and Coca-Cola Companies. Highlights in Business, Economics and Management, 22, 114-118

[5]. Duan, J.(2022) Analysis of Coca-Cola's Characteristics and Financial Indicators. BCP Business & Management

[6]. Prasad, M. R., & Patil, L. (2021). A Study on Analysis of Coca-Cola Company. Post Covid 19-Economic Opportunities & Challenges in India, 93.

[7]. Chowdhury, M. T., Sarkar, A., Paul, S. K., & Moktadir, M. A. (2022). A case study on strategies to deal with the impacts of the COVID-19 pandemic in the food and beverage industry. Operations Management Research, 15(1), 166-178.

[8]. Opait, G. (2020). The Coca-Cola and Pepsi-Cola Businesses, Fizzy Meeting” in the Management of the Pole Position. Economics and Applied Informatics, (1), 167-176.

[9]. Mace, T., & Stretcher, R. (2003). The Coca-Cola Company. In Allied Academies International Conference. International Academy for Case Studies. Proceedings, 10(1). 71.

[10]. Bai, Z. (2023). Business Analysis of PepsiCo and Coca-Cola Companies. Highlights in Business, Economics and Management, 22, 114-118.

[11]. Jallow, A. (2021). A strategic case study on PepsiCo. Available at SSRN 3828353.

[12]. Callahan, S. J. (2023). Monster Energy Makes Big Move to Challenge Coke and Pepsi. Retrieved from https://www.thestreet.com/retail/monster-steps-into-bang-deal#:~:text=Monster%20Takes%20Over,and%20minority%20owner%20Coca%20Cola.

[13]. Li, Y. (2024). Business Principles and Corporate Strategies of the Coca-Cola Company and PepsiCo, Inc. Journal of Education, Humanities and Social Sciences, 27, 227-234.

[14]. Alcorn, T. (2023). Big Soda’s Alcohol Drinks Worry Health Experts. The New York Times.