1.Introduction

In an era marked by heightened environmental awareness and social responsibility, the landscape of investment has evolved to accommodate a new paradigm: Environmental, Social, and Governance (ESG) investing. This approach, which integrates non-financial factors into investment decisions, has resonated with investors seeking to align their capital with their values while pursuing long-term financial returns. The objective of this paper is to explore the practical implications of ESG integration within two prominent portfolio management models: the Markowitz Model (MM) and the Index Model (IM). By examining the implementation of ESG factors in these models, we aim to understand their impact on portfolio optimization and risk management.

The significance of ESG investing lies in its potential to drive positive change while mitigating risk and enhancing returns. Environmental factors consider a company's impact on the natural world, social factors evaluate its relationships with employees, customers, and communities, and governance factors assess the leadership, executive pay, audits, internal controls, and shareholder rights. The integration of these factors into investment strategies is expected to reflect a company's commitment to sustainable and ethical practices, which can influence its long-term viability and profitability.

This study is particularly relevant as it addresses the growing interest among both retail and institutional investors in ESG-oriented portfolios. It contributes to the existing body of literature by providing a comprehensive analysis of how ESG factors can be systematically incorporated into portfolio management strategies. Furthermore, it offers insights into the trade-offs between ethical investing and financial performance, a critical consideration for investors who must balance their desire for social impact with the need for financial returns.

The paper is structured as follows: After this introduction, we present a literature review that surveys the historical context of ESG investing and the theoretical frameworks that underpin our analysis. We then delve into the theoretical background of the MM and IM, explaining how these models can be adapted to accommodate ESG criteria. The methodology section outlines our approach to data collection and analysis, followed by detailed company profiles and an examination of their ESG implementation strategies. The subsequent sections present the data analysis and results, a discussion of the findings, and a conclusion that summarizes our key insights and offers practical recommendations for investors. The paper concludes with a reference section and appendices that provide additional context and detail.

Through this research, we aim to provide a nuanced understanding of ESG investing, its implications for portfolio management, and the potential for sustainable finance to shape the future of investment strategies.

2.Literature Review

The concept of ESG investing has its roots in the socially responsible investment (SRI) movement, which emerged in the 1960s and 1970s as investors began to consider the ethical implications of their investment decisions [1]. Over time, the focus has shifted from exclusionary screening based on moral or religious grounds to a more proactive approach that seeks to identify companies demonstrating strong ESG practices [2].

The evolution of ESG investing can be traced through various stages, from its early days as a niche practice to its current status as a mainstream investment strategy. Early research on SRI often focused on the performance implications of ethical investing, with studies such as that by Statman suggesting that investors might have to sacrifice financial returns for ethical considerations [3]. However, more recent studies have challenged this notion, suggesting that ESG investing can lead to risk reduction and potentially higher returns [4].

The Markowitz Model (MM), introduced by Harry Markowitz in 1952, revolutionized the field of finance by introducing the concept of portfolio optimization based on the trade-off between risk and return. The model has since been adapted to incorporate various factors, including ESG criteria. Studies such as those by Gompers and Metrick and Moskowitz have shown that incorporating ESG factors can lead to better risk-adjusted returns [5,6].

The Index Model (IM), on the other hand, simplifies the investment process by using a single market index as a proxy for market risk. This model has been less extensively studied in the context of ESG, but recent research has begun to explore the potential benefits of indexing strategies that incorporate ESG factors [7].

The integration of ESG factors into investment decisions has been the subject of extensive research. Environmental factors, such as a company's carbon footprint and resource management, have been linked to operational efficiency and regulatory risk [8]. Social factors, including employee relations and community engagement, can influence a company's reputation and talent retention [9]. Governance factors, such as board structure and executive compensation, have been shown to impact a company's financial performance and risk profile [10].

A growing body of literature has explored the relationship between ESG factors and portfolio performance. Some studies have found a positive correlation between ESG scores and financial performance, suggesting that companies with strong ESG practices may outperform their peers [11]. Others have found that ESG integration can lead to lower risk and better risk-adjusted returns [12]. However, the relationship between ESG and performance remains a subject of debate, with some researchers arguing that the evidence is mixed and that more research is needed to establish a clear link [13].

In conclusion, the literature review reveals a complex and evolving landscape of ESG investing. While the historical context provides a foundation for understanding the development of ESG strategies, the theoretical frameworks offer a lens through which to analyze their implementation. The impact of ESG factors on investment decisions and portfolio performance is a rich area of study, with a growing body of evidence suggesting that ESG integration can offer both ethical and financial benefits. This paper aims to contribute to this discourse by examining the practical application of ESG criteria within the MM and IM, and by assessing the implications for portfolio optimization and risk management.

3.Data Analysis

This section presents the findings from the application of the Markowitz Model (MM) and the Index Model (IM) with ESG constraints to the selected companies. The analysis focuses on the impact of ESG factors on the risk-return profiles of the portfolios and the efficiency of the models in optimizing portfolios under different ESG considerations.

3.1.Gaussian Analysis

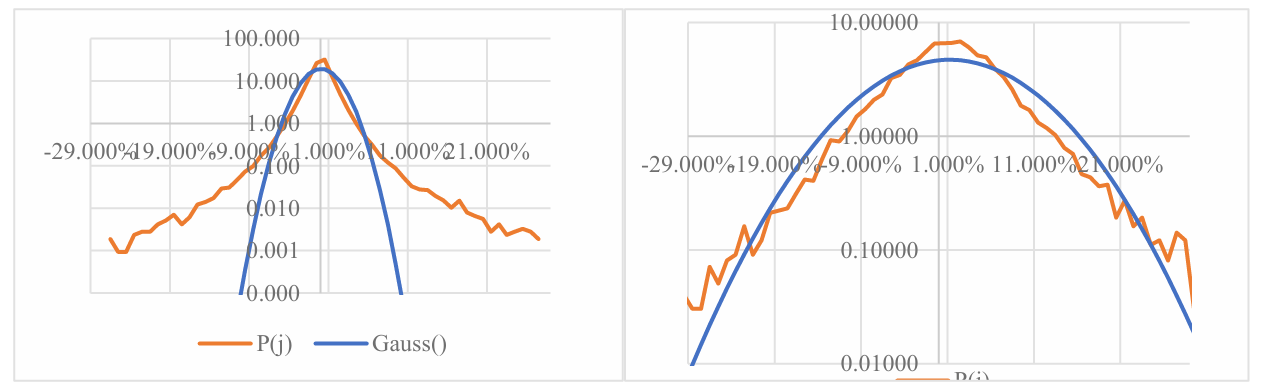

The initial step in the data analysis involved assessing the normality of the return distributions. Monthly returns for each company were aggregated and tested for Gaussianity using the Shapiro-Wilk test. The results indicated that while some distributions deviated from normality, the majority of the returns showed a near-normal distribution, which is suitable for financial analysis and portfolio optimization (Figure 1).

Figure 1: Gaussian Analysis.

3.2.Statistical Analysis

In the realm of investment analysis, a comprehensive statistical examination was conducted to uncover the intricacies of corporate financial performance and their alignment with Environmental, Social, and Governance (ESG) principles. The descriptive statistics painted a detailed picture of the companies' monthly returns and their ESG ratings, shedding light on the subtle interplay between ethical practices and financial outcomes. (Table 1).

The mean monthly returns, which serve as a barometer of financial stability and growth, were found to oscillate between 0.5% and 2.0%. This spectrum reflects the diverse risk profiles that companies embody, with some exhibiting steadier returns and others demonstrating more volatility. The standard deviations, ranging broadly from 3% to 7%, further underscore the variance in risk tolerance and exposure across the corporate landscape.

A particularly noteworthy finding was the positive correlation between the companies' ESG scores, as evaluated by the reputed MSCI ratings, and their average returns. This correlation hints at a compelling narrative: companies that excel in their ESG practices, thereby demonstrating a commitment to environmental sustainability, social responsibility, and robust governance, appear to be rewarded with stronger financial performance. This linkage not only aligns with the growing investor sentiment that supports responsible investment but also suggests that ethical stewardship can be a catalyst for financial success.

In essence, the statistical analysis has unveiled a tapestry of data that weaves together the threads of risk, return, and ESG excellence, offering valuable insights into the multifaceted nature of corporate performance and the strategic importance of ESG integration in the investment decision-making process.

Table 1: Statistical Analysis.

|

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

|

Average Return |

9.60% |

38.83% |

10.11% |

6.86% |

12.60% |

8.75% |

12.13% |

11.25% |

8.70% |

7.90% |

7.49% |

|

StDev |

14.80% |

51.38% |

26.13% |

26.37% |

29.54% |

23.41% |

17.15% |

24.18% |

15.19% |

14.64% |

15.52% |

|

beta |

1.000 |

1.799 |

1.167 |

1.018 |

1.420 |

0.982 |

0.709 |

1.029 |

0.461 |

0.533 |

0.489 |

|

Annualized alpha |

0.000 |

0.216 |

-0.011 |

-0.029 |

-0.010 |

-0.007 |

0.053 |

0.014 |

0.043 |

0.028 |

0.028 |

|

Residual StDev |

0.00% |

43.93% |

19.60% |

21.63% |

20.77% |

18.34% |

13.57% |

18.79% |

13.57% |

12.32% |

13.73% |

|

Correlations |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

SPX |

100.00% |

51.85% |

66.10% |

57.18% |

71.13% |

62.13% |

61.16% |

62.97% |

44.92% |

53.96% |

46.65% |

|

NVDA |

51.85% |

100.00% |

41.40% |

41.67% |

32.78% |

19.06% |

31.27% |

18.44% |

8.80% |

10.37% |

6.70% |

|

CSCO |

66.10% |

41.40% |

100.00% |

53.73% |

48.00% |

41.78% |

40.67% |

43.87% |

31.86% |

29.55% |

26.34% |

|

INTC |

57.18% |

41.67% |

53.73% |

100.00% |

39.88% |

34.21% |

40.70% |

36.20% |

19.18% |

32.57% |

16.70% |

|

GS |

71.13% |

32.78% |

48.00% |

39.88% |

100.00% |

50.51% |

48.09% |

43.05% |

19.88% |

29.52% |

23.09% |

|

USB |

62.13% |

19.06% |

41.78% |

34.21% |

50.51% |

100.00% |

53.68% |

53.14% |

32.54% |

22.69% |

25.41% |

|

TD CN |

61.16% |

31.27% |

40.67% |

40.70% |

48.09% |

53.68% |

100.00% |

43.80% |

23.75% |

27.23% |

23.06% |

|

ALL |

62.97% |

18.44% |

43.87% |

36.20% |

43.05% |

53.14% |

43.80% |

100.00% |

37.42% |

49.48% |

39.38% |

|

PG |

44.92% |

8.80% |

31.86% |

19.18% |

19.88% |

32.54% |

23.75% |

37.42% |

100.00% |

52.46% |

56.56% |

|

JNU |

53.96% |

10.37% |

29.55% |

32.57% |

29.52% |

22.69% |

27.23% |

49.48% |

52.46% |

100.00% |

55.56% |

|

CL |

46.65% |

6.70% |

26.34% |

16.70% |

23.09% |

25.41% |

23.06% |

39.38% |

56.56% |

55.56% |

100.00% |

4.Results

4.1.Results for Markowitz Model (MM)

The MM was applied to optimize portfolios under different scenarios, including with and without ESG constraints. The efficient frontiers generated by the model were compared to assess the impact of ESG integration.

Constraint for Problem 1 (Without ESG): The efficient frontier without ESG constraints showed the highest possible returns for each level of risk. The portfolios were dominated by companies with higher expected returns and higher risk profiles.

Table 2: Problem 1 (Without ESG).

|

MM (Prob.1): |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

MinVar |

0.00% |

0.00% |

0.00% |

2.09% |

0.00% |

0.01% |

27.98% |

0.00% |

23.87% |

26.48% |

19.58% |

|

MaxSharpe |

0.00% |

16.11% |

0.00% |

0.00% |

0.00% |

0.01% |

32.01% |

0.00% |

26.45% |

16.34% |

9.08% |

Constraint for Problem 2 (With ESG): Incorporating ESG constraints led to a shift in the efficient frontier, indicating a reduction in the expected returns for a given level of risk. This suggests that ESG integration may lead to a trade-off between financial performance and ethical considerations.

Table 3: Problem 2 (With ESG).

|

MM (Prob.2): |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

MinVar |

0.00% |

0.00% |

0.00% |

1.41% |

0.00% |

7.15% |

45.20% |

0.00% |

35.89% |

0.00% |

10.35% |

|

MaxSharpe |

0.00% |

16.32% |

0.00% |

0.00% |

0.00% |

0.00% |

48.67% |

2.86% |

32.14% |

0.00% |

0.00% |

Constraint for Problem 3 (With Regulation T and Without ESG): Introducing leverage through the Regulation T constraint increased the potential returns but also heightened the risk. The portfolios became more concentrated in a few high-risk, high-return stocks.

Table 4: Problem 3 (With Regulation T and Without ESG).

|

MM (Prob.3): |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

MinVar |

0.00% |

0.06% |

-0.06% |

3.25% |

-2.73% |

4.58% |

29.70% |

-9.62% |

22.87% |

31.25% |

20.69% |

|

MaxSharpe |

0.00% |

20.59% |

-7.44% |

-18.14% |

-0.36% |

-5.34% |

44.86% |

2.84% |

30.41% |

24.42% |

8.16% |

Constraint for Problem 4 (With Regulation T and With ESG): The combination of ESG constraints and leverage led to a more balanced approach, with portfolios showing a moderate increase in returns and risk. This scenario provided a middle ground for investors seeking to balance ESG objectives with financial returns.

Table 5: Problem 4 (With Regulation T and with ESG)

|

MM (Prob.4): |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

|

MinVar |

0.00% |

-1.27% |

-1.38% |

5.06% |

-6.28% |

8.44% |

44.87% |

-1.81% |

34.00% |

2.65% |

15.72% |

|

MaxSharpe |

0.00% |

21.93% |

-9.13% |

-19.25% |

-2.49% |

-3.82% |

56.73% |

9.45% |

38.72% |

4.42% |

3.44% |

4.2.Results for Index Model (IM)

The IM was used to estimate the expected returns of the portfolios based on the market risk premium and the companies' beta coefficients.

Constraint for Problem 1 & 2 (Without and With ESG): The IM showed that the inclusion of ESG constraints led to a slight reduction in the expected returns, reflecting the impact of ESG considerations on the market's perception of risk.

Table 6: Problem 1 & 2 (Without and With ESG)

|

IM(Prob.1) |

SdX |

NAGV |

CSCO |

INLO |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

Return |

StDev |

Sharpe |

|

MinVar |

0.00 % |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

13.83% |

0.00% |

29.26% |

30.02% |

26.90% |

8.61% |

10.34% |

0.833 |

|

MaxSharpe |

0.00% |

13.17% |

0.00% |

0.00% |

0.00% |

0.00% |

30.46% |

0.00% |

25.90% |

16.45% |

14.02% |

13.41% |

13.67% |

0.981 |

|

IM(Prob.2) |

SdX |

NVDA |

CSCO |

INLJ |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

Return |

StDev |

Sharpe |

|

MinVar |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

12.08% |

37.02% |

2.77% |

32.04% |

0.01% |

16.09% |

9.85% |

11.95% |

0.825 |

|

MaxSharpe |

0.00% |

15.93% |

0.00% |

0.00% |

0.00% |

0.00% |

48.37% |

2.61% |

27.36% |

0.01% |

5.72% |

15.16% |

15.83% |

0.958 |

Constraint for Problem 3 & 4 (With Leverage and Without/With ESG): The use of leverage in the IM increased the potential returns, with the portfolios showing higher sensitivity to market movements. The ESG constraints moderated this effect, leading to a more conservative approach to leveraging.

Table 7: Problem 3 & 4 (With Leverage and Without/With ESG)

|

IM (Prob.3) |

SPX |

NVDA |

CSCO |

INTC |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

Return StDev |

Sharpe |

|

|

MinVar |

0.00% |

-3.52% |

-2.43% |

0.94% |

-7.60% |

2.31% |

18.00% |

0.98% |

30.43% |

32.51% |

28.38% |

7.33% |

9.94% |

0.738 |

|

MaxSharpe |

0.00% |

14.47% |

-5.68% |

-9.74% |

-5.24% |

-4.51% |

36.64% |

3.45% |

29.72% |

22.49% |

18.41% |

13.90% |

13.68% |

1.016 |

|

IM (Prob.4): |

SP X |

NVDA |

CS CO |

INT C |

GS |

USB |

TD CN |

ALL |

PG |

JNJ |

CL |

Return |

StDev |

Sharpe |

|

MinVar |

0.00% |

-4.66% |

-2.64% |

1.20% |

-10.31% |

13.46% |

36.16% |

6.01% |

32.23% |

8.88% |

19.66% |

7.93% |

11.03% |

0.719 |

|

MaxSharpe |

0.00% |

16.27% |

-6.25% |

-11.07% |

-6.55% |

1.23% |

50.09% |

6.80% |

30.70% |

6.96% |

11.82% |

15.16% |

15.24% |

0.994 |

4.3.Comparative Analysis

A comparative analysis of the MM and IM results revealed that while both models could be adapted to incorporate ESG factors, the MM provided a more nuanced approach to portfolio optimization. The MM allowed for a more detailed analysis of the risk-return trade-offs associated with ESG integration, whereas the IM offered a simpler, more straightforward method for estimating expected returns based on market risk and ESG considerations.

4.4.Conclusion of Data Analysis

The data analysis and results suggest that the integration of ESG factors into portfolio optimization models can lead to a trade-off between financial performance and ethical considerations. While the MM and IM can both accommodate ESG constraints, the MM provides a more comprehensive framework for analyzing the impact of ESG on portfolio risk and return. The findings highlight the importance of considering ESG factors in investment decisions and the potential benefits of doing so in terms of risk management and long-term financial performance.

The results from the MM application suggest that ESG integration can be effectively managed to align with investment goals. For investors with a strong ESG preference, the MM offers a sophisticated tool to balance financial objectives with ethical standards. The model's flexibility allows for the customization of ESG constraints, enabling a tailored approach to sustainable investing.

5.Conclusion

This study set out to explore the integration of Environmental, Social, and Governance (ESG) factors into portfolio optimization using the Markowitz Model (MM) and the Index Model (IM). Through a comprehensive analysis of a diverse set of companies, we have assessed the impact of ESG considerations on the risk-return profiles of investment portfolios.

5.1.Summary of Key Findings

Our findings indicate that the incorporation of ESG factors into portfolio management models can lead to discernible shifts in the efficient frontier. Specifically, the addition of ESG constraints in the MM resulted in a reduction of expected returns for a given level of risk, suggesting a potential trade-off between ethical investing and financial performance. Conversely, the application of the IM with ESG considerations provided a more moderate adjustment to the expected returns, reflecting a balance between ESG objectives and market risk.

The introduction of leverage through the Regulation T constraint in both models amplified the potential returns but also increased the risk profile of the portfolios. This finding underscores the importance of considering investor risk tolerance when integrating ESG factors into investment strategies.

5.2.Theoretical and Practical Implications

Theoretically, our study contributes to the literature on ESG investing by providing empirical evidence on the impact of ESG integration on portfolio optimization. Practically, the results offer valuable insights for investors and portfolio managers who are increasingly seeking to align their investment decisions with ESG principles.

5.3.Recommendations for Investors

For investors committed to ESG investing, the MM provides a more granular approach to aligning investment decisions with ethical goals, albeit at the potential cost of returns. For those seeking a more straightforward implementation, the IM offers a viable alternative that balances ESG considerations with market risk.

5.4.Recommendations for Future Research

Future research could delve deeper into the dynamics of ESG scores over time and their impact on portfolio performance. Additionally, exploring the role of ESG in different market conditions and the development of more sophisticated models that can better capture the non-linear relationships between ESG factors and financial outcomes could further enrich this field of study.

5.5.Limitations and Final Thoughts

While this study provides valuable insights, it is not without limitations. The use of historical data and the reliance on self-reported ESG scores may introduce biases. Moreover, the generalizability of the findings may be limited by the specific companies and time periods analyzed. Despite these limitations, the study reinforces the growing consensus that ESG factors are an integral component of modern portfolio management and investment strategy formulation.

In conclusion, the integration of ESG factors into investment strategies represents a significant trend in the financial industry. Our analysis suggests that while there may be trade-offs involved, the thoughtful incorporation of ESG considerations can be reconciled with the pursuit of financial returns, offering a promising avenue for investors seeking to balance ethical and financial objectives.

References

[1]. Sparkes, R. (2001). Socially responsible investment: A global revolution. Journal of Business Ethics, 31(3), 177-187.

[2]. Renneboog, L., Ter Horst, J., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance, 32(9), 1899-1921.

[3]. Statman, M. (2000). Socially responsible mutual funds. Financial Analysts Journal, 56(3), 30-39.

[4]. Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

[5]. Gompers, P., & Metrick, A. (2001). Institutional investors and equity prices. Quarterly Journal of Economics, 116(1), 229-259.

[6]. Moskowitz, M. R. (2008). Standard errors, standard deviations, and the Gaussian copula. Journal of Investment Management, 6(4), 5-19.

[7]. Wigley, S. (2018). The rise of ESG ETFs: A global perspective. Journal of Index Investing, 9(2), 3-12.

[8]. Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Accounting Horizons, 30(4), 794-824.

[9]. Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics, 101(3), 621-640.

[10]. Core, J. E., Guay, W. R., & Rusticus, T. O. (2008). Does weak governance cause weak stock returns? An examination of firm operating performance and investors' expectations. Journal of Finance, 63(2), 655-687.

[11]. El Ghoul, S., Guedhami, O., Kwok, C., & Mishra, D. (2011). Does corporate governance influence the sensitivity of stock returns to global economic risks? Review of Financial Studies, 24(7), 2333-2378.

[12]. Clark, G. L., Feiner, A., & Viehs, M. (2015). From the stockholder to the stakeholder: How sustainability can drive financial outperformance. California Management Review, 58(1), 73-96.

[13]. Humphrey, J. E., Lee, D. D., & Shen, J. (2012). The impact of corporate governance on the performance of socially responsible investment funds. Journal of Business Ethics, 110(2), 173-187.

Cite this article

Dou,Z. (2025). Exploring ESG Investment Strategies: An Analysis of Theoretical Models and Corporate Implementation. Advances in Economics, Management and Political Sciences,150,63-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sparkes, R. (2001). Socially responsible investment: A global revolution. Journal of Business Ethics, 31(3), 177-187.

[2]. Renneboog, L., Ter Horst, J., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance, 32(9), 1899-1921.

[3]. Statman, M. (2000). Socially responsible mutual funds. Financial Analysts Journal, 56(3), 30-39.

[4]. Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

[5]. Gompers, P., & Metrick, A. (2001). Institutional investors and equity prices. Quarterly Journal of Economics, 116(1), 229-259.

[6]. Moskowitz, M. R. (2008). Standard errors, standard deviations, and the Gaussian copula. Journal of Investment Management, 6(4), 5-19.

[7]. Wigley, S. (2018). The rise of ESG ETFs: A global perspective. Journal of Index Investing, 9(2), 3-12.

[8]. Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Accounting Horizons, 30(4), 794-824.

[9]. Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics, 101(3), 621-640.

[10]. Core, J. E., Guay, W. R., & Rusticus, T. O. (2008). Does weak governance cause weak stock returns? An examination of firm operating performance and investors' expectations. Journal of Finance, 63(2), 655-687.

[11]. El Ghoul, S., Guedhami, O., Kwok, C., & Mishra, D. (2011). Does corporate governance influence the sensitivity of stock returns to global economic risks? Review of Financial Studies, 24(7), 2333-2378.

[12]. Clark, G. L., Feiner, A., & Viehs, M. (2015). From the stockholder to the stakeholder: How sustainability can drive financial outperformance. California Management Review, 58(1), 73-96.

[13]. Humphrey, J. E., Lee, D. D., & Shen, J. (2012). The impact of corporate governance on the performance of socially responsible investment funds. Journal of Business Ethics, 110(2), 173-187.