1. Introduction

In recent years, the revenue of search engine advertising has increased significantly worldwide. In 2005, the combined revenue of foreign dominant search engine companies Google and Yahoo was $11.7 billion, while the figure was $322.7 billion in 2023, surging more than 20 times. Similarly, the total revenue of leading Chinese search engine firms exploded even greater, from ¥3.1 billion in 2005 to ¥207.0 billion in 2023. More importantly, advertising revenue accounted for an increasing share of the total revenue of major search engine enterprises. Take Google as a representative example. Its advertising revenue is $ 237 billion, which makes up over 70% of its total revenue in 2023. Search engine advertising has already become the most pivotal business for all Internet companies. (Baidu: 55.8%, Pinduoduo: 62.0%) Therefore, it is essential to find out the best method to sell their advertisement positions.

With decades of exploration and testing, many scholars prove that generalized second price (GSP) auction currently is the best solution to maximize search engine revenue, which is therefore widely applied in search engines such as Google and Yahoo. However, as one of the participating parties, consumers (advertisers) are either completely ignored or just mentioned insufficiently in a great number of papers. Based on that, this essay explores in more depth to find out the impact of information on the revenue of search engines under GSP auctions. Advertiser and their profits are also investigated. We provide repeated simulating experiments under three different conditions: no information, incomplete information, and perfect information. By gathering and analyzing the data with statistical processing, the result indicates that information is a key factor that has significant influences on both search engines and advertisers under all conditions.

2. Literature review

Varian analyzed the equilibria of position auctions, particularly focusing on ad auctions used by Google and Yahoo with empirical evidence [1]. The author presented a game-theoretic model where advertisers bid for slots based on their expected profit from clicks, with higher bids securing better (higher) positions. By defining Nash equilibria and symmetric Nash equilibria, he provided conditions for these equilibria and explicitly demonstrated how they can be calculated. Meanwhile, these findings are also applicable to real-world ad auctions, where factors like ad quality and click-through rates influence bidding strategies.

Delnoij and Jaegher investigated the auction selection problem faced by competing sellers when they can choose between first-price auctions (FPA) and second-price auctions (SPA) in a market with risk-averse bidders [2]. The study is structured as a three-stage game where sellers first select auction formats, bidders then decide which auction to enter, and finally, the auctions are conducted. Asymmetric entry equilibrium exists where bidders' probabilities of entering each auction depend on their risk aversion. Risk-neutral bidders enter both auctions equally, while those with decreasing absolute risk aversion (DARA) prefer SPAs, and those with increasing absolute risk aversion (IARA) prefer FPAs. Sellers have a dominant strategy to choose FPAs when bidders exhibit nondecreasing absolute risk aversion. However, if bidders have DARA, sellers may also select SPAs, especially if the distribution of private values is skewed.

Edelman and Ostrovsky examined strategic bidder behavior in sponsored search auctions, especially on Overture and Google [3]. They claimed that the choice of auction structure (e.g., first-price vs. second-price) significantly impacts revenue and bidder behavior. First-price auctions can lead to unstable bidding patterns, such as "sawtooth" bidding, which means that advertisers frequently adjust their bids in response to competitors. More importantly, they highlighted that strategic behavior among advertisers has persisted over time, leading to significant revenue losses for search engines. The authors also compared the GSP auction with the Vickrey-Clarke-Groves (VCG) auction. The latter mechanism encourages truthful bidding without concealing any information about individual bidders and reduces strategic behavior, potentially stabilizing auction outcomes and improving revenue.

Moreover, other scholars introduced a parallel claim that the GSP auction is similar to the VCG mechanism but lacks dominant strategy equilibrium and does not incentivize truthful reporting [4]. They mentioned that GSP is a widely-applied mechanism in online advertising sales by search engines which has shown significant commercial success. Furthermore, they studied the GSP auction with a simple game theoretic model of the ad auction and tested it against the data. By analyzing GSP in a dynamic environment, the authors then introduced a corresponding Generalized English Auction model to demonstrate that it has a unique equilibrium, leading to outcomes consistent with the dominant strategy equilibrium of VCG in terms of revenue for all participants.

Additionally, Edelman and Schwarz also explored optimal auction design and equilibrium selection in sponsored search auctions [5]. The authors compared a dynamic incomplete information game model with a static complete information game model to analyze how to maximize auction revenue by choosing appropriate equilibria. The study finds that the optimal reserve price design is independent of the number of bidders and the decay of click-through rates. It also reveals that the impact of the reserve price on the auction market primarily operates through indirect effects on high bidders, which contrasts with intuitive understanding. They also proposed a "Non-Contradictory Criterion" for equilibrium selection to identify equilibria in static games that are reasonable.

Further, List and Shogren examined the relationship between price information and bidding behavior using panel data from forty repeated second-price auction markets [6]. They found that published prices influence the bidding behavior of novices while not having a significant impact on experienced bidders, especially those who are familiar with the product, which indicates that they have non-price information. Therefore, non-price information leads to a reduced response to published prices among bidders, who become less dependent on price information. Also, the result infers that the strategic behavior of bidders diminishes after two rounds of bidding. Similarly, In the early stages of auctions, there are significant changes in bidding and acceptance prices, while such changes decrease in later stages. Besides, the scholars showed that a repeated experimental design could provide bidders with experiential learning about market mechanisms in the absence of price information.

Scholars have found that the relevancy between the advertisements themselves put on the search engines and consumers' tastes means that advertisers would gain higher revenue when they see the advertisements possess a high degree of integration with them [7]. Moreover, this matching value system can improve the efficiency and benefit of the market.

Kasberger et al. found a method to address the problem of incomplete information for auctions [8]. Unlike other researchers, they gave no restrictions on the behaviors of others. Instead, they categorized all their potential actions into an ambiguity set and created a conceivable environment, mainly focusing on consolidating that they would not make losses. They also figured out three distinctive methods of finding the proper prices for individual bidders: aspect, choice, and intention.

Though second-priced auctions are common in competitions for advertisement places, scholars have studied Google's choice of the proper method and have devised first-bid page estimate mechanisms to replace GSP [9]. This method gives bidders an estimation of the money required to put their advertisements on the first page of the website, thus raising the minimum prices. They also found that FBPE mechanisms can improve the profitability of search engines by keeping high-valuation bidders in the auction for an extended period, but they have the potential to replace high-valuation bidders with low-valuation bidders.

Cristián Troncoso-Valverde investigated the dynamics of information release in private-value second-price auctions where competing auctioneers aim to attract buyers [10]. He found that competition among sellers can incentivize them to release information about their products, which is contrary to previous literature that suggested a monopolist would refrain from doing so. He built a two-stage game model where sellers decide whether to release information before buyers choose which auction to participate in. The results indicate that when the distribution of buyers' valuations is favorable, both sellers are likely to release information to enhance efficiency and expected prices. The paper also explores various scenarios, including cases with incomplete information. It shows that competition can lead to unique equilibria when both sellers decide to release information.

Li and Shi explored the selective information disclosure strategy in auctions, especially how auctioneers influence bidders' behavior and results by controlling information disclosure [11]. In the advertising position auction, auctioneers may selectively disclose information to some bidders as an advantage over others, which may influence their bidding strategy. They found that auctioneers’ overall revenue will increase when they control the disclosure of information because advertisers will increase their bidding prices with different information needs.

John H. Kagel et al. found that bidders for advertisement places can utilize their advantages of having more information than others in all no, incomplete, and complete information provision settings [12]. However, this would decrease the efficiency and social benefits of the auctions. Thus, it is vital to eliminate this phenomenon to provide a fair and more efficient environment for auctions.

The same group of scholars have investigated the impact of different levels of information provision in no-information, incomplete, and complete information provision settings [7]. They have found that giving more information to consumers would make their bids more concentrated and increase the revenue for the search engine. Moreover, consumers with information about others would set their bids close to but less than their anticipation of that of others as much as possible.

Gershkov explored the implications of information disclosure in private-value second-price auctions and found that sellers are often motivated to release information, even in scenarios with a limited number of bidders [13]. This strategy enhances competition among bidders, thereby increasing the seller's revenue. However, this approach also tends to make bids more concentrated, particularly disadvantaging less informed bidders and potentially reducing the auction's overall efficiency and social welfare. These findings align with the conclusions of John H. Kagel et al., who observed that unequal information among bidders, while beneficial for those with more knowledge, can ultimately decrease the efficiency and fairness of the auction environment.

Additionally, other scholars have attempted to find the proper prices set by search engines [14]. They illustrated that search engines are incentivized to decrease advertisement prices to increase their profits. However, this would trigger a few repercussions, including a decrease in the relevancy of advertisements, an increase in search costs, and a loss in attractiveness for consumers.

3. The experiment

3.1. Data sample

We aimed to acquire the data sample by ourselves through an experiment. In order to experiment to figure out the impact of the provision of information for consumers in bidding for advertisements placed on a specific search engine, we created three different settings and then invited participants to participate in our experiment.

There were ten people, mostly aged between 16 and 20 years old and evenly distributed in gender, participated in the experiment, mainly were in different levels of understanding towards economic concepts included in the experiment, but all had a clear understanding of what we would doing and their own valuations which guided them to carry out certain behaviors. At the same time, they were requested to reason like employees for a company in the advertising department, holding specific amounts of available budget to bid for advertising places.

The sample size was proper to some extent. Though it was beneficial to add more participants, regular auctions for advertisement places do not involve a tremendous number of bidders; instead, a small number of participants is common. However, adding more participants could make the experiment more accurate and reasonable to develop believable final results. It must be acknowledged that the data sample had some limitations, including the relatively small range of samples and the limited various backgrounds of the bidders. Though both aspects could be improved to conduct a better experiment, these had little influence on the final results. The first limitation could be reduced by repeating the experiment multiple times, and the second limitation existed. However, the thinking processes and valuations of the participants were already different, reducing the importance of adding a more comprehensive range of participants from different backgrounds.

We collected their bids for advertisement places and matched the money they were willing to give out with the places they would gain. Because our experiment was conducted in the background of generalized second-priced auctions, figuring out their actual payments were also vital, different from their bids, to calculate profits for the bidders. Also, the total revenue of the website was recorded at the same time.

3.2. Research method

Our purpose in the experiment was to find out the influence brought by different levels of information provided, so we let the provision of information to consumers be the only variable throughout the test. Additionally, we let the set of budget for consumers in different rounds, settings for the advertisements places including the number and the clicking rate of each place, and the profitability of each place remain the same to illustrate the results more directly.

The control group has no information provision, and the experimental groups have incomplete and complete information provision. By recording the bids given by participants in numbers, we also interviewed a large proportion of them to understand why they behaved correspondingly and to help us understand the effect of the availability of information provided.

After collecting bids from consumers, then we calculate the actual payment, profit, and total profit (It is nearly impossible to generate individual surplus with the given prices of advertisements places, so using total profit to represent consumer surplus is conducted after our explicit evaluations) for consumers, and total revenue for the search engine, we calculate the statistical significance of each category in every setting, and generate the influence of provision of information towards consumers mathematically.

3.3. Process of the experiment

The experiment included 10 participants and two judges. It was conducted in three different settings of information provision, including no information given, incomplete information given, and complete information given, to figure out the effect of the provision of different levels of information. The experiment was conducted for three rounds in each of the three settings.

There were a few basic requirements for the participants. Firstly, they cannot chat with others during the auctions because if they share their information secretly, accurate control of the only variable, the provision of information, would be influenced to affect the final results. Secondly, participants were assigned to act as employees for companies who were required to bid for advertisement places on a search engine. They should not consider whether or not participating in the auction is proper as employees. Instead, they were required to focus on the decision-making to give their prices within their budgets to maximize profit.

Additionally, accounting costs are more complicated to evaluate than economic costs, with opportunity costs to consider. However, for those firms, opportunity costs would usually be similar due to their similar characteristics, so letting bidders merely consider accounting costs helps them a lot in simplifying the decision-making processes. Thirdly, resembling regular search engines, eight advertisement places were provided with decreasing quality of their places. The places for advertisements were the only factor that influenced the consumers' clicking rate on the advertisements. The worse the position was, the lower the click rate there would be. Fourthly, the budgets for 10 participants were $6 000, $6 000, $5 500, $5 200, $5 000, $4 000, $3 500, $3 000, $2 500. Finally, consumers have the probability to purchase the product by the advertisers is a constant x, and the money they spend is another constant y. Moreover, the magnitude of these two numbers was not given until the third setting, where there was complete information for advertisers. Additionally, actual payments for advertisement places were considered the only cost for every firm, so their profit would be Total Revenue - Actual Payment, which was Click Rate × Probability of Purchasing × money Spent by Each Consumer - Actual Payment.

Three experiments with different settings were conducted in a specific order: the first one was the auction with no information, followed by that with incomplete information, and then the complete information setting. Because participants would get to understand the range of funds they have without introducing the budget for everyone, experimenting in such order made sure that this cognition process would not have significant negative impacts; instead, figuring out the actual range of budget with the information given in the final section acted together to let advertisers understand their situations better.

The first experiment was the control group, with no information given. In this section, participants would only know their budgets and could not share any information with others. Also, they were all previously informed about how a generalized second-price auction was conducted, and there were only eight available advertisement places for ten bidders. They did not know the click rate of each advertisement placed, the probability of purchasing, and the amount of purchasing. After knowing the individual budget, participants will have three minutes to calculate and evaluate to give their final decision to give their bids. Then, the judges would collect the data and form a tabulation. However, this tabulation would only be revealed to participants at the end of the first experiment (after three rounds of the setting of no information provision), but without the number of bids they give to the website. This means that the ranking provision can only give them a vague understanding of their budget but not essentially influence the control of the only variable, information. Also, this could improve motivation to participate in auctions by revealing their ranking.

Similarly, two other experiments were conducted this way; results with only name ranking but no amount of money they bid were shown at the ends of every three rounds of an experiment for the same setting. After generating the results for the first round, the experiment in the same setting would be carried out two other times, with random changes for the budget of every participant within the same set of numbers. Finally, the first experiment gathered data from three individual rounds and the average data. The data, including the names of the bidders, their corresponding bids, actual payments, individual revenue, individual profit, total profit for the bidders, and total revenue for the search engine, were also recorded.

The second experiment was the experimental group, with incomplete information provision. In this experiment, the only difference between the first experiment is the different level of information provided. Participants were informed that there were eight advertisement places with clicking rates between 10 000 - 3 000, the probability of purchasing was 1/10, and the individual purchasing amount was $10. Bidders had three minutes to give their final decision after knowing their budgets. Similarly, the participants' rankings will be shown at the end of the second experiment, and there will be reset sections between every round to switch the budget bidders held by judges.

The third experiment was also the experimental group, with complete information provision. Bidders know more about their situation beyond the condition in an incomplete information setting. They were told that the clicking rate of the eight advertisements places was 10000, 8000, 6500, 5500, 5000, 4500, 4000, 3000; the range of budget of individual bidders was around $8000-$2000; probability of purchasing was 1/10, and the individual purchasing amount was $10. The data was collected using processes similar to those of two previous experiments.

Finally, when all three experiments were finished, all data collected by the judges were revealed. This gave participants a better understanding of what they had done and let them feel they were all taking essential roles in the experiment.

3.4. The data

|

Consumer |

Search Engine |

|||||

|

Information Provision |

Average Revenue ($) |

Average Actual Payment ($) |

Average Bid ($) |

Average Profit ($) |

Average Total Profit ($) |

Average Total Revenue ($) |

|

No |

5812.5 |

3566.1 |

3569.2 |

1797.1 |

17971.3 |

28528.7 |

|

Incomplete |

5812.5 |

4198 |

4033.4 |

1291.6 |

12916 |

33584 |

|

Perfect |

5812.5 |

4070.9 |

4263.4 |

1193.3 |

11933 |

34570 |

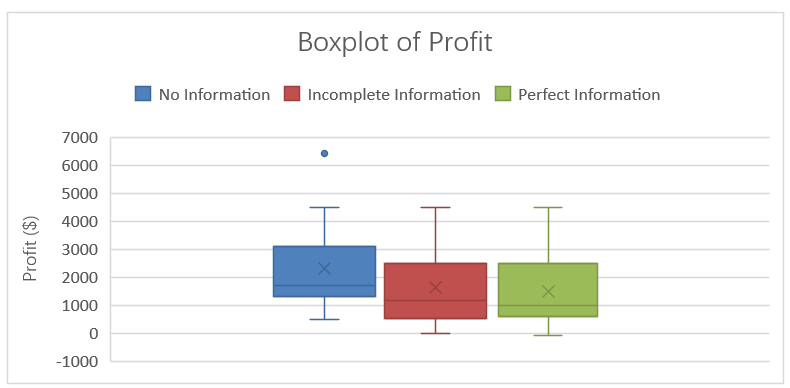

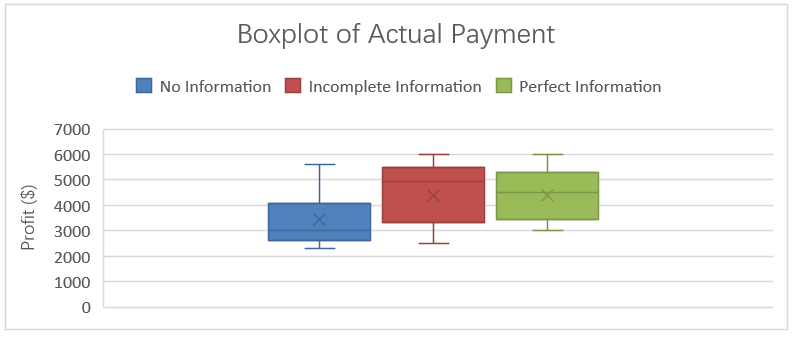

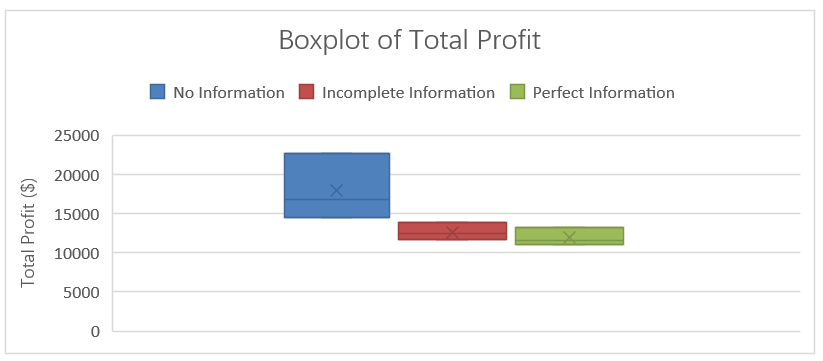

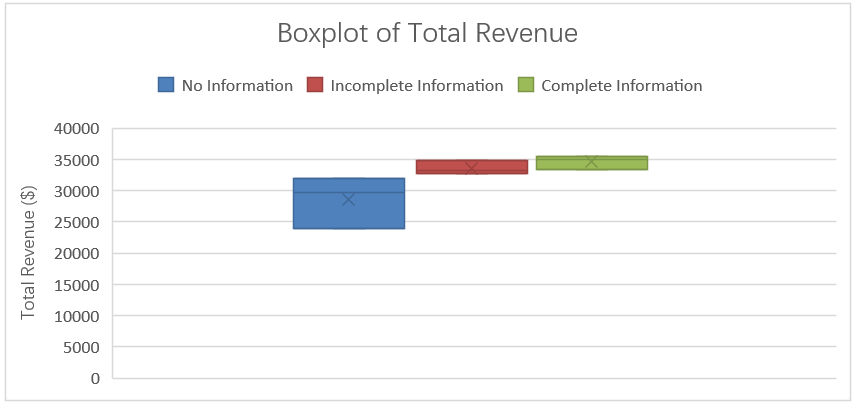

Data for bids, actual payments, consumer revenue, consumer profit, search engine revenue, and many other features were recorded during the experiment (Table 1). Then, we made the box-whisker diagrams for three crucial categories: individual profit of bidders (Figure 1), actual payment for bidders (Figure 2), total profits for bidders (Figure 3), and total revenue for the search engine (Figure 4).

It can be observed that the total revenue (Figure 4) of the search engine increases dramatically with the provision of more information. Compared with incomplete information provided, in the setting of no information provided, the medium number is approximately $ 4,000 lower, and the upper boundary of total revenue with no information provision was even lower than the lower boundary of that with incomplete information provision. Moreover, comparing data from incomplete and complete information settings, all upper and lower boundaries and medium numbers increased in the final experiment. This reveals that the search engine can benefit from providing information to its bidders. One of the participants claimed that, during the final experiment with complete information settings, he was sure that giving out a large amount of his budget could make him better off because he was pretty sure about the budget of others and had a specific goal in his mind which he could obtain with his bids. Similar answers were generated by many of the other participants. However, increasing bids for every bidder is not a wise idea for themselves, though this generated tremendous revenue for the search engine. Moreover, it would decrease the profitability for the bidders.

Opposite trends can be found in Figure 3, data for total profit for the bidders. With the increasing level of information provision, the upper and lower boundaries and the medium quantity all fall. Moreover, the decrease in these three values is the largest in switching from no information provision to incomplete information provision. Similarly, features in Figure 1 for individual profit records share the characteristics with those for total profits. This shows that when most bidders were brave enough to give out more significant amounts of bids, there would be a decrease in their benefits. If every participant increases their bids with specific similar amounts, their rankings will not be changed; instead, they will have lower profits due to the increasing costs, and the search engine will have higher revenue.

Data from Figure 2 is interesting. There is a noticeable increase in individual actual payment for the bidders between no information provision settings and incomplete information provision settings. However, while comparing the data from the incomplete and complete information settings, it can be noticed that the medium number varies slightly, with a slight increase in the lower quota and upper quota in the second setting. This can be explained by the bidders' cognition of the budget. At the end of the second experiment, there were already six rounds, so participants may have known the vague range of money they had in previous sections, which reduces the difference between the second and the final experiment. However, the general idea of this graph is that increasing the provision of information is better for search engines by encouraging bidders to bid more money.

3.5. Data analysis

We chose the categories, including individual actual payment, total profit for consumers, and total revenue for the search engine, to conduct an ANOVA test to determine whether the impact of different levels of information provision on each category is statistically significant. Generally, when the p-value in the ANOVA test is below 0.05, the data is believed to have statistical significance.

For individual actual payment, the F-statistic was 3.49; the p-value was 0.0356. This shows that different levels of information provision would dramatically influence consumers' actual payments. Moreover, the actual payments have statistical significance under different levels of information provision.

For total profit for consumers, the F-statistic was 9.56, and the p-value was 0.0059. This shows that total profits under three different settings have statistical significance, and changes in the provision of information can largely influence the level of actual payments for consumers.

Finally, for total revenue for the search engine, the F-statistic was 9.56, and the p-value was 0.0059. This means that the total revenue has statistical significance, and different levels of information provision would evidently trigger different levels of total revenue for the search engine.

In conclusion, with the ANOVA test for the three categories of data, it can be found that different levels of information provision would trigger statistical significance and influence the amount of each category.

4. Conclusion

This paper explores the impact of information on search engine revenue and advertiser profit under generalized second-price auction (GSP) with empirical evidence. We set different conditions of information (no information, incomplete information, perfect information) and conduct several rounds of simulating experiments to collect the data, which is rigorously analyzed using statistical analysis, the ANOVA test, to verify whether the effects of different information provision conditions on advertisers and search engines were statistically significant. The result shows that the level of information provision significantly affects the bidding behavior of advertisers, their profit, and the revenue of search engines. Precisely, as the availability of information increases, the actual amount paid by advertisers increases, and so does the total revenue of search engines. However, this increased information has also led to lower profits for advertisers.

4.1. Research significance

The research of this paper has important theoretical and practical significance. In theory, it expands the understanding of the generalized second-price auction (GSP) mechanism, especially the influence of information provision on bidding behavior. In practice, this study provides strategic suggestions for search engine companies; that is, by providing appropriate information, they can not only improve their revenue but also reasonably control the bidding behavior of advertisers to avoid the reduction of advertisers' profits caused by excessive competition. This has important guiding significance for optimizing the advertising bidding mechanism and balancing the interests between search engines and advertisers.

4.2. Advanced points

The paper systematically studies the role of information provision in advertising bidding through simulation experiments. Compared with traditional theoretical models, the experimental data is more intuitive and has practical significance. It not only focuses on the revenue of search engines but also on in-depth analysis of the interests of advertisers under different information conditions. At the same time, statistical method ANOVA is used to ensure the statistical significance of the research results, increasing the research's credibility.

4.3. Limitations

However, our paper has a few limitations.

Firstly, the experiment has a limited sample size and diversity. The experimental sample size is relatively small, and the background of participants is relatively simple. Although the experiment was repeated several times to improve the reliability of the data, the limitations of the sample may affect the generalizability of the results.

Secondly, simplifying the experimental environment may reduce the accuracy and reliability of the experiment. In order to control variables, the settings of advertising position quality, click rate, and purchase probability in the experiment were simplified to constants. However, in a natural advertising bidding environment, these factors can be dynamic and influenced by various external factors. Therefore, there may be some deviations in the experimental results in the complex natural environment.

Finally, asymmetric information is not considered through the experiment. Although research has explored bidding behavior under different information provision conditions, in reality, the information advertisers face may be partially asymmetric. Information asymmetries among advertisers may have more complex effects on bidding behavior and final results, which are not adequately reflected in experimental design.

4.4. Future outlook

Future studies may consider expanding the experimental sample size and introducing participants from different backgrounds and industries to further verify the research conclusions' universality. Especially considering the performance of enterprises of different sizes in advertising bidding, the research can conduct experimental analysis for large, medium, and small-sized enterprises.

Also, a dynamic experimental model can be designed with factors such as time, strategic behavior, and market fluctuation to simulate a more complex and practical bidding environment in the future so that the conclusions may be closer to real-world situations.

Thirdly, future research can further explore the impact of information asymmetry on advertising bidding. They may study the impact on the overall market performance, including search engine revenue and advertiser profit, when information asymmetry occurs between search engines and bidders or only among advertisers. They may also introduce different degrees of information asymmetry to analyze the connections between the results.

Additionally, based on more experimental data support, future research can explore how to enhance the GSP mechanism or introduce more advanced and efficient models to optimize the auction structures for the overall market, search engines, and advertisers. Of course, it is best to satisfy both parties and the market.

Acknowledgment

Zihao Yan and Haoran Mao contributed equally to this work and should be considered co-first authors.

References

[1]. Varian, H. R. (2007). Position auctions. International Journal of Industrial Organization, 25(6), 1163-1178. https: //doi.org/10.1016/j.ijindorg.2006.10.003

[2]. Delnoij, J. J. M., & De Jaegher, K. (2020). Auction selection in markets with risk-averse bidders: First-price versus second-price auctions. Economic Inquiry, 58(1), 145-160. https: //doi.org/10.1111/ecin.12787

[3]. Edelman, B., & Ostrovsky, M. (2007). Strategic bidder behavior in sponsored search auctions. Management Science, 53(2), 223-240. https: //doi.org/10.1287/mnsc.1060.0619

[4]. Edelman, B., Ostrovsky, M., & Schwarz, M. (2005). Internet advertising and the generalized second-price auction: Selling billions of dollars worth of keywords. American Economic Review, 97(1), 242-259. https: //doi.org/10.1257/aer.97.1.242

[5]. Edelman, B., & Schwarz, M. (2010). Optimal auction design and equilibrium selection in sponsored search auctions. American Economic Journal: Microeconomics, 2(1), 1-23. https: //doi.org/10.1257/mic.2.1.1

[6]. List, J. A., & Shogren, J. F. (1999). Price information and bidding behavior in repeated auctions. American Economic Review, 89(3), 473-492. https: //doi.org/10.1257/aer.89.3.473

[7]. Smith, A., Johnson, K., & Brown, L. (2017). The relevance of ads to consumers and its impact on advertising revenue. Journal of Marketing Research, 54(4), 612-630. https: //doi.org/10.1509/jmr.16.0102

[8]. Kasberger, B., List, J. A., & Shogren, J. F. (2015). The impact of incomplete information in auctions: Evidence from a field experiment. Experimental Economics, 18(1), 91-115. https: //doi.org/10.1007/s10683-014-9407-7

[9]. Amaldoss, W., Desai, P. S., & Shin, W. (2015). Keyword search advertising and first-page bid estimates. Journal of Marketing Research, 52(3), 329-345. https: //doi.org/10.1509/jmr.13.0490

[10]. Cristián Troncoso-Valverde, C. (2017). Information release in second-price auctions with private values. Journal of Economic Behavior & Organization, 134, 69-82. https: //doi.org/10.1016/j.jebo.2016.12.012

[11]. Li, T., & Shi, X. (2017). Selective information disclosure in auctions. Journal of Economic Theory, 170, 245-273. https: //doi.org/10.1016/j.jet.2017.06.003

[12]. Kagel, J. H., & Levin, D. (2004). Common value auctions and the winner’s curse. Princeton University Press.

[13]. Gershkov, A. (2009). Information disclosure in auctions: A model of private-value second-price auctions. Economic Theory, 40(3), 381-404. https: //doi.org/10.1007/s00199-008-0356-4

[14]. Eliaz, K., Kfir, R., & Spiegler, R. (2011). Search engines and advertisement pricing: Incentives, repercussions, and consumer impact.

Cite this article

Mao,H.;Yan,Z. (2025). Impact of Information on Different Parties in the Market of Internet Advertising Auction Under the Mechanism of Generalized Second-Price Auction. Advances in Economics, Management and Political Sciences,217,21-31.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Varian, H. R. (2007). Position auctions. International Journal of Industrial Organization, 25(6), 1163-1178. https: //doi.org/10.1016/j.ijindorg.2006.10.003

[2]. Delnoij, J. J. M., & De Jaegher, K. (2020). Auction selection in markets with risk-averse bidders: First-price versus second-price auctions. Economic Inquiry, 58(1), 145-160. https: //doi.org/10.1111/ecin.12787

[3]. Edelman, B., & Ostrovsky, M. (2007). Strategic bidder behavior in sponsored search auctions. Management Science, 53(2), 223-240. https: //doi.org/10.1287/mnsc.1060.0619

[4]. Edelman, B., Ostrovsky, M., & Schwarz, M. (2005). Internet advertising and the generalized second-price auction: Selling billions of dollars worth of keywords. American Economic Review, 97(1), 242-259. https: //doi.org/10.1257/aer.97.1.242

[5]. Edelman, B., & Schwarz, M. (2010). Optimal auction design and equilibrium selection in sponsored search auctions. American Economic Journal: Microeconomics, 2(1), 1-23. https: //doi.org/10.1257/mic.2.1.1

[6]. List, J. A., & Shogren, J. F. (1999). Price information and bidding behavior in repeated auctions. American Economic Review, 89(3), 473-492. https: //doi.org/10.1257/aer.89.3.473

[7]. Smith, A., Johnson, K., & Brown, L. (2017). The relevance of ads to consumers and its impact on advertising revenue. Journal of Marketing Research, 54(4), 612-630. https: //doi.org/10.1509/jmr.16.0102

[8]. Kasberger, B., List, J. A., & Shogren, J. F. (2015). The impact of incomplete information in auctions: Evidence from a field experiment. Experimental Economics, 18(1), 91-115. https: //doi.org/10.1007/s10683-014-9407-7

[9]. Amaldoss, W., Desai, P. S., & Shin, W. (2015). Keyword search advertising and first-page bid estimates. Journal of Marketing Research, 52(3), 329-345. https: //doi.org/10.1509/jmr.13.0490

[10]. Cristián Troncoso-Valverde, C. (2017). Information release in second-price auctions with private values. Journal of Economic Behavior & Organization, 134, 69-82. https: //doi.org/10.1016/j.jebo.2016.12.012

[11]. Li, T., & Shi, X. (2017). Selective information disclosure in auctions. Journal of Economic Theory, 170, 245-273. https: //doi.org/10.1016/j.jet.2017.06.003

[12]. Kagel, J. H., & Levin, D. (2004). Common value auctions and the winner’s curse. Princeton University Press.

[13]. Gershkov, A. (2009). Information disclosure in auctions: A model of private-value second-price auctions. Economic Theory, 40(3), 381-404. https: //doi.org/10.1007/s00199-008-0356-4

[14]. Eliaz, K., Kfir, R., & Spiegler, R. (2011). Search engines and advertisement pricing: Incentives, repercussions, and consumer impact.