1. Introduction

Due to the increasing campaign and awareness on climate change, many countries around the world have pledged to achieve net-zero emissions, with China planning to peak its carbon emissions by 2030 and achieve net zero by 2060. Zhang believes that since the transportation sector has been identified as one of the major polluters with relation to greenhouse gases, the move from internal combustion engine vehicles to electric vehicles (EVs) has become a major focus on the reduction of emissions [1]. The electric vehicle market therefore has monumental importance in China because it wants to reduce impacts on climate change and strive to be carbon-neutral. This paper is centered on how China’s policies on carbon neutrality impact EV sales and the market ecosystem. Specifically, it seeks to answer the following questions: What role have policies like subsidies by the government and tax incentives played in the adoption of EVs in the Chinese market? The following questions can therefore be posed: What new market trends have arisen since the establishment of these carbon-oriented policies? To answer these questions, this study uses quantitative research techniques, which involve analyzing sales data and policy reviews concerning carbon neutrality to evaluate the impact on the electric vehicle industry. Consequently, the discovery of this study is useful as it informs policymakers and key players in the industry. Understanding the link between the policy and the performance of the market, future policies will be more informed and the manufacturers will need to adjust to the changed market environment. Moreover, this research gives an understanding of how policy adjustments could help to spur EV markets, which will support Chinese carbon reductions.

2. Current Status and Trends of the EV Market

The electric vehicle (EV) market, particularly in China, has been evolving rapidly over the past decade. According to Grand View Research [2], there is rapidly growing demand for EVs owing to reasons, such as growing concern towards environmental issues, policies and incentives provided by governments and continuing development in technology. Internationally, the electric vehicle market was valued at nearly USD 163.01 billion in the year 2022 and is projected to reach a CAGR of more than 23% from the year 2023 to 2030. In this respect, China is leading the world with its largest automotive market has become a driving force for high-speed growth.

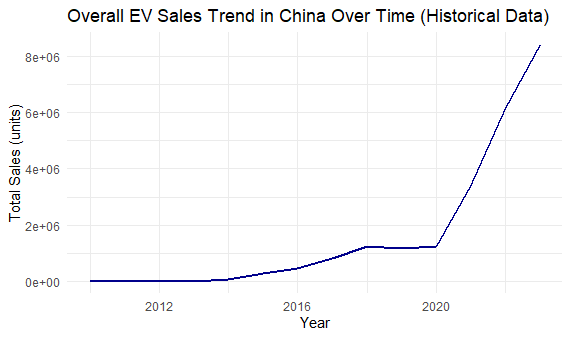

Figure 1: Overall EV Sales Trend in China Over Time

The China Association of Automobile Manufacturers [3] reported that China became the world’s largest market of new energy vehicles (NEVs), selling 1.51 million units of NEVs in 2023, which equals 57% of global sales. This is due to favorable government policy, global trends that show favor towards clean energy, and aggressive investments that include setting up a charging network in key cities.

The line graph given in Figure 1 shows exponential growth in sales, more prominently after 2018. People can directly link the enhanced rate in sales after 2020 to policy measures embracing the extension of purchase subsidies and the adoption of the enhanced China VI emissions specifications on vehicles. Furthermore, the growth of various EV models, ranging from the inexpensive mini-EV, Wuling Hongguang, to high-end models by first-tier EV companies, including NIO and Tesla has led to the satisfaction of the varying consumer needs.

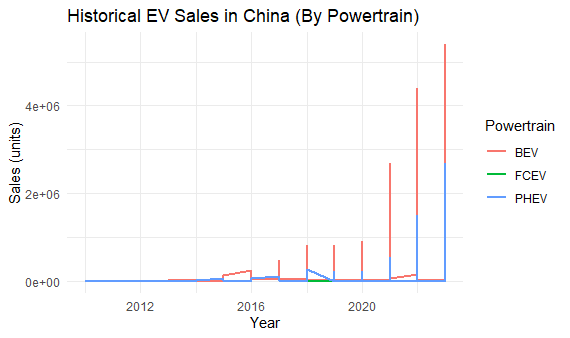

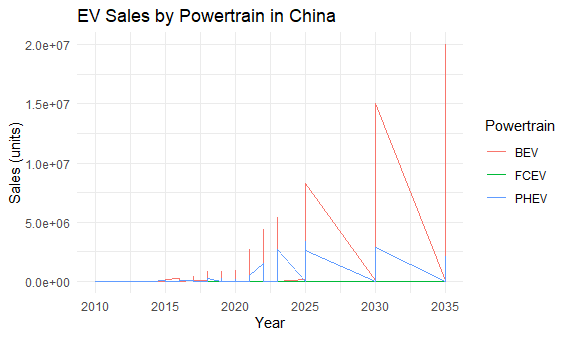

Figure 2: Historical EV sales in China by Powertrain

Also, Figure 2, showing EV sales by Powertrain, indicates the steep slope of BEVs as compared to PHEVs and FCEVs. The popularity of BEVs in China can be attributed to its customers’ demand for larger ranges and zero-emission automobiles and to the government’s aimed policies for BEVs rather than hybrids. There has been significant growth in new models being introduced to the market by manufacturers from China that have developed into new-tech automobile manufacturers such as BYD, XPeng, and NIO [3].

3. Carbon Neutrality Policy and Its Impact on the EV Market

The goal to make China a net-zero carbon emitter by 2060 is among the most aggressive plans for reducing emissions by any country globally. According to the research of Hergart, the transportation industry contributes to approximately 10% of the overall emission of carbon in the United States and is, therefore, central to this mission [4]. The plan launched in 2021, called the New Energy Vehicle (NEV) Industrial Development Plan (2021-2035), is a timely initiative by the Chinese government aimed at encouraging adoption of electric vehicles and dealing with the country’s dependence on fossil fuels. The NEV plan sets an ambitious target: It is stated that all the new vehicles being sold in China by 2035 should be NEVs.

In this case, the NEV policy has affected different areas of the market, from consumers to the supply chain. The government, through various policies, such as subsidies, tax exemptions, and exemptions from constraining license plates specifically in the urban areas, has seen the cost of ownership of EVs reduced to be comparable with ICEVs. Further, car manufacturers are motivated to achieve fuel economy and emission targets to make better and cleaner cars.

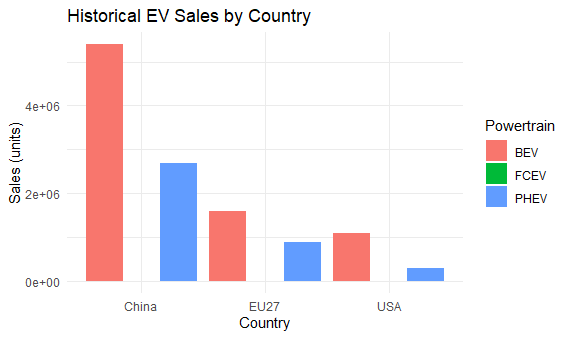

Figure 3: EV sales by country

According to IEA research for 2022 and as can be supported by the bar chart in Figure 3, China is seen to be ahead of other markets such as the EU and USA in terms of EV sales [5]. Sales of electric cars in the year 2021 were 3.2 million in China, 2.3 million in Europe and 610,000 in the USA. This gap is expected to increase as China proceeds to publish new policies on imposing production quotas for car makers to produce a fixed percentage of NEVs to evade fines.

One of the critical impacts of these policies is on the domestic automotive industry. While foreign automakers such as Tesla and Volkswagen have gained traction in China, domestic manufacturers like BYD, NIO, and XPeng have benefited significantly from local policies designed to boost indigenous technology and industry. BYD, for example, became the world’s largest EV manufacturer in 2023, overtaking Tesla in total units sold, thanks in large part to the Chinese government’s support for home-grown brands.

3.1. Policy and Market Interactions

A review of the literature on the role of policy in the EV market reveals that these policy frameworks act as important determinants in the market. Many researchers have found that policy supports in the shape of subsidies and tax credits make costs more affordable and increases the rate of adoption. According to Niu, China’s NEV subsidy program was able to cut the cost of electric cars by as much as 40% and level the playing field with gasoline automobiles [6]. This has been one of, if not the biggest factors in the sales of EVs in China and more so to the mid-end to lower-end buyers.

Ji holds that there is a considerable need to develop infrastructure in support of market resilience [7]. Currently, China has been rapidly increasing its charging stations from around 300,000 public charging points in 2018 to over 1.3 million in 2023 as per the National Energy Administration (NEA). This expansion has alleviated one of the primary consumer concerns about EVs: range anxiety. The availability of ultra-fast chargers, which can supply 80% of an EV battery in half an hour or less, also works in favor of EVs.

Comparisons with other countries also help uncover peculiarities of China’s model of market expansion. For example, high CO2 emission standards and incentives have caused higher uptake in the European Union although the market remains disaggregated compared to China. On the other hand, the United States has had rather erratic policies – some states, including California, have pushed forward aggressive zero-emission vehicle targets, while others have not.

3.2. Business Policy Adjustments and Market Responses

Companies that are involved in the EV market in China have had to deal with shifting market regulations. Local car manufacturers have increased their investments in the R&D section, with battery and self-driving car technology being promising areas. Battery production has turned into one of the few key sources of competitive advantage, with players, such as Contemporary Amperex Technology Co. Limited (CATL) pioneering lithium-ion batteries across the globe. Solid-state batteries that CATL is already developing are to bring their costs down further while increasing the range of vehicles and helping Chinese car makers outcompete worldwide rivals.

Others include advances in battery costs whereby LFP batteries for electric vehicles have made a significant impact in the industry. Such batteries, which are cheaper and have more stable power density compared to NMC batteries, are currently used by manufacturers like BYD for low-end electric vehicles. This change to LFP batteries has made it possible for companies to be profitable even with the start of the phase out of subsidies.

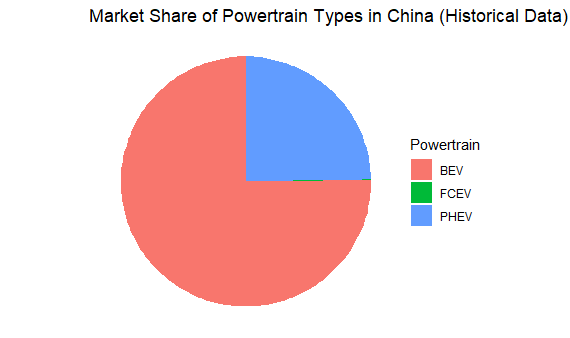

Figure 4: Market share by Powertrain Types in China

The data for the current state of the type of EVs in China can be found in the pie chart in Figure 4 market share of power train types in China (historical data). BEVs remain the most popular type of electric vehicle, taking up more than 80% of the market share, while PHEVs are a smaller but rising segment. Though FCEVs are still a small market, they are being actively pushed in the segments where range-extending capability is critical, such as commercial vehicles and buses.

Such a growth in the sales of EVs has also contributed to the intensification of competition among the manufacturers locally and globally. There are global players like Tesla, BMW and upcoming domestic players like NIO, XPeng, and BYD who are actively going cut throat both domestically and internationally. For instance, BYD Auto has applied the competencies gained through battery manufacturing to develop and sell cheaper cars with high performance that cuts across the different demographies.

4. Future Outlook of the EV Market Under Carbon Neutrality

With China progressing towards its carbon neutrality objective, there is likely to be more market growth in EVs, though not without some barriers. The government vision of developing NEVs from manufacturing to recycling means massive investment and new accomplishments in that field. Specific environmental topics that will be given a particular emphasis are battery recycling and the circular economy. At the moment, most EV batteries are Lithiumion, one of the most complicated and costly to reuse or recycle. But there are new technologies under consideration to reduce the environmental costs of EV production and disposal.

According to Zhang, the following are some of the factors that will propel the future of the EV market in China: First of all, the concept of autonomous cars will soon become a reality that will change the field significantly [8]. Currently, players such as Baidu and NIO have circulatory self-driving EVs, and full-scale circulation is estimated to reach the early 2030s. Second, renewable energy distribution into the grid will ensure that electricity powering EVs is sourced from carbon-neutral sources. The government’s intention of raising the proportion of renewables in the energy mixes to 80% by 2060 will offset the impacts of the majority of the EVs in a bid to lower their impacts on the environment.

Figure 5: Forecast EV sales by Powertrain

Finally, Constantine argues that the ever-growing unrest in the geopolitical supply chain of strategic EV materials, including semiconductors and rare earth metals, may affect the industry [9]. China now has a competitive edge in the processing of rare earth minerals; however, this is likely to be affected by political conflicts in the international market leading to a dearth in supply.

5. Conclusion

Specifically, the findings of the research concerning the EV market and the Chinese carbon neutrality policies are as follows: First, China, the world’s largest EV market, has consistently increased its demand for EVs through governmental policies, including subsidies, tax exemptions, and charging infrastructure in the past ten years. They have helped in the following way to remove barriers to the usage of EVs, making China the largest market for electric vehicles. Battery electric vehicles (BEVs) have led this evolution due to growing advancements in batteries and charging stations. The Chinese New Energy Vehicle (NEV) Industrial Development Plan has had a strong impact on market trends, forcing domestic and international automakers to increase production and development.

The Chinese carbon neutrality policies have built a solid foundation for the future of the EV market. Among these goals, the government has set 2060 as its target for achieving carbon neutrality with the sector of transportation. The findings of this study show not only positive effects of these policies in promoting the use of EVs but also on a range of environmental targets. BYD, XPeng, and NIO are homegrown automobile companies, making China’s plan to develop domestic manufacturing vital for the market’s future growth. Battery recycling, integration of renewable energy and self-driving cars are some of the efforts that are set to shape the second phase of the China green transport revolution.

However, this study also recognizes some limitations and challenges as well. First, due to the heavy dependence on subsidies and other government incentives, potential issues that relate to its long-term future when such incentives will be reduced are a concern. Also, the supply of raw materials, such as lithium, cobalt, and nickel, which are vital for battery production, is another supply chain that may affect the industry in the future.

There are geopolitical concerns on factors, such as rare earth minerals as well as semiconductors that make the picture even more uncertain. Ou argues that the issues of battery disposal and recycling also pose environmental challenges and, therefore, the development of EVs should make a significant positive contribution to China’s carbon neutrality goals [10]. There are also some potential issues that need further study. More researches should be directed towards the lifecycle environmental effects of EVs, starting from battery generation to their disposal. Evaluating battery recycling technologies and policies for the development of a circular economy in the operation of electric vehicles will be important. Further, conducting research on how the use of self-driving cars will work with renewable power sources could also help in enhancing the understanding of the Chinese topography for sustainable transport.

In general, the situation of China’s EV market lies between various technological advances, environmental steps, and the global economy. Some progress has been made but going forward, sustained government support, investment in infrastructure, and sustainability will be critical for market success and to meet the bold CO2 emission targets proposed for the year 2060.

References

[1]. Zhang S., Chen W., Zhang Q., Krey V., Byers E., Rafaj P., et al. Targeting net-zero emissions while advancing other sustainable development goals in China. Nature Sustainability. 2024 Jul 25.

[2]. Grand View Research. EV Market Size & Share | Global Electric Vehicles Industry Report, 2020 [Internet]. Grandviewresearch.com. 2023. Available from: https://www.grandviewresearch.com/industry-analysis/electric-vehicles-ev-market

[3]. Hove A. Clean energy innovation in China: Fact and fiction, and implications for the future. Econstoreu [Internet]. 2024; Available from: https://www.econstor.eu/handle/10419/301911

[4]. Hergart C. Sustainable Transportation. Energy, Environment, and Sustainability. 2021 Dec 14;7–38.

[5]. IEA. Global EV Outlook 2022 [Internet]. IEA. 2022. Available from: https://www.iea.org/reports/global-ev-outlook-2022.

[6]. Niu X., Song Y., Zhu H. Data-driven decision aids for purchasing battery electric vehicles based on PROMETHEE-II methodology. IEEE access. 2024 Jan 1;1–1.

[7]. Ji Z., Huang X. Plug-in electric vehicle charging infrastructure deployment of China towards 2020: Policies, methodologies, and challenges. Renewable and Sustainable Energy Reviews. 2018 Jul;90:710–27.

[8]. Zhang X., Rao R., Xie J., Liang Y. The Current Dilemma and Future Path of China’s Electric Vehicles. Sustainability. 2014 Mar 20;6(3):1567–93.

[9]. Constantine Karayannopoulos, Vasileios Tsianos. Lessons from Three Decades in the Rare Earth Trenches. Archimedes. 2023 Jan 1;81–106.

[10]. Ou S., Lin Z., Qi L., Li J., He X., Przesmitzki S. The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and industry profits in China. Energy Policy. 2018;121:597-610.

Cite this article

Cao,Y. (2025). The Impact of Carbon Neutrality Policy on China's Electric Vehicle Market: A Study Based on Sales Data and Policy Analysis. Advances in Economics, Management and Political Sciences,156,61-66.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang S., Chen W., Zhang Q., Krey V., Byers E., Rafaj P., et al. Targeting net-zero emissions while advancing other sustainable development goals in China. Nature Sustainability. 2024 Jul 25.

[2]. Grand View Research. EV Market Size & Share | Global Electric Vehicles Industry Report, 2020 [Internet]. Grandviewresearch.com. 2023. Available from: https://www.grandviewresearch.com/industry-analysis/electric-vehicles-ev-market

[3]. Hove A. Clean energy innovation in China: Fact and fiction, and implications for the future. Econstoreu [Internet]. 2024; Available from: https://www.econstor.eu/handle/10419/301911

[4]. Hergart C. Sustainable Transportation. Energy, Environment, and Sustainability. 2021 Dec 14;7–38.

[5]. IEA. Global EV Outlook 2022 [Internet]. IEA. 2022. Available from: https://www.iea.org/reports/global-ev-outlook-2022.

[6]. Niu X., Song Y., Zhu H. Data-driven decision aids for purchasing battery electric vehicles based on PROMETHEE-II methodology. IEEE access. 2024 Jan 1;1–1.

[7]. Ji Z., Huang X. Plug-in electric vehicle charging infrastructure deployment of China towards 2020: Policies, methodologies, and challenges. Renewable and Sustainable Energy Reviews. 2018 Jul;90:710–27.

[8]. Zhang X., Rao R., Xie J., Liang Y. The Current Dilemma and Future Path of China’s Electric Vehicles. Sustainability. 2014 Mar 20;6(3):1567–93.

[9]. Constantine Karayannopoulos, Vasileios Tsianos. Lessons from Three Decades in the Rare Earth Trenches. Archimedes. 2023 Jan 1;81–106.

[10]. Ou S., Lin Z., Qi L., Li J., He X., Przesmitzki S. The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and industry profits in China. Energy Policy. 2018;121:597-610.