ESG performance, Financial performance, Two-way synergistic effect, PVAR model.

1. Introduction

Under the "Principles of Responsible Investment," ESG (Environmental, Social, Governance) has become a recognized proxy for corporate social responsibility, influencing investment decisions. However, the link between ESG performance and financial performance remains unclear. Recent studies suggest a two-way causal relationship, termed the "benign/vicious cycle," with meta-analyses indicating that good ESG performance positively correlates with financial performance, reflecting a "virtuous circle." Yet, research demonstrating negative causality is limited.Many studies overlook potential endogenous issues, raising questions about their robustness. Factors like sample selection and analysis methods significantly influence this correlation, leaving a definitive conclusion elusive.

This paper analyzes A-share listed companies from 2011 to 2020 using the PVAR model to test the correlation between ESG and financial performance. It validates that better ESG performance correlates with improved financial outcomes and demonstrates a positive synergistic effect, highlighting the importance of considering both dimensions in corporate strategy [1].

2. Literature review and hypothesis

2.1. Synergy between ESG performance and financial performance

After over fifty years of exploration, a consensus has emerged in academia: there is a relationship between corporate ESG efforts and economic returns. While this connection may not always be significant, companies are not penalized for positive actions. Research indicates that strong ESG performance can enhance financial performance, but only firms with good returns have the surplus resources to invest in ESG activities[2-3]. Some scholars suggest a bidirectional causal relationship between ESG performance and financial performance. ESG accountability can enhance financial performance, while good financial performance ensures the necessary resources for fulfilling ESG responsibilities[4-5].This bidirectional relationship, known as the positive/negative synergy hypothesis, has been partially validated. Chinese scholars have examined this correlation in the A-share capital market, confirming a positive synergistic effect between ESG performance and financial performance, similar to increasing returns.According to the theory of idle resources and capital supply, firms need strong financial performance to undertake ESG responsibilities, as only those with good returns can invest in ESG activities[6]. ESG performance often results from both active motivation and passive requirements. On one hand, ESG activities can provide significant resources and competitive advantages, motivating firms to fulfill their responsibilities. On the other hand, especially for listed companies, institutional and normative pressures compel them to perform ESG duties to maintain legal status.Firms with strong financial performance possess the motivation and ability to absorb the extra costs associated with ESG, enhancing their capacity to secure scarce resources in the future. For instance, in the environmental dimension, good financial performance enables investments in environmental protection technology, optimizing management activities. In the social dimension, it allows for charitable donations, attracting talent, and protecting employee rights[7-8]. In corporate governance, strong financial performance encourages shareholders to invest in ESG activities, prompting management to act more responsibly toward stakeholders. In the long run, good financial performance not only supports ESG responsibilities but also helps firms obtain strategic resources and competitive advantages, promoting sustainable development and further enhancing financial performance, thus creating a "virtuous circle"[9-10].

Based on the above analysis, this article proposes H2 and its three sub hypotheses:

H2: There is a positive correlation between a company's ESG performance and financial performance towards synergistic effects.

H2a: There is a relationship between environmental dimension (E) performance and financial performance positive synergy effect.

H2b: There is a relationship between social dimension (S) performance and financial performance positive synergy effect.

H2c: There is a relationship between governance dimension (G) performance and financial performance positive synergy effect.

3. Methods

3.1. Sample selection and data sources

Selecting A-share listed companies from 2011 to 2020 as research subjects, and after excluding samples with missing data, a total of 1629 observation samples were obtained. The financial data of the sample companies are all sourced from the CSMAR database, while the environmental and social dimensions are sourced from the Hexun.com corporate social responsibility report rating database; Retrieve relevant data from the database based on the proposed 8 variables and organize them. The dimension data of corporate governance is calculated by constructing a governance indicator system, and its basic data comes from the Guotai An database. In addition, to control the influence of extreme values, all data were truncated at the 1% percentile. There may also be inconsistent data levels in the annual financial reports of enterprises. This phenomenon is mainly due to Guotai An's use of OCR technology to convert annual reports into structured data. During this process, the manual verification may not be sufficient, resulting in frequent data errors[11].

3.2. Variable setting

For financial performance (CFP), return on total assets (ROA) and return on equity (ROE) are adopted as proxy variables of accounting performance according to the common practice of academic circles.At the same time, TobinQ value (Tobin Q) and price-to-book ratio (PB) are used as proxy variables of market performance[12-13].

For ESG performance (ESGP), this paper uses the environmental performance score and social performance score in Hexun. com's corporate social responsibility report rating as proxy variables for the environmental and social performance of sample companies.

Subsequently, drawing on the practices of other scholars,eight indicators were selected to construct a governance indicator system, including the shareholding ratio of the largest shareholder (Top1), the shareholding ratios of the second to tenth largest shareholders (Top2-10), whether there is a parent company (Parent), whether it is listed on other markets (HB_Share), the proportion of independent directors (Indratio), the shareholding ratio of executives (Mana), and the general manager whether the two positions of chairman are held by the same person (Dual) and the nature of equity (State), and using principal component analysis to determine the first principal component as a proxy variable for the performance of corporate governance dimensions. After obtaining the scores of the three sub dimensions of the sample company's performance, the weighted average is taken as the overall ESG performance (ESG) of the sample company.

3.3. Research methods

The empirical analysis of this study adopts panel vector autoregressive model. This is a model based on multiple regression equations, which follows the advantages of the Vector Auto-regression (VAR) model in time series, that is, all variables in the model are regarded as endogenous variables without presupposing the causal relationship between variables, and the influence of the lag term of all variables is considered. The difference between PVAR model and traditional panel regression model is that PVAR model combines the method characteristics of VAR model with panel data, and can effectively solve the problem of individual heterogeneity by using the methods of system generalized moment estimation (SGMM), impulse response function (IRF) and variance decomposition (FEVD), and considers the time delay of variables, which can reflect the dynamic interaction among variables[14].

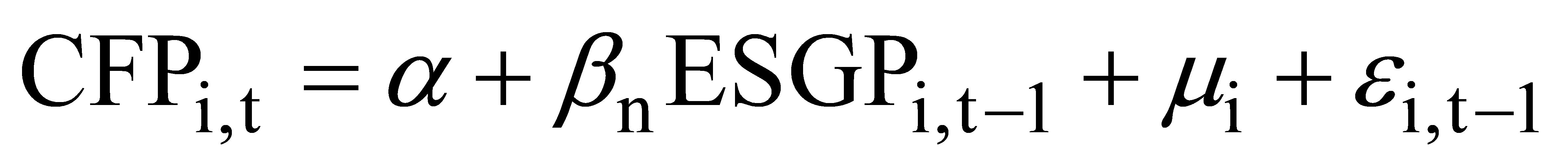

In order to use PVAR model to verify whether there is a two-way causal relationship between ESG performance and financial performance based on positive/negative cooperativity hypothesis, models (1) and (2) are constructed:

Among them, TobinQ, PB, ROA, and ROE are used to measure financial performance (CFP); ESG represents the performance of environmental (E), social (S), and corporate governance (G) dimensions, as well as overall (ESG) accountability; I represents the sample company, t represents the year; \( {μ_{i}} \) represents a specific fixed effect of the explained variable, while \( {ε_{i}} \) and \( t-1 \) are random perturbation terms.

4. Results and discussion

4.1. Descriptive statistics

Descriptive statistics are made on the main variables, and the results are shown in Table 1. E (Environment): A rating in the environmental dimension that reflects a company's performance in environmental protection.S (Social): A rating in the social dimension that reflects a company's performance in fulfilling its social responsibilities.G (Governance): A rating in the governance dimension that reflects a company's performance in corporate governance.ESG: A comprehensive evaluation of environmental, social, and governance aspects that reflects the overall ESG performance of a company.TobinQ: Tobin's Q ratio is a commonly used financial indicator used to measure the ratio of a company's market value to its replacement cost.PB: Price to Book ratio, which is the ratio of stock price to book value per share.ROA: Return on Assets, refers to the percentage of after tax profits earned by a company from its total assets to its total assets.ROE: Return on Equity, refers to the percentage of after tax profits earned by a company from shareholder equity to shareholder equity. From the overall ESG performance, the average value is 8.429, which is low, and there is a big gap between the maximum value and the minimum value, indicating that the ESG performance of the sample companies is uneven[18]. The ESG performance of the sample companies varies greatly, especially in the environmental and social dimensions, while the overall performance in the governance dimension is better. In terms of financial performance, Tobin's Q and the average return on equity are relatively high, indicating that these companies are performing well in terms of market value and shareholder returns. A large standard deviation indicates significant differences in performance between different companies in these dimensions. From the perspective of subdimensions, the performance of both environmental and social dimensions and corporate governance dimensions is not ideal, and there is a big gap. From the perspective of financial performance, the standard deviation of both accounting indicators and market performance indicators is large, and the difference between the maximum value and the minimum value is also large[15].

Table 1: Descriptive Statistics

Variable | Sample Size | Average Value | Standard Deviation | Minimum Value | Maximum value |

E | 16290 | 1.835 | 5.140 | 0.000 | 30.000 |

S | 16290 | 5.085 | 4.885 | -15.000 | 30.000 |

G | 16290 | 18.366 | 5.654 | -2.262 | 40.637 |

ESG | 16290 | 8.429 | 3.240 | -1.967 | 23.507 |

TobinQ | 16290 | 1.961 | 1.313 | 0.846 | 8.648 |

PB | 16290 | 3.095 | 2.734 | 0.494 | 18.442 |

ROA | 16290 | 0.039 | 0.058 | -0.191 | 0.216 |

ROE | 16290 | 0.068 | 0.114 | -0.513 | 0.361 |

4.2. Unit Root Test

Before using the PVAR model for statistical regression of sample companies, to avoid possible bias in the regression results of panel data, it is necessary to perform unit root tests on the panel data to ensure the stationarity of each variable. Three testing methods, LLC, IPS, and ADF Fisher, were used to perform unit root tests on the model variables, and the results are shown in Table 2.

Table 2: Unit Root Test

Testing method | TobinQ | PB | ROA | ROE | E | S | G | ESG |

LLC | - 83.789*** (0.000) | -82.507*** (0.000) | -1.100*** (0.000) | -1.100*** (0.000) | -1.400*** (0.000) | -1.600*** (0.000) | -1.000*** (0.000) | -1.100*** (0.000) |

IPS | -6.297*** (0.000) | -9.647*** (0.000) | -27.749*** (0.000) | -28.230*** (0.000) | -75.819*** (0.000) | -50.842*** (0.000) | -17.710*** (0.000) | -27.458*** (0.000) |

ADF-Fisher | 16.979*** (0.000) | 20.767*** (0.000) | 46.378*** (0.000) | 50.773*** (0.000) | 230.367***(0.000) | 75.415***(0.000) | 43.572***(0.000) | 79.474***(0.000) |

Note: The numbers in parentheses are P-values; *, * * And ∗∗∗ represent passing the test at confidence levels of 10%, 5%, and 1%, respectively.

Table 2 shows that the four proxy variables of financial performance (TobinQ, PB, ROA, ROE) and the four proxy variables of performance (E, S, G, ESG) all passed the LLC test, IPS test, and ADFFisher test at a significant level of 1%. Based on this, it can be considered that all variable sequences are stationary.

4.3. PVAR model estimation results

Due to the consideration of time effects in the PVAR model, it is necessary to obtain various variables The optimal lag order of the quantity to ensure the validity of the model estimation results. Root According to the information criterion, when the optimal lag order of the variable is determined to be 1, the model has better parameter estimation results.

ESG performance and market performance. Firstly, using generalized moment estimation estimation method for panel data. ESG performance of sample companies the regression results with market performance are shown in Table 3.

Table 3: Tobin's Q value and regression of ESG and various dimensional variables

Variable | TobinQ | ESG | Variable | TobinQ | ESG |

L.TobinQ | 0.685***(22.62) | 0.367***(9.10) | L.TobinQ | 0.734***(21.55) | 1.168***(12.96) |

L.ESG | 0.039***(10.47) | 0.626***(38.60) | L.ESG | 0.002***(2.65) | 0.520***(31.62) |

Variable | TobinQ | ESG | Variable | TobinQ | ESG |

L.TobinQ | 0.736***(21.74) | 0.267***(3.16) | L.TobinQ | 0.669***(22.96) | -0.004(-0.13) |

L.ESG | 0.014***(5.68) | 0.212***(9.89) | L.ESG | 0.079***(10.56) | 0.800***(35.22) |

Note: The number in parentheses represents the value of t, the same applies below

From Table 3, it can be seen that when Tobin's Q value is the dependent variable, the coefficient between ESG lagged by one period and the current Tobin's Q value is significantly positively correlated at the 1% level, and the coefficient between Tobin's Q value lagged by one period and the current Tobin's Q value is significantly positive. At the same time, when ESG is the dependent variable, the Tobin Q value lagged by one period has a significant positive coefficient on the current ESG at the 1% level, and the lagged ESG still has a significant positive coefficient on the current ESG. In addition, there is a significant positive correlation between the environmental and social dimensions and Tobin's Q value. However, in the dimension of corporate governance, lagging governance performance by one period can significantly improve the Tobin Q value of the current period, while lagging Tobin Q value by one period has a negative impact on current governance performance and is not significant. Similarly, will when the price to book ratio (PB) is regressed with ESG and various dimensions of performance as explanatory variables, it shows results similar to Tobin's Q value (due to space limitations, the results are not shown).

ESG performance and accounting performance as shown in Table 4, when the return on assets (ROA) is used as the dependent variable, the coefficient of lagged ESG to current ESG is 0.632, which is significantly positive at the 1% level. The coefficient of lagged ROA to current ROA is also significantly positive at the 1% level. When ESG is used as the dependent variable, the coefficient of lagged ROA to current ESG is also significantly positive at the 1% level. Moreover, the coefficient of lagged ESG for the current period is still significantly positive. The positive correlation between ROA and environmental, social, and governance dimensions remains significant. Similarly, when the return on equity (ROE) is regressed with ESG and other dimensional variables as dependent variables, similar results to ROA are presented (limited by space, results are not shown). Thus, H1, H2, and their three sub hypotheses have been preliminarily validated, indicating a significant positive correlation between financial performance and ESG and its sub dimensions. Unlike market performance, there is a significant bidirectional promotion relationship between accounting performance and corporate governance dimensions.

Table 4: ROA, ESG, and regression of various dimensional variables

Variable | ROA | ESG | Variable | ROA | E |

L. ROA | 0.356***(19.92) | 2.333***(4.09) | L. ROA | 0.375***(22.45) | 12.949***(11.08) |

L.ESG | 0.001***(4.13) | 0.632***(36.61) | L.E | 0.000***(1.65) | 0.517***(31.62) |

Variable | ROA | S | Variable | ROA | G |

L. ROA | 0.371***(21.79) | 1.646***(2.03) | L. ROA | 0.363***(21.08) | 2.453***(4.49) |

L.S | 0.000***(2.62) | 0.211***(9.19) | L.G | 0.002***(4.13) | 0.780***(32.54) |

4.4. Impulse Response Function (IRF) Analysis

The impulse response function in the PVAR model can reflect the dynamic impact that a specific variable in the model will have on its later stages and other variables when it is subjected to external shocks, thus characterizing the interaction between variables in the future period. By conducting 200 Monte Carlo simulations over the next 10 periods to generate relatively stable confidence intervals, an impulse response function was obtained to analyze the dynamic interaction between ESG performance and financial performance.

4.4.1. ESG performance and market performance

The Tobin Q value and the impulse response functions of ESG and its various dimensions are shown in Figure 1. From Figure 1(a), it can be seen that when ESG is positively impacted by one unit, it will have a gradually increasing positive promoting effect on Tobin's Q value, and will reach a maximum value of 0.11 in the second period in the future, gradually approaching 0 thereafter. However, although the impact has decreased, it will still show significant positive effects in the next 10 periods. This indicates that good ESG performance contributes to the improvement of market performance, and a positive impact on current ESG will have a similar positive effect on subsequent ESG, but will continue to decline and approach zero. Similarly, when Tobin's Q value is positively impacted by one unit, the overall ESG performance will have a gradually increasing positive promoting effect, until reaching a maximum value of 0.41 in the next two periods, and then gradually decreasing and approaching 0. This indicates that the improvement of current market performance can have an impact on future ESG The performance of fulfilling responsibilities has a positive impact, and the positive impact on Tobin's Q value in the current period will have a positive impact on subsequent Tobin's Q values, but the impact will continue to decrease. Similarly, as shown in Figures 1(b), (c), and (d), when the performance of environmental (E), social(S), and governance(G) dimensions is positively impacted, it will have a positive promoting effect on Tobin's Q value, but this effect will gradually weaken. In addition, the price to book ratio is related to ESG and its various dimensions of impulse response functions, as well as Tobin's Q value the results are similar.

4.4.2. ESG performance and accounting performance

In the impulse response function of return on total assets(ROA)and ESG and its various dimensions, when ESG is positively impacted by one unit, it will gradually enhance the positive promotion effect on ROA in the initial stage, and show a significant positive impact in the next 10 periods, indicating that a good ESG performance statement can help improve accounting performance. However, this impact is significantly weaker than market performance, but a positive impact on current ESG will have the same positive impact on subsequent ESG, and will continue to decline and approach zero. Similarly, when ROA is positively impacted by a unit, the positive promotion effect of overall ESG performance will continue to decline and approach zero, but still show a positive promotion effect, indicating that the improvement of current accounting performance can also have a positive impact on future ESG performance. Similarly, when the performance of environmental(E), social(S), and governance (G)dimensions is positively impacted ROA will have a positive promoting effect, but this effect will gradually weaken. The impulse response trends of return on assets(ROA), return on equity (ROE), ESG, and various dimensions are similar to Tobin's Q value, showing a dynamic interaction between the two variables. In short,ESG performance can effectively enhance financial performance in the coming period; Meanwhile, financial performance will also have a positive impact on ESG performance. Compared to accounting performance, the mutual positive promotion effect between market performance and ESG performance is particularly significant. Thus, H1 and H2 have been validated once again.

Figure 1: ROA, ESG, and regression of various dimensional variables

4.5. Variance Decomposition (FEVD) Analysis

To further clarify the long-term dynamic relationship between ESG performance and financial performance, variance decomposition analysis is used to evaluate the degree of mutual influence between the two variables by analyzing the variance contribution rates of each variable. By decomposing the variance of the three periods (SQ)(10th, 20th, and 30th),it can be seen that the variance decomposition results of the 20th and 30th prediction periods are basically consistent (see Tables 5 and 6).This indicates that in the long run, the explanatory power of inter variable shocks remains relatively stable.

It can be seen that both financial performance and ESG and sub dimensional performance have the greatest contribution to their own performance. From the perspective of market performance, after entering a stable state, ESG and its sub dimensional performance have a promoting effect on them, and market performance also supports the improvement of ESG performance. There is a positive synergistic effect between the two (see Table 5). Similarly, after entering a stable state, accounting performance and similar positive synergies still exist in the performance of ESG and its sub dimensions (see Table 6). However, overall, compared to accounting performance, the positive synergy effect between market performance and ESG is more significant, which is consistent with the conclusions drawn from impulse response analysis.

Table 5: Tobin's Q value, ESG, and variance decomposition of various dimensions

Variable | SQ | TobinQ | ESG | Variable | SQ | TobinQ | E |

TobinQ | 10 | 0.956 | 0.046 | TobinQ | 10 | 0.999 | 0.001 |

ESG | 10 | 0.099 | 0.899 | E | 10 | 0.206 | 0.794 |

TobinQ | 20 | 0.954 | 0.046 | TobinQ | 20 | 0.999 | 0.001 |

ESG | 20 | 0.101 | 0.899 | E | 20 | 0.208 | 0.792 |

TobinQ | 30 | 0.954 | 0.046 | TobinQ | 30 | 0.999 | 0.001 |

ESG | 30 | 0.101 | 0.899 | E | 30 | 0.208 | 0,792 |

Variable | SQ | TobinQ | S | Variable | SQ | TobinQ | G |

ESG | 10 | 0.994 | 0,006 | TobinQ | 10 | 0.787 | 0.213 |

S | 10 | 0.011 | 0.989 | Q | 10 | 0.003 | 0.997 |

ESG | 20 | 0.994 | 0.006 | TobinQ | 20 | 0.773 | 0.227 |

S | 20 | 0.011 | 0.989 | Q | 20 | 0.003 | 0.997 |

ESG | 30 | 0.994 | 0.006 | TobinQ | 30 | 0.773 | 0.227 |

S | 30 | 0.011 | 0.989 | Q | 30 | 0.003 | 0.997 |

Table 6: ROA, ESG, and Variance Decomposition of Various Dimensions

Variable | SQ | ROA | ESG | Variable | SQ | TobinQ | E |

ROA | 10 | 0.992 | 0.008 | ROA | 10 | 0.999 | 0.001 |

ESG | 10 | 0.038 | 0.962 | E | 10 | 0.206 | 0.794 |

ROA | 20 | 0.992 | 0.008 | ROA | 20 | 0.999 | 0.001 |

ESG | 20 | 0.038 | 0.962 | E | 20 | 0.208 | 0.792 |

ROA | 30 | 0.992 | 0.008 | ROA | 30 | 0.999 | 0.001 |

ESG | 30 | 0.038 | 0.962 | E | 30 | 0.208 | 0,792 |

Variable | SQ | TobinQ | S | Variable | SQ | ROA | G |

ROA | 10 | 0.999 | 0,001 | ROA | 10 | 0.965 | 0.035 |

S | 10 | 0.057 | 0.943 | G | 10 | 0.008 | 0.992 |

ROA | 20 | 0.999 | 0.001 | ROA | 20 | 0.965 | 0.035 |

S | 20 | 0.057 | 0.943 | G | 20 | 0.008 | 0.992 |

ROA | 30 | 0.999 | 0.001 | ROA | 30 | 0.965 | 0.035 |

S | 30 | 0.057 | 0.943 | G | 30 | 0.008 | 0.992 |

4.6. Robust Test

4.6.1. Granger causality test

From the perspective of market performance, the performance of corporate governance dimensions is a one-way Granger cause of Tobin's Q value and price to book ratio; From the perspective of accounting performance, the return on total assets is a one-way Granger cause in the environmental dimension, ESG is a Granger cause in the return on net assets, and the remaining accounting performance variables are mutually Granger causes with ESG and its sub dimensional variables. The results of Granger causality analysis are also consistent with the regression results of panel data, indicating a mutually reinforcing causal relationship between financial performance and ESG performance (limited by space, results not listed).

4.6.2. Replace proxy variables

Replace the rating data of the corporate social responsibility report of Hexun.com with the rating results of the Huazheng ESG evaluation system. Due to the fact that Huazheng ESG rating only provides an overall performance score, only the PVAR model regression is conducted between financial performance and overall ESG performance. The results show that the unit root test, impulse response function analysis, variance decomposition, and Granger test based on Huazheng ESG evaluation data (see Table 7) are basically similar to the results of the empirical analysis section and have passed the robustness test.

Table 7: Robustness test of Huazheng ESG data

Variable | H_TobinQ | H_ESG | Variable | H_PB | H_ESG |

L.h_TobinQ | 0.706∗∗∗(20.79) | 0.061∗∗∗(4.52) | L.h_PB | 0.641∗∗∗ (20.65) | 0.020∗∗∗ (3.86) |

L.h_ESG | 0.752∗∗∗(8.91) | 0.734∗∗∗ (11.65) | L.h_ESG | 1.867∗∗∗ (9.63) | 0.721∗∗∗ (11.68) |

Variable | H_ROA | H_ESG | Variable | H_ROE | H_ESG |

L.h_ROA | 0.419∗∗∗ (23.05) | 1.882∗∗∗ (7.76) | L.h_ROE | 0.333∗∗∗ (17.32) | 0.832∗∗∗ (7.30) |

L.h_ESG | 0.021∗∗∗(4.97) | 0.620∗∗∗ (11.66) | L.h_ESG | 0.055∗∗∗ (5.21) | 0.659∗∗∗ (11.73) |

5. Conclusion

This study analyzes A-share listed companies from 2011 to 2020 using the PVAR model, treating ESG performance and financial performance as endogenous variables. The findings include: first, better ESG performance correlates with improved financial performance across environmental, social, and governance dimensions. Second, strong ESG performance enhances financial performance, particularly in market performance, indicating ESG factors are now mainstream in investment decisions. Third, a positive synergistic effect exists between ESG and financial performance, especially in environmental and social dimensions. Corporate governance shows a significant bidirectional relationship with accounting performance and a unidirectional relationship with market performance. Stakeholders should recognize the value-added information from corporate ESG activities for investors.

References

[1]. Auer B R, Schuhmacher F. Do socially (ir)responsible investments pay? New evidence from international ESG data [J]. Quarterly Review of Economics and Finance, 2016, 59(Feb.): 51-62. http://dx.doi.org/10.1016/j.qref.2015.07.002

[2]. Carolina D o P N C S U R N, Minnestoa D o E P U o M M, Carolina D o P N C S U R N, et al . An analysis of motivation strategies used within the small‐group Accelerating Mathematics Performance through Practice Strategies (AMPPS‐SG) program [J]. Psychology in the Schools, 2020, 57(4): 540-555. http://dx.doi.org/10.1002/pits.22334

[3]. Darbandy G, Mothes S, Schröter M, et al . Performance analysis of parallel array of nanowires and a nanosheet in SG, DG and GAA FETs [J]. Solid State Electronics, 2019, 162: 107641-107641. http://dx.doi.org/10.1016/j.sse.2019.107641

[4]. ElSahlamy N M. Comparison of thermal hydraulic performance between horizontal and vertical steam generators in nuclear power plants [J]. Kerntechnik, 2024, 89(1): 48-59. http://dx.doi.org/10.1515/KERN-2023-0100

[5]. Emma V M, Takaaki K, Naotaka I. Effect of C- and Fe-doped GaN buffer on AlGaN/GaN high electron mobility transistor performance on GaN substrate using side-gate modulation [J]. Japanese Journal of Applied Physics, 2021, 60(SB): SBBD17-. http://dx.doi.org/10.35848/1347-4065/ABE999

[6]. Fatemi A M, Fooladi I J. Sustainable finance: A new paradigm [J]. Journal of International Financial Markets, Institutions & Money, 2013, 24(2): 101-113. http://dx.doi.org/10.1016/j.gfj.2013.07.006

[7]. Friede G, Busch T, Bassen A. ESG and financial performance: aggregated evidence from more than 2000 empirical studies [J]. Journal of Sustainable Finance & Investment, 2015, 5(4): 210-233. http://dx.doi.org/10.1080/20430795.2015.1118917

[8]. grid..d, University of Hamburg, Hamburg, Germany. R&D: the missing link between corporate social performance and financial performance? [J]. Management Review Quarterly: Systematic Literature Reviews, Meta-Analyses, and Replication Studies, 2020, 70(2): 243-255. http://dx.doi.org/10.1007/s11301-019-00166-5

[9]. Hao Z-Z, Peng X-Q, Tang C-H. Edible pickering high internal phase emulsions stabilized by soy glycinin: Improvement of emulsification performance and pickering stabilization by glycation with soy polysaccharide [J]. Food Hydrocolloids, 2020, 103: 105672-105672. http://dx.doi.org/10.1016/j.foodhyd.2020.105672

[10]. K. B, C. K, M. T. Tribological performance of (Cr,Al)N+Mo:W:Sg in fluid-free friction regime [J]. Wear, 2023, 512-513. http://dx.doi.org/10.1016/J.WEAR.2022.204557

[11]. Krüger P. Corporate goodness and shareholder wealth [J]. Journal of Financial Economics, 2015, 115(2): 304-329. http://dx.doi.org/10.1016/j.jfineco.2014.09.008

[12]. Lee S, Singal M, Kang K H. The corporate social responsibility–financial performance link in the U.S. restaurant industry: Do economic conditions matter? [J]. International Journal of Hospitality Management, 2013, 32: 2-10. http://dx.doi.org/10.1016/j.ijhm.2012.03.007

[13]. Lin W L, Law S H, Ho J A, et al . The causality direction of the corporate social responsibility – Corporate financial performance Nexus: Application of Panel Vector Autoregression approach [J]. North American Journal of Economics and Finance, 2019, 48: 401-418. http://dx.doi.org/10.1016/j.najef.2019.03.004

[14]. O'Higgins E, Thevissen T. Revisiting the Corporate Social and Financial Performance Link: A Contingency Approach [J]. Business and Society Review, 2017, 122(3): 327-358. http://dx.doi.org/10.1111/basr.12119

[15]. Skare M, Golja T. Corporate Social Responsibility and Corporate Financial Performance – Is There A Link? [J]. Economic Research-Ekonomska Istraživanja, 2015, 25: 215-242. http://dx.doi.org/11517563

Cite this article

Zhang,G. (2025). Test of Synergy Between ESG Performance and Financial Performance. Advances in Economics, Management and Political Sciences,162,73-83.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Auer B R, Schuhmacher F. Do socially (ir)responsible investments pay? New evidence from international ESG data [J]. Quarterly Review of Economics and Finance, 2016, 59(Feb.): 51-62. http://dx.doi.org/10.1016/j.qref.2015.07.002

[2]. Carolina D o P N C S U R N, Minnestoa D o E P U o M M, Carolina D o P N C S U R N, et al . An analysis of motivation strategies used within the small‐group Accelerating Mathematics Performance through Practice Strategies (AMPPS‐SG) program [J]. Psychology in the Schools, 2020, 57(4): 540-555. http://dx.doi.org/10.1002/pits.22334

[3]. Darbandy G, Mothes S, Schröter M, et al . Performance analysis of parallel array of nanowires and a nanosheet in SG, DG and GAA FETs [J]. Solid State Electronics, 2019, 162: 107641-107641. http://dx.doi.org/10.1016/j.sse.2019.107641

[4]. ElSahlamy N M. Comparison of thermal hydraulic performance between horizontal and vertical steam generators in nuclear power plants [J]. Kerntechnik, 2024, 89(1): 48-59. http://dx.doi.org/10.1515/KERN-2023-0100

[5]. Emma V M, Takaaki K, Naotaka I. Effect of C- and Fe-doped GaN buffer on AlGaN/GaN high electron mobility transistor performance on GaN substrate using side-gate modulation [J]. Japanese Journal of Applied Physics, 2021, 60(SB): SBBD17-. http://dx.doi.org/10.35848/1347-4065/ABE999

[6]. Fatemi A M, Fooladi I J. Sustainable finance: A new paradigm [J]. Journal of International Financial Markets, Institutions & Money, 2013, 24(2): 101-113. http://dx.doi.org/10.1016/j.gfj.2013.07.006

[7]. Friede G, Busch T, Bassen A. ESG and financial performance: aggregated evidence from more than 2000 empirical studies [J]. Journal of Sustainable Finance & Investment, 2015, 5(4): 210-233. http://dx.doi.org/10.1080/20430795.2015.1118917

[8]. grid..d, University of Hamburg, Hamburg, Germany. R&D: the missing link between corporate social performance and financial performance? [J]. Management Review Quarterly: Systematic Literature Reviews, Meta-Analyses, and Replication Studies, 2020, 70(2): 243-255. http://dx.doi.org/10.1007/s11301-019-00166-5

[9]. Hao Z-Z, Peng X-Q, Tang C-H. Edible pickering high internal phase emulsions stabilized by soy glycinin: Improvement of emulsification performance and pickering stabilization by glycation with soy polysaccharide [J]. Food Hydrocolloids, 2020, 103: 105672-105672. http://dx.doi.org/10.1016/j.foodhyd.2020.105672

[10]. K. B, C. K, M. T. Tribological performance of (Cr,Al)N+Mo:W:Sg in fluid-free friction regime [J]. Wear, 2023, 512-513. http://dx.doi.org/10.1016/J.WEAR.2022.204557

[11]. Krüger P. Corporate goodness and shareholder wealth [J]. Journal of Financial Economics, 2015, 115(2): 304-329. http://dx.doi.org/10.1016/j.jfineco.2014.09.008

[12]. Lee S, Singal M, Kang K H. The corporate social responsibility–financial performance link in the U.S. restaurant industry: Do economic conditions matter? [J]. International Journal of Hospitality Management, 2013, 32: 2-10. http://dx.doi.org/10.1016/j.ijhm.2012.03.007

[13]. Lin W L, Law S H, Ho J A, et al . The causality direction of the corporate social responsibility – Corporate financial performance Nexus: Application of Panel Vector Autoregression approach [J]. North American Journal of Economics and Finance, 2019, 48: 401-418. http://dx.doi.org/10.1016/j.najef.2019.03.004

[14]. O'Higgins E, Thevissen T. Revisiting the Corporate Social and Financial Performance Link: A Contingency Approach [J]. Business and Society Review, 2017, 122(3): 327-358. http://dx.doi.org/10.1111/basr.12119

[15]. Skare M, Golja T. Corporate Social Responsibility and Corporate Financial Performance – Is There A Link? [J]. Economic Research-Ekonomska Istraživanja, 2015, 25: 215-242. http://dx.doi.org/11517563