1. Introduction

Auctions are a fundamental mechanism for resource allocation and pricing. Auctions are used from selling goods such as art and antiques, to government procurement, and in financial transactions such as the IPO book building, where auction process is used to determine the price of a share. Understanding bidding behavior and expected revenue for bidders and auctioneers is crucial to help them to decide which types of auctions would best suit the product they are trying to buy or sell and design fair and effective mechanisms.

This study mainly focuses on the four types of seal-bid auctions: First-Price, Second-Price, Third Price, and All-Pay Auction, and discusses the equilibrium strategies and the auctioneer’s expected revenue in each of the four types of auctions and compare them among each other. What is the equilibrium biding strategies under each auction format? How does the expected revenue compare in different auction formats?

If assuming that for each type of auction, there exists an equilibrium strategy b(v), where v is the true value for the bidder, it is then possible to construct and mathematical model for the expected value

2. Types of auctions

Sealed bid auctions are auction formats where each bidder submits a bid without knowing others’ bids. The allocation of the price will depend on the rules of specific types of auctions. In a first-price auction, each bidder submits their bid, and the price will be allocated to whoever submitted the highest value. The winner must pay whatever they submitted to the auctioneer. In a second-price auction, the process is repeated; however, the highest bidder must pay the second-highest price submitted by other bidders in the auction to the auctioneer. Similarly, in a third price auction, the highest bidder pays the third-highest price submitted if they won the price. All pay auctions are slightly different from the three above; the rule is the highest bidder still wins the auction, but all bidders, including the winner in the auction, must pay their submitted value even if they did not win the price.

3. Equilibrium bidding strategies

To construct a mathematical model simulating the behavior of bidders during an auction, first assume all bidders are rational, meaning that they will all want to maximize their profit, and there exists a symmetrical equilibrium strategy. In game theory, symmetric games mean the payoffs of players are the same no matter who is playing what strategy [1]. This means there is a unique Nash equilibrium for the game; there is a strategy that maximizes players’ utility function [2]. For example, all bidders are identical on the day before the auction; on the day of the auction, all bidders who are going to participate in the auction wake up with a true value; only the bidder knows their own true value; and all bidders will use the same strategy: if the bidder’s value is v, then bid b(v).

3.1. First price

Since there is a symmetric equilibrium strategy for each type of auction let the bid function b(v) be,

where k is a constant and v is the true value.

The expected value

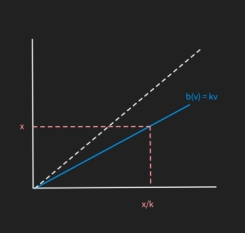

Next step is to calculate the probability of winning the auction when bidding the value x. First, draw a graph of the bid function. The x-axis represents the bidder’s true value, and the y-axis represents the value that the bidder should submit according to the symmetric equilibrium strategy. It is linear because the assumption is that the bid function is some constant times v and it must be below the 45°-line because if the bid value is higher than the bidder’s true value, then they would make a negative profit; hence, any function above the 45°-line in a first-price auction cannot be the equilibrium strategy even if there exists one. If a bidder bids value x and wins the auction, this means that all true values of other bidders must be below

Moving back to the expected value function

Since b(v) is the symmetric equilibrium strategy, at point x, which is also kv,

Using the two equations above, solve k in terms of n, which is the number of participants in the auction to get a bid function for first price auction.

Expanding brackets,

Differentiating

Compute

Finally, substituting k back into the bid function b(v), the symmetric equilibrium strategy for first price auction is

where n is the number of participants and v is the true value [3].

3.2. Second price

For second-price sealed-bid auctions, the equilibrium strategy will be different because the rules are different compared to first-price auctions. However, we do not need to calculate such a bid function for a second-price auction because there is a dominant strategy, where everyone who is rational will use this strategy. It is a dominant strategy in a second-price auction for a bidder to bid their true value [4]. Suppose the true value is v, and the bidder bids below v; it will not bring any benefit to the bidder because if the second-highest price of the auction is still below the submitted value, the bidder pays the same amount. Yet, bidding lower than v lowers the probability of winning, as there is a chance that someone else bids above the submitted value but lower than v. If the bidder bids above v, it increases the probability of winning, but there is also a chance that the second-highest price is below the submitted value but above v, resulting in negative profit for the bidder. Therefore, the dominant strategy for a second-price auction is to bid truthfully [5].

3.3. Third price

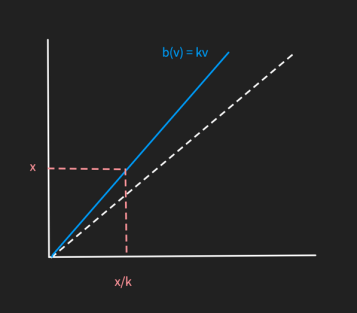

The bid function for the third-price auction is rather different from the two types above; in the third-price auction, the winner pays the third-highest bid submitted. In this case, maybe bidders should bid over their true value to a certain extent. To calculate the bid function, do the same thing as the first-price auction; first suppose the bid function b(v) is some sort of linear equation,

But this time, the bid function is expected to be above the 45° line because the equilibrium strategy might expect to bid higher than the true value (Figure 2).

Now, compute

To calculate the probability of winning, it is exactly the same as the first-price auction, because both auctions allocate the price to the highest bid submitted, but the only difference is the paid amount. Since all of the values are assumed to be distributed evenly across from [0,1], the third highest bid can be written as

where n is the number of participants and x is the submitted value.

The resulting two equations are as follows,

Repeating the steps from first price auction, by first multiplying out the brackets,

Differentiating

Compute

Bid function b(v) of third price auction is

where n is the number of participants in the auction and v is the true value.

From the calculated bid function, it is shown that the equilibrium strategy for a third-price auction is to bid above the true value.

As seen from the bid function for the first price, second price, and third price auctions, there might be a pattern for those functions,

perhaps the bid function of fourth price auction might be

but this can only be confirmed by proving it using similar calculations as the other auctions.

3.4. All-pay

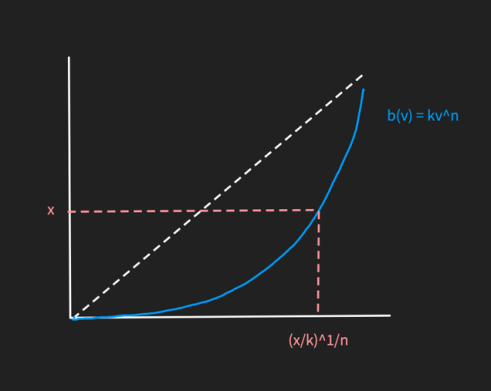

It was very lucky that the “guess” of the bid function for the auctions above were all correct; they were all linear bid functions, with a constant k in front of the true value v. Unfortunately, the bid function for all-pay auctions is non-linear; maybe there is another “guess” of the bid function. A linear bid function for an all-pay auction does not exist because if the method above is repeated with a linear bid function, kv, the final function is not linear. This contradicts the “guess” that the bid function is linear, so the result must be invalid.

Perhaps, the bid function could be exponential, and maybe is in the form,

The expected value function

where v is the true value and x is the submitted value. It must always be minus x at the end because bidders must all pay as long as they are participating in the auction.

Since the bid function is no longer the same, and it is non-linear, the probability of winning will be different; when bidding the value x, the corresponding true value, according to the new bid function, is (

Substituting this back into

Differentiating

Computing

Bid function b(v) for all-pay auction is,

4. Expected revenue

4.1. Calculations

So far, an equilibrium strategy for each auction format was found using the assumptions made at the beginning. The next step is to determine which auction format would bring the most revenue for the auctioneer by calculating the expected revenue.

To calculate the expected revenue for the first-price auction, first consider the case of two bidders and adopt the same assumptions used to calculate the equilibrium strategies. The values of the draws from each bidder are independent and drawn from a uniform distribution from the interval [0,100]. One way of winning is that bidder 1 has value x and bidder 2 has value less than or equal to x, another way is that bidder 2 has value x and bidder 1 has value less than or equal to x. From this, the probability that x is the highest value is

Now, consider there are n bidders, the probability of x is the highest value would be

The expected value of the highest bid would be the integral and solving it

Since each bidder bids

For second-price auctions, recall that the price is allocated to the bidder with the highest valuation, and the winner pays the second-highest actual valuation; therefore, the expected revenue for a second-price auction is the second-highest valuation. In a first-price auction, the bidder with the highest true value wins by estimating the value of the second highest. On average, the winner will have a valuation equal to the expected highest value if N values are drawn from the distribution; therefore, the expected winning bid on average will be equal to the expected 2nd-highest valuation [7].

4.2. Revenue equivalence theorem

From the calculations above, the expected revenues for both first- and second-price sealed-bid auctions are the same; it could be that there is a rule about expected revenues for all auction formats if they obey some specific properties. According to the revenue equivalence theorem, suppose bidders have independent and identically distributed valuations and are risk neutral. Then any symmetric and increasing equilibrium of a direct revelation auction A that assigns the item to the highest bidder such that the expected payment of the bidder with value 0 is 0, yields the same expected revenue [8]. In other words, the revenue equivalence theorem states that if there are N bidders with values drawn from the same continuous value distribution, then any standard auction will lead to the same revenue and expected bidder profit as the second-price auction [9]. Furthermore, the theorem says if each bidder’s type is drawn from a distribution where its CDF (cumulative distribution function) is increasing and continuous, bidders are risk neutral, the bidder with the highest type wins, and the bidder with the lowest possible type has an expected payoff of zero, then the expected revenue for all auctions is the same [10]. Thinking back to the auction formats of first, second, third, and all-pay auctions, they all satisfy the conditions for revenue equivalence; therefore, all four auction types in this study have an expected revenue of

5. Conclusion

The revenue equivalence theorem showed that auction formats might not matter for revenue under ideal assumptions. However, in practice, deviations from the assumptions, such as risk aversion and asymmetric information, could change the optimal choice. There are many limitations of the model in this study because of the assumptions, and these assumptions would rarely hold. For example, some bidders may be more risk averse, whereas some bidders may be more risk seeking; this changes the bid behaviors of bidders. Another example is that bidders have different beliefs about how valuations are distributed; this would affect the probability of winning differently. Emotions such as pride and rivalry can cause bidders to overbid, which is impossible to take into account when constructing a model like this.

The bid functions discovered in this study are only the most basic types of auctions; there are much more complicated cases that have not yet managed to be solved yet. For example, in an all-pay auction, there could be three prices, which are allocated to the highest, second-highest, and third-highest bidders. To compute a mathematical model for this, a three-dimensional cube would need to be used to illustrate the three prices and winners, which makes it much more complicated and difficult. All mathematical models do not predict exactly how something behaves, but we could make it close to what would happen with idealized assumptions such as, in this case, full rationality, risk neutrality, and perfect information about probability distributions.

References

[1]. Bahr B, Fiveable. (2025) Symmetric games - (Game Theory) - Vocab, Definition, Explanations | Fiveable. Fiveable.me. Accessed August 7. https: //library.fiveable.me/key-terms/game-theory/symmetric-games

[2]. Jin X., Dan M., Zhang N., Yu W., Fu X., Das S.K. (2012) Game Theory for Infrastructure Security. Handbook on Securing Cyber-Physical Critical Infrastructure, pp.31-53.

[3]. Zhang H. (2025) ECON20710 Lecture Auction as a Bayesian Game. Accessed August 11. https: //hanzhezhang.github.io/teaching/Chicago_ECON207/207sol_auction.pdf

[4]. EconPort. (2025) EconPort - Second-Price Sealed-Bid Auction. Econport.org. Accessed August 11. http: //www.econport.org/content/handbook/auctions/commntypes/secondpricesealed.html

[5]. Computational Thinking. (2025) Second Price Auction & Mechanism Design. YouTube. Published October 16. https: //www.youtube.com/watch?v=QJF5yR0ivuk

[6]. Professor Bergstrom. Notes on Expected Revenue from Auctions. https: //www.google.com/url?sa=t& source=web& rct=j& opi=89978449& url=https: //economia.uniroma2.it/master-science/economics/corso/asset/YTo0OntzOjI6ImlkIjtzOjM6IjQyMSI7czozOiJpZGEiO3M6NDoiMTExMiI7czoyOiJlbSI7TjtzOjE6ImMiO3M6NToiMjRhMDciO30%3D& ved=2ahUKEwjC4O2-nP2OAxUTha8BHSyIOU8QFnoECBYQAQ& usg=AOvVaw0glw6Pwe7E03Auz0jH5FPs

[7]. Dudnyk I. ECON 302 -Microeconomic Theory II: Strategic Behavior IRYNA DUDNYK Lecture Notes. Expected Revenue in Auctions. https: //www.sfu.ca/~idudnyk/Auctions_Part2_Revenue_Equivalence.pdf

[8]. Pellizzoni R. (2008) Algorithmic Game Theory. Published March 28. http: //chekuri.cs.illinois.edu/teaching/spring2008/Lectures/scribed/Notes20.pdf

[9]. Levin J. Notes on the Revenue Equivalence Theorem. https: //www.economics.utoronto.ca/damiano/ps426/RET-Levin-Notes.pdf

[10]. Munoz-Garcia F. (2025) Revenue Equivalence Theorem. Accessed August 9. https: //felixmunozgarcia.com/wp-content/uploads/2017/08/revenue_equivalence_in_auction_formats.pdf

Cite this article

Xu,N. (2025). First, Second, Third, and All Pay Auctions- Strategies, and Revenues. Advances in Economics, Management and Political Sciences,216,29-38.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bahr B, Fiveable. (2025) Symmetric games - (Game Theory) - Vocab, Definition, Explanations | Fiveable. Fiveable.me. Accessed August 7. https: //library.fiveable.me/key-terms/game-theory/symmetric-games

[2]. Jin X., Dan M., Zhang N., Yu W., Fu X., Das S.K. (2012) Game Theory for Infrastructure Security. Handbook on Securing Cyber-Physical Critical Infrastructure, pp.31-53.

[3]. Zhang H. (2025) ECON20710 Lecture Auction as a Bayesian Game. Accessed August 11. https: //hanzhezhang.github.io/teaching/Chicago_ECON207/207sol_auction.pdf

[4]. EconPort. (2025) EconPort - Second-Price Sealed-Bid Auction. Econport.org. Accessed August 11. http: //www.econport.org/content/handbook/auctions/commntypes/secondpricesealed.html

[5]. Computational Thinking. (2025) Second Price Auction & Mechanism Design. YouTube. Published October 16. https: //www.youtube.com/watch?v=QJF5yR0ivuk

[6]. Professor Bergstrom. Notes on Expected Revenue from Auctions. https: //www.google.com/url?sa=t& source=web& rct=j& opi=89978449& url=https: //economia.uniroma2.it/master-science/economics/corso/asset/YTo0OntzOjI6ImlkIjtzOjM6IjQyMSI7czozOiJpZGEiO3M6NDoiMTExMiI7czoyOiJlbSI7TjtzOjE6ImMiO3M6NToiMjRhMDciO30%3D& ved=2ahUKEwjC4O2-nP2OAxUTha8BHSyIOU8QFnoECBYQAQ& usg=AOvVaw0glw6Pwe7E03Auz0jH5FPs

[7]. Dudnyk I. ECON 302 -Microeconomic Theory II: Strategic Behavior IRYNA DUDNYK Lecture Notes. Expected Revenue in Auctions. https: //www.sfu.ca/~idudnyk/Auctions_Part2_Revenue_Equivalence.pdf

[8]. Pellizzoni R. (2008) Algorithmic Game Theory. Published March 28. http: //chekuri.cs.illinois.edu/teaching/spring2008/Lectures/scribed/Notes20.pdf

[9]. Levin J. Notes on the Revenue Equivalence Theorem. https: //www.economics.utoronto.ca/damiano/ps426/RET-Levin-Notes.pdf

[10]. Munoz-Garcia F. (2025) Revenue Equivalence Theorem. Accessed August 9. https: //felixmunozgarcia.com/wp-content/uploads/2017/08/revenue_equivalence_in_auction_formats.pdf