1. Introduction

At present, the sales of electric vehicles have been significantly improved with the promotion and policy support of the state, and they have gradually replaced traditional cars. In 2024, the electric vehicle market has reached new heights, and sales are expected to increase significantly in the coming years. At present, most consumers are more inclined to choose electric vehicles when buying cars, which not only benefits from the continuous breakthrough of battery technology, the improvement of battery life enables it to meet the needs of long-distance travel, but also by the improvement of infrastructure construction such as charging piles, and the acceleration of charging speed, thus alleviating consumers' anxiety about battery life. As a leader in the global electric vehicle industry, Tesla has gained an important position in the highly competitive market with its innovative business model, advanced technology and brand influence. Tesla CEO Elon Musk announced in July 2024 that it plans to obtain regulatory approval in Europe and China by the end of 2024 to implement supervised FSD to allow consumers to experience autonomous driving technology. In addition, the policy environment of various governments has also had an important impact on Tesla's development. For example, China lowered the threshold for Tesla to enter the domestic market, making it the first foreign new energy vehicle company to benefit, which reflects China's great attention to the new energy vehicle industry. The US federal government has provided tax credits for new energy vehicle purchases. Although the policy has been cancelled, the US government has continued to promote environmental protection policies, indirectly creating a favorable market environment for Tesla. Tesla has many aspects, such as technological innovation, market competition, policy impact, financial risk and social change. As a global leader in electric vehicles and clean energy, Tesla's development model, potential risks, and impact on the industry are worthy of in-depth discussion.

2. Tesla's internal and operational situation

Born in Pretoria, South Africa on June 28, 1971, Elon Reeve Musk is an entrepreneur, engineer, inventor and philanthropist with American, South African and Canadian citizenship. As one of the most influential technology entrepreneurs today, he has achieved excellence in multiple fields. In December 2024, Musk became the first person in the world to cross the $400 billion mark. Musk is not only the founder and CEO of Tesla, but also the CEO and CTO of SpaceX, chairman of the board of SolarCity, CEO of X (formerly Twitter), Neuralink founder Doubt, and co-founder of OpenAI. He was also elected a fellow of the US National Academy of Engineering and a Fellow of the Royal Society. Musk's strategic vision and technological innovation ability have provided solid leadership and direction for Tesla's development. He has driven breakthroughs in electric vehicles, battery technology and autonomous driving that have made Tesla the world's most valuable automaker.

Tesla's success depends not only on Musk's personal vision, but also on a top core team that plays a key role in technology development, design innovation, and strategic decisions. Straubel, as one of Tesla's early members and technical genius, was responsible for turning Musk's ideas into actual products, providing an important impetus for business expansion. Not only did he help build the world's first viable all-electric car manufacturer, he also drove Tesla's commitment to battery recycling. After leaving Tesla, he founded Redwood Materials, which focuses on battery recycling and supply chain sustainability. Franz von Holzhausen, as lead designer, used a "first principles" approach to product design and drew inspiration from architecture and fashion to create a unique look for Tesla. His portfolio includes the Model S, Model 3, Model X, Model Y and the upcoming production Cybertruck. Martin Eberhard is one of the cofounders of Tesla and a top automotive engineer. He has made important contributions to the development of electric vehicles. Although he later left the company over management differences, his early technical and business decisions laid the foundation for Tesla.

Although Nikola Tesla was not directly involved in the founding of Tesla, the retired electrical engineer has had a profound impact on the development of electric vehicles. His invention of the AC motor has become one of the key technologies of modern electric vehicles. Jeffrey Brian Straubel is the engineer responsible for turning Musk's ideas into actual products. After leaving, he founded a company that pioneered new ways to solve the industry's raw material problems [1].

As of April 2025, Tesla has a market capitalization of $863.50 billion, ranking as the world's 10th most valuable company. Market capitalization, or market cap, represents the total market value of a publicly traded company's outstanding shares and is commonly used to assess its overall worth [2].

In the first quarter of 2023, Tesla Model Y sales reached 267,200 units, reflecting a 55.3% year-over-year increase, according to data compiled by JATO and reported by Motor 1. Several new energy vehicle (NEV) manufacturers, including Chinese brands BYD, XPeng, Li Auto, and NIO, as well as traditional automakers like BMW, were also part of the global ranking.

A comparison of enterprise values highlights Tesla’s dominance, with a valuation of $490.89 billion, significantly surpassing XPeng’s $6.19 billion and Rivian’s $4.19 billion. Moreover, key financial indicators such as EBITDA, ROIC, and ROE reveal that XPeng, NIO, and Rivian all reported negative EBITDA, while XPeng and Li Auto exhibited negative ROIC. Additionally, the ROE of XPeng, Li Auto, NIO, and Rivian was also negative, indicating profitability challenges for these companies [3].

3. SWOT analysis

3.1. Advantages

As one of the earliest companies in the world to enter the electric vehicle (EV) market, Tesla has taken a leading position in the industry with its excellent technical strength and market strategy. Its core competitive advantages are mainly reflected in the advanced Battery Management System (BMS), perfect charging infrastructure, brand influence, and market recognition.

First, Tesla's strongest technology is its mature battery management system. It can directly affect the endurance, safety performance, and overall service life of electric vehicles. At present, Tesla cars mainly use Panasonic 18650 lithium cobalt acid battery; the entire battery contains thousands of independent batteries with high energy density, and a high safety factor, can be recycled, and has charging times that can well maintain the stability of the car operation. Relatively speaking, China's domestic production technology level and research and development capability of new energy vehicles lack advantages compared with Tesla [4]. In addition, unlike many of its competitors, which rely on third-party battery suppliers, Tesla operates a gigafactory in Nevada with Panasonic and is continuously advancing battery self-development initiatives, such as developing abless battery technology. To further improve battery performance and reduce costs.

Second, Tesla's global charging network construction provides strong support for its market expansion. Tesla has a large-scale distribution in the Americas, Asia, Europe, and Australia, while Chinese car companies such as Xiaopeng, BYD, NiO, and so on only have a small number of foreign markets; In the planning of market distribution, Chinese car companies are weaker than Tesla. At the same time, if an electric vehicle wants to enter a new market, it is essential to have sufficient charging facilities. If the charging facilities are insufficient or the construction of the facilities is not perfect, it will restrict the sales of charging vehicles in the local market. Relatively speaking, Tesla has relatively complete charging supporting facilities. By December 2019, Tesla's supercharging stations in China reached 300, covering more than 140 cities across the country, and the total number of supercharging piles exceeded 2,200. The dense charging network has solved the worries of Tesla car users [5].

In addition, Tesla has a relatively high brand effect and market recognition. Its high-end technology image and unique purchasing experience are also one of its competitive advantages. Tesla is the world's first manufacturer of electric vehicles, with a high-end and technological image. The industrial chain has three grades of high and low products, attracting low, middle, and high- income people. Unlike traditional car manufacturers that rely on 4S stores, Tesla adopts a direct-to-consumer model; that is, consumers can purchase vehicles directly through Tesla's official website or official stores. This model reduces intermediaries, makes prices more transparent, and optimizes consumers' car-buying experience. In addition, Tesla opened display centers in large shopping malls, making it easier for potential consumers to access Tesla products in the daily shopping process, improving brand visibility and market penetration. The above two points make Tesla have a novel way of buying, car price transparency, minimalist purchase, and other characteristics. In terms of market share, in 2025, Tesla is expected to further expand the user base through the release of production capacity in Shanghai, Berlin, and Texas factories, as well as the continuous iteration of Model Y/3 and low-cost model plans.

To sum up, Tesla maintains a leading position in the global electric vehicle market with its technological innovation, strong charging infrastructure, brand influence, and unique sales model. With further breakthroughs in battery technology and continued expansion of production capacity, Tesla is expected to continue to consolidate its market share in the future and maintain a competitive advantage in the new energy vehicle industry.

3.2. Disadvantages

Despite Tesla's leading position in the electric vehicle industry, it still faces many challenges in terms of production, cost control, product quality, and market competition.

First, Tesla faces the problem of insufficient production capacity, especially in the state of growing market demand, and the bottleneck of production capacity may affect the company's growth rate. Tesla is not yet able to achieve low-cost, efficient production. The reason is that the battery drive system of Tesla cars is still a high-tech category, coupled with the use of new materials to increase the safety of the car and enrich the appearance of the car, so that Tesla cars cannot achieve automated production, resulting in production that can not meet the market demand.

Second, Tesla's high cost structure puts a certain limit on its profitability. Although Tesla has been using "zero advertising expenses" to reduce marketing costs, it still faces huge costs in production and other aspects. On the one hand, the advanced battery technology used by Tesla vehicles makes it impossible for Tesla to achieve automated production and inevitably pays high raw material costs and labor costs; on the other hand, Tesla's expansion and maintenance of supercharging stations and charging piles in China also put Tesla under considerable financial pressure [3].

Third, Tesla's product quality and safety issues have caused market concern. Despite Tesla's leading technology in intelligent driving, powertrain, and battery management, there are still some controversies over its products in terms of quality control and durability. For example, in 2024, there were eight incidents of spontaneous combustion of Tesla vehicles in the Chinese market, which will bring concerns and worries to consumers in the era of the Internet.

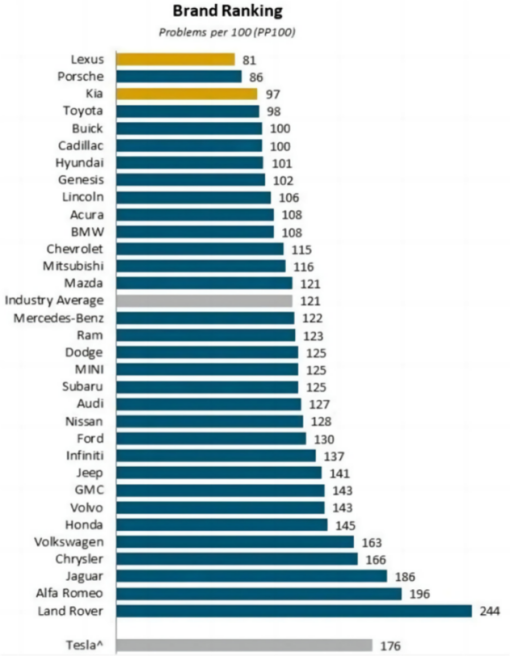

Figure 1: 2021 Vehicle dependability ranking [5]

According to the 2021 quality survey data, Tesla vehicles have 176 problems, ranking fourth in the quality ranking of major auto brands. There are 176 problems with Tesla cars (Figure 1). Among them, serious quality problems such as brake failure and bugs in the vehicle and machine system are frequently in the headlines. For example, in some traffic accidents, the brake failure problem was pointed at Tesla, which caused widespread concern in society, leading to some potential consumers being afraid of Tesla. At the same time, the frequent occurrence of Tesla's quality problems has reduced consumers' trust in Tesla, affecting the brand's word-of-mouth communication and market competitiveness.

Finally, Tesla is facing increasing competitive pressure in the Chinese market. China's local electric vehicle brands, such as BYD, Xiaopeng, NiO, and the newly listed Xiaomi SU7 in 2024, are rising rapidly and gradually narrowing the gap with Tesla in terms of price, battery life, intelligent configuration, and so on. For example, in the Chinese market in 2024, the newly launched millet su7 has strong horsepower, an advanced appearance, and a cheap price. In April of the same year, there are 7,058 units of sales, more than Tesla in China, setting the fastest 1,000 orders. If Tesla does not innovate, it will lose a lot of the Chinese market.

3.3. Opportunities

China's new energy vehicle market has great potential, and Tesla can use this trend to expand its market share. At present, China's economic development is in the rising stage, and the domestic economic environment is favorable for the development of new energy vehicles. As the world's largest auto market, the Chinese market has seen a sharp increase in new-energy vehicle sales. From 2017 to 2019, the total sales of new energy vehicles in China maintained an upward trend, rising from 1.426 million to 2.873 million. In 2020, due to the impact of the new coronavirus epidemic and consumers' wait-and-see on the national subsidy policy for new energy vehicles, sales fell to 1.367 million units. However, sales in 2021 increased rapidly again to 3.521 million, mainly because the subsidy standard for new energy vehicles in 2021 declined by 20% on the basis of 2020.

In addition, with the increasing environmental awareness of Chinese consumers, new energy vehicles will receive more and more attention. Electric vehicle charging facilities continue to improve. A network of charging stations has been established in public areas of the city, and charging piles have been set up to meet the needs of the development of new energy vehicles [6]. In the policy adjustment in 2023, the score value of standard models of new energy passenger vehicles is lowered by about 40% on average, and the point calculation method and the point value ceiling are adjusted accordingly, and the point pool management system is added. When the supply and demand ratio of positive and negative points of new energy vehicles exceeds 2 times, the point pool storage is started. Enterprises are allowed to store the positive points of new energy vehicles into the points pool on a voluntary basis, and this part of the points storage is valid for 5 years. Chinese car company BYD's new energy credits in 2023 are worth more than 8.6 billion yuan.

3.4. Challenges

With the rapid development of the new energy vehicle market, Tesla faces multiple challenges. First, consumers' bargaining power has increased. With the increase of product types in the new energy vehicle market, consumers' choice is becoming more and more extensive, and brand loyalty is also getting lower and lower. The development of digital technology has given consumers access to a large amount of information and enhanced their bargaining power. In addition, with the maturity of autonomous driving technology and the development of the sharing economy, consumers' desire to buy cars will also be affected [6].

In Tesla's external environment, there are always certain factors that pose a threat to the company's profitability and market position. Company managers should promptly identify threats to the company's future interests, evaluate, and take appropriate strategic actions to offset or mitigate their impact. External threats to the company may be the emergence of a powerful new competitor that will enter the market; substitutes grabbing company sales; the market growth rate of major products declining; adverse changes in exchange rates and foreign trade policies; demographic characteristics, adverse changes in social consumption patterns; improved negotiating power of customers or suppliers; and reduced market demand. Vulnerable to economic downturns and business cycles [7].

4. Conclusion

With its advantages in battery technology, autonomous driving systems, and global brand influence, Tesla occupies an important position in the new energy vehicle market. However, the company still faces many challenges and needs to further optimize its strategy to remain competitive.

Tesla has vigorously played its dominant position and continued to innovate in the battery field to improve battery life. Expand foreign markets, such as Tesla's monthly sales of less than 300 units in Japan; South Korea’s monthly sales are almost none. So Tesla still has a lot of foreign markets that have not been popularized. Disadvantage: Tesla's production capacity is a short board. Tesla can increase the construction of Tesla Gigafactory to improve production capacity. It is also necessary to pay attention to parts and innovation. At the same time, it is necessary to ensure the safety of the car. In terms of opportunities, Tesla builds charging infrastructure in large public parking lots such as airports, train stations, shopping malls, hospitals, and residential areas, as well as renovating and expanding charging facilities at existing high-speed service stations. Tesla's challenge lies in price, because now China's new energy vehicles have been fighting a price war, so Tesla should make price adjustments, increase production capacity, and reduce costs.

In terms of content, my thesis did not fully understand all the internal conditions of Tesla and the information parameters of the vehicle price advantage. Tesla has shortcomings and advantages in many areas. The amount of literature is too small. In the future, Tesla will strengthen the quality control in the production process, increase the supervision of parts suppliers, strictly implement quality testing standards, reduce the occurrence of quality problems such as brake failure and bugs in the vehicle machinery system from the source, and rebuild the brand quality image. Invest in research and development to further improve the safety and reliability of autonomous driving technology, optimize software systems, improve the stability and functionality of vehicle systems, and maintain a leading position in the field of electric vehicles and autonomous driving.

References

[1]. Qiche Baike. (2025, January 31). Key figures in Tesla’s development and their critical roles. Retrieved from https://baike.pcauto.com.cn/993175/1951584.html

[2]. Global Ranking. (2025). Market capitalization of Tesla (TSLA). Retrieved from https://companiesmarketcap.com/tesla/marketcap/?webview_progress_bar=1&push_animated=1&show_loading=0

[3]. Ren, Z., Weng, X., Xu, Y., & Xu, Z. (2023). Financial Analysis and Valuation of Tesla Inc. Advances in Economics, Management and Political Sciences, 42, 69-76.

[4]. Zhao, H., & Tian, M. (2020). SWOT analysis and insights on Tesla’s entry into the Chinese market. China Business Review, (21), 12-14.

[5]. Yan, Y. (2024, August). Navigating the ESG Landscape: An In-depth SWOT Analysis and Strategic Recommendations for Tesla’s Sustainable Growth. In 2024 2nd International Conference on Digital Economy and Management Science (CDEMS 2024) (pp. 102-111). Atlantis Press.

[6]. Liang, S. (2023). Investment analysis report on the new energy vehicle industry—A case study of Tesla. Northern Economy and Trade, (03), 131-133.

[7]. Zhang, Q. (2006). Application of SWOT analysis in strategic management. Enterprise Reform and Management, (02), 62-63.

Cite this article

Wang,Z. (2025). Tesla’s Business Model and Development Strategy: A SWOT Analysis. Advances in Economics, Management and Political Sciences,178,159-164.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Qiche Baike. (2025, January 31). Key figures in Tesla’s development and their critical roles. Retrieved from https://baike.pcauto.com.cn/993175/1951584.html

[2]. Global Ranking. (2025). Market capitalization of Tesla (TSLA). Retrieved from https://companiesmarketcap.com/tesla/marketcap/?webview_progress_bar=1&push_animated=1&show_loading=0

[3]. Ren, Z., Weng, X., Xu, Y., & Xu, Z. (2023). Financial Analysis and Valuation of Tesla Inc. Advances in Economics, Management and Political Sciences, 42, 69-76.

[4]. Zhao, H., & Tian, M. (2020). SWOT analysis and insights on Tesla’s entry into the Chinese market. China Business Review, (21), 12-14.

[5]. Yan, Y. (2024, August). Navigating the ESG Landscape: An In-depth SWOT Analysis and Strategic Recommendations for Tesla’s Sustainable Growth. In 2024 2nd International Conference on Digital Economy and Management Science (CDEMS 2024) (pp. 102-111). Atlantis Press.

[6]. Liang, S. (2023). Investment analysis report on the new energy vehicle industry—A case study of Tesla. Northern Economy and Trade, (03), 131-133.

[7]. Zhang, Q. (2006). Application of SWOT analysis in strategic management. Enterprise Reform and Management, (02), 62-63.