1. Introduction

In recent years, the global emphasis on environmental sustainability has intensified, driven by the urgent need to address climate change, resource depletion, and environmental degradation. Governments worldwide are implementing increasingly stringent environmental regulations and policies aimed at promoting sustainable development. However, these efforts are unfolding in a context of significant global economic uncertainty, fueled by factors such as geopolitical tensions, pandemics, and technological disruptions [1]. This uncertainty presents a unique challenge for companies as they strive to balance their profitability with their environmental responsibilities.

Understanding the interplay between economic uncertainty and corporate investment in green technologies is crucial. It reveals how companies navigate the complexities of maintaining environmental stewardship while pursuing economic objectives in a volatile market environment. Furthermore, this understanding provides valuable insights for businesses as they develop investment strategies that not only comply with environmental regulations but also ensure long-term economic viability [2].

The relationship between economic uncertainty and corporate investment has been extensively studied, with numerous scholars examining the various factors that influence this dynamic. One key finding is that economic uncertainty often leads to a significant reduction in investment activities, primarily due to the "option value of waiting." This concept suggests that firms tend to delay investment decisions until there is greater clarity in the economic environment, thereby minimizing the risks associated with uncertain outcomes [3]. However, when the focus shifts to environmental investment, the literature offers a more nuanced perspective. Some studies argue that stringent environmental regulations, rather than merely imposing constraints, can stimulate innovation within firms, leading to a "win-win" scenario where companies achieve both environmental and economic benefits through enhanced efficiency and innovation [4]. Additionally, recent research highlights the crucial role of government interventions, such as subsidies and tax incentives, in mitigating the adverse effects of economic uncertainty on green investment. These measures provide the necessary financial support for firms to pursue sustainable practices, even in uncertain economic conditions.

This paper aims to explore these dynamics in greater depth by analyzing how Tesla, a leader in the electric vehicle industry, has strategically aligned its investments with governmental goals for environmental protection and pollution reduction, particularly under conditions of economic uncertainty. Through a detailed case study, this research investigates Tesla's investment decisions aimed at reducing pollution and enhancing environmental sustainability, while also considering the impact of macroeconomic policies. The findings reveal that despite the challenges posed by economic uncertainty, Tesla's strategic adaptability and alignment with environmental regulations have positioned the company for continued growth and success.

2. Corresponding to Environmental Protection Policies

2.1. Background Description

The electric vehicle (EV) industry has experienced rapid growth in recent years, becoming a critical segment of the global automotive market. This expansion is driven by multiple factors, including government policies aimed at reducing greenhouse gas emissions, technological advancements, and growing consumer awareness of environmental sustainability [5]. According to data from the International Energy Agency (IEA), global EV sales reached approximately 10.5 million units in 2022, representing a year-on-year increase of about 55% and accounting for around 14% of total global vehicle sales [6]. Governments across the globe have enacted stringent environmental regulations and initiatives, including the European Union's "Fit for 55" plan, which seeks to achieve a reduction of at least 55% in greenhouse gas emissions by 2030. This regulatory framework has substantially intensified the demand for EVs. Moreover, advancements in battery technology have been pivotal in reducing production costs and enhancing vehicle performance. As indicated in the research, the average cost of lithium-ion batteries for EVs declined by approximately 14% per annum from 2007 to 2014 [7].

Tesla, as a leading player in the EV industry, has leveraged continuous innovation and efficient production processes to secure a significant share of the global market. In 2022, Tesla reported global deliveries of approximately 1.31 million units, reflecting a 40% increase compared to the previous year. The company's popular models, Model 3 and Model Y, together accounted for over 95% of these total sales, as detailed in Tesla's annual report. This success not only reinforces Tesla's leadership in the EV market but also underscores its role in driving the global transition to zero-emission vehicles.

Since its inception, Tesla has been committed to technological innovation with a mission to reduce environmental pollution and achieve sustainable development. Tesla's founder, Elon Musk, has consistently emphasized that the company's primary mission is to "accelerate the world's transition to sustainable energy." To fulfill this mission, Tesla has focused not only on developing electric vehicles but also on expanding its business into battery storage and solar energy. Products like the Tesla Powerwall and Powerpack, along with the Solar Roof, provide clean energy solutions for homes and businesses, furthering Tesla's commitment to sustainability.

In recent years, Tesla has significantly increased its investments in these areas, particularly in research and development (R&D) and the expansion of manufacturing facilities. The company invested $3.4 billion in global R&D in 2022, with most of the funds allocated to battery technology and autonomous driving systems. In addition, according to a Tesla report, the Gigafactory in Shanghai has an annual production capacity of 750,000 vehicles, making it one of the company's largest production facilities. However, despite its significant achievements in innovation and market expansion, Tesla faces new challenges due to the increasingly complex global economic environment.

2.2. Strategic Investment Challenges in a Volatile Economic Landscape

In the context of pervasive global economic volatility, Tesla is confronted with a series of pivotal investment decisions. Geopolitical tensions, supply chain disruptions, and inflationary pressures have exacerbated economic uncertainty, potentially precipitating a decline in market demand and adversely impacting the company’s revenue streams. For instance, escalating raw material costs coupled with persistent supply chain challenges may elevate Tesla's production expenses, thereby compressing profit margins. Empirical evidence from research underscores the volatility of critical battery materials, such as lithium and nickel, attributing these fluctuations to supply-demand imbalances, which in turn escalate production costs for EV manufacturers [8].

Nevertheless, government environmental policies and subsidies present new strategic opportunities for Tesla. The company must judiciously balance short-term profitability with long-term sustainability, particularly within such a volatile economic environment. Accordingly, Tesla needs to formulate investment strategies that can adapt to economic fluctuations while preserving its competitive advantage in the global EV market.

2.3. The Impact of Economic Uncertainty on Investment Decisions

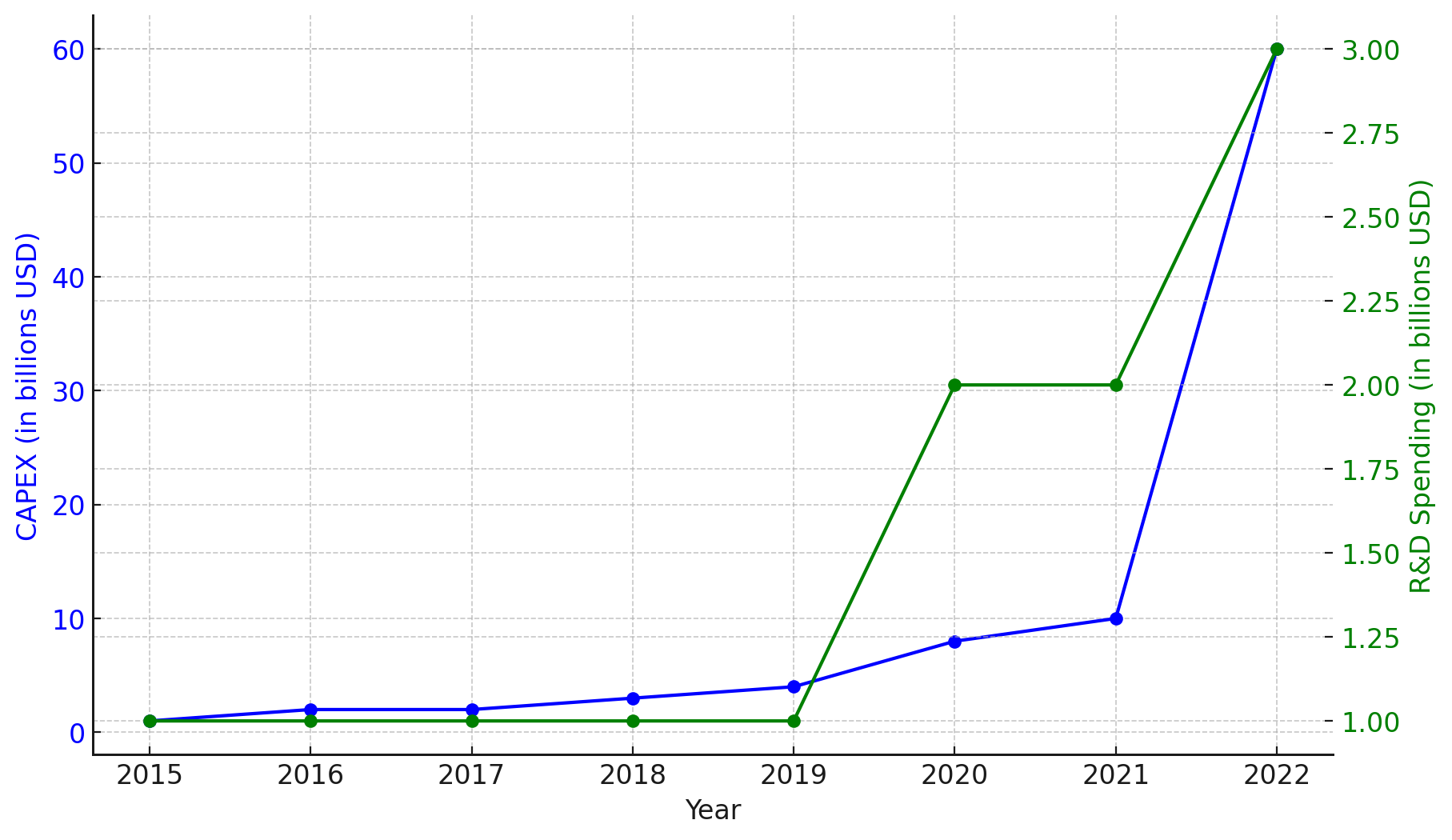

Global economic uncertainty exerts a profound influence on corporate investment decisions, particularly within capital-intensive industries such as electric vehicles. Fluctuations in economic cycles, encompassing variations in economic growth rates, inflation, and market confidence, directly impact firms’ resource allocation to capital expenditures (CAPEX) and R&D investments.

During periods of economic recession, firms typically curtail investments to mitigate risks and preserve liquidity. Conversely, during phases of economic expansion, firms are more inclined to augment investments to capture market share. It is suggested that economic uncertainty often compels firms to defer or curtail capital expenditures, thereby adversely affecting long-term growth trajectories [9]. However, Tesla has diverged from this conventional approach by persistently investing in critical areas despite prevailing economic uncertainty.

During the global economic downturn of 2020, Tesla markedly increased its R&D investments. Empirical studies indicate that highly innovative firms tend to exhibit counter-cyclical R&D investment behaviors, sustaining or even amplifying their R&D expenditures during periods of economic uncertainty [10]. For example, Tesla's R&D expenditure reached $1.49 billion in 2020, reflecting an 11.2% increase from 2019. This commitment to continuous technological innovation underscores Tesla’s ability to maintain its competitive edge, even amid an uncertain economic environment.

Furthermore, government economic policies have been instrumental in supporting environmentally conscious companies like Tesla. In recent years, governments globally have implemented policies aimed at fostering sustainable development and clean energy technologies. For instance, the US government’s Clean Energy Tax Incentives Act provides tax benefits to firms engaged in the development of new energy technologies. Such policies have substantially mitigated Tesla’s R&D costs, providing critical financial support for sustained investment during periods of economic uncertainty [11]. Similarly, the European Green Deal has facilitated direct funding and low-interest loans to support the expansion initiatives of EV companies. These policies have enabled Tesla to continue expanding its production capacity in Europe, despite the prevailing economic complexities in the region.

Figure 1 illustrates the variations in Tesla's CAPEX and R&D spending across different economic cycles, further highlighting the company’s strategic navigation through economic uncertainty.

Figure 1: Tesla's Capital Expenditure and R&D Spending (Data Source: Tesla Annual Report).

2.4. Strategic Planning

Tesla's adeptness in navigating economic uncertainty can be largely attributed to its flexible investment strategies. The company employs a multifaceted approach, carefully balancing the expansion of production capacity with strategic investments in new technologies and enhancements in supply chain efficiency. This strategic framework has proven particularly effective in mitigating risks associated with economic volatility.

Research posits that firms encountering global supply chain disruptions can effectively mitigate these risks through proactive, forward-looking planning and strategic investments [12]. Tesla exemplifies this approach, as demonstrated by its ability to maintain production levels during the global semiconductor shortage of 2021. The company’s strategic initiatives, including securing long-term supplier contracts and consistently investing in alternative technologies, collectively enabled Tesla to minimize the adverse impacts of supply chain disruptions and sustain robust production capacity.

Moreover, Tesla has strategically leveraged government incentives and low-interest loans as mechanisms to reduce investment risks while simultaneously enhancing returns. Empirical evidence from 2021 highlights that China’s EV subsidy policy significantly bolstered corporate profitability, thereby facilitating Tesla’s strategic expansion within the Chinese market [13]. These subsidies not only underpinned Tesla’s growth in China, but also played a pivotal role in reinforcing the company’s dominance within the global market. Furthermore, the European Green Deal’s objective of achieving carbon neutrality by 2050, coupled with substantial financial support for clean energy companies, has enabled Tesla to expand its production and sales network across Europe, further bolstering its market share. These policies have allowed Tesla to maintain stable growth amid economic uncertainty and continue its leadership in the global EV market.

3. Discussion and Recommendations

3.1. Strategies for Companies to Address Uncertainty

Tesla's successful experience underscores the critical importance of adopting a flexible and forward-looking investment strategy to foster corporate growth amid economic uncertainty. First, companies must maintain a high degree of agility, enabling them to swiftly adjust their investment trajectories in response to rapidly evolving market conditions. This agility encompasses the prompt realignment of product lines during economic downturns or the escalation of R&D investments in technology to secure a competitive advantage during economic recovery.

In this context, the option value theory provides robust theoretical underpinnings. This theory posits that investing in innovation during periods of uncertainty can yield significant long-term returns by affording firms the flexibility to capitalize on optimal expansion opportunities. Tesla’s strategic approach exemplifies this theory, as it has consistently invested heavily in electric vehicles and autonomous driving technologies during economic downturns, thereby positioning itself as a market leader during subsequent recoveries.

Second, companies can mitigate investment risks and secure additional financial support by fully exploiting government support mechanisms, such as tax incentives, low-interest loans, and green subsidies. For instance, policies in the United States and Europe offer various incentives for environmentally sustainable companies. Tesla has effectively utilized these policies to alleviate the financial burden of R&D costs, laying a solid foundation for future expansion [14].

Furthermore, in the face of uncertainty, companies should continue to prioritize innovation, particularly in core technology R&D. Despite global economic turbulence, Tesla has consistently allocated substantial resources to the development of electric vehicles and autonomous driving technologies, thereby preserving its competitive edge. This strategic alignment with the option value of waiting theory reinforces the notion that investing in innovation during periods of uncertainty can generate substantial long-term returns [15].

3.2. Implications for the Broader Economy

Tesla's success offers important insights for other companies and industries, particularly in how to respond to economic uncertainty through technological innovation and operational efficiency improvements. First, companies should prioritize technological innovation, which can help them navigate short-term market fluctuations and strengthen their long-term competitiveness. For example, investments in automation, digital transformation, and green technology can not only enhance production efficiency, but also help companies explore new markets, sustaining growth during economic downturns.

Second, government policies play a crucial role in helping companies address economic uncertainty. Tesla successfully leveraged relevant policies under the European Green Deal and the US Clean Energy Tax Incentives Act to continue investing in green technology and infrastructure during challenging economic conditions. These policies provided favorable economic conditions for companies, enabling them to maintain momentum in adverse market environments [16].

More broadly, these policies support not only individual companies but also promote sustainable development across the entire economy at the macro level. By encouraging green investments and technological innovation, government policies help companies reduce reliance on traditional energy sources, drive the transition to a low-carbon economy, and create new employment opportunities and economic growth points. By combining technological innovation and policy support, companies and governments can jointly address economic uncertainty, promoting sustainable development and economic recovery.

3.3. Lessons for Other Industries

Although Tesla's success is primarily centered on electric vehicles and renewable energy, its strategies for navigating economic uncertainty have broad applicability across various industries, especially in response to the government's strong support for green environmental protection policies and the use of low-carbon market demand. Tesla's investments in advanced manufacturing technologies and automation have not only increased production efficiency but also reduced environmental impact. Other manufacturing companies can adopt similar strategies by investing in clean production technologies and green supply chain management to meet the growing market demand for eco-friendly products. Additionally, companies can leverage government environmental policies and green financing from banks to lower capital costs and increase profitability. Tesla’s investments in renewable energy and storage technologies have benefited from government subsidies, carbon credits, and strong market demand for green energy, which significantly boosting profitability. Energy companies can invest more in solar, wind, and hydrogen technologies while utilizing green financing tools to meet the high demand for clean energy and strengthen market competitiveness. Traditional energy companies can also develop low-carbon projects and invest in carbon capture and storage technologies to align with government policies and capture greater market share. By integrating government policy support, market demand, and bank financing tools, companies across industries can remain competitive during economic uncertainty while achieving significant economic returns alongside environmental goals.

4. Conclusion

This paper has explored the intricate relationship between economic uncertainty and corporate investment, particularly in the context of green technologies and the electric vehicle industry. Through a detailed case study of Tesla, it has been demonstrated how a leading company can strategically align its investments with government environmental goals, even in the face of significant economic volatility. The analysis revealed that despite the challenges posed by global economic uncertainties—such as geopolitical tensions, supply chain disruptions, and inflationary pressures—Tesla has successfully navigated these challenges by maintaining a flexible and forward-looking investment strategy. The findings suggest that companies can effectively balance short-term profitability with long-term sustainability by investing in technological innovation, leveraging government incentives, and adopting a proactive approach to risk management. These strategies not only ensure the company's resilience in volatile markets but also reinforce its leadership position in the global transition to sustainable energy.

However, this study is not without its limitations. The analysis primarily focuses on Tesla, which, while representative of the EV industry, may not fully capture the diversity of strategies employed by other companies in different sectors. Additionally, the paper's reliance on historical data limits its ability to predict future trends with certainty, particularly in the rapidly evolving fields of green technology and global economics. Future research could address these limitations by examining a broader range of companies across various industries and by incorporating more recent data and emerging trends. Furthermore, longitudinal studies could provide deeper insights into how companies' strategies evolve over time in response to ongoing economic challenges, ultimately contributing to a more comprehensive understanding of the interplay between economic uncertainty and corporate investment in sustainable development.

References

[1]. Baker, S. R., Bloom, N. and Davis, S. J. (2016) Measuring economic policy uncertainty The Quarterly Journal of Economics, 131(4), 1593-1636.

[2]. Kose, M. A., Prasad, E. S. and Terrones, M. E. (2009). Does financial globalization promote risk sharing? Journal of Development Economics, 89(2), 258–270.

[3]. Bloom, N. (2007) The impact of uncertainty shocks. National Bureau of Economic Research, 13385.

[4]. He, Y., Ding, X. and Yang, C. (2021). Do environmental regulations and financial constraints stimulate corporate technological innovation? Evidence from China. Journal of Asian Economics, 72, 101265.

[5]. Raihan, A. and Tuspekova, A. (2022) Role of economic growth, renewable energy, and technological innovation to achieve environmental sustainability in Kazakhstan. Current Research in Environmental Sustainability, 4, 100165.

[6]. World Economic Forum. (2024) Electric vehicle sales leapt 55% in 2022 - here’s where that growth was strongest. Retrieved from: https://www.weforum.org/agenda/2023/05/electric-vehicles-ev-sales-growth-2022/

[7]. Liu, W., Placke, T. and Chau, K. (2022) Overview of batteries and battery management for electric vehicles. Energy Reports, 8, 4058–4084.

[8]. Cheng, A. L., Fuchs, E. R. H., Karplus, V. J. and Michalek, J. J. (2024). Electric Vehicle Battery Chemistry affects supply chain disruption vulnerabilities. Nature Communication, 15, 2143.

[9]. Claessens, S., Kose M. A., Laeven L. and F. Valencia. (2014) Financial Crises: Causes, Consequences, and Policy Responses. International Monetary Fund, Washington D.C.

[10]. Fabrizio K. R. and Tsolmon, U. (2014) An Empirical Examination of the Procyclicality of R&D Investment and Innovation. The Review of Economics and Statistics, 96 (4), 662–675.

[11]. Maradin, D. and Malnar, A. (2022) Sustainable and Clean Energy: The Case of Tesla Company. Journal of Economics, Finance and Management Studies, 5, 3531-3541

[12]. Difiglio, C. (2014) Oil, economic growth and strategic petroleum stocks. Energy Strategy Review, 5, 48–58.

[13]. Durugbo, C. M. and Al-Balushi, Z. (2022) Supply chain management in times of crisis: a systematic review. Management Review Quarterly, 73(3), 1179–1235.

[14]. Jiang, C., Zhang, Y., Zhao, Q. and Wu, C. (2020) The impact of purchase subsidy on enterprises’ R&D efforts: Evidence from China’s New Energy Vehicle Industry. Sustainability, 12(3), 1105

[15]. Xue, C., Zhou, H., Wu, Q., Wu, X. and Xu, X. (2021) Impact of Incentive Policies and Other Socio-Economic Factors on Electric Vehicle Market Share: A Panel Data Analysis from the 20 Countries. Sustainability, 13(5), 2928.

[16]. Struckell, E., Ojha, D., Patel, P. C. and Dhir, A. (2022) Strategic choice in times of stagnant growth and uncertainty: An institutional theory and organizational change perspective. Technological Forecasting and Social Change, 182, 121839.

Cite this article

Lin,Z. (2024). Navigating Economic Uncertainty: Strategic Corporate Investment in Green Technologies – A Case Study of Tesla. Advances in Economics, Management and Political Sciences,127,44-50.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Baker, S. R., Bloom, N. and Davis, S. J. (2016) Measuring economic policy uncertainty The Quarterly Journal of Economics, 131(4), 1593-1636.

[2]. Kose, M. A., Prasad, E. S. and Terrones, M. E. (2009). Does financial globalization promote risk sharing? Journal of Development Economics, 89(2), 258–270.

[3]. Bloom, N. (2007) The impact of uncertainty shocks. National Bureau of Economic Research, 13385.

[4]. He, Y., Ding, X. and Yang, C. (2021). Do environmental regulations and financial constraints stimulate corporate technological innovation? Evidence from China. Journal of Asian Economics, 72, 101265.

[5]. Raihan, A. and Tuspekova, A. (2022) Role of economic growth, renewable energy, and technological innovation to achieve environmental sustainability in Kazakhstan. Current Research in Environmental Sustainability, 4, 100165.

[6]. World Economic Forum. (2024) Electric vehicle sales leapt 55% in 2022 - here’s where that growth was strongest. Retrieved from: https://www.weforum.org/agenda/2023/05/electric-vehicles-ev-sales-growth-2022/

[7]. Liu, W., Placke, T. and Chau, K. (2022) Overview of batteries and battery management for electric vehicles. Energy Reports, 8, 4058–4084.

[8]. Cheng, A. L., Fuchs, E. R. H., Karplus, V. J. and Michalek, J. J. (2024). Electric Vehicle Battery Chemistry affects supply chain disruption vulnerabilities. Nature Communication, 15, 2143.

[9]. Claessens, S., Kose M. A., Laeven L. and F. Valencia. (2014) Financial Crises: Causes, Consequences, and Policy Responses. International Monetary Fund, Washington D.C.

[10]. Fabrizio K. R. and Tsolmon, U. (2014) An Empirical Examination of the Procyclicality of R&D Investment and Innovation. The Review of Economics and Statistics, 96 (4), 662–675.

[11]. Maradin, D. and Malnar, A. (2022) Sustainable and Clean Energy: The Case of Tesla Company. Journal of Economics, Finance and Management Studies, 5, 3531-3541

[12]. Difiglio, C. (2014) Oil, economic growth and strategic petroleum stocks. Energy Strategy Review, 5, 48–58.

[13]. Durugbo, C. M. and Al-Balushi, Z. (2022) Supply chain management in times of crisis: a systematic review. Management Review Quarterly, 73(3), 1179–1235.

[14]. Jiang, C., Zhang, Y., Zhao, Q. and Wu, C. (2020) The impact of purchase subsidy on enterprises’ R&D efforts: Evidence from China’s New Energy Vehicle Industry. Sustainability, 12(3), 1105

[15]. Xue, C., Zhou, H., Wu, Q., Wu, X. and Xu, X. (2021) Impact of Incentive Policies and Other Socio-Economic Factors on Electric Vehicle Market Share: A Panel Data Analysis from the 20 Countries. Sustainability, 13(5), 2928.

[16]. Struckell, E., Ojha, D., Patel, P. C. and Dhir, A. (2022) Strategic choice in times of stagnant growth and uncertainty: An institutional theory and organizational change perspective. Technological Forecasting and Social Change, 182, 121839.