1. Introduction

A pension scheme is important for ensuring the financial security of an individual after retirement.

By participating in a pension plan, an individual can accumulate savings during their work years to provide for their future retirement. The main types of pension plans include defined benefit (DB) plans and defined contribution (DC) plans. DB plans calculate retirement benefits based on the employee’s salary and years of service, and the employer bears the investment risk. On the other hand, DC plans are structured differently: The retirement benefits depend on how much employees contribute, and the investment performance of these contributions, which means that the employees bear the risk of investment, rather than the employers.

In recent years, an increasing number of employers have shifted from DB plans to DC plans, primarily to reduce financial liabilities and offer more flexible retirement savings options. Defined Benefit (DB) plans do not require employees to make decisions, but when shifted to Defined Contribution (DC) plans, employee agency becomes crucial. Employees can now choose different contribution rates and investment strategies, making it particularly important to understand how behavioral economics influences decision-making in DC plans.

Behavior economics studies how people often deviate from the rational behavior patterns assumed by traditional economics when faced with long-term decisions, which is particularly relevant in pension plans because employees must make decisions among complex investment options that can have a significant impact on their retirement income.

Behavioral economics highlights several cognitive biases that can impede optimal decision-making. One key concept from behavioral economics is status quo bias, which refers to the tendency of individuals to maintain the current state or default options. This tendency is widely utilized in the design of default options in DC plans. In practice, default options are employed in several ways to encourage participation and simplify decision-making. For instance, automatic enrollment in DC plans ensures that employees are enrolled by default, and this has been shown to significantly increase participation rates. Many employees tend to accept the pre-set choices, such as default contribution rates and investment options, rather than actively making changes. Research has shown that in 401(k) plans, automatic enrollment mechanisms have significantly increased employee participation rates because most employees choose to retain the default contribution rates and investment allocations. They keep the default 3% contribution rate and allocate their contributions entirely to money market funds. Default plans also significantly influence saving behavior, leading to higher trust in and adherence to the plan, simplifying decision-making for employees, and allowing them to easily obtain appropriate pension security.

Another important behavioral economics phenomenon is hyperbolic discounting, which is the tendency for people to prefer immediate returns over greater gains in the future, which has a profound impact on savings behavior in DC plans. Hyperbolic discounting makes individuals prefer consumption in the short term and ignore long-term financial needs, which may lead to insufficient savings and affect financial stability after retirement. Research shows that when faced with the choice of immediate consumption and future savings, people tend to choose the former, causing them to save insufficiently early in their careers and ultimately face financial difficulties in retirement. This behavior pattern is particularly detrimental to DC plans that require long-term accumulation of funds, because individuals may consume too much when they are young and fail to fully prepare for retirement.

In this paper, I reference dynamic programming methods and utility maximization models used by researchers to simulate consumption paths and investment decisions under different time preferences.

These models show that participants with higher impatience tend to exhibit significantly higher consumption early in their careers, leading to an early peak in wealth accumulation followed by a rapid decline, resulting in inadequate savings by the time they retire. Furthermore, data analysis reveals that individuals influenced by hyperbolic discounting often have a lower demand for immediate annuities, as they prioritize short-term gains over long-term financial security. These findings underscore the importance of addressing hyperbolic discounting when designing DC plans to ensure that participants are adequately prepared for retirement.

In summary, this paper will first delve into the concept of status quo bias, analyzing how default options in pension plans affect participation and savings decisions. This will be followed by a discussion of hyperbolic discounting, exploring its impact on consumption and wealth accumulation in pension plans. The paper will also consider the impact of these biases on pension scheme design, drawing on the successful Save More Tomorrow plan to provide policy and practice recommendations for improving retirement outcomes. By understanding and addressing these behavioral biases, we can better design pension schemes to help individuals achieve financial security in retirement.

2. Background

Defined benefit (DB) and defined contribution (DC) plan are the primary types of pension plans.

The Defined Benefit (DB) Plan rewards long service and pay benefits that depend on final salary and usually includes a formula of salary and years of service to provide retirement benefits. As a result, DB plan participants are exposed to job change risk and employer default risk. Conversely, The Defined Contribution (DC) plan is a pension scheme where the employer contributes a fixed amount of money each year to the employee’s retirement account and the final retirement benefit depends on the amount accumulated in the account and its investment income. Such a plan has been popular among employers and employees for its flexibility and cost-effectiveness[1].

Behavioral economics is important because it helps us understand the ways in which people actually make decisions, which are often different from the rationality assumed by traditional economics. While traditional economics usually assumes that individuals are rational decision makers who make decisions based on optimal economic benefit, behavioral economics suggests that individuals are often subject to a range of psychological biases when faced with long-term and complex decisions, such as present bias (favoring immediate rewards) and loss aversion (being overly cautious about potential losses).

In a DC plan, individuals make key retirement savings decisions, such as deciding on the amount of contributions to make and investment choices, which can have a long-term impact on their financial security in retirement. This can be challenging for some employed individuals who lack the necessary financial literacy, and behavioral economics can help understand and address these challenges by identifying common cognitive biases and decision-making flaws that can lead to poor financial outcomes.

The shift from DB to DC plans provides a broader context for understanding these challenges. In 1975, there were 27.2 million active participants in private sector DB plans in the United States, while DC plans had 11.2 million active participants. By 2019, the number of active participants in DB plans had decreased to 12.6 million, while the number of active participants in DC plans had increased to 85.5 million[2]. According to EIOPA’s 2023 Consumer Trends Report, the number of new members joining DC pension plans in 2022 increased by 115% compared to 2021, with a 610% increase in France and a 90% increase in Sweden[3]. This shows that the coverage of DC plans is rapidly expanding in in the United States and some European countries.

In the context of DC plan implementation, where inertia may lead individuals to not participate in pension schemes, behavioral economics offers interventions such as auto-enrolment and the provision of default plan as an option to help investors manage the risk of retirement savings more effectively. With individuals often failing to make informed long-term decisions due to current bias (overestimating immediate returns at the expense of future benefits) and underestimating future needs, behavioral economists have come up with a variety of innovative solutions for DC schemes[4]. A prime example is the “Save More Tomorrow” program. This plan allows DC plan participants to commit in advance to automatic increases in contribution rates in the event of future wage increases. It can help participants save more efficiently over time.

Unlike Defined Benefit Plans, DB plans, where the employer guarantees a specific retirement income, DC plans transfer the risk and responsibility to the individual[5]. Employees need to decide how much to contribute and how to invest their savings, so their retirement income depends on their investment decisions and market performance, so behavioral economics plays a specific and important role in DC plan.

3. Status quo bias---Default plan

Status quo bias, also known as default bias, is a cognitive bias where individuals show a strong preference for maintaining their current situation or default option. According to Samuelson and Zeckhauser[6], this bias occurs when people are faced with alternatives but still choose to maintain their current position rather than explore new possibilities. An example of status quo bias can be seen in retirement decision-making, where employees often stick with the default options provided in their pension plans. The Default Plan is a scheme that automatically applies when employees do not actively choose an option, simplifying decision-making and boosting participation in the Pension Scheme.

In “The Power of Suggestion: Inertia in 401(k) Participation and Savings Behavior,” the author found that many auto-enrolled 401(k) participants kept the default contribution rate and fund allocations, they retained the default 3% contribution rate and allocated their contributions entirely to the money market fund, which lead to a higher participation rate. This shows the default plan’s importance in pension schemes. The Defined Contribution (DC) Plan illustrates this, where retirement benefits depend on contributions and investment performance chosen by the employee. Default plans impact retirement savings across the savings life cycle, including participation, savings rates, asset allocation, and post-retirement distributions, which play an indispensable role in the pension scheme.

3.1. A default plan can significantly increase the participation rate of a pension scheme

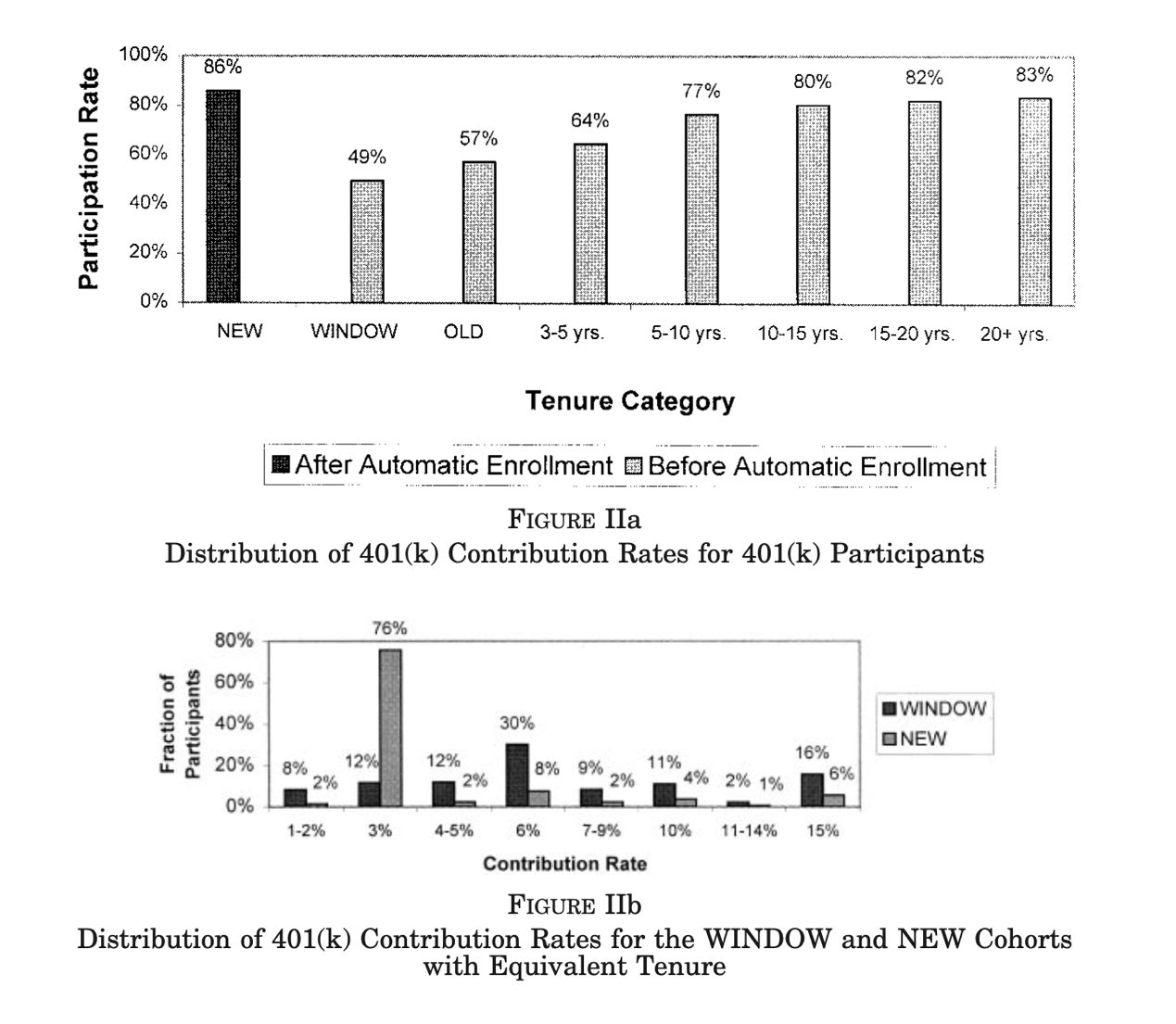

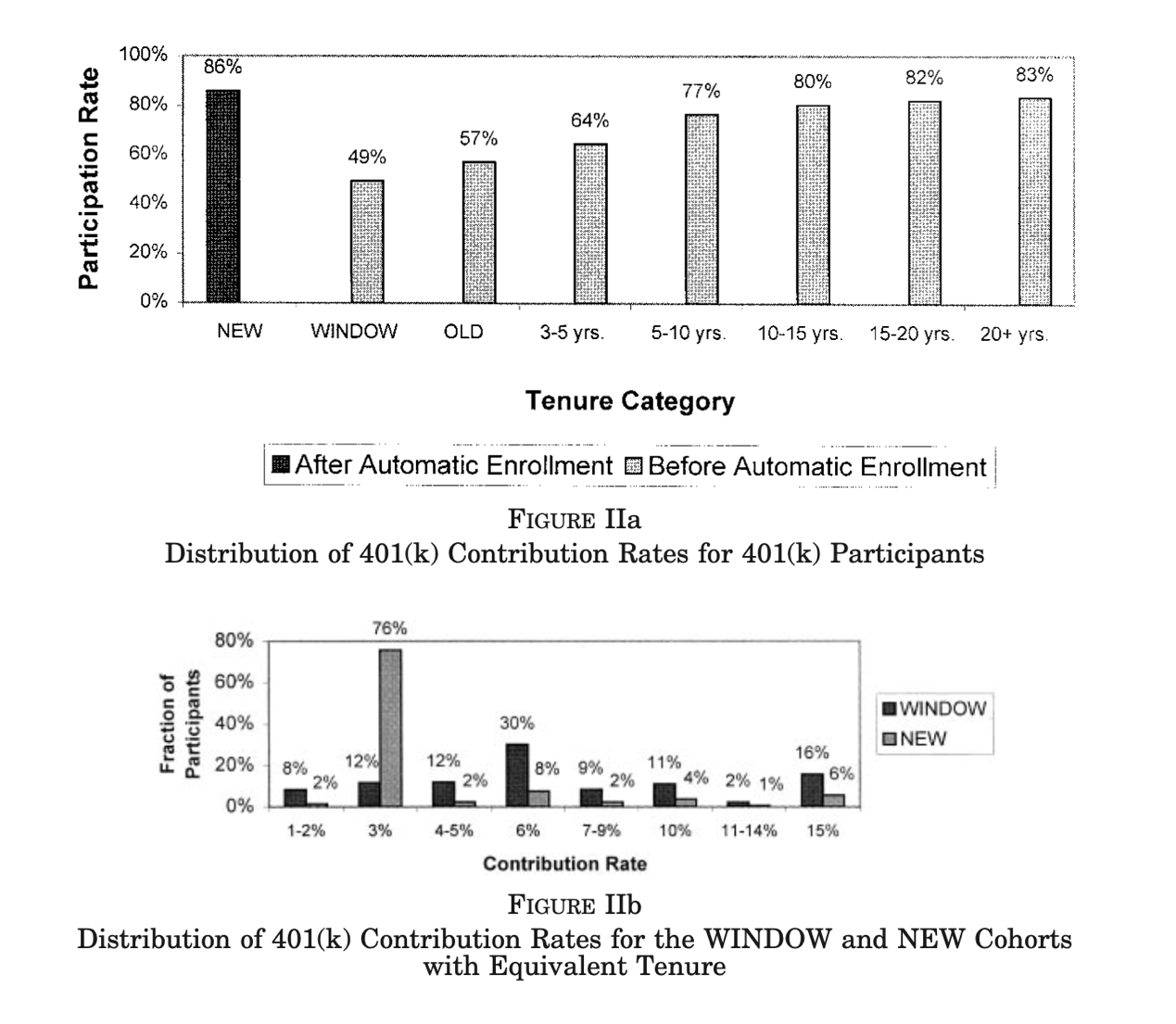

Numerous studies show that people often choose the status quo or default option because it requires the least cognitive effort. For example, Madrian and Shea[7] and Choi et al.[8] find that the default option strongly influences participation rates in 401(k) plans. The study by Madrian and Shea[7] focuses on the impact of automatic enrollment on 401(k) savings behavior at a large U.S. corporation in the healthcare and insurance industry.

Before April 1, 1998, employees had to actively opt into the 401(k) plan after one year of service. However, after this date, two key changes were implemented. First, all new employees were immediately eligible to participate in the 401(k) plan upon hire, and second, automatic enrollment was introduced, meaning employees were enrolled in the plan by default unless they opted out. New employees were assigned a default contribution rate of 3% of their salary, invested entirely in a money market fund, although they could change both the rate and fund at any time. The study compares the behavior of different employee cohorts: the “OLD” Cohort which refers to employees hired between April 1, 1996, and March 31, 1997, the “New” cohort, hired after this date with automatic enrollment, and the “Window” cohort, employees who were already hired before the implementation of automatic enrollment in April 1998 but were not yet eligible to participate in the 401(k) plan due to their tenure (they had less than one year of service). Unlike later employees, they were not automatically enrolled. They had to opt in affirmatively to participate.

Figure 1: Distribution of 401(k) Contribution Rates for 401(k) Participants.

(Source: Madrian and Shea, 2001)

As can be seen from Figure1, before automatic enrollment was introduced in 1998, the participation rate of WINDOW Cohort and OLD Cohort were low, after the introduction of automatic enrollment, the participation rate of new employees can reach 86% compared with previous employees. In the meanwhile, Before the introduction of automatic enrollment, employees had to actively choose to participate in the 401(k) plan and set their contribution rate, with most opting for 6%, the maximum employer match.

Figure 2: Distribution of 401(k) Contribution Rates for the WINDOW and NEW Cohorts with Equivalent Tenure.

(Source: Madrian and Shea, 2001)

However, with auto-enrollment, companies set a 3% default contribution rate for employees who did not actively choose. The study data (Figure2) show that before the application of automatic enrollment, the distribution of employees’ contribution rate was more dispersed and showed greater diversity, with a lower percentage of employees choosing the default 3% contribution rate. After the auto-enrollment, 76% of the new cohort chose the default 3% contribution rate, reflecting the strong influence of the default option in employee decision-making. This 3% rate was chosen to reduce the risk of employees opting out due to high contribution rates and to encourage participation. As a result, many employees no longer actively chose other rates, leading to a significant shift in contribution rates. New entrants increasingly selected the 3% default rate under the new system, rather than the previously common 6%, shifting contributions from active choice to being driven by the default.

The company also defaults to investing 100% of new employees’ funds in money market funds, which are low-risk investments in short-term financial products. These funds are chosen for their safety and stability, minimizing potential losses and ensuring the security of employees’funds. This strategy is ideal for employees who are unfamiliar with investing or unwilling to take higher risks. When 401(k) plans default to money market funds, many participants accept this option simply because it’s the default. Although money market funds may not offer the best long-term growth, employees often stick with them due to status quo bias. Companies select this low-risk default to keep employees in the plan, ensuring some return on investment and boosting participation rates.

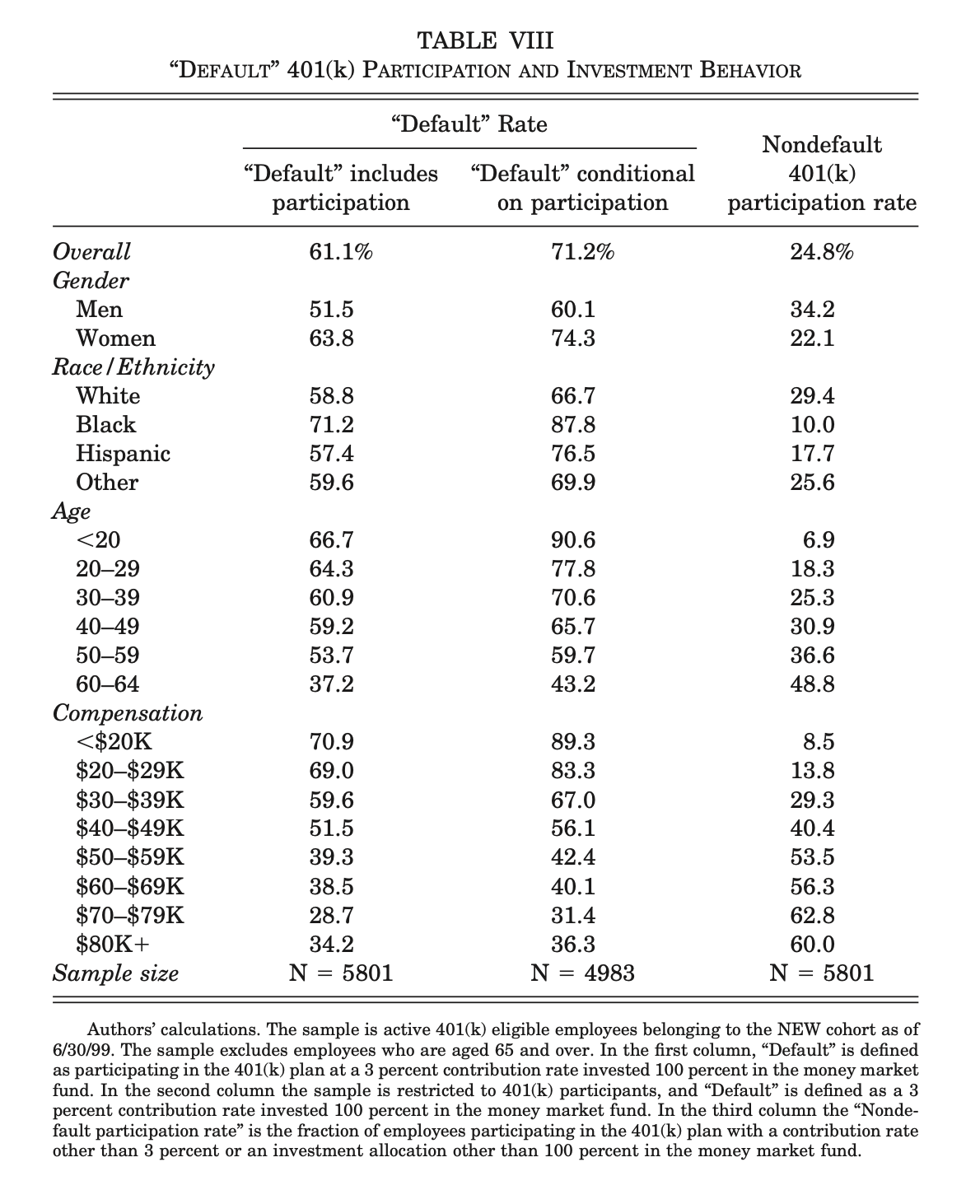

Additionally, as we can see in Fugure3, after the introduction of auto-enrolment, 61.1 percent of employees followed the default option exclusively, 71.2 percent chose the default 3 percent contribution rate and invested 100 percent of their money in a money market fund (a safe option for employees who have a lower risk tolerance or are unfamiliar with the investment market.) Only 24.8 percent of employees chose a non-default contribution rate or portfolio.

Figure 3: “DEFAULT” 401(k) Participation And Investment Behavior.

(Source: Madrian and Shea, 2001)

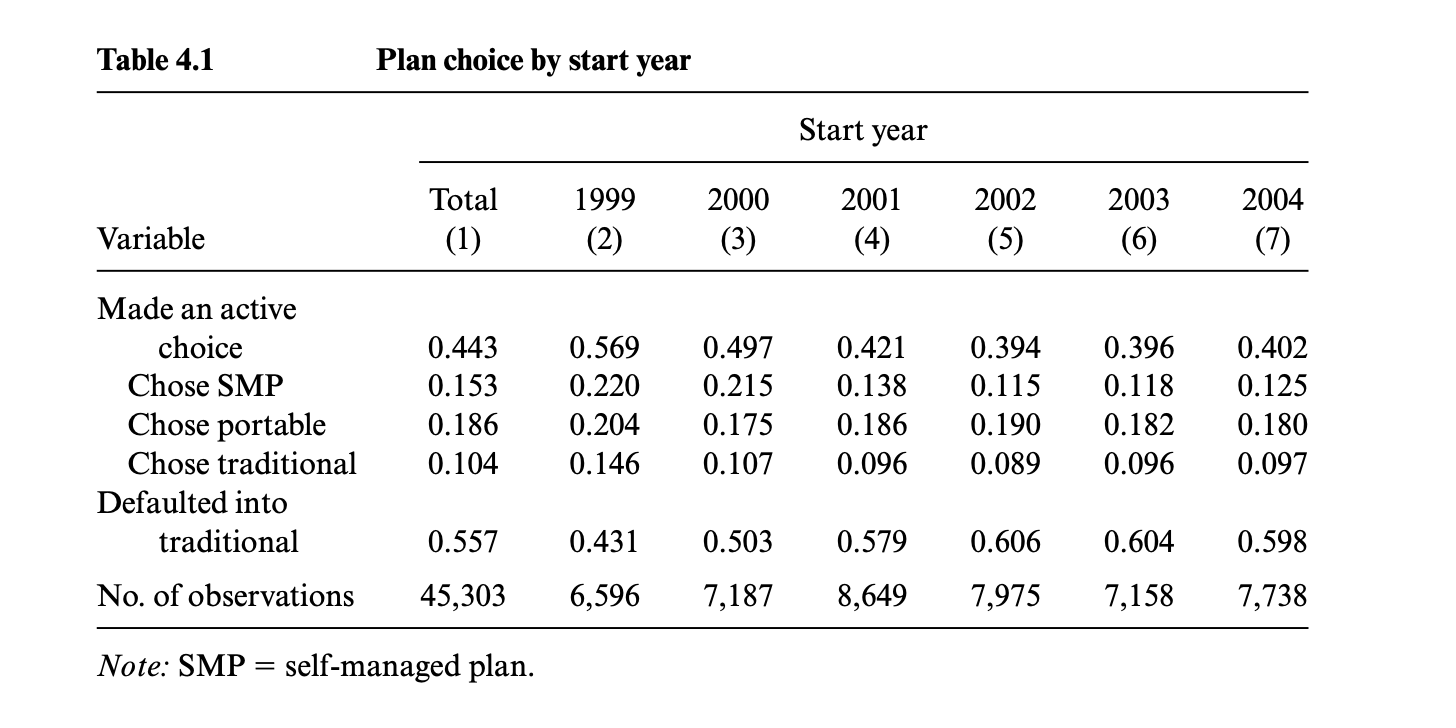

A study by Jeffrey R. Brown and Scott J. Weisbenner[9] summarized the pension plan choices of 45,303 employees at a large U.S. company between 1999 and 2004. The data in Fugure4 shows that 44.3 percent of employees actively chose a pension plan, while 55.7 percent were automatically enrolled in a traditional plan by default. The proportion of active choices was highest in 1999 at 56.9 percent but has been declining annually, while the proportion of employees defaulting into the traditional scheme has been increasing and stabilized at around 60 percent since 2002. This suggests that the default option strongly influences employee choice behavior.

Fugure 4: Plan Choice by Start Year.

(Source: Brown and Weisbenner, 2009)

Note. Over the entire sample period, we see that slightly under half the sample (44 percent) made an active pension selection, while the majority (56 percent) defaulted to the traditional benefits package.

3.2. Different occupational groups have different preferences for choosing a pension scheme.

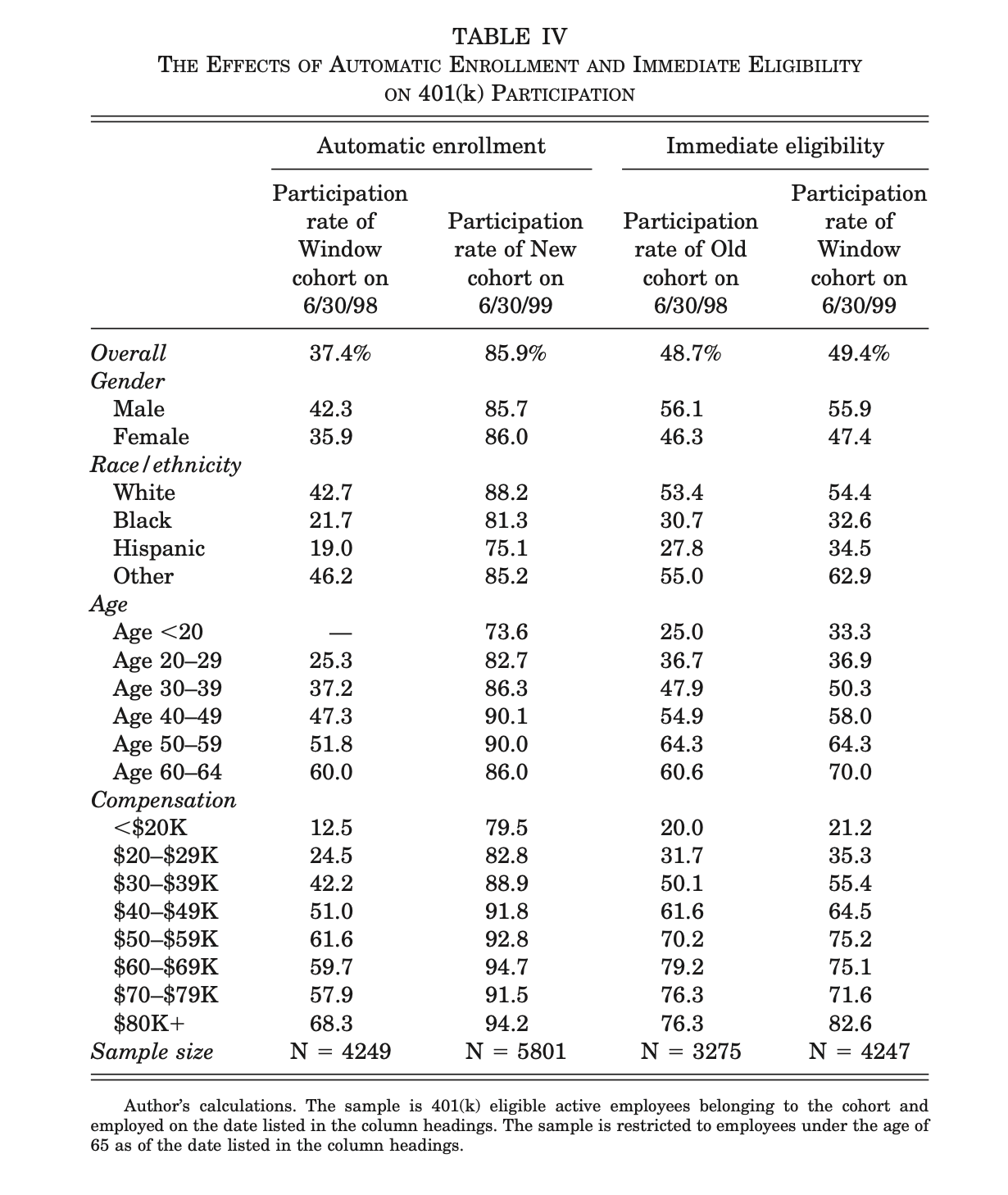

Women with higher incomes and married individuals are more likely to actively choose a suitable pension scheme on their own, while younger people tend to default to the pre-set option rather than making an active choice. Madrian and Shea[7] and Choiet al.[8] found that younger employees, women, and those with shorter tenure and lower incomes are more likely to retain both the default contribution rate and allocation. This tendency may explain why many young employees remain in the default plan, which can greatly influence their overall savings behavior, potentially resulting in higher savings rates and better retirement preparation. This also suggests that a default plan can be adapted to meet the needs of employees with different occupations and income levels[9]. As Fugure5 illustrates, the overall participation rate for employees under automatic enrollment jumped from 37.4 percent to 85.9 percent. The impact is notable across various demographics: for instance, participation among those earning less than $20,000 rose from 12.5 percent to 79.5 percent, and among employees aged 20-29, it increased from 25.3 percent to 82.7 percent. These changes indicate that automatic enrollment significantly reduces the gap in participation rates across different demographic groups, promoting a more equal participation environment.

Setting up a default plan creates a more equal participation environment across demographic groups. By removing barriers to entry, auto-enrollment has resulted in a significant reduction in the gap in participation rates across groups, thus equalizing pension scheme participation rates.

Fugure 5: The Effects of Automatic Enrollment and Immediate Eligibility on 401(k) Participation.

(Source: Madrian and Shea, 2001)

3.3. Default plans as implicit investment advice and decision-making simplifiers for employees

As it is often perceived by employees as an endorsement of the best course of action by their employers. Default plans effectively serve as implicit investment advice, leading to higher trust in and adherence to the plan, as employees believe that the default option is designed in their best interest. This perception is particularly important for individuals who may lack financial literacy or confidence in making complex investment decisions. Moreover, the default plan helps improve overall well-being by enabling participants to obtain good retirement benefit security even in the absence of sufficient information and expertise. For instance, in the SURS case, the Traditional Benefit Plan was designed as the default option because it provides a relatively stable and reliable source of retirement income suitable for the needs of most employees[9]. The default plan significantly reduces decision-making pressure for employees, simplifying the investment process and enabling easier participation. Default plans simplify decision-making for employees, who might otherwise feel overwhelmed by complex investment choices. By providing a straightforward option, default plans enable easier participation. They help simplify the decision-making process for participants, particularly those who lack the relevant knowledge or decision-making time, allowing them to easily obtain appropriate pension security. For instance, in the SURS case, the default choice of the Traditional Benefit Plan helped employees who failed to make a choice within the required time to automatically obtain pension security[9].

4. Hyperbolic discounting

Hyperbolic discounting is the phenomenon in which people prefer smaller but earlier rewards to larger but later rewards as the delay time decreases when deciding the trade-off between the present and the future. In the study by Joseph P. Redden[10], hyperbolic discounting is precisely defined as “the tendency for people to increasingly choose a smaller-sooner reward over a larger-later reward as the delay occurs sooner rather than later in time.”

A classic example illustrates that hyperbolic discounting with a simple example: Many people would prefer to get $100 now rather than $110 a day from now; but they would prefer to get $110 31 days from now rather than $100 30 days from now. He also explains the characteristic of hyperbolic discounting: the rate at which people discount future rewards declines as the length of the delay increases.

The implicit discount rates decline over a longer time horizon which is the characteristic of hyperbolic discounting. In Richard Thaler’s study[11], subjects were asked what amount they would need in the future to feel indifferent about the $15 they received now. The results showed that the average (annual) discount rate was 345 percent over a one-month time horizon, 120 percent over a one-year time horizon, and 19 percent over a ten-year time horizon.

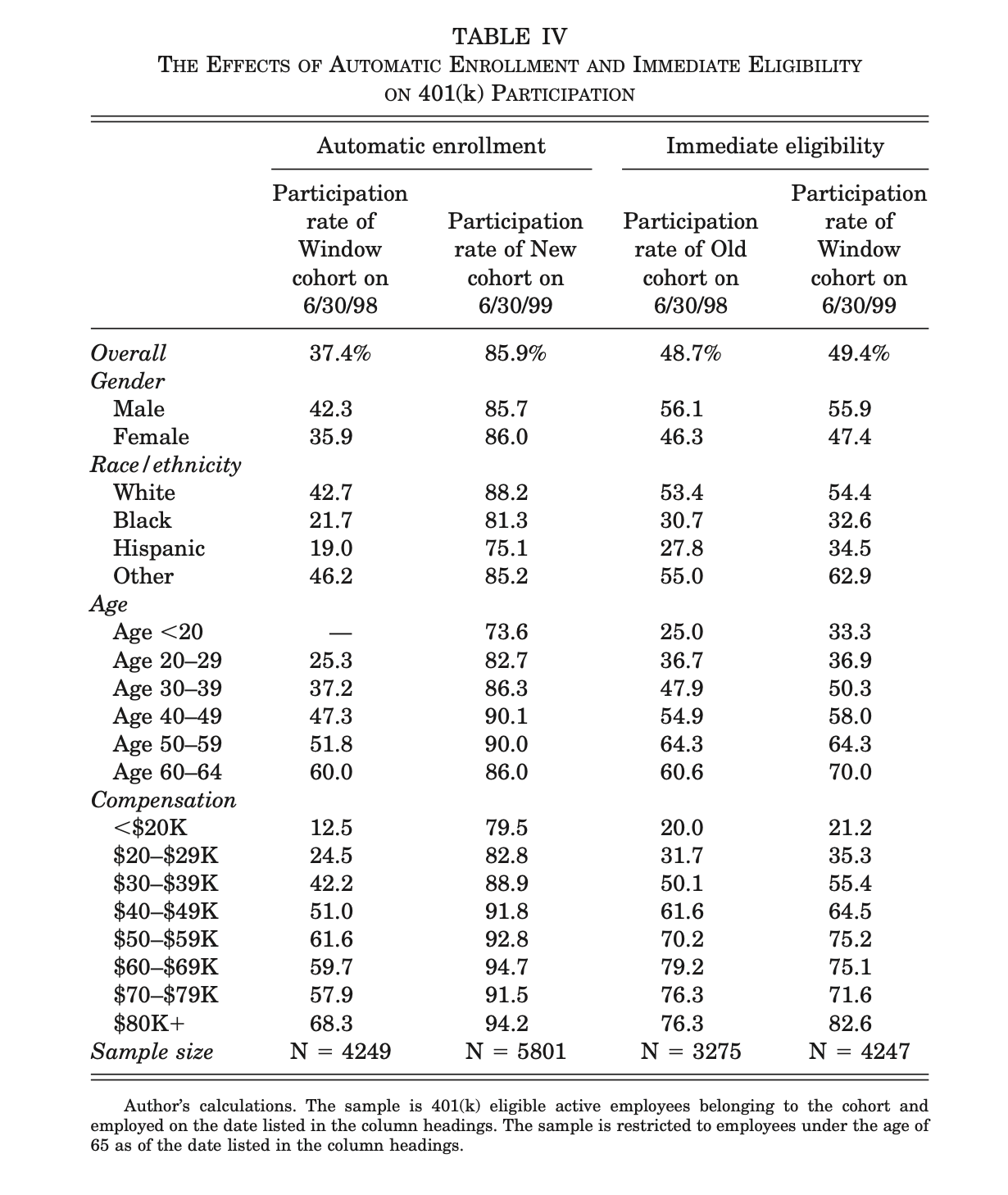

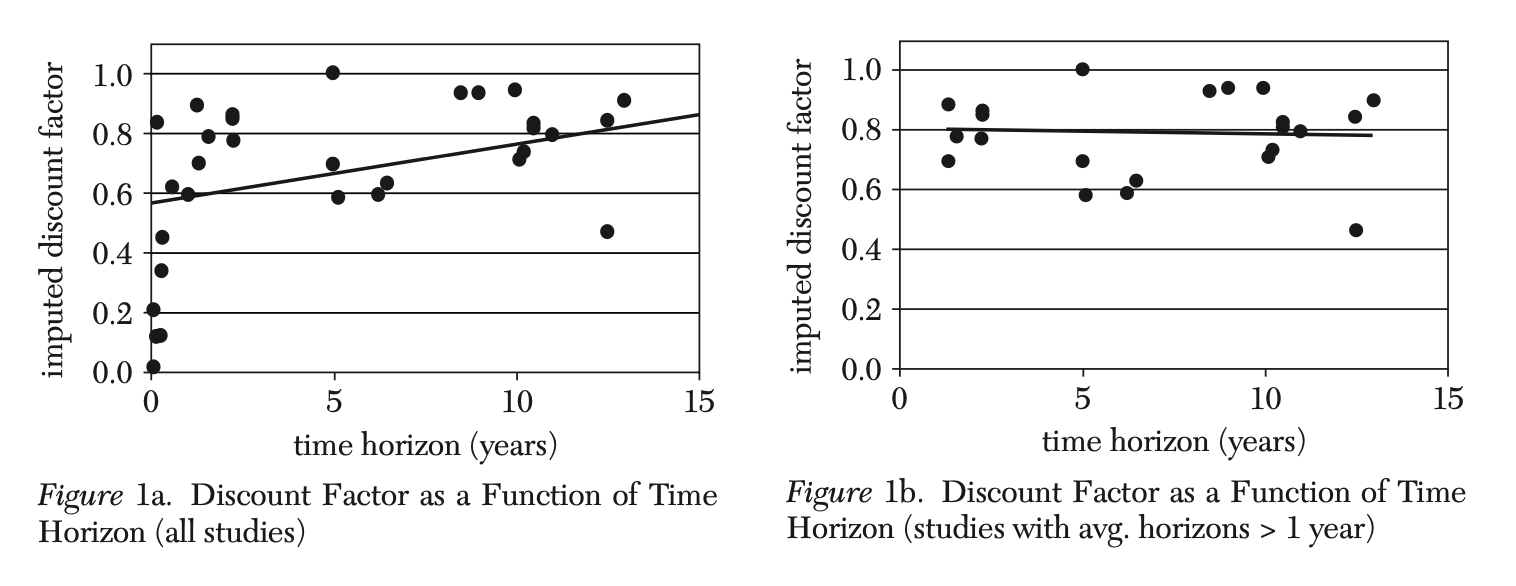

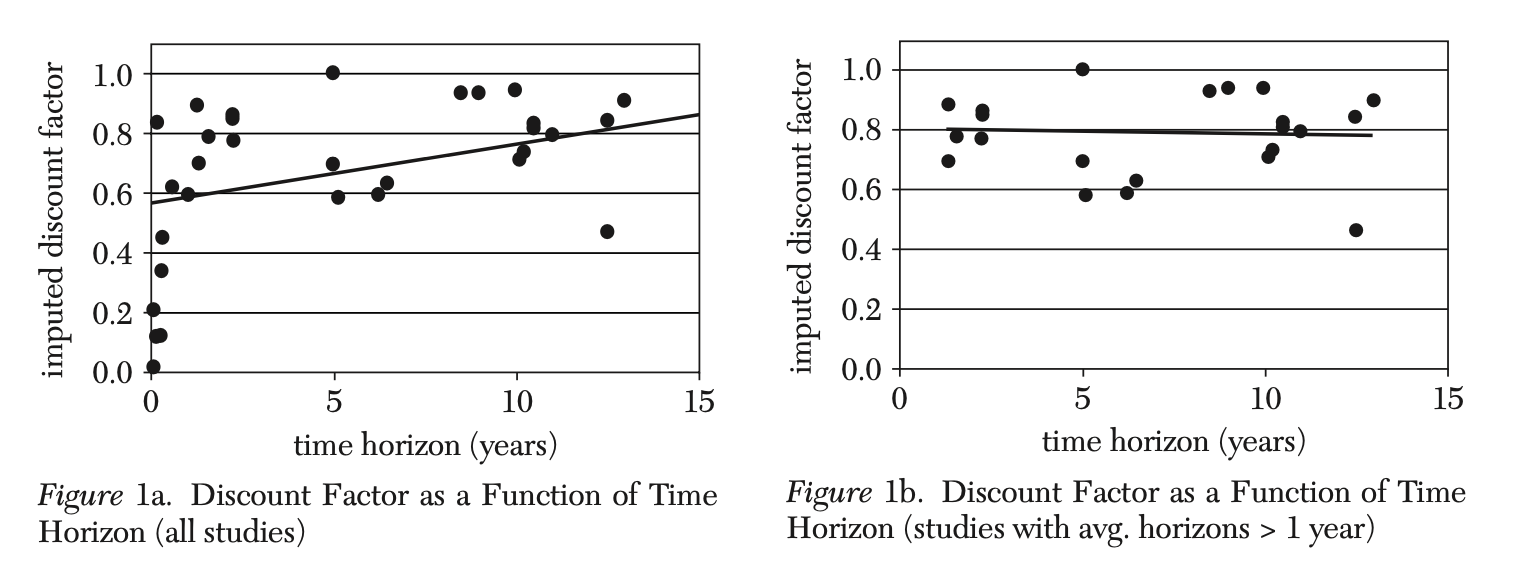

Frederick, Loewenstein, & O’Donoghue[12], summarized the research on implied discount rates:

Figure 6: Discount Factor as a Function of Time Horizon (all study).

(Source: Frederick, Loewenstein, & O'Donoghue, 2002)

Figure 7: Discount Factor as a Function of Time Horizon (studies with avg. horizons > 1 year).

(Source: Frederick, Loewenstein, & O'Donoghue, 2002)

The average estimated discount factor = 1/ (1+discount rate), figure6 compares the estimated discount rate to the average time horizon of the study, based on the formula, it is evident that the estimated discount rate decreases as the time horizon increases, which means that the discount rate is decreasing. Figure7 focuses on time horizons longer than 1 year showing a similar trend. Although the changes are smaller, it can still be seen that the discount factor increases with time. These figures illustrate that as people consider more distant futures, the degree to which they devalue future returns (i.e., the discount rate) decreases. This is consistent with the theory of hyperbolic discounting, indicating that people’s preference for immediate rewards gradually weakens as the time horizon extends. They begin to place greater importance on future returns, reducing immediate consumption, which in turn causes the discount factor to increase over time.

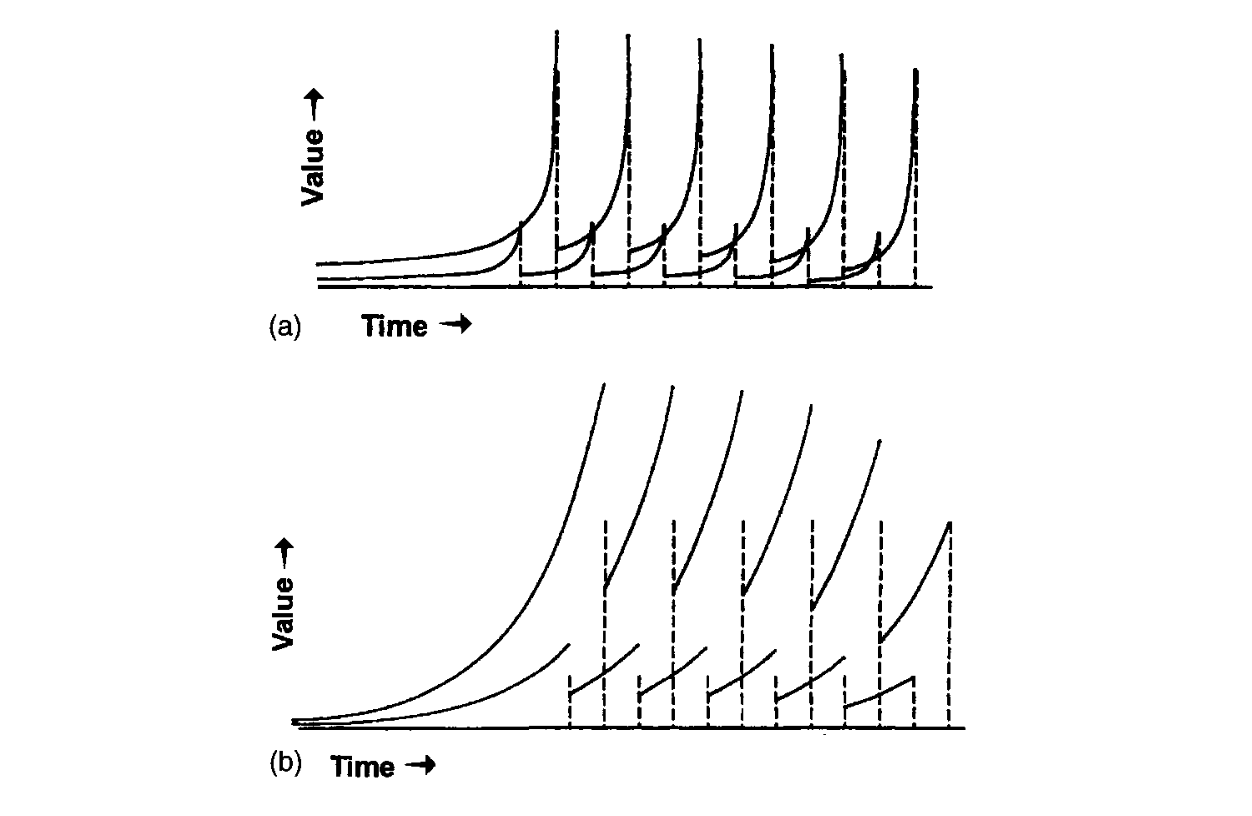

George Ainslie and John Monterosso[13], in their discussion in “Choice, Behavioral Economics and Addiction”, demonstrate two important aspects of hyperbolic discounting models for explaining why people show inconsistent preferences when confronted with immediate and delayed rewards. This is critical to understanding the relevance of hyperbolic discounting in pension plans.

Figure 8: Hyperbolic Discount Curves.

(Source: George Ainslie and John Monterosso, 2003)

Figure(a) of figure8 shows the hyperbolic discount curves of two rewards of different sizes at different time points. It can be seen that when a smaller early reward is about to be received, its value once exceeds the larger late reward, which shows that people may choose to obtain it immediately when facing an upcoming smaller reward, rather than waiting for a larger reward. Figure(b) of figure8 shows the changes in the hyperbolic discount curve when these rewards are regarded as a series of continuous choices. As the length of the reward series increases, the curve of the larger but later reward becomes relatively higher, while the advantage of the smaller but earlier reward gradually disappears. This means that when people take a series of future rewards into account, their tolerance for delay increases, making them more likely to choose larger long-term rewards.

Hyperbolic discounting leads individual to favor present enjoyment or leisure over tasks that require immediate attention, which can result in a pattern of procrastination. Procrastination usually manifests itself as a tendency to put off action when faced with a task because of the effort and cost involved. Hyperbolic discounting makes us more inclined to put off tasks into the future because we have a strong preference for immediate gratification in the present and prefer to enjoy the leisure of the moment rather than do the task immediately. In the future we may choose to postpone again, and so this postponing behavior is repeated, which is procrastination. Thus, procrastination is a consequence, especially for those with hyperbolic discounting preferences.

4.1. The impact of hyperbolic discounting on consumption and wealth accumulation in pension plans

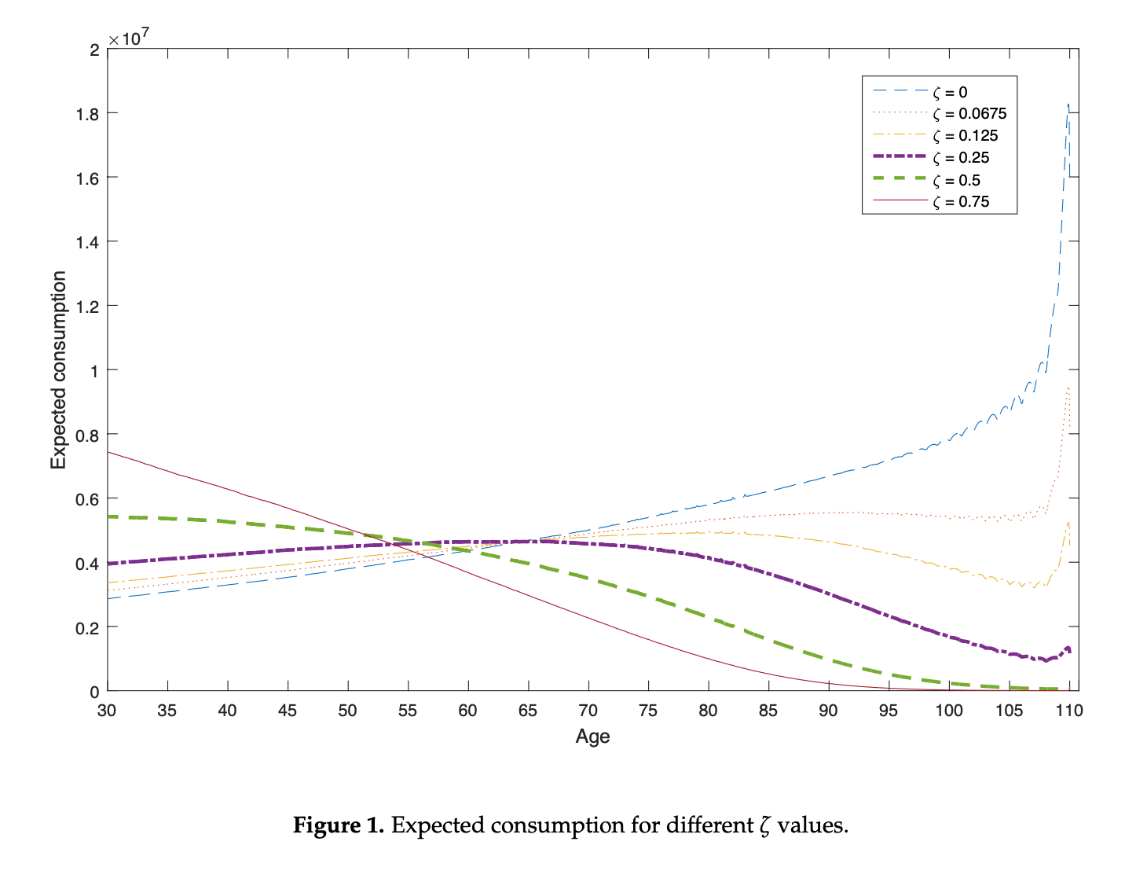

Influenced by hyperbolic discounting, there is a tendency to place more value on current benefits and undervalue the investment of future savings. By constructing a mathematical model, authors Siqi Tang et al.[14] show in detail how hyperbolic discounting affects the consumption behavior and annuity demand of pension plan participants. The authors use dynamic programming methods and utility maximization models to simulate consumption paths and investment decisions under different time preferences. The authors assume that the market is complete and that participants can purchase a fair share of life insurance and annuities in the market, then they introduce a time preference model with hyperbolic discounting, which assumes that participants’ discount rates vary over time, causing them to prefer immediate consumption and ignore future financial needs in their decision making.

In the mathematical model, participants’ consumption, portfolio, and inheritance levels are used as decision variables, and by solving for the optimal paths of these variables, the model demonstrates that the consumption paths of pension plan participants with different levels of impatience, ζ (higher ζ values indicate that the individual is more impatient and tends to consume in the present and underestimate future benefits), take on the shape of a hump (Figure9), which is represented by a higher consumption early in the career, with a gradually decreases in the middle of the career, and then significantly decreases when approaching retirement. For instance, with a high impatience factor (ζ=0.75), consumption peaks early in life, but this high consumption is unsustainable, leading to a rapid decline by age 70. In contrast, with ζ=0, consumption remains relatively stable, beginning at the lowest consumption at age 30 and gradually increasing to a high level by age 105. This indicates a more balanced approach to consumption and saving, where future needs are more adequately planned for.

Figure 9: Expected Consumption for Different ζ values.

(Source: Tang et al., 2018)

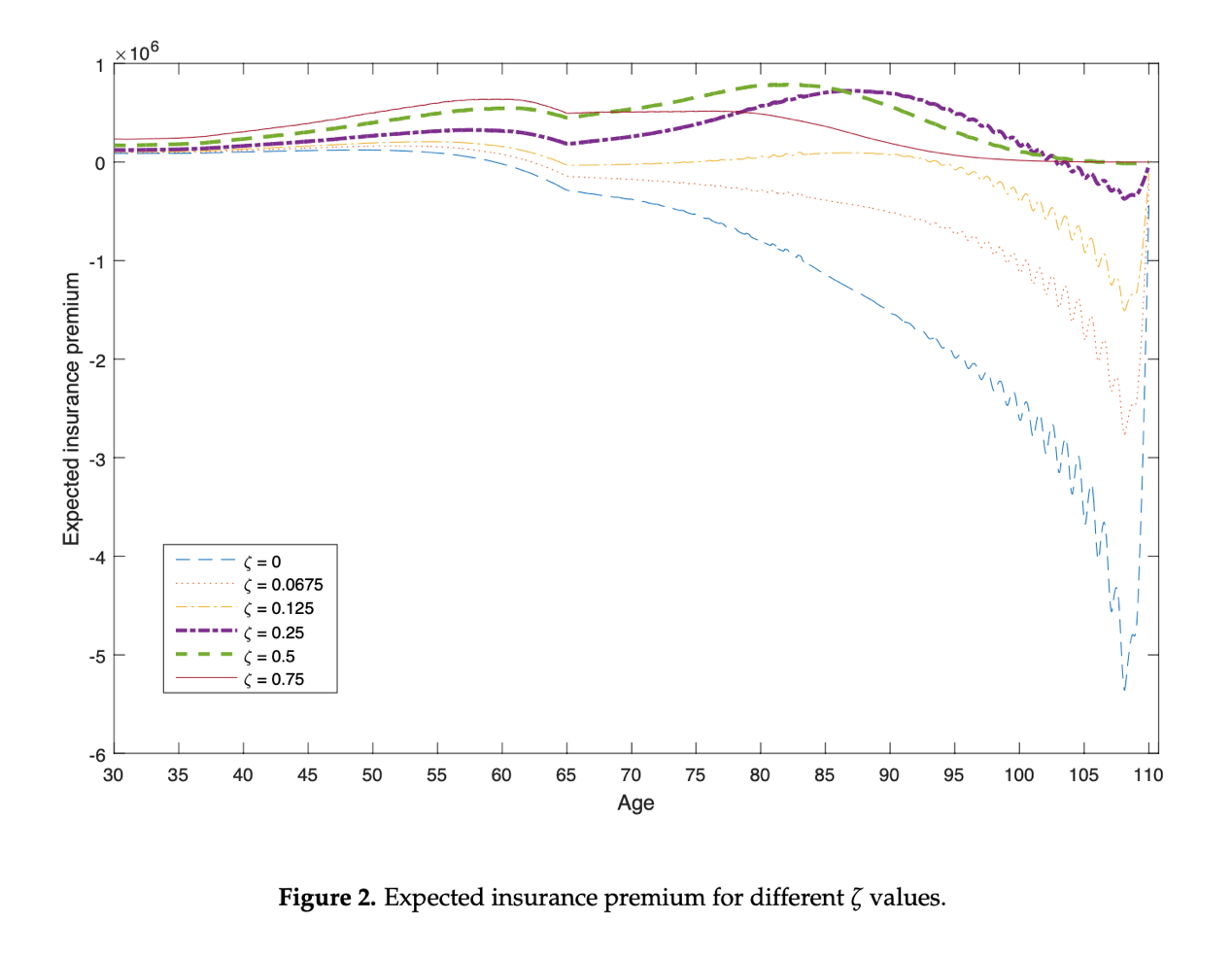

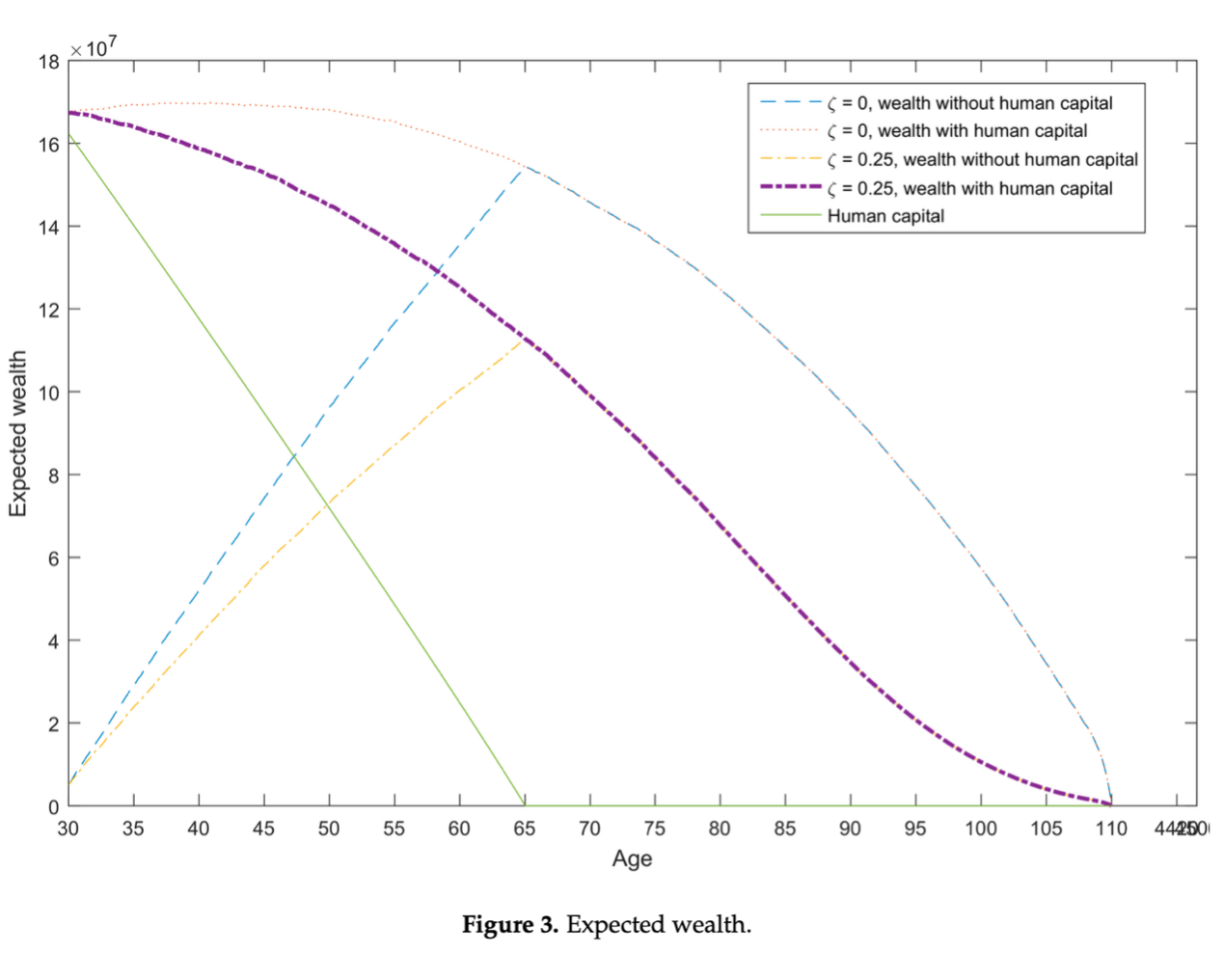

Numerical simulations and graphical analyses also show the changes in wealth accumulation and insurance demand under different values of the impatience level ζ.

Figure 10: Expected Insurance Premium for Different ζ Values.

(Source: Tang et al., 2018)

Figure10 demonstrates that the demand for life insurance increases with age, especially near retirement, while the demand for annuities is relatively low. For individuals with a high impatience factor (ζ=0.75), the expected insurance premium remains high during the early to middle stages of life, peaking near age 55. This high premium reflects the strong demand for life insurance, driven by insufficient financial wealth to meet bequest motives. However, as individuals age beyond 80, the premium begins to decrease, indicating a reduced demand for life insurance. This shows that these individuals tend to purchase life insurance when their wealth accumulation is insufficient. Conversely, for individuals with ζ=0, they have the habit of saving money and have enough savings to buy annuity, the insurance premium becomes negative around age 55, signifying an increased demand for annuities. This reflects the fact that individuals prioritize immediate consumption at the beginning of their careers over long-term financial planning and pension scheme investment.

Figure 11: Expected Wealth.

(Source: Tang et al., 2018)

Figure11 illustrates how wealth accumulation is influenced by different levels of impatience. With a relatively high impatience factor (ζ=0.25), individuals tend to consume more wealth in the early stage, which leads to the earlier peak of their wealth and a faster decline in wealth. This line shows a typical wealth accumulation pattern of “rapid rise-early peak-rapid decline”, reflecting the individual's preference for immediate consumption and neglect of long-term wealth accumulation under time inconsistency. In contrast, with ζ=0, their wealth gradually accumulates over their life cycle, reaches a certain peak, and then gradually declines as they age and their income decreases after retirement. This line shows that wealth increases steadily with age, peaks at around 70 years old, and then slowly declines, reflecting the tendency of individuals to maintain a certain wealth reserve in the later stages of their lives to ensure a stable retirement life. This figure shows that under the influence of hyperbolic discounting, an individual’s wealth accumulation is slower during his career, resulting in lower wealth accumulation and insufficient savings at retirement, which directly affects their ability to purchase annuities after retirement, posing a threat to their financial stability and pension security after retirement.

In a summary, hyperbolic discounting causes individuals to prioritize consumption when they are young, resulting in insufficient savings and insufficient funds to purchase annuities, which weakens financial stability after retirement. This phenomenon further weakens the ability of individuals to purchase annuities after retirement in pension plans, leading to insufficient savings and a decrease in the annuity rate.

4.2. The impact of hyperbolic discounting on the demand for immediate and deferred annuities in pension schemes

An annuity is a financial contract that provides a person with regular payments, usually after retirement, in return for a prior lump sum investment or installment payments[15]. Annuities are a core component of pension schemes. There are two main types of annuities: immediate annuities and deferred annuities.

Immediate annuity is an annuity product that begins paying out immediately upon purchase. Typically, once the policyholder pays a lump sum premium, they will immediately begin receiving regular annuity payments that will continue until the policyholder dies. The demand for immediate annuity in a pension scheme is reduced. Hyperbolic discounting reduces the attractiveness of immediate annuity, because immediate annuity requires an employee to pay a large sum of money at retirement, and the annuity company then pays a fixed amount of income to the purchaser until the purchaser’s death. This is designed to provide retirees with a stable and consistent stream of income. But because hyperbolic discounting leads people to have a strong preference for immediate consumption, they are reluctant to invest such large sums of money in such a financial instrument. This behavior explains the “annuity puzzle” that occurs in many pension schemes, where the theoretical benefits of immediate annuities are not reflected in the actual purchase rate.

In contrast, a deferred annuity can be somewhat more attractive, particularly for individuals with hyperbolic discounting tendencies. A deferred annuity is a product in which the pension benefits are not paid out immediately after purchase; instead, the payments begin once the purchaser reaches a certain predetermined age, typically several years after retirement. The key advantage of this product is that its initial purchase cost is usually lower because the payment is deferred. This lower initial cost, combined with the promise of future benefits, makes deferred annuities more appealing to those who exhibit hyperbolic discounting. Chen et al.[16] found that individuals with hyperbolic discounting tendencies tend to find deferred annuities particularly attractive because these products align better with their time-inconsistent preferences. Specifically, their study highlights that as the deferred period increases, the attractiveness of the annuity significantly rises, with individuals willing to pay substantially more than the actuarial fair price for long-term deferred annuities. The deferred nature of the payments allows these individuals to commit to future financial security while maintaining greater psychological comfort and flexibility in the present. This effect is especially pronounced when the deferred period is longer, as individuals perceive a greater value in securing longevity protection without the immediate financial commitment.

5. Cases and policy recommendations

In designing effective pension plans, understanding and leveraging behavioral biases and heuristics is crucial, as people are often influenced by these psychological factors and behavioral biases when making long-term financial decisions.

The Save More Tomorrow plan is an innovative and influential pension strategy designed to address the common issue of insufficient retirement savings among employees. Developed by behavioral economists Richard Thaler and Shlomo Benartzi. The Save More Tomorrow plan helps employees overcome the insufficient savings by gradually and automatically increasing the savings rate when future salary increases are made; it can be combined with the automatic enrollment to increase participation rates. The Save More Tomorrow plan is widely considered a critical success in the world of retirement savings. Research and practical applications show significant increases in employee participation and average savings rates in companies that implement this program. It cleverly uses status quo bias and hyperbolic discounting to design and optimize pension strategies to help employees ensure that they have more funds when they retire.

The Save More Tomorrow plan takes advantages of the status quo bias, that is, most people choose to keep their current choices and do not actively make changes. This automatic enrollment can significantly increase the participation rate of pension plans. In the Save More Tomorrow plan, employees are automatically enrolled in the plan without having to actively choose whether to participate. Once enrolled, employees do not have to take any further action to increase their savings, as the plan automatically adjusts the contribution rates with each salary increase. This “set it and forget it” approach ensures that employees are more likely to stick with the plan and increase their savings over time.

The Save More Tomorrow plan also addresses the biase that often hinder effective saving behavior: hyperbolic discounting. The Save More Tomorrow plan is designed to link the increase in the savings rate to future salary increases, this helps to address the negative impact of hyperbolic discounting. Since people are more sensitive to immediate consumption today and more tolerant of future decisions, by arranging the increase in the savings rate to coincide with future salary increases, and the actual income of participants will not decrease due to increased savings, the Save More Tomorrow plan reduces their psychological burden. The increase in savings will be achieved in the future, and people are more likely to accept the promise of gradually increasing savings in the future. Therefore, participants are more willing to accept this arrangement rather than sacrifice savings immediately, reducing immediate losses.

5.1. Given the analysis of the Save More Tomorrow program, it is recommended that the following policies be considered

5.1.1. Provide a Default Plan and automatic enrollment mechanism

The Save More Tomorrow plan effectively leverages status quo bias, which is the tendency for individuals to stick with default options. By introducing a default plan and an automatic enrollment mechanism in pension plans, status quo bias can be effectively exploited. Research shows that default options can significantly increase program participation rates because most people tend to stay in the status quo without actively making a choice. An automatic enrollment mechanism ensures that employees automatically participate in the plan without the need for active selection, which greatly simplifies the decision-making process and increases participation.

5.1.2. Linking the increase in the savings rate to wage increases

The Save More Tomorrow plan effectively leverages status quo bias, which is the tendency for individuals to stick with default options. By linking the increase in the savings rate to future wage increases can reduce employees’ concerns about an immediate reduction in income. By gradually increasing the savings rate when wages rise, employees are more likely to accept the change because they will not worry about the current reduction in income and are more inclined to be willing to save more in the future, reducing immediate consumption and relieving their psychological burden.

5.1.3. Governments can reduce barriers to adoption

Governments can facilitate broader adoption of pension schemes such as the Save More Tomorrow plan by reducing administrative barriers and regulatory obstacles. For example, simplifying the processes for automatic enrollment and default contributions can make it easier for businesses to adopt the pension scheme. Additionally, offering incentives for employers to implement automatic enrollment and contribution escalation mechanisms can promote wider use of such plans. By encouraging more companies to adopt these behavioral interventions, the government can help increase overall savings rates and enhance long-term retirement security for society[17]. Removing these barriers will also support smaller businesses, which might otherwise struggle with the administrative complexity of implementing such plans.

5.1.4. Focus on employee education

While automation and default options in the Save More Tomorrow plan are effective in driving participation, they do not eliminate the need for strong financial literacy among employees. Employers should complement the automated features of the plan with targeted financial education programs that emphasize the importance of long-term retirement planning. Employees need to understand how the gradual increase in savings contributions works and why it benefits their future financial security. By linking the education program with the behavioral principles underpinning the Save More Tomorrow plan—such as the importance of overcoming hyperbolic discounting and making consistent, future-focused decisions—employees can gain confidence in the pension system. Informed employees are more likely to trust the Save More Tomorrow plan, adhere to its automatic increases, and make more proactive financial decisions when necessary, thereby optimizing their retirement outcomes.

6. Conclusion

This paper systematically explores the behavioral principles that should be utilized in designing an effective pension scheme, specifically focusing on status quo bias and hyperbolic discounting. Through example-based analysis of how these principles impact the behavior of participants in defined contribution (DC) plans, it demonstrates the importance of default options in pension scheme design. Utilizing a default plan can effectively harness status quo bias to increase participation rates and improve participants’ savings outcomes. Additionally, the paper explores how hyperbolic discounting influences individuals’ preference for immediate consumption, thereby posing potential challenges to retirement planning, making it an important bias that cannot be ignored.

The paper also discusses the application of these behavioral principles through practical examples, such as the Save More Tomorrow plan, which strategically leverages these biases to encourage higher savings rates and help individuals better prepare for retirement. By understanding and applying these behavioral principles, pension scheme designers can create systems that align with human behavior, ultimately leading to more secure financial futures for participants.

References

[1]. Yang, T. (2005). Understanding the defined benefit versus defined contribution choice (PRC WP 2005-4). Pension Research Council, The Wharton School, University of Pennsylvania. https://prc.wharton.upenn.edu/prc/prc.html

[2]. Myers, E. A., & Topoleski, J. J. (2021, December 27). A visual depiction of the shift from defined benefit (DB) to defined contribution (DC) pension plans in the private sector. Congressional Research Service. https://crsreports.congress.gov

[3]. Pensions Europe. (2024, April). Road to DC: Understanding the Shift. Pensions Europe. https://pensionseurope.eu/wp-content/uploads/DC-paper-web-version-final.pdf

[4]. Langley, P., & Leaver, A. (2012). REMAKING RETIREMENT INVESTORS: Behavioural economics and defined-contribution occupational pensions. Journal of Cultural Economy, 5(4), 473–488. https://doi.org/10.1080/17530350.2012.691893

[5]. Pensions Policy Institute. (2003, July). The shift from defined benefit to defined contribution. Pensions Policy Institute. https://www.pensionspolicyinstitute.org.uk

[6]. Samuelson, W., & Zeckhauser, R. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty, 1(1), 7-59. https://doi.org/10.1007/BF00055564

[7]. Madrian, B. C., & Shea, D. F. (2001). The power of suggestion: Inertia in 401(k) participation and savings behavior. Quarterly Journal of Economics, 116(4), 1149-1187. https://doi.org/10.1162/003355301753265543

[8]. Choi, J. J., Laibson, D., Madrian, B. C., & Metrick, A. (2001). For better or for worse: Default effects and 401(k) savings behavior (NBER Working Paper No. 8651). National Bureau of Economic Research. https://doi.org/10.3386/w8651

[9]. Brown, J. R., & Weisbenner, S. J. (2009). Who chooses defined contribution plans? In J. R. Brown, J. Liebman, & D. A. Wise (Eds.), Social security policy in a changing environment (pp. 131–161). University of Chicago Press. http://www.nber.org/chapters/c4537

[10]. Redden, Joseph P. (2007), “Hyperbolic Discounting, ” in Encyclopedia of Social Psychology, ed. Roy F. Baumeister and Kathleen D. Vohs, Thousand Oaks, CA: Sage. https://www.jstor.org/stable/41760530

[11]. Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8(3), 201-207. https://doi.org/10.1016/0165-1765(81)90067-7

[12]. Frederick, S., Loewenstein, G. and O’Donoghue, T., 2002. Time Discounting and Time Preference: A Critical Review. Journal of Economic Literature, 40(2), pp.351-401.

[13]. Ainslie, G. & Monterosso, J. (2003) ‘Chapter 2 - Hyperbolic Discounting as a Factor in Addiction: A critical Analysis’, in Choice, Behavioural Economics and Addiction. [Online]. Elsevier Ltd. pp. 35–69. https://uosc.primo.exlibrisgroup.com/permalink/01USC_INST/273cgt/cdi_elsevier_sciencedirect_doi_10_1016_B978_008044056_9_50043_9

[14]. Tang, S. et al. (2018) Life insurance and annuity demand under hyperbolic discounting. Risks (Basel). [Online] 6 (2),1–10.https://uosc.primo.exlibrisgroup.com/permalink/01USC_INST/273cgt/cdi_proquest_journals_2125015494

[15]. National Council on Aging. (2024, January 16). What is an annuity and how does it work? National Council on Aging. https://www.ncoa.org/article/what-is-an-annuity-and-how-does-it-work/

[16]. Chen, A. et al. (2020) The implication of the hyperbolic discount model for the annuitisation decisions. Journal of pension economics & finance. [Online] 19 (3), 372–391.

[17]. Kay, Stephen J., and Tapen Sinha (2008), Lessons from Pension Reform in the Americas (Oxford, 2007; online edn, Oxford Academic, 1 Jan. 2008), https://doi.org/10.1093/acprof:oso/9780199226801.001.0001

Cite this article

Hu,J. (2025). What Behavioral Principles Should Be Used to Design a Pension Scheme: Insights from Status Quo Bias and Hyperbolic Discounting. Advances in Economics, Management and Political Sciences,133,82-97.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yang, T. (2005). Understanding the defined benefit versus defined contribution choice (PRC WP 2005-4). Pension Research Council, The Wharton School, University of Pennsylvania. https://prc.wharton.upenn.edu/prc/prc.html

[2]. Myers, E. A., & Topoleski, J. J. (2021, December 27). A visual depiction of the shift from defined benefit (DB) to defined contribution (DC) pension plans in the private sector. Congressional Research Service. https://crsreports.congress.gov

[3]. Pensions Europe. (2024, April). Road to DC: Understanding the Shift. Pensions Europe. https://pensionseurope.eu/wp-content/uploads/DC-paper-web-version-final.pdf

[4]. Langley, P., & Leaver, A. (2012). REMAKING RETIREMENT INVESTORS: Behavioural economics and defined-contribution occupational pensions. Journal of Cultural Economy, 5(4), 473–488. https://doi.org/10.1080/17530350.2012.691893

[5]. Pensions Policy Institute. (2003, July). The shift from defined benefit to defined contribution. Pensions Policy Institute. https://www.pensionspolicyinstitute.org.uk

[6]. Samuelson, W., & Zeckhauser, R. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty, 1(1), 7-59. https://doi.org/10.1007/BF00055564

[7]. Madrian, B. C., & Shea, D. F. (2001). The power of suggestion: Inertia in 401(k) participation and savings behavior. Quarterly Journal of Economics, 116(4), 1149-1187. https://doi.org/10.1162/003355301753265543

[8]. Choi, J. J., Laibson, D., Madrian, B. C., & Metrick, A. (2001). For better or for worse: Default effects and 401(k) savings behavior (NBER Working Paper No. 8651). National Bureau of Economic Research. https://doi.org/10.3386/w8651

[9]. Brown, J. R., & Weisbenner, S. J. (2009). Who chooses defined contribution plans? In J. R. Brown, J. Liebman, & D. A. Wise (Eds.), Social security policy in a changing environment (pp. 131–161). University of Chicago Press. http://www.nber.org/chapters/c4537

[10]. Redden, Joseph P. (2007), “Hyperbolic Discounting, ” in Encyclopedia of Social Psychology, ed. Roy F. Baumeister and Kathleen D. Vohs, Thousand Oaks, CA: Sage. https://www.jstor.org/stable/41760530

[11]. Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8(3), 201-207. https://doi.org/10.1016/0165-1765(81)90067-7

[12]. Frederick, S., Loewenstein, G. and O’Donoghue, T., 2002. Time Discounting and Time Preference: A Critical Review. Journal of Economic Literature, 40(2), pp.351-401.

[13]. Ainslie, G. & Monterosso, J. (2003) ‘Chapter 2 - Hyperbolic Discounting as a Factor in Addiction: A critical Analysis’, in Choice, Behavioural Economics and Addiction. [Online]. Elsevier Ltd. pp. 35–69. https://uosc.primo.exlibrisgroup.com/permalink/01USC_INST/273cgt/cdi_elsevier_sciencedirect_doi_10_1016_B978_008044056_9_50043_9

[14]. Tang, S. et al. (2018) Life insurance and annuity demand under hyperbolic discounting. Risks (Basel). [Online] 6 (2),1–10.https://uosc.primo.exlibrisgroup.com/permalink/01USC_INST/273cgt/cdi_proquest_journals_2125015494

[15]. National Council on Aging. (2024, January 16). What is an annuity and how does it work? National Council on Aging. https://www.ncoa.org/article/what-is-an-annuity-and-how-does-it-work/

[16]. Chen, A. et al. (2020) The implication of the hyperbolic discount model for the annuitisation decisions. Journal of pension economics & finance. [Online] 19 (3), 372–391.

[17]. Kay, Stephen J., and Tapen Sinha (2008), Lessons from Pension Reform in the Americas (Oxford, 2007; online edn, Oxford Academic, 1 Jan. 2008), https://doi.org/10.1093/acprof:oso/9780199226801.001.0001