1. Introduction

1.1. Background

Since the industrial revolution in the 18th century, greenhouse gas emissions caused by human activities have gradually increased. Climate change and global warming have become serious challenges for all countries worldwide, and they widely affect natural ecosystems and the living environment of human beings. With rapid economic growth, resource scarcity and environmental problems have become increasingly prominent in recent years, and environmental pollution has become widespread. According to the Emergency Events Database (EM-DAT), the number of natural disasters for the year 2023 is 399, resulting in economic losses of $202.7 billion, which exceeds the average for the period 2022-2023, with about 90% of the losses due to climatic causes.[1] Additionally, the World Economic Forum has ranked the global risks by severity over the short and long term.[2] Taking the 10-year ranking as an example, the top 3 are extreme weather events, critical changes to Earth systems, biodiversity loss and ecosystem collapse.

Given the significant impact of climate change on people's economic and social lives, the international community has reached a consensus on the response to climate change. The Paris Agreement, adopted by 197 countries in 2015 and formally entered into force in 2016, has become a legally binding international treaty. The Agreement proposes a long-term temperature goal of limiting the rise in global temperatures to within 2 degrees Celsius and striving to be within 1.5 degrees Celsius. It also aims to achieve net zero greenhouse gas emissions by 2050.[3]

Investor initiatives like the United Nations Principles for Responsible Investment (UNPRI) and the Carbon Disclosure Project (CDP) have also emerged due to global challenges. Agencies like Morgan Stanley Capital Index (MSCI), Bloomberg, and S&P Global integrate ESG data from financial data providers and evaluate indicators that reflect a company's performance for each ESG topic. Companies are highly recommended to offer voluntary, consistent disclosure of climate-related financial risk to stakeholders under international regulations like the Task Force on Climate-related Financial Disclosures (TCFD).

Therefore, global challenges, public perception, investor demand, investor initiatives, regulatory framework and data availability drive the growing interest in ESG integration in the corporate and investment sectors.

1.2. Research Objectives

The research comprises five sections that investigate how ESG integration affects corporate financial performance. The initial section summarises some existing literature. Then, the paper delineates the methodology employed in this study. The subsequent section presents visualised data and statistical results generated through Microsoft Excel. The penultimate section engages in a comprehensive discussion of the study's findings. The final section encapsulates the report through a concise conclusion.

2. Literature Review

2.1. Corporate financial performance faced by climate change

Climate change has a profound impact on corporate finance. It has been recognised that climate change significantly impacted the corporate financial performance and economy of countries at the macro level.[4] Regarding the overall relationship, Huang et al. suggested a negative correlation between climate risk and corporate finance, which was highly challenging to offset by insurance measures or loss prevention instruments.[5] Specifically, Berkman et al. further elucidated that increases in perceived costs and operational risks associated with climate change directly led to a decrease in the value of firms with high climate risk exposure.[6] This phenomenon was even more pronounced under extreme weather, with Hsiang concluding that extreme weather, such as hurricanes, reduced corporate finance and the economic growth rate of diversified industries.[7] Mitigation and amelioration of climate change have become a common goal for regulators and policymakers as awareness of the seriousness of climate change grows and governments exert pressure in related industries. Various studies have further shown that climate change and unstable political conditions were closely linked and that such a correlation impacted corporate finance and strategic decisions. [8]

2.2. Climate-related risks and opportunities faced by climate change

Task Force on Climate-related Financial Disclosure (TCFD) is a widely used reporting standard to regulate corporate behaviour in operating business, which suggests consistency in existing environmental disclosure frameworks. To assist companies in disclosing consistent and decision-supporting information about climate-related risks and opportunities in their financial reports, TCFD published four broad voluntary disclosure categories in 2017. These broad categories encompass crucial corporate processes, including strategy, governance, risk management, metrics, and targets.

Physical risks include direct and indirect damage to property, infrastructure and society caused by extreme weather events. For direct impacts, extreme weather events, temperature extremes, air quality, and sea level rise can directly affect the health risks to people in the region and the risk exposure of business operations. For indirect impacts, droughts in parts of the region were frequent under climate change, indirectly leading to hunger, displacement and other social problems. In addition, infectious diseases, water, and food insecurity were indirect physical risks that would inevitably harm society and business operations. [9]

Transition risk, a specific type of climate risk faced by business communities, is rooted in the relative uncertainty of the global move towards a more sustainable, net-zero-emissions economy. Typically, three types of transition costs were considered relevant to the financial sector: policy adjustments, technological change and changes in market preferences.[10] The characteristics of such transition risks are extensive, making them difficult to quantify or model. Regulatory, geopolitical and societal pressures can significantly impact a company's operations, reputation and asset value.

2.3. ESG investments strategies

Kofi Annan, the seventh Secretary-General of the United Nations, laid the groundwork for the creation of ESG by introducing the concept of the Global Compact at the 1999 Global Economic Forum.[11] ESG stands for Environmental, Social and Governance. The United Nations first put forward the concept in its 2004 'Who Cares Wins' report, which aimed to better integrate environmental, social and governance considerations into corporate investment decisions.

The Global Sustainable Investment Alliance (GSIA) observed existing ESG investments in the market. It summarised seven mainstream ESG investment strategies, including value-based exclusions, norms-based exclusions, best-in-class, sustainability-themed, ESG integration, corporate engagement and impact investing in the 2012 Global Sustainable Investment Review. Value-based screening, also known as negative screening, excluded companies that profit from harmful activities, such as gambling and tobacco. Norms-based screening excluded companies that violate international conventions such as the United Nations Global Conventions principles. Best-in-class invested in companies with better ESG performance and higher ratings than their peers. Sustainability-themed investing was a long-term investment in assets that contributed to environmental and social sustainability, such as renewable energy. ESG integration was the explicit inclusion of environmental, social and governance factors in financial analyses by financial institutions.[12] Corporate engagement influenced corporate behaviour by exercising shareholder power, such as submitting shareholder proposals and proxy voting guided by comprehensive ESG guidelines. Impact investing was the realisation of positive social and environmental impact through investments and measuring that impact in reports that clarified investor and underlying asset intentions.

2.4. Linkages

Decade-long academic research discovered that ESG integration led to positive financial returns, and companies with high ESG ratings were less vulnerable to systematic market risks. From Morningstar's assessment of European domiciled funds across different asset classes, it could be summarised that European ESG stocks had higher valuations. According to Friede et al. vote counting and meta-analysis of the data, about 90% of the studies found a non-negative correlation between ESG and Corporate Financial Performance (CFP), and more than 50% of the studies showed that good ESG performance could drive better corporate financial performance.[13] The positive correlation between ESG and CFP was more potent in North America and emerging markets, and there was a strong correlation between a company's operational metrics and reputation. Therefore, ESG integration represented a win-win solution to align with society's broader objectives and invested in companies with better financial performance.

According to Singhania and Gupta, ESG disclosure was significantly and negatively related to corporate risk, with a significant negative impact on environmental and social disclosure and an insignificant negative impact on governance disclosure.[14] They calculated the Pearson correlation coefficient between ESG disclosure and enterprise risk through subgroup analyses such as risk type, firm size, legal environment and meta-regression analyses such as disclosure index and financial flexibility. Generally speaking, as the level of ESG disclosure increased, corporate risks tended to decrease, especially the impact on corporate idiosyncratic risks, which was significant. Systemic events such as the 2008 financial crisis could trigger widespread financial distress, and the role of ESG integration in mitigating stakeholder risk and adopting a long-term investment strategy increased the Fund's resilience to risk.[15]

3. Methodology

3.1. Research design

This study adopted a mixed-methods approach, combining qualitative and quantitative research methodologies to comprehensively analyse the impact of ESG integration on corporate financial performance in the context of climate change.

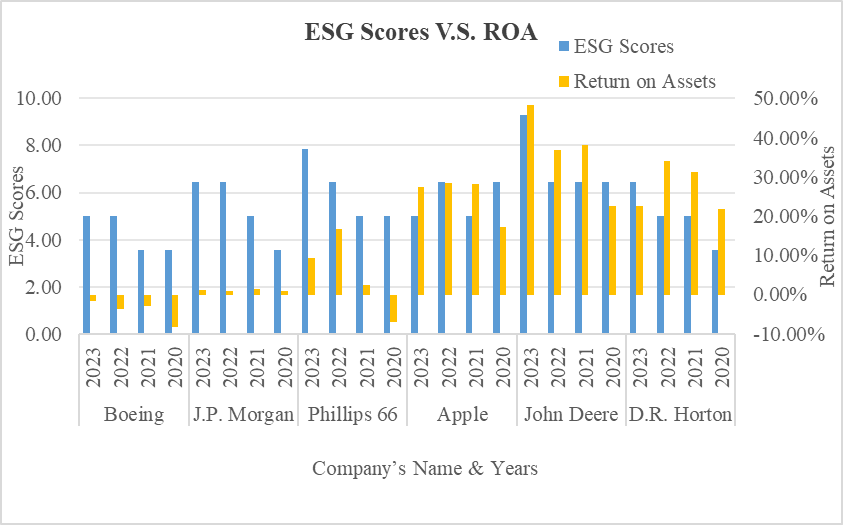

We selected six publicly listed US companies from various industries to ensure broader representation and collected data on their ESG scores and return on assets (ROA). We used Microsoft Excel to create a bar chart to visually represent the ESG performance and ROA of the selected companies, and we calculated the Pearson correlation coefficient between the two variables. The Pearson correlation coefficient was a statistical measure that quantified the linear relationship between two variables. By calculating this coefficient, we could objectively determine the strength and direction of the relationship between ESG performance and corporate financial performance. A positive correlation indicated higher ESG scores were associated with better financial performance, while a negative correlation indicated the opposite.

Arbitrage pricing theory (APT) was a well-established economic model proposed by Ross (1976) to study the relationship between expected returns on financial assets and various factors. In our study, by applying APT, we could analyse the changes in a company's financial performance due to the inclusion of ESG factors. A company's ESG characteristics, such as its environmental initiatives, social responsibility efforts, and governance structure, could be considered additional factors within the framework of APT. The equation was as follows:

\( E({R_{i}})={R_{f}} + \sum _{j=1}^{k}{β_{ij}} x [E{(F_{j}}) - {R_{f}}] \) (1)

E( \( {R_{i}} \) ) referred to the expected rate of return on security i. \( {R_{f}} \) referred to risk-free rate and the US Treasury bond rate was usually used as the risk-free rate. k stood for the number of factors that affected the security's return. \( {β_{ij}} \) represented the sensitivity of security i to the jth factor. E( \( {F_{j}} \) ) was the expected return of the jth factor.

To measure the climate-related risks and opportunities associated with a portfolio of assets, we used the scenario analysis and climate Value-at-risk. The TCFD recommended scenario analysis as a climate risk assessment methodology, which investors could use to gain a deeper insight into potential climate-related uncertainties. Scenario analysis could help to evaluate the performance and risk exposure of companies and portfolios under different scenarios. Climate Value-at-Risk was raised by MSCI ESG Research and was used as a forward-looking and return-based measure of the potential risks or opportunities that companies and portfolios could encounter under different climate scenarios. Climate VaR measured the potential loss in portfolio value due to climate change risk over a given time horizon and at a specified confidence level. This study combined scenario analysis and climate VaR to quantify the potential downside risk or upside opportunity for portfolios under three temperature scenarios.

3.2. Data collection

This study's primary source of financial data was the annual financial reports of six publicly traded US companies from various industries. These companies included Boeing, JPMorgan Chase, Phillips 66, Apple, John Deere, and D.R. Horton & Company. The financial reports from 2020 to 2023 were obtained directly from the official website. These reports provide detailed information on return on assets, which was essential to analyse the corporate financial performance of the selected companies.

To assess the ESG performance of the selected companies, we relied on ESG ratings provided by the Morgan Stanley Capital Index (MSCI). We collected ESG ratings for the six companies from 2022 to 2023. The ratings were based on the MSCI ESG Rating Methodology, which assessed companies across multiple environmental, social and governance dimensions. Based on the methodology, these companies were rated AAA, AA, A, BBB, BB, B, etc. We further translated these ratings into numerical scores to facilitate quantitative analyses, and the conversion table of letters to fractions is inside the Appendix.

In this study, we chose the asset portfolio built up by Barclays Private Bank Discretionary Portfolio Management for scenario analysis. The portfolio was assessed for climate risks and comprised 24 industrial sectors. From the investment perspective, the portfolio was categorised as medium risk, which could represent other portfolios well. Then, data on the physical risks of climate change to different sectors were obtained from the Intergovernmental Panel on Climate Change (IPCC), a leading climate research organisation, and weighted according to the proportion of sectors in the portfolio. Furthermore, we referred to sector-specific climate impact studies to assess the transition risks that the sectors in the portfolio might face as they moved to a low-carbon transition. Ultimately, we selected historical market performance data for the asset portfolio and market indicates related to climate-sensitive sectors. Then, we separately estimated the potential risks in the portfolio's value under different temperature scenarios by combining these financial data with climate-related projections.

4. Results

Figure 1: Correlation between ESG Scores & Return on Asset

Table 1: Scenario Analysis on climate-related risks and opportunities

Scenario | 1.5 °C | 2 °C | 3 °C |

Physical Risk | -0.5 | -0.7 | -1.1 |

Transition Risk | -1.8 | -0.2 | -0.2 |

Aggregated CVaR | -2.2 | -0.9 | -1.3 |

5. Discussion

5.1. Interpretation of Results

The bar chart in Figure 1 visualises the relationship between ESG scores and return on assets (ROA) for six US-listed companies, Boeing, JPMorgan Chase, Phillips 66, Apple, John Deere, and D.R. Horton, for 2020 to 2023. The left vertical axis shows the company's ESG scores and the right axis shows the ROA value. The horizontal axis lists the names of the six companies. Visually, we can observe the relative position of the bars for each company, which gives an initial indication of how their ESG scores and ROA compare. For some companies, we may notice that a relatively higher ROA accompanies a higher ESG score. The Pearson correlation coefficient calculated between the two variables is 0.49 and the data is in the Appendix, further quantifying the relationship. A positive correlation coefficient indicates that ESG scores and ROA tend to move in the same direction. In this case, the value is 0.49, indicating a moderate positive correlation. On average, as a company's ESG score increases, its ROA will also likely increase.

When a company has a high ESG rating, ESG can be considered an additional macroeconomic factor to be included in the APT model. Analysed from a cost-saving perspective, companies can improve their profitability by adopting more environmentally friendly production technologies and reducing energy consumption. On the social front, good employee relations help increase employee motivation and loyalty, increasing productivity. On the governance side, a sound governance structure can reduce losses from poor internal mismanagement. Combining these factors makes the company more competitive in the market. It increases profitability, which is reflected in the APT model, where if the market prices ESG factors positively, then the company's expected return will increase due to ESG factors. If is significant and positive, it means that a company's return on assets is more sensitive to changes in ESG factors. For companies with excellent ESG performance, their good ESG performance translates more significantly into economic benefits.

From Table 1, physical risk increases with rising temperature, indicating a significant positive association. Extreme weather and climate change have more impact on the portfolio, as evidenced by the CVaR, which is -0.5 for the 1.5°C temperature scenario and -1.1 for the 3°C temperature scenario. A CVaR of -1.8 indicates that, under a 1.5°C climatic temperature scenario, there is a 99% likelihood that the portfolio will experience the most considerable potential loss of 1.8% of its current portfolio value, assuming a confidence level of 99%. In terms of transition risk, the CVaR value of -1.8 in the 1.5°C scenario is lower than in the 2°C and 3°C scenarios, suggesting that sharp shifts in policy and technology transitions in the 1.5°C scenario expose the portfolio to larger potential losses. The Aggregated CVaR, which takes into account both transition and physical risks, is -2.2 for the 1.5°C disordered scenario, -0.9 for the below 2°C ordered scenario, and -1.3 for the 3°C greenhouse scenario, suggesting that the portfolio's exposure to the overall climate risk is highest for the 1.5°C disordered scenario, and relatively low for the below 2°C ordered scenario.

The findings align with the existing literature, as highlighted by Dell et al. and Huang et al., who emphasised that climate change significantly impacted corporate financial performance, as evidenced by the negative correlation between climate risk and firm value. The study of Pearson's correlation coefficient in this paper fits with the meta-analysis of the data by Friede et al. It explains the existence of a non-negative correlation between ESG rating and CFP. Climate Value-at-Risk (CVaR) analyses conducted in the context of rising temperatures highlight an increase in actual versus transition risk, further reinforcing Berkman et al. 's assertion that an increase in operational risk leads to a decrease in firm value.

Based on the above studies, the relationship between ESG integration and corporate financial performance can be explained. Integrating ESG factors in company development and financial analyses can contribute to the progress of financial performance and the identification of climate-related investment risks and opportunities. In addition, ESG integration reduces systematic risk in relative terms and provides some resilience to risk even in times of macroeconomic downturn.

5.2. Limitation of the study

Although the study provides a comprehensive analysis of ESG integration in corporate financial performance, it is essential to recognise that existing limitations may have affected the findings.

This study relies heavily on ESG ratings from the Morgan Stanley Capital Index (MSCI) to assess companies' ESG performance. However, different ESG rating agencies (e.g. S&P Global) use different metrics for their evaluation. Differences in rating methodologies may result in inconsistent ESG ratings for the same company. Rating differences may create bias in our analyses, as conclusions based on MSCI ratings may not hold up when considering the views of other rating agencies.

Analyses of corporate financial performance and climate-related risks and opportunities are conducted within the Task Force on Climate-related Financial Disclosures (TCFD) framework. While the TCFD provides a structured approach to disclosure, other frameworks, such as the Sustainability Accounting Standards Board (SASB) and the European Sustainability Reporting Standards (ESRS), also exist and provide reporting methods for presenting ESG-related information. Different disclosure frameworks may highlight different aspects of a company's ESG profile. In contrast, using a single framework may lead to a more one-sided analysis of a company's true ESG.

ESG investing originated mainly in European and American countries, and we may have overlooked the unique characteristics and challenges of ESG implementation in the Asia-Pacific region. This geographical limitation may limit the global replication of our findings. The application of the Pearson correlation coefficient, arbitrage pricing theory (APT) and climate value-at-risk is at the core of our quantitative analysis. However, all models have inherent limitations and specific conditions of use.

6. Conclusion

6.1. Summary of key findings

Climate change poses physical and transition risks to corporate financial performance, forcing costly adaptation. However, there is a positive correlation between ESG integration and financial performance. Companies with higher ESG scores perform better financially because environmental management reduces costs, social aspects enhance reputation, and good governance facilitates decision-making and operations. In addition, we use scenario analysis and CVaR to explore the climate-related risks and opportunities of asset portfolios, highlighting the importance of ESG integration for optimising corporate finance and managing climate risk.

6.2. Recommendations and reflection

We selected companies, investors, and policymakers as the main stakeholders in making recommendations. Companies should integrate ESG factors into their business strategies, set clear targets, such as emissions reduction targets and adopt recognised ESG reporting frameworks to provide accurate and detailed information to stakeholders. Investors should use shareholder rights to encourage companies to improve their ESG integration. Policymakers are supposed to develop clear and coherent regulations for ESG integration and climate change mitigation and provide incentives for companies to engage in ESG efforts actively.

References

[1]. 2023 Disasters in Numbers. EM-DAT - The international disaster database. (2023). https://files.emdat.be/reports/2023_EMDAT_report.pdf

[2]. Global risks report 2024. World Economic Forum. (2024, January 10). https://www.weforum.org/publications/global-risks-report-2024/

[3]. Streck, C., Keenlyside, P., & von Unger, M. (2016). The Paris Agreement: A new beginning. Journal for European Environmental & Planning Law, 13(1), 3–29. https://doi.org/10.1163/18760104-01301002

[4]. Dell, M., Jones, B. F., & Olken, B. A. (2014). What do we learn from the weather? the new climate-economy literature. Journal of Economic Literature, 52(3), 740–798. https://doi.org/10.1257/jel.52.3.740

[5]. Huang, H. H., Kerstein, J., & Wang, C. (2017). The impact of climate risk on firm performance and financing choices: An international comparison. Journal of International Business Studies, 49(5), 633–656. https://doi.org/10.1057/s41267-017-0125-5

[6]. Berkman, H., Jona, J., & Soderstrom, N. (2024b). Firm-specific climate risk and market valuation. Accounting, Organizations and Society, 112, 101547. https://doi.org/10.1016/j.aos.2024.101547

[7]. Hsiang, S. M. (2010). Temperatures and cyclones strongly associated with economic production in the Caribbean and Central America. Proceedings of the National Academy of Sciences, 107(35), 15367–15372. https://doi.org/10.1073/pnas.1009510107

[8]. Naseer, M. M., Khan, M. A., Bagh, T., Guo, Y., & Zhu, X. (2024). Firm climate change risk and financial flexibility: Drivers of ESG performance and firm Value. Borsa Istanbul Review, 24(1), 106–117. https://doi.org/10.1016/j.bir.2023.11.003

[9]. Beddow, D. H. (2024, August 15). Physical Climate Risk & Transition Climate Risk. UKGBC. https://ukgbc.org/news/what-is-the-difference-between-physical-climate-risk-and-transition-climate-risk/

[10]. Campiglio, E., Daumas, L., Monnin, P., & von Jagow, A. (2022). Climate‐related risks in financial assets. Journal of Economic Surveys, 37(3), 950–992. https://doi.org/10.1111/joes.12525

[11]. Pollman, E. (2022). The making and meaning of ESG. U of Penn, Inst for Law & Econ Research Paper, (22-23).

[12]. Hill, J. (2020). ESG, Sri, and impact investing. Environmental, Social, and Governance (ESG) Investing, 13–27. https://doi.org/10.1016/b978-0-12-818692-3.00002-5

[13]. Friede, G., Busch, T., & Bassen, A. (2015). ESG and Financial Performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. https://doi.org/10.1080/20430795.2015.1118917

[14]. Singhania, M., & Gupta, D. (2024). Impact of environmental, social and governance (esg) disclosure on firm risk: A meta‐analytical review. Corporate Social Responsibility and Environmental Management, 31(4), 3573–3613. https://doi.org/10.1002/csr.2725

[15]. Cerqueti, R., Ciciretti, R., Dalò, A., & Nicolosi, M. (2021). ESG investing: A chance to reduce systemic risk. Journal of Financial Stability, 54, 100887. https://doi.org/10.1016/j.jfs.2021.100887

Cite this article

Yang,X.;Shi,Y. (2024). Optimising Corporate Financial Performance Through ESG Integration Faced by Climate Change. Advances in Economics, Management and Political Sciences,128,1-10.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. 2023 Disasters in Numbers. EM-DAT - The international disaster database. (2023). https://files.emdat.be/reports/2023_EMDAT_report.pdf

[2]. Global risks report 2024. World Economic Forum. (2024, January 10). https://www.weforum.org/publications/global-risks-report-2024/

[3]. Streck, C., Keenlyside, P., & von Unger, M. (2016). The Paris Agreement: A new beginning. Journal for European Environmental & Planning Law, 13(1), 3–29. https://doi.org/10.1163/18760104-01301002

[4]. Dell, M., Jones, B. F., & Olken, B. A. (2014). What do we learn from the weather? the new climate-economy literature. Journal of Economic Literature, 52(3), 740–798. https://doi.org/10.1257/jel.52.3.740

[5]. Huang, H. H., Kerstein, J., & Wang, C. (2017). The impact of climate risk on firm performance and financing choices: An international comparison. Journal of International Business Studies, 49(5), 633–656. https://doi.org/10.1057/s41267-017-0125-5

[6]. Berkman, H., Jona, J., & Soderstrom, N. (2024b). Firm-specific climate risk and market valuation. Accounting, Organizations and Society, 112, 101547. https://doi.org/10.1016/j.aos.2024.101547

[7]. Hsiang, S. M. (2010). Temperatures and cyclones strongly associated with economic production in the Caribbean and Central America. Proceedings of the National Academy of Sciences, 107(35), 15367–15372. https://doi.org/10.1073/pnas.1009510107

[8]. Naseer, M. M., Khan, M. A., Bagh, T., Guo, Y., & Zhu, X. (2024). Firm climate change risk and financial flexibility: Drivers of ESG performance and firm Value. Borsa Istanbul Review, 24(1), 106–117. https://doi.org/10.1016/j.bir.2023.11.003

[9]. Beddow, D. H. (2024, August 15). Physical Climate Risk & Transition Climate Risk. UKGBC. https://ukgbc.org/news/what-is-the-difference-between-physical-climate-risk-and-transition-climate-risk/

[10]. Campiglio, E., Daumas, L., Monnin, P., & von Jagow, A. (2022). Climate‐related risks in financial assets. Journal of Economic Surveys, 37(3), 950–992. https://doi.org/10.1111/joes.12525

[11]. Pollman, E. (2022). The making and meaning of ESG. U of Penn, Inst for Law & Econ Research Paper, (22-23).

[12]. Hill, J. (2020). ESG, Sri, and impact investing. Environmental, Social, and Governance (ESG) Investing, 13–27. https://doi.org/10.1016/b978-0-12-818692-3.00002-5

[13]. Friede, G., Busch, T., & Bassen, A. (2015). ESG and Financial Performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. https://doi.org/10.1080/20430795.2015.1118917

[14]. Singhania, M., & Gupta, D. (2024). Impact of environmental, social and governance (esg) disclosure on firm risk: A meta‐analytical review. Corporate Social Responsibility and Environmental Management, 31(4), 3573–3613. https://doi.org/10.1002/csr.2725

[15]. Cerqueti, R., Ciciretti, R., Dalò, A., & Nicolosi, M. (2021). ESG investing: A chance to reduce systemic risk. Journal of Financial Stability, 54, 100887. https://doi.org/10.1016/j.jfs.2021.100887